China Internet Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Immediate Release

For Immediate Release TENCENT ANNOUNCES 2020 FIRST QUARTER RESULTS Hong Kong, May 13, 2020 – Tencent Holdings Limited (“Tencent” or the “Company”, 00700.HK), a leading provider of Internet value added services in China, today announced the unaudited consolidated results for the first quarter (“1Q2020”) ended March 31, 2020. 1Q2020 Key Highlights Revenues: +26% YoY, non-IFRS1 profit attributable to equity holders of the Company: +29% YoY ▪ Total revenues were RMB108,065 million (USD15,252 million2), an increase of 26% over the first quarter of 2019 (“YoY”). ▪ On a non-IFRS basis, which is intended to reflect core earnings by excluding certain one-time and/or non-cash items: - Operating profit was RMB35,575 million (USD5,021 million), an increase of 25% YoY. Operating margin remained stable at 33%. - Profit for the quarter was RMB27,984 million (USD3,950 million), an increase of 29% YoY. Net margin increased to 26% from 25% last year. - Profit attributable to equity holders of the Company for the quarter was RMB27,079 million (USD3,822 million), an increase of 29% YoY. - Basic earnings per share were RMB2.858. Diluted earnings per share were RMB2.817. ▪ On an IFRS basis: - Operating profit was RMB37,260 million (USD5,259 million), an increase of 1% YoY. Operating margin decreased to 34% from 43% last year. - Profit for the period was RMB29,403 million (USD4,150 million), an increase of 6% YoY. Net margin decreased to 27% from 33% last year. - Profit attributable to equity holders of the Company for the quarter was RMB28,896 million (USD4,078 million), an increase of 6% YoY. -

India Internet a Closer Look Into the Future We Expect the India Internet TAM to Grow to US$177 Bn by FY25 (Excl

EQUITY RESEARCH | July 27, 2020 | 10:48PM IST India Internet A Closer Look Into the Future We expect the India internet TAM to grow to US$177 bn by FY25 (excl. payments), 3x its current size, with our broader segmental analysis driving the FY20-25E CAGR higher to 24%, vs 20% previously. We see market share likely to shift in favour of Reliance Industries (c.25% by For the exclusive use of [email protected] FY25E), in part due to Facebook’s traffic dominance; we believe this partnership has the right building blocks to create a WeChat-like ‘Super App’. However, we do not view India internet as a winner-takes-all market, and highlight 12 Buy names from our global coverage which we see benefiting most from growth in India internet; we would also closely watch the private space for the emergence of competitive business models. Manish Adukia, CFA Heather Bellini, CFA Piyush Mubayi Nikhil Bhandari Vinit Joshi +91 22 6616-9049 +1 212 357-7710 +852 2978-1677 +65 6889-2867 +91 22 6616-9158 [email protected] [email protected] [email protected] [email protected] [email protected] 85e9115b1cb54911824c3a94390f6cbd Goldman Sachs India SPL Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs (Singapore) Pte Goldman Sachs India SPL Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. -

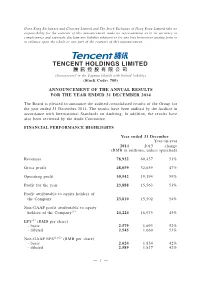

TENCENT HOLDINGS LIMITED 騰 訊 控 股 有 限 公 司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 700)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. TENCENT HOLDINGS LIMITED 騰 訊 控 股 有 限 公 司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 700) ANNOUNCEMENT OF THE ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2014 The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2014. The results have been audited by the Auditor in accordance with International Standards on Auditing. In addition, the results have also been reviewed by the Audit Committee. FINANCIAL PERFORMANCE HIGHLIGHTS Year ended 31 December Year-on-year 2014 2013 change (RMB in millions, unless specified) Revenues 78,932 60,437 31% Gross profit 48,059 32,659 47% Operating profit 30,542 19,194 59% Profit for the year 23,888 15,563 53% Profit attributable to equity holders of the Company 23,810 15,502 54% Non-GAAP profit attributable to equity holders of the Company(1) 24,224 16,975 43% EPS(2) (RMB per share) - basic 2.579 1.693 52% - diluted 2.545 1.660 53% Non-GAAP EPS(1)(2) (RMB per share) - basic 2.624 1.854 42% - diluted 2.589 1.817 42% — 1 — Unaudited Three months ended 31 31 Year- 30 Quarter- December December on-year September on-quarter 2014 2013 change 2014 change (RMB in millions, -

Update of Global Medium Term Note Programme Proposed Issue of Notes Under the Global Medium Term Note Programme and Extract of F

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No securities may be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the Company making the offer and its management and financial statements. The Company does not intend to make any public offering of securities in the United States. UPDATE OF GLOBAL MEDIUM TERM NOTE PROGRAMME PROPOSED ISSUE OF NOTES UNDER THE GLOBAL MEDIUM TERM NOTE PROGRAMME AND EXTRACT OF FINANCIAL INFORMATION References are made to the announcements of the Company dated 10 April 2014, 24 April 2015, 9 January 2018, 1 April 2019 and 25 May 2020 in relation to the establishment, increase of the Programme Limit and update of the Programme. The Board is pleased to announce that on 13 April 2021, the Company has updated the Programme to include, among other things, the Company’s recent corporate and financial information and increase the Programme Limit from US$20 billion to US$30 billion (or its equivalent in other currencies). -

A New Kind of Conglomerate: Bigtech in China

NOVEMBER 2018 A NEW KIND OF CONGLOMERATE: BIGTECH IN CHINA INSTITUTE of INTERNATIONAL FINANCE 7 TABLE OF CONTENTS INTRODUCTION..........................................................................................................................................2 TOTAL DIGITAL LIFE....................................................................................................................................2 Chinese Bigtech..............................................................................................................................3 Background on Chinese Bigtechs..................................................................................................4 ROLE AND REACH WITHIN CHINESE ECONOMY....................................................................................7 Financial Services........................................................................................................................................7 Mobile Payments...............................................................................................................8 Credit Rating and Lending................................................................................................9 Wealth Management.......................................................................................................10 Insurance..........................................................................................................................10 Offline Retail.................................................................................................................................11 -

Tencent Announces 2020 First Quarter Results

For Immediate Release TENCENT ANNOUNCES 2020 FIRST QUARTER RESULTS Hong Kong, May 13, 2020 – Tencent Holdings Limited (“Tencent” or the “Company”, 00700.HK), a leading provider of Internet value added services in China, today announced the unaudited consolidated results for the first quarter (“1Q2020”) ended March 31, 2020. 1Q2020 Key Highlights Revenues: +26% YoY, non-IFRS1 profit attributable to equity holders of the Company: +29% YoY ▪ Total revenues were RMB108,065 million (USD15,252 million2), an increase of 26% over the first quarter of 2019 (“YoY”). ▪ On a non-IFRS basis, which is intended to reflect core earnings by excluding certain one-time and/or non-cash items: - Operating profit was RMB35,575 million (USD5,021 million), an increase of 25% YoY. Operating margin remained stable at 33%. - Profit for the quarter was RMB27,984 million (USD3,950 million), an increase of 29% YoY. Net margin increased to 26% from 25% last year. - Profit attributable to equity holders of the Company for the quarter was RMB27,079 million (USD3,822 million), an increase of 29% YoY. - Basic earnings per share were RMB2.858. Diluted earnings per share were RMB2.817. ▪ On an IFRS basis: - Operating profit was RMB37,260 million (USD5,259 million), an increase of 1% YoY. Operating margin decreased to 34% from 43% last year. - Profit for the period was RMB29,403 million (USD4,150 million), an increase of 6% YoY. Net margin decreased to 27% from 33% last year. - Profit attributable to equity holders of the Company for the quarter was RMB28,896 million (USD4,078 million), an increase of 6% YoY. -

Offering Circular

IMPORTANT NOTICE THIS OFFERING IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER (1) QUALIFIED INSTITUTIONAL BUYERS UNDER RULE 144A OR (2) NON-U.S. PERSONS OUTSIDE OF THE UNITED STATES IMPORTANT: You must read the following before continuing. The following applies to the offering circular following this page (the “Offering Circular”), and you are therefore advised to read this carefully before reading, accessing or making any other use of the Offering Circular. In accessing the Offering Circular, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR OTHER JURISDICTION, AND SECURITIES IN BEARER FORM ARE SUBJECT TO U.S. TAX LAW REQUIREMENTS. THE SECURITIES MAY NOT BE OFFERED, SOLD OR (IN THE CASE OF NOTES IN BEARER FORM) DELIVERED WITHIN THE UNITED STATES, OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT (“REGULATION S”)) EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. THIS OFFERING CIRCULAR MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER, AND IN PARTICULAR, MAY NOT BE FORWARDED TO ANY ADDRESS IN THE UNITED STATES. -

2019 Fourth Quarter and Annual Results Corporate Overview

2019 Fourth Quarter and Annual Results Corporate Overview March 18, 2020 We Build Connections QQ Weixin For Enterprises: For Users: For Tencent: • Access to vast user base • Always connected • Deepen user stickiness via broadened • Unified user log-in enables CRM and • Enjoy a wide range of integrated social product offerings targeted advertising entertainment and content offerings, built • Increase traffic conversion through • Online payment facilitates transactions upon IPs and tech innovations transactions and advertising • Integrate capabilities across different • Access to rich mix of services and • Tap into new opportunities as the products to facilitate digital upgrades, e.g., transact at fingertips economy digitizes Weixin, WeChat Work, Tencent Meeting 2 Largest Communication and Social Platforms in China • Communication and social platform for PC and • Mobile-centric creation for smart phones mobile ➢ QQ 727 million 1 ➢ Weixin & WeChat 2 1,165 million1 ➢ Mobile QQ 2 647 million 1 • Young, entertainment-oriented users • White-collar users • Open Platform + Interest Groups • Mini Programs connect users to content developers and interest connect users and content and service providers groups, and expand use cases in verticals, e.g., moving into the digital space online education 1 Monthly active user accounts as of 31 December 2019 2 For smart devices 3 Key Platforms Update Online Games Platform Video • #1 by users in China across Online • #1 by mobile DAU PC and smart phone Games News • #1 globally by revenue • #1 news services by MAU Music • #1 music services platform Media Literature Weixin & WeChat • #1 online content library and publishing platform • #1 smart phone community • MAU at 1,165m QQ & Qzone • QQ smart devices MAU at 647m Communication FinTech • Qzone smart devices MAU & Social at 507m Mobile Payment • #1 by MAU & DAU Cloud App Store • #1 by MAU Cloud Mobile Security • #2 service provider by • #1 by MAU Utilities revenue Mobile Browser • #1 by MAU * All rankings above refer to China market, unless otherwise stated. -

Artificial Intelligence Described on a Single Chart

Asia Independent Research Conference 20 18 Paul Schulte Schulte Research Schulte Research is an independent research service founded in 2014 by Paul Schulte who has 27 years’ experience as an analyst. It focuses on banks, bank credit, corporate solvency and emerging “FinTech”. Schulte Research is published by IND-X Advisors Ltd., a Hong Kong-based investment advisory company, the origins of which can be traced back to 2003. IND-X is regulated by the Hong Kong SFC and is a registered investment advisor with the US SEC. 93 A new model of AI: The birth of the digital conglomerate: When more data is better. Paul Schulte, MA, MALD [email protected] www.schulte-research.com (+852) 9705 0777 Gavin Liu, CFA – Senior Analyst Representing the interests of the global hedge fund industry Artificial Intelligence Described on a Single Chart 1. Financial Services 2. Cognitive Services 40bn Sensors Computing 3. Lifestyle/ Health Quantum Neural Physical Digital Networks: IoT Infra. AI Data Data Machine 4. Autonomous cars Learning 5bn 5. Robotics Mobile Devices 6. Advertising Cloud Source: Schulte Research Project Conclusions Chinese Firms Conclusions PRC firms are better at monetizing technology for mass use. PRC has a long term, coherent plan for AI. The US has no plan. Chinese are more willing to surrender data. Alibaba and Ping An are much further into new territory than anyone else. Integration of finance and lifestyle is welcomed and encouraged by PRC. Source: Schulte Research PRC has a clear national policy of proliferating credit to individuals and SMEs. Project Conclusions Reasons for China’s Success over US US heavily entrenched incumbents & lobbying groups. -

Corporate Overview

1 Leading Services with Massive and Highly Engaged User Base Games Long-Form Video • #1 by users in China across • #1 by subscriptions PC and mobile Games News • #1 globally by revenue • #1 news services by MAU Music Digital • #1 music services provider Content Literature • #1 online content library and publisher Weixin & WeChat • #1 mobile community • MAU at 1,251m QQ Communication • QQ mobile devices MAU FinTech at 591m & Social Mobile Payment • #1 by MAU & DAU Cloud Mobile Browser • #1 by MAU Public Cloud Mobile Security • #2 service provider by Utilities • #1 by MAU revenue * All rankings above refer to China market, unless otherwise stated. Company data as of June 30, 2021. 2 Digital Ecosystem Fulfilling Everyday Needs of Consumers 1 billion+ RMB1.6 trillion+ 229 million daily average commercial payment total transaction value generated from total fee-based transactions on Weixin Pay (1) Weixin Mini Programs (2) VAS subscriptions (3) Tencent Weixin Tencent Mini WeiShi Video Video Accounts Games Games Watching Playing videos games 20 Tencent Tencent Health Weixin QQ Health Medipedia Code Seeking medical help Sharing Socialising QQ Music WeSing Communication Listening and Kugou Music Kuwo Music singing Work and collaboration Payment Reading transactions WeCom Tencent Tencent Meeting / Docs VooV Meeting QQ Qidian Weixin Weixin Pay QQ Wallet Reading Reading Reading 1. Since 4Q2019 2. Annual transaction value in 2020 3 3. Fee-based VAS subscriptions as of Jun 30, 2021 Weixin Reshapes Digital Lifestyle in China Weixin Chat Chat and Moments -

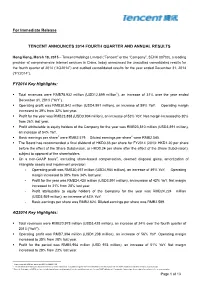

Tencent Announces 2014 Fourth Quarter and Annual Results

For Immediate Release TENCENT ANNOUNCES 2014 FOURTH QUARTER AND ANNUAL RESULTS Hong Kong, March 18, 2015 – Tencent Holdings Limited (“Tencent” or the “Company”, SEHK 00700), a leading provider of comprehensive Internet services in China, today announced the unaudited consolidated results for the fourth quarter of 2014 (“4Q2014”) and audited consolidated results for the year ended December 31, 2014 (“FY2014”). FY2014 Key Highlights: . Total revenues were RMB78,932 million (USD12,899 million1), an increase of 31% over the year ended December 31, 2013 (“YoY”). Operating profit was RMB30,542 million (USD4,991 million), an increase of 59% YoY. Operating margin increased to 39% from 32% last year. Profit for the year was RMB23,888 (USD3,904 million), an increase of 53% YoY. Net margin increased to 30% from 26% last year. Profit attributable to equity holders of the Company for the year was RMB23,810 million (USD3,891 million), an increase of 54% YoY. Basic earnings per share2 were RMB2.579. Diluted earnings per share2 were RMB2.545. The Board has recommended a final dividend of HKD0.36 per share for FY2014 (2013: HKD1.20 per share before the effect of the Share Subdivision, or HKD0.24 per share after the effect of the Share Subdivision), subject to approval of the shareholders. On a non-GAAP basis3, excluding share-based compensation, deemed disposal gains, amortization of intangible assets and impairment provision: - Operating profit was RMB30,497 million (USD4,984 million), an increase of 49% YoY. Operating margin increased to 39% from 34% last year. - Profit for the year was RMB24,420 million (USD3,991 million), an increase of 42% YoY. -

China's Tencent 2014 Net Profit up 54 Percent 18 March 2015

China's Tencent 2014 net profit up 54 percent 18 March 2015 Ma said its social platforms QQ and WeChat continued to "innovate and grow". Revenues from online games increased 40 percent to 44.76 billion yuan for 2014, driven by growth in PC and smartphone markets, while revenue from its social networks was up 43 percent to 18.56 billion yuan in the same period. Monthly active users of messaging app WeChat reached 500 million by the end of 2014, a year-on- year growth of 41 percent. WeChat, also known as "weixin", or micro-message in Chinese, has taken the country by storm since its Tencent operates online and social networking services launch in 2011. including instant messaging service QQ as well as mobile messaging service WeChat The app is more versatile than US rival WhatsApp, allowing its users to find each other by shaking their smartphones, book and pay for taxis, as well as send text, photos, videos and voice messages. Chinese Internet giant Tencent said its net profit was up 54 percent at 23.81 billion yuan ($3.82 Tencent has launched an online bank, called billion) in 2014 helped by "rapid development" of WeBank, which is fully Internet-based with no mobile gaming and social networking. physical branches, China Daily reported in January. Based in the southern export hub of Shenzhen, Tencent operates online and social networking © 2015 AFP services including instant messaging service QQ as well as mobile messaging service WeChat. Net profit for the year ending December 31, 2014 surged 54 percent from 15.50 billion yuan in 2013, it said in a filing to the Hong Kong stock exchange.