Living Large in Small Cities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State of New Jersey E NVIRONMENTAL J USTICE T ASK F ORCE

State of New Jersey E NVIRONMENTAL J USTICE T ASK F ORCE Acknowledgements The Environmental Justice Task Force would like to acknowledge all of the community members who spoke with and wrote to the State Environmental Justice Task Force and NJDEP’s Environmental Justice Program to provide input in the development of this report and action plan, including the City of Camden, the Honorable Mayor Gwendolyn A. Faison, Mr. Charles Lyons, Ms. Lula Williams, Monsignor Michael Doyle and the Heart of Camden, Ms. Olga Pomar, Ms. Barbara Pfeiffer, Mr. Marc Cadwell, Ms. Phyllis Holmes, Dr. Shirley Peterson, Mr. Roy Jones, Ms. Linda Selby, Ms. Jane Nagocki, Camden Churches Organized for People (CCOP), the Environmental Justice Advisory Council and a host of others that are committed to improving the quality of life and the health of residents and workers in Camden’s Waterfront South neighborhood. Environmental Justice Task Force Agencies and other Governmental Agencies: New Jersey Department of Environmental Protection New Jersey Department of Health and Senior Services New Jersey Department of Education New Jersey Department of Community Affairs New Jersey Department of Transportation New Jersey Division of Law and Public Safety New Jersey Economic Development Authority Economic Recovery Board Camden Redevelopment Authority City of Camden Camden County Health Department Environmental Justice Advisory Council Valorie Caffee, Chairperson Betty Kearns, First Vice Chairperson Ana Baptista Dawn Breeden Theodore Carrington Colandus “Kelly” Francis Avery Grant Michelle Garcia Kim Gaddy Juanita Joyner Donald McCloskey Frederic Martin The Environmental Justice Task Force would especially like to thank all agency staff who provided contributions to this report. -

Leveraging Industrial Heritage in Waterfront Redevelopment

University of Pennsylvania ScholarlyCommons Theses (Historic Preservation) Graduate Program in Historic Preservation 2010 From Dockyard to Esplanade: Leveraging Industrial Heritage in Waterfront Redevelopment Jayne O. Spector University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/hp_theses Part of the Historic Preservation and Conservation Commons Spector, Jayne O., "From Dockyard to Esplanade: Leveraging Industrial Heritage in Waterfront Redevelopment" (2010). Theses (Historic Preservation). 150. https://repository.upenn.edu/hp_theses/150 Suggested Citation: Spector, Jayne O. (2010). "From Dockyard to Esplanade: Leveraging Industrial Heritage in Waterfront Redevelopment." (Masters Thesis). University of Pennsylvania, Philadelphia, PA. This paper is posted at ScholarlyCommons. https://repository.upenn.edu/hp_theses/150 For more information, please contact [email protected]. From Dockyard to Esplanade: Leveraging Industrial Heritage in Waterfront Redevelopment Abstract The outcomes of preserving and incorporating industrial building fabric and related infrastructure, such as railways, docks and cranes, in redeveloped waterfront sites have yet to be fully understood by planners, preservationists, public administrators or developers. Case studies of Pittsburgh, Baltimore, Philadelphia/ Camden, Dublin, Glasgow, examine the industrial history, redevelopment planning and approach to preservation and adaptive reuse in each locale. The effects of contested industrial histories, -

Fall 2003 HISTORIC in THIS Preservation ISSUE: BULLETIN Spring Conference Update

Fall 2003 HISTORIC IN THIS Preservation ISSUE: BULLETIN Spring Conference Update ......9 New Jersey Department of Environmental Protection • Natural & Historic Resources Historic Preservation Office Rehabilitation Tax CreditWorkshop........................10 We Are Back! After a brief hiatus the Department of Environmental Protection, Historic Preservation Office is pleased to provide the Fall Issue of the Historic New Jersey and National Register Of Preservation Bulletin. As many of our constituents are aware the bulletin has Historic Places ........................11 been published quarterly and distributed statewide since July of 1992. For the foreseeable future the Historic Preservation Office has elected to web publish A century of the bulletin three times a year. All future issues of the bulletin will reside at Stewardship ..............................16 www.state.nj.us/dep/hpo or you may call (609) 984-0543 for a copy. Mission The Department of Environmental Protection, Historic Preservation Office is committed to enhancing the Centuries quality of life for the residents of New Jersey through preservation of Historic and appreciation of our collective past. 2 Our mission is to assist the residents Preservation in of New Jersey in identifying, preserving, protecting and sustaining our historic and archaeological resources through implementation of Connecticut Farms the state's historic preservation Presbyterian Church, EW program. HABS N We provide assistance through our annual conference, consultation with JERSEY professionals, training workshops, co- sponsorship of history and historic A CHRONOLOGY OF SOME preservation related activities, the Historic Preservation Bulletin and SIGNIFICANT EVENTS other free publications. As we celebrate the 100th anniversary of New Jersey’s Division of Parks and Forestry, which began with the purchase of a historic James E . -

The Wright Brothers' Drive for the Sky from Sand Dunes to Sonic Booms National Register of Historic Places FIRST WORD Reaffirmation

PRESERVING OUR NATION'S HERITAGE FALL 2003 Wings The Wright Brothers' Drive for the Sky From Sand Dunes to Sonic Booms National Register of Historic Places FIRST WORD Reaffirmation BY DE TEEL PATTERSON TILLER RECENTLY I MET WITH a small delegation from the Coalition of land tangible and accessible, IT REMAINS TO BE SEEN whether the Q/II Families—survivors and families and friends of those killed Coalition will be successful. New York City politics is a no-holds- in the attack on the World Trade Center on September 11, 2001. barred contact sport and much is at stake in the redevelopment of By their count their membership numbers around 3,000— the World Trade Center site. I hold out the hope that it may be roughly the same as lost that dark day more than two years ago. possible to find some compromise that preserves the remnants of The group's journey to Washington, DC, was borne of an inter the towers so that 100 or 1,000 years from now, Americans of est in seeing the remains of the towers designated as a National those generations will be able to walk over the bedrock and forge Historic Landmark. The putative leader of the delegation was a their own connections with this event that so changed our lives at young, purposeful man, Anthony Gardner, whose older brother, the beginning of the 21st century. Harvey Joseph Gardner, died in the collapse of the North Tower, THE MEETING WAS DIFFICULT and, at times, heart wrench ing. Everyone had a story making the tragedy compelling in mm We do what no book, television show, ways the media never could. -

Camden County Smart Growth Transit Analysis

Camden County Smart Growth Transit Analysis prepared for: The Senator Walter Rand Institute, The City of Camden, Camden County Board of Freeholders, and The Greater Camden Partnership prepared by: Voorhees Transportation Policy Institute Edward J. Bloustein School of Planning and Public Policy Rutgers, The State University of New Jersey December 2002 Alan M. Voorhees Transportation Center Transportation Opportunities and Constraints in the Camden Hub This report explores the potential for smart growth opportunities in the Camden Hub (the city of Camden and thirteen surrounding municipalities). Its purpose is to propose a transit-based redevelopment strategy that will promote sustainable development at both the local and regional levels within the Camden Hub. The Camden Hub possesses a number of public transit assets — PATCO Speedline (PATCO), the NJ Transit Atlantic City line, and the NJ Transit bus system — as well as the Southern New Jersey Light Rail Transit System (SNJLRTS) which will soon be opened for service, which could be capitalized on to better serve the development needs of the city of Camden and the surrounding region. These transit assets could provide an essential framework for the targeting of economic development and the revitalization of the city of Camden as a job, residential and recreation center. At the outset, the paper will briefly describe the experience of Jersey City, another city across the river from a major central business district, which has experienced smart growth development focused around its public transit assets. While there are many differences between the situations of Jersey City and Camden, valuable lessons can be learned from Jersey City that could be applicable to Camden’s circumstances. -

A River Runs Through Them: the Story of Philadelphia and Camden's

a river runs through them By Thomas Corcoran, Anthony Perno, III, and Jenny Greenberg Credit: Cooper’s Ferry Partnership have worked to re-invent their downtown waterfronts as regional destinations offering a mix of large-scale family Thomas Corcoran entertainment attractions, public events, festivals, con- is the president of certs, and fireworks displays. the Delaware River Waterfront Today, the master plans for Philadelphia and Cam- Corporation. den include significant low-to-mid-rise housing com- ([email protected]) ponents, integrated with retail and restaurants along with public amenities including parks and trails. Phila- Anthony Perno is delphia and Camden have come to view their down- chief executive officer town waterfronts as assets that must be leveraged to of Cooper’s Ferry serve residents of the city and region, as well as visitors. Partnership. (perno@ coopersferry.com) Today, employment in education and the health services sector has replaced industrial activity as the Jenny Greenberg principal driver in Philadelphia and Camden. The “eds is a fundraising and meds” account for 43 percent of employment in consultant and Camden and 37 percent in Philadelphia. (The Camden writer, who works Higher Education and Healthcare Task Force: A Winning on both sides of the Visitors disembark from the RiverLink Ferry on the Camden waterfront. Waterfront. The RiverLink provides a fun and scenic way to travel Investment for the City of Camden, 2012) In both cities, educational and medical institutions attract knowledge (jgreenberg@ between the two sides of Philadelphia and Camden’s growing drwc.org) regional waterfront destination. workers who are seeking amenities including vibrant waterfronts. -

Oct-Dec 2003

, ' V/ce p/canogtap/lic Eecozb %%¢¢m/a/% %l§z/e flow/m/éi $05.6? g/flt‘a gaérm/ A Society formed for the preservatlon of Recorded Sound OCTOBER/DECEMBER 2003 VOLUME 39, ISSUE 1 EDITOR: W- T. NOITiS, SECRETARY: Mrs S McGuigan, “Waipapa”, PO. Box 19839, Swannanoa, Woolston, Rangiora RD. 1, Christchurch, NEW ZEALAND. NEW ZEALAND. COLUMBIA DISC GRAPHOPHONE “REPUBLIC” MODEL BA. NO 91906 62 FOR YOUR INFORMATION Well here we are, another year is almost behind us, how time goes. The New Zealand dollar continues to rise, today 62 NZ cents to the US dollar — where will it end? We are fairly well stocked with parts, and have many reprints of catalogues for sale. It is only through Larry Schlick’s generosity that we are able to bring you more pictures of Larry Donelys last Swap Meet. We are able to include another small leaflet with this issue, and we hope you will all have a Merry Christmas and a Happy New Year. In the next issue we hope to include illustrations and information about a large auction of phonographs, music boxes and artefacts held in Auckland belonging to the Wagener Museum. Unusual for so much to come on the market at one time. Held over four days with up to 4,427 items offered for sale. We were sad to lose two fine artists during the year —— Slim Dusty and Johnny Cash. Walter Norris, Editor ANNUAL GENERAL MEETING The 38th Annual General Meeting was held on Monday 24th September 2003 in Christchurch. Election of Officers: Patron: Joffre Marshall; President: David Peterson; Vice President: Robert Sleeman; Treasurer: Tony Airs; Secretary: Shirley McGuigan. -

Future Thanks 8 Newsletter

NEW JERSEY Eight Awards for SMART GROWTH 3 Transferring DEVELOPMENT RIGHTS 7 FUTURE THANKS 8 NEWSLETTER Working for Smarter Growth... More Livable Places and Open Spaces Issue #2, 2004 VIEWPOINT Streamlining Development and Protecting the Highlands – A Look at the Legislation here and how will New Jersey grow? Two new New Jersey Future has a long history of strongly advocating pieces of legislation address this question. One for streamlined permitting and other incentives that W bill streamlines development permitting in smart encourage development in the right places, as expressed growth areas, and another aims to protect the Highlands. in the State Plan. We would have preferred a bill that draws from the experience of streamlining in other states. Permit Streamlining After we were advised that this bill would pass quickly as A new bill that streamlines development permitting in a part of the Highlands agreement, we chose to offer our New Jersey passed through the legislature with astonishing support in exchange for amendments that greatly speed and lack of debate as the result of an agreement improved the bill by restricting the locations where reached between legislators and the Governor to advance streamlining would apply. the Highlands bill. The Legislature passed the bill on June 17, and the Governor signed it into law on July 9. As a result, the areas that qualify for expedited permitting are areas identified for growth in the State Plan – Planning The bill is designed to streamline building permits in growth Area 1, Planning Area 2, centers, and other designated areas identified by the State Plan. -

CAMDEN County

NJ DEP - Historic Preservation Office Page 1 of 12 New Jersey and National Registers of Historic Places Last Update: 6/23/2021 CAMDEN County Brooklawn Borough CAMDEN County Brooklawn Traffic Circle (ID#5335) US Highway 130 and NJ Route 47 Bellmawr Borough SHPO Opinion: 8/29/2011 Bellmawr Park Mutual Housing Historic District (ID#4791) Roughly bounded by Carter and Princeton avenues, West Browning Noreg Village Historic District (ID#3018) Road and Big Timber Creek Second, Third, Fourth, Fifth, Sixth and Begren streets, Browning Road, SHPO Opinion: 7/6/2005 Chestnut, Christianna, Delaware, Hannevig and Haakon avenues, Lake Drive, Marne, New Jersey, Paris and Pennsylvania avenues, Pershing Street and Wilson Avenue William Harrison Jr. House (ID#5485) SHPO Opinion: 6/12/1996 515 West Browning Road SHPO Opinion: 11/26/2014 COE: 12/27/2016 Camden City (a.k.a. Hugg-Harrison-Glover House Demolished: American National Bank (ID#886) 3/2/2017) 1227 Broadway NR: 8/22/1990 (NR Reference #: 90001256) Berlin Borough SR: 1/11/1990 (Banks, Insurance, and Legal Buildings in Camden MPDF) Berlin Historic District (ID#2812) Washington, Taunton, and Haines avenues; parts of South White Horse Pike, Jackson Road, and Jefferson Avenue Banks, Insurance, and Legal Buildings in Camden MPDF (ID#888) NR: 4/14/1995 (NR Reference #: 95000408) NR: 8/24/1990 (NR Reference #: 64500396) SR: 3/3/1995 SR: 1/11/1990 (See individual listings in Camden County, Camden City) Berlin Hotel (ID#4077) 41-43 White Horse Pike South Benjamin Franklin Bridge (SI&A #4500010) (ID#3019) SHPO Opinion: 7/18/2000 US Route 676, US Route 30, and PATCO over Delaware River COE: 2/11/2021 DOE: 3/29/1983 (moved from 164 White Horse Pike South) SHPO Opinion: 4/18/2017 (Prior SHPO Opinion: 3/25/1985) Camden and Atlantic Railroad Historic District (ID#3862) Railroad right-of-way from Pennsauken and Camden to Atlantic City Volney G. -

2001 2Nd Quarter

Northeast U.S.—2Q 2001 Volume 64 Regional Review The National Real Estate Index extends its deepest sympathies and condolences to the victims of the World Trade Center, his QUARTERLY focuses on ten markets in the Pentagon and Pennsylvania tragedies and their families and Northeast along the Atlantic seaboard. Raleigh- friends. We would also like to extend our gratitude to the rescue Durham and Charlotte led the region in population T workers, medical personnel and other professionals and citizens growth with respective gains of 38.9% and 29% between who have come to the aid of those affected by the situation. 1990 and 2000. Job growth in nine of these markets sur- passed the 0.3% national average between the second quar- ters of 2000 and 2001. Washington, DC had the highest job gain (3.1%) and the lowest unemployment rate (2.8%). Central New Jersey’s proximity to New York contributed to Philadelphia, on the other hand, saw virtually no jobs added a 6.8% annual increase in rents for CBD office space. during the year. Baltimore and Northern New Jersey had the Boston also saw a significant rental gain at 5.7%. Boston highest unemployment rates at 4.8% each. topped the list for suburban office value gains (9.1%) fol- lowed by Northern New Jersey (6%). Conversely, Downtown Manhattan reaped the highest appreciation in CBD Philadelphia saw its suburban office space depreciate 4.4%. office values with a 13% uptake between June 2000 and June As for the industrial sector, no northeastern market regis- 2001. Sadly, this market was dealt a traumatic blow, in terms tered a price gain at or above the annual 4% benchmark. -

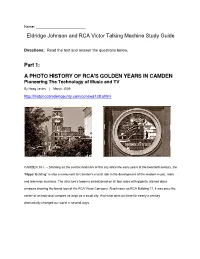

Eldridge Johnson and RCA Victor Talking Machine Study Guide Part 1

Name: _________________________ Eldridge Johnson and RCA Victor Talking Machine Study Guide Directions: Read the text and answer the questions below. Part 1: A PHOTO HISTORY OF RCA'S GOLDEN YEARS IN CAMDEN Pioneering The Technology of Music and TV By Hoag Levins | March, 2009 http://historiccamdencounty.com/ccnews138.shtml CAMDEN, N.J. -- Standing as the central landmark of this city since the early years of the twentieth century, the "Nipper Building" is also a monument to Camden's crucial role in the development of the modern music, radio and television business. The structure's tower is emblazoned on all four sides with gigantic stained glass windows showing the brand icon of the RCA Victor Company. Also known as RCA Building 17, it was once the center of an industrial complex as large as a small city. And what went on there for nearly a century dramatically changed our world in several ways. In this ramshackle workshop at 108 N. Front Street, Camden, in 1896, 29-year-old machinist Eldridge Johnson invented the spring mechanism that made recorded music a commercially viable possibility. By 1900 he was manufacturing recorded music on the flat disks we would come to know as "records." And by the next year, after prevailing in a series of grueling legal battles over the product, he started the Victor Talking Machine Company here. Its first hand-cranked music machine, bearing the "His Master's Voice" Nipper logo, is pictured above, right. With its business exploding, Victor Talking Machine quickly moved into this factory building (above, left) on Front Street just off Cooper. -

Archaeological Site Looting and the Loss of Public Heritage – a Tyranny of Small Decisions B U L L E T I N

Summer 2004 In This Bulletin: NJ & National Register of Historic Places National Register Photographs New Jersey Historic Preservation Awards… New Faces in the Historic Preservation Office DEP Appoints New Assistant Commissioner Historic Preservation Commission Training Opportunities Archaeological Site Looting and the Loss of Public Heritage – A Tyranny of Small Decisions B u l l e t i n New Jersey Department of Environmental Protection Natural & Historic Resources The New Jersey & Historic Preservation Office National Register of HI S T O R I C PL A C E S The National Register of Historic Places is the official list of the nation’s historic resources worthy of preservation. The first historical registry was established by Congress in 1935 and designated properties of national James E . McGreevey importance as National Historic Landmarks. In 1966, the National Historic Preservation Act (as amended) established a National Register of Historic Governor Places to include districts, sites, structures, buildings and objects of local, Bradley M. Campbell state and national significance. Commissioner The New Jersey Register of Historic Places is the official list of New Jersey’s historic resources of local, state and national interest. Created Mission by the New Jersey Register of Historic Places Act of 1970 The Department of Environmental Protection, (N.J.S.A. 13:1B-15.128 et seq.), the New Jersey Register is closely Historic Preservation Office is committed to modeled after the National Register program. Both Registers have the enhancing the quality of life for the residents of New Jersey through preservation and appreciation same criteria for eligibility, nomination forms and review process.