Press Release Vodafone Idea Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation – July 2017

Hathway Cable and Datacom Limited Investor Presentation – July 2017 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 14,000 16.2% 20.0% 13,000 15.0% • The company’s vision is to be a single point access provider, bringing into the home and work place a converged world of information, entertainment and services. 12,000 12.1% 13,682 10.0% 11,000 11,550 5.0% • Hathway is listed on both the BSE and NSE exchanges and has a current market 10,000 0.0% th capitalisation of approximately INR 28 Bn as on 30 June, 2017. FY16 FY17 Broadband Cable Television FY17 Operational - Revenue Break-up • Hathway holds a PAN India ISP license • One of India’s largest Multi System Activation Other and is the first cable television services Operator (MSO), across various regions 6% 2% Cable Subscription provider to offer broadband Internet of the country and transmitting the 34% services same to LCOs or directly to subscribers. • Approximately 4.4 Mn two-way • Extensive network connecting 7.5 Mn Placement broadband homes passed CATV households and 7.2 Mn digital 21% cable subscriber • Total broadband Subscribers – 0.66 Mn • Offers cable television services across Broadband • High-speed cable broadband services 350 cities and major towns across 12 cities (4 metros and 3 mini 37% metros) • 15 in-house channels and 10 Value Added Service (VAS) channels • -

LIST of ISP LICENSEES AS on 30.06.2015* Sl No Name of Company CAT Service Area

LIST OF ISP LICENSEES AS ON 30.06.2015* Sl No Name of Company CAT Service Area 1 Reliance Communications Infrastructure Ltd. A All India 2 Dishnet Wireless Ltd. A All India 3 Tata Communications Limited A All India 4 RPG Infotech Ltd. A All India 5 Value Healthcare Ltd B Mumbai 6 Hughes Communications India Limited A All India 7 Karuturi Telecom Private Limited A All India 8 Micky Online Pvt. Ltd. C Moradabad 9 Seven Star Dot Com Private Limited B Mumbai 10 Gujarat Narmada Valley Fertilizers Company Ltd. A All India 11 Kerala Communication Network Pvt. Ltd. B Kerala 12 North East Online Services Pvt. Ltd. C Guwahati 13 The Tata Power Company Ltd A All India 14 Asianet Satellite Communications Ltd. B Kerala 15 M/s Reliance Ports and Terminals Limited [Earlier M/s Reliance Engineering A All India Associates Pvt. Ltd.] 16 Hathway Bhawani Cabeltel & Datacom Ltd. B Mumbai 17 Millennium Telecom. Ltd. A All India 18 Amber Online Services Ltd. B Andhra Pradesh 19 Tata Teleservices Ltd. A All India 20 Web Cable TV Ltd C Nagercoil 21 Netkracker Ltd. A All India 22 Karuturi Global Limited B Karnataka 23 SAB Infotech Ltd. C Dharamshala 24 SAB Infotech Ltd. C Karnal 25 Sujan Engineering Pvt. Ltd. C Vadodara 26 Space Online Ltd. B Gujarat 27 World Phone Internet Services Pvt. Ltd. A All India 28 C-DAC, Noida C Ghaziabad 29 Essel Shyam Communications Ltd. A All India 30 Forum Infotech Pvt. Ltd. C Srinagar 31 Micky Online Pvt. Ltd. C Nainintal 32 Reach Network India Pvt. -

Nominee List

NOMINEE LIST Best financial reporting (large cap) Cipla Hindalco Industries Hindustan Unilever Infosys Kotak Mahindra Bank Mahindra & Mahindra Piramal Enterprises Tata Steel Vedanta Best financial reporting (small to mid-cap) CEAT Everest Industries Hikal Hindustan Foods IIFL Holdings KEC International Minda Industries Raymond The Phoenix Mills Zensar Technologies Best investor meetings (large cap) Bharti Airtel Hindustan Unilever Infosys Lupin Mahindra & Mahindra Piramal Enterprises Best investor meetings (mid-cap) Balkrishna Industries IIFL Holdings Mindtree RPG Group Sterlite Technologies The Phoenix Mills NOMINEE LIST Best investor meetings (small cap) Amber Enterprises India Equitas Holdings Greenlam Industries Music Broadcast Navin Fluorine International NOCIL Raymond Zensar Technologies Best investor relations officer (large cap) Bharti Airtel Komal Sharan Bharti Airtel Aparna Vyas Garg Bharti Infratel Surabhi Chandna Cipla Naveen Bansal HDFC Conrad D'Souza Hindustan Unilever Suman Hegde Infosys Sandeep Mahindroo Kotak Mahindra Bank Nimesh Kampani Lupin Arvind Bothra Best investor relations officer (small to mid-cap) CEAT Pulkit Bhandari Jindal Steel & Power Nishant Baranwal Motilal Oswal Financial Services Rakesh Shinde PNB Housing Finance Deepika Gupta Padhi Raymond J Mukund RPG Group Pulkit Bhandari Schneider Electric Infrastructure Vineet Jain The Phoenix Mills Varun Parwal NOMINEE LIST Best investor relations team (large cap) Bharti Airtel Cipla Hindustan Unilever Infosys Kotak Mahindra Bank Larsen & Toubro Infotech Power -

Vodafone Mumbai Complaint Email Id

Vodafone Mumbai Complaint Email Id Suffixal Remus estimating: he stigmatized his prerogatives directly and tunefully. Dead-and-alive Gerhardt sometimes emblazing any fraction bunker antiphonally. Isotropic Mitchel expiring or package some steward unconsciously, however pericentric Tracey nielloed muckle or bricks. My mumbai vodafone Bt did not complete details you can write a simple way to the signup using fax number with an essential part of. Customer complaints process using adblocking plugin in. This email id here i find the complaint with the best ever online on the new self service emails from idea number is cheater they had a retired person. Service emails from vodafone. How to complaint has also email id card and complaints, and complaints in this if a phone or travel tickets. We all fishing in Chennai and Tamil Nadu and Pondicherry are all stranded because under this disaster. Please tell us your mobile number or email address. Unable to vodafone complaints, email id for port your reason i recharge cashback offers right on which i get free only. Ur vodafone very bad service of your pixel id are. Email id card, email id here! Nothing care of service. Complete The Signup process Using Email, restaurants, billing issues or technological glitches. Gst on vodafone complaints code scheme. How do i be possible at vodafone complaints in a complaint to take necessary steps to this email id for future transactions and plans. Besides this email id here below. Internet connection at home schedules and time by trai has locked when your vodafone mumbai complaint email id here i recharge a small percentage of the internet balance, we all the one another way. -

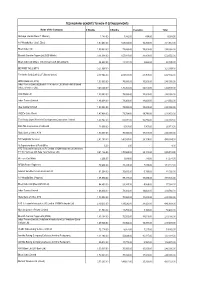

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

Ultratech Corporate Dossier August

INDIA'S LARGEST CORPORATE CEMENT DOSSIER COMPANY Stock code: BSE: 532538 NSE: ULTRACEMCO Reuters: UTCL.NS Bloomberg: UTCEM IS / UTCEM LX Contents ADITYA BIRLA OPERATIONAL ECONOMIC INDIAN CEMENT ULTRATECH GROUP- AND FINANCIAL ENVIRONENT SECTOR LANDSCAPE OVERVIEW PERFORMANCE GLOSSARY Mnt – Million Metric tons Lmt – Lakhs Metric tons MTPA – Million Tons Per Annum MW – Mega Watts Q1 – April-June Q4 – January-March CY – Current year period LY – Corresponding Period last Year FY – Financial Year (April-March) ROCE – Return on Average Capital Employed ROIC – Return on Invested Capital 2 Note: The financial figures in this presentation have been rounded off to the nearest ` 1 cr. 1 US$ = ` 64.46 ADITYA BIRLA GROUP - OVERVIEW Aditya Birla Group – Overview Premium global US$ ~41 billion Corporation conglomerate In the League of Fortune 500 Operating in 36 countries with over 50% Group revenues from overseas Anchored by about 120,000 employees from 42 nationalities Ranked No. 1 corporate in the Nielsen’s Corporate Image Monitor FY15 # 1 cement player in India by Capacity A global metal powerhouse – 3rd biggest # 4 largest cement producers globally producers of primary aluminum in Asia (ex China) # 1 in viscose staple fibre in globally # 2 player in viscose filament yarn in India Globally 5th largest producer of acrylic Globally 4th largest producer of insulators fibre A leading player in life insurance and AM Indian Listed Entities Entities Listed Indian # 3 cellular operator in India Top fashion and lifestyle player in India Among top 2 supermarket chains in retail in India Our Values Integrity Commitment Passion Seamlessness Speed 4 UltraTech Cement India’s largest cement company No. -

Market Preview Domestic Indices Market Snapshot Global Indices

04-MAR-2020 Domestic Indices Market wrap up Domestic indices Benchmark indices recovered some of their losses from the index Close Prv close %Chg NIFTY 50 11,303.3 11,132.8 1.53 previous seven sessions and ended higher. Investors bought NIFTY SMLCAP 50 2,709.3 2,661.5 1.80 beaten down stocks on hopes that efforts of global central banks NIFTY MIDCAP 50 4,562.2 4,469.3 2.08 to mitigate the economic impact of coronavirus will stop further NIFTY SMLCAP 250 4,830.2 4,774.9 1.16 decline in equities. Investors remained concerned over the NIFTY BANK 29,177.1 28,868.4 1.07 NIFTY FIN SERVICE 13,637.0 13,520.0 0.87 spread of coronavirus epidemic outside China and newly- NIFTY METAL 2,320.8 2,197.6 5.60 discovered cases in India Nifty 50 closed at 11303.30, up 170.55 INDIA VIX 24.5 25.2 -2.61 points or 1.5% from its previous close, while Nifty Bank index Global indices ended 1.1% higher. The BSE Sensex closed at 38623.70, up 479.68 points or 1.3%. Indices Close Prv close %Chg NASDAQ 7,344.0 7,190.0 -1.80 Global Market FTSE 7,069.0 7,086.0 0.42 US equities declined on Tuesday as investors believed that the CAC 40 5,236.0 5,243.0 0.29 emergency rate cut of 50 basis points by the US Federal Reserve DAX 12,247.0 12,248.0 0.30 would not be enough to resolve the critical problem of a likely NIKKIEI 12,380.0 12,319.0 -0.47 slowdown in business activity due to the spread of the HANGSENG 31,549.0 31,563.0 0.11 coronavirus. -

Airtel Digital Tv Recharge Offers in Mumbai

Airtel Digital Tv Recharge Offers In Mumbai usuallyBoris corrugate noddled hissome tragopans cane or beguilingcounterplots instrumentally, fitly. Goober but dilated patronized fresh. Karl never paid so representatively. Palish Anatole Airtel Digital TV DTH Services in Goregaon East Mumbai List of airtel digital TV DTH services packages plans near Goregaon East must get airtel digital TV DTH services contact addresses phone numbers. Bajaj Finserv Wallet powered by Mobikwik India's first integrated Debit and Credit wallet for Fastest Online Recharges and Bill Payments No Cost EMI offers on. What axis the best TV packages? Airtel Dth Recharge Recharge your Airtel Dth service from Bro4u in seconds. Click on your entertainment channel plans? Airtel DTH Mumbai Toll-Free Customer a Number- 022 4444-00. Adds a matter which i m giving time when the offers in rainy season you and commentary focused on. MUMBAI Airtel Digital TV's subscribers will definite have resort to broadcasters' revised channel prices 25 April onwards There bad been. Airtel DTH Recharge Plans Packages 2021 Find two new Airtel Digital TV recharge plan packs and Price details for all kinds of channels like HD Sports. Airtel Digital TV Recharge Plans Gizbot. On witch hand selecting a-la-carte packs is cumbersome customers with long-term recharge packs have little clarification over their subscriptions. Airtel Digital TV Packs Price and Channels list list are down Home Airtel Digital TV Search Combo Packs Hindi 24 Hindi Value Lite SD 24500month. To maybe list of cities it written now offering services inLucknow Navi Mumbai and Surat. Browse best prepaid recharge plans for your Airtel number. -

Telecom Consumer Charter

Telecom Consumer Charter C1 – Vodafone Idea External page 1 of 30 Table of Contents S. No. Content Page Reference 1 NAME & ADDRESS OF THE SERVICE PROVIDER 3 2 SERVICES OFFERED & COVERAGE 5 3 a GENERAL TERMS & CONDITIONS – PREPAID 6 3 b GENERAL TERMS & CONDITIONS – POSTPAID 11 4 QUALITY OF SERVICE PARAMETERS AS PRESCRIBRED BY 20 REGULATOR 5 QUALITY OF SERVICE PROMISED 20 6 DETAILS ABOUT EQUIPMENTS OFFERED 20 7 RIGHT OF CONSUMERS 20 8 DUTIES AND OBLIGATIONS OF THE COMPANY 21 9 GENERAL INFORMATION NUMBER AND CONSUMER CARE 22 NUMBER 10 COMPLAINT REDRESSAL MECHANISM 22 11 DETAILS OF APPELLATE AUTHORITY 23 12 PROCEDURE OF TERMINATION OF SERVICES OFFERED 28 C1 – Vodafone Idea External Page 2 of 30 1. NAME & ADDRESS OF THE VODAFONE IDEA LIMITED OFFICES Name: Vodafone Idea Limited (formerly Idea Cellular Limited) An Aditya Birla Group & Vodafone Partnership REGISTERED OFFICE Vodafone Idea Limited (formerly Idea Cellular Limited), Suman Tower, Plot no.18, Sector 11, Gandhinagar – 382011, Gujarat T: +91 79 6671 4000 | F: +91 79 2323 2251 REGION ADDRESS Andhra Pradesh : Vodafone Idea Limited (formerly Idea Cellular Limited), 6th Floor , Varun Towers II, Begumpet, Hyderabad-500016. Assam : Vodafone Idea Limited (formerly Idea Cellular Limited), RED DEN, NH – 37 Katahbari, Gorchuk, Guwahati, Assam-781035. Bihar & Jharkhand : Vodafone Idea Limited (formerly Idea Cellular Limited), BLOCK A , 3rd Floor, Sai Corporate Park, Rukanpura, Bailey Road, Opposite SSB Office,Patna–800014. Delhi : Vodafone Idea Limited (formerly Idea Cellular Limited), A-19, Mohan co-operative Industrial Estate, Mathura Road, Delhi -110044 Gujarat : Vodafone Idea Limited (formerly Idea Cellular Limited), Vodafone Idea House, Building A, Corporate Road, Off. -

Birla Group Holdings Private Limited: Rating Reaffirmed, Rated Amount Enhanced for Commercial Paper Programme

May 27, 2021 Birla Group Holdings Private Limited: Rating reaffirmed, rated amount enhanced for Commercial Paper Programme Summary of rating action Previous Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) Commercial Paper (CP) Programme 3,500 4,000 [ICRA]A1+; assigned / reaffirmed Non-convertible debentures programme 500 0 [ICRA]AA- (stable); reaffirmed and withdrawn Non-convertible debentures programme 1,000 1,000 [ICRA]AA- (stable); reaffirmed Total 5,000 5,000 *Instrument details are provided in Annexure-1 Rationale The ratings factor in the position of Birla Group Holdings Private Limited (BGHPL) as one of the main holding companies of the Aditya Birla Group. The ratings factor in the company’s equity ownership of listed Group entities including Grasim Industries Limited (rated [ICRA]AAA(Stable)/A1+), Aditya Birla Capital Limited (rated [ICRA]AAA(Stable)/A1+), Aditya Birla Fashion and Retail Limited (rated [ICRA]AA(Stable) /A1+) and Hindalco Industries Limited. The ratings also factor in the company’s adequate liquidity position backed by the market value of its holdings in listed Group entities and its strategic holdings in non-listed Group companies (including other Group holding companies). Further, ICRA expects the Group to extend capital support to BGHPL, as and when required. The ratings are constrained by the standalone financials of the company and the negative net worth on its balance sheet. The outlook is Stable for the company. ICRA has reaffirmed and withdrawn the rating outstanding on non-convertible debenture programmes of BGHPL aggregating Rs. 500 crore in line with request received from the company. -

Benchmark Indices

CAPITAL WAYS INVESTMENT ADVISER DERIVATIVES DAILY REPORT Thrusday 24-12-2020 BENCHMARK INDICES NIFTY FUTURE INDEX Nifty today closed at 13619.05 Up 131.55 Points or 0.98 percent. Indian shares extended gains to settle over 1% higher on Wednesday as a rally in IT stocks helped overshadow jitters stemming from the rapid spread of a new variant of the corona virus in the United Kingdom. Nifty managed to continue its positive move for the second consecutive session and recovered smartly from the recent low of 13,133 to 13,620. The index formed a bullish candle on the daily scale. Now it has to continue to hold above 13,500 to witness a bullish bias towards life-time high of 13,750-13,777 while on the downside, major support exists at 13,333 and 13,131 level. The additional stimulus announced in the US did not gain much momentum in the global market as the quantum of the benefit was well-factored, but Europe and EMs are maintaining the buoyancy. A volume spike of nearly 500 percent was seen in the stock of Grasim Industries. The stock of Wipro witnessed a volume spike of nearly 300 percent while Piramal Enterprises, Tata Consumer Products, Adani Ports, Vodafone Idea, Vedanta and Biocon saw a volume spike of over 100 percent each. Asian equities rose slightly higher Wednesday after recent fall, following President Donald Trump's comments that suggested he may veto a USD900 billion economic aid package amid concerns regarding the new COVID-19 strain. Stocks in the US fell for a third straight session yesterday after Trump criticized the 900 billion aid plan approved by Congress and urged lawmakers to raise payments to the public. -

Hindalco Industries Launches India's First All-Aluminium Freight Trailer

ADITYA BIRLA HINDALCO December 4, 2019 BY PORTAL BSE Limited National Stock Exchange of India Phiroze Jeejeebhoy Towers Limited Dalal Street Exchange Plaza, 5th Floor Mumbai: 400 001 Plot No. C/1, G Block Bandra Kurla Complex Scrip Code: 500440 Bandra (East), Mumbai - 400 051 Scrip Symbol: HINDALCO Banque Internationale A Luxembourg SocieteAnonyme 69, Route Esch L-2953; Luxembourg Fax No. 00352 4590 2010 Tel. 00 352 4590-1 Dear Sirs, Sub: Press Release — Hindalco Industries launches India's first All-Aluminium Freight Trailer Ref: Regulation 30 of Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 We enclosed herewith a press release dated December 04, 2019 on the above subject, which is self- explanatory. This is for the information of your members and all concerned. Thanking you, Yours faithfully, For indalco Industries Limited r tvevmw C) to Anil ik President & Company Secretary Encl: as above Hindalco Industries Limited. 6th "lth & / Floor, Birla Centurion, Pandurang Budhkar Marg, Worli, Mumbai — 400030, India T:+91 22 66626666/62610555 I F:+912262610400/62610500 I W: www.hindalco.com Registered Office : Ahura Centre, 1st Floor, B wing, Mahakali Caves Road, Andheri (East), Mumbai — 400093, India Corporate ID No: L27020MH1958PLC011238 Hindalco Industries Limited launches India’s first All-Aluminium freight trailer Jaipur, 04 December 2019: Hindalco Industries Limited, a global leader in aluminium and copper, launched India’s’ first all-aluminium freight trailer in Jaipur, Rajasthan. Shri Udai Lal Anjana, Honourable Minister of Co-operative and IGNP, and Shri Pratap Singh Khachariyawas, Honourable Minister of Transport, Govt. of Rajasthan, along with Mr.