Reliance Industries and Reliance Communications Sign Telecom Tower Pact

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation – July 2017

Hathway Cable and Datacom Limited Investor Presentation – July 2017 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 14,000 16.2% 20.0% 13,000 15.0% • The company’s vision is to be a single point access provider, bringing into the home and work place a converged world of information, entertainment and services. 12,000 12.1% 13,682 10.0% 11,000 11,550 5.0% • Hathway is listed on both the BSE and NSE exchanges and has a current market 10,000 0.0% th capitalisation of approximately INR 28 Bn as on 30 June, 2017. FY16 FY17 Broadband Cable Television FY17 Operational - Revenue Break-up • Hathway holds a PAN India ISP license • One of India’s largest Multi System Activation Other and is the first cable television services Operator (MSO), across various regions 6% 2% Cable Subscription provider to offer broadband Internet of the country and transmitting the 34% services same to LCOs or directly to subscribers. • Approximately 4.4 Mn two-way • Extensive network connecting 7.5 Mn Placement broadband homes passed CATV households and 7.2 Mn digital 21% cable subscriber • Total broadband Subscribers – 0.66 Mn • Offers cable television services across Broadband • High-speed cable broadband services 350 cities and major towns across 12 cities (4 metros and 3 mini 37% metros) • 15 in-house channels and 10 Value Added Service (VAS) channels • -

18 December 2020 Reliance and Bp Announce First Gas from Asia's

18 December 2020 Reliance and bp announce first gas from Asia’s deepest project • Commissioned India's first ultra-deepwater gas project • First in trio of projects that is expected to meet ~15% of India’s gas demand and account for ~25% of domestic production Reliance Industries Limited (RIL) and bp today announced the start of production from the R Cluster, ultra-deep-water gas field in block KG D6 off the east coast of India. RIL and bp are developing three deepwater gas projects in block KG D6 – R Cluster, Satellites Cluster and MJ – which together are expected to meet ~15% of India’s gas demand by 2023. These projects will utilise the existing hub infrastructure in KG D6 block. RIL is the operator of KG D6 with a 66.67% participating interest and bp holds a 33.33% participating interest. R Cluster is the first of the three projects to come onstream. The field is located about 60 kilometers from the existing KG D6 Control & Riser Platform (CRP) off the Kakinada coast and comprises a subsea production system tied back to CRP via a subsea pipeline. Located at a water depth of greater than 2000 meters, it is the deepest offshore gas field in Asia. The field is expected to reach plateau gas production of about 12.9 million standard cubic meters per day (mmscmd) in 2021. Mukesh Ambani, chairman and managing director of Reliance Industries Limited added: “We are proud of our partnership with bp that combines our expertise in commissioning gas projects expeditiously, under some of the most challenging geographical and weather conditions. -

Press Release Reliance Industries Limited

Press Release Reliance Industries LImited March 30, 2020 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) CARE AAA; Non-Convertible Debentures 10,386 Stable(Triple A; Assigned Outlook: Stable) Details of instruments/facilities in Annexure-1 Other Ratings Instruments Amount (Rs.Crore) Ratings Non-Convertible Debenture 40,000 CARE AAA; Stable Commercial Paper 34,500 CARE A1+ Detailed Rationale& Key Rating Drivers On March 18, 2020, the company announced that the Hon’ble National Company Law Tribunal (NCLT), Ahmedabad Bench has approved the Scheme, for transfer of certain identified liabilities from Reliance Jio Infocomm Limited (RJIL; rated CARE AAA; Stable/ CARE A1+, CARE AAA (CE); Stable) to Reliance Industries Limited (RIL). Pursuant to the Scheme of Arrangement amongst RJIL and certain classes of its creditors (the “Scheme”) as sanctioned by the Hon’ble National Company Law Tribunal, Ahmedabad Bench, vide its order dated March 13, 2020, RIL has assumed the NCDs issued by RJIL. The rating continues to factor in the immensely experienced and resourceful promoter group, highly integrated nature of operations with presence across the entire energy value chain, diversified revenue streams, massive scale of downstream business with one of the most complex refineries, established leadership position in the petrochemical segment as well as strong financial risk profile characterized by robust capital structure, stable cash flows and healthy liquidity position. The rating also factors in the increasing wireless subscriber base which has led its digital services business to attain a leadership position in the industry as well as the various steps announced by the management to reduce the debt on a consolidated level. -

Digital Payments Take Off in India December 9, 2016

DIGITAL PAYMENTS TAKE OFF IN INDIA DECEMBER 9, 2016 SUMMARY ABOUT ASG On November 8, Prime Minister Narendra Modi announced that at the stroke of Albright Stonebridge Group midnight, currency notes of Rs. 500 and Rs. 1,000 denominations would cease to be (ASG) is a leading global legal tender. business strategy firm. We help clients understand and Following the announcement, digital payments through credit and debit cards as well successfully navigate the as digital wallets have accelerated, and the government is continuing its push to economic, political, and decrease cash payments in the economy. social landscape in international markets. The government has announced incentives including waiving service taxes on ASG’s worldwide team of digital payments, discounts on purchases (petrol, railway tickets, highway tolls), commercial diplomats has and more. served clients in more than 110 countries. Over 12.6 trillion rupees ($185 billion) have been deposited into bank accounts since the government’s announcement on November 8. ALBRIGHTSTONEBRIDGE.COM GDP growth is expected to suffer in the short-run, according to S&P and Moody’s. Shortage of card-reading machines has been a boon for mobile payments companies. The Reserve Bank of India has waived off two-factor authentication requirements to transactions valued under Rs. 2,000. The Finance Ministry has announced plans to make all payments above Rs. 5,000 by government departments to contracts via electronic payments. A high-level committee of chief ministers has been formed to develop a roadmap for increased use of digital payments in the economy. The government is working on an upgraded Unified Payments Interface for banks to increase ease of use and security across the network. -

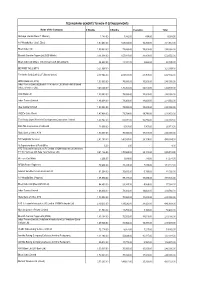

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

Reliance Communications Limited Dhirubhaiambani Knowledge

Reliance Communications Limited Tel : +91 022 3038 6286 DhirubhaiAmbani Knowledge City Fax: +91 022 3037 6622 Navi Mumbai - 400 710, India www.rcom.co.in September 06, 2019 BSE Limited National Stock Exchange of India Ltd. PhirozeJeejeebhoy Towers Exchange Plaza, C/1, Block G Dalal Street, Fort, Bandra - Kurla Complex, Bandra (East) Mumbai 400 001 Mumbai 400 051 BSE Scrip Code: 532712 NSE Scrip Symbol: RCOM Dear Sir(s), Sub: Notice of 15th Annual General Meeting and Annual Report 2018-19 This is to inform that the 15th Annual General Meeting of the members of Reliance Communications Limited (“Company”) shall be held on Monday, September 30, 2019 at 4:00 p.m. at Rama & Sundri Watumull Auditorium, Vidyasagar, Principal K. M. Kundnani Chowk, 124, Dinshaw Wachha Road, Churchgate, Mumbai – 400020 (“the AGM”). The Annual Report for the financial year 2018-19, including the Notice convening the AGM, as approved by the Interim Resolution Professional of the Company in the meeting dated May 27th, 2019 is attached herewith for your records. The Company will provide to its members the facility to cast their vote(s) on all resolutions set out in the Notice by electronic means ("e-voting") and through ballot at the venue of AGM. The e-voting communication giving instructions for e-voting, being sent along with the Annual Report is also enclosed. Thanking you. Yours faithfully, For Reliance Communications Limited Rakesh Gupta Company Secretary Encl: As above (Reliance Communications Limited is under Corporate Insolvency Resolution Process pursuant to the provisions of the Insolvency and Bankruptcy Code, 2016. Vide order dated June 21, 2019, the Hon’ble NCLT has replaced the interim resolution professional of the Company and with effect from June 28, 2019, its affairs, business and assets are being managed by, and the powers of the board of directors are vested in, the Resolution Professional, Mr. -

Hathway Digital Limited

HATHWAY DIGITAL LIMITED Financial Statements 2020-21 2 | HATHWAY DIGITAL LIMITED INDEPENDENT AUDITOR’S REPORT To the Members of Hathway Digital Limited (formerly known as Hathway Digital Private Limited) Report on the Audit of the Standalone Financial Statements Opinion We have audited the accompanying standalone financial statements of Hathway Digital Limited (formerly known as Hathway Digital Private Limited) (the Company), which comprise the Balance Sheet as at March 31, 2021, the Statement of Profit and Loss (including Other Comprehensive Income), the Statement of Changes in Equity and the Cash Flow Statement for the year then ended, and a summary of significant accounting policies and other explanatory information (hereinafter referred to as “the standalone financial statements”). In our opinion and to the best of our information and according to the explanations given to us, the aforesaid standalone financial statements give the information required by the Companies Act, 2013 (“the Act”) in the manner so required and give a true and fair view in conformity with the Indian Accounting Standards prescribed under section 133 of the Act read with the Companies (Indian Accounting Standards) Rules, 2015 as amended, (“Ind AS”) and other accounting principles generally accepted in India, of the state of affairs of the Company as at March 31, 2021, its profit (including other comprehensive income), its changes in equity and its cash flows for the year ended on that date. Basis for Opinion We conducted our audit of standalone financial statements in accordance with the Standards on Auditing (SAs) specified under section 143(10) of the Act. Our responsibilities under those Standards are further described in the Auditor’s Responsibilities for the Audit of the Standalone Financial Statements section of our report. -

Business Strategies in Telecom Sector: a Case of Reliance Jio Infocomm Ltd

RESEARCH PAPER Management Volume : 4 | Issue : 6 | June 2014 | ISSN - 2249-555X Business strategies in Telecom sector: A case of Reliance Jio Infocomm Ltd. KEYWORDS Telecom sector, Decision dynamics, strategic initiatives, Reentry Dr. Vaishali Rahate Prof. Parvin Shaikh Datta Meghe Institute of Management Studies Datta Meghe Institute of Management Studies Nagpur Nagpur India has immense opportunities for telecom operators and is one of the best markets for telecom business. ABSTRACT However it is equally fraught with challenges like Intense competition ,Infrastructure requirement & Rigorous Regulatory framework (License fees, Spectrum allocation & auction etc.) The case traces the series of events which led to the formation of RJio Infocomm and also elaborates about the various strategic initiatives by Mr.Mukesh Ambani,CMD RIL to ensure a successful reentry in the sector. This case presents a brief overview of the decision making dynamics of the CMD, for making a comeback in Telecom sector and also gives an opportunity for further discussion on the future strategies of RIL. Background: India has immense opportunities for telecom operators and Telecom Industry scenario in India is one of the best markets for telecom business. The history of the Indian Telecom sector goes way back to 1851, when the first operational landlines were laid by The Introduction: British Government in Calcutta. With independence, all for- Challenges in Telecom Industry scenario in India eign telecommunication companies were nationalized to The telecom sector in India remains one of the key business form Post, Telephone and Telegraph, a monopoly run by the grounds for telecom giants like Vodafone Group PLC (VOD), Government of India. -

Impact of Reliance JIO on the Indian Telecom Industry

www.ijemr.net ISSN (ONLINE): 2250-0758, ISSN (PRINT): 2394-6962 Volume-7, Issue-3, May-June 2017 International Journal of Engineering and Management Research Page Number: 259-263 Impact of Reliance JIO on the Indian Telecom Industry Noorul Haq Administrative Officer, Kalindi College, University of Delhi, INDIA ABSTRACT MHz band across seven circles. This way JIO has Telecom industry is under severe competition strengthened its passive infrastructure which is the key where number of players are using different marketing and the reason that it can compete with well-established strategies to lure and retain the customers. In the age of telecom players and offer high-speed of data and voice digital technology, this war is producing benefits to the calls. customers. The present study tends to produce the impact Now it has become a challenging time for the of launching of JIO in the Indian Market on the customers and other market players. To study this, references and incumbents. The company had launched its marketable data sources have been analyzed, and the overall impact on services from September 05, 2016, with very attractive the market condition, customer base and profitability of the offers which included free voice calls for lifetime and companies have been taken into consideration in a broader roaming services for its customers along with lowest manner. Besides this, the temporary impact of the JIO in ever data charges at about one-tenth of the prevailing the present conditions as well as the future prospects has rates, reversing a few well set trends of the Indian also been analyzed to understand the impact purposefully. -

Mukesh Ambani Buys 'Goldfinger' Stoke Park Golf Club for £57M

Mukesh Ambani buys ‘Goldfinger’ Stoke Park golf club for £57m Deal marks second UK trophy asset after 2019 purchase of Hamleys toy store Sean Connery’s James Bond plays against Auric Goldfinger at Stoke Park, in the 1964 film © Handout Asia’s richest man has bought an English country club that featured in two James Bond films for £57m, adding a trophy asset to a global portfolio that includes UK toy store Hamleys. A subsidiary of Mukesh Ambani’s Reliance Industries has agreed a deal for Stoke Park, a Georgian mansion on 300 acres in Buckinghamshire, which includes a luxury hotel and golf club. The acquisition adds glamour to Ambani’s conglomerate, which is better known for its Indian energy and telecoms businesses. “You can see Windsor Castle from the golf course: it is a trophy asset,” said Charles McDowell, a buying agent. Stoke Park has been in the hands of the King family, owners of healthcare company International Hospitals Group, since 1988. The family put the estate up for sale in 2018 and was originally aiming for a far higher price, according to two people with knowledge of the sale. The estate, which attracted interest from buyers from China and the Middle East as well as Ambani, had been hoped to fetch “more than £100m”, said one of the people. Before opening as a luxury country club in 1908, Stoke Park was a private residence. Roarie Scarisbrick, partner at buying agency Property Vision, said one potential buyer had considered converting the 49-bedroom hotel back into a home but pulled out because “they didn’t want the reputational fallout” from closing the golf club and sacking staff. -

Reaching for the Stars: the Incredible Rise of Arvind Kejriwal Vidya Subrahmaniam Feb 25, 2015

Reaching for the Stars: The Incredible Rise of Arvind Kejriwal Vidya Subrahmaniam Feb 25, 2015 Arvind Kejriwal, Chief Minister of Delhi. - FILE PHOTO: SHANKER CHAKRAVARTY Five years ago, Arvind Kejriwal was far from being the man of the masses he is today. The Hindu Centre's Senior Fellow Vidya Subrahmaniam, who as a correspondent with The Hindu followed Kejriwal's public life between 2006 and 2014, traces his rise from activism to political stardom. In the immediate afterglow of the Assembly election, everyone seemed to be smiling in Delhi. A friend out on his morning walk found strangers congratulating him on the Aam Aadmi Party’s (AAP’s) superhero-sized victory. He returned the compliment, aware that like him, they were ordinary citizens basking in the reflected glory of Arvind Kejriwal’s brilliantly executed electoral coup. As results poured in, television anchors, across channels, briefly forgot to be officious. The incorrigibly rude Arnab Goswami attempted poetry and watched bemusedly as the Bharatiya Janata Party (BJP) spokesperson and his counterpart in the AAP warred and sparred in shayari (Urdu poetry). Visuals suggested a carnival-like mood on the streets. Delhi did not erupt in such sheer joy even when the BJP’s Narendra Modi broke a 30-year jinx to win a majority in the 2014 Lok Sabha election. The emotional, spontaneous response was reminiscent of 1977, when the all-new Janata Party unseated Indira Gandhi after the Emergency. The AAP’s victory was the sweeter for having come in the most exacting circumstances. Kejriwal had ceased to be Kejriwal since quitting as Delhi’s Chief Minister in February 2014 — after only 49 days in office. -

India's Telecom Giant Vodafone Idea May Run out of Ideas with Liquidity

NUS Credit Research Initiative nuscri.org India’s telecom giant Vodafone Idea may run out of ideas with liquidity issues looming by Vivane Raj ● NUS-CRI 1-year PD illustrates a significant difference in credit health of Airtel and Vodafone Idea, two of the largest telecom providers in India ● A looming cash crunch and a substantial debt burden weigh heavily on Vodafone Idea, while Airtel fares relatively better with lower debt and growing market share ● NUS-CRI Forward PD indicates that both carriers’ short-term credit risks will increase Once the largest player in the Indian telecommunications sector, Vodafone Idea has suffered significantly as rivals Bharti Airtel (Airtel) and Reliance Jio1 have overtaken the top spots in the market. As a result of a price war with the introduction of Reliance Jio’s near-zero contract rates in 2016, Airtel and Vodafone Idea were forced to sustain prolonged losses in order to match these low rates. Currently, Vodafone Idea is facing cash burn from a burden of unpaid government licensing fees. This is supported by the meteoric jump in the NUS-CRI 1-year Probability of Default (PD) (1-year PD) in 2019 and 2020 for the company. While there was a drop in the PD from its highest levels in Feb 2020 as seen from Figure 1, the NUS-CRI Forward 1-year Probability of Default (Forward PD2) indicates a deterioration in credit outlook for Vodafone Idea (see Figure 3). This is contrasted by Airtel, which managed to weather the storm relatively better. In sum, this brief analyses the credit quality of Vodafone Idea compared to Airtel and explore the factors which have caused this divergence in credit health.