Burger King Corporate Complaint Number

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Restaurant Portfolio Investment Opportunity

RESTAURANT PORTFOLIO INVESTMENT OPPORTUNITY Burger King | Pontiac, MI Hardees | Columbia, SC Long John Silver’s | Cincinnati, OH Raising Cane’s | Blue Springs, MO Net Lease Restaurant Portfolio – Four Triple Net Lease Properties Available on an Individual or Portfolio Basis DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING PORTFOLIO OVERVIEW -

Dunkin' Brands 2019 Annual Report

Dear Valued Shareholders, For more than 70 years, Dunkin’ has been at the heart of the communities we serve, keeping America running. We take a lot of pride in being part of our guests’ everyday routine. As the world navigates the global health challenges and seismic changes that will likely come as a result of COVID-19, it is essential for us to be there for our guests when they need us most – and to be their place of comfort during all of this uncertainty. We are grateful for the dedication Our results were a combination DUNKIN’ AND of our franchisees and crew of many things – starting with BASKIN-ROBBINS members, who make our brands outstanding execution of our stand tall every day. Together, segment plans and our continued WERE RANKED we are on a journey to evolve focus on delivering for customers. #1 AND #13 BRANDS and transform our brands Our recent strategic investments – IN THE 2020 to be more relevant for our including our espresso and digital FRANCHISE 500 customers – through a focus on platforms – are driving topline ISSUE OF menu innovation with broader results and delivering a better consumer appeal, reimagining the guest experience. Our asset-light, ENTREPRENEUR restaurant experience, growing 100-percent franchised business MAGAZINE our digital and delivery platforms, model continues to deliver strong and integrating both brands into flow through, and we are proud modern culture. of our collaborative relationships with our nearly 2,000 franchisee As we navigate the unchartered and licensee partners around the waters ahead, we will stay true to world. -

On Better Footing 12M Price Target PHP 247.00 (+18%) Previous Price Target PHP 247.00

209. 40 January 21, 2020 Jollibee Foods (JFC PM) BUY Share Price PHP 209.40 On better footing 12m Price Target PHP 247.00 (+18%) Previous Price Target PHP 247.00 Company Description Showing signs of recovery; Reiterate BUY Engaged in the development, operation, and We are encouraged on JFC’s current state of operations as we recently franchising of quick-service restaurants in the met the company. Although not yet out of the woods, across-the-board Philippines and worldwide improvement in both domestic and international operations in 4Q19 raised our confidence in JFC’s 2020 outlook. With 2019 behind us, we think that our PHP5.5b (+23.5% YoY) core income forecast for 2020E is Statistics achievable. Reiterate our non-consensus BUY as current price level 52w high/low (PHP) 325.00/184.10 remains attractive. Our earnings forecasts and DCF-based TP (WACC: 3m avg turnover (USDm) 2.7 7.3%; LTG: 3.0%) are unchanged. Free float (%) 42.6 Issued shares (m) 1,097 Baby steps for Smashburger Market capitalisation PHP229.7B USD4.5B Consumer Staples In 9M19, Smashburger generated roughly PHP1.3b in losses as SSSG Major shareholders: reached double-digit negative figures. By Dec 2019, Smashburger’s SSSG Hyper Dynamic Corp. 25.6% was negative low single-digit (4Q19: mid- to high- negative), a stark Honeysea Corp. 12.0% Winall Holding Corp 5.1% improvement. However, we expect the magnitude of losses to sustain in the near-term as store closures were back-loaded in 4Q19. JFC Price Performance accelerated store closures in 4Q19 (35 stores closed) from 15 stores 340 150 closed as of 9M19. -

Restaurant Trends App

RESTAURANT TRENDS APP For any restaurant, Understanding the competitive landscape of your trade are is key when making location-based real estate and marketing decision. eSite has partnered with Restaurant Trends to develop a quick and easy to use tool, that allows restaurants to analyze how other restaurants in a study trade area of performing. The tool provides users with sales data and other performance indicators. The tool uses Restaurant Trends data which is the only continuous store-level research effort, tracking all major QSR (Quick Service) and FSR (Full Service) restaurant chains. Restaurant Trends has intelligence on over 190,000 stores in over 500 brands in every market in the United States. APP SPECIFICS: • Input: Select a point on the map or input an address, define the trade area in minute or miles (cannot exceed 3 miles or 6 minutes), and the restaurant • Output: List of chains within that category and trade area. List includes chain name, address, annual sales, market index, and national index. Additionally, a map is provided which displays the trade area and location of the chains within the category and trade area PRICE: • Option 1 – Transaction: $300/Report • Option 2 – Subscription: $15,000/License per year with unlimited reporting SAMPLE OUTPUT: CATEGORIES & BRANDS AVAILABLE: Asian Flame Broiler Chicken Wing Zone Asian honeygrow Chicken Wings To Go Asian Pei Wei Chicken Wingstop Asian Teriyaki Madness Chicken Zaxby's Asian Waba Grill Donuts/Bakery Dunkin' Donuts Chicken Big Chic Donuts/Bakery Tim Horton's Chicken -

Wendy's Final

FAST CASUAL FINAL RFP JHENI GIBSON EXECUTIVE SUMMARY What do we want to do? How will we do it? What’s the timeline? • Wendy’s would like to reposition its • We will address Wendy’s • This campaign plan will run for brand as “Fast Casual” offering higher quality foods and lite service millennial target audience by the full 2018 Fiscal Year. coupled with the convenience of exploring their habits, budget, • All testing will be completed quick output. lifestyle and priorities. within the first 2 months of • Competitors such as • We’ll test and launch campaigns the FY. Chipotle, Shake Shack, and that highlight Wendy’s fresher • Progress will be measured Smashburger have adopted ingredients, sourcing, nutrition, monthly to incrementally the fast casual business analyze success and optimize model and continue to and our new Fast Casual dining attract millennials taking experience. Channels used will towards goals through the market share from “fast be Advertising, PR, Sponsorships year. food” restaurants like and Promotions. • Final success metrics McDonalds, Wendy’s and • Creative and copy will will be gathered at the Burger King. feature fresh and end of the fiscal to • The Fast Casual dining observe if goals and experience provides a progressive images of modern, comfortable and new menu options and objectives have been inviting aesthetic where millennials enjoying a met. customers can enjoy a more quick and nutritious meal. upscale dining experience. • Food is locally sourced, honest and made to order. • . "Everybody in the world is talking about fast casual… It just has a broad appeal.” BONNIE RIGGS – INDUSTRY ANALYST WITH NPD GROUP (The Washington Post) BUSINESS SITUATION • With the success of fast casual restaurants, its evident that customers prefer an in- store, upmarket experience. -

Wendy's International, Inc

Wendy’s International, Inc. John Barker SVP Corporate Affairs & Investor Relations June 9, 2008 Today’s Presentation Wendy’s Overview Activist investors: A case history… the last 3 years Wendy’s & Triarc Merger 2 Corporate Affairs Department Overview Strategic Planning Public Relations Meetings / Event Planning Community Relations Investor & Shareholder Relations Dave’s Legacy (financial disclosure) Oversee Wendy’s Major Events All major public disclosures Wendy’s International Internal Communications Foundation (System) Dave Thomas Foundation for Government Relations & Wendy’s Adoption Political Action Committee (PAC) Corporate & Investor website Issues Management Graphic Design for restaurants Crisis Management and system projects Consumer Communications & PR Services – A/V support Consumer Relations 3 Corporate Affairs Department CEO & President CEO & President *Wendy’s 3-Tour Challenge, High School Heisman, KeKerriirii And Andeersrsonon Home for the Holidays Senior VP Exec Asst Senior VP Corp Affairs & IR Michelle Lemmon Corp Affairs & IR JoJohnhn Ba Barkrkeerr Dave Thomas DirectDirectoorr DirectDirectoorr VPVP Public Public Affairs Affairs & & SVSVPP Foundation IRIR & & Financial Financial CoConsumernsumer & & PR PR IssueIssue M Maananagemengement t CommuCommunicationsnications MediaMedia Relat Relationsions CommuCommunicationsnications *Special MaryMary Sc Schelhell l DenDennyny Lynch Lynch OpOpeenn BoBobb Bert Bertiniini Events (Mktg) Mgr. IR and Strat Planning Analysis Director Govt Manager Manager Dir. System Dir. Sys Comms Project Mgr. Events Mgmt Kim Messner Relations Comms Internal Comms Comms Improvement & PAC Mgr. Planner Kevin Lundy Kitty Munger Open Tom Clemens Gary Talbott Mary Fry Joel Nepa Mgr. Shareholder Relations & Admin Asst Media Enterprise Disclosure Open Supv. Consumer Editorial Svcs Mgr. Media Producer Wal Ozello Marsha Gordon Relations Consultant Production Jane Frazier Jeff Nastali Brian Rolston Spec. -

Local Restaurants

Local Restaurants Deli, Café, Coffee, ice Cream Chipotle Chelley Belly 1710 Columbus Pike 740-369-6360 59 N. Sandusky Street 740-369-5792 Kentucky Fried Chicken Choffey’s Coffee & Confection 134 S. Sandusky Street 740-362-9583 17 W. Winter Street 740-417-9406 Long John Silver’s Dairy Depot 1165 Columbus Pike 740-363-2942 390 N. Sandusky Street 740-363-5297 Mc Donald’s Jimmy John’s 279 S. Sandusky Street 740-363-1713 47 N. Sandusky Street 740-362-0111 Taco Bell Ollie’s Fine Ice Cream 1167 S. Sandusky Street 740-369-0138 19 S. Franklin Street 740-363-6554 Tim Hortons/Cold Stone Creamery Orange Leaf 89 W. Williams Street 740-362-3203 24 Troy Road 740-362-1855 Victor’s Taco Shop Panera 186 S. Sandusky Street 740-362-8000 750 W. Central Avenue 740-362-1001 Wendy’s Something Sweet Coffee & Bakery 185 S. Sandusky Street 740-369-3332 2 N. Sandusky Street 740-369-5282 Pizza Starbucks 1740 Columbus Pike 740-362-1338 Amato’s Woodfired Pizza (no delivery) 8 S. Sandusky Street 740-369-8797 Subway 16 S. Sandusky Street 740-369-7827 Delco Pizza 523 Pennsylvania Avenue 740-363-0033 Whit’s Frozen Custard 31 N. Sandusky Street 740-362-0715 Domino’s Pizza 90 W. William Street 740-363-9824 Fast Food Donato’s Pizza Arby’s 122 S. Sandusky Street 740-362-0682 216 S. Sandusky Street 740-417-8113 Gabby’s Place Pizza and Subs Burger King 3120 Olentangy River Road 740-369-4619 168 S. Sandusky Street 740-363-8080 Hungry Howie’s Pizza St. -

Tim Hortons and Burger King Worldwide Provide Transaction Update and Set Election Deadlines

Tim Hortons and Burger King Worldwide Provide Transaction Update and Set Election Deadlines Oakville, Ontario and Miami, Florida; December 5, 2014: Tim Hortons Inc. (TSX, NYSE: THI) and Burger King Worldwide Inc. (NYSE: BKW) today confirmed that the proposed transaction to create a new global quick service restaurant leader operating two iconic, independent brands has been approved by the Minister of Industry under the Investment Canada Act (“ICA”). In connection with this announcement, the companies are providing the following further updates regarding the transaction. The companies have set the deadline for registered shareholders of Tim Hortons or Burger King Worldwide to make an election with respect to the form of consideration they wish to receive, subject to pro-ration, as of December 9, 2014, prior to 5:00 p.m. (EST), which is based on the current expectation that the transaction will be completed on December 12, 2014. Registered shareholders are reminded that if they wish to make an election, they must complete, sign and return a Letter of Transmittal and Election Form to Computershare Trust Company, as exchange agent, by the election deadline. Shareholders holding shares through a broker, investment dealer or other intermediary should carefully follow the instructions provided by such broker, investment dealer or other intermediary if they wish to make an election. Shareholders with questions should contact DF King at 866-828-6934 (English) or 866-796-1285 (French). Tim Hortons and Burger King Worldwide also confirmed today that the transaction has previously received regulatory clearance under the Hart-Scott-Rodino Act (USA), the Competition Act (Canada) and the Canada Transportation Act. -

Table-For-10-Ebook.Pdf

TABLE OF CONTENTS Click below to jump to that chapter Meet Kelly 03 Introduction 04 CHAPTER 1: Recruiting and Hiring 09 CHAPTER 2: Shift and Labor Management 12 CHAPTER 3: Routine Management 16 CHAPTER 4: Security and Loss Prevention 19 CHAPTER 5: Inventory & Order Management 23 CHAPTER 6: 3rd-Party Consolidation 28 CHAPTER 7: Online Ordering 32 CHAPTER 8: Marketing 38 CHAPTER 9: Guest Feedback 46 CHAPTER 10: Data Aggregation and Analytics 51 Conclusion 55 Table for 10 - Ten Restaurant Technologies Collaborating to Help You Thrive in an Era of Uncertainty 3 MEET KELLY Kelly MacPherson is the former Chief Information Officer for Burger King, Popeyes and Tim Hortons, and has held technology leadership positions for prominent global brands such as Abercrombie and Fitch, MICROS, Planet Hollywood, and Hard Rock Cafe. MacPherson is a global visionary with a 20-year record of bold decision-making and resolute transformation leadership, driving evolution of operational excellence for multibillion- dollar global enterprises in the hospitality and retail industry. A transformative change agent with impeccable customer orientation, strong problem-solving abilities, and intrinsic instincts to consistently raise the bar to enable businesses to deliver results. She pioneered guest receipt surveys, has successfully innovated technology through two major economic downturns, and looks forward to using her experience to guide brands through the “new normal.” Table for 10 - Ten Restaurant Technologies Collaborating to Help You Thrive in an Era of Uncertainty 4 Introduction I’ve worked with Ovation to help restaurant owners and operators think through the technology that will help bridge the gap between the “new normal” and becoming just “the normal.” Driving both top line growth and margin improvements through a “connected restaurant experience” will only come through a robust ecosystem of partners built on a scalable flexible architecture enabling a seamless flow of data. -

Former Restaurant Pad Site 11965 S

BUILDING LEASE, GROUND LEASE OR BTS FORMER RESTAURANT PAD SITE 11965 S. STRANG LINE RD., OLATHE, KANSAS New Courtyard Marriott 1.1 Acres CAN BE SPLIT SITE Future Mixed-use Tenant LINE ROAD 33,600 CPD STRANG PROPERTY HIGHLIGHTS > 6,810 s.f. building available on 1.41 acres > Existing building can be split for 2 tenants > Existing Building can be demolished, and parcel redeveloped into two lots (Ground Lease or BTS) > One of the Kansas City Metro’s strongest retail intersections > Anchored by SuperTarget and highest volume AMC Theatre in the market > Strong Visibility and easy access at signalized intersection > 90,000 CPD on I-35 > 33,600 CPD on 119th Street > 23,000 CPD on Strang Line Road FOR INFORMATION: JEFF BERG COLEBY HENZLIK PARTNER PARTNER 913-914-7065 913-914-7146 [email protected] [email protected] FORMER RESTAURANT PAD SITE OLATHE, KS PROPERTY AERIAL NORTHRIDGE SC S. BLACK BOB RD. RD. BOB BOB BLACK BLACK S. S. 64,499 CPD 33,600 CPD WEST 119TH STREET OLATHE POINTE . RD STR INE ANG L PD 0 C ,00 23 OLATHE STATION 56,499 CPD 3 ELEVATE PROPERTY ADVISORS FORMER RESTAURANT PAD SITE OLATHE, KS PROPERTY FEATURES 6,10 SF 1.1 Acres BUILDING OR LOT SITE CAN BE SPLIT S . S TR ANG LINE RD . UTURE MIED-USE TET S. STRANG LINE CT. spacious outdoor patio 5 ELEVATE PROPERTY ADVISORS NEIGHBORHOOD FORMER RESTAURANT PAD SITE OLATHE, KS DYNAMICS RESTAURANTS The fast-casual and full-service restaurant scene at this regional node hosts an unbeatable mix of local and regional hometown heroes like Joe’s Kansas City Bar-B-Que, Doc Greens, Mr. -

Equity Research Report Jollibee Foods Corp. 24Th April 2019

Equity Research Report Jollibee Foods Corp. 24th April 2019 Murtaza Salman Abedin Anirudh Ganeriwala Harsharan Singh Muhammad Salik Raymond Widjaja Tang Man Chung Tommy Fang Yucheng Published By CityU Student Research & Investment Club THE FINAL PAGE OF THIS REPORT CONTAINS A DETAILED DISCLAIMER The content and opinions in this report are written by university students from the CityU Student Research & Investment Club, and thus are for reference only. Investors are fully responsible for their investment decisions. CityU Student Research & Investment Club is not responsible for any direct or indirect loss resulting from investments referenced to this report. The opinions in this report constitute the opinion of the CityU Student Research & Investment Club and do not constitute the opinion of the City University of Hong Kong nor any governing or student body or department under the University. 24 April 2019 Asia Pacific/Philippines Equity Research Restaurants Rating OUTPERFORM Price (22 April 19, PHP) 304.00 Target price (PHP) % up from Price on April, 22: 18.58% 360.49 Market cap. (PHP, m) 333,621 Enterprise Value (PHP m) 337,271.4 Jollibee Foods Corporation (JFC:PM) Stock ratings are relative to the coverage universe in each analyst's or each team's respective sector. Target price is for 12 months. Research Analysts: Jollibee Foods Corporation (JFC) is an Asian food service multinational company which owns and operates a large number of Quick Service Murtaza Salman Abedin +852 59858568 Restaurants (QSRs). The company is listed on the Philippines Stock [email protected] Exchange and has a market capitalization of PHP347.57 Billion (USD Anirudh Ganeriwala 6.72 Billion) and a revenue of PHP126.2 Billion (USD 2.43 Billion) as [email protected] of 2017. -

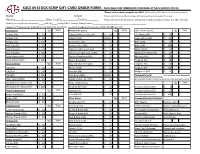

Sacs in Stock Scrip Gift Card Order Form

SACS IN STOCK SCRIP GIFT CARD ORDER FORM - AVAILABLE FOR IMMEDIATE PURCHASE AT SACS SCHOOL OFFICE ~Please make checks payable to: SACS (There will be a $25 fee for any returned payments.) Name:___________________________________________ Scrip #___________ ~Please note that the profit percentages offered by merchants are subject to change. Phone:(_____)________________ Order Total $____________Check #________ ~Please note that SCRIP gift cards can only be used to purchase goods or services, NOT other gift cards. Pickup/Delivery (Please select one):_____Pick-Up_____Send w/Child - Student Name/Teacher________________________________________________ Questions? Please contact Diane Mulcrone, SACS Scrip Coordinator, at [email protected] or (952)445-3387 ext. 140 Gas Stations Qty Total Restaurants (cont.) Qty Total Other Stores (cont.) Qty Total Holiday (4%) $ 25 $ Chipotle Mexican Grill (10%) $ 10 $ J.C. Penney (5%) $ 25 $ Holiday (4%) $ 50 $ Culver's (10%) $10/$25 $ JoAnn Fabrics (6%) $ 25 $ Holiday (4%) $ 100 $ Dairy Queen (3%) $ 10 $ Kohl's (5%) $ 25 $ Kwik Trip (5%) $ 25 $ Domino's Pizza (8%) $ 10 $ Kohl's (5%) $ 100 $ Kwik Trip (5%) $ 50 $ O'Brien's Public House (5%) $ 25 $ Macy's (10%) $ 25 $ Kwik Trip (5%) $ 100 $ Olive Garden/Red Lobster (9%) $ 25 $ Marshalls/TJ Maxx (7%) $ 25 $ Super America (4%) $ 25 $ Outback Steakhouse (8%) $ 25 $ Michael's (4%) $ 25 $ Super America (4%) $ 100 $ Panera Bread (9%) $ 10 $ Target (2.5%) $ 10 $ Grocery Stores Qty Total Papa Murphy's Pizza (8%) $ 10 $ Target (2.5%) $ 25 $ Cub (5%) $ 25 $ Perkin's (10%) $ 25 $ Target (2.5%) $ 100 $ Cub (5%) $ 50 $ Pizza Hut (8%) $ 10 $ Walgreen's (6%) $ 25 $ Cub (5%) $ 100 $ Pizza Ranch (10%) $10/$25 $ Community Scrip* This certificate is not designated Von Hanson's (10%) $ 25 $ Qdoba Mexican Grill (7%) $ 25 $ for a specific retailer.