Pakistan Iep Data Source Catalog Integrated Energy Planning

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View of These Submission He Has Prayed for Allowing the Listed Application

IN THE HIGH COURT OF SINDH AT KARACHI Suit No. 1404 of 2019 Plaintiff: Abdul Rashid Shaikh Through Dr. Shah Nawaz, Advocate. Defendants: M/s. National Refinery Ltd. & another Through Mr. Javed Ashgar Awan, Advocate. For hearing of CMA No. 11475/2019. Dates of hearing: 29.10.2019, 12.11.2019, 17.12.2019 & 20.12.2019. Date of order: 20.12.2019 O R D E R Muhammad Junaid Ghaffar, J. Through this Suit for Declaration, Injunction and Damages, the Plaintiff seeks reinstatement in service with Defendant No.1 by impugning Letter dated 11.06.2019, whereby, the Plaintiff has been retired pre-maturely. 2. Learned Counsel for the Plaintiff submits that the Plaintiff was initially employed vide Appointment Letter dated 01.09.1992 with State Petroleum Refining & Petrochemical Corporation (Pvt.) Ltd. (“PERAC”) and was thereafter transferred / absorbed in Defendant No.1 vide Letter dated 12.11.1994; that the Plaintiff has worked for 29 years of service, whereas, time and again his services have been appreciated and there is no allegation of any misconduct; that four years of his service were left when he was retired prematurely through impugned letter; that in the terms of appointment as well as the governing rules of service relationship, there is no provision for an early retirement; that neither any notice was ever issued to the Plaintiff nor an opportunity was provided; that the conduct of the Defendants is in violation of the principles of natural justice 2 including violation of Article 10-A of the Constitution; that the Defendants ought to have exercised discretion within certain parameters, and procedure should have been followed like issuance of a Show Cause Notice and conducting some inquiry; that it is a matter of exploitation employed by the Defendants to the very detriment of the Plaintiff and in view of these submission he has prayed for allowing the listed application. -

List of Acronyms

List of Acronyms A ABL Allied Bank Limited AC Air Conditioner ACP Annual Credit Plan ACAC Agriculture Credit Advisory Committee ACD Agriculture Credit Department ADs Authorized Dealers ADB Asian Development Bank ADF Asian Development Fund ADP Annual Development Plan AFS Available For Sale AIDS Acquired Immune Deficiency Syndrome APCMA All Pakistan Cement Manufacturers Association APL Attock Petroleum Limited ARPU Average Revenue per User ASEAN Association of South East Asian Nations B BAFL Bank AlFalah Limited BHU Basic Health Unit BISP Benazir Income Support Programme BMR Balancing Modernization and Replacing BOC Bank of China BOP Balance of Payment BP British Petroleum BPO Business Process Outsourcing BPRD Banking Policy Regulation Department BPS Basis Points BSC Bahbood Saving certificates, Benazir Smart Cards BSD Banking Surveillance Department BSE Bombay Stock Exchange Bt Bacillus thuringiensis C CAD Current Account Deficit CAB Current Account Balance CAGR Compound Annual Growth Rate CAR Capital Adequacy Ratio CBR Central Board of Revenue, Crude Birth Rate CBD Conventions on Biodiversity CBU Completely Built Unit CCC Climate Change Convention CDA Capital Development Authority CDR Crude Death Rate CDC Central Depository Company CDNS Central Directorate of National Saving CDs Certificate of Deposits CDS Credit Default Swap CDWA Clean drinking Water for All CDWI Clean Drinking Water Initiative CFC Common Facilities Centers CFS Continuous Funding System CFSMK-II Continuous Funding System Mark II CIA Central intelligence Agency CIB Credit -

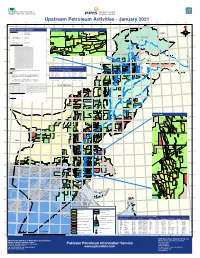

Upstream Petroleum Activities

Directorate General of Pakistan Petroleum Petroleum Concessions Information Service Upstream Petroleum Activities - January 2021 61.0.0 62.0.0 63.0.0 64.0.0 65.0.0 66.0.0 67.0.0 68.0.0 69.0.0 70.0.0 71.0.0 72.0.0 73.0.0 74.0.0 75.0.0 76.0.0 77.0.0 78.0.0 79.0.0 37.0.0 Inset North Average Production December ,2020 Oil 76,774.10 bbls /day BHAL SYEDAN 3371-10 Ʊ Ʋ Gas 3,582.33 mmcf/day OGDCL (KOHAT) Ʊ Ʋ LPG 2,263.61 m.tons/day OGDCL TOLANJ WEST SADKAL 36.0.0 MOL TOLANJ OGDCL Seismic Crews Active 07 MOL SOGHRI 3372-14 BDGBDU76GUDTU6I 2-D Seismic Acquisition Onshore 219.10 L.Kms. D&PL (FATEH JANG) 36.0.0 DHOK HUSSAIN 3-D Seismic Acquisition Onshore 91.75 Sq.Kms. OGDCL OGDCL 3371-17 OGDCL 4 (BARATAI) Gilgit Rigs Active 16 OGDCL Ʊ Ʋ 3370-3 DAKHNI Ʊ G I LG I T-BALTI STAN Area under Exploration Licences 206,736.00 Sq. Kms. (TAL) OGDCL Area under Mining/D&P Leases 14,010.00 Sq. Kms. MOL Area under Applications 114,396.00 Sq. Kms. MAMIKHEL 3371-5 RATANA (GURGALOT) OGDCL UCHRI OPI MAMIKHEL SOUTH DHURNAL BIDS OPENED FOR GRANT OF EL PARIWALI MOL POL OPI 3372-18 POL MAKORI&MAKORI DEEP 13 Bid round for following 20 blocks were held on January 15, 2021. MEYAL (IKHLAS) MOL MAKORI EAST 35.0.0 POL S.NO Block Name Zone POL MELA 3371-15 KHAUR 3372-23 OGDCL 1 Block No.3068-6 (Killa Saifullah) I (F) (DHOK SULTAN) POL (HISAL) 35.0.0 2 Block No.2762-2 (Desert) I (F) PPL PPL NASHPA DHULIAN 3 Block No.3067-7 (Sharan) I (F) OGDCL POL 4 Block No.3272-16 (Lilla) I CHANDA 5 Block No.3372-25 (Abbottabad) I OGDCL 6 Block No.3471-1 (Nowshera) I 3271-1 TOOT Ʊ Ʋ KALABAGH 10 (KARAK) OGDCL FC`7@SQ6FCUVIFCX6 7 Block No.3372-26 (Hazro) I MPCL MPCL HALINI 8 Block No.3273-5 (Jhelum) I MPCL 9 Block No.3372-27 (North Dhurnal) I Muzaffarabad 10 Block No.2668-23 (Khewari East) III 11 Block No. -

Preparatory Survey Report on the Project for Construction and Rehabilitation of National Highway N-5 in Karachi City in the Islamic Republic of Pakistan

The Islamic Republic of Pakistan Karachi Metropolitan Corporation PREPARATORY SURVEY REPORT ON THE PROJECT FOR CONSTRUCTION AND REHABILITATION OF NATIONAL HIGHWAY N-5 IN KARACHI CITY IN THE ISLAMIC REPUBLIC OF PAKISTAN JANUARY 2017 JAPAN INTERNATIONAL COOPERATION AGENCY INGÉROSEC CORPORATION EIGHT-JAPAN ENGINEERING CONSULTANTS INC. EI JR 17-0 PREFACE Japan International Cooperation Agency (JICA) decided to conduct the preparatory survey and entrust the survey to the consortium of INGÉROSEC Corporation and Eight-Japan Engineering Consultants Inc. The survey team held a series of discussions with the officials concerned of the Government of the Islamic Republic of Pakistan, and conducted field investigations. As a result of further studies in Japan and the explanation of survey result in Pakistan, the present report was finalized. I hope that this report will contribute to the promotion of the project and to the enhancement of friendly relations between our two countries. Finally, I wish to express my sincere appreciation to the officials concerned of the Government of the Democratic Republic of Timor-Leste for their close cooperation extended to the survey team. January, 2017 Akira Nakamura Director General, Infrastructure and Peacebuilding Department Japan International Cooperation Agency SUMMARY SUMMARY (1) Outline of the Country The Islamic Republic of Pakistan (hereinafter referred to as Pakistan) is a large country in the South Asia having land of 796 thousand km2 that is almost double of Japan and 177 million populations that is 6th in the world. In 2050, the population in Pakistan is expected to exceed Brazil and Indonesia and to be 335 million which is 4th in the world. -

Habibmetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION)

A N N U A L R E P O R T 2017 1 HabibMetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION) 2 A N N U A L R E P O R T 2017 JOURNEY OF CONTINUOUS SUCCESS A long term partnership Over the years, First Habib Modaraba (FHM) has become the sound, strong and leading Modaraba within the Modaraba sector. Our stable financial performance and market positions of our businesses have placed us well to deliver sustainable growth and continuous return to our investors since inception. During successful business operation of more than 3 decades, FHM had undergone with various up and down and successfully countered with several economic & business challenges. Ever- changing requirement of business, product innovation and development were effectively managed and delivered at entire satisfaction of all stakeholders with steady growth on sound footing. Consistency in perfect sharing of profits among the certificate holders along with increase in certificate holders' equity has made FHM a sound and well performing Modaraba within the sector. Our long term success is built on a firm foundation of commitment. FHM's financial strength, risk management protocols, governance framework and performance aspirations are directly attributable to a discipline that regularly brings prosperity to our partners and gives strength to our business model which is based on true partnership. Conquering with the challenges of our operating landscape, we have successfully journeyed steadily and progressively, delivering consistent results. With the blessing of Allah (SWT), we are today the leading Modaraba within the Modaraba sector of Pakistan, demonstrating our strength, financial soundness and commitment in every aspect of our business. -

OICCI CSR Report 2018-2019

COMBINING THE POWER OF SOCIAL RESPONSIBILITY Corporate Social Responsibility Report 2018-19 03 Foreword CONTENTS 05 OICCI Members’ CSR Impact 06 CSR Footprint – Members’ Participation In Focus Areas 07 CSR Footprint – Geographic Spread of CSR Activities 90 Snapshot of Participants’ CSR Activities 96 Social Sector Partners DISCLAIMER The report has been prepared by the Overseas Investors Chamber of Commerce and Industry (OICCI) based on data/information provided by participating companies. The OICCI is not liable for incorrect representation, if any, relating to a company or its activities. 02 | OICCI FOREWORD The landscape of CSR initiatives and activities is actively supported health and nutrition related initiatives We are pleased to present improving rapidly as the corporate sector in Pakistan has through donations to reputable hospitals, medical care been widely adopting the CSR and Sustainability camps and health awareness campaigns. Infrastructure OICCI members practices and making them permanent feature of the Development was also one of the growing areas of consolidated 2018-19 businesses. The social areas such as education, human interest for 65% of the members who assisted communi- capital development, healthcare, nutrition, environment ties in the vicinity of their respective major operating Corporate Social and infrastructure development are the main focus of the facilities. businesses to reach out to the underprivileged sections of Responsibility (CSR) the population. The readers will be pleased to note that 79% of our member companies also promoted the “OICCI Women” Report, highlighting the We, at OICCI, are privileged to have about 200 leading initiative towards increasing level of Women Empower- foreign investors among our membership who besides ment/Gender Equality. -

2005 Information

• Company Information 2 • Committees of BOD & Management 4 • Notice of Meeting 6 • Operating Highlights 8 • Directors' Report 12 Agriculture and Fertilizer Environment 14 Company Performance 16 Balancing, Modernization & Replacement 20 Profitability 22 Equity Participation & Shareholding 24 Good Governance & Listing Regulations 26 Safety, Health & Environment 36 Future Outlook & WTO Challenges 38 • Standard of Conduct for Directors / Employees 39 • Core Values 40 • Financial Statements of FFC 41 Statement of Compliance 42 Review Report to the Members 44 Auditors’ Report to the Members 45 Balance Sheet 46 Profit and Loss Account 48 Cash Flow Statement 49 Statement of Changes in Equity 50 Notes to the Financial Statements 51 • Consolidated Financial Statements 77 Auditors’ Report to the Members 79 Consolidated Balance Sheet 80 Consolidated Profit and Loss Account 82 Consolidated Cash Flow Statement 83 Consolidated Statement of Changes in Equity 84 Notes to the Consolidated Financial Statements 85 • Pattern of Shareholding 116 • Form of Proxy 119 Our achievements over the years in every business sphere have developed FFC into “The House of Excellence” 1 Company 2005 Information BOARD OF DIRECTORS REGISTERED OFFICE Lt Gen Syed Arif Hasan, HI(M) (Retired) 93-Harley Street, Rawalpindi Cantt. Chairman Website: www.ffc.com.pk Tel No. 92-51-9272307-14 Lt Gen Mahmud Ahmed, HI(M) (Retired) Fax No. 92-51-9272316 Chief Executive and Managing Director E-mail: [email protected] Dr Haldor Topsoe PLANTSITES Mr Qaiser Javed Goth Machhi Brig Arshad Shah, SI(M) (Retired) Sadikabad Mr Tariq Iqbal Khan (Distt: Rahim Yar Khan) Brig Aftab Ahmed, SI(M) (Retired) Tel No. 92-68-5786420-9 Brig Ghazanfar Ali, SI(M) (Retired) Fax No. -

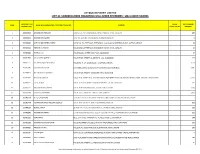

List of Unclaimed Shares and Dividend

ATTOCK REFINERY LIMITED LIST OF SHAREHOLDERS REGARDING UNCLAIMED DIVIDENDS / UNCLAIMED SHARES FOLIO NO / CDC SHARE NET DIVIDEND S/NO. NAME OF SHAREHOLDER / CERTIFICATE HOLDER ADDRESS ACCOUNT NO. CERTIFICATES AMOUNT 1 208020582 MUHAMMAD HAROON DASKBZ COLLEGE, KHAYABAN-E-RAHAT, PHASE-VI, D.H.A., KARACHI 450 2 208020632 MUHAMMAD SALEEM SHOP NO.22, RUBY CENTRE,BOULTON MARKETKARACHI 8 3 307000046 IGI FINEX SECURITIES LIMITED SUIT # 701-713, 7TH FLOOR, THE FORUM, G-20, BLOCK 9, KHAYABAN-E-JAMI, CLIFTON, KARACHI 15 4 307013023 REHMAT ALI HASNIE HOUSE # 96/2, STREET # 19, KHAYABAN-E-RAHAT, DHA-6, KARACHI. 15 5 307020846 FARRUKH ALI HOUSE # 246-A, STREET # 39, F-11/3, ISLAMABAD 67 6 307022966 SALAHUDDIN QURESHI HOUSE # 785, STREET # 11, SECTOR G-11/1, ISLAMABAD. 174 7 307025555 ALI IMRAN IQBAL MOTIWALA HOUSE NO. H-1, F-48-49, BLOCK - 4, CLIFTON, KARACHI. 2,550 8 307026496 MUHAMMAD QASIM C/O HABIB AUTOS, ADAM KHAN, PANHWAR ROAD, JACOBABAD. 2,085 9 307028922 NAEEM AHMED SIDDIQUI HOUSE # 429, STREET # 4, SECTOR # G-9/3, ISLAMABAD. 7 10 307032411 KHALID MEHMOOD HOUSE # 10 , STREET # 13 , SHAHEEN TOWN, POST OFFICE FIZAI, C/O MADINA GERNEL STORE, CHAKLALA, RAWALPINDI. 6,950 11 307034797 FAZAL AHMED HOUSE # A-121,BLOCK # 15,RAILWAY COLONY , F.B AREA, KARACHI 225 12 307037535 NASEEM AKHTAR AWAN HOUSE # 183/3 MUNIR ROAD , LAHORE CANTT LAHORE . 1,390 13 307039564 TEHSEEN UR REHMAN HOUSE # S-5, JAMI STAFE LANE # 2, DHA, KARACHI. 3,475 14 307041594 ATTIQ-UR-REHMAN C/O HAFIZ SHIFATULLAH,BADAR GENERALSTORE,SHAMA COLONY,BEGUM KOT,LAHORE 7 15 307042774 MUHAMMAD NASIR HUSSAIN SIDDIQUI HOUSE-A-659,BLOCK-H, NORTH NAZIMABAD, KARACHI. -

Pakistan Institute of Corporate Governance – PICG List of Directors Training Program NO

Pakistan Institute of Corporate Governance – PICG List of Directors Training Program NO. NAMES DESIGNATION COMPANY YEAR 1 Mr. Bazl Khan Chairman IGI Funds Limited 2007 2 Mr. Ali Azam Shirazee CEO IGI Funds Limited 2007 3 Mr. Hasanali Abdullah Joint MD EFU General Insurance Ltd 2007 4 Mr. Abdul Aziz Yousuf Director Gul Ahmed Textile Mills Ltd 2007 5 Mr. Iqbal AliMohammed Chairman / Director MYBANK Limited 2007 6 Mr. Mohammad Hanif Jakhura CEO Central Depository Company of Pakistan 2007 7 Mr. Kamran Ahmed Qazi CFO & Co. Secretary Central Depository Company of Pakistan 2007 8 Mr. Riyaz T. Chinoy Chief Operating Officer International Industries Ltd 2007 9 Mr. Tameez-ul-Haque Company Secretary Adamjee Insurance Company Limited 2007 10 Ms. Neelofar Hameed Company Secretary International Industries Limited 2007 11 Mr. Fuzail Abbas CFO & SEVP Habib Metropolitan Bank Ltd 2007 12 Mr. Ekhlaq Ahmed EVP / Secretary National Bank of Pakistan 2007 13 Mr. Zafar Hussain Memon Director M. Yousuf Adil Saleem & CO. 2007 14 Mr. Aleem Ahmed Dani Group Director Finance Dawood Hercules Chemicals Ltd 2007 15 Mr. Abdul Samad Dawood CEO Dawood Corporation (Pvt) Ltd. 2007 16 Mr. Shahid Mahmood Dir Finance & Company Secretary KSB Pumps Co. Ltd 2007 17 Syed Muhannad Ali Zamin SVP National Bank of Pakistan 2007 18 Mr. Moiz Ahmad Executive Director ICAP 2007 19 Ms. Sadia Khan Executive Director Delta Shipping (Pvt) Ltd 2007 20 Mr. Kaiser Naseem Manager PCG IFC 2007 M. Aslam & Company Chartered 21 Mr. Mohammed Aslam Principal 2007 Accountants Pakistan Institute of Corporate Governance – PICG List of Directors Training Program NO. NAMES DESIGNATION COMPANY YEAR 22 Mr. -

Dai Ly Quotati

D A I LY Q U O TAT I O N S No. 161/2021 Wednesday, Sep 1, 2021 LISTED COMPANIES - 531 MARKET REPORT UPTO 04:15 LISTED CAPITAL 1,458,220.972 M TRADING VOLUME TRADING VALUE MARKET CAPITALIZATION COS. TOTAL Pre. 378,832,096 Pre. 14,023,728,426 Pre: Rs.8,290,427,669,434 P LUS. 307 Cur. 536,640,545 Cur. 14,368,773,492 Cur: Rs. 8,307,132,366,059 MINUS. 207 N.Change: 16,704,696,625 E QUA L. 20 TOTA L. 534 TRADING VOLUME (B&B) TRADING VALUE (B&B) REMARKS Pre. 0 Pre. 0 For further details, please see debt instrument segments hereunder Cur. 0 Cur. 0 PSX INDICES Index Code Previous Current High Low Change %age Change K S E-100 47,419.74 47,413.46 47,629.20 47,352.54 -6.28 -0.01 K S E-A LL-Shares 32,394.47 32,460.77 32,590.08 32,394.47 66.30 0.20 K S E-30 19,027.87 19,029.27 19,129.16 19,011.66 1.40 0.01 K MI-30 77,641.73 77,663.99 78,115.66 77,574.99 22.26 0.03 B K Ti 12,936.20 12,886.42 13,009.69 12,866.71 -49.78 -0.38 OGTi 12,244.10 12,239.90 12,345.54 12,223.88 -4.20 -0.03 P S X-K MI-All-Shares 23,461.71 23,525.33 23,613.54 23,461.71 63.62 0.27 UP P9 13,056.93 13,065.87 13,129.56 13,048.09 8.94 0.07 NITP GI 9,744.65 9,746.77 9,793.90 9,738.20 2.12 0.02 NB P P GI 11,757.52 11,770.22 11,830.08 11,757.52 12.70 0.11 MZNP I 10,854.55 10,861.58 10,918.47 10,850.82 7.03 0.06 APPLIED FOR LISTING PROSPECTUS/OFFER FOR SALE APPROVED BY THE EXCHANGE COMPANY Sr. -

National Refinery Limited 2

The Pakistan Credit Rating Agency Limited Rating Report Report Contents 1. Rating Analysis National Refinery Limited 2. Financial Information 3. Rating Scale 4. Regulatory and Supplementary Disclosure Rating History Dissemination Date Long Term Rating Short Term Rating Outlook Action Rating Watch 28-May-2021 AA+ A1+ Negative Maintain - 30-May-2020 AA+ A1+ Negative Maintain - 29-Nov-2019 AA+ A1+ Stable Maintain - 31-May-2019 AA+ A1+ Stable Maintain - Rating Rationale and Key Rating Drivers The ratings reflect National Refinery Limited's (NRL) association with the integrated oil group – Attock Group (AG). The strength of the Company is its base oil business wherein NRL possesses a notable share in meeting the economy's demand for lubricants. NRL's core business remains exposed to the vicissitudes in international crude and petroleum products’ (POL) prices, which in turn, steer the gross refining margins (GRMs) of the Company. The Country’s refinery sector is going through some significant challenges for an extended period, majorly pertaining to up-gradation of the refining complexes. The global oil market was further struck by widespread uncertainty due to outbreak of COVID-19 pandemic. This had severely weakened the International Oil dynamics, creating a manifold impact on the domestic economy as well as the local refinery industry. In order to cater the issues, Working Group constituted by the Government, comprising of the Government officials and representative of refineries, had finalised a draft Refining Policy which envisages certain fiscal and tariff concessions to the refining sector which are likely to improve financial condition of the refineries enabling up-gradation of plants. -

Three Decades of Coastal Changes in Sindh, Pakistan (1989–2018): a Geospatial Assessment

remote sensing Article Three Decades of Coastal Changes in Sindh, Pakistan (1989–2018): A Geospatial Assessment Shamsa Kanwal 1,* , Xiaoli Ding 1 , Muhammad Sajjad 2,3 and Sawaid Abbas 1 1 Department of Land Surveying and Geo-Informatics, The Hong Kong Polytechnic University, Hong Kong, China; [email protected] (X.D.); [email protected] (S.A.) 2 Guy Carpenter Asia-Pacific Climate Impact Centre, School of Energy and Environment, City University of Hong Kong, Hong Kong, China; [email protected] 3 Department of Civil and Environmental Engineering, Princeton University, Princeton, NJ 08542, USA * Correspondence: [email protected] Received: 3 November 2019; Accepted: 13 December 2019; Published: 18 December 2019 Abstract: Coastal erosion endangers millions living near-shore and puts coastal infrastructure at risk, particularly in low-lying deltaic coasts of developing nations. This study focuses on morphological changes along the ~320-km-long Sindh coastline of Pakistan over past three decades. In this study, the Landsat images from 1989 to 2018 at an interval of 10 years are used to analyze the state of coastline erosion. For this purpose, well-known statistical approaches such as end point rate (EPR), least median of squares (LMS), and linear regression rate (LRR) are used to calculate the rates of coastline change. We analyze the erosion trend along with the underlying controlling variables of coastal change. Results show that most areas along the coastline have experienced noteworthy erosion during the study period. It is found that Karachi coastline experienced 2.43 0.45 m/yr of erosion and ± 8.34 0.45 m/yr of accretion, while erosion on the western and eastern sides of Indus River reached ± 12.5 0.55 and 19.96 0.65 m/yr on average, respectively.