ANNUAL REPORT 2012 Contents | Letter to Shareholders Page 1 | Form 10-K Page 5 | to Our Fellow Shareholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Final Version

ERASMUS UNIVERSITY ROTTERDAM ERASMUS SCHOOL OF ECONOMICS MSc Economics & Business Economics Master Thesis Financial Economics The formation of prominent private equity clubs and the involved alignment costs in club leveraged buyouts Author: Jurjen Spelde Student ID number: 454457 Thesis supervisor: Y.S. Gangaram-Panday MSc Second reader: Dr. J. Lemmen Date final version: 27-08-2020 J. Spelde (2020) Abstract In this research, I analyzed the pricing, target firm characteristics and involved alignment costs in club deal leveraged buyouts. Using a dataset of completed and withdrawn leveraged buyouts of publicly traded U.S. targets, I found that target shareholders receive between approximately 8,5% and 34% lower premiums compared to sole-sponsored leveraged buyouts in the pre-2006 time period. There is no difference in the premium in the post-2005 time period. These results are robust to the usual M&A control variables, including size, risk, and industry and time fixed effects. By examining withdrawn deals, I studied two influences: (1) the likelihood of a completed deal after the announcement is lower for club leveraged buyouts consisting of one merely one prominent private equity firm compared to sole-sponsored private equity deals, and (2) the duration between the announcement date and the date of completion/withdrawal is longer compared to sole-sponsored private equity deals, also merely for clubs consisting of one prominent private equity firm. I found motives for capital constraints in the post-2005 time period which is merely evident for clubs consisting of two prominent private equity firms, but no indication in favor of diversification motives. -

2008 Public Disclosure Authorized ABCDE

45490 2008 Public Disclosure Authorized ABCDE Annual World Bank Conference on Development Economics Regional Public Disclosure Authorized Higher Education and Development Public Disclosure Authorized Edited by Justin Yifu Lin and Public Disclosure Authorized Boris Pleskovic abcd_i-viii.qxd 8/7/08 8:59 PM Page i Higher Education and Development abcd_i-viii.qxd 8/7/08 8:59 PM Page ii abcd_i-viii.qxd 8/7/08 8:59 PM Page iii Annual World Bank Conference on Development Economics—Regional 2008 Higher Education and Development Edited by Justin Yifu Lin and Boris Pleskovic Washington, D.C. abcd_i-viii.qxd 8/7/08 8:59 PM Page iv © 2008 The International Bank for Reconstruction and Development / The World Bank 1818 H Street, N.W. Washington, D.C. 20433, U.S.A. Internet: www.worldbank.org E-mail: [email protected] All rights reserved 1 2 3 4 5 10 09 08 This volume is the product of the staff of the International Bank for Reconstruction and Development / The World Bank. The findings, interpretations, and conclusions expressed in this volume do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judg- ment on the part of The World Bank of the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. -

Career Advancement and Social Mobility Effects of Laureate Peru Higher Education

Career Advancement and Social Mobility Effects of Laureate Peru Higher Education An Impact Evaluation Final Report This report was prepared by C230 Consultores for: With the technical support and advice of: This document is confidential and may be circulated only with the client’s authorization. December 2016 Table of Contents Acknowledgements ............................................................................................................................................................ 3 0. Executive summary ..................................................................................................................................................... 4 1. Introduction ................................................................................................................................................................ 7 2. Context of the study ................................................................................................................................................... 9 i. Higher education in Peru ........................................................................................................................................ 9 ii. The Laureate education program ......................................................................................................................... 10 iii. Research objectives .............................................................................................................................................. 11 3. Methodology ........................................................................................................................................................... -

Laureate Education, Inc. Is Offering 29,000,000 Shares of Its Class a Common Stock

Subject to Completion, dated January 18, 2017 PROSPECTUS 29,000,000 Shares 20APR201207430833 Class A Common Stock Laureate Education, Inc. is offering 29,000,000 shares of its Class A common stock. This is our initial public offering and no public market currently exists for our shares of Class A common stock. We anticipate that the initial public offering price will be between $17.00 and $20.00 per share. Following this offering, we will have two classes of outstanding common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock will be identical, except with respect to voting and conversion. Each share of Class A common stock will be entitled to one vote per share. Each share of Class B common stock will be entitled to ten votes per share and will be convertible at any time into one share of Class A common stock. Outstanding shares of Class B common stock will represent approximately 97.9% (or 97.6% if the underwriters exercise in full their option to purchase additional shares of Class A common stock) of the voting power of our outstanding capital stock following this offering. egistration statement filed with the Securities and Exchange Commission e securities in any jurisdiction where the offer or sale is not permitted. After completion of this offering, Wengen Alberta, Limited Partnership, an Alberta limited partnership (‘‘Wengen’’), our controlling stockholder, will continue to control a majority of the voting power of our outstanding common stock. As a result, we are a ‘‘controlled company’’ within the meaning of the Nasdaq Global Select Market (‘‘Nasdaq’’) corporate governance standards. -

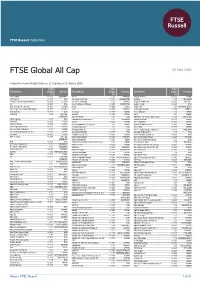

FTSE Publications

2 FTSE Russell Publications 20 May 2020 FTSE Global All Cap Indicative Index Weight Data as at Closing on 31 March 2020 Index Index Index Constituent weight Country Constituent weight Country Constituent weight Country (%) (%) (%) 1&1 Drillisch <0.005 GERMANY Accor 0.01 FRANCE Aedas Homes <0.005 SPAIN 1st Source <0.005 USA Accordia Golf Trust <0.005 SINGAPORE Aedifica 0.01 BELGIUM 21Vianet Group ADS (N Shares) <0.005 CHINA Accton Technology 0.01 TAIWAN Aegean Airlines SA <0.005 GREECE 2U <0.005 USA Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 360 Security (A) (SC SH) <0.005 CHINA Acea <0.005 ITALY Aegon NV 0.01 NETHERLANDS 361 Degrees International (P Chip) <0.005 CHINA Acer <0.005 TAIWAN Aekyung Industrial <0.005 KOREA 3-D Systems <0.005 USA Acerinox <0.005 SPAIN Aena SME SA 0.02 SPAIN 3i Group 0.02 UNITED Achilles <0.005 JAPAN Aeon 0.04 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Credit Service (M) Berhad <0.005 MALAYSIA 3M Company 0.17 USA Ackermans & Van Haaren 0.01 BELGIUM AEON DELIGHT <0.005 JAPAN 3M India <0.005 INDIA Acom <0.005 JAPAN Aeon Fantasy <0.005 JAPAN 3SBio (P Chip) <0.005 CHINA ACS Actividades Cons y Serv 0.01 SPAIN AEON Financial Service <0.005 JAPAN 51job ADS (N Shares) <0.005 CHINA Activision Blizzard 0.1 USA Aeon Mall <0.005 JAPAN 58.com ADS (N Shares) 0.01 CHINA Acuity Brands Inc 0.01 USA Aeon Thana Sinsap Thailand Pcl <0.005 THAILAND 5I5j Holding Group (A) (SC SZ) <0.005 CHINA Acushnet Holdings <0.005 USA AerCap Holdings N.V. -

Laureate Education Laureate Are the World’S Largest Private University Chain

QUALITY ASSURANCE & TEACHER TRAINING Laureate Education Laureate are the world’s largest private university chain. They have nearly 70 institutions in 25 countries across the world. SUMMARY Between 2009 and 2018 Bell partnered with Laureate to provide quality Bell has also provided teacher training and academic management assurance services and teacher training to Laureate’s English language training for Laureate, for example: departments. During the peak years of this project Bell employed 2 • Providing academic management training at Laureate’s annual full-time QAD assessors based on Mexico to deal with the Latin America Academic Director meetings. region. • Sending Bell experts Jim Scrivener and Silvana Richardson to provide training at the UVM annual academic manager’s meetings. Bell’s role was to visit the English departments in selected campuses • Giving CLIL training at Laureate Universities in Brazil and assess the academic management and learning and teaching • Workshops on reflective teaching and active learning at ULatina taking place at these centres using Bell’s specially developed Quality Costa Rica Assurance framework. Following each visit a detailed report was produced containing rec- ommendations for further development. Bell also delivered bespoke training for teachers and managers across the Laureate network. Bell have conducted assessment visits at Laureate institutions in the following countries: Brazil, Chile, Costa Rica, Ecuador, Honduras, Mexico, Peru, Morocco, Saudi Arabia, Spain, Portugal, Turkey, Thailand and -

September 30, 2020

September 30, 2020 William Blair Funds Portfolios of Investments Table of Contents Portfolio of Investments Growth Fund . 1 Large Cap Growth Fund . 3 Mid Cap Growth Fund . 5 Small-Mid Cap Core Fund . 7 Small-Mid Cap Growth Fund . 10 Small-Mid Cap Value Fund . 13 Small Cap Growth Fund . 16 Small Cap Value Fund . 19 Global Leaders Fund . 22 International Leaders Fund . 26 International Growth Fund . 30 Institutional International Growth Fund . 37 International Small Cap Growth Fund . 44 Emerging Markets Leaders Fund . 49 Emerging Markets Growth Fund . 53 Emerging Markets Small Cap Growth Fund . 58 Bond Fund . 63 Income Fund . 69 Low Duration Fund . 74 Macro Allocation Fund . 79 Notes to Portfolios of Investments . 84 Growth Fund Portfolio of Investments, September 30, 2020 (all dollar amounts in thousands) (unaudited) Issuer Shares Value Common Stocks Information Technology—37.1% * Adobe, Inc. 16,561 $ 8,122 * Advanced Micro Devices, Inc. 56,297 4,616 * Alarm.com Holdings, Inc. 22,475 1,242 * Arista Networks, Inc. 19,811 4,099 Fidelity National Information Services, Inc. 39,335 5,791 * Grid Dynamics Holdings, Inc. 110,452 854 * Inphi Corporation 17,835 2,002 Mastercard, Inc. Class “A” 34,336 11,611 Microsoft Corporation 120,250 25,292 * MongoDB, Inc. 8,105 1,876 National Instruments Corporation 92,178 3,291 * Nice, Ltd.—ADR 15,715 3,568 * PayPal Holdings, Inc. 43,394 8,550 Perspecta, Inc. 95,890 1,865 * Pure Storage, Inc. 269,132 4,142 Texas Instruments, Inc. 42,528 6,073 * Verra Mobility Corporation 138,561 1,338 * Workday, Inc. -

LAUREATE EDUCATION, INC. Form 424B5 Filed 2018-11-16

SECURITIES AND EXCHANGE COMMISSION FORM 424B5 Prospectus filed pursuant to Rule 424(b)(5) Filing Date: 2018-11-16 SEC Accession No. 0001047469-18-007294 (HTML Version on secdatabase.com) FILER LAUREATE EDUCATION, INC. Mailing Address Business Address 650 S. EXETER STREET 650 S. EXETER STREET CIK:912766| IRS No.: 521492296 | State of Incorp.:DE | Fiscal Year End: 1231 BALTIMORE MD 21202 BALTIMORE MD 21202 Type: 424B5 | Act: 33 | File No.: 333-224405 | Film No.: 181190716 4108436100 SIC: 8200 Educational services Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Use these links to rapidly review the document TABLE OF CONTENTS TABLE OF CONTENTS CALCULATION OF REGISTRATION FEE Proposed Maximum Proposed Maximum Title of Each Class of Securities Amount To Be Amount of Offering Price Per Aggregate Offering to be Registered Registered Registration Fee Share Price(1) Class A common stock, par value 12,250,000 $14.00 $171,500,000 $20,785.80 $0.004 per share (1) Calculated pursuant to Rule 457(a) based on the Amount To Be Registered multiplied by the Proposed Maximum Offering Price Per Share. Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents Filed Pursuant to Rule 424(b)(5) Registration No. 333-224405 PROSPECTUS SUPPLEMENT (To Prospectus Dated April 23, 2018) 12,250,000 Shares Class A Common Stock The selling stockholder named in this prospectus supplement is offering 12,250,000 shares of our Class A common stock, par value $0.004 per share. -

FTSE Dev Small Cap

2 FTSE Russell Publications 19 August 2021 FTSE Dev Small Cap Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 10X Genomics 0.22 USA Aggreko 0.04 UNITED Alteryx 0.07 USA 1Life Healthcare 0.05 USA KINGDOM Altra Industrial Motion 0.06 USA 1st Source 0.01 USA Agios Pharmaceuticals 0.05 USA Altri SGPS 0.01 PORTUGAL 2U 0.04 USA Agrana Beteiligungs AG <0.005 AUSTRIA AMA Group <0.005 AUSTRALIA 3-D Systems 0.07 USA Agree Realty 0.06 USA Ambarella Inc 0.05 USA 77 Bank 0.01 JAPAN Ahnlab 0.01 KOREA AMC Networks 0.03 USA 888 Holdings 0.02 UNITED Ai Holdings 0.01 JAPAN Amedisys Inc 0.11 USA KINGDOM Aichi Bank Ltd <0.005 JAPAN AMERCO 0.07 USA 8x8 0.04 USA Aichi Corp <0.005 JAPAN American Assets Trust Inc. 0.03 USA AAK 0.05 SWEDEN Aichi Steel <0.005 JAPAN American Axle & MFG Holdings 0.02 USA Aaon Inc 0.04 USA Aida Engineering 0.01 JAPAN American Campus Communities 0.09 USA AAR Corp 0.02 USA Aiful 0.01 JAPAN American Eagle Outfitters 0.08 USA Aareal Bank AG 0.02 GERMANY AIMS APAC REIT 0.01 SINGAPORE American Equity Investment Life 0.04 USA Abacus Property Group 0.01 AUSTRALIA Aiphone <0.005 JAPAN American Finance Group Hldg. 0.12 USA AbClon <0.005 KOREA Air Canada Cl B 0.05 CANADA American Homes 4 Rent 0.15 USA Abercrombie & Fitch A 0.04 USA Air France-KLM 0.02 FRANCE American National Group Inc 0.02 USA ABL Bio 0.01 KOREA Air Lease 0.06 USA American States Water 0.04 USA Able C&C <0.005 KOREA Airport Facilities <0.005 JAPAN American Well 0.03 USA ABM Industries Inc 0.04 USA Airtech Japan <0.005 JAPAN American Woodmark 0.02 USA Academy Sports and Outdoors 0.03 USA Airtel Africa 0.01 UNITED Americold Realty Trust 0.13 USA Acadia Healthcare 0.08 USA KINGDOM Ameris Bancorp 0.05 USA Acadia Pharmaceuticals 0.04 USA Aisan Industry <0.005 JAPAN AMG Advanced Metallurgical Group N.V. -

Cross-Border Tertiary Education

Cross-border Tertiary Education A WAY TOWARDS CAPACITY DEVELOPMENT Cross-border Tertiary Cross-border higher education is emerging to become a fascinating but very complex phenomenon. The mobility of students, professors, knowledge and even Education values has been part of higher education for centuries, but it has recently grown at an unprecedented pace. The last two decades have seen a significant growth in the A WAY TOWARDS CAPACITY mobility of higher education programmes and providers through physical and virtual Public Disclosure Authorized DEVELOPMENT modes of delivery. This presents many new opportunities among which are increased access to higher education, strategic alliances between countries and regions, as Education Tertiary Cross-border well as the expansion of human resource and institutional capacity. Parallel to these opportunities are an equal number of challenges: a potential increase in low quality or rogue providers, a lack of recognition of foreign qualifications by domestic employers or education institutions, along with elitism and the tensions it creates. In many cases, these new trends lead countries to revisit different aspects of their tertiary education policy, especially regulatory frameworks for quality assurance and private higher education. The purpose of this book is to cast light on these opportunities and challenges, especially for developing countries willing to leverage cross-border higher education as a tool for development. This book discusses the concept of capacity-building through cross-border education, emphasising the critical role of quality assurance Public Disclosure Authorized and trade negotiations. This volume should be of particular interest to both A WAY TOWARDS CAPACITY DEVELOPMENT CAPACITY TOWARDS WAY A education policy makers and the myriad stakeholders in higher education from developing countries. -

Annual Report Xtrackers

Xtrackers** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Annual Report and Audited Financial Statements For the year ended 31 December 2020 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers** accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. ** This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Directors’ Report 6 Independent Auditor’s Report 15 Information for Hong Kong Residents 19 Statistics 20 Statement of Net Assets as at 31 December 2020 41 Statement of Operations and Changes in Net Assets for the year ended 31 December 2020 61 Statement of Changes in Shares Issued for the year ended 31 December 2020 82 Statement of Investments as at 31 December 2020 85 Xtrackers MSCI WORLD SWAP UCITS ETF* 85 Xtrackers MSCI EUROPE UCITS ETF 90 Xtrackers MSCI JAPAN UCITS ETF 101 Xtrackers MSCI USA SWAP UCITS ETF* 108 Xtrackers EURO STOXX 50 UCITS ETF 112 Xtrackers DAX UCITS ETF 114 Xtrackers FTSE MIB UCITS ETF 115 Xtrackers SWITZERLAND UCITS ETF 117 Xtrackers FTSE 100 INCOME UCITS ETF 118 Xtrackers FTSE 250 UCITS ETF 121 Xtrackers MSCI UK ESG UCITS ETF(1) 127 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 131 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 135 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 138 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 140 Xtrackers MSCI TAIWAN UCITS ETF 142 Xtrackers