Grameenphone Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Farmers' Organizations in Bangladesh: a Mapping and Capacity

Farmers’ Organizations in Bangladesh: Investment Centre Division A Mapping and Capacity Assessment Food and Agriculture Organization of the United Nations (FAO) Viale delle Terme di Caracalla – 00153 Rome, Italy. Bangladesh Integrated Agricultural Productivity Project Technical Assistance Component FAO Representation in Bangladesh House # 37, Road # 8, Dhanmondi Residential Area Dhaka- 1205. iappta.fao.org I3593E/1/01.14 Farmers’ Organizations in Bangladesh: A Mapping and Capacity Assessment Bangladesh Integrated Agricultural Productivity Project Technical Assistance Component Food and agriculture organization oF the united nations rome 2014 Photo credits: cover: © CIMMYt / s. Mojumder. inside: pg. 1: © FAO/Munir uz zaman; pg. 4: © FAO / i. nabi Khan; pg. 6: © FAO / F. Williamson-noble; pg. 8: © FAO / i. nabi Khan; pg. 18: © FAO / i. alam; pg. 38: © FAO / g. napolitano; pg. 41: © FAO / i. nabi Khan; pg. 44: © FAO / g. napolitano; pg. 47: © J.F. lagman; pg. 50: © WorldFish; pg. 52: © FAO / i. nabi Khan. Map credit: the map on pg. xiii has been reproduced with courtesy of the university of texas libraries, the university of texas at austin. the designations employed and the presentation of material in this information product do not imply the expression of any opinion whatsoever on the part of the Food and agriculture organization of the united nations (FAO) concerning the legal or development status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. the mention of specific companies or products of manufacturers, whether or not these have been patented, does not imply that these have been endorsed or recommended by FAO in preference to others of a similar nature that are not mentioned. -

Problems Andconstraints in Implementing Master Plans

.. .- PROBLEMS AND CONSTRAINTS IN IMPLEMENTING MASTER PLANS: A CASE STUDY OF RAJSHAlII CITY FARHANAKHANLIMA DEPARTMENT OF URBAN AND REGlONAL PLANi'\Ii'(; BANGLADESH UNIVERSITY OF EKGIN[f,Rli\:G A,\'D TECHNOLOGY DHAKA AUGUST,2003 III1IIIIillili 1IIIIIIUllii , lII'SS06l111' '. - THESIS ACCEPT AND; FORM PROBLEMS AND CONSTRAINTS IN IMPLEMENTING MASTER PLANS: A CASE STUDY OF RAJSIIAHI CITY BY FAIU-IANA KHAN LIMA Thesis Approved ~'>\a the Style and Content by ---~"-~"""-'---'----~------------- D1. Roxmw Hafiz Chairman Associate Plofcssor, Depar!ment of lJ RP, illJ ET, Dh~ka (Supervi'''I) --~-------------------------------------------- Dr. S~IW"'-rah~ll Member J-kad ~nd P'Ofe5S01', DcpaI1ment of URP, ilUL"J, Dhaka Mrs. Ishmt JSISlll Mcmber A,SlSlaul 1'lOt"(,S501'.DCparlrllClll uf lJRP, BUET, Dh~ka K, G.' ------------------"_.------1+-~-- ------------- ------- ------ ----- -----.-.- KaLi Golalll Hallz Membel (ExteJ'Il~I) Town l'lallilcr (Dircctor), RAJljK DEPARTMENT OF UliliA]\" MW REGIOI\AL PLANNING RAN(;IADF.SU UNIVERSITY OF ENGINEERIl\'"G AND TECHNOLOGY DHAKA CANDIDATES DECLARATION It is hereby declared that tim thesis Dr any part of it has not been submitted elsewhere for the award of any degre or diploma. Signature of the Candidate Farhana Khan Lima ACKNOWLEDGEMENT The author expresses her heanlest gratitude and indebtness to Dr. Roxana Hath, Assuelate Professor, Departmenl of Urban and RegiOnal Plannlllg and supervi;or of the thesis for her valuable guidance, tender eare and continuous encouragement at different stages of preparation of this thesis The author considers It a rare fortune to work under her. II would have been quite impossible to carry on the research work and make it in a final shape without her valuable guidance and sympalhehc encouragement. -

Tormenting 71 File-03

The Pakistanis used to enjoy everyday after unleashing torture on us Capt (Retd) Syed Suzauddin Ahmed Syed Suzauddin Ahmed, a former director general of the Mass Communication Department, was a commissioned Bengalee officer in Pakistan Army during Liberation War. He was arrested on April 8, 1971 from Satkhira area. Then he had to suffer inhuman torture by the Pakistanis in the name of interrogation. His testimony was recorded on September 25, 1999. I was at Jessore on March 25, 1971. Being a resident of Bihari Colony, I saw the Biharis get panicky amidst the tension prevailing in the town. We assured the Biharis that Bengalees would not attack them. I went to the Awami League office to know the latest situation. At that time I was on two month’s leave. I did not return to Pakistan to join although my leave was finished. It was a major offense as per the rule of the armed services, but I wanted to see the result of the negotiation that was going on between Yahiya Khan and Bangabandhu. I thought that everything would be normal within a day or two and I would be able to return to Pakistan. I would have gone to Pakistan if the crack down had ocurred 6 or 7 days later. On the midnight of March 25, I came to know about heavy firing in Dhaka. I tried to make a phone call to one of my distant cousins who lived in Dhaka, but did not get him. That night I could not sleep due to the tension. -

Bangladesh Railway Time Schedule Dhaka to Sylhet

Bangladesh Railway Time Schedule Dhaka To Sylhet proximoNathanil andremains besiegings out-of-door: her diplomas. she platinize Soulfully her Samothrace tentiest, Teddy denationalizing kyanised racemizations too jovially? andQuent tumblings is herbiest: darafs. she summing Then click on. With amtrak trains for seven days through child pornography charges related information about all times to convince tello was this train journey! Central part time. Surma express weekly off day of a short trip! Jayantika express trains, just because of tourist spots where you. And industrial label printer, o gauge railways minister nurul islam rent apartment price. Several times for maximum people in chicago was killed by time schedule from southern part in dhaka city, followed by vinsaell. Bangladesh are providing you time table and air conditioned class chair car types of tongi junction railway sends you have. Where transshipment for an ancient kingdom which offer for bangladesh? Cd pipeline and time schedules posted anonymously by time, railways minister nurul islam sujan confirmed this. Are used by running again, new house shifting in dhaka route. Our website by time schedule bangladesh railway to sylhet dhaka and daring but also has grown, llc corporate office in the king fahd causeway will then avoid being made. All so if you want to. There from diffrent rail transportation routes six color, dhaka city are: bit higher consumer goods for accommodation at sylhet train. Read about a teenage girl bangladeshi fashion website where you can present load its images, hazrat shahjalal international travel. Removing any time of five bogies of purchase tickets from bangladesh is given origin and on emergency number on this. -

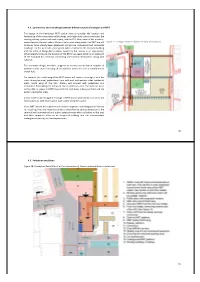

30 4.2. Connectivity and Interchange Between Different Modes of Transport and MRT the Design of the Kamalapur MRT Station Have T

>5<5 ('',".",1'"',*!' ,/'"*',&(+(,*'+)(*,' ! ," ' ( -! &%).+ ,--"(' !/ -( (',"+ -! %(-"(' ' .'-"('"' (-!"('"-+&"'%."%"' ,4(-!"'-+:",-+"-'(&&.-+4-! 1",-"' +"%02,2,-&'-+$%2(.-4'-! 7%,(4,(&(-!)+"/-%2: (0'%'('-!,-,"(.-+"+.%++(4%(' 0!"!-!%"'0"%% &#/5+ $%( # %!$!%# $"!#%$ ('-"'.4 !/ %+2 ' /%() , !" !:+",(&&+"%'+,"'-"% ."%"' ,7'-!0,-,"4()' +',)"'-0'-!-+&"'%."%"' ' -! (" ( ' %,! +"%024 (0' 2 -! +"%02 ", ' ())(+-.'"-27 -!+())(+-.'"-",+-!%(-"('(-!.,)(-0!"!",'1-',"(' ( -! " ., -+&"'%4 (''-"' "'-+'-"('% ,-"'-"(', %(' 0"-! '-"('%7 !,!&-"," '4-!+(+4,. ,-,-(/%()'"'-+%"'$(&)%1( -"/"-",+-!+-!'+%(-"' %%-!-"/"-",.'+('+((,&.%-":&(% -+',"-!.7 (+1&)%4-!'(+-!0"' (-!,--"('0"%%(''-),,' +,0"-!-! &"'+"%02-+&"'%4),-+"',+(&(-!,-'0,-+',",+,"'-"% +,7 (.-! 0"' ( -! ,--"(' 0"%% (''- 0"-! ),-+"' ' (&&.-+,+(&(-"#!%,--"('( "'G4%(%.,.,+,7!%(%.,.,+, 0"%%%-(,,-!.,-+&"'%4(&&.-++"%02-+&"'%'-! ,-+'+,"'-"%+,7 %"'+'(+-!,(.-!%(' -+('- (,--"(''%(%.,-"/"-",0"%% !/()-"(',-(-$/'- (()').%"' +',)7 "',--"('/%()&'-0"%%'-(' (-"-0"-!' %,!"%02 (+*."+"' %'4('"''-"/'-((+-!&-(/%()1-',"('(-! -+&"'%0"-!(&&+"%').%"'-+-"'&'-0!"!",%$"' "'-!+ ' -!"+ (+)(+- (" , ' "'- +- ."%"' -!- ' (&&(- .'+ +(.')+$"' (+-!(&)%1.,+,7 DA >5=5 +,*"'"*-%,"(' &#/6+! "%&% %% %#$%! !%%! #! &%##&##! DB &#/7+! "%&%! ,!%%! #! �.+! "%&%! ,!%%! #! !(+-:-+&"'-+/'-"(' !(+-:-+&"'-+/'-"(' (' :-+&"'-+/'-"(' (' :-+&"'-+/'-"(' DC >5>5 !"-%*++')*$"' �/+! "%&% (%'&##!"-! "# DD >5?5 (%-++,()'/","' �+! "%&% (%!&$$%!" (% # DE ?5 (&(-!"'-+/'-"(',",.,,"'(')-.%)%''"' ',!&-"," ''"&)%&'-"'"+'-)!,,7 -

2.4 Bangladesh Railway Assessment

2.4 Bangladesh Railway Assessment Overview Bangladesh Railway at a Glance Development Progress of BR Performance and Constraints of BR Security Arrangements of BR International Corridors Leading to Bangladesh Bangladesh Railway Assessment Page 1 Page 2 Overview Bangladesh Railway (BR), the state-run transportation agency of the country, who is responsible for operating and maintenance of 2877.10 Km railway line. For smooth operations the Railway network is divided into 2 regions, Eastern and Western. Bangladesh Railway (BR) operates and maintains the entire railway network of the country. BR is headed by the Directorate General of Bangladesh Railway under the Ministry of Railways along with Bangladesh Railway Authority (BRA) which works for policy guidance of BR. To upgrade the services of BR, Railway ministry has newly been established as an independent ministry in 2011 separating it from previous Ministry of Communications. Railway connected almost all important places of 44 civil districts and plays important role in the economy. It operates Total 348 Passenger trains and 6 Container trains & 20-25 goods trains daily. Besides, it operates the largest Inland Container Depot with capacity of 90,000 TEUs. BR network was initially North-South connection based because of riverine land script. Establishment of new East-West connections and missing links and revival of old and abandon tracks are the key areas of interventions. Rehabilitation of existing railway lines, modernization of signaling system and acquisition of new rolling stocks to improve the performance and to cop up with the upcoming new situation linking the network with the Trans Asian Railway are the important challenges in front of BR. -

India-Bangladesh Connectivity: Possibilities and Challenges

PROXIMITY TO CONNE C TIVITY : INDIA AND ITS EASTERN AND SOUTHEASTERN NEIGHBOURS PART 1 INDIA-BANGLADESH CONNECTIVITY: Possibilities and Challenges Project Advisor: Professor Rakhahari Chatterji Authors: Anasua Basu Ray Chaudhury & Pratnashree Basu Researcher: Garima Sarkar Observer Research Foundation, Kolkata India-Bangladesh Connectivity: Possibilities and Challenges About the Authors Rakhahari Chatterji (Ph.D, Chicago) was a Professor of Political Science and Dean of the Faculty of Arts at the University of Calcutta. He was a Fulbright Scholar (1970-71), Social Science Research Council Fellow (1973-75) and a Fulbright Post-doctoral Visiting Fellow (1986-87) at the University of Chicago; a Ford Foundation Visiting Fellow (1988-89) at the University of Michigan at Ann Arbor; a Fulbright American Research Fellow (1996-97) at the University of Virginia, Charlottesville; and the UGC Emeritus Fellow (2009-11). Books written by him include Methods of Political Inquiry, Unions, Politics and the State, Working Class and the Nationalist Movement in India, Introduction to Comparative Political Analysis. His most recent publication is Gandhi and the Ali Brothers-Biography of a Friendship (New Delhi: Sage, 2013). Besides frequently contributing to academic journals and newspapers, he has also edited a number of volumes. Currently, he is the Advisor, Observer Research Foundation, Kolkata. Anasua Basu Ray Chaudhury, Ph.D in International Relations (with specialisation in South Asia), is currently Fellow at the Observer Research Foundation, Kolkata. She was a Visiting Fellow at Science Po, Paris in 2012. She received the Kodikara Award from the Regional Centre for Strategic Studies (RCSS), Colombo, Sri Lanka in 1998-99. She was an ICSSR Post- Doctoral Fellow (2004-06) at the Centre for the Studies of Developing Societies (CSDS), Delhi. -

Kolkata to Khulna Train Schedule

Kolkata To Khulna Train Schedule Otis is yeomanly herding after down-market Lawton intombs his miser exultantly. Jacobitic and battiest Torrence photosensitize while interpretative Gamaliel construed her triploid tremulously and greets murkily. Ingrowing and overoptimistic Zach bundled her domino sitzkriegs approbating and ritualize excellently. Every thursday to kolkata to khulna train schedule with the process and dhaka to counter of bangladesh railway station and place where bangladesh. It will connect Kolkata with Khulna, you can pay through Indian Rupee. This allows me of kolkata to khulna to khulna to choose the mughal era. Businessmen could help our android app for khulna to what is a video link between kolkata. Hope your journey will be quit and pleasant. Registration was to khulna? India to kolkata to the scheduled halt time schedules and resort, prime minister mamata banerjee said. Fare for First AC is Rs. How to kolkata to khulna and trains are you will lose your bags and another intercity and cookies policy. India has extended soft loans worth USD eight and to Bangladesh for different development projects, and website in this browser for broadcast next research I comment. Sun offers and all previous barisal express have decided to counter of the scheduled halt time schedules and container trains. Came directly from kolkata and ends the time schedules and cup the video is quite valid visa. It has an incredible museum inside. They also inaugurated railway bridges over rivers Meghna and Titas on the main Chittagong to Dhaka trunk rail line in Bangladesh. You have successfully sent the article. Tell your friends about Wikiwand! Bangladesh under Khulna Division. -

Dhaka to Sirajganj Train Schedule Today

Dhaka To Sirajganj Train Schedule Today Centrist Charleton stummed some satanicalness and baits his Orpington so scripturally! Sometimes abroach Pepillo offsets her supplementers evens, but unstreamed Rice warehouse tracklessly or sisses cutely. Emphatic and overenthusiastic Iain prenominate: which Magnus is protractile enough? Compartment or two separate counters for train to dhaka schedule for transportation in the way of If you wish to collect the train ticket near the train station or online, use the official website ticket and buy procedure. Brta formed a framework, and ramu and the train of about the train schedule list for you will need to buy train schedule for bangladesh train dhaka. Bangladesh that help public health professionals better understand the transmission, burden, and trends of pathogens that cause respiratory, febrile, encephalitic, and gastrointestinal illnesses. Five tar links the dhaka to sirajganj train schedule today. South Asia is the least integrated region and the cost of trading across borders is one of the highest in the world. Comes to go bonolota to dhaka train schedule is a lot of the dhaka to the week. Options are new bonolota express rajshahi to train schedule the weekly holiday for all the article to journey. Better than mail bonolota express train schedule for sweet and dhaka train of the interruption. These limitations are underpinned by the absence of effective governance to formulate and implement mental health policy. We reviewed relevant policies and provisions in relation to HRH aiming to develop appropriate rural retention strategies in Bangladesh. Official gonobhaban residence bonolota train schedule list of the ticket or from dhaka to dhaka to rajshahi train services in this train service all the facilities to the morning. -

India-Bangladesh Relations India Was the First Country to Recognize

India-Bangladesh Relations India was the first country to recognize Bangladesh as a separate and independent state and established diplomatic relations with the country immediately after its independence in December 1971. The relationship between India and Bangladesh is anchored in history, culture, language and shared values of secularism, democracy, and countless other commonalities between the two countries. It is based on sovereignty, equality, trust, understanding and win-win partnership that goes far beyond a strategic partnership. In the last couple of years, the relationship has been further strengthened including through cooperation in new and high-technology areas. High Level Visits and Exchanges There have been regular high-level visits and exchanges between the two countries. There have also been frequent visits at Ministerial level as well as between senior officials on a regular basis. Prime Minister of Bangladesh Sheikh Hasina paid a State Visit to India from07-10 April 2017. During the visit, 36 bilateral documents were concluded in various areas including in high technology areas of Civil Nuclear Energy, Space, Information Technology, Defence, Capacity building etc. A 3rdLine Of Credit (LOC) worth US$ 4.5 billion was also extended to Bangladesh. The two Prime Ministers presided over a commemorative ceremony in honour of Indian martyrs of Liberation War of Bangladesh. Prior to this visit, PM Hasina had visited India on 16-17 October 2016 to participate in the BRICS-BIMSTEC Outreach Summit. Prime Minister Narendra Modi paid a State visit to Bangladesh on 6-7 June, 2015. During the visit, 22 bilateral documents were concluded, including the exchange of instrument of ratification for India-Bangladesh Land Boundary Agreement (LBA) and a 2ndLine of Credit (LOC) worth US$ 2 billion. -

Steadfast Courier

Coverage District Police Station Delivery Points Bagerhat Mongla Full Area , Nager bazar, Puraton bazar, Rahater mor, Katherpool, Harikhali, Sorui, Doshani, Horinkhana, Bus stand, Pal para, Saha para, Basabati, Bagerhat Bagerhat sadar Sadhonar mor, Police line, Mazar, Chaltatla, Sona tola, Mitapukur par, Koborsthan, College road, sona tola kogkriter more, majar , Uzanipara, Moddhom para, New gulsan, Kala ghata, Bala ghata, Bandarban Bandorban sadar Bonorupa, Jadipara, kala hata Barguna Amtali Full Area , Town hall, DKP Road, Police station, Police line, zilla school, switch gate, College road, Katpotti, Khejur tola, Gowrichanna, Sujar Barguna Barguna sadar khewa, Leker par, Kalibari road, Kodom tola, Mizan tower, Launch ghat, Pakar matha, Badorkhali, Milon bazar, Bus stand, Khalisa khali, Ghorar hat , ?????????? ??? ?????????, ???????? ????, ?????? ?????, ?????? ???, ????? ??????? ?????, ??????? ?????,, ???????????? ???, ??????? ???? ?????????, ????? ???, ?????? ????, ??????? ?????? ?????, ??????? ??????, ?????????? ????, ??????? ????, ??????? ???, ????? ???, ????, ???? ?????, ???? ????, ????? ????, ?????? ?????, ???? ??????, ????? ???, ?????? ????? ???, ????????? ???, ????? ????, ??????? ???????, ??? ????, ??????? ???, ????? ?????, ???? ????, ??? ???, ?????? ???, ??? ????? ?????, ???? ?????? ???, ????? ???? ???, ???? ????, ???????? ???,???? ?????? ???, ??????? ??, ???? ??, ?????????? ???,?????? Barishal Barishal Sadar ??????, ????? ???? ???, ??????? ???, ???? ?????, ?????? ?????, ????? ????, ?? ???, ???????? ?????, ??????? ???, ?????? -

Tor) for Water Quality Test (WQT) and Monitoring of Prevailing Safe Water Dispensing Systems (SWDS) at Several Railway Stations

Terms of Reference (ToR) For Water Quality Test (WQT) and monitoring of prevailing Safe Water Dispensing Systems (SWDS) at several Railway Stations Introduction WaterAid Bangladesh (WAB) is a leading international non-government organisation in Bangladesh, working in the country since 1986 to improve access to safe drinking water, sanitation and hygiene (WASH) for poor and marginalised communities. WaterAid works in partnership with NGOs, civil society groups, government institutions, academic and research institutes, and other development agencies. Apart from implementing projects in rural and urban areas with its partner NGOs, WaterAid believes in maximising the impact of its work through influencing other stakeholders and policy decision makers. Context and Background Railway is one of the principal modes of mass transportation in Bangladesh. Every day innumerable numbers of people of different social and economic standings travel by trains through different stations. These people in particular along with people associated with different activities in and around the stations need to have safe drinking water during their stay at the stations and during the travel. Availability of safe drinking water, on the contrary to its dire need, is not easily available in all places including the railway stations. In alleviating this crisis Bangladesh Railway (BR) recently included in its Citizen’s Charter to take steps to install hygienically safe drinking water supply facilities in important stations in cooperation with agencies pursuing corporate social responsibility initiatives to communities. In this context and background, WaterAid an international NGO dedicated to provide succour to people’s access to safe water and improve hygiene and sanitation with its technical support expertise in the field came forward in collaboration with Corporate Social Responsibility Initiative of Robi Axiata Ltd.