Issuance Overpricing of China's Corporate Debt Securities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 1 Corporate Overview

ai161915073836_Yida AR20 Cover_21.5mm_output.pdf 1 23/4/2021 下午12:05 C M Y CM MY CY CMY K Contents Corporate Overview 2 Corporate Information 3 Financial Summary 5 Chairman’s Statement 7 Management Discussion and Analysis 11 Environmental, Social and Governance Report 39 Profile of Directors and Senior Management 60 Directors’ Report 65 Corporate Governance Report 80 Independent Auditor’s Report 90 Consolidated Financial Statements • Consolidated Statement of Profit or Loss 97 • Consolidated Statement of Comprehensive Income 98 • Consolidated Statement of Financial Position 99 • Consolidated Statement of Changes in Equity 101 • Consolidated Statement of Cash Flows 103 • Notes to the Consolidated Financial Statements 105 Yida China Holdings Limited 2020 Annual Report 1 Corporate Overview Yida China Holdings Limited (the “Company”), together with its industrial upgrading strategies, fully integrated internal and external subsidiaries (collectively referred to as the “Group”), founded in resources, further developed and operated Dalian Ascendas IT Park, 1988, headquartered in Shanghai, is China’s largest business park Tianjin Binhai Service Outsourcing Industrial Park, Suzhou High- developer and leading business park operator. The main business tech Software Park, Wuhan Guanggu Software Park, Dalian Tiandi, involves business park development and operation, residential Dalian BEST City, Wuhan Software New Town, Yida Information properties within and outside business parks and office properties Software Park and many other software parks and technology sales, business park entrusted operation and management and parks. It helped the Group achieve its preliminary strategic goals of construction, decoration and landscaping services. On 27 June “National Expansion, Business Model Exploration and Diversified 2014, the Company was successfully listed (the “Listing”) on the Cooperation”. -

Orient Securities Co. (3958.HK)

August 29, 2016 EARNINGS REVIEW Orient Securities Co. (3958.HK) Neutral Equity Research In line with expectations: Sequential recovery led by trading, IB improved What surprised us Investment Profile DFZQ reported 2Q16 NPAT of Rmb860mn, 28%/17% of GSe/Bloomberg Low High consensus for 2016E NPAT. 1H profits are consistent with preliminary Growth Growth disclosure in August. 2Q16 profit declined -78% yoy, but sequentially grew Returns * Returns * 103% qoq, led by trading. ROE/ROA recovered to 10.3%/1.8% annualized in Multiple Multiple Volatility Volatility 2Q. Key positives: 1) IB income up 28% yoy to Rmb290bn, led by growth Percentile 20th 40th 60th 80th 100th in both ECM and DCM underwriting. Coupled with a strong 1Q, first-half IB Orient Securities Co. (3958.HK) income has been the strongest in the past few years. 2) Trading income Asia Pacific Banks Peer Group Average up 90% qoq from a very low base in 1Q16 on recovering investment yield, * Returns = Return on Capital For a complete description of the investment profile measures please refer to the even though still down 85% yoy. Revenue contribution from trading disclosure section of this document. decreased to 27% in 1H16, vs. 65% on average for FY13 to FY15. Principal investment book was flat at Rmb 49bn hoh with equity down to Rmb 6.2bn Key data Current Price (HK$) 8.21 and bond investment up; 3) Stock pledged lending balance rose 20% hoh 12 month price target (HK$) 9.20 Market cap (HK$ mn / US$ mn) 35,153.1 / 4,532.4 to Rmb 29bn despite weaker margin finance as the company shifts its Foreign ownership (%) -- focus to corporate client financing. -

Q3 2019 Holding Lijst

Aandelen Obligaties 360 Security Technology Inc 3SBio Inc 3i Group PLC Abbott Laboratories 3M Co AbbVie Inc 3SBio Inc Acadia Healthcare Co Inc 51job Inc adidas AG 58.com Inc ADLER Real Estate AG AAC Technologies Holdings Inc ADO Properties SA ABB Ltd Aermont Capital LLP Abbott Laboratories AES Corp/VA AbbVie Inc African Development Bank ABIOMED Inc Aggregate Holdings SA Aboitiz Equity Ventures Inc Air France-KLM Absa Group Ltd Air Transport Services Group I Accell Group NV Akamai Technologies Inc Accenture PLC Aker BP ASA Accor SA Albertsons Investor Holdings L Acer Inc Alcoa Corp ACS Actividades de Construccio Alfa SAB de CV Activision Blizzard Inc Alibaba Group Holding Ltd Acuity Brands Inc Allergan PLC Adecco Group AG Alliander NV adidas AG Allianz SE Adobe Inc Ally Financial Inc Advance Auto Parts Inc Almirall SA Advanced Info Service PCL Altice USA Inc Advanced Micro Devices Inc Amazon.com Inc Advantech Co Ltd America Movil SAB de CV Aegon NV American International Group I AES Corp/VA Amgen Inc Affiliated Managers Group Inc ams AG Agilent Technologies Inc ANA Holdings Inc AIA Group Ltd Anglian Water Group Ltd Aier Eye Hospital Group Co Ltd Anglo American PLC Air LiQuide SA Anheuser-Busch InBev SA/NV Air Products & Chemicals Inc Antero Resources Corp AirAsia Group Bhd APA Group Airbus SE APERAM SA Aisino Corp Aphria Inc Akamai Technologies Inc Apollo Global Management Inc Aker BP ASA Apple Inc Akzo Nobel NV Aptiv PLC Alcon Inc Arab Republic of Egypt Alexandria Real Estate Equitie Arconic Inc Alfa Laval AB ARD Holdings SA Alfa SAB de -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Preliminary Thesis Outline

THE PENNSYLVANIA STATE UNIVERSITY SCHREYER HONORS COLLEGE DEPARTMENT OF ECONOMICS LOCAL GOVERNMENT FINANCING VEHICLES (LGFVS) – A LENS OF THE POTENTIAL FINANCIAL INSTABILITY IN CHINA YIYANG ZENG SRPING 2014 A thesis submitted in partial fulfillment of the requirements for baccalaureate degrees in economics and sociology with honors in economics Reviewed and approved* by the following: Ruilin Zhou Associate Professor of Economics Thesis Supervisor Russell Chuderewicz Senior Lecturer of Economics Honors Adviser * Signatures are on file in the Schreyer Honors College. i ABSTRACT China has experienced rapid credit expansion since late 2008 as the result of its response to the 2007-2009 global financial crisis. The stimulus plan offered by the central government has significantly encouraged local governments’ borrowing and infrastructure spending. Due to the limited funding sources, the local governments have been heavily dependent on a peculiar financing form called the Local Government Financing Vehicle (LGFV) to help finance their investments. However, despite the short-term positive effects, the expansion of LGFVs has implanted critical risks and vulnerabilities in China’s economic system. The obscure and sophisticated relationships among the local governments, the LGFVs, the commercial banks and other financial institutions, and the investors are unsustainable in the long run. Without active policy reforms, the LGFV financing will bring unbearable debt burdens to local governments in a few years. As a result, measures have to be taken to prevent the financial position of the local governments from further deteriorating and to consolidate the safety of China’s financial system. Keywords: Credit, local government, LGFV, debt, wealth management products, bond, financial crisis ii TABLE OF CONTENTS List of Figures ............................................................................................................. -

FSSA China a Shares Fund Class III USD a Subfund of First Sentier Investors Global Umbrella Fund Plc (The Company)

Monthly Fund Factsheet 31 August 2021 FSSA China A Shares Fund Class III USD a subfund of First Sentier Investors Global Umbrella Fund plc (the Company) Investment objective and policy Ten Largest Company Holdings The Fund aims to grow your investment. Stock Name % The Fund invests at least 70% of its assets in shares of companies listed Chinese Stock Exchanges. China Merchants Bank Co., Ltd. Class A 8.8 The Fund may invest up to 100% of its assets in any industry and in companies of Zhejiang Weixing New Building any size. 8.4 Materials Co. Ltd. Class A The Fund may invest up to 100% of its assets in China A Shares and up to 10% in China B shares. Bank of Ningbo 7.4 The Fund may use derivatives with the aim of risk reduction or efficient management. China Mengniu Dairy Co. Ltd. 5.4 Fund information Midea Group 4.4 China Resources Land Limited 4.1 Fund Launch Date 04 June 2019 S.F. Holding Co., Ltd. Class A 4.0 Share Class Launch Date 26 July 2019 Gree Electric Appliances, Inc. of Zhuhai Fund Size (US$m) 974.2 3.1 Co., Ltd. Class A Benchmark MSCI China A Onshore Net Index Zhejiang Chint Electrics Co., Ltd Class A 3.1 Number of holdings 43 Ping An Insurance (Group) Company of 2.9 Fund Manager(s) Winston Ke/Martin Lau China, Ltd. Class A Minimum Investment US$500,000 Initial charge 0%< Sector Breakdown Ongoing Charges † 1.50% Industrials 32.4% (15.5%*) Financials 21.8% (18.1%*) Share Type Accumulation Consumer Discretionary 10.5% (8.3%*) Sedol BKF2S62 Health Care 9.4% (9.5%*) Consumer Staples 9.1% (11.7%*) ISIN IE00BKF2S627 Real Estate 4.7% -

Aviva Investors Société D'investissement À Capital

AVIVA INVESTORS SOCIÉTÉ D’INVESTISSEMENT À CAPITAL VARIABLE (SICAV) ANNUAL REPORT AND AUDITED FINANCIAL STATEMENTS R.C.S. Luxembourg B 32.640 31 December 2020 avivainvestors.com For the following sub-funds of Aviva Investors no notification for distribution in the Federal Republic of Germany has been submitted and shares in these sub-funds may NOT be offered to investors within the scope of the German investment code. As a consequence, the following sub-funds are NOT available to investors in Germany: Aviva Investors – Asian Equity Income Fund Aviva Investors – Emerging Markets Equity Income Fund Aviva Investors – European Corporate Bond Fund Aviva Investors – European Equity Fund Aviva Investors – European Equity Income Fund Aviva Investors – European Real Estate Securities Fund Aviva Investors – Global Emerging Markets Index Fund Aviva Investors – Global Sovereign Bond Fund (name change as of 17 February 2020 from previous Global Aggregate Bond Fund) Aviva Investors – UK Listed Equity High Alpha Fund Aviva Investors Société d’investissement à capital variable (SICAV) Contents Director’s Report 3 Manager’s Market Review 6 Management and Administration 7 Audit Report 8 Notes on the portfolio of investments disclosure 11 Aviva Investors - Asian Equity Income Fund 12 Aviva Investors - Climate Transition Global Equity Fund 14 Aviva Investors - Climate Transition European Equity Fund 16 Aviva Investors - Emerging Markets Bond Fund 18 Aviva Investors - Emerging Markets Corporate Bond Fund 23 Aviva Investors - Emerging Markets Equity Income -

Companies That Made a Full-Time O Er to One Or More MSOR/IE Students

Companies that made a full-time oer to one or more MSOR/IE students who graduated in October 2019 or February 2020 26% Data Science & Business Analytics Firms include: Amazon, Wayfair, 360i, AccrueMe LLC, Amadeus, American Express, Amherst Holdings, Aretove Technologies, Barclays, BNP Paribas, Capgemini, Cubesmart, DIA Associates, Expedia, Goldenberry, LLC, Intellinum Analytics Inc, Jellysmack, Kalo Inc, LGO Markets, Ly, Mediacom, NBCUniversal Media, LLC, Neuberger Berman, PepsiCo, Amazon, Robinhood, Shareablee, State Administration of Foreign Exchange, Swiss Re, Two Sigma, Whiterock AI Titles include: Big Data Analyst, Business Analyst, Business Intelligence Analyst, Credit Risk Analyst, Data Analyst, Data Engineer, Data Scientist, Insight Analyst, Investment Analytics Analyst, Quant Researcher/Developer, Quantitative Analytics Associate, Research Analyst and Solutions Engineer 20% Quantitative Research Firms include: Citi, Goldman Sachs, Aflac Global Investments, American Express, Arrowstreet Capital, CME Group, Credit Agricole, Credit Suisse, Deutsche Bank, Global A.I., Jp Morgan Chase, Krane Funds Advisors, New York International Capital, PingAn Technology Inc., Puissance Capital, Rayens Capital, SG Americas Securities LLC, Shanghai Kingstar Soware Technology Co., Ltd., Vidrio FInancial, Wolfe Research Titles include: Analyst, Applied Quantitative Research & Development, Associate Vice President, CFR Senior Analyst, Consumer & Investment Management Senior Analyst, Data Modeling Analyst, FICC Strategic Analyst, Investment Analyst, Markets Quantitative Analyst, Post Trade & Optimization Services Quant Risk Manager, Quantitative Analyst, Quantitative Associate, Quantitative Strategist, Quantitative Strategist Associate, Quantitative Strategy & Modeling, Risk Appetite Model & Methodology Analyst, Securitization Quant, Sell Side M&A Investment Banking Analyst and Treasury/CIO Senior Associate 19% Engineering & Technology Firms include: Alibaba, Amazon, Anheuser-Busch InBev, AntX LLC, Baco SA,Beijing Huahui Shengshi Energy Technology Co. -

2014 ANNUAL REPORT 1 BANK of NINGBO Co.,Ltd 2 2014 ANNUAL REPORT 3 BANK of NINGBO Co.,Ltd 1

2014 ANNUAL REPORT 1 BANK OF NINGBO Co.,Ltd 2 2014 ANNUAL REPORT 3 BANK OF NINGBO Co.,Ltd 1 Chapter One Important Notes The Board of Directors, Board of Supervisors, directors, supervisors and senior managers of the Company ensure the authenticity, accuracy and completeness of contents, and guarantee no fraulds, misleading statements or major omissions in this report. They are willing to burden any individual and joint legal responsibilities. All the directors, supervisors and senior managers are able to guarantee the authenticity, accuracy and completeness of this report without any objection. The 6th meeting of the 5th Board of Directors of the company approval the text and abstract of 2014 Annual Report on 24 April 2015. 15 out of 17 directors were present. Director Li Hanqiong authorize director Chen Guanghua to vote. Director Ben Shenglin authorize director Zhu Jiandi to vote. Part of supervisors attended this meeting as well. The Company's profit distribution plan was passed by the Board of Directors as follows: taking the total share capital on 31 Dec. 2014 as the base number, cash bonus of RMB 4.5 yuan (including tax) per 10 shares was distributed to all shareholders, and 2 shares for every 10 shares were given by converting capital reserve into share capital. This plan will be submitted to 2014 general meeting of stockholders for further approval. The Chairman of the board Mr. Lu Huayu, the president Mr. Luo Mengbo, the vice president Mr. Luo Weikai, who is in charge of accounting, and the general manager of accounting department Ms. Sun Hongbo hereby declare to pledge the authenticity, accuracy and completeness of financial statements in the annual report. -

FTSE Publications

2 FTSE Russell Publications 01 October 2020 FTSE Value Stocks China A Share Indicative Index Weight Data as at Closing on 30 September 2020 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Agricultural Bank of China (A) 4.01 CHINA Fuyao Glass Group Industries (A) 1.43 CHINA Seazen Holdings (A) 0.81 CHINA Aisino Corporation (A) 0.52 CHINA Gemdale (A) 1.37 CHINA Shanghai Fosun Pharmaceutical Group (A) 1.63 CHINA Anhui Conch Cement (A) 3.15 CHINA GoerTek (A) 2.12 CHINA Shenwan Hongyuan Group (A) 1.11 CHINA AVIC Investment Holdings (A) 0.61 CHINA Gree Electric Appliances Inc of Zhuhai (A) 7.48 CHINA Shenzhen Overseas Chinese Town Holdings 0.66 CHINA Bank of China (A) 2.23 CHINA Guangdong Haid Group (A) 1.24 CHINA (A) Bank Of Nanjing (A) 1.32 CHINA Guotai Junan Securities (A) 1.99 CHINA Sichuan Chuantou Energy (A) 0.71 CHINA Bank of Ningbo (A) 2 CHINA Hangzhou Hikvision Digital Technology (A) 3.56 CHINA Tbea (A) 0.86 CHINA Beijing Dabeinong Technology Group (A) 0.56 CHINA Henan Shuanghui Investment & Development 1.49 CHINA Tonghua Dongbao Medicines(A) 0.59 CHINA China Construction Bank (A) 1.83 CHINA (A) Weichai Power (A) 2.09 CHINA China Life Insurance (A) 2.14 CHINA Hengtong Optic-Electric (A) 0.59 CHINA Wuliangye Yibin (A) 9.84 CHINA China Merchants Shekou Industrial Zone 1.03 CHINA Industrial and Commercial Bank of China (A) 3.5 CHINA XCMG Construction Machinery (A) 0.73 CHINA Holdings (A) Inner Mongolia Yili Industrial(A) 6.32 CHINA Xinjiang Goldwind Science&Technology (A) 0.74 -

Lazard Global Investment Funds Plc

Lazard Global Investment Funds plc Für in der Schweiz eingetragene Teilfonds Auszug aus dem Jahresbericht und geprüften Abschluss Für das am 31. März 2020 endende Geschäftsjahr Inhalt Verwaltungsrat und sonstige Informationen .................................................................. 4 Bericht des Verwaltungsrates ........................................................................................ 6 Bericht des Anlageverwalters....................................................................................... 13 Bericht der Verwahrstelle ............................................................................................. 33 Gesamtergebnisrechnung ............................................................................................ 34 Bilanz ............................................................................................................................ 38 Aufstellung der Veränderungen im Nettovermögen der Anteilinhaber von Redeemable Participating Shares ................................................................................ 42 Anmerkungen zum Abschluss ...................................................................................... 46 Vermögensaufstellung der Portfolios ......................................................................... 107 Aufstellung der wesentlichen Anlageveränderungen (ungeprüft) .............................. 159 Offenlegung der Vergütung gemäß OGAW V (ungeprüft) .......................................... 169 Anhang 1: Zusätzliche Informationen für Anleger -

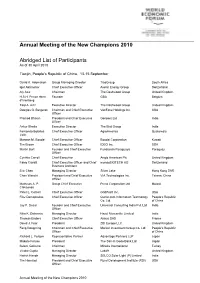

Annual Meeting of the New Champions 2010 Abridged List Of

Annual Meeting of the New Champions 2010 Abridged List of Participants As of 30 April 2010 Tianjin, People's Republic of China, 13-15 September David K. Adomakoh Group Managing Director TisoGroup South Africa Igor Akhmerov Chief Executive Officer Avelar Energy Group Switzerland Aly Aziz Chairman The Dashwood Group United Kingdom H.S.H. Prince Henri Founder GBA Belgium d'Arenberg Taqi A. Aziz Executive Director The Dashwood Group United Kingdom Douglas G. Bergeron Chairman and Chief Executive VeriFone Holdings Inc. USA Officer Pramod Bhasin President and Chief Executive Genpact Ltd India Officer Ankur Bhatia Executive Director The Bird Group India Fernando Bolaños Chief Executive Officer AgroAmerica Guatemala Valle Marwan M. Boodai Chief Executive Officer Boodai Corporation Kuwait Tim Brown Chief Executive Officer IDEO Inc. USA Martin Burt Founder and Chief Executive Fundación Paraguaya Paraguay Officer Cynthia Carroll Chief Executive Anglo American Plc United Kingdom Fabio Cavalli Chief Executive Officer and Chief mondoBIOTECH AG Switzerland Business Architect Eric Chen Managing Director Silver Lake Hong Kong SAR Chen Wenchi President and Chief Executive VIA Technologies Inc. Taiwan, China Officer Mathews A. P. Group Chief Executive Press Corporation Ltd Malawi Chikaonda Peter L. Corsell Chief Executive Officer GridPoint Inc. USA Fritz Demopoulos Chief Executive Officer Qunar.com Information Technology People's Republic Co. Ltd. of China Jay P. Desai Founder and Chief Executive Universal Consulting India Pvt. Ltd India Officer Nitin K. Didwania Managing Director Hazel Mercantile Limited India Thomas Enders Chief Executive Officer Airbus SAS France David J. Fear President ZBI Europe LLC United Kingdom Feng Dongming Chairman and Chief Executive Markor Investment Group Co.