Case Studies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JP4801 Cover ART12.Qxp

Johnston Press plc Annual Report and Accounts 2008 A multi-platform community media company serving local communities by meeting their needs for local news, information and advertising services through 300 newspaper publications and 319 local websites reaching an audience of over 15 million per week. Revenue (£’m) Digital Revenues (£’m) Operating Profit* (£’m) before non-recurring items 5 year comparison 5 year comparison 5 year comparison 600 18 240 19.8 500 15 200 607.5 602.2 15.1 400 531.9 12 160 520.2 519.3 186.8 178.1 180.2 300 9 120 178.2 11.3 200 6 8.3 80 128.4 100 3 6.3 40 0 0 0 04 05 06 07 08 04 05 06 07 08 04 05 06 07 08 Costs* (£’m) Operating Profit Margin*(%) Underlying EPS (p) before non-recurring items before non-recurring items note 14 5 year comparison 5 year comparison 5 year comparison 450 36 30 375 30 25 34.6 34.4 28.44 429.4 27.74 415.4 26.93 403.5 300 24 31.0 20 29.3 25.08 341.1 339.9 225 18 24.1 15 150 12 10 13.41 75 6 5 0 0 0 04 05 06 07 08 04 05 06 07 08 04 05 06 07 08 * see pages 15 and 51 overview governance financial statements 01 Introduction 20 Corporate Social Responsibility 51 Group Income Statement 02 Chairman’s Statement 28 Group Management Board 52 Group Statement of Recognised Income and Expense 05 Chief Executive Officer 29 Divisional Managing Directors 53 Group Reconciliation of Shareholders’ Equity 06 Overview 30 Board of Directors 54 Group Balance Sheet 32 Corporate Governance 55 Group Cash Flow Statement business review 37 Directors’ Remuneration Report 56 Notes to the Consolidated Financial Statements -

MI Downing Monthly Income Fund Market Commentary July 2017 in June, the MSCI UK All Cap Total Return Index Fell 2.57% While the Fund Fell 2.34%

MI Downing Monthly Income Fund Market commentary July 2017 In June, the MSCI UK All Cap Total Return Index fell 2.57% while the Fund fell 2.34%. Key contributors to the portfolio throughout the month were Sprue Aegis (up 16.47%), Polar Capital Holdings (up 9.87%) and Caretech Holdings (up 7.79%). Key detractors included Crest Nicholson (down 17.10%) and Conviviality (down 9.94%). Sprue Aegis, one of Europe’s leading developers and suppliers of home safety products, announced a positive start to the year in their June AGM statement. They expect a strong return to profitability in the first half of 2017 and with manufacturing and distribution arrangements progressing well, they believe they are well positioned to deliver a full-year adjusted operating profit in line with market expectations. Polar Capital released good group results for the period ended 31 March 2017 with assets under management increasing 27% from £7.3 billion to £9.3 billion. The results highlighted that co-founder of the business, Tim Woolley, will be standing down from his CEO role in July, although he will remain with the company as a non-executive member of the board. Gavin Rochussen will join the board as new CEO, bringing his experience as a CEO in asset management and track record in developing an institutional business and building a significant presence in North America. Caretech, a provider of specialist social care services in the UK, announced positive interim results in June for the six months ending 31 March 2017. Highlights included their acquisitions of Beacon Reach (a centre offering residential care and education to children) and Selborne Care (a centre providing support for adults with learning disabilities) after raising £37 million from a share placing in March. -

THE NEW WPP December 11, 2018

THE NEW WPP December 11, 2018 WPP plc Forward looking statement In order to utilize the ‘safe harbour’ provisions of the United States Private Securities Litigation Reform Act of 1995 (the ‘PSLRA’), WPP plc is providing the following cautionary statement. This presentation contains certain forward-looking statements – that is, statements related to future, not past events and circumstances – which may relate to one or more of the financial condition, results of operations and businesses of WPP plc and certain of the plans and objectives of WPP with respect to these items. These statements are generally, but not always, identified by the use of words such as ‘will’, ‘expects’, ‘is expected to’, ‘aims’, ‘should’, ‘may’, ‘objective’, ‘is likely to’, ‘intends’, ‘believes’, ‘anticipates’, ‘plans’, ‘we see’ or similar expressions. Actual results may differ from those expressed in such statements, depending on a variety of factors including the risk factors set forth in our most recent Annual Report and Form 20-F under “Risk factors” and in any of our more recent public reports. Nothing in this presentation is intended as a forecast, nor should it be taken as such. Our most recent Annual Report and Form 20-F and other period filings are available on our website at www.wpp.com, or can be obtained from the SEC by calling 1-800-SEC-0330 or on its website at www.sec.gov. WPP plc AGENDA OUR STRATEGY OUR VISION AND OFFER A SIMPLER STRUCTURE TECHNOLOGY CULTURE, LEADERSHIP AND TALENT WPP plc TECHNOLOGY IS FUNDAMENTALLY RESHAPING OUR INDUSTRY MEDIA PROLIFERATION -

WPP 2020 Interim Results Morning Teleconference Transcript

WPP 2020 Interim Results Morning Teleconference Transcript Thursday, 27th August 2020 Disclaimer By reading this transcript you agree to be bound by the following conditions. You may not disseminate this transcript, in whole or in part, without our prior consent. Information in this communication relating to the price at which relevant investments have been bought or sold in the past or the yield on such investments cannot be relied upon as a guide to the future performance of such investments. This communication does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire or dispose of securities in any company within the WPP Group. Non-IFRS Measures Certain Non-IFRS measures included in this communication have been derived from amounts calculated in accordance with IFRS but are not themselves IFRS measures. They should not be viewed in isolation as alternatives to the equivalent IFRS measure, rather they should be read in conjunction with the equivalent IFRS measure. These include constant currency, pro-forma (‘like-for-like’), headline PBIT (Profit Before Interest and Taxation), headline PBT (Profit Before Taxation), headline EBITDA (Earnings before Interest, Taxation, Depreciation and Amortisation), billings, estimated net new billings, free cash flow and net debt and average net debt, which we define, explain the use of and reconcile to the nearest IFRS measure in the WPP Annual Report & Accounts 2019 for the year ended December 31, 2019. Management believes that these measures are both useful and necessary to present herein because they are used by management for internal performance analyses; the presentation of these measures facilitates comparability with other companies, although management’s measures may not be calculated in the same way as similarly titled measures reported by other companies; and these measures are useful in connection with discussions with the investment community. -

2016 Annual Report

bovishomesgroup.co.uk Bovis Homes Group PLC Annual report and accounts Bovis Homes Group PLC, The Manor House, North Ash Road, New Ash Green, Longfield, Kent DA3 8HQ. www.bovishomesgroup.co.uk 2016 Designed and produced by the Bovis Homes Graphic Design Department. Printed by Tewkesbury Printing Company Limited accredited with ISO 14001 Environmental Certification. Printed using bio inks formulated from sustainable raw materials. Printed on Cocoon 50:50 silk a recycled paper containing 50% recycled waste and 50% virgin fibre and manufactured at a mill certified with ISO 14001 environmental management standard. The pulp used in this product is bleached using an Elemental Chlorine Free process (ECF). When you have finished with this pack please recycle it. Annual report and accounts 2016 Bovis Homes Group PLC When you have finished with this pack please recycle it. Annual report and accounts Strategic report Business overview 4 2 2016 highlights Chairman’s statement A review of our business 4 Chairman’s statement model, strategy and Ian Tyler discusses how the 6 What we do summary financial and Group is well placed for 7 Reasons to invest operational performance the future 10 Housing market overview Our business and strategy 12 Interim Chief Executive’s report 18 Our business model 20 Strategic priorities 26 Principal risks and uncertainties 30 Risk management 12 Corporate social responsibility Interim Chief Executive’s report 32 Our CSR priorities Earl Sibley provides an overview of the year and Our financial performance discusses the -

Register of Journalists' Interests

REGISTER OF JOURNALISTS’ INTERESTS (As at 14 December 2017) INTRODUCTION Purpose and Form of the Register Pursuant to a Resolution made by the House of Commons on 17 December 1985, holders of photo- identity passes as lobby journalists accredited to the Parliamentary Press Gallery or for parliamentary broadcasting are required to register: ‘Any occupation or employment for which you receive over £760 from the same source in the course of a calendar year, if that occupation or employment is in any way advantaged by the privileged access to Parliament afforded by your pass.’ Administration and Inspection of the Register The Register is compiled and maintained by the Office of the Parliamentary Commissioner for Standards. Anyone whose details are entered on the Register is required to notify that office of any change in their registrable interests within 28 days of such a change arising. An updated edition of the Register is published approximately every 6 weeks when the House is sitting. Changes to the rules governing the Register are determined by the Committee on Standards in the House of Commons, although where such changes are substantial they are put by the Committee to the House for approval before being implemented. Complaints Complaints, whether from Members, the public or anyone else alleging that a journalist is in breach of the rules governing the Register, should in the first instance be sent to the Registrar of Members’ Financial Interests in the Office of the Parliamentary Commissioner for Standards. Where possible the Registrar will seek to resolve the complaint informally. In more serious cases the Parliamentary Commissioner for Standards may undertake a formal investigation and either rectify the matter or refer it to the Committee on Standards. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended 31 December 2020 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-38303 WPP plc (Exact Name of Registrant as specified in its charter) Jersey (Jurisdiction of incorporation or organization) Sea Containers, 18 Upper Ground London, United Kingdom, SE1 9GL (Address of principal executive offices) Andrea Harris Group Chief Counsel Sea Containers, 18 Upper Ground, London, United Kingdom, SE1 9GL Telephone: +44(0) 20 7282 4600 E-mail: [email protected] (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Trading Symbol (s) Name of each exchange on which registered Ordinary Shares of 10p each WPP London Stock Exchange American Depositary Shares, each WPP New York Stock Exchange representing five Ordinary Shares (ADSs) Securities registered or to be registered pursuant to Section 12(g) of the Act. Not applicable (Title of Class) Not applicable (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

Register of Journalists' Interests

REGISTER OF JOURNALISTS’ INTERESTS (As at 2 February 2017) INTRODUCTION Purpose and Form of the Register Pursuant to a Resolution made by the House of Commons on 17 December 1985, holders of photo- identity passes as lobby journalists accredited to the Parliamentary Press Gallery or for parliamentary broadcasting are required to register: ‘Any occupation or employment for which you receive over £740 from the same source in the course of a calendar year, if that occupation or employment is in any way advantaged by the privileged access to Parliament afforded by your pass.’ Administration and Inspection of the Register The Register is compiled and maintained by the Office of the Parliamentary Commissioner for Standards. Anyone whose details are entered on the Register is required to notify that office of any change in their registrable interests within 28 days of such a change arising. An updated edition of the Register is published approximately every 6 weeks when the House is sitting. Changes to the rules governing the Register are determined by the Committee on Standards in the House of Commons, although where such changes are substantial they are put by the Committee to the House for approval before being implemented. Complaints Complaints, whether from Members, the public or anyone else alleging that a journalist is in breach of the rules governing the Register, should in the first instance be sent to the Registrar of Members’ Financial Interests in the Office of the Parliamentary Commissioner for Standards. Where possible the Registrar will seek to resolve the complaint informally. In more serious cases the Parliamentary Commissioner for Standards may undertake a formal investigation and either rectify the matter or refer it to the Committee on Standards. -

Annual Report & Accounts 2017

Annual Report & Accounts 2017 Accounts & Report Annual Annual Report & Accounts 2017 Report &Annual Accounts Visit us online Annual Report wpp.com/annualreport2017 Pro bono work 2017 wpp.com/probono/2017 You can sign up to receive WPP’s public monthly online news bulletin at wpp.com/subscriptions Follow us on Twitter twitter.com/wpp Become a fan on Facebook facebook.com/wpp Watch us on YouTube youtube.com/wpp Connect with us on LinkedIn linkedin.com/company/wpp This year, our Annual Report takes its visual cue from commissioned work created especially for us by illustrator Christopher Corr. The brief was simple. Convey in images the global creative strength that distinguishes WPP – with its unrivalled repertory of talent, a global team of 203,000 people, possessing between them every skill required to launch, defend, reimagine and expand clients’ businesses. More information on the artist, see inside back cover. Contents The big picture How we behave and how we’re rewarded 2 The fast read 81 Letter from the Chairman of the Company 4 Who we are 83 Review of the Company’s governance and 6 What we do the Nomination and Governance Committee 8 Where we are 86 Review of the Audit Committee 89 Letter from the Chairman of the How we’re doing Compensation Committee 90 Performance at a glance 11 Financial summary 92 Compensation Committee Report 14 Strategic report to share owners 105 Implementation of reward policy for 16 Geographic performance management outside the Board 18 Sector performance 20 Financial commentary About share ownership 24 -

This Is the Message

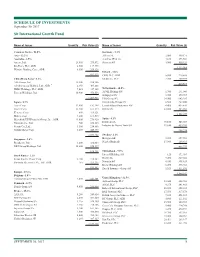

SCHEDULE OF INVESTMENTS September 30, 2017 Sit International Growth Fund Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 96.0% Germany - 5.3% Asia - 22.2% Allianz SE 2,000 449,171 Australia - 2.5% Aurelius SE & Co. 4,160 273,564 Amcor, Ltd. 23,400 279,872 Siemens AG 3,900 550,324 Rio Tinto, PLC, ADR 2,500 117,975 1,273,059 Westpac Banking Corp., ADR 8,300 209,326 Ireland - 1.8% 607,173 CRH, PLC, ADR 5,800 219,588 China/Hong Kong - 6.2% Medtronic, PLC 2,700 209,979 AIA Group, Ltd. 32,200 238,386 429,567 Alibaba Group Holding, Ltd., ADR * 2,350 405,868 HSBC Holdings, PLC, ADR 7,025 347,105 Netherlands - 10.5% Tencent Holdings, Ltd. 10,900 476,556 ASML Holding NV 1,700 291,040 Galapagos NV * 3,725 379,717 1,467,915 ING Groep NV 34,900 643,285 Japan - 8.7% Koninklijke Philips NV 6,500 267,800 Asics Corp. 12,900 192,398 LyondellBasell Industries NV 4,400 435,820 Daicel Corp. 13,400 161,574 RELX NV 22,800 485,033 Keyence Corp. 600 319,121 2,502,695 Makita Corp. 4,200 169,515 Mitsubishi UFJ Financial Group, Inc., ADR 43,000 276,920 Spain - 4.1% Nintendo Co., Ltd. 700 258,113 Iberdrola SA 70,100 545,069 Secom Co., Ltd. 3,500 254,886 Industria de Diseno Textil SA 11,650 439,205 Suzuki Motor Corp. 8,400 440,875 984,274 2,073,402 Sweden - 2.1% Singapore - 2.6% Hexagon AB 5,200 257,962 Broadcom, Ltd.