Regional Report – Kyushu

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

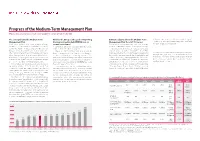

Progress of the Medium-Term Management Plan Making Steady Progress to Reach Our Management Goals Ahead of Schedule

Interview with the President Progress of the Medium-Term Management Plan Making steady progress to reach our management goals ahead of schedule The concept behind the Medium-Term Why has the Group set the goal of improving Estimates adjusted from the Medium-Term fiscal 2016 is expected to exceed the previous plan’s target of Management Plan the interest-bearing debt/EBITDA ratio to Management Plan: fiscal 2016 forecast 7.0 times to 6.8 times. We are steadily taking steps to reach these On the occasion of the management integration of Hankyu around seven times? Current estimates indicate that we will achieve our goals slightly management goals as early as possible. and Hanshin, the Group formulated and announced the six- To answer this question, I will once again explain the manage- ahead of schedule and forecasts have been adjusted accordingly. year Hankyu Hanshin Holdings Group 2007 Medium-Term ment indicators that the Group is aiming for. Operating income for the fiscal 2016 target year is forecast to Management Plan (fiscal 2008–fiscal 2013), for which we estab- The Group’s mainstay railway and real estate leasing surpass the previous plan (¥83.0 billion) by ¥2.0 billion to ¥85.0 Over six years have passed since the management integration lished yearly adjusted estimates and implemented initiatives to businesses generate stable cash flows. Yet, these businesses billion, reflecting currently robust railway operation revenue and of Hankyu Holdings, Inc. and Hanshin Electric Railway Co., Ltd. in achieve the plan’s targets. This plan was intended to clarify the are characterized by the need to own large amounts of fixed higher rental income mainly from the Umeda Hankyu Building. -

12. Development of Kansai Urban Area (PDF, 113KB)

CORPORATE OPERATING WEST JAPAN RAILWAY COMPANY CONTENTS BUSINESS事事 DATA OTHER OVERVIEW ENVIRONMENT 12 Business Development of Kansai Urban Area DEVELOPMENT OF KANSAI URBAN AREA *New station names are provisional. (As of May 2015) DEVELOPMENT OF THE DISTRICTS AROUND OSAKA STATION Tanigawa JR-West Group Medium-Term Management Plan 2017 Update JR Shichijyo* New station Spring 2019 Yamashina New “LUCUA osaka” Ibaraki Station Kyoto Kusatsu improvement and Kyoto Objectives Revenue target: Total of ¥77.0 billion for LUCUA 1100 and LUCUA development inside New Railway (FY2016) Visitor number target: 70.0 million station Spring 2018 Musuem Spring 2016 • Renovation of the OSAKA STATION CITY North Gate Building Himeji Maya* Nara Line • Securing wide range of customers through superiority of location and New station Shin-Osaka Takatsuki Station Double track Spring 2016 improvement Spring 2023 scale (largest concentration of commercial facilities in Osaka/Umeda Kakogawa Spring 2016 area) and through suitability for excursions • Leveraging promotional system and ability to attract highly popular JR Soujiji* Shin-Kobe specialty stores, cultivated through shopping center operations Kyobashi New station Higashi Himeji* Sannomiya Spring 2018 • Opening stores by Isetan in LUCUA 1100 specializing in fashion and New station Amagasaki Nara sundries, in which Isetan has strength Spring 2016 Kobe Nishi-Akashi Osaka Tennoji • Synergies with railway operations • Taking steps to enhance transport services, such as new rolling stock Oji introduction and timetables -

H2O Retailing / 8242

H2O Retailing / 8242 COVERAGE INITIATED ON: 2020.04.30 LAST UPDATE: 2021.06.24 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. H2O Retailing / 8242 RCoverageCoverage LAST UPDATE: 2021.06.24 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 -

Hallyeo National Marine Park View Ropeway, Tongyeong City, South Korea TOURISM SCOPE a Contents

2015. Vol. 34 ISSN 1739-5089 The Official Magazine of the Tourism Promotion Organization for Asia Pacific Cities Hallyeo National Marine Park View Ropeway, Tongyeong city, South Korea TOURISM SCOPE A Contents 02 Special Theme Exploration of Ho Chi Minh City 06 City Inside Yogjakarta, Encounter with Ancient Java 10 Focus On Walking Trail of Ulsan Yeongnam Alps 14 Concept Travel Heaven for Shopaholics The Best Shopping Malls of the World 18 TPO People Mr. Kim Dong-Jin, Mayor of Tongyeong city, South Korea 20 TPO News & Info 22 Zoom in Festival Tourism Promotion Organization for Asia Pacific Cities TPO is a network among cities in the Asia Pacific region and is an international tourism organization established for the development of the tourism industry. TPO exchanges tourism information between member cities to promote the tourism industry, and also carries out projects including tourism product development, joint marketing projects, and tourism industry education as well as human resources development. 75 city governments and 38 Industry members currently participate in as members of the TPO. Industry members consist of travel industry related associations, research institutes, and destination marketing organizations(DMO). TPO strives for the development of sustainable tourism and city tourism within the Asia Pacific region. TOURISM SCOPE 01 SPECIAL Exploration of Ho Chi Minh City A colony of France in the past, the city is full of vintage architectures and tasty food that is loved by people all over the world. With beautiful tree-lined street sceneries, it is also known as the ‘Paris of the East’. The city which is also the center of the financial district of Vietnam is called Ho Chi Minh City About Ho Chi Minh City Location 100km North West of Cap Saint Jacque, South of Annamese Cordillera in Southern Vietnam Area 2,099km2 Population 7,396,446 (2010) Weather A year-long hot weather with extremely high temperature and humidity. -

January 22, 2014 Update Financial Results Briefing Materials for The

Table of Contents 1. Executive Summary ・・・・・・・・・・ ・・・・・・・・・ 2 2. External Growth Strategies ・・・・・・・・・・・・・・・・ 11 3. Internal Growth Strategies・・・・・・・・・・・・・・・・・ 20 4. Financial Strategies ・・・・・・・・・・・・・・・・・・・ 28 5. Overview of Financial Results for the 17th Fiscal Period ・・・・ 33 6. APPENDIX・・・・・・・・・・・・・・・・・・・・・・・・ 40 This material includes forward-looking statements based on present assumptions and future outlook. Actual results may differ from the forward-looking statement values due to various factors. This material is not intended as a solicitation to acquire investment securities of Hankyu REIT nor is it intended as a solicitation to sign contracts relating to transactions of other financial instruments. When undertaking any investment, please do so based on your own judgment and responsibility as an investor. Before purchasing investment securities of Hankyu REIT, please consult with a securities company that is a “Type I Financial Instruments Business Operator.” This material is an English translation of the original, which was issued in the Japanese language. There are sections that display property names in abbreviated form. 1 1. Executive Summary 2 1-1. Towards the Growth Path April 2013 November 2013 Asset replacements Acquisition of new properties Improvement of Continuous acquisition of properties portfolio’s health 127.8 billion yen Acquisition of Kita-Aoyama 3 cho-me 121.3 billion yen Building HEP (part), NU sold 116.1 billion yen 18.8bn 17.3bn 50.9bn 41.2bn Acquisition of Hankyu Corporation Head Office Building 41.1bn June 2013 2nd PO Return to growth path 13.0bn 30.9bn Acquisition of AEON MALL 13.0bn SAKAIKITAHANADA and MANDAI Toyonaka Honan Store Acquisition of HANKYU 13.0bn NISHINOMIYA GARDENS 54.6bn 44.6bn 26.3bn Asst size (total acquisition price) End of 15th FP End of 16th FP End of 17th FP (End of Nov. -

Message to Our Shareholders 2007

Message to Our Shareholders 2007 Hankyu Department Stores, Inc. Contents ・To Our Shareholders ・The shift to a holding company structure ・Management integration with Hanshin Department Store ・Topics ・Redevelopment project near JR Oimachi Station ・Uni-President Hankyu Department Store in Kaohsiung, Taiwan ・Preparing to expand the scale of supermarket operations ・Launch of joint use of Persona Card and Hanshin's Emerald Card ・Settlement report (from 1st April 2006 to 31st March 2007) ・Corporate data To Our Shareholders During fiscal 2006, our Group saw both revenues and earnings increase. Performance was driven by curtailment of revenue losses arising from diminished sales space following the launch of reconstruction works at Umeda Main Store in the previous fiscal year, by increased revenues at other branches, and by opening of new supermarkets and the acquisition of retailer Nissho Corp. (now Hankyu Nissho Store). We made steady progress in the development of business infrastructure and expansion of operational scale as we pursued long-term business goals, grouped as the Grand Prix 10 (GP10) Plan. In addition to the acquisition of Nissho, we decided to open a new store in New Hakata Station Building, scheduled to open its doors in the spring of 2011, and rebuild multiple-use buildings within the redevelopment project near JR Oimachi Station in Tokyo’s Shinagawa Ward. We also established of Hanshoku Co., Ltd. as an President and Representative Director intermediary holding company to oversee our growing supermarket operations. Nobuaki Nitta In negotiations launched in September 2006 for our business alliance with The Hanshin Department Store, Ltd., we came to the conclusion that integrating our businesses would be the most efficient way forward for both of us. -

Hankyu Hanshin Holdings 2020

Hankyu Hanshin Holdings 2020 https://www.hankyu-hanshin.co.jp/en/ Printed in Japan Hankyu Hanshin Holdings Group Management Philosophy Message from the Top Management What we try to achieve In October 2006, Hankyu Hanshin Holdings was established as a result of the management integration of Hankyu Holdings and Hanshin Electric Railway. Since then, the Hankyu Hanshin Holdings Group has worked in unison to heighten the competitiveness of each business. At the same time, the Group Mission has used its collective strength to increase its overall profitability and grow its earnings. In conjunction By delivering “Safety and Comfort” and “Dreams and Excitement”, with these efforts, we have steadily improved our financial position. we create satisfaction among our customers and contribute to society. However, the business environment of the Group is likely to change significantly as the population of areas served by its railway lines declines due to falling birth rates and an aging population, and as the lifestyles and conditions of everyday life evolve with the progress of technological innovation. What is important to us Aiming to become a corporate group that can focus strongly on sustained growth even in such an environment, we announced the Hankyu Hanshin Holdings Group Long-Term Management Vision for Values 2025 (fiscal 2026) in 2017. We have also formulated a medium-term management plan, which covers 1 Customer First fiscal 2019 through fiscal 2022, as concrete actions for the realisation of the long-term vision, and are Everything we do is for the customer. That’s where it all starts. steadily advancing measures based on the plan. -

11. Development in Kansai Urban Area (PDF, 156KB)

WEST JAPAN RAILWAY COMPANY CORPORATE OPERATING CONTENTS BUSINESS DATA OTHER Fact Sheets 2019 OVERVIEW ENVIRONMENT 11 Business Development in Kansai Urban Area DEVELOPMENT in KANSAI URBAN AREA (As of March 2019) DEVELOPMENT in OSAKA LOOP LINE AREA JR Kyoto Line Osaka Higashi Line Tanikawa Umekoji-Kyotonishi (northern part) New station Shin-Osaka Hanaten – Shin-Osaka Opened in March 2019 Yamashina Kusatsu Relocate a portion of a Opened in March 2019 Ibaraki Station branch line of the Tokaido Kyoto Line underground and improvement and Kyoto development inside JR Kobe Line open a new station Railway Osaka Spring 2023 Opened in April 2018 Museum Hanaten Opened in Kyobashi Gakkentoshi Line April 2016 Himeji Maya New station Opened in Shin-Osaka Nara Line Nishikujo March 2016 Double track JR Tozai Line Kakogawa II stage JR Soujiji Spring 2023 Naniwasuji Line Shin-Kobe New station Yumeshima Umekita (Osaka) underground Kyobashi Opened in (Candidate site for station – JR Namba Higashi-Himeji Sannomiya March 2018 World Expo 2025 and Spring 2031 New station an integrated resort) Opened in Amagasaki Nara JR-Namba March 2016 Kobe Nishi-Akashi Osaka Tennoji Kizurikamikita Osaka New station Oji Higashi Line Opened in (southern part) March 2018 Takada Tennoji Yamatoji Line Kansai-airport Kyuhoji : JR-West related MAJOR PROJECTS facilities HOTEL • Naniwasuji Line • Relocate a portion of a branch line of • Osaka Higashi Line construction project VISCHIO OSAKA the Tokaido Line underground and by GRANVIA Project overview open a new station Project overview · Total cost: Approx. 330.0 billion yen · Total cost: Approx. 120.0 billion yen Project overview · length: Approx. -

Kitaôji Rosanjin (1883-1959)

KITAÔJI ROSANJIN (1883-1959) 1883 Born in the village of Kamigamo to the north of Kyoto as the second son of Shinto priest Kiyoaya Kitaioji Given name Kitaioji Fusajirô 1889 Left the Hattori famly in April and was registered as the adopted son of Takezô Fukuda, a woodblock carver 1895 Inspired the works by Takeuchi Seiho, aspires to become a painter 1899 Becomes a painter of the then-popular Western-style signboards; studied calligraphy 1900 Started to collect antiques 1903 Settled in Tokyo 1905 Became a live-in apprentice of the renowned commercial calligrapher Katei Okamoto 1907 Left Okamoto and became an independent calligrapher Began accepting calligraphy pupils under the name Fukuda Ôtei 1910 Visited Seoul, Korea and stayed there for three years On the way to Japan, met Chinese calligrapher and seal engraver Wu Chang-shi in Shanghai 1913 Went by the artist name Fukuda Taikan. Visted Nagahama, Shiga Prefecture, and carved inscriptions on wooden plaques for wealthy local merchants. Through friend, was introduced to Kyoto magnate and art collector Naiki Seiki, whose influence on Rosanjin was to be enormous. Rosanjin began touring around, taking meals at the homes of friends and patrons along the way 1915 Succeeded to the Kitaôji name. He toured the Hokuriku district, and first became to be involved in pottery making, decorating blue-and-white porcelain and red overglaze enameled wares, at the kiln of the potter Suda Seika in Ishikawa 1916 Used the name Kitaôji Rokei (Rokyô) on advertising leaflets for his seal engraving buisiness. 1919 Began antique appraisal business with Nakamura Takeshiro 1921 Began membership-based Gourmets' Club (Bishoku kurabu); the club becomes fashionable among Tokyo food-lovers 1922 Changed name into Kitaôji Rosanjin 1924 Produced dishes such as porcelain for the Gourmets' Club, and met a ceramic artist Arakawa Toyozô 1925 Opened Hoshigaoka Restaurant in the precincts of Hie Shrine; Rosanjin became manager and chief chef 1926 Established the kiln in order to produce dishes for the Hoshigaoka Restaurant. -

Udon Saga Daumants Grants

Udon Saga Daumants Grants The Udon Saga The Musings and Meanderings of Daumants Grants Page 1 Udon Saga Daumants Grants Page 2 Udon Saga Daumants Grants Contents Life in the Big Udon ........................................................................................................... 4 More from the Big Udon..................................................................................................... 7 Slurpings from the Big Udon .............................................................................................. 9 Revenge of the Big Udon .................................................................................................. 11 Half-Life at the Little Udon .............................................................................................. 16 Cubing it at the Big Udon ................................................................................................. 21 The Seventh Samurai of the Big Udon ............................................................................. 24 Veggin' Out at the Big Udon ............................................................................................. 28 Heartbreak Ridge at the Big Udon .................................................................................... 33 Return to the Big Udon ..................................................................................................... 36 Go Wet, Big Udon! Go Wet to Nara................................................................................. 41 Ramblings and Roses (Stinking) -

Hankyu Hanshin Holdings Group Results Briefing Materials for Fiscal 2020 (Fiscal Year Ended 31St March 2020)

Hankyu Hanshin Holdings Group Results Briefing Materials for Fiscal 2020 (fiscal year ended 31st March 2020) May 19, 2020 Hankyu Hanshin Holdings, Inc. 9042 http://www.hankyu-hanshin.co.jp/en/ Contents Ⅰ. Performance Highlights for Fiscal 2020 (fiscal year ended 31st March 2020) ・・・ 2 Ⅱ. Forecast for fiscal 2021 (fiscal year ending 31st March 2021) ・・・ 31 Ⅲ. Sustainable Business Practices ・・・ 34 Ⅳ. Referential Materials (1) Summary of the Medium-Term Management Plan ・・・ 43 (Reproduced from the results briefing materials released in May 2019) (2) Progress in Each Project ・・・ 51 (3) Other ・・・ 60 Business forecasts and other projections herein are based on information available at present and logical assessments and do not represent any promise by the Company. The actual results may differ significantly from these projections due to various factors. 1 Ⅰ. Performance Highlights for Fiscal 2020 (fiscal year ended 31st March 2020) 2 Blank page 3 Consolidated Statements of Income(Summary) FY2020 Results FY2019 Results Change Consolidated Subsidiaries 93 companies 94 companies -1 (2 companies increase, 3 company decrease) Equity-Method Affiliates 11 companies 11 companies ±0 Total 104 companies 105 companies -1 (¥ million) FY2020 FY2019 COVID-19 impact Change Remarks -22.0billion yen Results Results Revenue from operations -28,776 (-3.6%) 762,650 791,427 For details, please see next page Operating income -15.4billion yen 95,170 114,937 -19,767 (-17.2%) Equity in income of affiliates Non-operating income 7,331 9,377 -2,046 -1,573 Non-operating -

H2O Retailing / 8242

H2O Retailing / 8242 COVERAGE INITIATED ON: 2020.04.30 LAST UPDATE: 2020.04.30 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. H2O Retailing / 8242 RCoverageCoverage LAST UPDATE: 2020.04.30 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6