SIES ISR Annual Report 2018-19.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

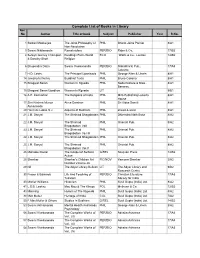

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

Financing the Home You Desire Is Now Just a Click Away

HOME FINANCE ANNUAL REPORT 2020-21 FINANCING THE HOME YOU DESIRE IS NOW JUST A CLICK AWAY. Aditya Birla Housing Finance Ltd. (A part of Aditya Birla Capital Ltd.) Contents Management Discussion & Analysis 2 Board’s Report 10 Annexure 18 Independent Auditor's Report 44 Standalone Balance Sheet 52 Statement of Profit and Loss Account 53 Cash Flow Statement 54 Statement of Changes in Equity 56 Notes 57 Corporate Information BOARD OF DIRECTORS INFORMATION TECHNOLOGY DEBENTURES TRUSTEES Mr. Ajay Srinivasan (IT) STRATEGY COMMITTEE Vistra ITCL (India) Limited Non-Executive Director Mr. V. Chandrasekaran Plot C-22, G- Block, BKC Bandra (E), Mr. Rakesh Singh Mr. Netrapal Singh Mumbai – 400 052 Non-Executive Director Mr. Tushar Kotecha Tel: +91 22 2653 3333 Mrs. Anita Ramachandran Mr. Dharmendra Patro (Member w.e.f Independent Director May 30, 2020) REGISTRAR & SHARE Mr. V Chandrasekaran Mr. Ganesh Kotian TRANSFER AGENT Independent Director Mr. Krishna Iyer (Member w.e.f Linkintime India Private Limited May 30, 2020) C 101, 247 Park, L B S Marg, Vikhroli COMMITTEES OF THE BOARD Mr. Sudesh Puthran (Resigned w.e.f. West, Mumbai - 400 083 AUDIT July 01, 2020) Tel: +91 22 49186000 Mr. Aseem Joshi Fax: +91 22 49186060 Mr. Ajay Srinivasan Mr. Ashish Rane E-mail Id: [email protected] Mrs. Anita Ramachandran Mr. Debaprasad Das Mr. V Chandrasekaran Mr. Vaman Nene REGISTERED OFFICE NOMINATION AND REMUNERATION Mr. Gopakumar Panicker Indian Rayon Compound, Veraval - 362 266 Mr. Ajay Srinivasan KEY MANAGERIAL PERSONNEL Gujarat Mr. Rakesh Singh Mr. Netrapal Singh T: +91 2243567000 Mrs. Anita Ramachandran Chief Executive Officer F: +91 2243567266 Mr. -

Foreign Affairs Record VOL XXXIX NO 1 January, 1993

1993 January Volume No XXXIX NO 1 1995 CONTENTS Foreign Affairs Record VOL XXXIX NO 1 January, 1993 CONTENTS BHUTAN King of Bhutan, His Majesty Jigme Singye Wangchuck Holds Talks with Indian Leaders 1 Indo-Bhutan Talks 1 CANADA Shrimati Sahi Calls for Indo-Canadian Industrial Cooperation 2 Canadian Parliamentary Delegation Meets the President 3 CHILE India, Chile Sign Cultural Pact 4 IRAN Protection of Iranian and other Foreign Nationals 4 MALDIVES Shri Eduardo Faleiro, Minister of State for External Affairs Visits Maldives 4 MAURITIUS Indo-Mauritius Joint Venture 5 MISCELLANEOUS New Welfare Scheme for Handloom Weavers - Project Package Scheme Extended 5 START-II Treaty 6 OIC Bureau Meeting at Dakar 7 Training of Foreign Diplomats by India under the ITEC Programme and the Africa Fund 7 Projecting India as a Safe and Exciting Destination - two day's Overseas Marketing Conference 8 Programme of Elimination of Child Labour Activities Launched 9 OFFICIAL SPOKESMAN'S STATEMENTS Move to Organise a March to Ayodhya by Some Bangladeshis 10 Expulsion of 418 Palestinians by Israel 10 Exchange of Lists of Nuclear Installations in India and Pakistan 10 Reduction in Staff-Strength by Pakistan High Commission 11 SAARC Summit at Dhaka 11 Organisation of Islamic Conference Meeting at Dakar 12 India's Reaction to OIC's Announcement 12 Prime Minister's Meeting with some Indian Heads of Missions from various Countries 12 Allied Air Strikes Against Iraq 12 Assumption of Charge by New External Affairs Minister and the MOS 13 Bangladesh Parliament Passes Resolution on Ayodhya 13 Meeting between the Indian Prime Minister and British Prime Minister 14 Indo-Russian Talks 15 Indo-Russian Talks on the Issue of Palestinian Deportees 16 PAKISTAN Joint Secretary, Ministry of External Affairs, Shri M. -

HINDALCO INDUSTRIES LIMITED Registered Office: Century Bhavan, 3Rd Floor, Dr

LETTER OF OFFER November 25, 2005 For Equity Shareholders of the Company Only HINDALCO INDUSTRIES LIMITED Registered Office: Century Bhavan, 3rd Floor, Dr. Annie Besant Road, Worli, Mumbai 400 025, India. We were incorporated on December 15, 1958 as Hindustan Aluminium Corporation Limited under the provisions of the Companies Act, 1956. We changed our name from Hindustan Aluminium Corporation Limited to Hindalco Industries Limited on October 9, 1989. The Registered Office of the Company was shifted from Industry House, 159 Churchgate Reclamation, Mumbai 400 020, India effective September 1, 1970. (For further details see “History of the Company and Other Corporate Matters” on page 80 of this Letter of Offer.) Tel: +91-22-56626666; Fax: +91-22-24227586/24362516 Contact Person: Mr. Anil Malik, Company Secretary and Compliance Officer E-mail: [email protected], Website: www.hindalco.com For private circulation to the Equity Shareholders of the Company only LETTER OF OFFER FOR PRIVATE CIRCULATION TO THE ORDINARY SHAREHOLDERS OF THE COMPANY ONLY ISSUE, ON A RIGHTS BASIS OF 231,936,993 EQUITY SHARES WITH A FACE VALUE OF Re. 1 EACH AT A PREMIUM OF Rs. 95 PER EQUITY SHARE FOR AN AMOUNT AGGREGATING Rs. 22,266 MILLION TO THE EXISTING EQUITY SHAREHOLDERS IN THE RATIO OF ONE EQUITY SHARE FOR EVERY FOUR EXISTING EQUITY SHARES HELD BY THE EXISTING SHAREHOLDERS ON THE RECORD DATE, i.e., NOVEMBER 28, 2005 ON A PARTLY PAID BASIS IN TERMS OF THIS LETTER OF OFFER (“ISSUE”). THE ISSUE PRICE FOR THE EQUITY SHARES WILL BE PAID IN THREE INSTALLMENTS: 25% OF THE ISSUE PRICE WILL BE PAYABLE ON APPLICATION; 25% OF THE ISSUE PRICE WILL BECOME PAYABLE, AT THE OPTION OF THE COMPANY, BETWEEN 9 AND 12 MONTHS AFTER THE ALLOTMENT DATE; AND 50% OF THE ISSUE PRICE WILL BECOME PAYABLE, AT THE OPTION OF THE COMPANY, BETWEEN 18 AND 24 MONTHS AFTER THE ALLOTMENT DATE. -

Manjul Bhargava

The Work of Manjul Bhargava Manjul Bhargava's work in number theory has had a profound influence on the field. A mathematician of extraordinary creativity, he has a taste for simple problems of timeless beauty, which he has solved by developing elegant and powerful new methods that offer deep insights. When he was a graduate student, Bhargava read the monumental Disqui- sitiones Arithmeticae, a book about number theory by Carl Friedrich Gauss (1777-1855). All mathematicians know of the Disquisitiones, but few have actually read it, as its notation and computational nature make it difficult for modern readers to follow. Bhargava nevertheless found the book to be a wellspring of inspiration. Gauss was interested in binary quadratic forms, which are polynomials ax2 +bxy +cy2, where a, b, and c are integers. In the Disquisitiones, Gauss developed his ingenious composition law, which gives a method for composing two binary quadratic forms to obtain a third one. This law became, and remains, a central tool in algebraic number theory. After wading through the 20 pages of Gauss's calculations culminating in the composition law, Bhargava knew there had to be a better way. Then one day, while playing with a Rubik's cube, he found it. Bhargava thought about labeling each corner of a cube with a number and then slic- ing the cube to obtain 2 sets of 4 numbers. Each 4-number set naturally forms a matrix. A simple calculation with these matrices resulted in a bi- nary quadratic form. From the three ways of slicing the cube, three binary quadratic forms emerged. -

(Instituted from 2004) B: National Metallurgist Award (Inst

1NATIONAL METALLURGIST’S DAY AWARDS: A: Lifetime Achievement Award (Instituted from 2004) 1 2004 Prof. T R Anantharaman Chancellor,AshramAtmadeep, Gurgaon 2 2005 Dr P L Agrawal Former Chairman: SAIL, Udaipur 3 2006 Prof. C. V. Sundaram Former Director, IGCAR, Kalpakkam 4 2007 Dr. V. S. Arunachalam Former Scientific Adviser to Defence Minister & Secretary, DRDO, Distinguished Services Prof., Carnegie Mellon University, USA 5 2008 Dr. J. J. Irani Director, Tata Sons Ltd., Mumbai 6 2009 Prof. Palle Rama Rao Chairman, Governing Council, International Advanced Research Centre for Powder Metallurgy & New Materials, Hyderabad 7 2010 ShriAvinash Chandra Former CMD, HZL and Former Chairman,Scope, Former Wadhawan Vice Chairman of the Asia pacific Region International Lead-Zinc Association 8 2011 ShriSupriya Das Gupta Former Chairman & MD, M N Dastur& Co. Pvt Ltd 9 2012 Prof S. Ranganathan Honorary Professor & Sr. HomiBhabha Fellow, Dept of Materials Engg& Digital Information Services Centre, Indian Institute of Science, Bangalore 10 2013 DrSaibalKanti Gupta Director,JSW Steel Ltd 11 2014 DrRangachari Krishnan Former Director Gas Turbine Research Establishment, DRDO, Bangalore 12 2015 ShriRabindraNath Parbat Management Consultant and Non – Executive Director of Shalimar Industries Ltd. and former Director & Chief Executive Officer of Indian Aluminium Co Ltd, Former Director of Indal-Hydro Extrusions Ltd, Former Chairman of Hirakud Power Ltd. and Utkal Alumina International Ltd. 13 2016 DrTridibesh Mukherjee Independent director, Bharat Forge Ltd. & Former Dy. Managing Director, Tata Steel B: National Metallurgist Award (Instituted from 1997) 1 1997 Dr J JIrani Managing Director, Tata Steel 2 1998 Dr S K Gupta Executive Vice Chairman, Jindal Vijayanagar Steel Ltd. -

Proceedings of 33 Rd Meeting of the Executive

bl ~(I fctsg fch"l I~~ I TRIPURA UNIVERSITY ~<f"i fU1 '1~1 VSuryamaninagar, ~/Tripura - 799022 F· .. ruiRE01E·c/33:AiiO t9• ....................................................... Date: 30th August, 2019 1 Proceedings of the 33rd Meeting of Executive Council held on 30 h August, 2019 at 11 :30 AM in the Council Hall, Administrative Building, Tripura University. Members present in the meeting: I. Prof. V.L. Dharurkar, Vice-Chancellor, T.U. - Ex-officio Chairman 2. Prof. S. Sinha, Senior-most Professor, T.U. - Member 3. Prof. C.B. Maju1nder -Member Dean, Faculty of Arts & Commerce, T.U. 4. Prof. S. Banik, Dean, Faculty of Science, T.U. - Member 5. Prof. T.V. Kattimani - Member (Visitor's Nominee) Vice-Chancellor, IGNTU, Amarkantak 6. Prof. Khemsingh Daheriya - Member (Visitor's Nominee) Department of Hindi & Dean, Faculty of Humanities and Philosophy, IGNTU, Amarkantak (MP) 7. Prof. N. Lokendra Singh - Member (Visitor's Nominee) Head, Department of History, Manipur University, Imphal 8. Director, Higher Education, Govt. of Tripura - Member (Nominee of the Secretary, Higher Education) 9. Prof. B.K. Datta, Registrar (i/c), T.U . - Ex-officio Secretary At the outset, the Hon'ble Vice-Chancellor welcomed all members to the 33rd \1eeting of Executive Council, T.U. He specially thanked Visitor's Nominees for their kind presence in the meeting. The membi;rs, who attended the meeting first time, were felicitated by books and mementos. Before starting the day's business, the Hon'ble Vice-Chancellor ap raised the members about the verdict of the litigation filed against Tripura University w.r.t. app intment of Registrar and validity of the 32nd Meeting of the Executive Council, which was in favour of the University. -

Magazine Can Be Printed in Whole Or Part Without the Written Permission of the Publisher

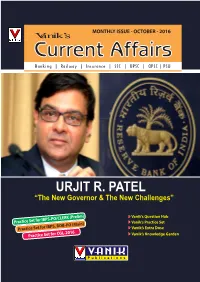

MONTHLY ISSUE - OCTOBER - 2016 CurrVanik’s ent Affairs Banking | Railway | Insurance | SSC | UPSC | OPSC | PSU URJIT R. PATEL “The New Governor & The New Challenges” Vanik’s Question Hub -PO/CLERK (Prelim) Practice Set for IBPS Vanik’s Practice Set -PO (Main) Practice Set for IBPS, BOB Vanik’s Extra Dose GL-2016 Practice Set for C Vanik’s Knowledge Garden P u b l i c a t i o n s VANIK'S PAGE INTERNATIONAL AIRPORTS OF INDIA NAME OF THE AIRPORT CITY STATE Rajiv Gandhi International Airport Hyderabad Telangana Sri Guru Ram Dass Jee International Airport Amristar Punjab Lokpriya Gopinath Bordoloi International Airport Guwaha ti Assam Biju Patnaik International Airport Bhubaneshwar Odisha Gaya Airport Gaya Bihar Indira Gandhi International Airport New Delhi Delhi Andaman and Nicobar Veer Savarkar International Airport Port Blair Islands Sardar Vallabhbhai Patel International Airport Ahmedabad Gujarat Kempegowda International Airport Bengaluru Karnatak a Mangalore Airport Mangalore Karnatak a Cochin International Airport Kochi Kerala Calicut International Airport Kozhikode Kerala Trivandrum International Airport Thiruvananthapuram Kerala Raja Bhoj Airport Bhopal Madhya Pradesh Devi Ahilyabai Holkar Airport Indore Madhya Pradesh Chhatrapati Shivaji International Airport Mumbai Maharashtr a Dr. Babasaheb Ambedkar International Airport Nagpur Maharashtr a Pune Airport Pune Maharashtra Zaruki International Airport Shillong Meghalay a Jaipur International Airport Jaipur Rajasthan Chennai International Airport Chennai Tamil Nadu Civil Aerodrome Coimbator e Tamil Nadu Tiruchirapalli International Airport Tiruchirappalli Tamil Nadu Chaudhary Charan Singh Airport Lucknow Uttar Pradesh Lal Bahadur Shastri International Airport Varanasi Uttar Pradesh Netaji Subhash Chandra Bose International Airport Kolkata West Bengal Message from Director Vanik Publications EDITOR Dear Students, Mr. -

Accidental Prime Minister

THE ACCIDENTAL PRIME MINISTER THE ACCIDENTAL PRIME MINISTER THE MAKING AND UNMAKING OF MANMOHAN SINGH SANJAYA BARU VIKING Published by the Penguin Group Penguin Books India Pvt. Ltd, 11 Community Centre, Panchsheel Park, New Delhi 110 017, India Penguin Group (USA) Inc., 375 Hudson Street, New York, New York 10014, USA Penguin Group (Canada), 90 Eglinton Avenue East, Suite 700, Toronto, Ontario, M4P 2Y3, Canada (a division of Pearson Penguin Canada Inc.) Penguin Books Ltd, 80 Strand, London WC2R 0RL, England Penguin Ireland, 25 St Stephen’s Green, Dublin 2, Ireland (a division of Penguin Books Ltd) Penguin Group (Australia), 707 Collins Street, Melbourne, Victoria 3008, Australia (a division of Pearson Australia Group Pty Ltd) Penguin Group (NZ), 67 Apollo Drive, Rosedale, Auckland 0632, New Zealand (a division of Pearson New Zealand Ltd) Penguin Group (South Africa) (Pty) Ltd, Block D, Rosebank Offi ce Park, 181 Jan Smuts Avenue, Parktown North, Johannesburg 2193, South Africa Penguin Books Ltd, Registered Offi ces: 80 Strand, London WC2R 0RL, England First published in Viking by Penguin Books India 2014 Copyright © Sanjaya Baru 2014 All rights reserved 10 9 8 7 6 5 4 3 2 1 The views and opinions expressed in this book are the author’s own and the facts are as reported by him which have been verifi ed to the extent possible, and the publishers are not in any way liable for the same. ISBN 9780670086740 Typeset in Bembo by R. Ajith Kumar, New Delhi Printed at Thomson Press India Ltd, New Delhi This book is sold subject to the condition that -

Vishwa Dharma Digest

Yugabdh: 5122 1970-2020 Golden Jubilee Year Shaka Samvat: 1942 Vikram Samvat: 2077 VOL: L No: 2 April-June 2020 Vishwa Dharma Digest APRIL-JUNE 2020 1 1970-2020 Golden Jubilee Year 2 APRIL-JUNE 2020 1970-2020 Golden Jubilee Year WORLD HINDU COUNCIL OF AMERICA (VHPA) NATIONAL OFFICE: www.vhp-america.org Tel.: 732-744-0851 P. 0. Box 2009, [email protected] Natick, MA 01760 VOLUME: L NO: 2 APRIL-JUNE 2020 इहैव तैर्焿त: स셍嵋 येषां सामये स्锿तं मन: | रन셍嵋षं रह समं ब्रह्म त्मा饍 ब्रह्मरि ते स्锿ता: || -�셀मद्भ셍वद셍셀ता 5.19 ihaiva tair jitaḥ sargo yeṣhāṁ sāmye sthitaṁ manaḥ nirdoṣhaṁ hi samaṁ brahma tasmād brahmaṇi te sthitāḥ || -Bhagvad Gita 5.19 Even in this life, the world is conquered by those whose mind is established in equality. Brahman is free from defects and is the embodiment of equality; therefore, become established in Brahman. About the HINDU VISHWA World Hindu Council of America (VHPA) publishes the Hindu Vishwa issue quarterly, except when combined with EDITORIAL TEAM special publications. For subscription, please fill out the membership form on the last page. For Advertising inquiries please contact: Shyam Tiwari @ 7709622669 or email: [email protected] Managing Editor: World Hindu Council of America (VHPA), founded in Shyam Tiwari 1970 and incorporated in the state of New York in 1974, is an independent, nonprofit, tax-exempt and volunteer- [email protected] based charitable organization serving the needs of Hindu Editor: community in USA. It aims to build a dynamic and vibrant Hindu society rooted in the eternal values of Dharma and Ronica (Rajranee) Jaipershad inspired by the lofty ideal of Vasudhaiva Kutumbakam, i.e. -

Quote of the Week

31st October – 6th November, 2014 Quote of the Week Character cannot be developed in ease and quiet. Only through experience of trial and suffering can the soul be strengthened, ambition inspired, and success achieved. – Helen Keller < Click icons below for easy navigation > Through Chennai This Week, compiled and published every Friday, we provide information about what is happening in Chennai every week. It has information about all the leading Events – Music, Dance, Exhibitions, Seminars, Dining Out, and Discount Sales etc. CTW is circulated within several corporate organizations, large and small. If you wish to share information with approximately 30000 readers or advertise here, please call 98414 41116 or 98840 11933. Our mail id is [email protected] Entertainment - Film Festivals in the City Friday Movie Club @ Cholamandal presents - Film: BBC Modern Masters - Andy Warhol The first in a four-part series exploring the life and works of the 20th century's artists: Matisse; Picasso; Dali and Warhol. In this episode on Andy Warhol, Sooke explores the king of Pop Art. On his journey he parties with Dennis Hopper, has a brush with Carla Bruni and comes to grips with Marilyn. Along the way he uncovers just how brilliantly Andy Warhol pinpointed and portrayed our obsessions with consumerism, celebrity and the media. This film will be screened on 31st October, 2014 at 7.00 pm - 8.30 pm. at Cholamandal Centre for Contemporary Art (CCCA), Cholamandal Artists’ Village, Injambakkam, ECR, Chennai – 600 115. Entry is free. For more information, contact 9500105961/ 24490092 / 24494053 Entertainment – Music & Dance Bharat Sangeet Utsav 2014 Bharat Sangeet Utsav, organised by Carnatica and Sri Parthasarathy Swami Sabha is a well-themed concert series and comes up early in November. -

J. W. De Jong Bibliography 1949–1986, Hokke Bunka Kenky∑ 14 (1988), Pp

J. W. de Jong Bibliography ( 1949 – 2000) 1 Abbreviations ALB = Bulletin of the Adyar Library AM = Asia Major AS = Asiatische Studien Bespr. = Besprechung BSOAS = Bulletin of the School of Oriental and African Studies (University of London) CAJ = Central Asiatic Journal CR = Compte rendu FEQ = Far Eastern Quarterly HJAS = Harvard Journal of Asiatic Studies IBK = Indogaku Bukkyøgaku Kenky∑ (Journal of Indian and Buddhist Studies) IIJ = Indo-Iranian Journal JA = Journal Asiatique JAOS = Journal of the American Oriental Society JIABS = Journal of the International Association of Buddhist Studies JIP = Journal of Indian Philosophy OLZ = Orientalistische Literaturzeitung TP = T’oung Pao ZAS = Zentralasiatische Studien ZDMG = Zeitschrift der deutschen morgenländischen Gesellschaft * This Bibliography is based on J. W. de Jong Bibliography 1949–1986, Hokke bunka kenky∑ 14 (1988), pp. 1–63. J. W. de Jong Bibliography 1987–1997, Hokke bunka kenky∑ 25 (1999), pp. 1–63. Minoru HARA,J. W. de Jong hakase no chøsei o itamu, Tøhøgaku, no. 100, 2000, pp. 301-309. 2 1949 l. Cinq chapitres de la Prasannapadå (= Buddhica. Documents et Travaux pour l’étude du Bouddhisme. Collection fondée par Jean Przyluski, publiée sous la direction de Marcelle Lalou, première série: Mémoires, tome IX). Paris: Paul Geuthner, 1949; XVI + 167 pp. [Ph.D. thesis, University of Leiden]. 2. Contributions à Bibliographie bouddhique, IX-XX, Paris, 1949. 1950 3. Le problème de l’absolu dans l’école Madhyamaka, Revue philosophique de la France et de l’étranger, Paris, 1950; pp. 322-327. [Cf. no. 200] 1951 4. Suggestions for a Polyglot Buddhist Dictionary, Våk, I (Poona, Dec. 1951), pp. 5-7.