BP P.L.C. Group Results Third Quarter and Nine Months 2018 Highlights Third Quarter Financial Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Modified UK National Implementation Measures for Phase III of the EU Emissions Trading System

Modified UK National Implementation Measures for Phase III of the EU Emissions Trading System As submitted to the European Commission in April 2012 following the first stage of their scrutiny process This document has been issued by the Department of Energy and Climate Change, together with the Devolved Administrations for Northern Ireland, Scotland and Wales. April 2012 UK’s National Implementation Measures submission – April 2012 Modified UK National Implementation Measures for Phase III of the EU Emissions Trading System As submitted to the European Commission in April 2012 following the first stage of their scrutiny process On 12 December 2011, the UK submitted to the European Commission the UK’s National Implementation Measures (NIMs), containing the preliminary levels of free allocation of allowances to installations under Phase III of the EU Emissions Trading System (2013-2020), in accordance with Article 11 of the revised ETS Directive (2009/29/EC). In response to queries raised by the European Commission during the first stage of their assessment of the UK’s NIMs, the UK has made a small number of modifications to its NIMs. This includes the introduction of preliminary levels of free allocation for four additional installations and amendments to the preliminary free allocation levels of seven installations that were included in the original NIMs submission. The operators of the installations affected have been informed directly of these changes. The allocations are not final at this stage as the Commission’s NIMs scrutiny process is ongoing. Only when all installation-level allocations for an EU Member State have been approved will that Member State’s NIMs and the preliminary levels of allocation be accepted. -

Permit ID Installation ID Operator Name Installation Name 2013 2014

Installation Operator Name Installation Name 2013 2014 2015 2016 2017 2018 2019 2020 Permit ID ID DTI1015 204463 Premier Oil E&P UK Ltd Voyager Spirit FPSO 72,740 37,302 36,642 35,981 35,321 34,660 33,999 33,339 DTI1016 202656 Ithaca Energy UK Limited Athena 41,458 40,737 40,015 39,294 0000 DTI9910 207103 EnQuest Heather Limited EnQuest Producer 0 0 14,726 79,970 78,502 77,033 75,565 74,097 CNR International (UK) Petrojarl Banff DTI9950 206523 0 26,039 31,970 31,394 30,818 30,241 29,665 29,088 Limited FPSO Nexen Petroleum U.K. DTI9960 206591 Golden Eagle 0 6,010 26,378 27,736 27,227 26,718 26,209 25,699 Limited Anasuria Operating DTI9991 715 Anasuria 43,325 13,457 41,811 22,330 40,264 39,479 38,684 37,887 Company Limited DTI9999 8 Premier Oil E&P UK Ltd Balmoral 34,174 33,580 32,980 32,379 31,760 31,140 30,513 29,884 GB-DTI0200 2 Centrica Storage Ltd Rough 47/3B 66,144 64,995 63,833 62,658 30,736 30,136 29,530 28,921 GB-DTI0300 3 EnQuest Heather Limited Kittiwake Alpha 61,921 60,846 14,940 29,329 57,547 56,425 55,288 54,148 GB-DTI0400 4 Apache North Sea Limited Forties Alpha 69,336 68,131 66,913 65,682 64,437 63,181 61,909 60,632 GB-DTI0600 6 Apache North Sea Limited Forties Charlie 47,229 46,409 45,579 44,740 43,892 43,037 42,170 41,300 GB-DTI0700 7 Apache North Sea Limited Forties Delta 66,347 65,195 64,029 62,851 61,660 60,458 59,240 58,019 ConocoPhillips (UK) GB-DTI1000 10 Britannia 286,653 281,674 276,637 271,547 266,402 261,207 255,947 250,670 Britannia Limited GB-DTI-1001 693 Chrysaor Limited Lomond 65,871 64,727 63,570 62,400 61,218 60,024 58,815 57,603 GB-DTI-1002 696 Chrysaor Limited Everest North 41,385 40,666 39,939 39,204 38,461 37,711 36,952 36,190 GB-DTI1003 686 Britoil Ltd Bruce 142,795 280,628 137,805 270,538 265,413 260,237 254,997 249,739 Spirit Energy North Sea Oil Sevan Marine GB-DTI-1010 1123 127,129 124,921 122,687 120,430 118,148 115,844 113,512 111,171 Limited Hummingbird GB-DTI1011 18 Perenco UK Limited Thames Alpha 23,338 22,933 0 0 0000 Nexen Petroleum U.K. -

United Kingdom Overview

‹ Countries United Kingdom Last Updated: June 3, 2014 (Notes) full report Overview The United Kingdom is the largest producer of oil and the second-largest producer of natural gas in the European Union. Following years of exports of petroleum and natural gas, the UK became a net importer of all fossil fuels for the first time in 2013. The United Kingdom (UK) is the sixth largest economy in the world, as well as the largest producer of oil and the second-largest producer of natural gas in the European Union (EU). Following years of exports of both fuels, the UK became a net importer of natural gas and crude oil in 2004 and 2005, respectively. Production from UK oil and natural gas fields peaked around the late 1990s and has declined steadily over the past several years as the discovery of new reserves and new production has not kept pace with the maturation of existing fields. The UK became a net importer of petroleum products in 2013, making it a net importer of all fossil fuels for the first time. The UK government, aware of the country's increasing reliance on imported fuels, has developed key energy policies to address the domestic production declines. These include: using enhanced recovery from current and maturing oil and gas fields, promoting energy efficiency, decreasing the use of fossil fuels and thus reliance on imports, promoting energy trade cooperation with Norway, and decarbonizing the UK economy by investing heavily in renewable energy. However, for the UK to decarbonize its economy, huge investments in the energy infrastructure are needed. -

Date: 2..4- 2017 Call Option Deed in Respect Of

DATE: 2..4- 2017 CALL OPTION DEED IN RESPECT OF INTERESTS IN THE SULLOM VOE TERMINAL, THE NINIAN PIPELINE SYSTEM, THE NORTHERN LEG GAS PIPELINE, THE MAGNUS FIELD AND THE MAGNUS SOUTH FIELD Between BP EXPLORATION OPERATING COMPANY LIMITED AND ENQUEST NNS LIMITED UK - 212318988.3 TABLE OF CONTENTS 1. Definitions and Interpretation 1 2. Grant of the Call Option 2 3. Period between signing and exercise of call option 3 4. Termination 3 5. Call Option Guarantee 4 6. General 4 Schedule 1 Form of Call Option Notice 13 Schedule 2 Sale and Purchase Terms 14 1. Definitions and Interpretation 15 2. Agreement to Sell the Additional Sale Interests 33 3. Consideration for the Additional Sale Interests 33 4. Conditions and Termination 34 5. Period between the Call Option Notice Date and Completion 37 6. Completion 37 7. Post Completion 38 8. Seller's Warranties 39 9. Limitations on Seller's Liability and Third Party Claims 40 10. Buyer's Warranties 40 11. Decommissioning, Environment and General Indemnities 40 12. Tax 43 Exhibit 1 Additional Sale Interests Documents 44 Exhibit 2 Consideration Adjustments and payment mechanism 45 Exhibit 3 Period between Signing and Completion 65 Exhibit 4 Completion Obligations 68 Exhibit 5 Seller's Warranties 70 Exhibit 6 Limitations on Seller's Liability 76 Exhibit 7 Buyer's Warranties 82 Exhibit 8 Tax 84 Schedule 3 Form of Call Option Guarantee 89 UK - 212318988.3 THIS DEED is made on I January 2017 BETWEEN: (1) BP EXPLORATION OPERATING COMPANY LIMITED, a company incorporated in England & Wales (company number 00305943), having its registered office at Chertsey Road, Sunbury on Thames, Middlesex, TW16 7BP (the "Seller"); arid (2) ENQUEST NNS LIMITED, a company incorporated in England & Wales (company number 10573715 having its registered office at 5th Floor, Cunard House, 15 Regent Street, London, SW1Y 4LR (the "Buyer"). -

World Oil: Market Or Mayhem?

Journal of Economic Perspectives—Volume 23, Number 3—Summer 2009—Pages 145–164 World Oil: Market or Mayhem? James L. Smith nergy analysts sometimes speak of oil’s “golden era,” that 100-year stretch between 1874 and 1974 when the real price was relatively stable within a E range from $10 to $20 per barrel (BP, 2008) in 2007 dollars. Figure 1 shows that in recent decades, that stability has ended. In October 1973, several Arabic members of the Organization of the Petroleum Exporting Countries (OPEC) announced that in response to U.S. support for Israel during the 1973 Arab–Israeli war, they would place an embargo on oil exports to the United States. That action caused real oil prices to soar from $12 to $53 per barrel within four months. Later in the 1970s, political turmoil in Iran and the Iran–Iraq war again rattled the market and by January 1981 pushed the real price up to $95. Eventually, oil prices fell back to earth with a thud, bottoming out at $21 per barrel in July 1986. The roller coaster ride of prices has continued more recently. After oil prices skidded to a low of $12 per barrel in December 1998 in the wake of the Asian financial crisis, oil stabilized again around $30 during 2000–2004 before a breathtaking ascent that reached $145 per barrel by July 2008—only to dip below $40 per barrel again before the end of 2008. A unique combination of economic circumstances surrounds oil markets. A short list would include extremely high price volatility; the prominent role and unusual longevity of a major cartel (OPEC); the absolute size and scope of the oil industry and its important links to industrialization, economic growth, and the global distribution of wealth; nagging doubts about the sustainability of the re- source base; substantial volumes of petroleum-related CO2 emissions that pull oil y James L. -

United Kingdom, Port Facility Number

UNITED KINGDOM Approved port facilities in United Kingdom IMPORTANT: The information provided in the GISIS Maritime Security module is continuously updated and you should refer to the latest information provided by IMO Member States which can be found on: https://gisis.imo.org/Public/ISPS/PortFacilities.aspx Port Name 1 Port Name 2 Facility Name Facility Number Description Longitude Latitude AberdeenAggersund AberdeenAggersund AberdeenAggersund Harbour - Aggersund Board Kalkvaerk GBABD-0001DKASH-0001 PAXBulk carrier[Passenger] / COG 0000000E0091760E 000000N565990N [Chemical, Oil and Gas] - Tier 3 Aberdeen Aberdeen Aberdeen Harbour Board - Point GBABD-0144 COG3 0020000W 570000N Law Peninsular Aberdeen Aberdeen Aberdeen Harbour Board - Torry GBABD-0005 COG (Chemical, Oil and Gas) - 0000000E 000000N Marine Base Tier 3 Aberdeen Aberdeen Caledonian Oil GBABD-0137 COG2 0021000W 571500N Aberdeen Aberdeen Dales Marine Services GBABD-0009 OBC [Other Bulk Cargo] 0000000E 000000N Aberdeen Aberdeen Pocra Quay (Peterson SBS) GBABD-0017 COG [Chemical, Oil and Gas] - 0000000E 000000N Tier 3 Aberdeen Aberdeen Seabase (Peterson SBS) GBABD-0018 COG [Chemical, Oil and Gas] - 0000000E 000000N Tier 3 Ardrishaig Ardrishaig Ardrishaig GBASG-0001 OBC 0000000W 000000N Armadale, Isle of Armadale GBAMD-0001 PAX 0342000W 530000N Skye Ayr Ayr Port of Ayr GBAYR-0001 PAX [Passenger] / OBC [Other 0000000E 000000N Bulk Cargo] Ballylumford Ballylumford Ballylumford Power Station GBBLR-0002 COG [Chemical, Oil and Gas] - 0000000E 000000N Tier 1 Barrow in Furness Barrow in -

Fact Book Fact

FACT BOOK FACT ConocoPhillips Fact Book About the Cover As the world’s need for energy continues to expand, ConocoPhillips is growing to meet that need with a portfolio of new investments. (On the cover, left to right) Announced in 2005, the company will begin a multi-year, domestic refining investment program designed to create an integrated advantage through its existing assets, such as the Borger, Texas, refinery. In the Timor Sea, the Bayu-Undan project was advanced with the connection of a natural gas pipeline from the offshore facilities to the liquefied natural gas facility near Darwin, Australia. The Burlington Resources acquisition, including major producing fields in Canada, has expanded ConocoPhillips’ presence in North America through high-quality, long-life reserves and assets. Through the dedication of the company’s solid work force, these and other projects will provide sustainable shareholder value well into the future. ConocoPhillips Key Assets, Operations and Locations As of March 31, 2006, unless noted otherwise. Third-largest integrated energy company in the United States. Fifth-largest proved reserves holder worldwide.* Fourth-largest refiner worldwide,* second-largest in the United States. About 38,000 employees worldwide.** 1,808 active patents in about 70 countries. *Of nongovernment-controlled companies. **Based on the Annual Reports on Form 10-K of ConocoPhillips and Burlington Resources for the year ended Dec. 31, 2005. Worldwide Locations Branded Marketing 2005 Worldwide Production Algeria Hungary Saudi Arabia -

Future Hydrogen Production in Shetland Agenda

Future Hydrogen Production in Shetland Agenda • Shetland Statistics • Main Wealth Creating Sectors and Employment • Energy Resources • Energy Use – Our Carbon Footprint • The Opportunity for Change • Our Ambition – the ORION Project • Shetland Energy Futures Map • Taking the First Steps into Commercial Hydrogen Production • Our Action Plan Shetland Statistics • 22,000 people living in 16 islands • Lerwick, population 7,000, is the main centre and port • Annual Economic Production - £1.1 Billion • 1697 miles of coastline • 225 miles from Bergen • 211 miles from Aberdeen Main Wealth Creating Sectors • Oil and Gas – 200,000 barrels of oil equivalent per day • Fishing – 123,000 tonnes of fish landed annually • Salmon Farming – 40,000 tonnes a year (25% of Scottish Total) • Mussel Farming – 6,500 tonnes a year (75% of the Scottish Total) • Agriculture – 90,000 lambs/sheep exported every year 83% of the population are economically active Wealth Creating Sector Employment • Oil and Gas – 1000 FTE • Fisheries and Aquaculture – 1200 FTE • Agriculture – 500 FTE • 30% of Shetland’s 9000 FTE workforce Our Energy Resources Interconnector Onshore and Offshore Wind Resource Oil & Gas Infrastructure Hub Key components available to supply both local and regional clean energy Our Energy Use • On-island energy use in 2018 was 1,222 GWh; • 78% of the total energy supplied was in the form of refined liquid hydrocarbons (Marine Gas Oil, Diesel and Petrol); • The total renewable heat and power contribution to the energy mix was 95.19GWh, 8% of the total energy supplied in Shetland; • The total CO2 emissions from Shetland’s energy sources was 491,235 tonnes; • 13% of the energy consumed in Shetland was electricity produced by the Lerwick (oil fuelled) and Sullom Voe Terminal (gas fuelled) Power Stations; • Shetland consumers spend £58M a year on refined liquid hydrocarbon fuels. -

1 Issue Six 2018

UT THREE UNDERWATER TECHNOLOGY Issue Six 2018 Issue SEABED MINING • UNDERWATER1 VEHICLES Capital-Efficient THREE Subsea Solutions UT UNDERWATER Society for Underwater TECHNOLOGY Production Tree Technology Unified Controls Lead time: 12 months 1 Fetter Lane Lead time: 12 months London EC4A 1BR Pump Lead time: 18 months Wellhead Lead time: 8 months Manifold Lead time: 18 months Connection System Lead time: 6 months Seabed nodule collector Image: Krypton Ocean ISSN: 1752-0592 Vol 12 No 6 +44 (0) 1480 370007 Editor: John Howes [email protected] Editorial Assistant: Eddie Current Production: Redefine economic viability with a new Sue Denham approach to subsea production. Advertising: Zinat Hassan The OneSubsea portfolio of standardized designs supports streamlined processes, documentation, [email protected] and manufacturing to deliver integrated production systems that enable achieving first oil as soon as 24 months after contract award. Customized to your field architecture, these capital-efficient solutions help you maximize recovery from new fields to transform deepwater economics across the life of the asset. Find out more at Published by UT2 Publishing for and on behalf of the Society for Underwater Technology. Reproduction of UT2 in whole or in part, onesubsea.slb.com/standardization without permission, is prohibited. The publisher and the SUT assumes no responsibility for unsolicited material, nor responsibility for content of any advertisement, particularly infringement of copyrights, trademarks, intellectual property rights and patents, nor liability for misrepresentations, false or misleading statements and illustrations. These are the sole responsibility of the advertiser. Opinions of the writers are not necessarily those of the SUT or the publishers. -

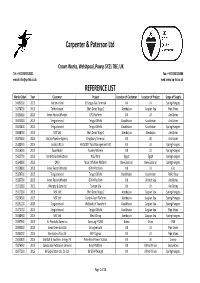

Reference List 2016.Xlsx

Carpenter & Paterson Ltd Crown Works, Welshpool, Powys SY21 7BE, UK Tel: +44 1938 552061 Fax: +44 1938 555306 email: info@cp‐ltd.co.uk web: www.cp‐ltd.co.uk REFERENCE LIST Works Order Year Customer Project Location of Customer Location of Project Scope of Supply 14095500 2015 National Grid St Fergus Gas Terminal UK UK Spring Hangers 14278700 2015 Tekfen Insaat Shah Deniz Stage 2 Azerbaijan Caspian Sea Pipe Shoes 15035600 2015 Amec Foster Wheeler CP1 Platform UK UK Ancillaries 15052000 2015 Tengizchevroil Tengiz Oilfield Kazakhstan Kazakhstan Ancillaries 15052800 2015 Tengizchevroil Tengiz Oilfield Kazakhstan Kazakhstan Spring Hangers 15068700 2015 MST Ltd Shah Deniz Stage 2 Azerbaijan Azerbaijan Ancillaries 15073600 2015 British Pipeline Agency Kingsbury Terminal UK UK Ancillaries 15108300 2015 Jacobs UK Ltd 61050027 Tails Management FAC UK UK Spring Hangers 15116000 2015 ExxonMobil Fawley Refinery UK UK Spring Hangers 15125700 2015 United Gas Derivatives NGL Plant Egypt Egypt Spring Hangers 15149800 2015 OMV Maari Offshore Platform New Zealand New Zealand Spring Hangers 15150800 2015 Amec Foster Wheeler DPPA Platform UK UK Fab 15159700 2015 Tengizchevroil Tengiz Oilfield Kazakhstan Kazakhstan Roller Assy 15205700 2015 Amec Foster Wheeler DPPA Platform UK UK Irish Sea Ancillaries 15215900 2015 J Murphy & Sons Ltd Towton Site UK UK Ancillaries 15217200 2015 MST Ltd Shah Deniz Stage 2 Azerbaijan Caspian Sea Spring Hangers 15220500 2015 MST Ltd Central Azeri Platform Azerbaijan Caspian Sea Spring Hangers 15231100 2015 Tengizchevroil Wellpads -

Challenge Booklet

DATE OF ISSUE FONASBA MARCH 2007 THE FEDERATION OF NATIONAL ASSOCIATIONS OF SHIP BROKERS AND AGENTS 85, Gracechurch Street, London EC3V 0AA Great Britain Tel: + 44 20 7623 3113, e-mail: [email protected], website: www.fonasba.com INTERTANKO POSEIDON CHALLENGE PORT RECEPTION FACILITIES SURVEY PRESENTED AT THE INTERTANKO HOUSTON TANKER EVENT MARCH 2007 INTERTANKO POSEIDON CHALLENGE — PORT RECEPTION FACILITIES SURVEY 2007 Page 2 © FONASBA - MARCH 2007 INTERTANKO POSEIDON CHALLENGE — PORT RECEPTION FACILITIES SURVEY 2007 Page 3 FONASBA’S CONTRIBUTION TO THE POSEIDON CHALLENGE When INTERTANKO launched its “POSEIDON CHALLENGE” in Singapore last year, there was never any question that FONASBA would not throw its full weight behind the ini- tiative. One of FONASBA’s primary objectives as an association is the promotion of high levels of professionalism within the agency and broking sectors wherever and whenever the opportunity arises. At the Singapore event it therefore gave me much pleasure to commit FONASBA to play- ing its part in achieving the “Three Zero’s” that are central to the Challenge and also to of- fering the services of our member associations in developing an industry-led database of port reception facilities as our tangible contribution to the project. One year on, and in conjunction with the INTERTANKO Houston event, FONASBA takes pleasure in publishing this first edition of the guide. I describe it as the first edition because the provision of port waste reception facilities for tankers is an on-going process and it will therefore be necessary to regularly update the information provided. We are aware that there are gaps in its coverage and FONASBA will endeavour to close those gaps in future edi- tions. -

Environmental and Social Review 20

environmental and social review 2000 exploration and production Activities: Present in 25 countries; production operations in 21 countries Daily production: 1.93 million barrels of crude oil and 7.6 billion cubic feet of natural gas (60% oil, 40% gas) Discoveries: 33 giant finds 1996-2000 (>250mmboe) Reserves: 15.2 billion barrels of oil equivalent (50% oil, 50% gas) Reserve replacement ratio: 160% Reserve replacement exceeded production in 2000 for the seventh consecutive year gas and power Activities: Gas sales contracts in 24 countries Gas sales volumes: 14.5 billion cubic feet a day Power: 1,900MW power generation projects under development or construction refining and marketing Refineries (wholly or partly owned): 24 Refinery throughput: 2.9 million barrels of crude oil a day Oil product marketing sales: 3.8 million barrels a day Service stations: 29,000 chemicals Sites worldwide: 55 Production: 22.1 million tonnes a year Revenues: $11.2 billion a year solar energy Activities: Products used in more than 150 countries Production: 42MW of solar panel generating capacity sold in 2000 Find regular updates, latest view video footage, downloads, and online much more on our website Search function Audio footage Video footage Downloads FAQs @ www.bp.com 1 introduction 2 guide to our 4 the global environmental context and social 5 Climate change 7 Human rights reporting 9 Lower carbon energy introduction by Chris Gibson-Smith Welcome to this Environmental and Social Review for the year 2000. As last year, our corporate reporting on the bp.com website offers a comprehensive account of our financial, social and environmental performance, together with location reports from a range of different business operations around the world.