Anglogold Ashanti Australia Electronic Letterhead

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minesafe Magazine for More Information on the Harmonisation Process

minesafeWESTERN AUSTRALIA Volume 20 no. 3 DECEMBER 2011 Conveyors – guarding against inadequacy TOOLS TO HANDLE WORKPLACE OSH ISSUES FEEDBACK SOUGHT ON DRILLING CODE OF PRACTICE MINES SAFETY PRIORITIES FOR THE REGULATOR 07 04 22 17 19 CONTENTS DEPARTMENTAL NEWS OCCUPATIONAL HEALTH 2011 SOUTH WEST CRUNCHING THE NUMBERS 02 Harmonisation of 13 More to CONTAM than EMERGENCY RESPONSE 51 Distribution of safety and occupational health and meeting quotas SKILLS CHALLENGE health representatives as safety laws 26 Taking up the challenge at 30 September 2011 DANGEROUS GOODS 03 Comment sought for MIAC 28 Motley crew gets the job 52 Monthly exploration SAFETY review done workforce to September 14 Report missing explosives 2011 DIVISIONAL NEWS 30 First aid scenario in tempo 15 Is your explosives or SRS with drum warnings 53 Monthly mining workforce to September 2011 04 Regulators meet in Darwin licence still valid? 32 Beau puts his body and 06 Resources Safety hosts 16 Shotfiring training – new mind on the line SIGNIFICANT INCIDENT PM’s 2011 Pacific Award competencies Recipient 2011 UNDERGROUND REPORTS AND SAFETY BULLETINS 07 Roadshows increase INDUSTRY ACTIVITIES MINE EMERGENCY opportunities for 17 Mines safety priorities for RESPONSE COMPETITION 54 Mines Safety SIR 173 consultation Employee burnt while the regulator 40 Sunrise Dam continues setting up scenario for winning trend SIMON SAYS 18 MARK YOUR DIARY emergency response 42 Universal language of training 09 2011 was a momentous mine rescue year of change SAFETY ALERTS AND 55 Mines Safety Bulletin -

IGO Interactive Annual Report 2020

2021 ANNUAL REPORT We believe in a green energy future. IGO Limited is an ASX 100 listed ACKNOWLEDGEMENTS Company focused on creating a We acknowledge the Traditional Owners of the land on better planet for future generations by which we operate and on which we work. We recognise their connection to land, waters and culture, and pay our discovering, developing, and delivering respects to their Elders past, present and emerging. products critical to clean energy. We would like to thank Neil Warburton who retired from the IGO Board in FY21 for his significant contribution to IGO over the last five years. WHO WE ARE We are also pleased to welcome two new appointments IGO Limited is an ASX 100 listed Company focused on to the Board, Xiaoping Yang as a Non-executive Director creating a better planet for future generations by discovering, and Michael Nossal as a Non-executive Director who developing, and delivering products critical to clean energy. transitioned to the Chair role on 1 July 2021. As a purpose-led organisation with strong, embedded values and a culture of caring for our people and our stakeholders, We would also like to take this opportunity to thank Peter we believe we are Making a Difference by safely, sustainably Bilbe, who was appointed to the IGO Board in 2009, for his and ethically delivering the products our customers need substantial contribution to the Company. Over his tenure, to advance the global transition to decarbonisation. Peter has overseen the positive transformation of IGO, culminating in the announcement on 30 June 2021 of the Through our upstream mining and downstream processing completion of the transaction with Tianqi Lithium Corporation. -

PDF.Js Viewer

Exploration and Innovation The Discovery and Evolution of the 2Moz Vogue Gold Resource, Sunrise Dam Gold Mine, Western Australia M Nugus1,2, N Oliver3, T G Blenkinsop4, J Hill5, J G McLellan6, JCleverley5, L Fisher5, N Brunacci7, H Moore8 and A Jenkins9 ABSTRACT The 2 Moz Vogue mineral resource is a recent discovery at the Sunrise Dam gold mine (SDGM), lying approximately 600 m vertically below the Sunrise Dam open pit. Unlike most other lodes, which are dominated either by steep vein sets or shallow high-strain (shear) zones, it lies broadly in the hinge of a folded felsic porphyry body, where it cuts intermediate volcanic lavas and volcaniclastic rocks and is not speciÀcally concentrated at a lithofacies contact. The mineralisation is controlled by a complex interplay of moderate to shallow, west-dipping high-strain zones that are transected by irregular and discontinuous high-grade, north-west-, north–south- and east– west-trending breccia sheets that initially caused problems with attempts to model broad domains. However, by combining the structural controls and styles with the distribution of gold, arsenic, sulfur and antimony, we have improved opportunities for scheduling, extracting and processing the most appropriate material considering the current mining and processing constraints. The early delineation process for the Vogue lode revealed a signiÀcant mineral resource for the SDGM, coupled with the recognition of some potentially difÀcult downstream implications for mining and processing. The ultimate success of mining at Vogue will be a consequence of combining standardised data collection and geological modelling techniques with the results of the novel innovative techniques applied at an early stage of the project. -

Anglogold Ashanti Limited (Anglogold Ashanti) Publishes a Suite of Reports to Record Its Overall Performance Annually

ANNUAL FINANCIAL ANNUAL FINANCIAL STATEMENTS ANNUAL FINANCIAL STATEMENTS STATEMENTS 2013 2013 GUIDE TO REPORTING AngloGold Ashanti Limited (AngloGold Ashanti) publishes a suite of reports to record its overall performance annually. The Annual Financial Statements 2013 addresses our statutory reporting requirements. The full suite of 2013 reports for AngloGold Ashanti Limited comprises: Annual Integrated Report 2013, the primary report; Annual Financial Statements 2013; Annual Sustainability Report 2013; and Mineral Resource and Ore Reserve Report 2013. Other reports available for the financial year are the operational and project profiles and country fact sheets. The full suite of 2013 reports have been furnished to the United States Securities and Exchange Commission (SEC) on Form 6-K. These reports are all available on our annual report portal at www.aga-reports.com. FOR NOTING: The following key parameters should be noted in respect of our reports: Production is expressed on an attributable basis unless otherwise indicated; Unless otherwise stated, $ or dollar refers to US dollars throughout this suite of reports; Group and company are used interchangeably, except for in the group and company annual financial statements; Statement of financial position and balance sheet are used interchangeably; and The company implemented an Enterprise Resource Planning System (ERP), i.e. SAP at all its operations, except for the Continental Africa region. ERP and SAP are used interchangeably. 1 VISION, MISSION AND VALUES To create value for our shareholders, our employees and our business and social partners through safely and responsibly exploring, mining and marketing our products. Our primary focus is gold, but we will pursue value creating opportunities in other minerals where we can leverage our existing assets, skills and experience to enhance the delivery of value. -

Water Pluto Project Port Study

WESTERN AUSTRALIA’S INTERNATIONAL RESOURCES DEVELOPMENT MAGAZINE March–May 2007 $3 (inc GST) Print post approved PP 665002/00062 approved Print post WATER The potential impact of climate change and lower rainfall on the resources sector PLUTO PROJECT Site works begin on the first new LNG project in WA for 25 years PORT STUDY Ronsard Island recommended as the site for a new Pilbara iron ore port DEPARTMENT OF INDUSTRY AND RESOURCES Investment Services 1 Adelaide Terrace East Perth • Western Australia 6004 Tel: +61 8 9222 3333 • Fax: +61 8 9222 3862 Email: [email protected] www.doir.wa.gov.au INTERNATIONAL OFFICES Europe European Office • 5th floor, Australia Centre Corner of Strand and Melbourne Place London WC2B 4LG • UNITED KINGDOM Tel: +44 20 7240 2881 • Fax: +44 20 7240 6637 Email: [email protected] India — Mumbai Western Australian Trade Office 93 Jolly Maker Chambers No 2 9th floor, Nariman Point • Mumbai 400 021 • INDIA Tel: +91 22 6630 3973 • Fax: +91 22 6630 3977 Email: [email protected] India — Chennai Western Australian Trade Office - Advisory Office 1 Doshi Regency • 876 Poonamallee High Road From the Director General Kilpauk • Chennai 600 084 • INDIA Tel: +91 44 2640 0407 • Fax: +91 44 2643 0064 Email: [email protected] Indonesia — Jakarta Western Australia Trade Office A climate for opportunities and change JI H R Rasuna Said Kav - Kuningan Jakarta 12940 • INDONESIA Tel: +62 21 5290 2860 • Fax: +62 21 5296 2722 Many experts and analysts are forecasting that 2007 will bring exciting new Email: [email protected] opportunities and developments in the resources industry in Western Australia. -

Independence Group NL

For personal use only Sustainability Report 2016 Creating a leading diversified mining company For personal use only sustaining our future managing the impact of our growth JOINT MESSAGE FROM THE CHAIRMAN AND CEO 2 ABOUT IGO 5 Who We Are 5 Vision, Mission and Values 6 Our Code of Conduct 8 Governance 9 APPROACH TO SUSTAINABILITY 11 Continual Improvement 12 About this Report 15 743 Stakeholders and Materiality 16 Stakeholder Engagement 18 people are ORGANISATIONAL PROFILE 21 employed at IGO The Mining and Exploration Process 23 Business Strategy 26 Management Systems 26 OPERATIONS 29 Tropicana Gold Mine 30 Independence Group NL (IGO) is an Long Operation 32 Jaguar Operation 34 ASX-listed diversified, mining and exploration GROWTH 37 company that is currently producing gold, Nova Project 38 Stockman Project 40 nickel, copper, zinc and silver from three Exploration 42 mining operations in Western Australia. IGO's Lake MacKay Project 44 Bryah Basin Project 45 world-class Nova Project will commence Salt Creek Project 45 production in December 2016. Fraser Range Project 46 Scandinavian Project 47 ECONOMIC IMPACT 49 Independence Group NL Operating Performance 50 ABN 46 092 786 304 FY16 Financial Performance 50 Socio-economic Contributions 50 Suite 4, Level 5 Procurement 51 South Shore Centre Customers 54 85 South Perth Esplanade South Perth WA 6151 SOCIAL IMPACT 57 Our People 58 Postal: PO Box 496 Safety 60 South Perth WA 6951 Occupational Health 63 Enquiries: Keith Ashby IGO Corporate Giving 66 Sustainability Manager Community Development and Assistance 66 Traditional Land Use 68 Telephone: +61 8 9238 8300 Native Title 70 Email: [email protected] Heritage Protection 71 Website: www.igo.com.au Statutory Compliance 71 Stakeholder Feedback 71 ENVIRONMENTAL IMPACT 73 Statistics related to hours worked as presented in Environmental Conditions 74 this report include both permanent full-time and Land and Biodiversity Management 75 part-time Independence Group NL (IGO) employees Flora and Fauna 76 and contractors. -

Modelling the Optimum Interface Between Open Pit and Underground Mining for Gold Mines

MODELLING THE OPTIMUM INTERFACE BETWEEN OPEN PIT AND UNDERGROUND MINING FOR GOLD MINES Seth Opoku A thesis submitted to the Faculty of Engineering and the Built Environment, University of the Witwatersrand, Johannesburg, in fulfilment of the requirements for the degree of Doctor of Philosophy. Johannesburg 2013 DECLARATION I declare that this thesis is my own unaided work. Where use was made of the work of others, it was duly acknowledged. It is being submitted for the Degree of Doctor of Philosophy in the University of the Witwatersrand, Johannesburg. It has not been submitted before in any form for any degree or examination at any other university. Signed …………………………….. (Seth Opoku) This……………….day of……………..………2013 i ABSTRACT The open pit to underground transition problem involves the decision of when, how and at what depth to transition from open pit (OP) to underground (UG). However, the current criteria guiding the process of the OP – UG transition are not well defined and documented as most mines rely on their project feasibility teams’ experiences. In addition, the methodologies used to address this problem have been based on deterministic approaches. The deterministic approaches cannot address the practicalities that mining companies face during decision-making, such as uncertainties in the geological models and optimisation parameters, thus rendering deterministic solutions inadequate. In order to address these shortcomings, this research reviewed the OP – UG transition problem from a stochastic or probabilistic perspective. To address the uncertainties in the geological models, simulated models were generated and used. In this study, transition indicators used for the OP - UG transition were Net Present Value (NPV), ratio of price to cost per ounce of gold, stripping ratio, processed ounces and average grade at the run of mine pad. -

Gold Industry Since 1851 YEARS 'In the Eyes of Most Australians, Gold Belongs to the Romantic Past

Australia's 21st Century Delivering value for Australia 165 RushGold Industry since 1851 YEARS 'In the eyes of most Australians, gold belongs to the romantic past. But as this book shows, it remains a mighty industry.' Professor Geoffrey Blainey AC | Historian Australia's 21st Century Gold Industry + 282t $16b $2.4b 27k $143 k PRODUCTION EXPORTS ROYALTIES EMPLOYMENT HIGH WAGES Australia produced Export earnings in Royalties paid by the More than 27,000 Average wages in the 9 million troy ounces in 2015-16. Australia industry since 2005-06. people were directly gold industry exceed 2015-16, 10 per cent of exports gold to more In 2014-15, the industry employed by the gold $140,000 – 70 per global gold production. than 55 countries. paid $317 million. industry in 2015. cent above average. Cadia Newcrest Mining Limited discovered the Cadia Hill orebody in 1992. Today, Cadia is one of Australia's largest gold mining operations. Since commercial production began in 1999, Cadia has produced more than 9 million ounces of gold. Image courtesy: Newcrest 'In the eyes of most Australians, gold belongs to the romantic past. But as this book shows, it remains a mighty industry.' Gulgong miners Miners try their luck at Gulgong in New South Wales (circa 1870). Records show the area produced 555,205 ounces of gold between 1870 and 1927, although the true figure is thought to be closer to 1 million ounces. Image courtesy: State Library of New South Wales 'The rush for Australian gold, which so excited the world, has never ended.' • Geoffrey Blainey AC Foreword by Professor Geoffrey Blainey AC Delivering value for Australia 165 since 1851 YEARS 165 golden years Australia’s first big rush in search of gold began in 1851. -

Influence of Structural Setting on Sulfur Isotopes in Archean Orogenic Gold Deposits, Eastern Goldfields Province, Yilgarn, Western Australia

1 Influence of Structural Setting on Sulfur Isotopes in Archean Orogenic Gold Deposits, Eastern Goldfields Province, Yilgarn, Western Australia Hodkiewicz, P. F.1,2*, Groves, D. I.1, Davidson, G. J.3, Weinberg, R. F.4, and Hagemann, S. G.1 1Centre for Exploration Targeting, University of Western Australia, 35 Stirling Highway, Crawley, WA 6009, Australia 2SRK Consulting, 10 Richardson Street, West Perth, WA 6005 Australia 3School of Earth Sciences, University of Tasmania, Private Bag 79, Hobart, TAS 7001 Australia 4School of Geosciences, Monash University, Building 28, Clayton, VIC 3800 *Corresponding author and contacts: • Email – [email protected] • Tel: +61-8-9288-2000 • Fax: +61-8-9288-2001 2 Abstract The published mean δ34S values of ore-related pyrites from orogenic gold deposits of the Eastern Goldfields Province, Yilgarn Craton lie between -4‰ and +4‰. As for orogenic gold deposits worldwide, most deposits have positive means and a restricted range of δ34S values, but some have negative means and wider ranges of δ34S values. Wall-rock carbonation and back-mixing of similar- source fluids with different fluid pathways can explain some of the more negative δ34S signatures. However, structural setting appears to be the most important factor controlling ore-fluid oxidation state and hence the distribution of δ34S values in gold-related pyrites. Shear-hosted deposits appear to have experienced fluid-dominated processes such as phase separation, whereas stockwork, vein-hosted or disseminated deposits formed under conditions of greater rock buffering. At Victory-Defiance, in particular, negative δ34S values are more common in gently-dipping dilational structures, compared to more compressional steeply-dipping structures. -

Downer in Western Australia

Downer in Western Australia Location 1 Albany 2 Argyle diamond mine 3 Barrow Island Legend 4 Brockman 2 and 4 iron ore mines 5 Bunbury 6 Burrup Peninsula Transport Rail Utilities Services Technology & Engineering, Mining 7 Canning Vale Services Communications Construction Services & Maintenance 8 Cannington 9 Cape Preston magnetite mine 10 Carosue Dam gold mine 11 Channar iron ore mine 12 Christmas Creek iron ore mine 13 Collie Argyle diamond mine 2 14 East Perth 15 Eastern Ridge iron ore mine Engineering Road Services Utilities Mining Rail 16 Granny Smith gold mine Construction & Maintenance 17 Gosnells Burrup Peninsula 6 18 Hope Downs iron ore mine Port Hedland 40 43 South Hedland Barrow Island 3 Karratha 25 19 Jimblebar iron ore mine Cape Preston magnetite mine 9 49 West Angelas Ore mine 20 Jundee gold mine Mesa A and J iron ore mines 37 Pannawonica iron ore mine 30 Telfer gold mine 47 21 Kalgoorlie Brockman 2 and 4 iron ore mines 4 Roy Hill iron ore mine 42 Yandi iron ore mines 50 22 Kambalda Christmas Creek iron ore mine 12 Marandoo iron ore mine 29 51 Yandicoogina iron ore mine 23 Kanowna Belle gold mine Tom Price iron ore mine 48 Newman 35 18 Hope Downs iron ore mine 24 Karara magnetite mine Paraburdoo iron ore mine 38 Channar iron ore mine 11 32 Mt Whaleback iron ore mine 25 Karratha WA Eastern Ridge Iron Ore mine 15 19 Jimblebar iron ore mine 26 KCGM gold mine 27 Kwinana Mt Keith nickel mine 31 28 Maddington 20 29 Marandoo iron ore mine Jundee gold mine WA 30 Mesa A and J iron ore mines 31 Mt -

The Mineral Industry of Australia in 2015

2015 Minerals Yearbook AUSTRALIA [ADVANCE RELEASE] U.S. Department of the Interior November 2018 U.S. Geological Survey The Mineral Industry of Australia By Spencer D. Buteyn During the past 10 years, Australia’s mineral industry fiscal year 2015, to 163,484 people from 177,670 (Department benefited from a significant boom in investment. This of Industry, Innovation, and Science, 2016a, p. 37; Australian investment was driven by increases in the prices of Australia’s Bureau of Statistics, 2017a, b). key mineral commodity exports—particularly coal and iron In calendar year 2015, the net inflow of foreign direct ore—owing largely to high demand in China, which was investment (FDI) in mining totaled AUD15.3 billion Australia’s largest export market. In the past few years, however, (US$11.4 billion), which was a 57% decrease from that of 2014. China’s slowing economic growth led to lower demand and Mining accounted from 51% of Australia’s total net inflow decreases in the prices of coal and iron ore, which negatively of FDI. The total net inflow of FDI to Australia from Japan affected Australia’s export revenue. In 2015, Australia’s mineral increased by 145% to AUD14.1 billion (US$10.5 billion) and sector continued the transition from an investment phase to accounted for 48% of Australia’s total, making Japan the leading a production phase. Investment in mining, which peaked in source of FDI to Australia. The United States accounted for 2013, decreased by 30% in fiscal year 2016.1 This decrease in the second largest share of Australia’s total net inflow of FDI, investment was attributed to decreased international demand accounting for 33%. -

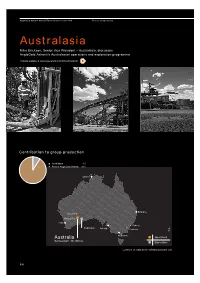

Australasia Mike Erickson, Senior Vice President – Australasia, Discusses Anglogold Ashanti’S Australasian Operations and Exploration Programme

AngloGold Ashanti Annual Financial Statements 2009 Review of operations Australasia Mike Erickson, Senior Vice President – Australasia, discusses AngloGold Ashanti’s Australasian operations and exploration programme Podcast available at www.aga-reports.com/09/podcasts.htm Contribution to group production Australasia 9% Rest of AngloGold Ashanti 91% Darwin Brisbane Laverton Kalgoorlie Perth Sydney Tropicana Adelaide Canberra N Melbourne Australia Operations Sunrise Dam 401,000 oz Exploration Locations on maps are for indication purposes only. P90 AngloGold Ashanti Annual Financial Statements 2009 AngloGold Ashanti’s sole operating asset in Australasia is Sunrise Dam. The group also has an extensive exploration programme under way in Australasia, the most advanced of which is Tropicana, a joint venture in which AngloGold Ashanti holds 70% and the Independence Group NL has 30%. Tropicana is managed by AngloGold Ashanti and covers 13,500km2 of tenements. This project is the focus of the group’s exploration activities in Australasia. Exploration in the Australasia region is also currently being conducted in the Philippines and the Solomon Islands. Further information on the progress being made here is presented in the Exploration review on page 114 of this report. In January 2009, AngloGold Ashanti agreed to sell its 33.33% interest in the Boddington project in Australia to joint venture partner, Newmont Mining Corporation. This project is therefore not covered in this report. The Australasian operation produced 401,000oz of gold in 2009, equivalent to 9% of total group production. Australia For information on the regulatory environment and licence to operate in Australia, refer to the section entitled Regulatory environment enabling AngloGold Ashanti to mine on page 142 of this report.