I Mmmmmmmm I I Mmmmmmmmm I M I M I Mmmmmmmmmm 5A Gross

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 Domestic Operational Law Handbook For

DOMESTIC OPERATIONAL LAW HANDBOOK 2018 FOR JUDGE ADVOCATES CENTER FOR LAW AND MILITARY OPERATIONS September 2018 2018 DOMESTIC OPERATIONAL LAW HANDBOOK A PRACTITIONER’S GUIDE FOR JUDGE ADVOCATES EDITORS and CONTRIBUTING AUTHORS LTC Ted Martin, USA MAJ Corey E. Thomas, ARNGUS 2018 CONTRIBUTING AUTHORS COL Pat Butler LTC Richard Sudder LTC Bayne Johnston LTC Michael McCann LTC Stephen Faherty LTC Robert Kavanaugh LTC Benjamin Currier LTC Thomas Forrest CDR Michael Gesele MAJ Sean Rogers MAJ Ryan Kerwin Maj Dimple Nolly LCDR James Zoll LCDR Jonathan Perry CPT Charles W. VanDerMiller Mr. Kevin Kapitan Mr. Robert Goodin Mr. Jonathan Russell Mr. Robert Gonzales As well as numerous past editors and contributors to the Domestic Operational Law Handbook. The contents of this publication are not to be construed as official positions, policies, or decisions of the United States Government or any department or agency thereof. Center for Law and Military Operations (CLAMO) The Judge Advocate General’s Legal Center and School, U.S. Army Charlottesville, VA 22903-1781 Cover design by MAJ Corey E. Thomas The Judge Advocate General’s Legal Center & School Cover Photos: Hurricanes Hurricane Irma rips through Puerto Rico. (September 7, 2017) (Photo courtesy Joshua Hoyos and Mi.I. Nestel ABC News) Domestic Imagery/Incident Awarness and Assessment Workers prepare an MQ-1C Gray Eagle drone at Michael Army Airfield, Dugway Proving Ground in Utah September 15, 2011. Reuters/U.S. Army/Spc. Latoya Wiggins/Handout Chemica/Biological/Radiological/Nuclear/Environmental Staff Sgt. Hector Pena, 48th Chemical Bde., participates in a situational training lanes exercise during the 20th CBRN Command Best Warrior Competition July 23, 2014 at Aberdeen Proving Ground, Md. -

AMONG La . Q On

PROGRAMMATIC AGREEMENT n° «oflttenV G&$ AMONG La . q on REGION 9OF THE GENERAL SERVICES ADMINISTR Qfi& V&tyG" THE STATE HISTORIC PRESERVATION OFFICERS £n Q.\^Q ARIZONA, CALIFORNIA, HAWAII, AND NEVAD, AND THE ADVISORY COUNCIL ON HISTORIC PRESERVATION REGARDING PRESERVATION, MAINTENANCE, REHABILITATION, AND USE OF HISTORIC PROPERTIES AND CONSIDERATION OF HISTORIC PROPERTIES IN PLANNING ACTIVITIES WHEREAS, General Services Administration's Pacific Rim Region (GSA-R9) owns, manages, leases or disposes of properties in four western states, including properties listed on, or eligible for inclusion in, the National Register of Historic Places (historic properties), and properties not yet eligible but potentially eligible for future inclusion in the National Register; and WHEREAS, GSA-R9 continues to maintain an inventory ofproperties under its jurisdiction or control, or properties in which GSA-R9 has leased space, and has determined which ofthese properties are listed on, eligible for inclusion in, or potentially eligible for the National Register ofHistoric Places (Register); and WHEREAS, GSA-R9 is in the process of completing National Register eligibility studies on all properties over 50 years old and potentially eligible properties that identify properties with historic significance, and will comply with Sections 106 and 110 ofthe National Historic Preservation Act in the nomination ofeligible properties for inclusion in the Register; and WHEREAS, GSA-R9 continues to maintain and produce Historic Structure Reports (HSR) for properties in -

Energy Efficiency Systems, Dations for Long-Term, Low-Carbon, Prosperity

Kopi fra DBC Webarkiv Kopi af: Shaping the sustainable economy : summary report of the World Business Summit on Climate Change, Copenhagen, 24-26 May 2009 Dette materiale er lagret i henhold til aftale mellem DBC og udgiveren. www.dbc.dk e-mail: [email protected] Shaping the sustainable economy Summary report of the World Business Summit on Climate Change Copenhagen, 24-26 May 2009 A Monday Morning Initiative Summary report THERE IS NOT MUCH TIME. WE HAVE TO DO IT THIS YEAR. NOT NEXT YEAR. THIS YEAR […] THE CLOCK IS TICKING BECAUSE MOTHER NATURE DOES NOT DO BAILOUTS.” Former U.S. Vice President Al Gore Summary report Foreword 3 Foreword The World Business Summit on Climate Change was convened in Copenhagen from 24-26 May at the same venue that will host the COP15 in December this year. Over the course of three days, global leaders from business, policy, civil society, and science, all engaged in dialogue on the road to a low-carbon future and the recommendations for an ambitious new climate change framework. They heard from the United Nations Secretary-General on the need for business engagement and leadership; former U.S. Vice-President Al Gore on the critical impor- tance of an effective climate treaty and business leaders from more than 40 countries. The key objective of the World Business Summit on Cli- What we take from this Summit is a positive commit- mate Change was to contribute input to the work of the ment to action. It is clear to all that the world is in the Danish government and the United Nations negotiations midst of a global recession. -

Gavin Newsom Governor of California

GAVIN NEWSOM GOVERNOR OF CALIFORNIA Life in Brief Quick Summary Born: October 10, 1967 Progressive politician who has established a reputation of advocating for marginalized Hometown: San Francisco, CA groups such as racial minorities and the LGBT community through unorthodox means. Current Residence: Greenbrae, CA Effectively leveraged family connections to jumpstart career Religion: Catholic • Embraces forging his own path on progressive issues; publicly goes against the status quo Education: • Fights for what he believes is right through • BS, Political Science, Santa Clara University, unconventional means; as Mayor of San 1989 Francisco, broke the state law to support same- sex marriage, putting his reputation at risk with Family: the broader Democratic Party • Wife, Jennifer Siebel, documentary filmmaker • Shifted from the private sector to politics after and actress working for Willie Brown • Divorced, Kimberly Guilfoyle, political analyst • Working for Jerry Brown allowed him to learn and former Fox News commentator tools of the trade and become his successor • Four children • Well connected to CA political and philanthropic elites; Speaker Nancy Pelosi is his aunt and Work History: political mentor, and he is friends with Sen. • Governor of California, 2019-present Kamala Harris and the Getty family • Lt. Governor of California, 2011-2019 • Advocates for constituents to engage with their • Mayor of San Francisco, 2004-2011 government, using technology to participate • Member of the San Francisco Board of nd Supervisors from the -

Press Release

NEWS FROM THE GETTY news.getty.edu | [email protected] DATE: June 5, 2019 MEDIA CONTACTS: FOR IMMEDIATE RELEASE Julie Jaskol Getty Communications (310) 440-7607 [email protected] J. PAUL GETTY TRUST BOARD OF TRUSTEES ELECTS DR. DAVID L. LEE AS CHAIR Dr. David L. Lee has served on the Board since 2009; he begins his four-year term as chair on July 1 LOS ANGELES—The Board of Trustees of the J. Paul Getty Trust today announced it has elected Dr. David L. Lee as its next chair of the Board. “We are delighted that Dr. Lee will lead the Getty Board of Trustees as we embark on many exciting initiatives,” said Getty President James Cuno. “Dr. Lee’s involvement with the international community, his experience in higher education and philanthropy, and his strong financial acumen has served the Getty well. We look forward to his leadership.” Dr. Lee was appointed to the Getty Board of Trustees in 2009. Dr. Lee will serve a four-year term as chair of the 15-member group that includes leaders in art, education, and business who volunteer their time and expertise on behalf of the Getty. “Through its extensive research, conservation, exhibition and education programs, the Getty’s work has made a powerful impact not only on the Los Angeles region, but around the world,” Dr. Lee said. “I am honored to be part of such a generous, inspiring organization that makes a lasting difference and is a source of great pride for our community.” The J. Paul Getty Trust 1200 Getty Center Drive, Suite 403 Tel: 310 440 7360 www.getty.edu Communications Department Los Angeles, CA 90049-1681 Fax: 310 440 7722 Dr. -

Long-Term Strategic Directions to the 2050 Vision for Biodiversity

INDICATIVE CHRONOLOGY OF KEY ACTIVITIES AND MILESTONES LEADING TO THE CONSIDERATION OF THE POST-2020 GLOBAL BIODIVERSITY FRAMEWORK BY COP 15, CP- MOP 10 AND NP-MOP 4 Note: Rows in green indicate consultations events with Parties and observers to the Convention and Protocols and stakeholders. Rows in blue indicate when key documents in the preparation process will become available and consultation windows. Rows in grey indicate the timing of key meetings organised under the Convention and Protocols. Rows in pink are key international events (does not represent an exhaustive list of events) 2019 Date Activity January 2018 Initial discussion paper, grounded on submissions received and other sources of knowledge. January-15 April 2019 Parties and observers invited to provide views on the initial discussion paper as well as any additional views and inputs arising from their national and regional consultations. 28 January – 1 February Asia-Pacific Group Regional Consultation, in Nagoya, Japan 2019 19 February 2019 Webinar on the Integration of Article 8(j) and provisions related to indigenous peoples and local communities in the work of the Convention and its Protocols 19 February- 12 March Online Forum on the integration of Article 8(j) and provisions related to indigenous 2019 peoples and local communities in the work of the Convention and its Protocols 28 February- 15 April Parties and observers invited to provide views on relevant biosafety elements of the 2019 post-2020 global biodiversity framework 11-15 March 2019 Fourth session -

“Climategate” (PDF)

The Emails from the University of East Anglia’s Climatic Research Unit On or about November 19, 2009, as yet unknown persons hacked into an email server at the University of East Anglia’s Climatic Research Unit (CRU) in Norwich, U.K. The CRU is an academic department specializing in climate research and is particularly known for reconstructing past global surface temperatures on the decade to millennium time scales. The CRU is one of three organizations worldwide that have independently compiled thermometer measurements of local temperatures from around the world to reconstruct the history of average global surface temperature for the past 130 ‐ 150 years. The other two groups are in the United States (NOAA’s National Climatic Data Center and the NASA Goddard Institute for Space Studies). From a much larger number of emails, the hackers selected and posted more than 1000 on a publicly accessible file server in Russia. The vast majority of the 1000+ emails are routine and unsuspicious. Perhaps one or two dozen of the email exchanges give the appearance of controversy, though no unethical behavior has yet been documented. Professor Phil Jones, director of the CRU, was involved in most of these email exchanges. He has temporarily stepped down as the CRU director pending the outcome of an independent investigation instigated by the university. Although a small percentage of the emails are impolite and some express animosity toward opponents, when placed into proper context they do not appear to reveal fraud or other scientific misconduct by Dr. Jones or his correspondents. The most common accusations of misconduct center around two general themes: 1. -

Italy Italian Republic

2020 International Student Summit Restarting the Global Economy Post COVID-19: A Model G7+5 Summit Italy Italian Republic Key Facts Head of State / Head of Government: President Sergio Mattarella is the Chief of State and Prime Minister Giuseppe Conte is the Head of Government. Capital city: Rome Population: 62,402,659 Currency: the Euro Gross domestic product (PPP): $2.317 trillion Legal System: Civil law system with judicial review of legislation in the Constitutional Court. Political system: Italy is a member of the European Union and is a parliamentary republic. The legal voting age is 18, except for senatorial elections, where voters must be age 25 or older. The government is broken up into three branches: the executive branch, the legislative branch, and the judicial branch. Economy Italy has the third largest economy in the eurozone, but it also has a great deal of debt. Background: The north of the country has a highly developed economy with a large number of private companies that produce consumer goods. The south of the country has a less developed economy and a greater focus on agriculture. The country also has a lot of debt. Because of this, investors and European partners have been pressuring the country to address their economic problems. However, since 2014, the economy has been experiencing modest growth. Unemployment moved down to 11.4% but youth unemployment remained at 37.1%. The World Affairs Council of Philadelphia 2020 International Student Summit Restarting the Global Economy: A G7+5 Summit December 2020 Main Industries: A large part of Italy’s economy is made up of the manufacturing of high quality consumer goods that are produced by mostly small and medium sized enterprises, many of which are family owned businesses. -

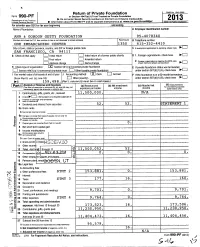

Return of Private Foundation

s III, OMB No 1545-0052 0, Return of Private Foundation Form 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation Treasury Do not enter Social Security numbers on this form as it may be made public. 2013 Department of the ► InterAal Revenue Service Information about Form 990-PF and its separate instructions is at www.,rs.gov/form9!9Opf. en o u is ns ec ion For calendar year 2013 or tax year beginning and ending Name of foundation A Employer Identification number ANN & Gn RT)ON aRTTY FOUNDATION 95-4078340 Number and street (or P O box number if mail is not delivered to street address) Room/suite B Telephone number ONE EMBARCADERO CENTER 1350 415-352-441 0 City or town , state or province , country, and ZIP or foreign postal code C If exemption application is pending , check here ► SAN FRANCISCO, CA 94111 G Check all that apply Initial return Initial return of a former public charity D 1. Foreign organizations , check here Final return Amended return 2. Foreign organizations meeting the 85% test, ► O Address chan g e Name chan g e check here and attach computation H Check type of organization OX Section 501 (c)(3) exempt private foundation E If private foundation status was terminated Section 4947(a )( 1 nonexem pt charitable trust = Other taxable p rivate foundati on under section 507(b)(1)(A), check here ► ^ I Fair market value of all assets at end of year J Accounting method Cash L_J Accrual F If the foundation is in a 60-month termination (from Part ll, col. -

Title: the Distribution of an Illustrated Timeline Wall Chart and Teacher's Guide of 20Fh Century Physics

REPORT NSF GRANT #PHY-98143318 Title: The Distribution of an Illustrated Timeline Wall Chart and Teacher’s Guide of 20fhCentury Physics DOE Patent Clearance Granted December 26,2000 Principal Investigator, Brian Schwartz, The American Physical Society 1 Physics Ellipse College Park, MD 20740 301-209-3223 [email protected] BACKGROUND The American Physi a1 Society s part of its centennial celebration in March of 1999 decided to develop a timeline wall chart on the history of 20thcentury physics. This resulted in eleven consecutive posters, which when mounted side by side, create a %foot mural. The timeline exhibits and describes the millstones of physics in images and words. The timeline functions as a chronology, a work of art, a permanent open textbook, and a gigantic photo album covering a hundred years in the life of the community of physicists and the existence of the American Physical Society . Each of the eleven posters begins with a brief essay that places a major scientific achievement of the decade in its historical context. Large portraits of the essays’ subjects include youthful photographs of Marie Curie, Albert Einstein, and Richard Feynman among others, to help put a face on science. Below the essays, a total of over 130 individual discoveries and inventions, explained in dated text boxes with accompanying images, form the backbone of the timeline. For ease of comprehension, this wealth of material is organized into five color- coded story lines the stretch horizontally across the hundred years of the 20th century. The five story lines are: Cosmic Scale, relate the story of astrophysics and cosmology; Human Scale, refers to the physics of the more familiar distances from the global to the microscopic; Atomic Scale, focuses on the submicroscopic This report was prepared as an account of work sponsored by an agency of the United States Government. -

Aid and Agriculture

Aid and Agriculture A constructivist approach to a political economy analysis of sustainable agriculture in Ghana Thesis submitted in partial fulfillment of the requirements for the degree Doctor of Philosophy (Dr. phil.) at the Faculty of Environment and Natural Resources, Albert-Ludwigs-Universität Freiburg im Breisgau Jasmin Marston 2017 Dean: Prof. Dr. Tim Freytag 1st Supervisor: Prof. Dr. Rüdiger Glaser 2nd Supervisor: Prof. Dr. Tim Freytag 2nd Reviewer: Prof. Dr. Michael Pregernig Date of thesis defense:12.06.2018 In memory of: Karl Wendelin Klober and Uwe Josef Kristen (06.11.1928-26.09.2015) (22.03.1960-11.11.2016) Acknowledgements i Acknowledgements This study has been inspired and supported by a wide array of individuals and institutions that my gratitude extends to. The quality of research benefited tremendously from the support given by the members of the Department of Physical Geography and Faculty of Environment and Natural Resources at the University of Freiburg (im Breisgau, Germany). Specifically I would like to thank Prof. Dr. Rüdiger Glaser, Prof. Dr. Tim Freytag, Prof. Dr. Michael Pregernig, as well as the entire Physical Geography team, for the trust and support they have given me at crucial parts of this study. Likewise I am deeply grateful for the support extended through the UrbanFoodPlus project, which is jointly funded by the Bundesministerium für Wirtschafltiche Zusammenarbeit und Entwicklung (BMZ, Federal Ministry for Economic Cooperation and Development), Germany, and the Bundesministerium für Bildung und Forschung (BMBF, Federal Ministry of Education and Research), Germany. In particular I would like to thank Prof. Dr. Axel Drescher, who was the Principle Investigator and a crucial supporter throughout the ups and downs I encountered as a researcher. -

NEWS from the GETTY DATE: June 10, 2009 for IMMEDIATE RELASE

The J. Paul Getty Trust 1200 Getty Center Drive, Suite 400 Tel 310 440 7360 Communications Department Los Angeles, California 90049-1681 Fax 310 440 7722 www.getty.edu [email protected] NEWS FROM THE GETTY DATE: June 10, 2009 FOR IMMEDIATE RELASE GETTY PARTICIPATES IN 2009 GUADALAJARA BOOK FAIR Getty Research Institute and Getty Publications to help represent Los Angeles in the world’s largest Spanish-language literary event Julius Shulman’s Los Angeles At the Museo de las Artes, Guadalajara, Mexico November 27, 2009–January 31, 2010 LOS ANGELES—The Getty today announced its participation in the 2009 International Book Fair in Guadalajara (Feria Internacional del Libro de Guadalajara or FIL), the world’s largest Spanish-language literary event. This year, the city of Los Angeles has been invited as the fair’s guest of honor – the first municipality to be chosen for this recognition, which is usually bestowed on a country or a region. Both Getty Publications and the Getty Research Institute (GRI) will participate in the fair for the first time. Getty Publications will showcase many recent publications, including a wide selection of Spanish-language titles, and the Getty Research Institute will present the extraordinary exhibition, Julius Shulman’s Los Angeles, which includes 110 rarely seen photographs from the GRI’s Julius Shulman photography archive, which was acquired by the Getty Research Institute in 2005 and contains over 260,000 color and black-and-white negatives, prints, and transparencies. “We are proud to help tell Los Angeles’ story with this powerful exhibition of iconic and also surprising images of the city’s growth,” said Wim de Wit, the GRI’s senior curator of architecture and design.