LTN201903281383.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Orient Securities Co. (3958.HK)

August 29, 2016 EARNINGS REVIEW Orient Securities Co. (3958.HK) Neutral Equity Research In line with expectations: Sequential recovery led by trading, IB improved What surprised us Investment Profile DFZQ reported 2Q16 NPAT of Rmb860mn, 28%/17% of GSe/Bloomberg Low High consensus for 2016E NPAT. 1H profits are consistent with preliminary Growth Growth disclosure in August. 2Q16 profit declined -78% yoy, but sequentially grew Returns * Returns * 103% qoq, led by trading. ROE/ROA recovered to 10.3%/1.8% annualized in Multiple Multiple Volatility Volatility 2Q. Key positives: 1) IB income up 28% yoy to Rmb290bn, led by growth Percentile 20th 40th 60th 80th 100th in both ECM and DCM underwriting. Coupled with a strong 1Q, first-half IB Orient Securities Co. (3958.HK) income has been the strongest in the past few years. 2) Trading income Asia Pacific Banks Peer Group Average up 90% qoq from a very low base in 1Q16 on recovering investment yield, * Returns = Return on Capital For a complete description of the investment profile measures please refer to the even though still down 85% yoy. Revenue contribution from trading disclosure section of this document. decreased to 27% in 1H16, vs. 65% on average for FY13 to FY15. Principal investment book was flat at Rmb 49bn hoh with equity down to Rmb 6.2bn Key data Current Price (HK$) 8.21 and bond investment up; 3) Stock pledged lending balance rose 20% hoh 12 month price target (HK$) 9.20 Market cap (HK$ mn / US$ mn) 35,153.1 / 4,532.4 to Rmb 29bn despite weaker margin finance as the company shifts its Foreign ownership (%) -- focus to corporate client financing. -

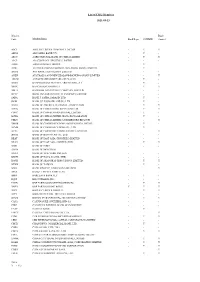

Q3 2019 Holding Lijst

Aandelen Obligaties 360 Security Technology Inc 3SBio Inc 3i Group PLC Abbott Laboratories 3M Co AbbVie Inc 3SBio Inc Acadia Healthcare Co Inc 51job Inc adidas AG 58.com Inc ADLER Real Estate AG AAC Technologies Holdings Inc ADO Properties SA ABB Ltd Aermont Capital LLP Abbott Laboratories AES Corp/VA AbbVie Inc African Development Bank ABIOMED Inc Aggregate Holdings SA Aboitiz Equity Ventures Inc Air France-KLM Absa Group Ltd Air Transport Services Group I Accell Group NV Akamai Technologies Inc Accenture PLC Aker BP ASA Accor SA Albertsons Investor Holdings L Acer Inc Alcoa Corp ACS Actividades de Construccio Alfa SAB de CV Activision Blizzard Inc Alibaba Group Holding Ltd Acuity Brands Inc Allergan PLC Adecco Group AG Alliander NV adidas AG Allianz SE Adobe Inc Ally Financial Inc Advance Auto Parts Inc Almirall SA Advanced Info Service PCL Altice USA Inc Advanced Micro Devices Inc Amazon.com Inc Advantech Co Ltd America Movil SAB de CV Aegon NV American International Group I AES Corp/VA Amgen Inc Affiliated Managers Group Inc ams AG Agilent Technologies Inc ANA Holdings Inc AIA Group Ltd Anglian Water Group Ltd Aier Eye Hospital Group Co Ltd Anglo American PLC Air LiQuide SA Anheuser-Busch InBev SA/NV Air Products & Chemicals Inc Antero Resources Corp AirAsia Group Bhd APA Group Airbus SE APERAM SA Aisino Corp Aphria Inc Akamai Technologies Inc Apollo Global Management Inc Aker BP ASA Apple Inc Akzo Nobel NV Aptiv PLC Alcon Inc Arab Republic of Egypt Alexandria Real Estate Equitie Arconic Inc Alfa Laval AB ARD Holdings SA Alfa SAB de -

Lazard Global Investment Funds Plc

Lazard Global Investment Funds plc Für in der Schweiz eingetragene Teilfonds Auszug aus dem Jahresbericht und geprüften Abschluss Für das am 31. März 2020 endende Geschäftsjahr Inhalt Verwaltungsrat und sonstige Informationen .................................................................. 4 Bericht des Verwaltungsrates ........................................................................................ 6 Bericht des Anlageverwalters....................................................................................... 13 Bericht der Verwahrstelle ............................................................................................. 33 Gesamtergebnisrechnung ............................................................................................ 34 Bilanz ............................................................................................................................ 38 Aufstellung der Veränderungen im Nettovermögen der Anteilinhaber von Redeemable Participating Shares ................................................................................ 42 Anmerkungen zum Abschluss ...................................................................................... 46 Vermögensaufstellung der Portfolios ......................................................................... 107 Aufstellung der wesentlichen Anlageveränderungen (ungeprüft) .............................. 159 Offenlegung der Vergütung gemäß OGAW V (ungeprüft) .......................................... 169 Anhang 1: Zusätzliche Informationen für Anleger -

China Vanke Co., Ltd. 2013 First Quarterly Report

China Vanke Co., Ltd. 2013 First Quarterly Report §1 Important Notice 1.1 The Board, the Supervisory Committee, Directors, members of the Supervisory Committee and senior management of the Company warrant that in respect of the information contained in this Quarterly Report, there are no misrepresentations or misleading statements, or material omission, and individually and collectively accept full responsibility for the authenticity, accuracy and completeness of the information contained in this Quarterly Report. 1.2 None of the Directors, members of the Supervisory Committee and senior management fails to assure or disputes with the authenticity, accuracy and completeness of the contents of this Quarterly Report. 1.3 Deputy Chairman Qiao Shibo and Director Wei Bin were not able to attend the board meeting in person due to their business engagements and had authorised Director Chen Ying to represent them and vote on behalf of them. Director Yu Liang was not able to attend the board meeting in person due to personal reasons and had authorised Director Xiao Li to represent him and vote on behalf of him. 1.4 This quarterly financial report of the Company has not been audited. 1.5 The Company’s Chairman Wang Shi, Director and President Yu Liang, and Executive Vice President and Supervisor of Finance Wang Wenjin declare that the financial report contained in this Quarterly Report is warranted to be true and complete. §2 Basic Corporate Information 2.1 Major accounting data and financial guidance (Unit: RMB’000) As at 31 March 2013 As at 31 -

LEAGUE TABLES H1 2018 Preliminary As of 25 June 2018 H1 2018 PRELIMINARY AS of 25 JUNE 2018 MANAGER RANKINGS ASIA PACIFIC CAPITAL MARKETS

ASIA PACIFIC CAPITAL MARKETS LEAGUE TABLES H1 2018 Preliminary As of 25 June 2018 H1 2018 PRELIMINARY AS OF 25 JUNE 2018 MANAGER RANKINGS ASIA PACIFIC CAPITAL MARKETS The Bloomberg Capital Markets Tables represent the top arrangers, bookrunners and advisors across a broad array of deal types including loans, bonds, equity and M&A transactions; according to Bloomberg standards. LEAG<GO> for a full range of league tables MA<GO> for a full range of merger & acquisition tables NI LEAG CRL<GO> or http://www.bloomberg.com/ for a full range of market-specific league table publications Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release and data found on the Bloomberg Professional Service. DATA SUBMISSIONS AND QUERIES Contact Phone Email Equities Zhen Hao Toh +65 6499 2931 [email protected] Fixed Income Jennifer Passos +65 6231 9677 [email protected] Loans Colin Tang +65 6499 2949 [email protected] APAC League Xin Yu Chen +65 6212 1123 [email protected] © 2018 Bloomberg Finance L.P. All rights reserved. Bloomberg Preliminary APAC Capital Markets | H1 2018 Asia ex-Japan G3 Currency Bonds: Industry Breakdown Asia Pacific Fixed Income 13% 6% 6% Asia ex-Japan G3 Currency Bonds 7% 55% H1 2018 H1 2017 12% Mkt Volume (USD Deal Prev Prev Mkt Mkt Share Firm Rank Share(%) Mln) Count Rank Share(%) Chg(%) HSBC 1 7.327 10,159 126 1 9.020 -1.693 Citi 2 5.929 8,219 85 3 6.455 -0.526 Financials 55% Bank of China 3 5.352 7,421 115 4 5.037 0.315 Government 12% Standard Chartered Bank 4 -

Global Mergers & Acquisitions Review

Global Mergers & Acquisitions Review FIRST HALF 2020 | FINANCIAL ADVISORS Global Mergers & Acquisitions Review First Half 2020 | Financial Advisors Global Deals Intelligence Global Announced M&A $4,500 30,000 WORLDWIDE DEAL MAKING FALLS 41%; LOWEST FIRST HALF SINCE 2013 Worldwide M&A activity totaled US$1.2 trillion during the first half of 2020, a decrease of 41% compared $4,000 to year-ago levels and the slowest opening six-month period for mergers & acquisitions since the first 25,000 half of 2013. The second quarter of 2020 registered a 25% decrease compared to the first quarter of the year and marks the slowest quarter of deal making since the first quarter of 2012. By number of $3,500 worldwide deals, deal making declined 16% compared to year ago levels, a six-year low. $3,000 20,000 CROSS-BORDER M&A DECLINES 15% TO SEVEN-YEAR LOW $2,500 Cross-border M&A activity totaled US$440.7 billion during the first half of 2020, a 15% decrease 15,000 compared to a year ago and the slowest first half for cross-border M&A since 2013. The Industrials, $2,000 Technology and Energy and Power sectors accounted for 37% of cross-border deals during the first half of 2020, down from 40% a year ago. $1,500 10,000 US TARGET M&A DECLINES 69%, LOWEST PERCENTAGE OF TOTAL M&A ON RECORD $1,000 M&A activity for US targets totaled US$354.9 billion during the first half of 2020, a decrease of 69% 5,000 compared to the level of activity seen during the first half of 2019 and the lowest opening six-month $500 period for US deal making since 2012. -

List of CMU Members 2021-08-18

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

China Securities

China Financials 14 August 2017 China Securities Normalisation of regulations on the horizon CSRC has upgraded the risk classification rating for a few listed securities firms, including CITICS and HTS, to AA from BBB We see this as an important signal that previously over-tightened regulations in the China Securities Sector are being relaxed Current valuations suggest strong option value; reiterating our Positive Leon Qi, CFA (852) 2532 4381 sector stance; our top sector pick is CITICS [email protected] What’s new: China Securities Regulatory Commission (CSRC) announced Major securities firms: CSRC regulatory rating (2014-2017) the latest 2017 regulatory rating classification for China securities firms on Net assets CSRC rating 2014 2015 2016 2017 14 August 2017. The ratings of a few major listed securities firms, including ranking* CITICS and HTS, have been upgraded from BBB to AA in the latest review. CITICS 1 AA AA BBB AA HTS 2 AA AA BBB AA GTJA 3 AA AA AA AA What’s the impact: CSRC’s securities firm rating classification system Huatai 4 AA AA BBB AA is based on annual reviews of securities firms’ level of compliance with GFS 5 AA AA BBB AA regulations, capability of risk management, and market competitiveness. In CMS 6 AA AA AA AA CGS 7 AA AA A AA June 2017, CSRC revised its scoring system and introduced new bonus Shenwan Hongyuan 8 AA AA AA AA points based on the securities firms’ operating metrics such as revenue Everbright Securities 9 C A AA A scale, overseas business contribution, investment banking, etc. -

Sinic Holdings (Group) Company Limited 新力控股(集團)有限公司 (Incorporated in the Cayman Island with Limited Liability) (Stock Code: 2103)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The securities referred to herein will not be registered under the Securities Act, and may not be offered or sold in the United States except pursuant to an exemption from, or a transaction not subject to, the registration requirements of the Securities Act. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the company making the offer and its management and financial statements. The Company does not intend to make any public offering of securities in the United States. The communication of this announcement and any other document or materials relating to the issue of the Notes offered hereby is not being made, and such documents and/or materials have not been approved, by an authorized person for the purposes of section 21 of the United Kingdom’s Financial Services and Markets Act 2000, as amended (the “FSMA”). -

2019 Global Wealth Management Key Findings

China Onshore Strategy – Foreign Financial Institution May 2020 Introduction Key speakers: Karen Ko Jay Sala Li Cui Partner Partner Chief Economist and APAC Financial Services APAC Financial Services Head of Macro Research at China Strategy & Operations Performance Improvement Construction Bank International Hong Kong Hong Kong [email protected] [email protected] [email protected] Also with you today … David Scott Loretta So Henry Zhu Michael Chen Andy Xie Partner Partner Senior Manager Senior Manager Senior Manager Financial Services International Tax and Risk Management – Financial Services Financial Services Risk Management Transaction Services Financial Regulation Strategy & Operations Strategy & Operations [email protected] [email protected] [email protected] [email protected] [email protected] Page 2 Agenda Introduction Financial liberalization The business case Navigating the path Market entries Target Operating Model (TOM) for China Page 3 Background: Financial Liberalization provides opportunities to oversea players 2020 is another fruitful year that sees new opening-up policies in China - fund management allows 100% foreign ownership from 01 April and China’s securities regulator have removed foreign ownership cap on domestic securities firm. Next year, WFOEs are expected to be allowed to apply for fund licenses and enjoy full stake in domestic targets to expand their China onshore capabilities. China further opens up financial sector series To date, EY has released a series of 8 POV reports covering the following agenda and beyond: ► The impact of the 11-point liberalization plan on the wealth and asset management industry ; exposure draft of the CSRC’s new regulations and a comparative analysis of the QFII and RQFII regime ► Opportunities to incumbent foreign financial institutions and challenges such as China’s unique operating environment – more details to be discussed later. -

Issuance Overpricing of China's Corporate Debt Securities

Internet Appendix for “Issuance Overpricing of China’s Corporate Debt Securities” Yi Ding Wei Xiong Jinfan Zhang In this Internet Appendix, we report the following figures, tables, and additional analyses omitted from the main paper. Fig. A1 depicts debt security issuance across the interbank market and the exchange market from 2009 to 2019. In Table A1, we list the 68 licensed underwriters in the interbank market at the end of 2019. Information on underwriters is obtained from NAFMII. In Table A2, we summarize overpricing for CP and MTNs separately for both before and after the rebate ban period. Although the magnitude declined after the ban for both CP and MTNs, overpricing remains statistically significantly. Taken together, we find significant overpricing in all these issuance categories. In Table A3, we report summary statistics of issuance overpricing by using excess returns of the first secondary-market trading day as the overpricing measure. The table shows that the overpricing is robust across time, debt securities, and issuers with different characteristics, consistent with Table 3 in the main paper. In Tables A4 and A5, we conduct difference-in-difference analyses to examine how the underwriter rebate ban affects the excess return across different issuers and across different underwriters. Consistent with results in Tables 5 and 6 of the main paper from using the yield-spread measure, these tables show that after the ban, the drop in overpricing is significantly greater for securities issued by central SOEs than for those issued by other firms, and the drop in overpricing is significantly smaller for issuances underwritten by the Big Four banks. -

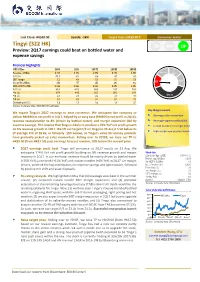

Tingyi (322 HK) up MP OP Preview: 2Q17 Earnings Could Beat on Bottled Water and Expense Savings

Last Close: HK$10.92 Upside: -18% Target Price: HK$9.00↑ Consumer Sector Tingyi (322 HK) UP MP OP Preview: 2Q17 earnings could beat on bottled water and expense savings Financial Highlights Y/E 31 Dec 2015 2016 2017E 2018E 2019E LT Revenue (US$m) 9,103 8,372 8,756 9,154 9,580 Neutral BUY YoY (%) -11.1 -8.0 4.6 4.5 4.7 EBIT margin 5.2 4.8 5.1 5.3 5.6 SELL BUY Net profit (US$m) 256 177 245 280 332 Diluted EPS (US$) 0.046 0.032 0.044 0.050 0.059 YoY (%) -35.9 -30.9 38.5 14.1 18.7 P/E (x) 30.8 44.6 32.2 28.2 23.8 P/B (x) 2.0 2.3 2.2 2.0 1.9 Stock P/S (x) 0.9 0.9 0.9 0.9 0.8 Dividend yield (%) 1.6 1.1 1.6 1.8 2.1 Source: Company data, BOCOM Int’l estimates Key things to watch We expect Tingyi’s 2Q17 earnings to beat consensus. We anticipate the company to deliver RMB361m net profit in 2Q17, helped by an easy base (RMB76m net profit in 2Q16), Beverage sales momentum revenue reacceleration to 8% (driven by bottled water), and margin expansion (led by Beverage segment profitability expense savings). This implies that Tingyi is likely to produce a 76% YoY net profit growth Instant noodle EBIT margin trend on 6% revenue growth in 1H17. We lift our target P/E on Tingyi to 23.4x (-0.5 SD below its High-margin new product launch LT-average P/E of 26.0x, vs formerly -1SD below), as Tingyi’s value-for-money products have gradually picked up sales momentum.