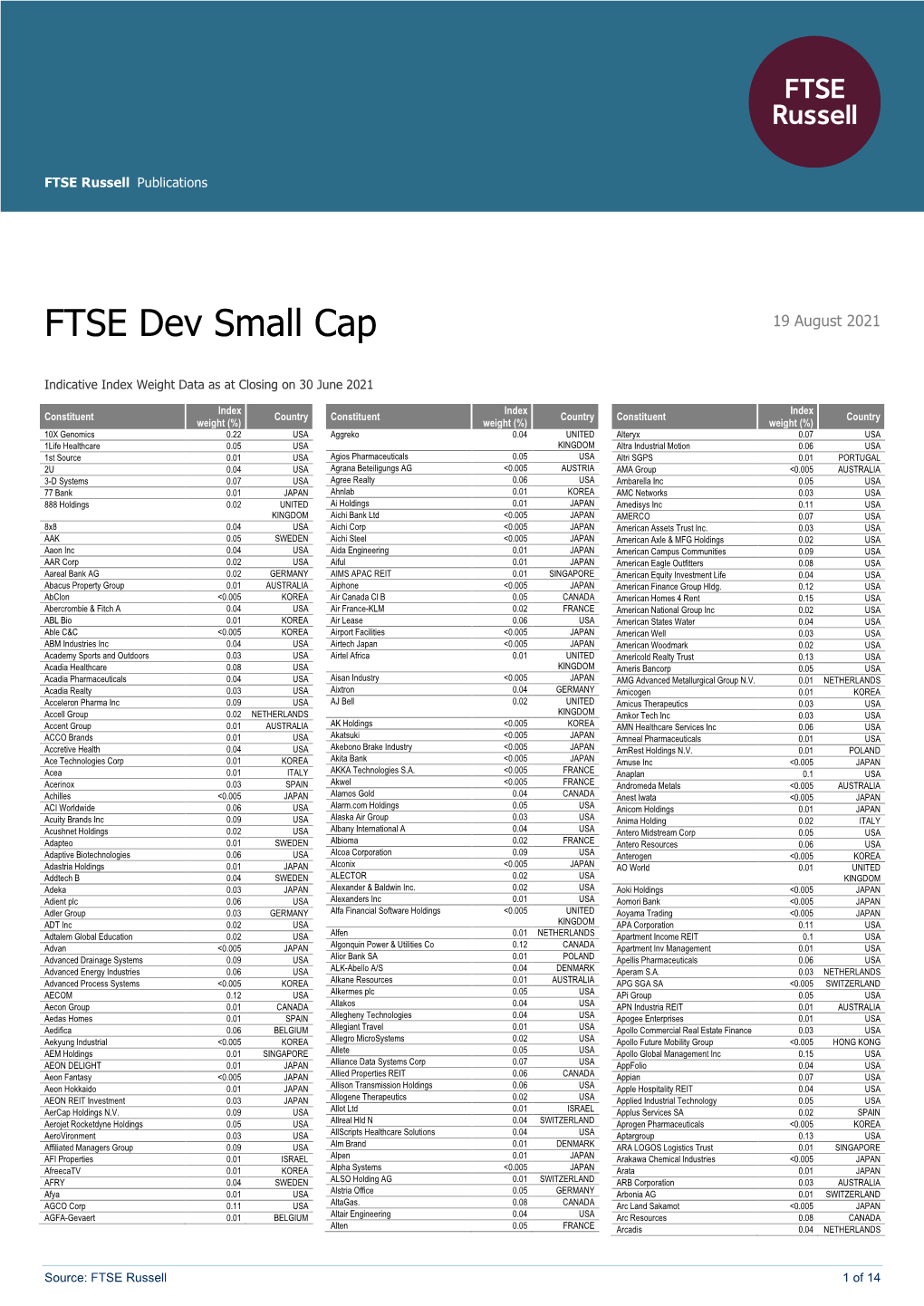

FTSE Dev Small Cap

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Outdoor Club Japan (OCJ) 国際 アウトドア・クラブ・ジャパン Events

Outdoor Club Japan (OCJ) 国際 アウトドア・クラブ・ジャパン Events Norikuradake Super Downhill 10 March Friday to 12 March Monday If you are not satisfied ski & snowboard in ski area. You can skiing from summit. Norikuradake(3026m)is one of hundred best mountain in Japan. This time is good condition of backcountry ski season. Go up to the summit of Norikuradake by walk from the top of last lift(2000m). Climb about 5 hours and down to bottom lift(1500m) about 50 min. (Deta of last time) Transport: Train from Shinjuku to Matsumoto and Taxi from Matsumoto to Norikura-kogen. Return : Bus from Norikura-kogen to Sinshimashima and train to Shinjuku. Meeting Time & Place : 19:30 Shijuku st. platform 5 car no.1 for super Azusa15 Cost : About Yen30000 Train Shinjuku to matsumoto Yen6200(ow) but should buy 4coupon ticket each coupon Yen4190 or You can buy discount ticket shop in town price is similar. (price is non-reserve seat) Taxi about Yen13000 we will share. Return bus Yen1300 and local train Yen680. Inn Yen14000+tax 2 overnight 2 breakfast 1 dinner (no dinner Friday) Japanese room and hot spring! Necessary equipment : Skiers & Telemarkers need a nylon mohair skin. Snowboarders need snowshoes. Crampons(over 8point!) Clothes: Gore-tex jacket and pants, fleece, hut, musk, gloves, sunglasses, headlamp, thermos, lunch, sunscreen If you do not go up to the summit, you can enjoy the ski area and hot springs. 1 day lift pass Yen4000 Limit : 12persons (priority is downhill from summit) In Japanese : 026m)の頂上からの滑降です。 ゲレンデスキーに物足りないスキーヤー、スノーボーダー向き。 山スキーにいいシーズンですが、天気次第なので一応土、日と2日間の時間をとりました。 -

Public Report: First Destination 2019

First Destination 2019 - University of Notre Dame Undergraduates (status known for 93% of graduates) Primary Post-Graduation Activity Geographic Locations USMidwest 44% USNortheast 17% USMid-Atlantic 9% USSouth 9% 2%3% USSouthwest 5% 7% 21% USWest 11% 2% International 4% Median Salary Full-Time Jobs 69,000 Education Employment 65% Post-Baccalaureate Military Degrees Enrolled Service 19% Seeking employment (MDo..doctorate Medical Other doctor.. healthcare Other 5% PhD or other doctoratePhD other or 17% University level, unduplicated counts. (Law)Doctor Juris 13% Source: 2019 First Destination Survey (Office of Strategic Planning & Institutional degreeMaster's 40% Research and the Center for Career Development) Non-degreePre-Health 1% Certificate or License or Certificate 1% Novitiate/ discernment Novitiate/ 1% Other 4% Including only graduates whose primary postgraduation activity is further education. Page 1 First Destination 2019 - Notre Dame Undergraduates by College Source: 2019 First Destination Survey (Office of Strategic Planning & Institutional Research and the Center for Career Development)Career for Center Researchthe and Institutional & Planning Strategic of (Office Survey Destination 2019First Source: Primary Post-Graduation Activity by College of Degree Seeking Employment Education Service Military employment Other Grand Total College of Arts and Letters 49% 27% 13% 2% 3% 6% 100% College of Engineering 81% 11% 2% 3% 2% 1% 100% College of Science 40% 40% 12% 2% 1% 5% 100% Mendoza College of Business 87% 9% 1% 0% 2% 2% 100% School -

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

The Insights Review

REVIEWS OF THE WORLD’S LEADING INSIGHTS JUNE 2021 T H E I N S I G H T S REVIEW © Internal Consulting Group Pty Ltd 2021 IN THIS ISSUE STRATEGY SUPPLY CHAIN RETAIL & BUSINESS BANKING LEADERSHIP & EXECUTIVE DEVELOPMENT INNOVATION & DISRUPTION FINTECH GOVERNANCE, RISK & COMPLIANCE CYBER SECURITY & PRIVACY CORPORATE & INVESTMENT BANKING HUMAN CAPITAL TRANSFORMATION GENERAL INSURANCE CUSTOMER EXPERIENCE & MARKETING MACRO FINANCIAL SERVICES LOCAL GOVERNMENT & HEALTH OPERATIONS & CHANGE ARTICLE OF THE MONTH: “World FinTech Report 2021” - Capgemini About this Report Insight Sources The Insights Review by ICG presents timely abstract ICG sources candidate insights reviews of the most relevant ‘open published’ perspectives for review from the best and most and research reports from the world’s leading branded relevant material published openly management consulting firms. by (at least) the following branded This publication ensures that executives and their internal consulting firms: consultants are exposed to the widest range of high quality • ACC – The Association of ideas, techniques and methodologies developed across the Corporate Council management consulting industry globally. • Accenture Relevant insights are identified and classified once only, • AT Kearney either in a general category, or by topic alignment to an industry segment or a functional area using our proprietary • Bain taxonomy. • BDO • BCG Access to Full Reports • Capgemini If you find an insight review of interest and wish to • Deloitte access the full report, simply follow the link beneath • Ernst & Young the title. Where possible, this will take you to the full report. Occasionally, the publisher may require the user • FMCG to complete a registration or payment process prior to • Huron Consulting Group accessing the report. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Tuesday July 30, 1996

7±30±96 Tuesday Vol. 61 No. 147 July 30, 1996 Pages 39555±39838 federal register 1 II Federal Register / Vol. 61, No. 147 / Tuesday, July 30, 1996 SUBSCRIPTIONS AND COPIES PUBLIC Subscriptions: Paper or fiche 202±512±1800 FEDERAL REGISTER Published daily, Monday through Friday, Assistance with public subscriptions 512±1806 (not published on Saturdays, Sundays, or on official holidays), by General online information 202±512±1530 the Office of the Federal Register, National Archives and Records Administration, Washington, DC 20408, under the Federal Register Single copies/back copies: Act (49 Stat. 500, as amended; 44 U.S.C. Ch. 15) and the Paper or fiche 512±1800 regulations of the Administrative Committee of the Federal Register Assistance with public single copies 512±1803 (1 CFR Ch. I). Distribution is made only by the Superintendent of Documents, U.S. Government Printing Office, Washington, DC FEDERAL AGENCIES 20402. Subscriptions: The Federal Register provides a uniform system for making Paper or fiche 523±5243 available to the public regulations and legal notices issued by Assistance with Federal agency subscriptions 523±5243 Federal agencies. These include Presidential proclamations and For other telephone numbers, see the Reader Aids section Executive Orders and Federal agency documents having general applicability and legal effect, documents required to be published at the end of this issue. by act of Congress and other Federal agency documents of public interest. Documents are on file for public inspection in the Office of the Federal Register the day before they are published, unless earlier filing is requested by the issuing agency. -

Public Companies Profiting from Illegal Israeli Settlements on Palestinian Land

Public Companies Profiting from Illegal Israeli Settlements on Palestinian Land Yellow highlighting denotes companies held by the United Methodist General Board of Pension and Health Benefits (GBPHB) as of 12/31/14 I. Public Companies Located in Illegal Settlements ACE AUTO DEPOT LTD. (TLV:ACDP) - owns hardware store in the illegal settlement of Ma'ale Adumim http://www.ace.co.il/default.asp?catid=%7BE79CAE46-40FB-4818-A7BF-FF1C01A96109%7D, http://www.machat.co.il/businesses.php, http://www.nytimes.com/2007/03/14/world/middleeast/14israel.html?_r=3&oref=slogin&oref=slogin&, http://investing.businessweek.com/research/stocks/snapshot/snapshot.asp?ticker=ACDP:IT ALON BLUE SQUARE ISRAEL LTD. (NYSE:BSI) - has facilities in the Barkan and Atarot Industrial Zones and operates supermarkets in many West Bank settlements www.whoprofits.org/company/blue- square-israel, http://www.haaretz.com/business/shefa-shuk-no-more-boycotted-chain-renamed-zol-b-shefa-1.378092, www.bsi.co.il/Common/FilesBinaryWrite.aspx?id=3140 AVGOL INDUSTRIES 1953 LTD. (TLV:AVGL) - has a major manufacturing plant in the Barkan Industrial Zone http://www.unitedmethodistdivestment.com/ReportCorporateResearchTripWestBank2010FinalVersion3.pdf (United Methodist eyewitness report), http://panjiva.com/Avgol-Ltd/1370180, http://www.haaretz.com/print-edition/business/avgol- sees-bright-future-for-nonwoven-textiles-in-china-1.282397 AVIS BUDGET GROUP INC. (NASDAQ:CAR) - leases cars in the illegal settlements of Beitar Illit and Modi’in Illit http://rent.avis.co.il/en/pages/car_rental_israel_stations, http://www.carrentalisrael.com/car-rental- israel.asp?refr= BANK HAPOALIM LTD. (TLV:POLI) - has branches in settlements; provides financing for housing projects in illegal settlements, mortgages for settlers, and financing for the Jerusalem light rail project, which connects illegal settlements with Jerusalem http://www.haaretz.com/print-edition/business/bank-hapoalim-to-lead-financing-for-jerusalem-light-rail-line-1.97706, http://www.whoprofits.org/company/bank-hapoalim BANK LEUMI LE-ISRAEL LTD. -

S&P Dow Jones Indices Announces September 2016 Quarterly

S&P Dow Jones Indices Announces September 2016 Quarterly Rebalance of the S&P/NZX Indices SYDNEY, SEPTEMBER 2, 2016: S&P Dow Jones Indices announced today the changes in the S&P/NZX indices, effective after the close of trading on September 16, 2016 as a result of the September quarterly review. S&P/NZX 10 – No change. S&P/NZX 15 Index – September 16, 2016 After Market Close Action Code Company Addition CNU Chorus Limited Removal AIR Air New Zealand Limited S&P/NZX 20 – No change. S&P/NZX 50 & S&P/NZX 50 Portfolio Index – September 16, 2016 After Market Close Action Code Company Addition SCL Scales Corporation Limited Addition VGL Vista Group International Limited Removal SKL Skellerup Holdings Limited Removal STU Steel & Tube Holdings Limited INDEX ANNOUNCEMENT c G R A S&P/NZX MidCap Index – September 16, 2016 After Market Close Action Code Company Addition SCL Scales Corporation Limited Addition VGL Vista Group International Limited Removal SKL Skellerup Holdings Limited Removal STU Steel & Tube Holdings Limited S&P/NZX SmallCap Index – September 16, 2016 After Market Close Action Code Company Addition NZM NZME Limited Addition SKL Skellerup Holdings Limited Addition STU Steel & Tube Holdings Limited Removal SCL Scales Corporation Limited Removal VGL Vista Group International Limited S&P/NZX All Index – September 16, 2016 After Market Close Action Code Company Addition NZM NZME Limited S&P/NZAX All – No change. S&P/NZX Morrison – No change. S&P/NZX SciTech – No change. S&P/NZX Farmers Weekly Agriculture Equity Index – No change. S&P/NZX Farmers Weekly Agriculture Equity Investable Index – No change. -

Posco International Corporation

POSCO INTERNATIONAL CORPORATION Sustainability Report 2019 About This Report The 2019 POSCO INTERNATIONAL Sustainability Report, the forth annual publication, illustrate the Company’s performance fulfill- ing its economic, social, and environmental responsibility. POSCO INTERNATIONAL aims to transparently disclose its sustainability management activities for the year 2019 and communicate with wide-ranging stakeholders. Reporting Guidelines Global Reporting Initiative(GRI) Standards: Core Option Reporting Period January 1, 2019 ~ December 31, 2019 * 2017 ~ H1 of 2020 for a portion of the performance data Reporting Scope Economy: On a consolidated basis in accordance with the K-IFRS 〮 Society & Environment: POSCO INTERNATIONAL Headquarters, 〮 POSCO SPS1), and overseas worksites (Myanmar, Indonesia, and Uzbekistan) Areas where major operations are based: Republic of Korea 〮 1) This refers to the STS Division, the TMC Division and the Plate Fabrication Division that were split off as subsidiaries in April 2020. Reporting Cycle Annually(publication of the most recent report: 2019) Assurance Financial data: Earnst & Young Han Young 〮 Non-financial data: DNV GL 〮 Contact Details Address: 165 Convensia-daero(POSCO Tower-Songdo), Yeonsu-gu, Incheon, Republic of Korea Tel: +82-2-759-2861 Department in charge: Sustainability Management Section E-mail: [email protected] POSCO INTERNATIONAL CORPORATION Sustainability Report 2019 03 Global CSR Activities 01 We Make Sustainability 02 Sustainability Management Strategy 102 Global CSR Overview -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

Business Services Report Q3 2017

60 48 50 Financial 40 34 20% 29 30 24 26 18 20 15 7 10 5 2 Strategic - 80% Education Business Facility Human Information Marketing Real Estate IT Services Specialty Professional and Training Process Services and Resources Services Services Services Consulting Services Outsourcing Industrial Services Amount Date Target Buyer(s) Segment TEV/ Rev TEV/ EBITDA ($ in Mil) 9/21/2017 Acturus, Inc. MetrixLab BV Specialty Consulting 13.40 0.58x 4.47x 9/21/2017 Smart Resources, Inc. BG Staffing, Inc. Human Resources 6.00 0.45x - 9/20/2017 Absolute Consulting, Inc. GSE Performance Solutions, Inc. Specialty Consulting 8.75 0.22x - 9/7/2017 Institutional Shareholder Services, Inc. Genstar Capital LLC Business Process 720.00 - - 8/7/2017 Symphony Health Solutions Corp. Pharmaceutical Research Associates, Inc. SpecialtyOutsourcing Consulting 530.00 - - 8/3/2017 Latam Digital Ventures Prisa Brand Solutions SL Marketing Services 2.96 0.29x - 7/31/2017 CDI Corp. AE Industrial Partners LLC Human Resources 151.74 0.20x NM 7/25/2017 Intacct Corp. The Sage Group Plc Professional Services 850.00 8.85x - 7/12/2017 Wells Fargo & Co. (Share Registration & Equiniti Group Plc Professional Services 227.00 2.18x - Services Bus) 7/12/2017 GCA Services Group, Inc. ABM Industries, Inc. Facility Services and 1,250.00 - - Industrial Services 7/5/2017 Accountable Healthcare Holdings Corp. Mitsui & Co., Ltd. Human Resources 88.39 0.62x - Strategic Buyer Inv. Date Select Corporate Acquisitions Arrow Exterminators, Inc. 3/9/2017 ▪ Exterm-A-Tech, Inc. 12/1/2016 ▪ Action Termite & Pest Control LLC 11/02/2016 ▪ Whitco Pest Management, Inc. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd.