Business Cycles in a Small Open Economy Model: the Case of Hong Kong.∗

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Changing Political Economy of the Hong Kong Media

China Perspectives 2018/3 | 2018 Twenty Years After: Hong Kong's Changes and Challenges under China's Rule Changing Political Economy of the Hong Kong Media Francis L. F. Lee Electronic version URL: https://journals.openedition.org/chinaperspectives/8009 DOI: 10.4000/chinaperspectives.8009 ISSN: 1996-4617 Publisher Centre d'étude français sur la Chine contemporaine Printed version Date of publication: 1 September 2018 Number of pages: 9-18 ISSN: 2070-3449 Electronic reference Francis L. F. Lee, “Changing Political Economy of the Hong Kong Media”, China Perspectives [Online], 2018/3 | 2018, Online since 01 September 2018, connection on 21 September 2021. URL: http:// journals.openedition.org/chinaperspectives/8009 ; DOI: https://doi.org/10.4000/chinaperspectives. 8009 © All rights reserved Special feature China perspectives Changing Political Economy of the Hong Kong Media FRANCIS L. F. LEE ABSTRACT: Most observers argued that press freedom in Hong Kong has been declining continually over the past 15 years. This article examines the problem of press freedom from the perspective of the political economy of the media. According to conventional understanding, the Chinese government has exerted indirect influence over the Hong Kong media through co-opting media owners, most of whom were entrepreneurs with ample business interests in the mainland. At the same time, there were internal tensions within the political economic system. The latter opened up a space of resistance for media practitioners and thus helped the media system as a whole to maintain a degree of relative autonomy from the power centre. However, into the 2010s, the media landscape has undergone several significant changes, especially the worsening media business environment and the growth of digital media technologies. -

Hongkong a Study in Economic Freedom

HongKOng A Study In Economic Freedom Alvin Rabushka Hoover Institution on War, Revolution and Peace Stanford University The 1976-77 William H. Abbott Lectures in International Business and Economics The University of Chicago • Graduate School of Business © 1979 by The University of Chicago All rights reserved. ISBN 0-918584-02-7 Contents Preface and Acknowledgements vn I. The Evolution of a Free Society 1 The Market Economy 2 The Colony and Its People 10 Resources 12 An Economic History: 1841-Present 16 The Political Geography of Hong Kong 20 The Mother Country 21 The Chinese Connection 24 The Local People 26 The Open Economy 28 Summary 29 II. Politics and Economic Freedom 31 The Beginnings of Economic Freedom 32 Colonial Regulation 34 Constitutional and Administrative Framework 36 Bureaucratic Administration 39 The Secretariat 39 The Finance Branch 40 The Financial Secretary 42 Economic and Budgetary Policy 43 v Economic Policy 44 Capital Movements 44 Subsidies 45 Government Economic Services 46 Budgetary Policy 51 Government Reserves 54 Taxation 55 Monetary System 5 6 Role of Public Policy 61 Summary 64 III. Doing Business in Hong Kong 67 Location 68 General Business Requirements 68 Taxation 70 Employment and Labor Unions 74 Manufacturing 77 Banking and Finance 80 Some Personal Observations 82 IV. Is Hong Kong Unique? Its Future and Some General Observations about Economic Freedom 87 The Future of Hong Kong 88 Some Preliminary Observations on Free-Trade Economies 101 Historical Instances of Economic Freedom 102 Delos 103 Fairs and Fair Towns: Antwerp 108 Livorno 114 The Early British Mediterranean Empire: Gibraltar, Malta, and the Ionian Islands 116 A Preliminary Thesis of Economic Freedom 121 Notes 123 Vt Preface and Acknowledgments Shortly after the August 1976 meeting of the Mont Pelerin Society, held in St. -

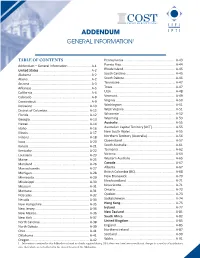

Addendum General Information1

ADDENDUM GENERAL INFORMATION1 TABLE OF CONTENTS Pennsylvania ......................................................... A-43 Addendum – General Information ......................... A-1 Puerto Rico ........................................................... A-44 United States ......................................................... A-2 Rhode Island ......................................................... A-45 Alabama ................................................................. A-2 South Carolina ...................................................... A-45 Alaska ..................................................................... A-2 South Dakota ........................................................ A-46 Arizona ................................................................... A-3 Tennessee ............................................................. A-47 Arkansas ................................................................. A-5 Texas ..................................................................... A-47 California ................................................................ A-6 Utah ...................................................................... A-48 Colorado ................................................................. A-8 Vermont................................................................ A-49 Connecticut ............................................................ A-9 Virginia ................................................................. A-50 Delaware ............................................................. -

Bay to Bay: China's Greater Bay Area Plan and Its Synergies for US And

June 2021 Bay to Bay China’s Greater Bay Area Plan and Its Synergies for US and San Francisco Bay Area Business Acknowledgments Contents This report was prepared by the Bay Area Council Economic Institute for the Hong Kong Trade Executive Summary ...................................................1 Development Council (HKTDC). Sean Randolph, Senior Director at the Institute, led the analysis with support from Overview ...................................................................5 Niels Erich, a consultant to the Institute who co-authored Historic Significance ................................................... 6 the paper. The Economic Institute is grateful for the valuable information and insights provided by a number Cooperative Goals ..................................................... 7 of subject matter experts who shared their views: Louis CHAPTER 1 Chan (Assistant Principal Economist, Global Research, China’s Trade Portal and Laboratory for Innovation ...9 Hong Kong Trade Development Council); Gary Reischel GBA Core Cities ....................................................... 10 (Founding Managing Partner, Qiming Venture Partners); Peter Fuhrman (CEO, China First Capital); Robbie Tian GBA Key Node Cities............................................... 12 (Director, International Cooperation Group, Shanghai Regional Development Strategy .............................. 13 Institute of Science and Technology Policy); Peijun Duan (Visiting Scholar, Fairbank Center for Chinese Studies Connecting the Dots .............................................. -

Urban Forms and the Politics of Property in Colonial Hong Kong By

Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong by Cecilia Louise Chu A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in Architecture in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Nezar AlSayyad, Chair Professor C. Greig Crysler Professor Eugene F. Irschick Spring 2012 Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong Copyright 2012 by Cecilia Louise Chu 1 Abstract Speculative Modern: Urban Forms and the Politics of Property in Colonial Hong Kong Cecilia Louise Chu Doctor of Philosophy in Architecture University of California, Berkeley Professor Nezar AlSayyad, Chair This dissertation traces the genealogy of property development and emergence of an urban milieu in Hong Kong between the 1870s and mid 1930s. This is a period that saw the transition of colonial rule from one that relied heavily on coercion to one that was increasingly “civil,” in the sense that a growing number of native Chinese came to willingly abide by, if not whole-heartedly accept, the rules and regulations of the colonial state whilst becoming more assertive in exercising their rights under the rule of law. Long hailed for its laissez-faire credentials and market freedom, Hong Kong offers a unique context to study what I call “speculative urbanism,” wherein the colonial government’s heavy reliance on generating revenue from private property supported a lucrative housing market that enriched a large number of native property owners. Although resenting the discrimination they encountered in the colonial territory, they were able to accumulate economic and social capital by working within and around the colonial regulatory system. -

Political Economy of Hong Kong's Open Skies Legal Regime

The Political Economy of Hong Kong's "Open Skies" Legal Regime: An Empirical and Theoretical Exploration MIRON MUSHKAT* RODA MUSHKAT** TABLE OF CONTENTS I. IN TRO DU CTIO N .................................................................................................. 38 1 II. TOW ARD "O PEN SKIES". .................................................................................... 384 III. H ONG K ONG RESPONSE ..................................................................................... 399 IV. QUEST FOR ANALYTICAL EXPLANATION ............................................................ 410 V. IMPLICATIONS FOR INTERNATIONAL REGIMES .................................................... 429 V 1. C O N CLU SION ..................................................................................................... 4 37 I. INTRODUCTION Hong Kong is widely believed to epitomize the practical virtues of the neoclassical economic model. It consistently outranks other countries in terms of the criteria incorporated into the Heritage Foundation's authoritative Index of Economic Freedom. The periodically challenging and potentially * Adjunct Professor of Economics and Finance, Syracuse University Hong Kong Program. ** Professor of Law and Director of the Center for International and Public Law, Brunel Law School, Brunel University; and Honorary Professor, Faculty of Law, University of Hong Kong. tumultuous transition from British to Chinese rule has thus far had no tangible impact on its status in this respect. A new post-1997 political -

DFK Doing Business in Hong Kong

Doing Business in Hong Kong This document describes some of the key commercial and taxation factors that are relevant on setting up a business in Hong Kong. dfk.com Prepared by AMA CPA Limited +44 (0)20 7436 6722 2 Doing Business in Hong Kong Background Country overview The financial and securities sectors are regulated by: Hong Kong is located on the Southeast coast of China with a land area of about • The Hong Kong Monetary Authority; 1,100 square kilometres, comprising of Hong Kong Island, Kowloon Peninsula, • The Securities and Futures the New Territories and the outlying Commission; and islands. Hong Kong has a population of more than 7 million and three official • The Stock Exchange of Hong Kong languages which are English, Cantonese Limited. and Putonghua. Cantonese is the mother tongue in Hong Kong. Economic overview The People’s Republic of China (“PRC”) Hong Kong operates under a “laissez- resumed its sovereignty over Hong faire” economic system with minimal Kong when the Hong Kong Special Government interference in all sectors of Administrative Region (“HKSAR”) of the PRC the economy, and there are no exchange was established on July 1, 1997. The head controls. Hong Kong maintains its own of HKSAR is the Chief Executive who is monetary system and the Hong Kong elected for a five-year term, with approval dollar is pegged to the US dollar at the of the PRC. rate of 1US$ = 7.78 HKD. The Basic Law, which was adopted on April The HKSAR Government welcomes foreign 4, 1990, forms the written constitution of investment and there is no restriction on Hong Kong. -

Public Land Leasing in Hong Kong: Flexibility and Rigidity in Allocating the Surplus Land Value

PUBLIC LAND LEASING IN HONG KONG: FLEXIBILITY AND RIGIDITY IN ALLOCATING THE SURPLUS LAND VALUE by YU HUNG HONG B.S., Northeastern University (1987) M.C.P., Massachusetts Institute of Technology (1989) Submitted to the Department of Urban Studies and Planning in Partial Fulfillment to the Requirements for the Degree of DOCTOR OF PHILOSOPHY at the Massachusetts Institute of Technology May 1995 Yu Hung Hong, 1995. All rights reserved. The author hereby grants to MIT permission to reproduce and to distribute copies of this thesis document in whole or in part. Signature of Author Yu Hung Hong Department of Urban Studies and Planning May 1995 Certified by Karen R. Polenske Professor of Regional Political Economy and Planning Dissertation Supervisor Accepted by Karen R. Polenske Chairperson, Ph.D. Committee MASSACHUSE-rsSm Department of Urban Studies and Planning MASAum INSTITUTE JUL 111995 PUBLIC LAND LEASING IN HONG KONG: FLEXIBILITY AND RIGIDITY IN ALLOCATING THE SURPLUS LAND VALUE by Yu Hung Hong Submitted to the Department of Urban Studies and Planning in May 1995 in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Urban and Regional Studies ABSTRACT In this study, I examined the viability of four mechanisms of land-value capture under the public land-leasing systems, using Hong Kong as a case. Because the State is the landowner under a leasehold system, it can capture the land value through four ways: (1) at the initial establishment of land contracts, (2) by the collection of an annual land rent, (3) during lease renewals, and (4) through modifications of lease conditions. -

Tax and Investment Facts a Glimpse at Taxation and Investment in Hong Kong WTS Consulting (Hong Kong) Limited Hong Kong

Hong Kong Tax and Investment Facts A Glimpse at Taxation and Investment in Hong Kong WTS consulting (Hong Kong) Limited Hong Kong WTS Alliance, to which WTS WTS Hong Kong, part of WTS Hong Kong belongs, is a global which is headquartered network of selected consulting in Germany, offers a firms represented in more comprehensive service than 100 countries worldwide. portfolio to both national and Within our service portfolio we international corporations are focused on tax, legal and and individuals with regard to consulting. Our clients include their investments in Greater multinational groups, national China and across Asia. We and international medium- advise on a range of topics, sized companies, non-profit including Hong Kong, Chinese, organizations and private European and International tax clients. law, accounting, market entry and transfer pricing. Strategic Contact in Hong Kong planning for expatriate Ms. Connie Lee assignment programmes is a Head of Tax further key area of expertise. [email protected] +852 2380 2003 WTS Hong Kong provides value added services in the following areas: → International tax → Corporate tax → Tax controversy services → Transfer pricing → Mergers & acquisitions → Global expatriate services → International project management → Accounting and bookkeeping → Human resources advisory 2 Tax and Investment Facts | Hong Kong Table of Contents 1 Types of Business Structure / Legal Forms of Companies 4 2 Corporate Taxation 5 3 Double Taxation Agreements / Tax Information Exchange Agreements 12 4 Transfer Pricing 15 5 Anti-avoidance Measures 16 6 Taxation of Individuals / Social Security Contributions 17 7 Indirect Taxes 22 8 Inheritance and Gift Tax 25 9 Wealth Tax 25 Tax and Investment Facts | Hong Kong 3 1 Types of Business Structure / Legal Forms of Companies The most common legal forms of business in Hong Kong are the limited liability company, partnership, sole proprietorship, branch office of parent company and representative office. -

A Global Compendium and Meta-Analysis of Property Tax Systems

A Global Compendium and Meta-Analysis of Property Tax Systems Richard Almy © 2013 Lincoln Institute of Land Policy Lincoln Institute of Land Policy Working Paper The findings and conclusions of this Working Paper reflect the views of the author(s) and have not been subject to a detailed review by the staff of the Lincoln Institute of Land Policy. Contact the Lincoln Institute with questions or requests for permission to reprint this paper. [email protected] Lincoln Institute Product Code: WP14RA1 Abstract This report is a global compendium of significant features of systems for recurrently taxing land and buildings. It is based on works in English, many of which were published by the Lincoln Institute of Land Policy. Its aim is to provide researchers and practitioners with useful infor- mation about these sources and with facts and patterns of system features, revenue statistics, and other data. It reports on systems in 187 countries (twenty-nine countries do not have such taxes; the situation in four countries is unclear). Accompanying the report are an Excel workbook and copies of the works cited when available in digital form. Keywords: Tax on property, recurrent tax on immovable property, property tax, real estate tax, real property tax, land tax, building tax, rates. About the Author Richard Almy is a partner in Almy, Gloudemans, Jacobs & Denne, a US-based consulting firm that works exclusively in property tax administration, chiefly for governments and related insti- tutions. Mr. Almy began his career as an appraiser with the Detroit, Michigan, Board of Asses- sors. Later he served as research director and executive director of the International Association of Assessing Officers (IAAO). -

Asian Development Outlook Supplement June 2020

ASIAN DEVELOPMENT OUTLOOK SUPPLEMENT JUNE 2020 HIGHLIGHTS LOCKDOWN, LOOSENING, AND Developing Asia will barely grow in 2020, the 0.1% forecast in this ASIA’S GROWTH PROSPECTS Supplement is a further downward revision from 2.2% projected in April in Asian Development Outlook 2020 and the region’s slowest growth rate in 6 decades. From this low base, growth will Recent developments pick up to 6.2% in 2021. Excluding Coronavirus disease (COVID-19) has continued to spread, and containment newly industrialized economies, measures have greatly disrupted economic activity. In the 2 months since Asian regional growth is forecast at 0.4% Development Outlook 2020 was released on 3 April, the number of COVID-19 in 2020 and 6.6% in 2021. cases worldwide has risen from less than 1 million to over 7 million by 12 June, Growth prospects for East Asia in with developing Asia accounting for 10.7% of the total (Figure 1). Domestic 2020 are downgraded from 2.0% to outbreaks have occurred in more economies in the region, with 21 of the 46 1.3%. This reflects expansion in the Asian Development Bank (ADB) developing member economies recording more People’s Republic of China by only than 1,000 cases each. In response, many governments have imposed lockdowns 1.8% in 2020, rebounding to 7.4% in of varying stringency and duration, with average stringency higher in South and 2021 and lifting subregional growth Central Asia and lower in East Asia (Figure 2). Many economies are now starting to 6.8%. to exit their lockdowns. -

British Economic Interests and the Decolonization of Hong Kong

James Blair Historical Review Volume 9 Issue 2 Article 3 2019 Setting the Sun on the British Empire: British Economic Interests and the Decolonization of Hong Kong Abby S. Whitlock College of William and Mary, [email protected] Follow this and additional works at: https://scholarworks.wm.edu/jbhr Part of the History Commons Recommended Citation Whitlock, Abby S. (2019) "Setting the Sun on the British Empire: British Economic Interests and the Decolonization of Hong Kong," James Blair Historical Review: Vol. 9 : Iss. 2 , Article 3. Available at: https://scholarworks.wm.edu/jbhr/vol9/iss2/3 This Article is brought to you for free and open access by the Journals at W&M ScholarWorks. It has been accepted for inclusion in James Blair Historical Review by an authorized editor of W&M ScholarWorks. For more information, please contact [email protected]. Whitlock: British Economic Interests and the Decolonization of Hong Kong Setting the Sun on the British Empire: British Economic Interests and the Decolonization of Hong Kong Abby Whitlock Ruled under the Union Jack from 1841 to 1997, the British acquired Hong Kong during the second wave of European colonialism focused on Asia. Along with countries such as Germany, France, Portugal, and the Netherlands, Britain looked for new areas to provide support for mercantile capitalism and manufacturing developments. Under Britain’s 154 years of rule, the stable nature of British government systems and thorough economic investments caused Hong Kong to become a wealthy international trade center in the twentieth century. Despite these economic investments and interests, the nature of the New Territories Lease under which Britain acquired the totality of Hong Kong, which was to expire in 1997, opened the question of who was to control Hong Kong.