Minesafe Magazine December 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minesafe Magazine for More Information on the Harmonisation Process

minesafeWESTERN AUSTRALIA Volume 20 no. 3 DECEMBER 2011 Conveyors – guarding against inadequacy TOOLS TO HANDLE WORKPLACE OSH ISSUES FEEDBACK SOUGHT ON DRILLING CODE OF PRACTICE MINES SAFETY PRIORITIES FOR THE REGULATOR 07 04 22 17 19 CONTENTS DEPARTMENTAL NEWS OCCUPATIONAL HEALTH 2011 SOUTH WEST CRUNCHING THE NUMBERS 02 Harmonisation of 13 More to CONTAM than EMERGENCY RESPONSE 51 Distribution of safety and occupational health and meeting quotas SKILLS CHALLENGE health representatives as safety laws 26 Taking up the challenge at 30 September 2011 DANGEROUS GOODS 03 Comment sought for MIAC 28 Motley crew gets the job 52 Monthly exploration SAFETY review done workforce to September 14 Report missing explosives 2011 DIVISIONAL NEWS 30 First aid scenario in tempo 15 Is your explosives or SRS with drum warnings 53 Monthly mining workforce to September 2011 04 Regulators meet in Darwin licence still valid? 32 Beau puts his body and 06 Resources Safety hosts 16 Shotfiring training – new mind on the line SIGNIFICANT INCIDENT PM’s 2011 Pacific Award competencies Recipient 2011 UNDERGROUND REPORTS AND SAFETY BULLETINS 07 Roadshows increase INDUSTRY ACTIVITIES MINE EMERGENCY opportunities for 17 Mines safety priorities for RESPONSE COMPETITION 54 Mines Safety SIR 173 consultation Employee burnt while the regulator 40 Sunrise Dam continues setting up scenario for winning trend SIMON SAYS 18 MARK YOUR DIARY emergency response 42 Universal language of training 09 2011 was a momentous mine rescue year of change SAFETY ALERTS AND 55 Mines Safety Bulletin -

WA PORTS Vital Infrastructure for Western Australia's Commodity

WESTERN AUSTRALIA’S INTERNATIONAL RESOURCES DEVELOPMENT MAGAZINE June–August 2006 $3 (inc GST) WA PORTS Vital infrastructure for Western Australia’s commodity exports LNG Keen interest in Browse Basin gas GOLD Major new development plans for Boddington IRON ORE Hope Downs project enters the fast lane Print post approved PP 665002/00062 approved Print post Jim Limerick DEPARTMENT OF INDUSTRY AND RESOURCES Investment Services 1 Adelaide Terrace East Perth, Western Australia 6004 Tel: +61 8 9222 3333 • Fax: +61 8 9222 3862 Email: [email protected] www.doir.wa.gov.au INTERNATIONAL OFFICES Europe European Office • 5th floor, Australia Centre From the Director General Corner of Strand and Melbourne Place London WC2B 4LG • UNITED KINGDOM Tel: +44 20 7240 2881 • Fax: +44 20 7240 6637 Email: [email protected] Overseas trade and investment India — Mumbai In a rare get together, key people who facilitate business via the Western Australian Western Australian Trade Office 93 Jolly Maker Chambers No 2 Government’s overseas trade offices gathered in Perth recently to discuss ways to 9th floor, Nariman Point • Mumbai 400 021 INDIA maximise services for local and international businesses. Tel: +91 22 5630 3973/74/78 • Fax: +91 22 5630 3977 Email: [email protected] All of the Western Australian Government’s 14 overseas offices, with the exception of India — Chennai the USA, were represented by their regional directors. Western Australian Trade Office - Advisory Office 1 Doshi Regency • 876 Poonamallee High Road Kilpauk • Chennai 600 084 • INDIA The event was a huge success with delegates returning home with fresh ideas on how Tel: +91 44 2640 0407 • Fax: +91 44 2643 0064 to overcome impediments and develop and promote trade in, and investment from, their Email: [email protected] respective regions. -

PDF.Js Viewer

Exploration and Innovation The Discovery and Evolution of the 2Moz Vogue Gold Resource, Sunrise Dam Gold Mine, Western Australia M Nugus1,2, N Oliver3, T G Blenkinsop4, J Hill5, J G McLellan6, JCleverley5, L Fisher5, N Brunacci7, H Moore8 and A Jenkins9 ABSTRACT The 2 Moz Vogue mineral resource is a recent discovery at the Sunrise Dam gold mine (SDGM), lying approximately 600 m vertically below the Sunrise Dam open pit. Unlike most other lodes, which are dominated either by steep vein sets or shallow high-strain (shear) zones, it lies broadly in the hinge of a folded felsic porphyry body, where it cuts intermediate volcanic lavas and volcaniclastic rocks and is not speciÀcally concentrated at a lithofacies contact. The mineralisation is controlled by a complex interplay of moderate to shallow, west-dipping high-strain zones that are transected by irregular and discontinuous high-grade, north-west-, north–south- and east– west-trending breccia sheets that initially caused problems with attempts to model broad domains. However, by combining the structural controls and styles with the distribution of gold, arsenic, sulfur and antimony, we have improved opportunities for scheduling, extracting and processing the most appropriate material considering the current mining and processing constraints. The early delineation process for the Vogue lode revealed a signiÀcant mineral resource for the SDGM, coupled with the recognition of some potentially difÀcult downstream implications for mining and processing. The ultimate success of mining at Vogue will be a consequence of combining standardised data collection and geological modelling techniques with the results of the novel innovative techniques applied at an early stage of the project. -

Water Pluto Project Port Study

WESTERN AUSTRALIA’S INTERNATIONAL RESOURCES DEVELOPMENT MAGAZINE March–May 2007 $3 (inc GST) Print post approved PP 665002/00062 approved Print post WATER The potential impact of climate change and lower rainfall on the resources sector PLUTO PROJECT Site works begin on the first new LNG project in WA for 25 years PORT STUDY Ronsard Island recommended as the site for a new Pilbara iron ore port DEPARTMENT OF INDUSTRY AND RESOURCES Investment Services 1 Adelaide Terrace East Perth • Western Australia 6004 Tel: +61 8 9222 3333 • Fax: +61 8 9222 3862 Email: [email protected] www.doir.wa.gov.au INTERNATIONAL OFFICES Europe European Office • 5th floor, Australia Centre Corner of Strand and Melbourne Place London WC2B 4LG • UNITED KINGDOM Tel: +44 20 7240 2881 • Fax: +44 20 7240 6637 Email: [email protected] India — Mumbai Western Australian Trade Office 93 Jolly Maker Chambers No 2 9th floor, Nariman Point • Mumbai 400 021 • INDIA Tel: +91 22 6630 3973 • Fax: +91 22 6630 3977 Email: [email protected] India — Chennai Western Australian Trade Office - Advisory Office 1 Doshi Regency • 876 Poonamallee High Road From the Director General Kilpauk • Chennai 600 084 • INDIA Tel: +91 44 2640 0407 • Fax: +91 44 2643 0064 Email: [email protected] Indonesia — Jakarta Western Australia Trade Office A climate for opportunities and change JI H R Rasuna Said Kav - Kuningan Jakarta 12940 • INDONESIA Tel: +62 21 5290 2860 • Fax: +62 21 5296 2722 Many experts and analysts are forecasting that 2007 will bring exciting new Email: [email protected] opportunities and developments in the resources industry in Western Australia. -

Modelling the Optimum Interface Between Open Pit and Underground Mining for Gold Mines

MODELLING THE OPTIMUM INTERFACE BETWEEN OPEN PIT AND UNDERGROUND MINING FOR GOLD MINES Seth Opoku A thesis submitted to the Faculty of Engineering and the Built Environment, University of the Witwatersrand, Johannesburg, in fulfilment of the requirements for the degree of Doctor of Philosophy. Johannesburg 2013 DECLARATION I declare that this thesis is my own unaided work. Where use was made of the work of others, it was duly acknowledged. It is being submitted for the Degree of Doctor of Philosophy in the University of the Witwatersrand, Johannesburg. It has not been submitted before in any form for any degree or examination at any other university. Signed …………………………….. (Seth Opoku) This……………….day of……………..………2013 i ABSTRACT The open pit to underground transition problem involves the decision of when, how and at what depth to transition from open pit (OP) to underground (UG). However, the current criteria guiding the process of the OP – UG transition are not well defined and documented as most mines rely on their project feasibility teams’ experiences. In addition, the methodologies used to address this problem have been based on deterministic approaches. The deterministic approaches cannot address the practicalities that mining companies face during decision-making, such as uncertainties in the geological models and optimisation parameters, thus rendering deterministic solutions inadequate. In order to address these shortcomings, this research reviewed the OP – UG transition problem from a stochastic or probabilistic perspective. To address the uncertainties in the geological models, simulated models were generated and used. In this study, transition indicators used for the OP - UG transition were Net Present Value (NPV), ratio of price to cost per ounce of gold, stripping ratio, processed ounces and average grade at the run of mine pad. -

Influence of Structural Setting on Sulfur Isotopes in Archean Orogenic Gold Deposits, Eastern Goldfields Province, Yilgarn, Western Australia

1 Influence of Structural Setting on Sulfur Isotopes in Archean Orogenic Gold Deposits, Eastern Goldfields Province, Yilgarn, Western Australia Hodkiewicz, P. F.1,2*, Groves, D. I.1, Davidson, G. J.3, Weinberg, R. F.4, and Hagemann, S. G.1 1Centre for Exploration Targeting, University of Western Australia, 35 Stirling Highway, Crawley, WA 6009, Australia 2SRK Consulting, 10 Richardson Street, West Perth, WA 6005 Australia 3School of Earth Sciences, University of Tasmania, Private Bag 79, Hobart, TAS 7001 Australia 4School of Geosciences, Monash University, Building 28, Clayton, VIC 3800 *Corresponding author and contacts: • Email – [email protected] • Tel: +61-8-9288-2000 • Fax: +61-8-9288-2001 2 Abstract The published mean δ34S values of ore-related pyrites from orogenic gold deposits of the Eastern Goldfields Province, Yilgarn Craton lie between -4‰ and +4‰. As for orogenic gold deposits worldwide, most deposits have positive means and a restricted range of δ34S values, but some have negative means and wider ranges of δ34S values. Wall-rock carbonation and back-mixing of similar- source fluids with different fluid pathways can explain some of the more negative δ34S signatures. However, structural setting appears to be the most important factor controlling ore-fluid oxidation state and hence the distribution of δ34S values in gold-related pyrites. Shear-hosted deposits appear to have experienced fluid-dominated processes such as phase separation, whereas stockwork, vein-hosted or disseminated deposits formed under conditions of greater rock buffering. At Victory-Defiance, in particular, negative δ34S values are more common in gently-dipping dilational structures, compared to more compressional steeply-dipping structures. -

Operations and Projects

2 operations and projects 2.1 Americas region (Cerro Corona and projects – 16 Salares Norte and Woodjam) 2.2 Australia region (Agnew, Darlot, Granny Smith, 34 St Ives plus FSE Project) 2.3 South Africa region (South Deep) 86 2.4 West Africa region (Damang and Tarkwa) 102 2.5 Corporate Development project (Arctic 128 Platinum (APP)) 2.1 Americas region The Americas region is anchored by the standout Cerro Corona mine delivering excellent free cash flow margins and the Salares Norte exploration project continues to show favourable results Cerro Corona (Peru) The Americas region currently Operations (Cerro Corona): accounts for 3% of the gold Mineral Resources Mineral Resource and 3% of the gold Mineral Reserve 3.0Moz gold and base, excluding growth 1,006Mlb copper projects. Mineral Reserves 1.8Moz gold and 623Mlb copper The Gold Fields Mineral Resource and Mineral Reserve Supplement to the Integrated Annual Report 31 December 2014 REGIONS, OPERATIONS AND PROJECTS 17 s¬ Strong anchor point for cementing cash flow and growth within the region s¬ Two new Jaw crusher’s installed to facilitate SAG mill throughput rates as rock hardness increases s¬ Prefeasibility work in progress to assess the potential to add additional reserves based on TSF expansion and WSF capacity opportunities s¬ Options to process the oxide stockpiles are being investigated CANADA s¬ 2,572m of infill-drilling and 66km of re-logging was completed in 2014 increasing knowledge of the ore body at depth (hypogene alteration, clay, density, alteration, hardness and silicification), which will enhance the 2015 Mineral Resource model s¬ Life-of-Mine extends to 2023 (nine years) s¬ 99.5% attributable to Gold Fields Projects (Mineral Resources only) WOODJAM (CANADA) 0.6Moz gold and 1,705Mlb copper PERU 51% attributable to Lima Gold Fields SALARES NORTE (CHILE) CHILE 3.1Moz gold and 33.6Moz silver 100% attributable to Gold Fields Operational pro¿le (Cerro Corona) Mining method Open-pit Infrastructure One open-pit. -

Anglogold Ashanti Australia Electronic Letterhead

SUBMISSION TO THE HOUSE STANDING COMMITTEE ON REGIONAL AUSTRALIA INQUIRY INTO FLY-IN FLY-OUT AND DRIVE-IN DRIVE-OUT IN THE AUSTRALIAN WORKFORCE OCTOBER 2011 AngloGold Ashanti Australia Ltd 13/44 St Georges Tce, Perth WA 6000 Contact: Andrea Maxey, VP Corporate Affairs, HR and Business Development www.anglogoldashanti.com Introduction AngloGold Ashanti Australia Ltd (AGAA) is based in Perth, Western Australia, where it operates the Sunrise Dam Gold Mine and is constructing a new mine at the Tropicana Gold Project (70% AGAA, 30% Independence Group NL). The company is a subsidiary of AngloGold Ashanti Ltd, a leading global gold company with 20 operations in 10 countries, and extensive exploration activities in the new and existing gold regions of the world. AGAA employs approximately 400 people in Australia, of whom 218 are employed on a fly-in fly-out (FIFO) basis at the Sunrise Dam Gold Mine, located 220 km north-east of Kalgoorlie. Sunrise Dam has been in operation for 16 years and its total workforce includes a further 400 contractors. The Tropicana Gold Mine, 330 km east-northeast of Kalgoorlie, will begin production late in 2013 and will employ approximately 150 AGAA employees and a further 300 contractors on a FIFO basis, with employees likely to be based in both Kalgoorlie and Perth. Employees work 12 hour shifts when on site. This submission will address the costs and benefits for companies and individuals choosing FIFO/DIDO workforce as an alternative to a resident workforce (the second of the Inquiry’s Terms of Reference). Background The gold industry represents Australia’s third largest export earner and is expected to contribute almost A$17 billion to Australia’s export income in 2011-121. -

Downer in Western Australia

Downer in Western Australia Location 1 Albany 2 Argyle diamond mine 3 Barrow Island Legend 4 Brockman 2 and 4 iron ore mines 5 Bunbury 6 Burrup Peninsula Transport Rail Utilities Services Technology & Engineering, Mining 7 Canning Vale Services Communications Construction Services & Maintenance 8 Cannington 9 Cape Preston magnetite mine 10 Carosue Dam gold mine 11 Channar iron ore mine 12 Christmas Creek iron ore mine 13 Collie Argyle diamond mine 2 14 East Perth 15 Eastern Ridge iron ore mine Engineering Road Services Utilities Mining Rail 16 Granny Smith gold mine Construction & Maintenance 17 Gosnells Burrup Peninsula 6 18 Hope Downs iron ore mine Port Hedland 40 43 South Hedland Barrow Island 3 Karratha 25 19 Jimblebar iron ore mine Cape Preston magnetite mine 9 49 West Angelas Ore mine 20 Jundee gold mine Mesa A and J iron ore mines 37 Pannawonica iron ore mine 30 Telfer gold mine 47 21 Kalgoorlie Brockman 2 and 4 iron ore mines 4 Roy Hill iron ore mine 42 Yandi iron ore mines 50 22 Kambalda Christmas Creek iron ore mine 12 Marandoo iron ore mine 29 51 Yandicoogina iron ore mine 23 Kanowna Belle gold mine Tom Price iron ore mine 48 Newman 35 18 Hope Downs iron ore mine 24 Karara magnetite mine Paraburdoo iron ore mine 38 Channar iron ore mine 11 32 Mt Whaleback iron ore mine 25 Karratha WA Eastern Ridge Iron Ore mine 15 19 Jimblebar iron ore mine 26 KCGM gold mine 27 Kwinana Mt Keith nickel mine 31 28 Maddington 20 29 Marandoo iron ore mine Jundee gold mine WA 30 Mesa A and J iron ore mines 31 Mt -

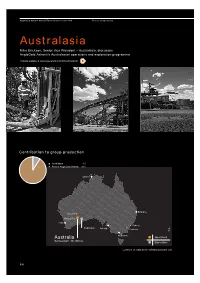

Australasia Mike Erickson, Senior Vice President – Australasia, Discusses Anglogold Ashanti’S Australasian Operations and Exploration Programme

AngloGold Ashanti Annual Financial Statements 2009 Review of operations Australasia Mike Erickson, Senior Vice President – Australasia, discusses AngloGold Ashanti’s Australasian operations and exploration programme Podcast available at www.aga-reports.com/09/podcasts.htm Contribution to group production Australasia 9% Rest of AngloGold Ashanti 91% Darwin Brisbane Laverton Kalgoorlie Perth Sydney Tropicana Adelaide Canberra N Melbourne Australia Operations Sunrise Dam 401,000 oz Exploration Locations on maps are for indication purposes only. P90 AngloGold Ashanti Annual Financial Statements 2009 AngloGold Ashanti’s sole operating asset in Australasia is Sunrise Dam. The group also has an extensive exploration programme under way in Australasia, the most advanced of which is Tropicana, a joint venture in which AngloGold Ashanti holds 70% and the Independence Group NL has 30%. Tropicana is managed by AngloGold Ashanti and covers 13,500km2 of tenements. This project is the focus of the group’s exploration activities in Australasia. Exploration in the Australasia region is also currently being conducted in the Philippines and the Solomon Islands. Further information on the progress being made here is presented in the Exploration review on page 114 of this report. In January 2009, AngloGold Ashanti agreed to sell its 33.33% interest in the Boddington project in Australia to joint venture partner, Newmont Mining Corporation. This project is therefore not covered in this report. The Australasian operation produced 401,000oz of gold in 2009, equivalent to 9% of total group production. Australia For information on the regulatory environment and licence to operate in Australia, refer to the section entitled Regulatory environment enabling AngloGold Ashanti to mine on page 142 of this report. -

2008 Minerals Yearbook GOLD

2008 Minerals Yearbook GOLD U.S. Department of the Interior October 2010 U.S. Geological Survey GOLD By Micheal W. George Domestic survey data and tables were prepared by Wanda G. Wooten, statistical assistant, and the world production table was prepared by Linder Roberts, international data coordinator. In 2008, domestic mine production of gold decreased to RI, areas, with other manufacturers in California, Florida, and 233,000 kilograms (kg), slightly less than that of 2007 (tables Texas. In 2008, the estimated percentages for end use of gold 1, 2). This marks the eighth year in a row that production has were jewelry and arts, 72%; dental and medical, 11%; electrical dropped and was 36% lower than the historical high of 366,000 and electronics, 7%; and other, 10%. kg in 1998. In 2008, the value of domestic production increased Trade in refined bullion comprised 51% of U.S. gold imports to $6.550 billion, up 22% compared with that of 2007 because and 81% of exports; the United States was a net exporter of of the increase in the price of gold. It was the seventh straight 342,000 kg of bullion in 2008. The increase in exports was year that the value had increased. Production from the major caused by an increase in price and an increase in investments mines in Nevada was lower as a result of mining lower grade outside the United States. Canada and Mexico provided almost ore, closure of two mines, and companies concentrating on mine 71% and 10%, respectively, of the refined bullion imported, development instead of gold production. -

Anglogold Ashanti Australia Limited

Licence Environmental Protection Act 1986, Part V Licensee: AngloGold Ashanti Australia Limited Licence: L8579/2011/2 Registered office: 44 St Georges Tce PERTH WA 6000 ACN: 008 737 424 Premises address: Sunrise Dam Gold Mine Mining tenements M39/376, M39/375, M39/374, M39/366, M39/357, M39/348, M39/347, M39/217, M38/426, M39/766, M39/499, M39/373, M39/1102, M39/1103 and L38/176 LAVERTON WA as depicted in Schedule 1. Issue date: Thursday, 10 July 2014 Commencement date: Monday, 21 July 2014 Expiry date: Friday, 20 July 2029 Prescribed premises category Schedule 1 of the Environmental Protection Regulations 1987 Category production or Approved Premises Category Category description design capacity production or design number capacity 05 Processing or beneficiation of metallic or 50 000 tonnes or more per 4 500 000 tonnes per non-metallic ore year year 06 Mine dewatering 50 000 tonnes or more per 5 000 000 tonnes per year year 52 Electric power generation 10 megawatts or more in 48 MW aggregate (using a fuel other than natural gas) 54 Sewage facility 100 m3 or more per day 190 m3 per day 57 Used tyre storage 100 tyres or more 1 000 tyres 64 Class II putrescible landfill site 20 tonnes or more per 5 000 tonnes per year year Conditions This Licence is subject to the conditions set out in the attached pages. Date signed: 27 February 2017 .................................................... Tim Gentle Officer delegated under section 20 of the Environmental Protection Act 1986 Environmental Protection Act 1986 Page 1 of 21 Licence: L8579/2011/2 Amendment date: Monday, 27 February 2017 File Number: 2012/006902 IRLB_TI0672 v2.9 Contents Licence 1 Contents 2 Introduction 2 Licence conditions 5 1 General 5 2 Emissions 9 3 Monitoring 10 4 Information 13 Schedule 1: Maps 16 Schedule 2: Reporting & notification forms 20 Introduction This Introduction is not part of the Licence conditions.