Sector Update Utilization in China to Rebound Gradually

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAIC MOTOR CORPORATION LIMITED Annual Report 2016

SAIC MOTOR ANNUAL REPORT 2016 Company Code:600104 Abbreviation of Company: SAIC SAIC MOTOR CORPORATION LIMITED Annual Report 2016 Important Note 1. Board of directors (the "Board"), board of supervisors, directors, supervisors and senior management of the Company certify that this report does not contain any false or misleading statements or material omissions and are jointly and severally liable for the authenticity, accuracy and integrity of the content. 2. All directors attended Board meetings. 3. Deloitte Touche Tohmatsu Certified Public Accountants LLP issued standard unqualified audit report for the Company. 4. Mr. Chen Hong, Chairman of the Board, Mr. Wei Yong, the chief financial officer, and Ms. Gu Xiao Qiong. Head of Accounting Department, certify the authenticity, accuracy and integrity of the financial statements contained in the annual report of the current year. 5. Plan of profit distribution or capital reserve capitalization approved by the Board The Company plans to distribute cash dividends of RMB 16.50 (inclusive of tax) per 10 shares, amounting to RMB 19,277,711,252.25 in total based on total shares of 11,683,461,365. The Company has no plan of capitalization of capital reserve this year. The cash dividend distribution for the recent three years accumulates to RMB48,605,718,485.39 in total (including the year of 2016). 6. Risk statement of forward-looking description √Applicable □N/A The forward-looking description on future plan and development strategy in this report does not constitute substantive commitment to investors. Please note the investment risk. 7. Does the situation exist where the controlling shareholders and their related parties occupy the funds of the Company for non-operational use? No. -

2017 Passenger Vehicles Actual and Reported Fuel Consumption: a Gap Analysis

2017 Passenger Vehicles Actual and Reported Fuel Consumption: A Gap Analysis Innovation Center for Energy and Transportation December 2017 1 Acknowledgements We wish to thank the Energy Foundation for providing us with the financial support required for the execution of this report and subsequent research work. We would also like to express our sincere thanks for the valuable advice and recommendations provided by distinguished industry experts and colleagues—Jin Yuefu, Li Mengliang, Guo Qianli,. Meng Qingkuo, Ma Dong, Yang Zifei, Xin Yan and Gong Huiming. Authors Lanzhi Qin, Maya Ben Dror, Hongbo Sun, Liping Kang, Feng An Disclosure The report does not represent the views of its funders nor supporters. The Innovation Center for Energy and Transportation (iCET) Beijing Fortune Plaza Tower A Suite 27H No.7 DongSanHuan Middle Rd., Chaoyang District, Beijing 10020 Phone: 0086.10.6585.7324 Email: [email protected] Website: www.icet.org.cn 2 Glossary of Terms LDV Light Duty Vehicles; Vehicles of M1, M2 and N1 category not exceeding 3,500kg curb-weight. Category M1 Vehicles designed and constructed for the carriage of passengers comprising no more than eight seats in addition to the driver's seat. Category M2 Vehicles designed and constructed for the carriage of passengers, comprising more than eight seats in addition to the driver's seat, and having a maximum mass not exceeding 5 tons. Category N1 Vehicles designed and constructed for the carriage of goods and having a maximum mass not exceeding 3.5 tons. Real-world FC FC values calculated based on BearOil app user data input. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

25Th International Colloquim of Gerpisa Revolutions New

25th International Colloquim of Gerpisa Revolutions New Technologies and services in the automotive industry 14-16 june 2017 ENS Cachan, Paris. Electric vehicle platform strategies by Chinese automakers: what's going on on EV arena in China? Sergio Muñiz & Bruce Belzowski Electric Vehicle Platform Strategies by Chinese Automakers: What’s Going On EV Arena In China? Presentation for the 25th Gerpisa International Colloquium 2017 - Paris (Cachan): R/Evolutions. New technologies and services in the automotive industry BRUCE M. BELZOWSKI SERGIO TADEU GONÇALVES MUNIZ CAMILLE CU Belzowski, Bruce; Muniz, Sergio; Cu, Camille. - Electric Vehicle Platform Strategies by Chinese Automakers: What’s Going On EV Arena In China? THE AUTHORS: Bruce M. Belzowski Managing Director of University of Michigan Transportation Research Institute (UMTRI) Automotive Futures Group. Sergio Tadeu Gonçalves Muniz Associate Professor - Federal University of Technology - Paraná (UTFPR), Brazil and was visiting researcher at University of Michigan Transportation Research Institute (UMTRI), Automotive Futures Group. Camille Cu Undergraduate Student at University of Michigan. UMTRI Automotive Futures Assistant in Research. Belzowski, Bruce; Muniz, Sergio; Cu, Camille. - Electric Vehicle Platform Strategies by Chinese Automakers: What’s Going On EV Arena In China? Chinese market In the EV market, more than 95% of the market are dominated by domestic brands: the price and government subsidies are crucial. China electric vehicle industry: 200+ carmakers, with currently about 4,000 new energy vehicle (NEV) models in development. China became the world’s leading automotive market in 2009. China surpassed the U.S. in 2015 to become the world’s biggest market for New Energy Vehicles (NEVs): comprising PHEVs, BEVs, FCEVs Great Potential: in United States: 0.8 vehicles/resident; in China: 0.1 vehicles/resident. -

Chassis and Impact Attenuator Design for Formula Student Racing

CHASSIS AND IMPACT ATTENUATOR DESIGN FOR FORMULA STUDENT RACE CAR MECH 5825M Professional Project Chassis and Impact Attenuator design for Formula student Race car Ahmed Oshinibosi Project Supervisor: Prof. D.C Barton 30th August 2012 AKNOWLEGDEMENT Firstly, I would like to appreciate the effort of my supervisor, Professor David Barton who is the head of school of mechanical engineering for his invaluable contribution towards the successful completion of this project. Secondly, I am indebted to my employer, Tallent Automotive Limited who did not only provide financial assistance to me in order to pursue this postgraduate Master’s degree, but also gave me the permission to utilise the company’s software packages to carry out this project. I also want to use this opportunity to thank the faculty of engineering for awarding me the International Excellence scholarship which also contributed towards my tuition fees. ABSTRACT Generally, in the automotive industry, weight reduction, cost of engineering design and reduction in vehicle development cycle time are becoming increasingly focused on. In order to tackle this, Computer Aided Engineering (CAE) is popularly being used to lead design process. This is more efficient than just using CAE as a verification tool. In the design of the F15 chassis, suitable Finite Element Analysis (FEA) optimisation techniques have been adopted from the early design stage. The design problem in view of weight reduction and increasing torsional stiffness has been solved by means of topology optimisation and also by applying gauge optimisation at the later stage of the design phase to optimise the size of structural members of the chassis. -

Understanding Auto Fincos

Global Research 18 March 2019 Fundamental Analytics Equities Behind the numbers: Autos Global Valuation, Modelling & Accounting Geoff Robinson, CA FCA Analyst [email protected] +44-20-7567 1706 Julian Radlinger, CFA Analyst [email protected] +44-20-7568 1171 Renier Swanepoel Analyst [email protected] +44-20-7568 9025 Patrick Hummel, CFA Analyst [email protected] +41-44-239 79 23 Guy Weyns, PhD Analyst We launch the second of our series of collaborative sector analyses … [email protected] The Fundamental Analytics team has teamed up with the UBS Global Auto Sector team +65-6495 3507 (17 analysts across six regions) to deliver the second in its series of collaborative reports Paul Gong (see the first one on pharmaceuticals here). This report focuses on all things Autos. It is Analyst written to (1) provide investors new to Autos with an exhaustive overview of everything [email protected] that's relevant to understand the sector from an industry and company perspective, (2) +852-2971 7868 help new and seasoned investors alike frame their financial statement and earnings Colin Langan, CFA quality analysis, and (3) provide a guide to the most commonly used accounting Analyst practices and pitfalls specific to the sector, how to spot them, interpret and adjust for [email protected] +1-212-713 9949 them. This report is the go-to Global Auto sector hand-book for equity investors. Kohei Takahashi … including a detailed global sector run-through … Analyst Our report starts with a ~50-page sector primer written on the basis of the combined [email protected] expertise and wealth of resources of the UBS Global Auto Sector team. -

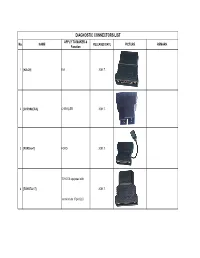

DIAGNOSTIC CONNECTORS LIST APPLY to MAKER & No

DIAGNOSTIC CONNECTORS LIST APPLY TO MAKER & No. NAME RELEASED DATE PICTURE REMARK Function 1 [KIA-20] KIA 2001.7. 2 [CHRYSLER-6] CHRYSLER 2001.7. 3 [FORD-6+1] FORD 2001.7. TOYOTA equipped with 4 [TOYOTA-17] 2001.7. semicircular 17pin DLC 5 [MITSUBISHI/HYUNDAI-12+16] MITSUBISHI & HYUNDAI 2002.11. 6 [HONDA-3] HONDA 2002.11. MAZDA equipped with 7 [MAZDA-17] 2002.12. semicircular 17pin DLC 8 [HAIMA-17] HAINAN MAZDA 2002.12. Most maker any model 9 [SMART OBDII-16] 2002.5. without CAN BUS 10 [NISSAN-14+16] NISSAN 2003.10. 11 [CHANGAN-3] CHANGAN 2003.11. 12 [JIANGLING-16] JIANGXI ISUZU 2003.3. 13 [SUZUKI-3] SUZUKI 2003.3. 14 [ZHONGHUA-16] ZHONGHUA CAR 2003.3. 15 [HAINAN MAZDA-17F] HAINAN MAZDA 2003.4. 16 [AUDI-4] AUDI 2003.6. 17 [DAIHATSU-4] DAIHATSU 2003.6. 18 [BENZ-38] BENZ 2003.7. 19 [UNIVERSAL-3] BENZ 2003.7. 20 [BMW-20] BMW 2003.9. All BMW models with 16 pin 21 [BMW-16] 2003.9. DLC 22 [HAIMA-16] HAINAN MAZDA 2004.10. 23 [FIAT-3] FIAT 2004.10. 24 [HAIMA-3] HAINAN MAZDA 2004.10. 25 [FORD-20] Australia FORD 2004.11. For 2002- LX470 and LAND 26 [TOYOTA-16] TOYOTA 2004.11. CRUISE 27 [HONDA5] HONDA 2004.11. Only for Russian HONDA 28 [GM/VAZ-12] GMVAZ 2004.3. 29 [DAEWOO-12] DAEWOO,SPARK 2004.3. 30 [SEDAN-3] VW models in Mexico 2004.3. Only for Mexico 31 [COMBI-4] VW models in Mexico 2004.3. Only for Mexico 32 [GAZ-12] GAZ 2004.5. -

Program Review Department of Computer Science

PROGRAM REVIEW DEPARTMENT OF COMPUTER SCIENCE UNIVERSITY OF NORTH CAROLINA AT CHAPEL HILL JANUARY 13-15, 2009 TABLE OF CONTENTS 1 Introduction............................................................................................................................. 1 2 Program Overview.................................................................................................................. 2 2.1 Mission........................................................................................................................... 2 2.2 Demand.......................................................................................................................... 3 2.3 Interdisciplinary activities and outreach ........................................................................ 5 2.4 Inter-institutional perspective ........................................................................................ 6 2.5 Previous evaluations ...................................................................................................... 6 3 Curricula ................................................................................................................................. 8 3.1 Undergraduate Curriculum ............................................................................................ 8 3.1.1 Bachelor of Science ................................................................................................. 10 3.1.2 Bachelor of Arts (proposed) ................................................................................... -

Products Catalogue

XHORSE PRODUCTS Xhorse Electronics www.xhorse.com CATALOGUE 2019 . 01 ANNUAL PRODUCT Xhorse Electronics www.xhorse.com MANUAL 2019.01 ANNUAL PRODUCT MANUAL Xhorse Electronics 2019.01 www.xhorse.com Xhorse Product Catalogue CONDOR DOLPHIN VVDI I Introduction II III V Key Cutting Machine Series Key Cutting Machine Series Universal Remote Series DOLPHIN XP-005 Company Introduction CONDOR XC-MINI Plus 39 71 VVDI KEY TOOL 03 07 (Automatic Key Cutting machine) (Automatic Key Cutting machine) DOLPHIN XP-007 74 MINI KEY TOOL Patent and software copyright 23 CONDOR XC-002 44 04 (Automatic Key Cutting machine) certificates (Manual Key Cutting machine) 77 Wireless Remote 29 CONDOR XC-003 (Manual Key Cutting machine) 78 Smarty Remote IV VVDI Series 33 CONDOR XC-008 80 Wireless Remote (Manual Key Cutting machine) 47 VVDI 2 35 CONDOR XC-009 85 Wire Remote (Manual Key Cutting machine) 51 VVDI MB TOOL 92 Garage Remote 53 VVDI BMW 95 Renew Adapter 59 VVDI PROG VI Other Product Series 105 Frequency tester 106 VVDI RKE BOX 107 46、4D、48 transponder 02 Company Introduction Certificate Patent and Software Copyright Certificates Xhorse Electronics Co., Ltd. Xhorse Electronics Co., Ltd. is a specialized company which was founded in 2010 with the aim to develop products and services based on intelligent market research and development. It is the leading brand in the automobile security industry. Xhorse has a complete system of independent Certificate NO:26918Q00142R0M Thisistocertifythat Shenzhen Xhorse Electronics Co.,Ltd. intellectual property rights and it is dedicated to providing security products and solutions Unified social credit code: 91440300553867739G Address:2009-2011,Changhong Science and Technology Building, Science Park South Twelfth Road, Nanshan District, Shenzhen, Guangdong, China Hasbeenauditedto conformto thefollowingQualitymanagementsystem worldwide. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

CHAPTER 5 the Indian Automotive Industry and the ASEAN Supply Chain Relations

Chapter 5 The Indian Automotive Industry and the ASEAN Supply Chain Relations Tristan Leo Dallo Agusin Mitsubishi Fuso Martin Schröder Waseda University November 2014 This chapter should be cited as Agustin, T. L. D. and M. Schröder (2013), ‘The Indian Automotive Industry and the ASEAN Supply Chain Relations’, in Waseda University (ed.), Automibile and Auto Components Industires in ASEAN: Current State and Issues. ERIA Research Project Report 2013-7, pp.50-113. Available at: http:/www.eria.org/RPR_FY2013_No.7_Chapter_5.pdf CHAPTER 5 The Indian Automotive Industry and the ASEAN Supply Chain Relations TRISTAN LEO DALLO AGUSTIN Mitsubishi Fuso MARTIN SCHRÖDER Research Institute of Auto Parts Industries, Waseda University Introduction The topic of automotive supply chains has been increasingly studied as it raises questions of economic development, especially from the perspectives of simultaneous globalisation and regionalisation, and trade. While ASEAN is a prime example of intraregional production networks, supply chains that connect ASEAN and India have not been studied indepth. Therefore, this paper investigates the Indian automotive industry, which is composed of automobile original equipment manufacturers (OEMs) and parts and components producers, and other supply chain connections to the neighbouring ASEAN region. This study is structured as follows. First, we will take a look at the historic development of the automotive industry in India, as it provides the context for the development of companies and their capabilities that are crucial determinants for their ability to join supply chains. The investigation will not 51 be limited to Indian firms because as case studies of the ASEAN region forcefully demonstrate, foreign OEMs and parts suppliers may use developing and emerging markets as specialised production bases of their global and regional supply chains. -

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] Whatsapp: +86 13634216230 QYT No

QYT AUTO PARTS CO., LTD Email: [email protected] ; [email protected] WhatsApp: +86 13634216230 QYT no. Description Corss Ref. Application TOYOTA;LEXUS (SO0001‐SO0300) TOYOTA CAMRY ACV40 06‐12; SO0001 Steering Tie rod ends 45470‐09090 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY ACV40 06‐12; SO0002 Steering Tie rod ends 45460‐09140 LEXUS LEXUS ES350/ES240 07‐ TOYOTA CAMRY SO0003 Steering Tie rod ends 45460‐09160 ACV50(2012‐) TOYOTA CAMRY SO0004 Steering Tie rod ends 45460‐09250 ACV50(2012‐) GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0005 Steering Tie rod ends 45047‐49045 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE GEELY PANDA,HAIJING,GEELY YUANJING, YUANJING 18‐, SO0006 Steering Tie rod ends 45046‐49115 YUANJINGX3,GEELY EMGRAND EC7,GEELY ENGLON ,BINRUI;BYD F0,BYD F3/F3R/G3/G3R/L3;TOYOTA COROLLA;LIFAN LIFAN 620;JAC YUEYUE CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0007 Steering Tie rod ends 45460‐39615 LEXUS ES300/MCV30 01‐06 CHANGAN RAETON;TOYOTA CAMRY2.4/3.0 (03),PREVIA ACR30 (34M); SO0008 Steering Tie rod ends 45470‐39215 LEXUS ES300/MCV30 01‐06 BYD SURUI,SONG MAX;ZOTYE Z300; SO0009 Steering Tie rod ends 45046‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ BYD SURUI ,SONG MAX;ZOTYE Z300; SO0010 Steering Tie rod ends 45047‐09590 TOYOTA COROLLA 07‐/VERSO 11‐/LEVIN 14‐ SO0011 Steering Tie rod ends 45464‐30060 TOYOTA REIZ/CROWN;LEXUS LEXUS IS250/300 06‐,GS300/350/430 05‐ SO0012 Steering Tie rod ends 45463‐30130 TOYOTA REIZ/CROWN;LEXUS LEXUS