2015 International Report on Mountain Tourism

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Module No. 1840 1840-1

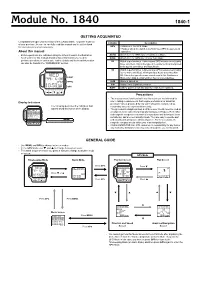

Module No. 1840 1840-1 GETTING ACQUAINTED Congratulations upon your selection of this CASIO watch. To get the most out Indicator Description of your purchase, be sure to carefully read this manual and keep it on hand for later reference when necessary. GPS • Watch is in the GPS Mode. • Flashes when the watch is performing a GPS measurement About this manual operation. • Button operations are indicated using the letters shown in the illustration. AUTO Watch is in the GPS Auto or Continuous Mode. • Each section of this manual provides basic information you need to SAVE Watch is in the GPS One-shot or Auto Mode. perform operations in each mode. Further details and technical information 2D Watch is performing a 2-dimensional GPS measurement (using can also be found in the “REFERENCE” section. three satellites). This is the type of measurement normally used in the Quick, One-Shot, and Auto Mode. 3D Watch is performing a 3-dimensional GPS measurement (using four or more satellites), which provides better accuracy than 2D. This is the type of measurement used in the Continuous LIGHT Mode when data is obtained from four or more satellites. MENU ALM Alarm is turned on. SIG Hourly Time Signal is turned on. GPS BATT Battery power is low and battery needs to be replaced. Precautions • The measurement functions built into this watch are not intended for Display Indicators use in taking measurements that require professional or industrial precision. Values produced by this watch should be considered as The following describes the indicators that reasonably accurate representations only. -

LIECHTENSTEIN the 341 © Lonely Planet Publications Planet Lonely © Malbun Triesenberg Schloss Vaduz Trail LANGUAGE: GERMAN LANGUAGE: Fürstensteig

© Lonely Planet Publications 341 Liechtenstein If Liechtenstein didn’t exist, someone would have invented it. A tiny mountain principality governed by an iron-willed monarch in the heart of 21st-century Europe, it certainly has novelty value. Only 25km long by 12km wide (at its broadest point) – just larger than Man- hattan – Liechtenstein doesn’t have an international airport, and access from Switzerland is by local bus. However, the country is a rich banking state and, we are told, the world’s largest exporter of false teeth. Liechtensteiners sing German lyrics to the tune of God Save the Queen in their national anthem and they sure hope the Lord preserves their royals. Head of state Prince Hans Adam II and his son, Crown Prince Alois, have constitutional powers unmatched in modern Europe but most locals accept this situation gladly, as their monarchs’ business nous and, perhaps also, tourist appeal, help keep this landlocked sliver of a micro-nation extremely prosperous. Most come to Liechtenstein just to say they’ve been, and tour buses disgorge day- trippers in search of souvenir passport stamps. If you’re going to make the effort to come this way, however, it’s pointless not to venture further, even briefly. With friendly locals and magnificent views, the place comes into its own away from soulless Vaduz. In fact, the more you read about Fürstentum Liechtenstein (FL) the easier it is to see it as the model for Ruritania – the mythical kingdom conjured up in fiction as diverse as The Prisoner of Zenda and Evelyn Waugh’s Vile Bodies. -

From Slovenian Farms Learn About Slovenian Cuisine with Dishes Made by Slovenian Housewives

TOURISM ON FARMS IN SLOVENIA MY WAY OF COUNTRYSIDE HOLIDAYS. #ifeelsLOVEnia #myway www.slovenia.info www.farmtourism.si Welcome to our home Imagine the embrace of green 2.095.861 surroundings, the smell of freshly cut PEOPLE LIVE grass, genuine Slovenian dialects, IN SLOVENIA (1 JANUARY 2020) traditional architecture and old farming customs and you’ll start to get some idea of the appeal of our countryside. Farm 900 TOURIST tourism, usually family-owned, open their FARMS doors and serve their guests the best 325 excursion farms, 129 wineries, produce from their gardens, fields, cellars, 31 “Eights” (Osmice), smokehouses, pantries and kitchens. 8 camping sites, and 391 tourist farms with Housewives upgrade their grandmothers’ accommodation. recipes with the elements of modern cuisine, while farm owners show off their wine cellars or accompany their guests to the sauna or a swimming pool, and their MORE THAN children show their peers from the city 200.000 how to spend a day without a tablet or a BEE FAMILIES smartphone. Slovenia is the home of the indigenous Carniolan honeybee. Farm tourism owners are sincerely looking Based on Slovenia’s initiative, forward to your visit. They will help you 20 May has become World Bee Day. slow down your everyday rhythm and make sure that you experience the authenticity of the Slovenian countryside. You are welcome in all seasons. MORE THAN 400 DISTINCTIVE LOCAL AND REGIONAL FOODSTUFFS, DISHES AND DRINKS Matija Vimpolšek Chairman of the Association MORE THAN of Tourist Farms of Slovenia 30.000 WINE PRODUCERS cultivate grapevines on almost 16,000 hectares of vineyards. -

Hiking the Via Dinarica

Hiking the Via Dinarica 22 Days Hiking the Via Dinarica On this multi-country trek on one of Europe's least-explored mountain ranges, the Dinaric Alps, discover rich cultures and spellbinding landscapes of the Western Balkans. From Slovenia's capital, Ljubljana, across Croatia, Bosnia and Herzegovina, Montenegro, Kosovo and down to Albania — the 1,200-mile-long Via Dinarica is every hiker's dream come true. Raft whitewater rapids down Europe's largest canyon, marvel at old-growth forests and glacier-fed lakes, dip into the royal-blue Adriatic Sea, and tour Sarajevo's nostalgic old town. On this epic three-week adventure, the most challenging part is bidding farewell to the beautiful Balkans. Details Testimonials Arrive: Ljubljana, Slovenia "We made our way to the Balkans with a desire and willingness to experience whatever Via Dinarica Depart: Tirana, Albania offered. We enjoyed this stunning region from all angles and left with a great appreciation of its Duration: 22 Days natural and cultural beauty—it was truly difficult to leave." Group Size: 4-15 Guests Jen S. Minimum Age: 18 Years Old "I have traveled extensively around the world. The Activity Level: experience with MT Sobek was by far the best I have ever had. Thank you for such excellence." . Marianne W. REASON #01 REASON #02 REASON #03 The only North American company Follow local expert guides as explore On top of incredibly scenic to take you on this six country six national parks in six Western treks, hikers get to explore adventure, from Slovenia to Albania Balkan countries, and summit historical cities such as Mostar, trek in the Western Balkans. -

By Funitel to the Mont Parnes Casino Near Athens Rejuvenated Funicular

September 2006 No. 170 • 31st Year In Istanbul the underground funicular from the port of Kabatas to the transport hub Taksim was officially opened on June 29 By Funitel to the Mont Parnes Casino near Athens The combination lift Sunnegga-Blauherd in An installation with a host of special features p.2 Zermatt is the first installation in Switzerland Rejuvenated funicular in Mondovì with a 50-50 split of 8-seater gondolas Designer Giugiaro styled the vehicles for the 120-year-old railway p.8 and 6-seater chairs p. 18 Detachable quad chair in Bohemia The Czech Republic’s first CEN-compliant chair lift is in the Giant Mountains p.10 RPD improves operational safety What users say about the new rope position detection system p.17 Magazine for Customers and Employees 2 Doppelmayr/Garaventa-Gruppe Gondola ride to the casino The Mont Parnes Casino Greece currently has nine gaming opera- tel from Doppelmayr, which can still be near Athens is accessed tions. The Mont Parnes Casino Resort in used at wind force 10 (storms of approx. the Mt. Parnitha National Park is the fourth 100 km/h, 60 mph). (The old tram had to by a ropeway: Since largest with an annual revenue of around stop operating at wind speeds of around March, a Doppelmayr EUR 90 million1. The resort includes the 50 km/h, 30 mph). Funitel has provided this actual casino itself, a hotel, bar/café, service. The installation restaurant and meeting rooms. High wind stability The Mont Parnes resort can be reached has a host of special by ropeway; the infrastructure is currently Wind stability is extremely important be- features: e.g. -

June 21, 2017 Purpose: Update the Board Of

June21,2017 Purpose:UpdatetheBoardofDirectorsontheprocessofhiringamasterplanconsultantforthe downhillskiareaatTahoeDonnerAssociation. Background: Tahoe Donner’s current Downhill Ski Lodge was built by DART in 1970, with subsequent additions and remodels through the last 45 years, attempting to accommodate growingvisitationnumbersandservicelevels.Afewyearsago,theGeneralPlanCommittee’s DownhillSkiAreaSubͲgroupworkedtoprovideacomprehensive2013report,includinganalysis ofthefollowingmetricsoftheDownhillSkiOperations,seeattached; OnAugust6,2016,Aprojectinformationpaper(PIP)wasprovidedtotheBoardofDirectors,and duringthe2016BudgetProcess,a$50KDevelopmentFundbudgetwasidentifiedandapproved bytheBoardofDirectorsforexpenditurein2017.OnNovember10,2016,TheGPCinitiateda TaskForcetoregainthe2013momentum,toidentifyanddetailfurtheropportunitiesatthe DownhillSkiArea.InAprilof2017,theTaskForcereceivedapprovaltoproceedwiththeRFP processtosolicittwoindustryleaderswithexperienceinskiareamasterplanning,seeattached SOQ’s. Discussion: 1. BothconsultantsprovidedfeeproposalsbythedeadlineofJune16th.Afterqualifying bothproposals,bothwerethoroughandwellmatched,bothwithpositivereferences. 2. BothfeeproposalsarewithintheBoardapproved$50KDFbudgetfor2017. 3. Furtherclarificationsandquestionsarecurrentlyunderwaywithbothconsultants,so thatscoringresultsandweightingcanbefinalizedandtallied.Ifacontractcanbe executedinearlyJuly,thedraftreportcouldbeavailableandpresentedatthe SeptemberGPCMeeting,whichwouldreflectnearly80%ofthecontentinfinalreport. 4. Oncefeedbackisprovided,thefinalversionwouldbecompletedwithinsixweeks. -

Montenegro Guidebook

MONTENEGRO PREFACE Podgorica, the capital of Montenegro, lies in a broad plain crossed by five rivers and surrounded by mountains, just 20 kilometers from the Albanian border. The city has a population of around 180,000 people. Bombed into rubble during World War II, Podgorica was rebuilt into a modern urban center, with high-rise apartment buildings and new office and shopping developments. While the latest Balkan war had a low impact on the physical structures, the economic sanctions had a devastating effect on employment and infrastructure. With the help of foreign investment, urban renewal is evident throughout the city, but much of it may still appear run down. Podgorica has a European-style town center with a pedestrian- only walking street (mall) and an assortment of restaurants, cafes, and boutiques. To many, its principal attraction is as a base for the exploration of Montenegro’s natural beauty, with mountains and wild countryside all around and the stunning Adriatic coastline less than an hour away. This is a mountainous region with barren moorlands and virgin forests, with fast-flowing rivers and picturesque lakes; Skadar Lake in particular is of ecological significance. The coastline is known for its sandy beaches and dramatic coves: for example, Kotor – the city that is protected by UNESCO and the wonderful Cathedral of Saint Typhoon; the unique baroque Perast; Saint George and Our Lady of the Rock islands – all locations that tell a story of a lasting civilization and the wealth of the most wonderful bay in the world. The area around the city of Kotor is a UNESCO World Heritage site for its natural beauty and historic significance. -

Located in Tierra Del Fuego, 20 Minutes from the National Park And

Located in Tierra del Fuego, 20 minutes from the National Park and within Cerro Alarkén Natural Reserve, Arakur Ushuaia overlooks its stunningly beautiful locale from atop an outcrop just outside the city surrounded by stunning panoramic views, native forests, and natural terraces harmoniously integrated into the environment. Arakur Ushuaia is a member of The Leading Hotels of the World and it is the only resort in the Southern Patagonia to have become part of this exclusive group of hotels. Location Arakur Ushuaia extends along a spectacular natural balcony 800 feet above sea level in the mythical province of Tierra del Fuego. Surrounded by stunning panoramic views of the city of Ushuaia and of the Beagle Channel, Arakur Ushuaia is located just 10 minutes from the city and the port of Ushuaia and 20 minutes from the international airport and the Cerro Castor Ski Resort. Located within the Cerro Alarkén Nature Reserve close to Mount Alarken’s summit amidst 250 acres of native forests of lengas, ñires and coihues, diverse species of fauna and flora, the location offers the perfect balance between calmness and adventure. Accommodations The magnificent lobby welcomes the guests with its large windows, the warmth of their fireplaces, and a sophisticated décor made with fine materials from different Argentine regions, such as craft leather and South American aromatic wood. Arakur Ushuaia was created for enjoyment of the environment, and the hotel practices and promotes wise and sustainable use of resources. Over 100 rooms and suites are decorated with custom-made solid wood furniture, craft leather and the bathrooms are appointed with Hansgrohe faucets and Duravit bathroom appliances with Starck design. -

2014 International Report on Snow & Mountain Tourism

Laurent Vanat Consultant 19, Margelle CH-1224 Genève Tel / fax / messagerie : (+41) 022 349 84 40 Courriel : [email protected] Internet : www.vanat.ch 2014 International Report on Snow & Mountain Tourism Overview of the key industry figures for ski resorts t t a a n n a a V V t t n n e e r r April 2014 u u a a L L Table of contents Introduction ............................................................................. - 5 - Glossary ................................................................................... - 6 - The world ski market ................................................................ - 7 - Participating countries................................................................................... - 7 - Ski resorts and infrastructure ........................................................................ - 8 - Evolution of worldwide skier visits ............................................................... - 10 - Market share of worldwide skier visits .......................................................... - 11 - Skiers per region of origin ........................................................................... - 11 - International skiers flows ............................................................................ - 12 - Future trends in market share ..................................................................... - 14 - Comparative key figures.............................................................................. - 14 - General benchmarking ............................................................................... -

Mapa Engleski 2010.Indd

BASIC INFORMATION Montenegro belongs to the Middle Mediterranean region of southern Europe. It is located between 41°52’- 43°42’ north latitude and 18°26’- EXPLORE MONTENEGRO 20°22’ east longitude. Montenegro borders on Serbia to the north, Albania to the southeast, the Adriatic Sea to the south, and Croatia and Bosnia and Herzegovina to the west. Boka Kotorska Budvanska rivijera Sveti Stefan Total area: 13,812 km2 Population: 662,000 Whether you reach Boka Below the steep Like a ship made of rocks Length of borders: 614 km by land or by sea you will peaks of Mount which has gone aground, Capital: Podgorica (173,000 inhabitants) - the administrative and eco- be fascinated by its beauty. Lovćen lies the Sveti Stefan is anchored in the nomic centre To the visitor it appears the Bud vanska Riviera. central part of the Budvanska Historic capital: Cetinje - the historical and cultural centre mountains have cracked Strung along the Riviera. It was recorded for Length of sea coast: 293 km and let the sea in. This is coast southeast the first time in 1442 as a fish- Length of beaches: 73 km the southernmost fjord in of Budva are the ermen’s village. Since 1960 it The longest beach: Velika plaza, Ulcinj - 13,000 m Europe. High mountain pe- picturesque small has become a famous island The highest peak: Bobotov kuk (mountain Durmitor) - 2522m aks rise above the narrow towns of Sveti Ste- hotel with luxurious villas The largest lake: Skadar - 391 km2 coastline of Boka, protect- fan, Miločer, and and apartments. Isolated The deepest canyon: Tara - 1300 m ing the bay from the severe Petrovac. -

Oberhofen (SUI), November 2010 2

To the INTERNATIONAL SKI FEDERATION - Members of the FIS Council Blochstrasse 2 - National Ski Associations 3653 Oberhofen/Thunersee - Committee Chairmen Switzerland Tel +41 33 244 61 61 Fax +41 33 244 61 71 th Oberhofen, 9 November 2010 Short Summary FIS Council Meeting 6th November 2010, Oberhofen (SUI) Dear Mr. President, Dear Ski friends, In accordance with art. 32.2 of the FIS Statutes we take pleasure in sending you today the Short Summary of the most important decisions of the FIS Council Meeting, 6 th November 2010 in Oberhofen (SUI). 1. Members present The following Council Members were present at the meeting in Oberhofen, Switzerland on 6th November 2010: President Gian Franco Kasper, Vice-Presidents Yoshiro Ito, Janez Kocijancic, Bill Marolt and Sverre Seeberg, Members Mats Årjes, Dean Gosper, Alfons Hörmann, Roman Kumpost, Sung-Won Lee, Giovanni Morzenti, Vedran Pavlek, Eduardo Roldan, Peter Schröcksnadel, Patrick Smith, Matti Sundberg, Michel Vion and Secretary General Sarah Lewis. Guest: Urs Lehmann, President of the Swiss Ski Association. The Council clarified that the position of the attendance of the President of the host National Ski Association at a Council Meeting (who is not an elected Council Member) is only extended for the Council Meetings in the host nation. Furthermore, the Council highlighted the following article of the FIS Statutes: 30.5 Council Members act and vote as independent individuals and not as representatives of their National Association. Following the admission from Council Member Giovanni Morzenti that he has been convicted by a court in Cuneo, Italy of extortion, the Council decided to accept the proposal of Giovanni Morzenti to provisionally suspend himself as a Member of the FIS Council until such time as the case is concluded. -

Response to Comments

Response to Comments Table of Contents 1.0 Collation Summary ......................................................................................................................................... 1 1.1 Background ................................................................................................................................................ 1 1.2 Comment Procedure ................................................................................................................................... 1 1.3 Comment Tracking Method ........................................................................................................................ 2 2.0 Comments and Responses ............................................................................................................................... 2 3.0 Letters from Indian Tribes and Government Agencies ............................................................................... 238 Response to Comments Index By Resource Area: 02.0 – Non-Substantive Comments ............................................................................................................................... 3 03.0 – Out-of-Scope Comments .................................................................................................................................. 13 05.0 – General Comments ........................................................................................................................................... 29 10.0 – Climate and Snow Comments..........................................................................................................................