Market Trends, Formulation Strategies and Tips for Marketing Nutrition Bars

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q3 14 Choice Plus Approved Products Choice Plus Snack Requirements

Q3 14 Choice Plus Approved Products Choice Plus Snack Requirements (per package): ≤ 250 calories, ≤ 10 g fat*, ≤ 3 g saturated fat, 0 g trans fat, ≤ 230 mg of sodium, ≤ 20 g of sugar** (*Nuts and seeds are exempt from the total fat criteria due to their fiber, vitamin E and better fat content. These items must still meet the criteria for sodium and calories. **unsweetened dried fruit exempt) PLEASE NOTE: Snack products that meet ALL Choice Plus requirements above are approved for usage. Manufacturer Product (* Items qualify for 2bU program) Distributor(s) Size (oz) Size (g) Cal Cal Fat % Fat Fat (g) Sat. Fat (g) % Sat Fat Chol. (mg) Sod. (mg) Carb (g) Prot. (g) Trans fat Sugars (g) Dietary Fiber (g) 20/20 LifeStyles Protein Bar Cocoa Almond Vistar 1.00 27 110 50 8.00% 5 1 5 0 60 11 8 0 6 2 Cherry/Banana Vistar/Direct 0.64 18 55 3 1.00% 1 0 0% 0 0 12 1 0 6 2 Bare Fruit Mango/ Pineapple Vistar/Direct 0.64 18 34 2 1.00% 1 0 0% 0 7 8 1 0 8 1 Mini Chocolate Chunk Cookies* UNFI 9.50 26 130 50 9.00% 6 1.5 8% 0 70 17 2 0 9 1 SNACKWELL'S MINI Creme Sandwich Cookies Vistar 1.00 48 210 50 8.00% 5 1.5 8% 0 170 38 2 0 17 0 Back To Nature SNACKWELL'S COOKIE CAKES DEVIL'S FOOD FAT FREE Vistar 1.00 28 85 3 0.00% 0.0 0.0 0% 0 49 21 1 0 12 0 Honey Graham Stick Cookies* UNFI 8.00 31 130 25 5.00% 3 0 0% 0 170 25 30 0 9 1 Balance Bar Peanut Butter Vistar 1.00 50 200 60 11.00% 7 3 15 0 170 21 15 0 17 <1 Barbara's Bakery Snackimals Animal Cookies Chocolate Chip Vistar 1.00 30 120 35 6.00% 4 0 0 0 80 19 1 0 8 0 Biscomerica Basil's Low Fat Animal Snackers Vistar -

Item # Description Pk Ships Gf Nf Tnf Sf V Df K Lf Vegan

J. POLEP'S ALLERGEN FREE LISTING KEY GF = Gluten free NF = Nut Free TNF = Tree Nut Free SF = Soy Free V = Vegetarian DF = Dairy Free K = Kosher LF = Lactose Free Vegan = Vegan L=Local ITEM # DESCRIPTION PK SHIPS GF NF TNF SF V DF K LF VEGAN LOCAL NON-GMO BEVERAGES - REFRIGERATED 738708 FAIRLIFE CHOC MILK 2% 11.5OZ 12 REFER 738682 FAIRLIFE MILK 2% 11.5 OZ 12 REFER 737056 POM COCONUT DRINK 12 OZ 6 REFER X X 737072 POM HULA DRINK 12 OZ 6 REFER X X 737064 POM MANGO DRINK 12 OZ 6 REFER X X 719948 POM POMEGRANATE JUICE 16 OZ 6 REFER X X X X X X 723809 POM POMEGRANATE JUICE 8 OZ 8 REFER X X X X X X 725051 SIMPLY APPLE JUICE 340 ML 12 REFER X X X X X X 730028 SIMPLY CRANBERRY 340 ML 12 REFER X X X X X X 739037 SIMPLY FRUIT PUNCH 340ML 12 REFER 725085 SIMPLY LEMONADE 340 ML 12 REFER X X X X X X 725044 SIMPLY LIMEADE 340 ML 12 REFER X X X X X X 725036 SIMPLY ORANGE CALCIUM 340 ML 12 REFER X X X X X X 725069 SIMPLY ORANGE JUICE 340 ML 12 REFER X X X X X X 730267 SIMPLY ORANGE JUICE 59 OZ 6 REFER 728220 SIMPLY ORANGE MANGO 340 ML 12 REFER X X X X X X 725077 SIMPLY RASP LEMONADE 340 ML 12 REFER X X X X X X 739045 SIMPLY TROPICAL 340 ML 12 REFER Page 1 of 78 J. -

Cadenza Document

VGM Club Report Date: Jul 2019 Contracted Manufacturer Report Mfr Name Has Rebate Has Pricing 3M Y Y Abbott Nutrition Y N ACH Food Companies Y N Advance Food Products LLC AFP Y Y AdvancePierre Y Y Agro Farma Inc Y Y Ajinomoto Windsor Inc (formerly Windsor Frozen Foods) Y N Allied Buying Corporation (ABC) Y N All Round Foods Bakery Products Y N Alpha Baking/National Baking Y N American Licorice Co Y N American Metalcraft Y N American Roland Food Corp Y N Amplify Snack Brands Y N Amy's Kitchen Inc Y N Anchor Packaging Y Y Antonio Mozzarella Factory Y N Appetizers And Inc Y Y Apple & Eve Y Y Argo Tea Y Y Arizona Tea - Hornell Brewing Company Y Y Armanino Foods Y Y Armour-Eckrich Meats LLC DBA Carando Y N Armour Eckrich - Smithfield Y Y Ateeco/Mrs T's Pierogies Y Y Atlantic Mills Co Y Y Awake Chocolate Y N Azar Nut Company Y N Bagcraft Packaging LLC Y N Bake N Joy Inc Y N Bakery De France Y Y Ballard Brands Y Y BarFresh Corporation Inc Y Y Barilla America Inc Y Y Basic American Food Co Y Y Bay Valley Foods LLC Y N Belgioioso Cheese Inc Y N Bel Kaukauna Cheese Co Y Y Berks Packing Co Inc Y N Berry Plastics Diet Kits Y N Berry Plastics Liners Y Y Beverage Air Y N Page 1 Of 9 VGM Club Report Date: Jul 2019 Contracted Manufacturer Report Mfr Name Has Rebate Has Pricing Beyond Meat Y Y B&G Foods Inc Y Y Big City Reds /American Foods Y N Big Red Inc Y Y BioSelect N Y Biscomerica Corp. -

Snack, Cereal and Nutrition Bars in the United States

International Markets Bureau MARKET ANALYSIS REPORT | SEPTEMBER 2013 Snack, Cereal and Nutrition Bars in the United States Source: Mintel GNPD. Source: Mintel GNPD. Snack, Cereal and Nutrition Bars in the United States EXECUTIVE SUMMARY INSIDE THIS ISSUE Total health and wellness food and beverage sales in the Executive Summary 2 United States are on the rebound, growing by 2% from 2011 to 2012 (and 6% from 2010 to 2012), despite the economic Market Snapshot 3 slowdown that the U.S. experienced these past 5 years. It now appears that with a recovering economy, Americans are again Snack Bars Market Sizes 4 receptive to buying health foods. However, future growth may be hampered by the frugality that American consumers have Health and Wellness Snack 5 adopted, meaning that consumers may be more price-sensitive Bars Market in shopping for healthy options. Organic Snack Bars 6 U.S. packaged food as a whole is recovering from the economic downturn; U.S. organic packaged food sales are also Energy and Nutrition Bars 7 recovering. Organic products are sub-category of the health and wellness sector. Organic products carry a higher price Consumer Trends 8 than their conventional counterparts, so it is not surprising that sales were affected by the economic slowdown. Before the Claims Analysis 11 recession of 2008, organic packaged food value sales enjoyed double-digit growth before plunging. Now organic packaged Market Shares by Brand 12 food value sales are recovering again; they increased by 2.1% and Company between 2011 and 2012, to reach US$12.2 billion. Distribution Channels 13 Snack, cereal and nutrition bars continued their growth in 2012, with an ever-expanding array of flavours and healthy varieties. -

C&U C-Store Best Practice Pogs

C&U C-Store Best Practice POGs 4ft Nutrition Page: 1 of 3 | 1.25.2016 Shelf Schematic Report Planogram #2 Name: 4ft Nutrition h: 4 ft 6.00 in w: 4 ft d: 2 ft # of segments: 1 Shelf Name: 1 w: 48.00 in Merch Height: 10.00 in d: 24.00 in Available Linear: 0.10 in Notch #: 44 Location ID UPC Name Size UOM Facings Height Width Depth 1 88462310037 BEAR NAKED ENERGY BAR CHOC PB 2.00OZ 1 2.40 in 5.15 in 0.75 in 2 88462310040 BEAR NAKED ENERGY BAR PNT BTR 2.00OZ 1 2.25 in 5.20 in 0.70 in 3 3800000011 SPECIAL K PROTEIN BAR STRAW 1.59OZ 1 1.90 in 6.45 in 1.00 in 4 3800000071 SPECIAL K PROTEIN BAR CRN WLNT 1.59OZ 1 1.95 in 6.65 in 0.80 in 5 3800000055 SPECIAL K PROTEIN BAR CHOC CRML 1.59OZ 1 2.10 in 6.75 in 0.70 in 6 3800000010 SPECIAL K PROTEIN BAR CHOC P-BTR 1.59OZ 1 1.90 in 6.55 in 0.80 in 7 3800000012 SPECIAL K PROTEIN BAR DBL CHOC 1.59OZ 1 2.10 in 6.40 in 6.70 in 8 3800000001 SPECIAL K PROTEIN BAR C-CHP 1.59OZ 1 1.85 in 6.25 in 0.90 in Shelf Name: 2 w: 48.00 in Merch Height: 10.00 in d: 24.00 in Available Linear: 2.42 in Notch #: 37 Location ID UPC Name Size UOM Facings Height Width Depth 9 3800012937 SPECIAL K CHEWY NUT BAR CHOC ALM 0.00 1 5.69 in 5.56 in 1.00 in 10 3800012934 SPECIAL K CHEWY NUT BAR CRAN ALM 0.00 1 5.69 in 5.56 in 1.00 in 11 1600050766 NATURE VALLEY PRTN BR P-BTR CHOC 1.42OZ 1 1.95 in 5.90 in 0.80 in 12 1600050887 NATURE VALLEY PRTN BR CARAMEL NT 1.42OZ 1 2.00 in 5.90 in 0.85 in 13 1600050618 NATURE VALLEY ENERGY CRAN ALM 1.77OZ 1 2.15 in 7.30 in 0.70 in 14 1600050617 NATURE VALLEY ENERGY CHR DRK CH 1.77OZ 1 2.15 in 7.20 in -

1 TOP PROTEIN and ENERGY BARS TESTED * = Author's Top Picks

TOP PROTEIN AND ENERGY BARS TESTED * = author’s top picks based upon the test criteria BRAND NAME BAR NAME WEIGHT GRAMS CALORIES GRAM WITHSTANDS DURABLE / WEBSITE OUNCES OF S OF HEAT WELL PLIABLE PROTEIN CARBS 22 DAYS Vegan Protein 2.6 20 290 24 YES YES- www.22daysnutrition.com Bar * GREAT QuestBar Protein Bar * 2.12 20 170 25 YES-GREAT YES www.questnutrition.com Rise Protein Bar * 2.1 17 260 22 YES YES www.risebar.com Odawalla Protein Bar * 2.0 14 210 30 YES YES www.odawalla.com Elisabeth Nogii High 1.93 17 230 24 OK OK www.nogii.com Hasselbeck’s Protein Bar PowerBar Protein Bar 2.12 20 210 25 NO NO www.powerbar.com Clif Bar Builder’s Protein 2.4 20 270 31 NO NO www.clifbar.com Bar Balance Bar Protein (Peanut 1.76 15 200 21 OK OK www.balance.com Butter) Zone Perfect 1.76 14 210 24 NO NO www.zoneperfect.com Zero Impact High Protein 3.5 30 400 35 NO NO www.vpxsports.com Mealbar Bear Valley MealPack 3.75 16 400 56 YES OK www.mealpack.com Concentrated Food Bar* Pro Bar Meal* 3 9 370 48 YES YES www.theprobar.com Clif Bar Energy Bar 2.4 11 250 41 YES YES www.clifbar.com PowerBar Harvest Energy 2.29 9 240 42 OK OK www.powerbar.com PowerBar Performance 2.2 9 240 44 YES-GREAT YES- www.powerbar.com Energy Bar * GREAT First Strike Nutritious 2.3 4 280 46 YES YES Sterling Foods (military MRE Energy Bar bar) Pure Organic Banana Coconut 2.0 6 200 25 OK OK www.thepurebar.com Picky Bars Energy Bar 1.6 7 200 28 OK NO www.pickbars.com Greens+ Energy Bar 2.0 8 260 32 OK OK www.greensplus.com/chia Bixby Bar Whippersnappe 1.5 3 220 19 OK NO www.bixbyco.com r Chocolate Bar Tanka Bar Buffalo Meat 1.0 7 70 7 YES YES www.tankbar.com Jerky WHERE TO GET IT • Recreational Equipment Incorporated (REI) www.rei.com – store or online / carries almost everything • Vitamin Shoppe www.vitaminshoppe.com – widespread store chain • Whole Foods www.wholefoodsmarket.com – premium and vegan / more healthy selections • PowerBar www.powerbar.com – can order online under products • Your local supermarket or pharmacy 1 . -

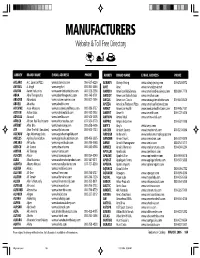

Mfg Index.Pmd

MANUFACTURERS Website & Toll Free Directory nfu ABBREV BRAND NAME E-MAIL ADDRESS PHONE ABBREV BRAND NAME E-MAIL ADDRESS PHONE ACLARO A.C. Larocco Pizza www.aclarocco.com 866-527-6226 ALWAYS Always Young www.alwaysyoung.com 800-252-8572 AVOGEL A. Vogel www.vogel.nl 800-864-3546 AME Ame www.naturalgroup.net AARON Aaron Industries www.aaronindustriesinc.com 800-525-2558 AMRBIO American BioSciences www.americanbiosciences.com 888-884-7770 ABRA Abra Therapeutics www.abratherapeutics.com 800-745-0761 AMBIOT American Biotech Labs www.amsilver.com ABSORB Absorbaid www.naturessources.com 800-827-7656 AMCLS American Classic www.onceagainnutbutter.com 800-804-8520 ABUELI Abuelita www.abuelita.com APIZZA American Flatbread Pizza www.americanflatbread.com ACCUME Accu-Measure www.accumeasurefitness.com 800-886-2727 AMHLT American Health www.americanhealthvitamins.com 800-445-7137 ACTION Action Labs www.nutraceutical.com 800-932-2953 AMRFIT Amerifit www.amerifit.com 800-722-3476 ADVCAL Advacal www.lanelabs.com 800-526-3005 AMINOV Amino Vital www.amino-vital.com AFRICN African Red Tea Imports www.africanredtea.com 877-564-0770 AMPRO Ampro Industries 800-632-1998 AFTRBT After Bite www.tendercorp.com 800-258-4696 AMY’S Amy’s www.amys.com ATF After The Fall (Smuckers) www.atfjuices.com 800-903-7724 ANCIEN Ancient Secrets www.lotusbrands.com 800-824-6936 AGEADV Age Advantage Labs www.ageadvantagelabs.com ANDSGR Anderson’s www.andersonsmaplesyrup.com AGELSS Ageless Foundation www.agelessfoundation.com 888-456-3335 ANNCHN Annie Chun’s www.anniechun.com 866-972-6879 -

Your 2017 Good-To-Go Item List Available at Vistar *Updated July, 2017 Brand Category Item Description Item # Size Pack

VISTAR GOOD-TO-GO ITEM LIST FOR 2017 (UPDATED JULY 2017) VISTAR: 800.880.9900 • [email protected] YOUR 2017 GOOD-TO-GO ITEM LIST AVAILABLE AT VISTAR *UPDATED JULY, 2017 BRAND CATEGORY ITEM DESCRIPTION ITEM # SIZE PACK 180Snaks SPECIALTY BETTER4YOU Bites Nutty Rice Blueberry MRBB09529 1.25 oz 48 180Snaks SPECIALTY BETTER4YOU Bar Bluebrry Pomegrnte Crunch MRB00005 1.1 oz 6/12 180Snaks SPECIALTY BETTER4YOU Bar Cranberry Pomegrnt Crunch MRB00006 1.1 oz 6/12 180Snaks SPECIALTY BETTER4YOU Bar Almond Cashew Pumpkin Seed MRB00009 1.1 oz 6/12 180Snaks SPECIALTY BETTER4YOU Blueberry Pomegrant Clisters MRB00089 2 oz 12 180Snaks SPECIALTY BETTER4YOU Bar Bluebrry Pomegrnte Crunch MRB01003 1.1 oz 6/12 180Snaks SPECIALTY BETTER4YOU Bar Almond Cashew Pumpkin Seed MRB01007 1.1 oz 6/12 180Snaks SPECIALTY BETTER4YOU Bites Nutty Rice Blueberry MRB09510 1.25 oz 8 180Snaks SPECIALTY BETTER4YOU Bites Nutty Rice Cranberry MRB09511 1.25 oz 8 180Snaks SPECIALTY BETTER4YOU Bites Nutty Rice Mango MRB09512 1.25 oz 8 180Snaks SPECIALTY BETTER4YOU Clusters Almd Chw w/Pmpkn Seed MRB09513 1 oz 10 180Snaks SPECIALTY BETTER4YOU Clusters Blueberry Pomegranate MRB09514 1 oz 10 180Snaks SPECIALTY BETTER4YOU Clusters Cranberry Pomegrante MRB09515 1 oz 10 180Snaks SPECIALTY BETTER4YOU Clusters Blueberry Pomegrante MRB09517 2 oz 8 180Snaks SPECIALTY BETTER4YOU Clusters Cranberry Pomegrante MRB09518 2 oz 8 180Snaks SPECIALTY BETTER4YOU Clusters Almd Chw w/Pmpkn Seed MRB09520 1 oz 48 180Snaks SPECIALTY BETTER4YOU Clusters Blueberry Pomegranate MRB09521 1 oz 48 180Snaks SPECIALTY -

H.U.M.A.N. Catalog Vending Items

H.U.M.A.N. Catalog Vending Items www.HealthyVending.com • [email protected] Contents 3 Best Sellers - Natural 11 Best Sellers - Sports 17 Natural - Bars & Snacks 28 Natural - Beverages 38 Sports - Bars, Snacks & Supplements 50 Sports - Beverages 55 Mass - Beverages Best Sellers Natural Best Sellers - Natural Bars & Snacks Code# Description UPC Code Size Cost/Item Cost/Case MSVRP/Unit BARS BARBARA`S BAKERY Fruit & Yogurt Bars 32241 Blueberry Apple Blueberry Apple 8/8.9 OZ $0.48 $22.88 $1.00 32240 Strawberry Apple Strawberry Apple 8/8.9 OZ $0.48 $22.88 $1.00 CLIF BARS Clif Bars - 100% Natural Nutrition Bars 30489 Chocolate Chip Peanut Crunch 722252-101303 12/2.4 OZ $1.06 $12.72 $2.00 30476 Cranberry Apple Cherry 722252-100801 12/2.4 OZ $1.06 $12.72 $2.00 30479 Crunchy Peanut Butter 722252-101204 12/2.4 OZ $1.06 $12.72 $2.00 31866 Oatmeal Raisin Walnut 722252-500038 12/2.4 OZ $1.06 $12.72 $2.00 31818 Pnut Toffee Buzz 722252-102409 12/2.4 OZ $1.06 $12.72 $2.00 Luna Bars - The Whole Nutrition Bar for Women 31820 Dulce de Leche 722252-104403 15/1.69 OZ $1.06 $15.90 $2.00 31883 Iced Oatmeal Cookie 722252-100634 15/1.69 OZ $1.06 $15.90 $2.00 30808 Lemon Zest 722252-103307 15/1.69 OZ $1.06 $15.90 $2.00 30806 Nutz Over Chocolate 722252-103109 15/1.69 OZ $1.06 $15.90 $2.00 31881 Peanut Butter Cookie 722252-100610 15/1.69 OZ $1.06 $15.90 $2.00 Builder`s Bars 31855 Cookies N` Cream 722252-601407 12/2.4 OZ $1.33 $16.00 $2.50 31856 Pnut Butter 722252-601414 12/2.4 OZ $1.33 $16.00 $2.50 ZBaRs 31863 Chocolate Brownie 722252-192035 6/6/1.27 OZ $0.57 -

Your 2018 Good-To-Go Item List Available at Vistar *Updated July, 2018 Brand Category Item Description Item # Size Pack

YOUR 2018 GOOD-TO-GO ITEM LIST AVAILABLE AT VISTAR *UPDATED JULY, 2018 BRAND CATEGORY ITEM DESCRIPTION ITEM # SIZE PACK FieldTrp SNACKS Beef Jerky Original No3 FLD00500 2.2 oz 9 180Snaks BARS Bar Bluebrry Pomegrnte Crunch MRB00005 1.1 oz 6/12 180Snaks BARS Bar Cranberry Pomegrnt Crunch MRB00006 1.1 oz 6/12 180Snaks BARS Bar Bluebrry Pomegrnte Crunch MRB01003 1.1 oz 6/12 180Snaks BARS Bar Cranberry Pomegrnt Crunch MRB01005 1.1 oz 6/12 180Snaks BARS Bar Almond Cashew Pumpkin Seed MRB01007 1.1 oz 6/12 180Snaks BARS Bar Almond Cashew Pumpkin Seed MRB00009 1.1 oz 6/12 180Snaks SNACKS Blueberry Pomegrant Clisters MRB00089 2 oz 12 180Snaks SNACKS Bites Nutty Rice Blueberry MRB09510 1.25 oz 8 180Snaks SNACKS Bites Nutty Rice Cranberry MRB09511 1.25 oz 8 180Snaks SNACKS Bites Nutty Rice Mango MRB09512 1.25 oz 8 180Snaks SNACKS Clusters Almd Chw w/Pmpkn Seed MRB09513 1 oz 10 180Snaks SNACKS Clusters Blueberry Pomegranate MRB09514 1 oz 10 180Snaks SNACKS Clusters Cranberry Pomegrante MRB09515 1 oz 10 180Snaks SNACKS Clusters Blueberry Pomegrante MRB09517 2 oz 8 180Snaks SNACKS Clusters Cranberry Pomegrante MRB09518 2 oz 8 180Snaks SNACKS Clusters Almd Chw w/Pmpkn Seed MRB09520 1 oz 48 180Snaks SNACKS Clusters Blueberry Pomegranate MRB09521 1 oz 48 180Snaks SNACKS Cluster Cranberry Pomegrante MRB09522 1 oz 48 180Snaks SNACKS Cluster Almd Chw w/Pmpkn Seed MRB09523 2 oz 48 180Snaks SNACKS Clusters Blueberry Pomegrante MRB09524 2 oz 48 180Snaks SNACKS Clusters Cranberry Pomegrante MRB09525 2 oz 48 180Snaks SNACKS Bites Nutty Rice Blueberry MRB09526 .62 -

Food Stamp Program Eligible Food Determinations 1

FOOD STAMP PROGRAM ELIGIBLE FOOD DETERMINATIONS 1 FEBRUARY 18, 2005 Date Product Eligible Ineligible 3/14/02 40-30-30 BALANCE, DRINK MIX, X (ALL FLAVORS) 8/29/94 ACCESS FAT CONVERSION ACTIVITY X BAR 5/17/78 ACIDOPHILUS CULTURE X 1/13/03 ADVANTEDGE CARB CONTROL X NUTRITION BAR 1/13/03 ADVANTEDGE CARB CONTROL X READY-TO-DRINK 1/13/03 ADVANTEDGE EXTREME OUTDOOR X ENERGY BAR 1/13/03 ADVANTEDGE NUTRITION BAR X 1/13/03 ADVANTEDGE QUICK SHAKE X 1/13/03 ADVANTEDGE READY-TO-DRINK X 1/13/03 ADVANTEDGE SOY PROTEIN X 1/13/03 ADVANTEDGE WHEY PROTEIN X 5/17/78 ALFALFA SEED X 12/11/92 ALITRAC X 2/16/84 ALL STAR PROTEIN POWDER X 9/20/84 ALLFOODTABS X 5/16/02 ALMOND BREEZE X 11/3/03 ALMOND BROWNIE BALANCE BARS X 1/14/00 ALOE BLOSSOM HERBAL TEA X 2/18/93 ALOE PLUS X DETERMINATION ON THIS PRODUCT WAS CHANGED FROM INELIGIBLE TO ELIGIBLE ON THE DATE NOTED. PRODUCT IS INELIGIBLE BECAUSE IT IS NOT SOLD THROUGH FIRMS WHICH QUALIFY FOR AUTHORIZATION TO ACCEPT FOOD STAMP BENEFITS. FOOD STAMP PROGRAM ELIGIBLE FOOD DETERMINATIONS 2 FEBRUARY 18, 2005 Date Product Eligible Ineligible 5/17/78 ALOE VERA GEL X 4/9/86 ALOE VERA JUICE X 4/13/84 ALTERNATIVE VINEYARDS, NON- X ALCOHOLIC BEVERAGES 7/18/91 AMAZING MICRO BARS X (ALL FLAVORS) 7/18/91 AMAZING MICRO CHILI X 7/18/91 AMAZING MICRO DRINKS X (ALL FLAVORS) 7/18/91 AMAZING MICRO MUESLI X 7/18/91 AMAZING MICRO PASTA, MARINARA X 7/18/91 AMAZING MICRO PASTA, TETRAZZINI X 7/18/91 AMAZING MICRO SOUPS X (ALL FLAVORS) 11/2/83 AMERICAN GOLD BEVERAGE MIXES X (ALL FLAVORS) 11/2/83 AMERICAN GOLD TOFU MIXES X 4/26/02 AMERICAN WHEY PROTEIN X 3/17/03 AMINO 1000 X 10/23/02 AMP ENERGY DRINK X 11/3/03 APPLE CRISP ZOE FLAX AND SOY X BARS 6/10/02 ARGINAID EXTRA X 9/18/98 ARM AND HAMMER DENTAL CARE X GUM DETERMINATION ON THIS PRODUCT WAS CHANGED FROM INELIGIBLE TO ELIGIBLE ON THE DATE NOTED. -

Resnick Distributors 800-828-3865 Snacks Product No Description U/M

Resnick Distributors Snacks 800-828-3865 Product No Description U/M Case Pack Retail Book Cat 14477 CEREAL CUPS APPLE JACKS 6 10 1.59 422 17674 CEREAL CUPS CHEERIOS 1.38Z! 6 10 1.39 422 17676 CEREAL CUPS CINNAMON TOAST ! 6 10 1.39 422 14487 CEREAL CUPS COCOA KRISP 2.3Z 6 10 1.59 422 14473 CEREAL CUPS CORN POPS 6 10 1.59 422 14481 CEREAL CUPS FROOT LOOPS 6 10 1.59 422 14471 CEREAL CUPS FROSTED FLAKES 6 10 1.59 422 17675 CEREAL CUPS HONEY NUT CHEERIO! 6 10 1.39 422 35700 CEREAL CUPS KRAVE CHOC 6 10 1.59 422 17678 CEREAL CUPS LUCKY CHARMS ! 6 10 1.39 422 25401 CEREAL CUPS OATMAL MORNHARV 3Z 8 1 1.99 422 25400 CEREAL CUPS OATMEAL CRNCH 2.3Z 8 1 2.69 422 25402 CEREAL CUPS OATMEAL ORCH 2.5Z 8 1 1.99 422 55002 CEREAL CUPS QUAK OAT BRNSGR 1 12 1.99 422 14475 CEREAL CUPS RAISIN BRAN 6 10 1.59 422 14479 CEREAL CUPS SPECIAL K 6 10 1.59 422 14489 RACK CEREAL CUPS 36CT 1 1 422 20968 7 DAY SOFT CROISSANT CHOCOLAT 6 4 1.29 426 20969 7 DAY SOFT CROISSANT VANILLA 6 4 1.29 426 22990 BALANCE BAR CHOCOLATE 50g ! 6 8 1.69 426 22991 BALANCE BAR COOKIE DOUGH 50g! 6 8 1.69 426 22992 BALANCE BAR GOLD CARML NUT 50g 6 8 1.69 426 22993 BALANCE BAR GOLD CHOC/PB 50g ! 6 8 1.69 426 22994 BALANCE BAR YOGURT HONY PNUT50 6 8 1.69 426 20408 BEAR NAKED CHOCCHIP PNUT BAR2z 8 6 1.79 426 20410 BEAR NAKED PEANUT BTR BAR 2oz 8 6 1.79 426 25346 BELVITA BLUEBERRY CRACKER 1.76 8 8 1.19 426 25323 BELVITA BREAKFAST CIN BRWN SGR 8 8 1.19 426 25348 BELVITA GOLDEN OAT CRACKER 1.7 8 8 1.19 426 25328 BELVITA SOFT BAKED BANANA 1.7Z 8 8 1.12 426 53000 BREAK-A-WAY CASHEW CHIA 1.41oz 12 6