Mobile Payments Guide 2012 Offers Clarity and Sound Guidance to Manoeuver Through the Complex and Crowded Mobile Payments Environment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital Payments Company Descriptions

CREDIT SUISSE AG Sales and Trading Services Structured Products (ZUEF 1) Tel. +41 44 335 76 091 credit-suisse.com/derivatives Provided by S&P Capital IQ Digital Payments Company Descriptions 14 January 2015 Company / Country Description ACI Worldwide, Inc. develops, markets, installs, and supports software products and services for facili- ACI Worldwide Inc. tating electronic payments worldwide. The company offers products and services covering various domains, including online banking and cash management that manages payments and cash flows United States through the online or mobile channel; managing and processing monetary, non monetary, sales, and account origination financial transactions; and managing trade related transaction types. Blackhawk Network Holdings, Inc. provides various prepaid products and payment services. It distrib- Blackhawk Network utes digital media and e-commerce, dining, electronics, entertainment, fashion, gasoline, home im- Holdings Inc. provement, and travel closed loop gift cards; and single-use non-reloadable gift cards. The company also distributes prepaid handsets; and a range of prepaid wireless or cellular cards that are used to United States load airtime onto the prepaid handsets. Discover Financial Services, a bank holding company, provides a range of financial products and ser- vices in the United States. The company operates in two segments, Direct Banking and Payment Discover Financial Ser- Services. The Payment Services segment operates the Discover Network, a payment card transaction vices processing network for Discover-branded credit cards, as well as for credit, debit, and prepaid cards issued by third parties. This segment also operates the PULSE network, an electronic funds transfer United States network, which provides financial institutions issuing debit cards on the PULSE network with access to automated teller machines; and point-of-sale terminals at retail locations for debit card transactions. -

Xoom Rolls out Domestic Money Transfer Services in the U.S

Xoom Rolls Out Domestic Money Transfer Services in the U.S. November 12, 2019 PayPal's international money transfer service works with Walmart and Ria to offer cash pick-up in minutes at 4,700 Walmart and 175 Ria locations across the country SAN JOSE, Calif., Nov. 12, 2019 /PRNewswire/ -- Xoom, PayPal's international money transfer service, today rolled out the ability for customers to send money to recipients in the U.S. for the first time. Through strategic alliances with Walmart and Ria, Americans can now use Xoom to send money fast for cash pick-up typically in minutes at nearly 5,000 locations across the country*. Xoom's services potentially benefit more than 44 million foreign-born people in the U.S.1 who send remittances to family and friends in their home countries. With the introduction of domestic money transfer services, Xoom will now serve even more customers, including more than half of Americans who make domestic person-to-person (P2P) payments2. Using Xoom's mobile app or website, consumers will have the ability to send money quickly and securely for cash pick-up at any Walmart or Ria-owned store in the U.S. "Many of our customers in the U.S. already send money to loved ones in the country, and they usually prefer that the money is available right away," shared Julian King, Xoom's Vice President and General Manager. "This rollout reinforces our commitment to make money transfers fast, easy and affordable for everyone, whether they are at home or on-the-go." "At Ria, we are delighted to further consolidate our relationship with Xoom and Walmart," said Juan Bianchi, CEO of Euronet's Money Transfer Segment. -

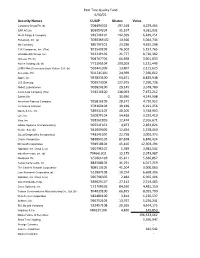

Pear Tree Quality Fund 6/30/21

Pear Tree Quality Fund 6/30/21 Security Names CUSIP Shares Value Compass Group Plc (b) '20449X302 197,348 4,229,464 SAP AG (b) '803054204 31,197 4,381,931 Wells Fargo & Company '949746101 142,399 6,449,251 Facebook, Inc. (a) '30303M102 14,566 5,064,744 3M Company '88579Y101 23,286 4,625,298 TJX Companies, Inc. (The) '872540109 76,502 5,157,765 UnitedHealth Group, Inc. '91324P102 21,777 8,720,382 Unilever Plc (b) '904767704 66,698 3,901,833 Roche Holding Ltd. (b) '771195104 109,203 5,131,449 LVMH Moët Hennessy-Louis Vuitton S.A. (b) '502441306 13,407 2,115,625 Accenture Plc 'G1151C101 24,969 7,360,612 Apple, Inc. '037833100 64,471 8,829,948 U.S. Bancorp '902973304 127,975 7,290,736 Abbott Laboratories '002824100 29,145 3,378,780 Coca-Cola Company (The) '191216100 138,093 7,472,212 Safran SA 0 30,650 4,249,998 American Express Company '025816109 28,572 4,720,952 Johnson & Johnson '478160104 38,189 6,291,256 Merck & Co., Inc. '589331107 48,205 3,748,903 Lyft, Inc. '55087P104 54,438 3,292,410 Visa, Inc. '92826C839 12,474 2,916,671 Adobe Systems Incorporated (a) '00724F101 4,873 2,853,824 Nestle, S.A. (b) '641069406 12,654 1,578,460 Quest Diagnostics Incorporated '74834L100 22,758 3,003,373 Oracle Corporation '68389X105 87,878 6,840,424 Microsoft Corporation '594918104 45,416 12,303,194 Alphabet, Inc. Class C (a) '02079K107 1,589 3,982,542 salesforce.com, inc. -

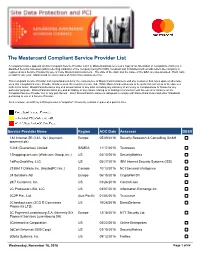

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Annual Report

2017 Annual Report 2018 Notice & Proxy Statement February 8, 2018 Dear Fellow Stockholder: You are cordially invited to attend the 2018 Annual Meeting of Stockholders of VeriFone Systems, Inc. (“Verifone”). We will hold the meeting on Thursday, March 22, 2018 at 8:30 a.m., local time, at Verifone’s principal offices located at 88 W. Plumeria Drive, San Jose, CA 95134. We hope that you will be able to attend. Details of the business to be conducted at the Annual Meeting are provided in the attached Notice of 2018 Annual Meeting of Stockholders (the “Notice of Annual Meeting”) and Proxy Statement. As a stockholder, you will be asked to vote on a number of important matters. We encourage you to vote on all matters listed in the enclosed Notice of Annual Meeting. The Board of Directors recommends a vote FOR the proposals listed as proposals 1, 2 and 3 in the Notice of Annual Meeting. Board Oversight. As a Board of Directors, we are actively engaged in the oversight of Verifone. As directors, each of us makes a commitment to the extensive time and rigor required to serve on the Board. During 2017, the Board’s discussions focused in particular on the Company’s objectives of scaling its next-generation devices and in linking the Company’s device footprint to the Company’s cloud infrastructure. We also continued to focus on the Company’s strategy to return to growth. We believe that the Company has made significant progress on its transformation and look forward to the Company continuing to implement its growth strategy. -

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

MOBILE Payments Market Guide 2013

MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM OVER 350 COMPANIES WORLDWIDE INSIDE Extensive global distribution via worldwide industry events As the mobile payments ecosystem is becoming increasingly more crowded and competitive, the roles of established and new players in the mobile market is shifting, with new opportunities and challenges facing each category of service providers. Efma, the global organization that brings together more than 3,300 retail financial services companies from over 130 countries, welcomes the publication of the Mobile Payments Market Guide 2013 by The Paypers as a valuable source of information and guidance for all actors in the mobile transaction services space. Patrick Desmarès - CEO, Efma MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM Authors Ionela Barbuta Sabina Dobrean Monica Gaza Mihaela Mihaila Adriana Screpnic RELEASE | VERSION 1.0 | APRIL 2013 | COPYRIGHT © THE Paypers BV | ALL RIGHTS reserved 2 MOBILE PAYMENTS MARKET GUIDE 2013 INTRODUCTION Introduction You are reading the Mobile Payments Market Guide 2013, a state- se and the way commerce is done. From a quick and accessible of-the-art overview of the global mobile transaction services channel for banking on the move to a sophisticated tool for shop- ecosystem and the most complete and up-to-date reference ping, price comparison and buying, the saga of the mobile device source for mobile payments, mobile commerce and mobile is an on-going story that unfolds in leaps and bounds within a banking-related information at global level. This guide is published progressively crowded (and potentially fragmented) ecosystem. -

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV “BPC Processing”, LLC Europe 03/31/2017 Informzaschita 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

An Empirical Analysis of New Zealand Bank Customers' Satisfaction

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Lincoln University Research Archive Lincoln University Digital Thesis Copyright Statement The digital copy of this thesis is protected by the Copyright Act 1994 (New Zealand). This thesis may be consulted by you, provided you comply with the provisions of the Act and the following conditions of use: you will use the copy only for the purposes of research or private study you will recognise the author's right to be identified as the author of the thesis and due acknowledgement will be made to the author where appropriate you will obtain the author's permission before publishing any material from the thesis. AN EMPIRICAL ANALYSIS OF NEW ZEALAND BANK CUSTOMERS’ SATISFACTION _______________________________________________________ A thesis submitted in partial fulfillment of the requirements for the Degree of Master of Commerce and Management at Lincoln University by Jing Wei _______________________________________________________ Lincoln University 2010 Abstract of a thesis submitted in partial fulfilment of the requirements for the Degree of M.C.M AN EMPIRICAL ANALYSIS OF NEW ZEALAND BANK CUSTOMERS’ SATISFACTION By Jing Wei It is important that banks deliver quality services which in turn results in customer satisfaction in today’s competitive banking environment. Within the New Zealand financial service market, competition is deemed to be strong given that there have been new entrants into the market as well as mergers and acquisition and exits over the last ten years (Chan, Schumacher, and Tripe, 2007). In order to retain the customers, customer satisfaction becomes a crux issue to bank management. -

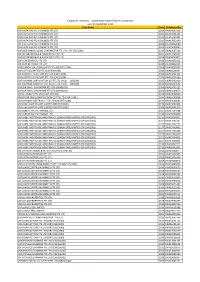

CW Compiled 30092020.Xlsx

Corporate Insolvency - Outstanding Assets (Defunct Companies) as at 30 September 2020 Case Name YearReference No. (DF) ALFA-PACIFIC NOMINEES PTE LTD 2014CWA14002198 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2015CWA15001105 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2016CWA16002481 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2017CWA17002340 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2018CWA18002680 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2019CWA19009686 (DF) BEE LIAN BUILDING CONTRACTOR PTE LTD ( OR 373/1998 ) 2019CWA19007268 (DF) BT BROKERAGE & ASSOCIATES PTE LTD 2017CWA17003225 (DF) BT BROKERAGE & ASSOCIATES PTE LTD 2018CWA18003875 (DF) CAK SEAFOOD PTE LTD 2018CWA18002228 (DF) CAK SEAFOOD PTE LTD 2018CWA18002253 (DF) CANON SOLUTION (S) PTE LTD; (OR/652/2004) 2018CWA18005037 (DF) CITY SECURITIES PTE (CW/450/1986) 2016CWA16001604 (DF) CORTEN FURNITURE PTE LTD (CW/33/04) 2013CWA13001331 (DF) CORTEN FURNITURE PTE LTD (CW/33/04) 2013CWA13001666 (DF) CROWM CORPORATION (S) PTE LTD OR/11 88/1998 2015CWA15002420 (DF) CROWM CORPORATION (S) PTE LTD OR/11 88/1998 2016CWA16003502 (DF) DAIMARU SINGAPORE PTE LTD (OR993/03) 2016CWA16003125 (DF) DAIMARU SINGAPORE PTE LTD (OR993/03) 2016CWA16004673 (DF) EE REALTY PTE LTD (OR/537/1993) 2014CWA14002840 (DF) FOUR SEAS CONSTRUCTION CO PTE LTD ( 314/1998 ) 2014CWA14002808 (DF) GAMMA ELECTRONIC PTE LTD (CW/397/1986) 2014CWA14000086 (DF) GIM HUAT PRIVATE LIMITED (OR/797/2000) 2019CWA19007464 (DF) GIM HUAT PRIVATE LIMITED (OR/797/2000) 2020CWA20001470 (DF) GREAT PACIFIC FINANCE LTD 2017CWA17004788 (DF) GREAT PACIFIC FINANCE LTD 2018CWA18004478 (DF) -

Customers Preference Towards Mobile Payment App

Pramana Research Journal ISSN NO: 2249-2976 CUSTOMERS PREFERENCE TOWARDS MOBILE PAYMENT APP Dr. U. Thaslim Ariff*, K. Akshaya** *Assistant Professor, Department of Commerce, Sri GVG Visalakshi college for Women, Udumalpet. **Student (Final year), Department of Commerce, Sri GVG Visalakshi college for Women, Udumalpet. ABSTRACT Mobile payment app is referred as mobile money or mobile money transfer. It is performed via a mobile phone. The main objective of the study is to examine the level of satisfaction among the respondents and determine the customer’s preference towards Mobile App for Payment. A sample of 100 respondents was conveniently selected from Udumalpet. The statistical tools used for analysis are Simple percentage, Scaling technique and Ranking method. The research concludes that customers satisfaction towards mobile payment applications are gradually going high. KEYWORDS: Mobile, Payments, Apps, bank, transaction, customers, money, transfer, cards, etc. INTRODUCTION Mobile payment app is referred as mobile money or mobile money transfer. It is performed via a mobile phone. It is generally refers to payment services and operated under financial regulations. Instead of paying with cash, cheque or ATM cards a customer can use a mobile phone to pay for a wide range of services. Customers can make three types of payments with a mobile device such as a mobile phone or laptop or computer. The first is a person-to-person transfer initiated from a mobile device. These transfers include non-commercial payments from one customer to another customer and commercial payments from a customer to a merchant. The second is goods and services purchased over the Internet on a mobile device. -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite