FY 2017 Investors' Briefing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Thank You, Lolo Kiko! for Braving Stormy Weather in Tacloban for Consoling Yolanda Survivors for Reminding Pres

Welcome 2015 Special Issue on Happy New Year! Pope Francis’ PH Visit JANUARY 2015 Vol. 4 No. 1 January is month of the Santo Niño THANK YOU, LOLO KIKO! FOR BRAVING STORMY WEATHER IN TACLOBAN FOR CONSOLING YOLANDA SURVIVORS FOR REMINDING PRES. PINOY ON CORRUPTION FOR INSPIRING HOPE ON FILIPINOS Like the historic promise of Gen. approaching the Leyte capital from Douglas MacArthur to return and the west instead of from the east. finally landing in Leyte, Pope Francis But the Pope has to cut short his made a similar vow to land in the Leyte schedules and had to leave same spot in Palo, Leyte to fulfill his hours early to avoid flying head on vow to visit and sympathize with the against the storm and returned safe- victims and survivors of typhoon ly to Manila. Yolanda. A rented private executive jet carry- Braving a strong incoming storm in ing some members of President the Visayas, His Holiness went on Aquino’s cabinet were not as lucky with a scheduled flight fraught with as it met an accident at the airport, risk, landed safely in Tacloban air- skidding off the runway on its take- port in time to say mass before thou- off on the return to Manila. sands of adoring Taclobenos and Pope Francis is shown with the orphans of Tulay ng Kabataan Foundation in Manila other Filipino pilgrims. The Leyte trip was the denouement of a passionate plot of a 5-day It was about Filipinos who were vic- He said it was his wish to personally The pilot of the Philippine Airlines “pastoral visit” of the popular and tims and survivors of Yolanda that convey his “mercy and compassion”. -

September 2017 Asian Eye Covers All Bases

SEPTEMBER 2017 www.lopezlink.ph Out in full force for WTT@11! Story on page 10. http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Asian Eye covers all bases AS the country observed Sight Saving Month in August, a news report placed the number of bilaterally blind Filipinos at more than 330,000, with cataracts, errors of refraction (EOR) and glaucoma as the leading causes of blindness. Bilateral low vision due to EOR and cataract is more prevalent, with more than 2 million Filipino sufferers. Turn to page 6 1H financials: RNIs Alisa de los Reyes, Grand …page 2 …page 12 stable …pagesocial 9 worker gestures Lopezlink September 2017 Lopezlink September 2017 Biz News JANUARY TO JUNE 2017 FINANCIAL RESULTS (UNAUDITED, CONSOLIDATED) Total revenues Net income attributable to equity First Gen recurring net income holders of the parent company First Gen-PREHC PLP remembered 2016 2017 % change 2016 2017 % change slightly lower at $84M FIRST Gen Corporation re- ty increased to $851 million for tal consolidated revenues (see tender offer agreement ABS-CBN P20.990B P19.344B -8 P2.273B P1.455B -36 ported recurring net income the first half of 2017 compared related story). By Joel Gaborni EDC P17.005B P17.747B +4 P4.923B P4.615B -6 at midyear review attributable to equity holders to $804 million for the same The 132-MW Pantabangan- By Carla Paras-Sison First Gen $804.311M $850.935M +6 $113.009M $57.993M -49 of the parent of $84 million for period last year. Masiway hydroelectric plants’ FPH P44.142B P51.482B +17 P3.512B P2.516B -28 the first semester of 2017. -

PH - Songs on Streaming Server 1 TITLE NO ARTIST

TITLE NO ARTIST 22 5050 TAYLOR SWIFT 214 4261 RIVER MAYA ( I LOVE YOU) FOR SENTIMENTALS REASONS SAM COOKEÿ (SITTIN’ ON) THE DOCK OF THE BAY OTIS REDDINGÿ (YOU DRIVE ME) CRAZY 4284 BRITNEY SPEARS (YOU’VE GOT) THE MAGIC TOUCH THE PLATTERSÿ 19-2000 GORILLAZ 4 SEASONS OF LONELINESS BOYZ II MEN 9-1-1 EMERGENCY SONG 1 A BIG HUNK O’ LOVE 2 ELVIS PRESLEY A BOY AND A GIRL IN A LITTLE CANOE 3 A CERTAIN SMILE INTROVOYS A LITTLE BIT 4461 M.Y.M.P. A LOVE SONG FOR NO ONE 4262 JOHN MAYER A LOVE TO LAST A LIFETIME 4 JOSE MARI CHAN A MEDIA LUZ 5 A MILLION THANKS TO YOU PILITA CORRALESÿ A MOTHER’S SONG 6 A SHOOTING STAR (YELLOW) F4ÿ A SONG FOR MAMA BOYZ II MEN A SONG FOR MAMA 4861 BOYZ II MEN A SUMMER PLACE 7 LETTERMAN A SUNDAY KIND OF LOVE ETTA JAMESÿ A TEAR FELL VICTOR WOOD A TEAR FELL 4862 VICTOR WOOD A THOUSAND YEARS 4462 CHRISTINA PERRI A TO Z, COME SING WITH ME 8 A WOMAN’S NEED ARIEL RIVERA A-GOONG WENT THE LITTLE GREEN FROG 13 A-TISKET, A-TASKET 53 ACERCATE MAS 9 OSVALDO FARRES ADAPTATION MAE RIVERA ADIOS MARIQUITA LINDA 10 MARCO A. JIMENEZ AFRAID FOR LOVE TO FADE 11 JOSE MARI CHAN AFTERTHOUGHTS ON A TV SHOW 12 JOSE MARI CHAN AH TELL ME WHY 14 P.D. AIN’T NO MOUNTAIN HIGH ENOUGH 4463 DIANA ROSS AIN’T NO SUNSHINE BILL WITHERSÿ AKING MINAHAL ROCKSTAR 2 AKO ANG NAGTANIM FOLK (MABUHAY SINGERS)ÿ AKO AY IKAW RIN NONOY ZU¥IGAÿ AKO AY MAGHIHINTAY CENON LAGMANÿ AKO AY MAYROONG PUSA AWIT PAMBATAÿ PH - Songs on Streaming Server 1 TITLE NO ARTIST AKO NA LANG ANG LALAYO FREDRICK HERRERA AKO SI SUPERMAN 15 REY VALERA AKO’ Y NAPAPA-UUHH GLADY’S & THE BOXERS AKO’Y ISANG PINOY 16 FLORANTE AKO’Y IYUNG-IYO OGIE ALCASIDÿ AKO’Y NANDIYAN PARA SA’YO 17 MICHAEL V. -

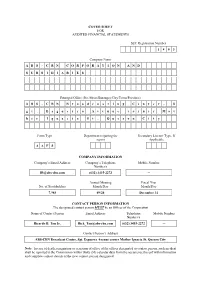

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A

COVER SHEET FOR AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A B S - C B N C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) A B S - C B N B r o a d c a s t i n g C e n t e r , S g t . E s g u e r r a A v e n u e c o r n e r M o t h e r I g n a c i a S t . Q u e z o n C i t y Form Type Department requiring the Secondary License Type, If report Applicable A A F S COMPANY INFORMATION Company’s Email Address Company’s Telephone Mobile Number Number/s [email protected] (632) 3415-2272 ─ Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 7,985 09/24 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Ricardo B. Tan Jr. [email protected] (632) 3415-2272 ─ Contact Person’s Address ABS-CBN Broadcast Center, Sgt. Esguerra Avenue corner Mother Ignacia St. Quezon City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

MY MIIC STAR PHILIPPINES SONGS 4378 SONGS No

MY MIIC STAR PHILIPPINES SONGS 4378 SONGS No. Artist Song Title 55142 17:28 NETWORK I 55143 17:28 SUKOB NA 56237 1017 BERTING 58528 1017 CHARING 58685 1017 SANA 56247 14K DADAANIN KO NA LANG SA KANTA 59345 14K SAMA SAMA 57152 2 Unlimited NO LIMIT 59075 2001 CC TSUBIBO 55105 6 cycle mind SANDALAN 56102 6 Cycle Mind BIGLAAN 58345 6 CYCLE MIND I 58544 6 Cycle Mind CIRCLE 56314 6 Cyclemind MAGSASAYA 56908 6 Cyclemind TRIP 57005 6 cyclemind GAYA NG NOON 57030 6 Cyclemind NALILITO 58447 6 Cyclemind UMAASA 58494 6 Cyclemind WAIT OR GO 58547 6 Cyclemind DINAMAYAN 58619 6 Cyclemind AAMININ 58684 6 Cyclemind SALUDO 59024 6 Cyclemind WALANG IWANAN 56134 6 cylce mind PABA 56204 6 cylce mind SIGE 59176 7th Coral Group KAPUSO 56747 92 AD DIWA NG PASKO 57504 A. PASCUAL ANG TANGING ALAY KO 55477 A.TORRES MAHIWAGA 55391 A.Torres & R.Malaga SARONG BITUON (BICOLANO) 58594 Abdilla SABALAN 58596 Abdilla SURATAN 58597 Abdilla WAY BULI RAPAT 58608 Abdilla SIMASANDUNG 58609 Abdilla SUSA ATAY DAYANG 58675 Abdilla INA AMA 58680 Abdilla MALASA MAGTUNANG 57952 Abigail BONGGAHAN 58562 Acel PAKIUSAP 58584 Acel Bisa ONE LOVE 57247 Acosta & Russell DEEP IN MY SOUL 57269 Acosta-Rusell DON'T FADE AWAY 56921 Adamo ALINE khe.com.au khe.co.nz picknmix.com.au miicstar.com.au MY MIIC STAR PHILIPPINES SONGS 4378 SONGS No. Artist Song Title 58917 Adelaida Ramones KARIK KENKA 58934 Adelaida Ramones REBBENG NA KADI 58946 Adelaida Ramones TOY AYAT KO 58905 Adelaida Ramones & Randy Corpuz APAY NGA INAYAT NAK 58943 Adelaida Ramones & Randy Corpuz SIKSIKA 55470 Aegis BASANG BASA SA -

Ar-2004 Pdf Comp

abs-cbn annual report 2004 1 2 abs-cbn annual report 2004 abs-cbn annual report 2004 3 4 abs-cbn annual report 2004 abs-cbnabs-cbn annual annual report report 2004 2004 55 6 abs-cbn annual report 2004 abs-cbn annual report 2004 7 8 abs-cbn annual report 2004 abs-cbn annual report 2004 9 10 abs-cbn annual report 2004 abs-cbn annual report 2004 11 12 abs-cbn annual report 2004 abs-cbn annual report 2004 13 14 abs-cbn annual report 2004 abs-cbn annual report 2004 15 16 abs-cbn annual report 2004 abs-cbn annual report 2004 17 18 abs-cbn annual report 2004 abs-cbnabs-cbn annual annual report report 2004 20041919 ABS-CBN BROADCASTING CORPORATION AND SUBSIDIARIES BALANCE SHEETS (Amounts in Thousands) Parent Company Consolidated December 31 2003 2003 (As restated - (As restated - 2004 Note 2) 2004 Note 2) ASSETS Current Assets Cash and cash equivalents (Note 4) $356,772 $803,202 $1,291,557 $1,580,355 Receivables - net (Notes 5, 7 and 12) 2,181,412 2,338,136 3,757,824 3,789,278 Current portion of program rights (Note 9) 490,685 566,992 872,983 880,975 Other current assets - net (Note 6) 296,182 193,317 629,426 508,681 Total Current Assets 3,325,051 3,901,647 6,551,790 6,759,289 Noncurrent Assets Due from related parties (Notes 7 and 12) 159,741 150,894 262,435 273,303 Investments and advances (Notes 5, 7, 9, 12 and 15) 3,622,061 3,417,545 239,962 342,111 Noncurrent receivables from Sky Vision (Note 7) 1,800,428 – 1,800,428 – Property and equipment at cost - net (Notes 8, 12, 13 and 14) 10,250,015 10,580,136 10,650,285 10,909,767 Program rights -

'Tito Roby'…Page 9 ABS-CBN Lauded at CG Training…

NOVEMBER 2018 www.lopezlink.ph Story on page 2. http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Innovators take the spotlight at LAA 2018 IN Negros Oriental, slash-and-burn farmers become protectors of the forests they used to mindlessly burn. In Marawi, journalists uncover the stories of a people isolated and displaced by armed conflict. In Leyte, typhoon victims transform from jobless into members of an empowered community who run their own businesses and are able to send their children to school. Turn to page 6 Social worker ABS-CBN lauded at The Rockwellist: …page 3 gives back for Beauty’s best CG training …page 12 ‘Tito Roby’…page 9 Lopezlink November 2018 Biz News Lopezlink November 2018 With built-in apps, PVR, companion app and more ABS-CBN lauded at corporate SKY upgrades PH cable TV viewing Climate change with new SKY On Demand box governance training By Carla Paras-Sison SKY gives cable TV viewing Tube, and SKY On Demand, digital era, making it a relevant ABS-CBN Corporation was Transpar- in the country a boost as it its online streaming service ex- product in Filipino homes. lauded by former deputy priva- ent is the enemy launches its all-new SKY On clusive to SKY subscribers. “Online viewing is gaining cy commissioner Dondi Mapa M a p a By Carla Paras-Sison Demand box that promises to The SKY On Demand box also ground in the Philippines given at the corporate governance said being inability of the delayed central bank action on in- give Filipino families a better promises convenience for sub- the growing internet penetra- training held for directors and transparent country to link terest rates to ease exchange rate TV viewing experience. -

40368512.Pdf

Msgr. Gutierrez Elections 2010 Ogie Cruz All Saints’ Day: Get Out Pinakamagaling na Zacchaeus: from sin to aktres sa lahat ng repentance. ...p. 15 and Vote! panahon... p. 22 October 29 - November 4, 2010 Japan’s Itochu invests $120M in Isabela ethanolItochu Corp. plant of Japan is investing $120 million in an PROMISED LAND ethanol plant in San Mariano, Veritas taps Smart for e-trading Isabela, which is expected to become the Philippines’ biggest project to benefit urban poor and the only integrated biofuel plant by 2012. A Gift from Heaven The project would be under- “Hulog siya ng langit sa taken by Green Future Innova- atin (She’s a gift from tions Inc. (GFII), a joint venture of Itochu, another Japanese firm heaven),” she told her hus- JGC Corp., the Philippine Bio- band who was still with- ethanol and Energy Investments holding judgment until Corp., and Taiwanese holding the final ruling. But in her firm GCO. heart, Ditas was already Under the plan, the joint convinced Mikaela was Shown in the photo during the MOA-signing ceremony held recently (from left to right) are: Perry V. Bayani, Marketing Group Head for Talk her daughter. Like she had ‘N Text; Orlando B. Vea, SMART Chief Wireless Advisor; Manuel V. Pan- said, Ditas believed she’s a gilinan, PLDT and Smart Chairman; Fr. Benigno P. Beltran, SVD, Chair- gift from heaven, granted man and CEO of Veritas; Carlos Palad, COO of Veritas; Girlie Santos, Environment Planner for Veritas. through the intercession of her deceased father. This Residents of Tondo may of Smokey Mountain and was why she even bore his soon enjoy the benefits of Tondo, will use Smart’s name, “Miguel” which is buying and selling goods communication and e-com- the Spanish and male ver- over the internet through merce solutions to support sion of “Mikaela”. -

Magic Karaoke 2011 Version Et-19K Pinoy 2,300 Songs

<b><font size="5">MAGIC KARAOKE 2011 VERSION ET -19K PINOY SONG LIST< ... Page 1 of 60 MAGIC KARAOKE 2011 VERSION ET-19K PINOY 2,300 SONGS SONG LIST 1,800 ALL TIME FAVORITE POP ENGLISH SONGS AND 800 OPM SONGS WWW.MAGICKARAOKE.COM FATHER'S DAYS SPECIAL SAVE $23 USE THIS COUPON CODE " SALAMAT-PAPA " NO TITLE ARTIST COMPOSER 7992 AH DOO DOO DOO WILLIE REVILLAME L. CAMO 7993 BILOG ANG MUNDO MANNY PACQUIAO L. CAMO 7994 BOOM TARAT TARAT WILLIE REVILLAME L. CAMO 7995 CHAMPION SA KANTAHAN MANNY PACQUIAO L. CAMO HEPHEP HOORAY (HAPPY 7996 WILLIE REVILLAME L. CAMO BIRTHDAY) 7997 IKAW AT AKO MANNY PACQUIAO L. CAMO 7998 LABAN NATING LAHAT ITO MANNY PACQUIAO L. CAMO PANALO KA SA PUSO KO 7999 SARAH GERONIMO L. CAMO (EXTREME JINGLE) PARA SA 'YO ANG LABAN NA 8000 MANNY PACQUIAO L. CAMO 'TO 8001 A WHOLE NEW WORLD P. BRYSON & R. BELLE MENKEN/RICE 8002 ALMOST PARADISE MIKE RENO & ANN WILSON E. CARMEN/D. PITCHFORD DIANA ROSS & LIONEL 8003 ENDLESS LOVE L. RICHIE RICHIE 8004 FROM A DISTANCE BETTE MIDLER GOLD, JULIE 8005 HAND IN MY POCKET ALANIS MORISSETTE BALLARD/MORISSETTE 8006HELLO LIONEL RICHIE L. RICHIE 8007 HERE I AM AIR SUPPLY N. SALLITT 8008 HERO MARIAH CAREY CAREY/AFANASIEFF I JUST CALLED TO SAY I LOVE 8009 STEVIE WONDER S. WONDER YOU I WANNA DANCE WITH 8010 WHITNEY HOUSTON G. MERRILL/S. RUBICAM SOMEBODY 8011 TEARS IN HEAVEN ERIC CLAPTON JENNINGS/CLAPTON TONIGHT I CELEBRATE MY 8012 P. BRYSON & R. FLACK G. GOFFIN/M. MASSER LOVE 8013 BAKIT LABIS KITANG MAHAL LEA SALONGA A. -

JM De Guzman Vows to Do Better This Time As He Headlines a Soap Opera with Neophyte Leading Lady Barbie Imperial #Insideshowbizlovesjuanbie

MARCH 10 - 16, 2018 ISSUE EXCLUSIVE TELL-ALL INTERVIEW! “Kinakabahan ako kasi I was given another chance and they trusted me again” THE COMEBACK JM de Guzman vows to do better this time as he headlines a soap opera with neophyte leading lady Barbie Imperial #InsideShowbizLovesJuanBie JENICA MAGQUILAT EDITOR ANGELU ZAFE WEB CONTENT WRITER ART NICOLE VILLARUEL, BRIA CARDENAS MULTIMEDIA ARTISTS DENNIS FLORORITA FINAL ARTIST SPECIAL PROJECTS MARGA TUPAZ HEAD RED DE LEON ASSOCIATE CREATIVE DIRECTOR MARA MADRID, CHARLENE TY, ANDREA LAM, ANGELI MANABAT, LOUISE SICAT COPYWRITERS DEN FAJARDO, ALEXA MANLANGIT GRAPHIC ARTISTS BETTINA DE LOS REYES, JOSHUA ARGOSINO, CARMINA AGLIPAY MULTIMEDIA ARTISTS CONTRIBUTOR JERICK SANCHEZ PHOTOGRAPHER ROSY MINA WRITER ERICA LUNA EDITORIAL ADMIN ASSOCIATE SUKI SALVADOR VICE-PRESIDENT — MAGAZINE & PRINT BUSINESS ARCHIE CARRASCO EXECUTIVE VICE PRESIDENT AND PUBLISHER FOUNDER & CEO SARI YAP CHAIRMAN J. TIU FOUNDING CREATIVE DIRECTOR LORRAINE BELMONTE MAKING WAVES The right time has come for JM de Guzman and Barbie Imperial as they embark on their biggest break in showbiz to date It is a picture-perfect afternoon. The seawater is tranquil. The sun is not so punishing. The clouds are like light strokes painted on the bright blue sky. Everything is calm. More so are the people at the beach location. In the midst of a whole-day taping, the crew and cast seem to be relaxed. It is a laidback set and its leading man is just as chill. JM de Guzman enters the scene, a picture of calm and composure with his deep-set eyes and gentle demeanor. Yet, he admits to feeling a little bit uneasy lately. -

Duterte Says Money Is Found and All Fillipinos Will Be Vaccinated 1 1 Honey Shot She Sings, She Dances, She Composes Songs

NOVEMBER 2020 L is for Rabbit DepEd Online modules with questions like “How do Airplanes Sound” confuses mom and baffles Broadway actress and singer Lea Salonga PHILIPPINES - Everyone seems to deal with confusing learning modules. module because it asked this question: reposted online almost 18,000 times, be struggling with blended learning, Last month, a parent named what do airplanes sound like? including parents who have had to Kristine Joy Rivera posted her child’s The questionnaire, which has been L IS FOR RABBIT continued on page 25 Nostalgia HEAVEN CARRIEDO STREET, MANILA 1960’S Peralejo Happy to be the Philippines starts lead in national ID cards a new Government hopes system will spur consumer adoption of electronic payments series The planned Philippine ID system could accelerate adoption of electronic payments in the Southeast Asian country. MANILA-The Philippines without bank accounts to began registering millions access financial services. of citizens for its national All Philippine citizens identification system, hop- and resident foreigners are ing to promote electronic required to register such payments and make it eas- NATIONAL ID ier for low-income earners on page 26 UK TO DONATE TO TYPHOON RELIEF Gov’t clears Duterte’s Typhoon Absence Calida trying to unseat SC Leonen Andi Eigenmann’s Simple Life Why No Designer Stuff for Danica Sotto MANILA, Philippines — The Supreme Court should thwart Senate Minority Leader Solicitor General Jose Calida’s effort to repeat history by unseating Franklin Drilon said Calida’s No Nudity for Phoebe Walker Associate Justice Marvic Leonen through his wealth declaration CALIDA statements or the lack of it, a Senate leader said on Sunday. -

C Ntentasia 2016

11-24 January C NTENTASIA 2016 www.contentasia.tv l https://www.facebook.com/contentasia?fref=ts facebook.com/contentasia l @contentasia l www.contentasiasummit.com Netflix baits Asia’s censors U.S. streamer shuts eyes to region’s content codes, regulatory slap in the face for local players If Netflix was a country, the world may well be prepping for war right now. Instead, law makers in Asia (with the exception of China, which Netflix hasn’t dared enter yet) seem to be rolling out the red carpet to the U.S. streaming serv- ice. Others haven’t said a word, so effec- tively, the carpet is equally plush. What’s deeply puzzling about this pic- ture? As staggeringly wonderful as Netflix is (and it is, truly deeply), Asia’s regulators are effectively giving the finger to program- mers in the region who have followed the rules, been respectful, paid their taxes, created jobs, trained people, contributed on the ground in so many ways. The big swinging ballsiness of Netflix’s move into Asia is overshadowed only by the mammoth unfairness that now hangs heavy over the entire industry. Unless, of course, regulators plan to use the situation to open up everything to everyone, and let parental controls/ PIN codes rule. A level playing field. Now wouldn’t that really be something? Right now, there’s a lot of hairsplitting over which digital services are actually covered by what regulations. How much is being censored? How much did Me- diaCorp actually cut out of Weeds on Toggle despite parental controls? What exactly did HBO Go cut from Game of Thrones in Singapore? Will regulators take the shackles off? Maybe.