Financial Statements Analysis of Idea Cellular & Reliance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation – July 2017

Hathway Cable and Datacom Limited Investor Presentation – July 2017 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 14,000 16.2% 20.0% 13,000 15.0% • The company’s vision is to be a single point access provider, bringing into the home and work place a converged world of information, entertainment and services. 12,000 12.1% 13,682 10.0% 11,000 11,550 5.0% • Hathway is listed on both the BSE and NSE exchanges and has a current market 10,000 0.0% th capitalisation of approximately INR 28 Bn as on 30 June, 2017. FY16 FY17 Broadband Cable Television FY17 Operational - Revenue Break-up • Hathway holds a PAN India ISP license • One of India’s largest Multi System Activation Other and is the first cable television services Operator (MSO), across various regions 6% 2% Cable Subscription provider to offer broadband Internet of the country and transmitting the 34% services same to LCOs or directly to subscribers. • Approximately 4.4 Mn two-way • Extensive network connecting 7.5 Mn Placement broadband homes passed CATV households and 7.2 Mn digital 21% cable subscriber • Total broadband Subscribers – 0.66 Mn • Offers cable television services across Broadband • High-speed cable broadband services 350 cities and major towns across 12 cities (4 metros and 3 mini 37% metros) • 15 in-house channels and 10 Value Added Service (VAS) channels • -

LIST of ISP LICENSEES AS on 30.06.2015* Sl No Name of Company CAT Service Area

LIST OF ISP LICENSEES AS ON 30.06.2015* Sl No Name of Company CAT Service Area 1 Reliance Communications Infrastructure Ltd. A All India 2 Dishnet Wireless Ltd. A All India 3 Tata Communications Limited A All India 4 RPG Infotech Ltd. A All India 5 Value Healthcare Ltd B Mumbai 6 Hughes Communications India Limited A All India 7 Karuturi Telecom Private Limited A All India 8 Micky Online Pvt. Ltd. C Moradabad 9 Seven Star Dot Com Private Limited B Mumbai 10 Gujarat Narmada Valley Fertilizers Company Ltd. A All India 11 Kerala Communication Network Pvt. Ltd. B Kerala 12 North East Online Services Pvt. Ltd. C Guwahati 13 The Tata Power Company Ltd A All India 14 Asianet Satellite Communications Ltd. B Kerala 15 M/s Reliance Ports and Terminals Limited [Earlier M/s Reliance Engineering A All India Associates Pvt. Ltd.] 16 Hathway Bhawani Cabeltel & Datacom Ltd. B Mumbai 17 Millennium Telecom. Ltd. A All India 18 Amber Online Services Ltd. B Andhra Pradesh 19 Tata Teleservices Ltd. A All India 20 Web Cable TV Ltd C Nagercoil 21 Netkracker Ltd. A All India 22 Karuturi Global Limited B Karnataka 23 SAB Infotech Ltd. C Dharamshala 24 SAB Infotech Ltd. C Karnal 25 Sujan Engineering Pvt. Ltd. C Vadodara 26 Space Online Ltd. B Gujarat 27 World Phone Internet Services Pvt. Ltd. A All India 28 C-DAC, Noida C Ghaziabad 29 Essel Shyam Communications Ltd. A All India 30 Forum Infotech Pvt. Ltd. C Srinagar 31 Micky Online Pvt. Ltd. C Nainintal 32 Reach Network India Pvt. -

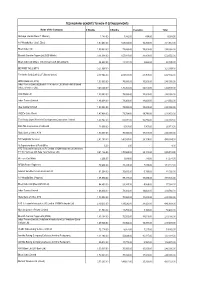

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

Telecom Consumer Charter

Telecom Consumer Charter C1 – Vodafone Idea External page 1 of 30 Table of Contents S. No. Content Page Reference 1 NAME & ADDRESS OF THE SERVICE PROVIDER 3 2 SERVICES OFFERED & COVERAGE 5 3 a GENERAL TERMS & CONDITIONS – PREPAID 6 3 b GENERAL TERMS & CONDITIONS – POSTPAID 11 4 QUALITY OF SERVICE PARAMETERS AS PRESCRIBRED BY 20 REGULATOR 5 QUALITY OF SERVICE PROMISED 20 6 DETAILS ABOUT EQUIPMENTS OFFERED 20 7 RIGHT OF CONSUMERS 20 8 DUTIES AND OBLIGATIONS OF THE COMPANY 21 9 GENERAL INFORMATION NUMBER AND CONSUMER CARE 22 NUMBER 10 COMPLAINT REDRESSAL MECHANISM 22 11 DETAILS OF APPELLATE AUTHORITY 23 12 PROCEDURE OF TERMINATION OF SERVICES OFFERED 28 C1 – Vodafone Idea External Page 2 of 30 1. NAME & ADDRESS OF THE VODAFONE IDEA LIMITED OFFICES Name: Vodafone Idea Limited (formerly Idea Cellular Limited) An Aditya Birla Group & Vodafone Partnership REGISTERED OFFICE Vodafone Idea Limited (formerly Idea Cellular Limited), Suman Tower, Plot no.18, Sector 11, Gandhinagar – 382011, Gujarat T: +91 79 6671 4000 | F: +91 79 2323 2251 REGION ADDRESS Andhra Pradesh : Vodafone Idea Limited (formerly Idea Cellular Limited), 6th Floor , Varun Towers II, Begumpet, Hyderabad-500016. Assam : Vodafone Idea Limited (formerly Idea Cellular Limited), RED DEN, NH – 37 Katahbari, Gorchuk, Guwahati, Assam-781035. Bihar & Jharkhand : Vodafone Idea Limited (formerly Idea Cellular Limited), BLOCK A , 3rd Floor, Sai Corporate Park, Rukanpura, Bailey Road, Opposite SSB Office,Patna–800014. Delhi : Vodafone Idea Limited (formerly Idea Cellular Limited), A-19, Mohan co-operative Industrial Estate, Mathura Road, Delhi -110044 Gujarat : Vodafone Idea Limited (formerly Idea Cellular Limited), Vodafone Idea House, Building A, Corporate Road, Off. -

Reliance Industries and Reliance Communications Sign Telecom Tower Pact

Reliance Industries and Reliance Communications Sign Telecom Tower Pact The Ambani brothers have signed a mega deal to share mobile telecom towers. The agreement would permit Reliance Jio Infocomm, a subsidiary of Mukesh Ambani's, Reliance Industries Limited to rent 45000 telecom towers of Anil's Reliance Communications for a period of 15 years. Reliance Jio Infocomm will pay Rs. 12000 crores to Reliance Communication for this lease, which translates to around Rs. 14000-15000 per tower per month. The deal is a win-win for both the companies as it provides a regular income stream for Reliance Comunications and a quicker and economical network capability to Reliance Jio Infocomm when it rolls out its 4G services. Reliance Jio Infocomm could commence occupying some of the towers in the next six months. As per the market sources, Reliance Jio Infocomm did a hard bargain as the prevailing market rental value for a telecom tower ranges around Rs. 25000 - 30000 per month. Reliance Communication will use a large part of the proceeds to retire debt. It has an outstanding debt of around Rs 39,000 crores. This is the second telecom business deal between the two Ambani brothers. Earlier, in April this year these two companies had signed a Rs. 1200 crore pact to share the optic fibre network for carrying call traffic across the country. According to Gurdeep Singh - chief executive (mobility), Reliance Communications, it is possible that these two firms will sign more deals that are mutually beneficial. Synergies in telecom operations appear to have brought the two family factions together. -

Reliance Communications Limited Dhirubhaiambani Knowledge

Reliance Communications Limited Tel : +91 022 3038 6286 DhirubhaiAmbani Knowledge City Fax: +91 022 3037 6622 Navi Mumbai - 400 710, India www.rcom.co.in September 06, 2019 BSE Limited National Stock Exchange of India Ltd. PhirozeJeejeebhoy Towers Exchange Plaza, C/1, Block G Dalal Street, Fort, Bandra - Kurla Complex, Bandra (East) Mumbai 400 001 Mumbai 400 051 BSE Scrip Code: 532712 NSE Scrip Symbol: RCOM Dear Sir(s), Sub: Notice of 15th Annual General Meeting and Annual Report 2018-19 This is to inform that the 15th Annual General Meeting of the members of Reliance Communications Limited (“Company”) shall be held on Monday, September 30, 2019 at 4:00 p.m. at Rama & Sundri Watumull Auditorium, Vidyasagar, Principal K. M. Kundnani Chowk, 124, Dinshaw Wachha Road, Churchgate, Mumbai – 400020 (“the AGM”). The Annual Report for the financial year 2018-19, including the Notice convening the AGM, as approved by the Interim Resolution Professional of the Company in the meeting dated May 27th, 2019 is attached herewith for your records. The Company will provide to its members the facility to cast their vote(s) on all resolutions set out in the Notice by electronic means ("e-voting") and through ballot at the venue of AGM. The e-voting communication giving instructions for e-voting, being sent along with the Annual Report is also enclosed. Thanking you. Yours faithfully, For Reliance Communications Limited Rakesh Gupta Company Secretary Encl: As above (Reliance Communications Limited is under Corporate Insolvency Resolution Process pursuant to the provisions of the Insolvency and Bankruptcy Code, 2016. Vide order dated June 21, 2019, the Hon’ble NCLT has replaced the interim resolution professional of the Company and with effect from June 28, 2019, its affairs, business and assets are being managed by, and the powers of the board of directors are vested in, the Resolution Professional, Mr. -

Business Strategies in Telecom Sector: a Case of Reliance Jio Infocomm Ltd

RESEARCH PAPER Management Volume : 4 | Issue : 6 | June 2014 | ISSN - 2249-555X Business strategies in Telecom sector: A case of Reliance Jio Infocomm Ltd. KEYWORDS Telecom sector, Decision dynamics, strategic initiatives, Reentry Dr. Vaishali Rahate Prof. Parvin Shaikh Datta Meghe Institute of Management Studies Datta Meghe Institute of Management Studies Nagpur Nagpur India has immense opportunities for telecom operators and is one of the best markets for telecom business. ABSTRACT However it is equally fraught with challenges like Intense competition ,Infrastructure requirement & Rigorous Regulatory framework (License fees, Spectrum allocation & auction etc.) The case traces the series of events which led to the formation of RJio Infocomm and also elaborates about the various strategic initiatives by Mr.Mukesh Ambani,CMD RIL to ensure a successful reentry in the sector. This case presents a brief overview of the decision making dynamics of the CMD, for making a comeback in Telecom sector and also gives an opportunity for further discussion on the future strategies of RIL. Background: India has immense opportunities for telecom operators and Telecom Industry scenario in India is one of the best markets for telecom business. The history of the Indian Telecom sector goes way back to 1851, when the first operational landlines were laid by The Introduction: British Government in Calcutta. With independence, all for- Challenges in Telecom Industry scenario in India eign telecommunication companies were nationalized to The telecom sector in India remains one of the key business form Post, Telephone and Telegraph, a monopoly run by the grounds for telecom giants like Vodafone Group PLC (VOD), Government of India. -

Comparative Study of Public and Private Telecom Wireless Services in India

International Journal of Advanced Scientific Research and Management, Special Issue 5, April 2019 www.ijasrm.com ISSN 2455-6378 Comparative Study of Public And Private Telecom Wireless Services In India Neha Shrivastava S. R. K. University, Bhopal, (M.P.), India Abstract incremented from 209.13 million in March 2016 to India has seen fair share of both public and 272.76 million at the end of March 2017. As private players in telecom market and this research compared to 342.65 million as on 31st March 2016 paper aims in projecting a comparative study of both the internet subscriber base in the country stands at telecom wireless of public and private telecom 422.19 million on 31st March 2017. On the other wireless services providers like BhartiAirtel Limited, hand, the total broadband customer in the country Tata Communications Limited, Idea Cellular has enhanced to 276.52 million on March 2017 from Limited, Reliance Communications Limited, 149.75 million on March 2016. Vodafone India Limited and Bharat Sanchar Nigam The leading telecom service providers in India are as Limited (BSNL). The research presented in this follows:- paper is on the basis of secondary data which 1. BSNL: Indian state-owned telecom company includes data from last five year. headquartered in New Delhi, Bharat Sanchar Nigam Key Words:JIO, BSNL, Airtel, Vodafone, Idea, Limited (BSNL) was incorporated on 15 September Telecom, Wireless Services. 2000. It took over the business from the Central Government Departments of Telecom Services 1. Introduction: (DTS) and Telecom Operations (DTO) of providing The Indian telecom industry holds the of telecom services and network management with position of second largest telecom provider in the effect from 1 October 2000. -

Bridging the Last Mile: an Exploration of Ict Policy Through Bharatnet

BRIDGING THE LAST MILE: AN EXPLORATION OF ICT POLICY THROUGH BHARATNET Deepti Bharthur A Dissertation Submitted to the Graduate College of Bowling Green State University in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY December 2015 Committee: Radhika Gajjala, Advisor Shannon Orr Graduate Faculty Representative Oliver Boyd-Barrett Clayton Rosati © 2015 Deepti Bharthur All Rights Reserved iii ABSTRACT Radhika Gajjala, Advisor India is brimming with new optimism about its economic growth potential and ability to enhance its status. Democratic and demographic dividends play a crucial role in its aspiration. As a key IT player with regard to the services and allied sectors its transformation from telecom as a luxury to appreciable levels of teledensity is a narrative in itself. Its tryst with harnessing communication for development integrates the modernization approaches with all the consequent set of problems and issues. The liberal framework in which telecom reforms were initiated have spread the vision of modern handheld communication devices as harbingers of empowerment, entitlement and entertainment. Connectivity and access in the last mile is no doubt a significant variable and required a major policy articulation and push by the government. It was against this reality shared by many other nations that incremental articulations for broadband access in keeping with the vision of creating an information society were made. Through a historical institutional analysis, this study unravels the pattern leading -

Investor Presentation Q1FY17

Idea Cellular Limited Confidential 1 Presentation Segments Indian Mobile Telecom • Industry & Idea Performance Snapshot The Emerging Mobile Data Opportunity • Spectrum Auctions 2016 Industry Projections Idea Digital Services Indian Tower Industry & Opportunities Confidential 2 Presentation Segments Indian Mobile Telecom • Industry & Idea Performance Snapshot The Emerging Mobile Data Opportunity • Spectrum Auctions 2016 Industry Projections Idea Digital Services Indian Tower Industry & Opportunities Confidential 3 Confidential India Subscriber Penetration Large headroom for new subscribers addition in India India Mobility Active Subs - VLR (Mn) India Subscriber Penetration - VLR % 1000 936 90% 863 900 • India subscribers on VLR penetration remains 791 85% 800 723 low @ 73.7% v/s Global average @ 92.1% 683 80% 700 (Global subs: 7.3 Bn, Active: 6.8 Bn)^ 75% 600 500 70% • Indian Industry adding ~70 Mn active 400 73.7% 68.7% 65% subscribers per annum consistently for the last 300 63.8% 60% 200 3 years 59.0% 55% 100 56.5% 0 50% • Idea subscribers on VLR v/s reported subs Mar '12 Mar '13 Mar '14 Mar '15 Mar '16 Net Adds highest @ 105% against Indian Industry’s 91% 112 (Mn.) 40 68 72 74 (Mar ‘16) India India India India Rural Subs Urban Subs Rural Penetration Urban Penetration 1200 200% 1000 162.8% 148.7% 150% • Over the last 4 years, all Indian subscriber 800 addition has come from rural geographies 555.7 588.8 600 595.9 525.3 532.7 100% • Despite that, India rural subscriber penetration 400 38.3% 50.9% 50% remains low at 50.9% 200 323.3 342.5 371.8 414.2 444.8 0 0% • Rural segment key strength of Idea Total FY12 FY13 FY14 FY15 FY16 Reported 919 868 905 970 1,033 Subs (Mn.) 4 Source: TRAI Reports, ^ GSMA Intelligence, Q1 2016 Confidential Idea gaining amongst the highest incremental subscriber Net Adds share over last 4 years Industry & Idea EoP Subscriber trend Industry & Idea Net Annual Subs Addition trend (in Mn.) (in Mn.) Idea EoP Subscriber Industry EoP Subscriber Idea EoP Subs Market Share Idea Annual Subs Industry Annual Subs Idea Incr. -

A Study on Impact of Disruption and Consolidation in Telecom Industry on Jobs

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 50-55 www.iosrjournals.org A Study on Impact of Disruption And Consolidation In Telecom Industry on Jobs Mr. Madhav Durge, Dr. Aruna Deshpande, PhD Scholar ADMIFMS, Associate Professor ADMIFMS Abstract: Telecommunication companies across the world are sharpening their merger and acquisition focus as 48 per cent executives surveyed indicate that they are actively pursuing a M&A in the next 12 months, says an EY report. Sector convergence and advances in technology and digitalization are altering the telecommunications landscape globally. Some of the major factors that are driving the M&A in the telecom sector include - sector convergence, impact of digital technology on their business model and acquiring talent among others. The sector, which has been witnessing rough weather in terms of profitability due to rising competition and lower margins, has witnessed large scale lay-offs making job scenario uncertain. In the telecom industry, manpower accounts for 4-5% of the costs, but in the last few years there was no reining in of salaries. Now that expenses need to be harnessed, employees will be the first casualty. This instability in the market has affected startups as well as multinational companies which have induced anxiety in majority of employees. This study will be on the disruptions in telecom industries in India and decisions regarding their closures and merger. The study will be according to published data of this sector and the impact on their employee’s job loss. Keywords: Telecom industry, disruption, employee jobs, mergers and acquisitions I. -

Cross-Sector Infrastructure Sharing Toolkit February 2017 Page I

TOOLKIT ON CROSS-SECTOR INFRASTRUCTURE SHARING M A C M I L L A N K ECK A T T O R N E Y S & S OLICITORS Jerome Greene Hall 1120 Avenue of the Americas, 4th Floor 435 West 116th Street New York, NY 10036 USA New York, NY 10027 Tel: +1 212 626-6666 Phone: (212) 854-1830 Fax: +1 646 349-4989 Fax: (212) 854-7946 www.macmillankeck.pro ccsi.columbia.edu February 2017 Table of Contents Foreword ........................................................................................................................................................ iii Acknowledgements ........................................................................................................................................ iii About the authors and contributors ............................................................................................................... v About the World Bank team ........................................................................................................................... vi CROSS-SECTOR INFRASTRUCTURE SHARING ................................................................................ 1 Introduction ....................................................................................................................... 2 Executive summary ............................................................................................................ 5 1 The origins and development of cross-sector infrastructure sharing ................................... 13 1.1 The telegraph and railroads paved the way ...............................................................