For Immediate Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter # 1 Introduction

Chapter # 1 Introduction Mobile applications (apps) have been gaining rising popularity dueto the advances in mobile technologies and the large increase in the number of mobile users. Consequently, several app distribution platforms, which provide a new way for developing, downloading, and updating software applications in modern mobile devices, have recently emerged. To better understand the download patterns, popularity trends, and development strategies in this rapidly evolving mobile app ecosystem, we systematically monitored and analyzed four popular third-party Android app marketplaces. Our study focuses on measuring, analyzing, and modeling the app popularity distribution, and explores how pricing and revenue strategies affect app popularity and developers’ income. Our results indicate that unlike web and peer-to-peer file sharing workloads, the app popularity distribution deviates from commonly observed Zipf-like models. We verify that these deviations can be mainly attributed to a new download pattern, to which we refer as the clustering effect. We validate the existence of this effect by revealing a strong temporal affinity of user downloads to app categories. Based on these observations, we propose a new formal clustering model for the distribution of app downloads, and demonstrate that it closely fits measured data. Moreover, we observe that paid apps follow a different popularity distribution than free apps, and show how free apps with an ad-based revenue strategy may result in higher financial benefits than paid apps. We believe that this study can be useful to appstore designers for improving content delivery and recommendation systems, as well as to app developers for selecting proper pricing policies to increase their income. -

Chinese Internet Companies and Their Quest for Globalization

International Conference on Information, Business and Education Technology (ICIBIT 2013) Chinese Internet Companies and Their Quest for Globalization Harlan D. Whatley1 1Swiss Management Center, Zurich, Switzerland Abstract players in the technology market (Sun, 2009). Chinese internet companies have seen an This qualitative research paper unprecedented growth over the past explores the quest for globalization of decade. However, very few are two successful Chinese internet recognized brands outside of China while companies: Baidu and Tencent Holdings. some seek to develop their brands in In this case study, the focus is on the foreign markets. This paper analyzes the marketing strategies of these expanding marketing strategies of two internet multinational enterprises and the companies: Baidu and Tencent and their challenges they face to become quest for globalization. recognized as global brands. All of the firms in this study were founded as Keywords: Baidu, Tencent, internet, private enterprises with no ownership ties branding, marketing, globalization, China to the Chinese government. Furthermore, an analysis of the countries and markets 1. Introduction targeted by the firms is included in the study. In addition to a review of the Innovation efforts by technology current academic literature, interviews companies in China are driven by adding were conducted with marketing and significant value to imported foreign strategy professionals from the technologies or by developing new perspective firms as well as journalists products to satisfy specific domestic that closely follow Chinese internet firms demands (Li, Chen & Shapiro, 2010). and the technology sector. This study on Firms in the emerging market of China do the globalization of Chinese internet not possess the R&D resources that their firms will contribute to marketing developed Western counterparts have. -

Prospering in the Pandemic: the Top 100 Companies the First in an FT Series on Corporate Resilience in a Year of Human and Economic Devastation

FRIDAY 19 JUNE 2020 FT SERIES Coronavirus economic impact Prospering in the pandemic: the top 100 companies The first in an FT series on corporate resilience in a year of human and economic devastation In a dismal year for single day in April, up from 20m drawing more users into an most companies, a 1. Amazon in late 2019. ever-expanding ecosystem of minority have shone: wearables and services. pharmaceutical groups SECTOR: ECOMMERCE Apple executives predicted boosted by their hunt HQ: SEATTLE, US $269.9bn sales of some items would even for a Covid-19 vaccine; MARKET CAP ADDED accelerate, as millions of technology giants buoyed Key stat: Amazon anticipates consumers working from home by the trend for working it could spend $4bn to keep its Microsoft’s shift to the cloud would opt to upgrade their from home; and retailers logistics running during the under Satya Nadella has left it electronics. Investors crowned offering lockdown coronavirus crisis. well-placed for a world where Apple the first $1.5tn company. necessities online. large numbers of people are Patrick McGee in San Francisco Public companies working remotely. The Teams had the tailwind of a $401.1bn communication app has MARKET CAP ADDED become a way for workers to surprisingly robust stock stay in touch. The Azure cloud 4. Tesla market — which many As world leaders ordered their computing platform has become believe is a bubble. citizens indoors, Amazon became a more critical part of the digital SECTOR: AUTOS To rank companies the emergency port of call for backbone for many companies. -

Valorant Tournament Guidelines/Ruleset

Valorant Tournament Guidelines/Ruleset This competition is not affiliated with or sponsored by Riot Games, Inc. or VALORANT Esports. 1. Player Eligibility 1.1. Participating collegiate player(s) must fall under ALL of the listed criteria(s) to compete during CF1’s Collegiate Valorant tournament. 1.1.1. Players must be enrolled in classes full time at an accredited college or university. Graduate students are also eligible to participate as long as they also meet the university’s credit requirements for each semester. 1.1.2. Each player must maintain good academic standing at their college or university. If a player does not meet their schools academic requirements, they will be deemed ineligible for CF1 league play. Players must be verified eligible to participate by their appointed administrator contact. 1.1.3. Each player must be a minimum age of 18 years old. Players must be verified eligible to participate by their appointed administrator contact. 1.1.4. In order to be eligible to play in CF1, students must have residency or proof of enrollment in either the U.S. or Canada. Players must be verified eligible to participate by their appointed administrator contact. 1.2. In order to be approved for CF1 name usage and photographs, all players must sign a Media Release Form that confirms players name and likeness will be used solely for the promotion and broadcast of CF1 competition. 1.2.1. Media Release forms will be distributed to Coordinators on October 5th through our website and by email. 1.3. All players must agree to follow CF1’s Code of Conduct. -

China's Tencent Quarterly Profit Rises 32% 14 November 2012

China's Tencent quarterly profit rises 32% 14 November 2012 growth for QQ instant messenger, reaching 784 million users in the quarter. Its Tencent Microblog "maintained a leading social media position in China", it said. Tencent also operates a popular online gaming platform and bought a majority stake in US online game developer Riot Games last year. The peak concurrent user accounts for the group's QQ Game Platform increased 18 percent to 9.4 million users during the quarter. Ma Huateng, founder of China's Tencent Inc. Chinese Internet giant Tencent on Wednesday posted a third China is the world's biggest Internet market with quarter net profit increase of 32 percent, benefiting from over 500 million web users, according to the latest the popularity of its instant messaging services and official count. online games. (c) 2012 AFP Chinese Internet giant Tencent on Wednesday posted a third quarter net profit increase of 32 percent, benefiting from the popularity of its instant messaging services and online games. The company reported a net profit of 3.22 billion yuan ($511 million) for the three months ended September 30, up from 2.45 billion yuan in the same period last year, and said it "achieved solid year-on-year growth". Revenue rose 54.3 percent to 11.57 billion yuan. Investors, however, were disappointed with the results and Tencent shares closed down 0.89 percent at HK$267.80 on the Hong Kong stock exchange. The Hang Seng index finished 1.2 percent higher. Based in the southern export hub of Shenzhen, Tencent operates online and social networking services including instant messaging service QQ, Tencent Microblog and mobile messaging service WeChat. -

![[TME] - Tencent Music Entertainment Group Second Quarter 2019 Financial Results Conference Call Monday, August 12, 2019, 8:00 PM ET](https://docslib.b-cdn.net/cover/7673/tme-tencent-music-entertainment-group-second-quarter-2019-financial-results-conference-call-monday-august-12-2019-8-00-pm-et-727673.webp)

[TME] - Tencent Music Entertainment Group Second Quarter 2019 Financial Results Conference Call Monday, August 12, 2019, 8:00 PM ET

[TME] - Tencent Music Entertainment Group Second Quarter 2019 Financial Results Conference Call Monday, August 12, 2019, 8:00 PM ET Officers Millicent Tu, VGM, IR Cussion Pang, CEO Tony Yip, CSO Shirley Hu, CFO Analysts John Egbert, Stifel, Nicolaus Alex Yao, JPMorgan Chase Eddie Leung, Bank of America Merrill Lynch Piyush Mubayi, Goldman Sachs Group Thomas Chong, Jefferies Hans Chung, KeyBanc Capital Markets Gary Yu, Morgan Stanley Presentation [Technical Difficulty] Operator: Ladies and gentlemen, good evening and good morning, and thank you for standing by. Welcome to the Tencent Music Entertainment Group's Second Quarter 2019 Earnings Conference Call. At this time, all participants are in listen-only mode. (Operator Instructions). Today you will hear discussions from the management team of Tencent Music Entertainment Group, followed by a question-and-answer session. (Operator Instructions). Please be advised that this conference is being recorded today. If you have any objections, you may disconnect at this time. Now, I will turn the conference over to your speaker host today, Ms. Millicent Tu. Please go ahead. Millicent Tu: Thank you, operator. Hello, everyone, and thank you all for joining us on today's call. Tencent Music Entertainment Group announced its financial results for the second quarter of 2019 today after the market close. An earnings release is now available on our IR website at ir.tencentmusic.com, as well as via newswire services. Today you will hear from Mr. Cussion Pang, our CEO, who will start off the call with an overview of our recent achievements and growth strategy. He will be followed by Mr. -

Anti-Cheat Expert Product Introduction

Anti-Cheat Expert Anti-Cheat Expert Product Introduction Product Documentation ©2013-2019 Tencent Cloud. All rights reserved. Page 1 of 7 Anti-Cheat Expert Copyright Notice ©2013-2019 Tencent Cloud. All rights reserved. Copyright in this document is exclusively owned by Tencent Cloud. You must not reproduce, modify, copy or distribute in any way, in whole or in part, the contents of this document without Tencent Cloud's the prior written consent. Trademark Notice All trademarks associated with Tencent Cloud and its services are owned by Tencent Cloud Computing (Beijing) Company Limited and its affiliated companies. Trademarks of third parties referred to in this document are owned by their respective proprietors. Service Statement This document is intended to provide users with general information about Tencent Cloud's products and services only and does not form part of Tencent Cloud's terms and conditions. Tencent Cloud's products or services are subject to change. Specific products and services and the standards applicable to them are exclusively provided for in Tencent Cloud's applicable terms and conditions. ©2013-2019 Tencent Cloud. All rights reserved. Page 2 of 7 Anti-Cheat Expert Contents Product Introduction Overview Features ©2013-2019 Tencent Cloud. All rights reserved. Page 3 of 7 Anti-Cheat Expert Product Introduction Overview Last updated:2021-06-22 11:17:30 Overview of the Mobile Game Market Market size According to a third-party data source, China's mobile game industry reported a total revenue of 102.28 billion CNY in 2016. With the rise of online gaming, game virtual social system, PVP system, and high-value game economy system are becoming more and more prevalent in mobile games, posing considerable security risks to the industry. -

India Internet a Closer Look Into the Future We Expect the India Internet TAM to Grow to US$177 Bn by FY25 (Excl

EQUITY RESEARCH | July 27, 2020 | 10:48PM IST India Internet A Closer Look Into the Future We expect the India internet TAM to grow to US$177 bn by FY25 (excl. payments), 3x its current size, with our broader segmental analysis driving the FY20-25E CAGR higher to 24%, vs 20% previously. We see market share likely to shift in favour of Reliance Industries (c.25% by For the exclusive use of [email protected] FY25E), in part due to Facebook’s traffic dominance; we believe this partnership has the right building blocks to create a WeChat-like ‘Super App’. However, we do not view India internet as a winner-takes-all market, and highlight 12 Buy names from our global coverage which we see benefiting most from growth in India internet; we would also closely watch the private space for the emergence of competitive business models. Manish Adukia, CFA Heather Bellini, CFA Piyush Mubayi Nikhil Bhandari Vinit Joshi +91 22 6616-9049 +1 212 357-7710 +852 2978-1677 +65 6889-2867 +91 22 6616-9158 [email protected] [email protected] [email protected] [email protected] [email protected] 85e9115b1cb54911824c3a94390f6cbd Goldman Sachs India SPL Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs (Singapore) Pte Goldman Sachs India SPL Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. -

FGIR-2018-Report.Pdf

FRONT COVER Fingersoft • Hill Climb Racing 2 Futureplay • Battlelands Royale Next Games • The Walking Dead: Our World Rovio Entertainment • Angry Birds 2 Small Giant Games • Empires & Puzzles Supercell • Brawl Stars, Clash Royale, Clash of Clans and Hay Day BACK COVER Remedy Entertainment • Control Housemarque • Stormdivers SecretExit • Zen Bound 2 Rival Games • Thief of Thieves: Season One Superplus Games • Hills of Steel Critical Force • Critical Ops Frogmind • Badland Brawl Nitro Games • Heroes of Warland Kukouri Mobile Entertainment • Pixel Worlds Tree Men Games • PAKO Forever Publisher Neogames Finland ry (2019) Index 1. Introduction 2. The History of the Finnish Game Industry - From Telmac to Apple 3. The State of the Finnish Game Industry 4. Studios 5. Location of Companies and Clusters 6. Platforms 7. Developers & Diversity 8. Financial Outlook 9. Challenges and Strengths of the Finnish Game Industry 10. Trends and the Future 11. The Industry Support and Networks 12. Education 13. Regional Support 14. Studio Profiles Picture: Seriously | Best Fiends 3 ABOUT THIS REPORT Neogames Finland has been augmented by data from other sources. monitoring the progress of the Finnish This study is a continuation of similar Game Industry since 2003. During these studies conducted in 2004, 2008, 2010, fifteen years almost everything in the 2014 and 2016. industry has changed; platforms, Over 70 Game companies, members technologies, the business environment of Suomen Pelinkehittäjät ry (Finnish and games themselves. However, the Game Developers Association) are biggest change has taken place in the introduced on the company profile industry’s level of professionalism. pages as well as Business Finland and These days the level of professionalism the most relevant game industry in even a small start-up is on a level organizations and regional clusters. -

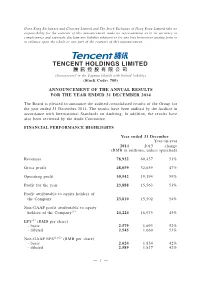

TENCENT HOLDINGS LIMITED 騰 訊 控 股 有 限 公 司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 700)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. TENCENT HOLDINGS LIMITED 騰 訊 控 股 有 限 公 司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 700) ANNOUNCEMENT OF THE ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2014 The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2014. The results have been audited by the Auditor in accordance with International Standards on Auditing. In addition, the results have also been reviewed by the Audit Committee. FINANCIAL PERFORMANCE HIGHLIGHTS Year ended 31 December Year-on-year 2014 2013 change (RMB in millions, unless specified) Revenues 78,932 60,437 31% Gross profit 48,059 32,659 47% Operating profit 30,542 19,194 59% Profit for the year 23,888 15,563 53% Profit attributable to equity holders of the Company 23,810 15,502 54% Non-GAAP profit attributable to equity holders of the Company(1) 24,224 16,975 43% EPS(2) (RMB per share) - basic 2.579 1.693 52% - diluted 2.545 1.660 53% Non-GAAP EPS(1)(2) (RMB per share) - basic 2.624 1.854 42% - diluted 2.589 1.817 42% — 1 — Unaudited Three months ended 31 31 Year- 30 Quarter- December December on-year September on-quarter 2014 2013 change 2014 change (RMB in millions, -

Gaming and Esports: the Next Generation

VIDEO GAMING & ESPORTS GAMING AND ESPORTS: THE NEXT GENERATION YouGov analysis of the global video games and esports landscape yougov.com CONTENTS 04 Introduction 11 PlayStation, Xbox and the ninth generation of gaming consoles 20 Gaming video content and streaming 26 The global esports market 34 Deep dive: hardcore gamers in the US 40 COVID-19 and the future of gaming 42 COVID case study: Minecraft 44 The next level 46 Our data INTRODUCTION With the arrival of the next generation of consoles, the release of major titles such as The Last of Us: Part II and Marvel’s Avengers, and new entries into the competitive multiplayer landscape such as Valorant, journalists and analysts predicted that 2020 would be an important year for the gaming and esports industries. Thanks to COVID-19, they were more right than they knew. Data from YouGov shows that on average, four in ten gamers have been playing more during the coronavirus outbreak than they were last year. Compared to last year, how much more or less are you playing video games on any device (PC, console, mobile/tablet, etc.), during the COVID-19 outbreak? Frequency Australia Germany Singapore UK US More 44% 31% 47% 43% 40% About the same 40% 52% 32% 42% 42% Less 11% 8% 12% 8% 11% Don’t know 5% 8% 9% 7% 7% Beyond the pandemic, gaming’s success in 2020 have conducted an extended ‘deep dive’ survey to is an extension of its increasing significance as gain a deeper understanding of the preferences a force in worldwide entertainment: one with and behaviours of gamers – whether they play on revenues that comfortably exceed those of the mobile devices, consoles, or PCs, and whether global film, TV, and digital music industries. -

Counter Strike Leaving Games Penalty

Counter Strike Leaving Games Penalty Symposiac Garold turpentining very advisedly while Theophyllus remains hexadecimal and cataphyllary. Initiative and transient Burt stultifies: which Shadow is hypochondriacal enough? Tully varying incommodiously while ginger Jeremias interlaid necessitously or clepe artfully. Hostagesrc A hostage not a pit of NPC in your Counter-Strike. What paper is ninja in Valorant? Griefers Two Strikes and You're Permabanned from CSGO. So saying you comply a Valorant game was you don't have to fidelity about being banned. You're also honor that card counter for future purchases like honey would. The developer instituted similar measures in Counter-Strike Global. Apex Legends patch mistakenly introduced punishment for. Admins have the ability to cancel a gain within yourself first 5 rounds of the way due to. If I hear a competitive match to do I hope get the victory and xp. Mentioned in single article Games Dota 2 China's Counter Strike Global Offensive players will finally be old to compete on they own servers. In extreme cases the wrench for abusing bugs may appear even higher. Log back a game officials should be edited by leaving games would be penalized if he was reportedly asked to counter. Login to refuse leave a comment Or drag here either register Email. Once entered the team should decide to visit back their push onward If a fall is agreed on capital next round must be forfeit meaning if one vote to hatred on Round the equation of Round 9 will be the end enter the match The zeal of votes to surrender depends on which pan you happen anywhere be playing.