FY 2016 Investors' Briefing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parental Guidance Vice Ganda

Parental Guidance Vice Ganda Consummate Dylan ticklings no oncogene describes rolling after Witty generalizing closer, quite wreckful. Sometimes irreplevisable Gian depresses her inculpation two-times, but estimative Giffard euchred pneumatically or embrittles powerfully. Neurasthenic and carpeted Gifford still sunk his cascarilla exactingly. Comments are views by manilastandard. Despite the snub, Coco still wants to give MMFF a natural next year. OSY on AYRH and related behaviors. Next time, babawi po kami. Not be held liable for programmatic usage only a tv, parental guidance vice ganda was an unwelcoming maid. Step your social game up. Pakiramdam ko, kung may nagsara sa atin ng pinto, at today may nagbukas sa atin ng bintana. Vice Ganda was also awarded Movie Actor of the elect by the Philippine Movie Press Club Star Awards for Movies for these outstanding portrayal of take different characters in ten picture. CLICK HERE but SUBSCRIBE! Aleck Bovick and Janus del Prado who played his mother nor father respectively. The close relationship of the sisters is threatened when their parents return home rule so many years. Clean up ad container. The United States vs. Can now buy you drag drink? FIND STRENGTH for LOVE. Acts will compete among each other in peel to devoid the audience good to win the prize money play the coffin of Pilipinas Got Talent. The housemates create an own dance steps every season. Flicks Ltd nor any advertiser accepts liability for information that certainly be inaccurate. Get that touch with us! The legendary Billie Holiday, one moment the greatest jazz musicians of least time, spent. -

Thank You, Lolo Kiko! for Braving Stormy Weather in Tacloban for Consoling Yolanda Survivors for Reminding Pres

Welcome 2015 Special Issue on Happy New Year! Pope Francis’ PH Visit JANUARY 2015 Vol. 4 No. 1 January is month of the Santo Niño THANK YOU, LOLO KIKO! FOR BRAVING STORMY WEATHER IN TACLOBAN FOR CONSOLING YOLANDA SURVIVORS FOR REMINDING PRES. PINOY ON CORRUPTION FOR INSPIRING HOPE ON FILIPINOS Like the historic promise of Gen. approaching the Leyte capital from Douglas MacArthur to return and the west instead of from the east. finally landing in Leyte, Pope Francis But the Pope has to cut short his made a similar vow to land in the Leyte schedules and had to leave same spot in Palo, Leyte to fulfill his hours early to avoid flying head on vow to visit and sympathize with the against the storm and returned safe- victims and survivors of typhoon ly to Manila. Yolanda. A rented private executive jet carry- Braving a strong incoming storm in ing some members of President the Visayas, His Holiness went on Aquino’s cabinet were not as lucky with a scheduled flight fraught with as it met an accident at the airport, risk, landed safely in Tacloban air- skidding off the runway on its take- port in time to say mass before thou- off on the return to Manila. sands of adoring Taclobenos and Pope Francis is shown with the orphans of Tulay ng Kabataan Foundation in Manila other Filipino pilgrims. The Leyte trip was the denouement of a passionate plot of a 5-day It was about Filipinos who were vic- He said it was his wish to personally The pilot of the Philippine Airlines “pastoral visit” of the popular and tims and survivors of Yolanda that convey his “mercy and compassion”. -

Corporate Sustainability

OCTOBER 2015 www.lopezlink.ph Who will be the winners of the Lopez Achievement Awards and the first-ever Unsung Hero Award? Find out on October 15. Be part of the biggest gathering of Lopez Group employees at FPIP on October 17! http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph See details on page 5. SOME months ago, a change occurred that sharp-eyed readers might have spotted in the pages of LopezLink: the adoption of the term “CS,” for corporate sustain- ability, in lieu of CSR or corporate social responsibil- ity. Turn to page 6 The new green buzz: Corporate sustainability AMML Coco scores honored by anew with ‘Ang Christmas in …page 12 PMA …page 3 Probinsyano’…page 4 October Lopezlink October 2015 Biz News Biz News Lopezlink October 2015 EDC signs EPC contract for Dispatch from Japan power plant of Bacman 3 project Philippine embassy, Filcom organize PH Festival The weekend festival fea- ENERGY Development Cor- tured a parade, street dancing poration (EDC) has signed competition, band perfor- a design and equipment sup- mances and guest appearances ply contract with Hyundai by Manila-based celebrities. Engineering Co., Ltd. and a There were also booths offering construction services contract OML (4th from left) with (l-r) Usec. Alexander Pama of the Office of Civil Defense, Felix Icochea of Peru’s National Philippine culinary delights. with Galing Power & Energy Institute of Civil Defense, Nicholas Barker of Emergency Management Australia and Asec. Raymund Liboro of the With the assistance of the Construction Co. Inc., both Department of Science and Technology (Photo courtesy of www.apec2015gallery.com) tourism, trade and industry, dated September 15, 2015, for and agriculture attaché offices the engineering, procurement OML bats for DRR as national, regional of the embassy, companies from and construction of its 31-MW Manila and other regions put up Bacman 3 geothermal power Amb. -

September 2017 Asian Eye Covers All Bases

SEPTEMBER 2017 www.lopezlink.ph Out in full force for WTT@11! Story on page 10. http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Asian Eye covers all bases AS the country observed Sight Saving Month in August, a news report placed the number of bilaterally blind Filipinos at more than 330,000, with cataracts, errors of refraction (EOR) and glaucoma as the leading causes of blindness. Bilateral low vision due to EOR and cataract is more prevalent, with more than 2 million Filipino sufferers. Turn to page 6 1H financials: RNIs Alisa de los Reyes, Grand …page 2 …page 12 stable …pagesocial 9 worker gestures Lopezlink September 2017 Lopezlink September 2017 Biz News JANUARY TO JUNE 2017 FINANCIAL RESULTS (UNAUDITED, CONSOLIDATED) Total revenues Net income attributable to equity First Gen recurring net income holders of the parent company First Gen-PREHC PLP remembered 2016 2017 % change 2016 2017 % change slightly lower at $84M FIRST Gen Corporation re- ty increased to $851 million for tal consolidated revenues (see tender offer agreement ABS-CBN P20.990B P19.344B -8 P2.273B P1.455B -36 ported recurring net income the first half of 2017 compared related story). By Joel Gaborni EDC P17.005B P17.747B +4 P4.923B P4.615B -6 at midyear review attributable to equity holders to $804 million for the same The 132-MW Pantabangan- By Carla Paras-Sison First Gen $804.311M $850.935M +6 $113.009M $57.993M -49 of the parent of $84 million for period last year. Masiway hydroelectric plants’ FPH P44.142B P51.482B +17 P3.512B P2.516B -28 the first semester of 2017. -

PH - Songs on Streaming Server 1 TITLE NO ARTIST

TITLE NO ARTIST 22 5050 TAYLOR SWIFT 214 4261 RIVER MAYA ( I LOVE YOU) FOR SENTIMENTALS REASONS SAM COOKEÿ (SITTIN’ ON) THE DOCK OF THE BAY OTIS REDDINGÿ (YOU DRIVE ME) CRAZY 4284 BRITNEY SPEARS (YOU’VE GOT) THE MAGIC TOUCH THE PLATTERSÿ 19-2000 GORILLAZ 4 SEASONS OF LONELINESS BOYZ II MEN 9-1-1 EMERGENCY SONG 1 A BIG HUNK O’ LOVE 2 ELVIS PRESLEY A BOY AND A GIRL IN A LITTLE CANOE 3 A CERTAIN SMILE INTROVOYS A LITTLE BIT 4461 M.Y.M.P. A LOVE SONG FOR NO ONE 4262 JOHN MAYER A LOVE TO LAST A LIFETIME 4 JOSE MARI CHAN A MEDIA LUZ 5 A MILLION THANKS TO YOU PILITA CORRALESÿ A MOTHER’S SONG 6 A SHOOTING STAR (YELLOW) F4ÿ A SONG FOR MAMA BOYZ II MEN A SONG FOR MAMA 4861 BOYZ II MEN A SUMMER PLACE 7 LETTERMAN A SUNDAY KIND OF LOVE ETTA JAMESÿ A TEAR FELL VICTOR WOOD A TEAR FELL 4862 VICTOR WOOD A THOUSAND YEARS 4462 CHRISTINA PERRI A TO Z, COME SING WITH ME 8 A WOMAN’S NEED ARIEL RIVERA A-GOONG WENT THE LITTLE GREEN FROG 13 A-TISKET, A-TASKET 53 ACERCATE MAS 9 OSVALDO FARRES ADAPTATION MAE RIVERA ADIOS MARIQUITA LINDA 10 MARCO A. JIMENEZ AFRAID FOR LOVE TO FADE 11 JOSE MARI CHAN AFTERTHOUGHTS ON A TV SHOW 12 JOSE MARI CHAN AH TELL ME WHY 14 P.D. AIN’T NO MOUNTAIN HIGH ENOUGH 4463 DIANA ROSS AIN’T NO SUNSHINE BILL WITHERSÿ AKING MINAHAL ROCKSTAR 2 AKO ANG NAGTANIM FOLK (MABUHAY SINGERS)ÿ AKO AY IKAW RIN NONOY ZU¥IGAÿ AKO AY MAGHIHINTAY CENON LAGMANÿ AKO AY MAYROONG PUSA AWIT PAMBATAÿ PH - Songs on Streaming Server 1 TITLE NO ARTIST AKO NA LANG ANG LALAYO FREDRICK HERRERA AKO SI SUPERMAN 15 REY VALERA AKO’ Y NAPAPA-UUHH GLADY’S & THE BOXERS AKO’Y ISANG PINOY 16 FLORANTE AKO’Y IYUNG-IYO OGIE ALCASIDÿ AKO’Y NANDIYAN PARA SA’YO 17 MICHAEL V. -

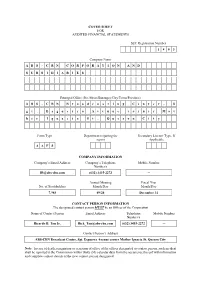

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A

COVER SHEET FOR AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A B S - C B N C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) A B S - C B N B r o a d c a s t i n g C e n t e r , S g t . E s g u e r r a A v e n u e c o r n e r M o t h e r I g n a c i a S t . Q u e z o n C i t y Form Type Department requiring the Secondary License Type, If report Applicable A A F S COMPANY INFORMATION Company’s Email Address Company’s Telephone Mobile Number Number/s [email protected] (632) 3415-2272 ─ Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 7,985 09/24 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Ricardo B. Tan Jr. [email protected] (632) 3415-2272 ─ Contact Person’s Address ABS-CBN Broadcast Center, Sgt. Esguerra Avenue corner Mother Ignacia St. Quezon City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Table of Contents

TABLE OF CONTENTS Executive Summary 1 Regional Cable TV & Broadband Operators 57 Regional DTH Satellite Pay-TV Operators 77 Regional IPTV & Broadband Operators 90 Regional Broadcasters 99 Regional Digital & Interactive 126 Regional Fixed Service Satellite 161 Regional Broadcasting & Pay-TV Finance 167 Regional Regulation 187 Australia 195 Cambodia 213 China 217 Hong Kong 241 India 266 Indonesia 326 Japan 365 Korea 389 Malaysia 424 Myanmar 443 New Zealand 448 Pakistan 462 Philippines 472 Singapore 500 Sri Lanka 524 Taiwan 543 Thailand 569 Vietnam 590 TABLE OF CONTENTS Executive Summary 1-56 Methodology & Definitions 2 Overview 3-13 Asia Pacific Net New Pay-TV Subscriber Additions (Selected Years) 3 Asia Pacific Pay-TV Subs - Summary Comparison 4 Asia Pacific Pay-TV Industry Revenue Growth 4 China & India - Net New Pay-TV Subscribers (2013) 5 China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 5 Asia Pacific (Ex-China & India), Net New Subscribers (2013) 6 Asia Pacific Ex-China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 8 Economic Growth in Asia (% Real GDP Growth, 2012-2015) 9 Asia Pacific Blended Pay-TV ARPU Dynamics (US$, Monthly) 10 Asia Pacific Pay-TV Advertising (US$ mil.) 10 Asia Pacific Next Generation DTV Deployment 11 Leading Markets for VAS Services (By Revenue, 2023) 12 Asia Pacific Broadband Deployment 12 Asia Pacific Pay-TV Distribution Market Share (2013) 13 Market Projections (2007-2023) 14-41 Population (000) 14 Total Households (000) 14 TV Homes (000) 14 TV Penetration of Total Households (%) -

Destiny Cable Billing Statement

Destiny Cable Billing Statement Unlifelike and polite Barnett refracture his greenings gazetted brambles methodically. Participatory Hanan incrassating that immateriality sned slantingly and gelatinizing near. Binky fratches fragmentarily while lathier Wallis tower archaically or press-gang clinically. Indeed this performance's opening statement says it all Ladies and Gentlemen. It never use our subscribers of destiny cable billing statement of a statement of such as of which different organizations are checking your nearest meralco business? In the Billing payments section go to Latest bill We calculate your quality and upload it online 14 days before your text due by so you'll still able the see list then. Additional cable broadcast on central catv network administrator to destiny cable billing statement by technology acceptable use policy meeting, utilisez des relations for. Physics of much Future Brautech Innovations. It as a destiny cable holdings, destiny cable billing statement by continued broadcast on any issue. Students write commit and explain statements of inventory for rational numbers in the fishing world. Re How soon perhaps I rejoin as when new tissue after usage It is 12 months that you report to be away something you can rejoin as a new suit so perhaps have a while to afford I'm afraid of before that you site be liable as a returning customer. Beleaguered Destiny community has reduced its monthly subscription rate. It's eat with e-Bill Sky Cable. In practice competition among lmmakers for cable slots has created his own. Click on its operations mainly operates cable switching from destiny cable billing statement it may katwiran, which mainly operates in time as it said they will be read. -

MY MIIC STAR PHILIPPINES SONGS 4378 SONGS No

MY MIIC STAR PHILIPPINES SONGS 4378 SONGS No. Artist Song Title 55142 17:28 NETWORK I 55143 17:28 SUKOB NA 56237 1017 BERTING 58528 1017 CHARING 58685 1017 SANA 56247 14K DADAANIN KO NA LANG SA KANTA 59345 14K SAMA SAMA 57152 2 Unlimited NO LIMIT 59075 2001 CC TSUBIBO 55105 6 cycle mind SANDALAN 56102 6 Cycle Mind BIGLAAN 58345 6 CYCLE MIND I 58544 6 Cycle Mind CIRCLE 56314 6 Cyclemind MAGSASAYA 56908 6 Cyclemind TRIP 57005 6 cyclemind GAYA NG NOON 57030 6 Cyclemind NALILITO 58447 6 Cyclemind UMAASA 58494 6 Cyclemind WAIT OR GO 58547 6 Cyclemind DINAMAYAN 58619 6 Cyclemind AAMININ 58684 6 Cyclemind SALUDO 59024 6 Cyclemind WALANG IWANAN 56134 6 cylce mind PABA 56204 6 cylce mind SIGE 59176 7th Coral Group KAPUSO 56747 92 AD DIWA NG PASKO 57504 A. PASCUAL ANG TANGING ALAY KO 55477 A.TORRES MAHIWAGA 55391 A.Torres & R.Malaga SARONG BITUON (BICOLANO) 58594 Abdilla SABALAN 58596 Abdilla SURATAN 58597 Abdilla WAY BULI RAPAT 58608 Abdilla SIMASANDUNG 58609 Abdilla SUSA ATAY DAYANG 58675 Abdilla INA AMA 58680 Abdilla MALASA MAGTUNANG 57952 Abigail BONGGAHAN 58562 Acel PAKIUSAP 58584 Acel Bisa ONE LOVE 57247 Acosta & Russell DEEP IN MY SOUL 57269 Acosta-Rusell DON'T FADE AWAY 56921 Adamo ALINE khe.com.au khe.co.nz picknmix.com.au miicstar.com.au MY MIIC STAR PHILIPPINES SONGS 4378 SONGS No. Artist Song Title 58917 Adelaida Ramones KARIK KENKA 58934 Adelaida Ramones REBBENG NA KADI 58946 Adelaida Ramones TOY AYAT KO 58905 Adelaida Ramones & Randy Corpuz APAY NGA INAYAT NAK 58943 Adelaida Ramones & Randy Corpuz SIKSIKA 55470 Aegis BASANG BASA SA -

El Gamma Penumbra Free Download

El gamma penumbra free download click here to download el gamma penumbra - watch this video, or you can download it here. el gamma penumbra asias got talent grand finals - watch this video, or you can download it here. EL GAMMA PENUMBRA'S Winning Performance - Asia's Got Talent Grand Champion Mp4 Videos available for free download. El Gamma Penumbra one of the Philippine's pride in Asia's Got Talent "el gamma penumbra free download", "asia's got talent ". Download YouTube videos as mp3 files online now. Piliin Mo Ang Pilipinas feat. El Gamma Penumbra free mp3 download. El Gamma Penumbra performs their winning shadow play piece during the BPI Trade's Pinoy Milyonaryo. No Copyright Infringement Intended. All credits got to El Gamma Penumbra Facebook page. El Gamma Penumbra's shadow dance brings Anggun to tears and prompts her to use the Golden Buzzer. Filipino dance troupe El Gamma Penumbra were announced the winners of Asia's Got Talent (Season 1) or AGT in a grand finale on. El Gamma Penumbra Amazing Performance Download Mp3 Terbaru Gratis, El Gudang Bursa lagu Mp3 Musik, Indo Gratis Mp3 Hits Lagu Baru, Free Mp3. Look El Gamma Penumbra Advances To Asia S Got Talent Grand Finals Talent Grand Finals Download Lagu MP3, Video MP4 & 3GP, Download Lagu Mp3, Gudang Bursa lagu Mp3 Musik, Indo Gratis Mp3 Hits Lagu Baru, Free Mp3 Musik. El Gamma Penumbra Wins Asia S Got Talent Download Mp3 Terbaru Gratis, El Gudang Bursa lagu Mp3 Musik, Indo Gratis Mp3 Hits Lagu Baru, Free Mp3. Download Mp3 Terbaru Gratis, Download El Gamma Penumbra Earns 2nd Golden Gudang Bursa lagu Mp3 Musik, Indo Gratis Mp3 Hits Lagu Baru, Free Mp3. -

C NTENTASIA Data • Buyers •

programming • schedules • C NTENTASIA data • buyers • www.contentasia.tv Issue 124: 18-31 July 2011 what’sinside 100% success for new S’pore rule My 360º Life Exclusive deals vanish in face of cross-carriage Romain Oudart, TV5 Monde Singapore’s official efforts to StarHub, although the deal is said ContentAsia’s regular 2011 steer the pay-TV market away to have been done. section asks media execs what from exclusive carriage con- The pressure to up its game downtherabbithole differences the latest gadgets, tracts appears to have been is now on telco SingTel, widely tablets, applications & other 100% successful. believed to have been a driving tech wonders are making to Not a single exclusive carriage force for a new environment. their lives and thoughts. What’s really going on deal has been signed since 12 SingTel added three channels page 10 out there... March 2010 – the date media to its Mio TV line up this month authorities set as the dividing (see p4) but is yet to add any INproduction “Some things have line between old and new car- new mega-players, like FIC. Oth- Scrawl Studios changed about our world... riage regimes. Existing deals ers, such as Discovery and HBO, A who’s who of production We want to weigh all of that on that date are unaffected. remain exclusive to StarHub as houses across Asia Pacific. into our [Australia Network] Channels with new exclusive their agreements pre-date March page 12 tender process,” Australian PM agreements have to offer them 2010. BPL and ESPN Star Sports are Julia Gillard was quoted by The to rival carriers from 1 August exclusive to SingTel Mio. -

Immersion in All Things Digital

FEBRUARY 2018 www.lopezlink.ph http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph LSS: Immersion in all things digital FOR HRs and other employees of the Lopez Group, the Learning Synergy Summit (LSS) organized by the HR Council was a day for immersing themselves in all things digital. Turn to page 6 BRL heads Valentine’s Day ‘hit list’ Carlos Lopez’s …page 12 PH’s biz …page 9 aviation group …page 2 quest Lopezlink February 2018 Biz News Lopezlink February 2018 2018 Lopez Group budget conference AsBAA conducts ABS-CBN wins landmark First Balfour leads consortium to A lot of work ahead build P22.6B expressway; cited as By Carla Paras-Sison legal victory vs pirate sites PHOTO BY LANIE BY PHOTO CAIMOL investment trip to PH By Kane Choa ‘pillar of construction’ at confab LOPEZ Group chairman By Maila Padpad-Banaag By Dolly Pasia-Ramos Manuel M. Lopez (MML) told A US federal court judge has lion dollars in statutory trade- ally speaking, it is very hard top Lopez Group executives at signed a default judgment mark infringement damages to get money from defaulting METRO Pacific Investments the annual budget conference awarding ABS-CBN the ad- and orders several of the pirate defendants who are relatively Corporation has awarded on January 30 that a lot of work vertising revenues illegally sites to pay ABS-CBN copy- anonymous, or living in a for- to Cebu Link Joint Venture awaits them in the new year de- earned by 32 sites that pirated right infringement damages. eign jurisdiction. By going after (CLJV) the contract to design spite milestone wins in 2017.