2020 Final Results Announcement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

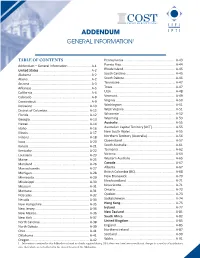

Addendum General Information1

ADDENDUM GENERAL INFORMATION1 TABLE OF CONTENTS Pennsylvania ......................................................... A-43 Addendum – General Information ......................... A-1 Puerto Rico ........................................................... A-44 United States ......................................................... A-2 Rhode Island ......................................................... A-45 Alabama ................................................................. A-2 South Carolina ...................................................... A-45 Alaska ..................................................................... A-2 South Dakota ........................................................ A-46 Arizona ................................................................... A-3 Tennessee ............................................................. A-47 Arkansas ................................................................. A-5 Texas ..................................................................... A-47 California ................................................................ A-6 Utah ...................................................................... A-48 Colorado ................................................................. A-8 Vermont................................................................ A-49 Connecticut ............................................................ A-9 Virginia ................................................................. A-50 Delaware ............................................................. -

香港物業管理公司協會有限公司the Hong Kong Association of Property Management Companies Limited

香港物業管理公司協會有限公司 The Hong Kong Association of Property Management Companies Limited 會員轄下物業資料 Date : 2016-01-08 Members Portfolios Property Registers 會員編號 F-0060/99 公司名稱: 冠威管理有限公司 Membership No.: Company Name: Goodwill Management Limited 總樓宇面積 單位面積 (平方呎) 類別 物業名稱及地點 物業地址 類別/座數 單位數目 Unit Size GFA 樓齡 管理年數 Type Properties Properties Address Type/No. of Blocks No. of Units Min/Max Sq. Ft. Age Yrs.Managed C AIA Tower 183 Electric Road North Point HK 515645.00 17. 8 17. 8 C Dawning Views Plaza 23 Yat Ming Rd Fanling NT 96365.00 16. 7 16. 7 C Fanling Centre Shopping Arcade 33 San Wan Road Fanling NT 151513.00 25. 1 25. 1 C FWD Financial Centre 308-320 Des Voeux Rd C HK 225851.00 21. 3 21. 3 C Golden Centre 188 Des Voeux Rd Central HK 156562.00 24. 10 24. 10 C Grand Waterfront Plaza 38 San Ma Tau Street Ma Tau Kok KLN 147481.00 9. 2 8. 8 C Green Code Plaza 1 Ma Sik Road Fan Ling NT 136533.00 1. 6 0. 5 C Kolour.Tsuen Wan I 68 Chung On Street Tsuen Wan NT 394258.00 19. 4 19. 4 C Kolour.Tsuen Wan II 67-95 Market St Tsuen Wan NT 156369.00 25. 1 17. 8 C Kolour.Yuen Long 1 Kau Yuk Road Yuen Long NT 152948.00 21. 1 21. 1 C Kowloon Building 555 Nathan Rd Yau Ma Tei KLN 113384.00 28.0 16. 2 C Manhattan Plaza 23 Sai Ching St Yuen Long NT 48358.00 26. -

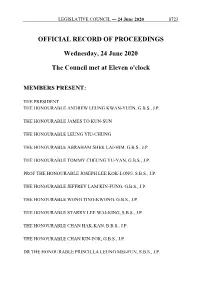

Official Record of Proceedings

LEGISLATIVE COUNCIL ― 24 June 2020 8723 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 24 June 2020 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, G.B.S., J.P. THE HONOURABLE STARRY LEE WAI-KING, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, B.B.S., J.P. THE HONOURABLE CHAN KIN-POR, G.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. 8724 LEGISLATIVE COUNCIL ― 24 June 2020 THE HONOURABLE WONG KWOK-KIN, S.B.S., J.P. THE HONOURABLE MRS REGINA IP LAU SUK-YEE, G.B.S., J.P. THE HONOURABLE PAUL TSE WAI-CHUN, J.P. THE HONOURABLE CLAUDIA MO THE HONOURABLE MICHAEL TIEN PUK-SUN, B.B.S., J.P. THE HONOURABLE STEVEN HO CHUN-YIN, B.B.S. THE HONOURABLE FRANKIE YICK CHI-MING, S.B.S., J.P. THE HONOURABLE WU CHI-WAI, M.H. THE HONOURABLE YIU SI-WING, B.B.S. THE HONOURABLE MA FUNG-KWOK, S.B.S., J.P. THE HONOURABLE CHARLES PETER MOK, J.P. THE HONOURABLE CHAN CHI-CHUEN THE HONOURABLE CHAN HAN-PAN, B.B.S., J.P. -

Business Cycles in a Small Open Economy Model: the Case of Hong Kong.∗

Business cycles in a small open economy model: The case of Hong Kong.∗ Paulina Etxeberria Garaigortay Amaia Izaz The University of the Basque Country. January, 2011 Abstract This paper analyzes the business cycle properties of the Hong Kong economy du- ring the 1982-2004 period, which includes the financial crisis experienced in Hong Kong in 1997-98. We show that output, output growth rate and real interest rates volatilities in Hong Kong are higher than their respective average volatilities among developed economies. In this paper, we build a stochastic neoclassical small open economy model that seeks to replicate the main business cycle characteristics of Hong Kong, and through which we try to quantify the role played by exogenous Total Factor Productivity and real interest rates shocks. The main finding is that, in order to ex- plain the Hong Kong business cycle characteristics, the trend volatility has to be higher than the volatility of the transitory fluctuations around the trend, and that the coun- try risk spread is the responsible for both the high variability and its countercyclicality. Keywords: Asian Financial Crisis, Small Open Economy, Neoclassical model. JEL Classification: E13, E32, F41. ∗We thank Cruz Angel´ Echevarr´ıa for useful comments. This paper was presented at the All China Economics (ACE) International Conference, Hong Kong, 2006, XXXIII Symposium of Economic Analysis, Spain, 2007, DEGIT XVI Dynamics, Economic Growth and International Trade, Los Angeles, USA, 2009. Financial support from Universidad del Pa´ısVasco MACLAB, project IT-241-07, and Ministerio de Ciencia e Innovaci´on,project ECO2009-09732 are gratefully acknowledged. Any remaining errors are the authors' responsibility. -

DOUBLE COVE Ma on Shan, Hong Kong Chairman’S Statement

DOUBLE COVE Ma On Shan, Hong Kong Chairman’s Statement Profit Attributable to Shareholders The Group’s reported profit attributable to equity shareholders for the year ended 31 December 2016 amounted to HK$21,916 million, representing an increase of HK$590 million or 3% over HK$21,326 million for the previous year. Reported earnings per share were HK$6.03 (2015: HK$5.87 as adjusted for the bonus issue in 2016). Excluding the fair value change (net of non-controlling interests and tax) of investment properties and investment properties under development, the Group’s Underlying Profit attributable to equity shareholders for the year ended 31 December 2016 was HK$14,169 million, representing an increase of HK$3,160 million or 29% over HK$11,009 million for the previous year. Underlying Earnings Per Share were HK$3.90 (2015: HK$3.03 as adjusted for the bonus issue in 2016). Dr The Honourable Lee Shau Kee, GBM Chairman and Managing Director Chairman’s Statement Dividends Hong Kong The Board recommends the payment of a final dividend of Property Sale HK$1.13 per share to shareholders whose names appear Hong Kong’s property market has become active since the on the Register of Members of the Company on Tuesday, second quarter of 2016. In response to the continuing price 13 June 2017, and such final dividend will not be subject to increases, the Government in November 2016 raised the any withholding tax in Hong Kong. Including the interim ad valorem stamp duty on residential property transactions for dividend of HK$0.42 per share already paid, the total non first-time buyers to a flat rate of 15%. -

Whole Fruit Address Store List

Whole Fruit Address Store List Shop C, G/F., Elle Bldg., 192-198 Shaukiwan Road, Shaukiwan, HK Shop 3 & 4 Yue Fung House, Yue Wan Estate, HK Shop 120 & Portion of Shop 119 Level 1, New Jade Shopping Arcade, Chai Wan, HK Shop E, G/F, Hing Cheung Building, 15-31 Shaukiwan Road, HK Shop A, G/F, Healthy Village, 180-182 Tsat Tsz Mui Rd, Podium Lvl, NP, HK G/F & C/L, Siu King Bldg., 14-16 Tsat Tsz Mui Rd, North PoiN.T., HK G/F., 98 Electric Road, North PoiN.T., HK Shop G14 on G/F., Fu Shan Mansion, Stage III, Tai Koo Shing, HK Shop No.47 + 48, Harmony Garden, 9 Siu Sai Wan Road, Chai Wan, HK Shop C,D,E & F, G/F., 8 North PoiN.T. Road, North PoiN.T., HK G/F., Shop 3, Hing Wah Shopping CeN.T.re, Hing Wah Estate, Chai Wan, HK Shop No.G5, G/F., Fok Cheong Building, Nos.1032-1044 King's Rd., HK G/F., King's Road 963A, Quarry Bay, HK Shop 6 G/F, Home World, ProvideN.T. CeN.T.re, 21-53 Wharf Rd, North PoiN.T., HK Shop 3, G/F., Youth Outreach Jockey Club Building,1-18 Hing Man Street, Shaukeiwan, HK Shop No.1 on Lower Ground Floor, Braemar Hill Shopping CeN.T.re, No.45 Braemar Hill Road, Braemar Hill, HK Shop GC04, G/F., Lei King Wan, Site C, 35 Tai Hong Street, HK Shop C & D, G/F, Yan Wo Building, 70 Java Road, North PoiN.T., HK Shop No. -

Urban Forms and the Politics of Property in Colonial Hong Kong By

Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong by Cecilia Louise Chu A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Architecture in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Nezar AlSayyad, Chair Professor C. Greig Crysler Professor Eugene F. Irschick Spring 2012 Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong Copyright 2012 by Cecilia Louise Chu 1 Abstract Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong Cecilia Louise Chu Doctor of Philosophy in Architecture University of California, Berkeley Professor Nezar AlSayyad, Chair This dissertation traces the genealogy of property development and emergence of an urban milieu in Hong Kong between the 1870s and mid 1930s. This is a period that saw the transition of colonial rule from one that relied heavily on coercion to one that was increasingly “civil,” in the sense that a growing number of native Chinese came to willingly abide by, if not whole-heartedly accept, the rules and regulations of the colonial state whilst becoming more assertive in exercising their rights under the rule of law. Long hailed for its laissez-faire credentials and market freedom, Hong Kong offers a unique context to study what I call “speculative urbanism,” wherein the colonial government’s heavy reliance on generating revenue from private property supported a lucrative housing market that enriched a large number of native property owners. Although resenting the discrimination they encountered in the colonial territory, they were able to accumulate economic and social capital by working within and around the colonial regulatory system. -

DFK Doing Business in Hong Kong

Doing Business in Hong Kong This document describes some of the key commercial and taxation factors that are relevant on setting up a business in Hong Kong. dfk.com Prepared by AMA CPA Limited +44 (0)20 7436 6722 2 Doing Business in Hong Kong Background Country overview The financial and securities sectors are regulated by: Hong Kong is located on the Southeast coast of China with a land area of about • The Hong Kong Monetary Authority; 1,100 square kilometres, comprising of Hong Kong Island, Kowloon Peninsula, • The Securities and Futures the New Territories and the outlying Commission; and islands. Hong Kong has a population of more than 7 million and three official • The Stock Exchange of Hong Kong languages which are English, Cantonese Limited. and Putonghua. Cantonese is the mother tongue in Hong Kong. Economic overview The People’s Republic of China (“PRC”) Hong Kong operates under a “laissez- resumed its sovereignty over Hong faire” economic system with minimal Kong when the Hong Kong Special Government interference in all sectors of Administrative Region (“HKSAR”) of the PRC the economy, and there are no exchange was established on July 1, 1997. The head controls. Hong Kong maintains its own of HKSAR is the Chief Executive who is monetary system and the Hong Kong elected for a five-year term, with approval dollar is pegged to the US dollar at the of the PRC. rate of 1US$ = 7.78 HKD. The Basic Law, which was adopted on April The HKSAR Government welcomes foreign 4, 1990, forms the written constitution of investment and there is no restriction on Hong Kong. -

G.N. (E.) 91 of 2016 G.N

G.N. (E.) 91 of 2016 G.N. XX ELECTORAL AFFAIRS COMMISSION (ELECTORAL PROCEDURE) (ELECTION COMMITTEE) REGULATION (Cap 541 sub. leg. I) (Section 18 of the Regulation) NOTICE OF VALID NOMINATIONS ELECTION COMMITTEE SUBSECTOR ORDINARY ELECTIONS CHINESE MEDICINE SUBSECTOR Date of Election: 11 December 2016 The following candidates are validly nominated for the Chinese medicine subsector: Particulars as shown on Nomination Form Candidate Number Name of Candidate Address 1 MA CHUN HO FLAT 1 26/F BLOCK A SMITHFIELD TERRACE NO.71-77 SMITHFIELD ROAD KENNEDY TOWN HONG KONG 2 WONG KIT FLAT 24 15/F MAN WAH BLDG MAN WUI ST JORDAN KOWLOON 3 LO TING YU (EDDE LO) BLK 8 25/F FLAT D TSUI CHUK GARDEN WONG TAI SIN KOWLOON 4 WONG CHE MING ROOM A 20/F HAN KUNG MANSION TAIKOO SHING 26 TAIKOO SHING ROAD HONG KONG 5 YU KWOK WAI (YU SIU WAI) 新界粉嶺祥華邨祥智樓 B 座 807 室 6 LEE YU MING FLAT D 8/F NO 73A BUTE STREET MONG KOK KOWLOON 7 LAU MEI YUE ROOM 812 MEI SAU HOUSE MEI TIN ESTATE SHATIN NEW TERRITORIES 8 CHAN MAN HON ROOM A706 CHEUNG CHI HOUSE CHEUNG WAH ESTATE FANLING NEW TERRITORIES 9 TSEA PING CHUNG FLAT D 15/F BLOCK 23 LASSAU STREET MEI FOO SUN CHUEN KOWLOON 10 NG CHUN LOI RM 509 5/F BLOCK Q KORNHILL QUARRY BAY HONG KONG 11 GAN PEI TZENG FLAT E 10/F BLOCK 9 CITY GARDEN 233 ELECTRIC ROAD NORTH POINT HONG KONG 12 KWAN KA LUN FLAT 8 1/F LOK FU BUILDING 28 TAK MAN STREET HUNGHOM KOWLOON 13 HUANG XIANZHANG FLAT A 26/F BLOCK 7 THE PACIFICA 9 SHAM SHING ROAD CHEUNG SHA WAN KOWLOON 14 CHEUNG WAI SANG FLAT E 1/F MING YIN BUILDING 390A LOCKHART ROAD WAN CHAI HONG KONG 15 WU -

Public Land Leasing in Hong Kong: Flexibility and Rigidity in Allocating the Surplus Land Value

PUBLIC LAND LEASING IN HONG KONG: FLEXIBILITY AND RIGIDITY IN ALLOCATING THE SURPLUS LAND VALUE by YU HUNG HONG B.S., Northeastern University (1987) M.C.P., Massachusetts Institute of Technology (1989) Submitted to the Department of Urban Studies and Planning in Partial Fulfillment to the Requirements for the Degree of DOCTOR OF PHILOSOPHY at the Massachusetts Institute of Technology May 1995 Yu Hung Hong, 1995. All rights reserved. The author hereby grants to MIT permission to reproduce and to distribute copies of this thesis document in whole or in part. Signature of Author Yu Hung Hong Department of Urban Studies and Planning May 1995 Certified by Karen R. Polenske Professor of Regional Political Economy and Planning Dissertation Supervisor Accepted by Karen R. Polenske Chairperson, Ph.D. Committee MASSACHUSE-rsSm Department of Urban Studies and Planning MASAum INSTITUTE JUL 111995 PUBLIC LAND LEASING IN HONG KONG: FLEXIBILITY AND RIGIDITY IN ALLOCATING THE SURPLUS LAND VALUE by Yu Hung Hong Submitted to the Department of Urban Studies and Planning in May 1995 in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Urban and Regional Studies ABSTRACT In this study, I examined the viability of four mechanisms of land-value capture under the public land-leasing systems, using Hong Kong as a case. Because the State is the landowner under a leasehold system, it can capture the land value through four ways: (1) at the initial establishment of land contracts, (2) by the collection of an annual land rent, (3) during lease renewals, and (4) through modifications of lease conditions. -

Tax and Investment Facts a Glimpse at Taxation and Investment in Hong Kong WTS Consulting (Hong Kong) Limited Hong Kong

Hong Kong Tax and Investment Facts A Glimpse at Taxation and Investment in Hong Kong WTS consulting (Hong Kong) Limited Hong Kong WTS Alliance, to which WTS WTS Hong Kong, part of WTS Hong Kong belongs, is a global which is headquartered network of selected consulting in Germany, offers a firms represented in more comprehensive service than 100 countries worldwide. portfolio to both national and Within our service portfolio we international corporations are focused on tax, legal and and individuals with regard to consulting. Our clients include their investments in Greater multinational groups, national China and across Asia. We and international medium- advise on a range of topics, sized companies, non-profit including Hong Kong, Chinese, organizations and private European and International tax clients. law, accounting, market entry and transfer pricing. Strategic Contact in Hong Kong planning for expatriate Ms. Connie Lee assignment programmes is a Head of Tax further key area of expertise. [email protected] +852 2380 2003 WTS Hong Kong provides value added services in the following areas: → International tax → Corporate tax → Tax controversy services → Transfer pricing → Mergers & acquisitions → Global expatriate services → International project management → Accounting and bookkeeping → Human resources advisory 2 Tax and Investment Facts | Hong Kong Table of Contents 1 Types of Business Structure / Legal Forms of Companies 4 2 Corporate Taxation 5 3 Double Taxation Agreements / Tax Information Exchange Agreements 12 4 Transfer Pricing 15 5 Anti-avoidance Measures 16 6 Taxation of Individuals / Social Security Contributions 17 7 Indirect Taxes 22 8 Inheritance and Gift Tax 25 9 Wealth Tax 25 Tax and Investment Facts | Hong Kong 3 1 Types of Business Structure / Legal Forms of Companies The most common legal forms of business in Hong Kong are the limited liability company, partnership, sole proprietorship, branch office of parent company and representative office. -

A Global Compendium and Meta-Analysis of Property Tax Systems

A Global Compendium and Meta-Analysis of Property Tax Systems Richard Almy © 2013 Lincoln Institute of Land Policy Lincoln Institute of Land Policy Working Paper The findings and conclusions of this Working Paper reflect the views of the author(s) and have not been subject to a detailed review by the staff of the Lincoln Institute of Land Policy. Contact the Lincoln Institute with questions or requests for permission to reprint this paper. [email protected] Lincoln Institute Product Code: WP14RA1 Abstract This report is a global compendium of significant features of systems for recurrently taxing land and buildings. It is based on works in English, many of which were published by the Lincoln Institute of Land Policy. Its aim is to provide researchers and practitioners with useful infor- mation about these sources and with facts and patterns of system features, revenue statistics, and other data. It reports on systems in 187 countries (twenty-nine countries do not have such taxes; the situation in four countries is unclear). Accompanying the report are an Excel workbook and copies of the works cited when available in digital form. Keywords: Tax on property, recurrent tax on immovable property, property tax, real estate tax, real property tax, land tax, building tax, rates. About the Author Richard Almy is a partner in Almy, Gloudemans, Jacobs & Denne, a US-based consulting firm that works exclusively in property tax administration, chiefly for governments and related insti- tutions. Mr. Almy began his career as an appraiser with the Detroit, Michigan, Board of Asses- sors. Later he served as research director and executive director of the International Association of Assessing Officers (IAAO).