Country Analysis Brief: United Kingdom

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Electricity) and 2009/73/EC (Gas)

2016 Great Britain and Northern Ireland National Reports to the European Commission National Reports in relation to Directives 2009/72/EC (Electricity) and 2009/73/EC (Gas) Ofgem 2016 National Report to the European Commission Overview All National Regulatory Authorities (NRAs) are obliged to report annually to the European Commission, in accordance with Directives 2009/72/EC (Electricity Directive) and 2009/73/EC (Gas Directive). The structure of the report is agreed at the Council of European Energy Regulators (CEER). Ofgem is the UK Office of Gas and Electricity Markets. It is governed by the Gas and Electricity Markets Authority (the Authority).1 The terms ‘the Authority’, ‘Ofgem’, ‘us’ and ‘we’ are used interchangeably in this document. The Northern Ireland National Report is in the second section of this UK response. The Great Britain (GB) report covers: Developments in the GB energy markets in 2015 and Quarter I + II of 2016; The regulation and performance of the GB electricity and gas markets along the themes of network regulation, promoting competition, and security of supply Our compliance with the Electricity and Gas Directives on consumer protection and dispute settlement Since GB energy markets have been fully liberalised and the regulatory structures in place for a number of years, this report is intended as an updated version of the submissions made since 2007. The structure of this report and much of the information remains unchanged, although latest data is supplied. Finally, for further information on Ofgem’s activities, please consult our Annual Reports. The 2015-16 Ofgem Annual Report is available at the link below.2 Contacts: Sean Hennity Ryan McLaughlin Ofgem, EU Coordination Ofgem, Head of European Wholesale Markets 9 Millbank, London, SW1 3GE 9 Millbank, London, SW1 3GE 0207 3269 9951 020 3269 9615 [email protected] [email protected] 1 The Authority determines strategy, sets policy priorities and takes decisions on a range of matters, including price controls and enforcement. -

Annual Review 2007 Delivering Gas to the North of England Northern Gas Networks

Annual Review 2007 Delivering gas to the North of England Northern Gas Networks 2 Annual Review 2007 Corporate Directory Northern Gas Networks Limited 1100 Century Way Thorpe Park Business Park Colton LEEDS LS15 8TU Telephone: 0113 397 5300 Facsimile: 0113 397 5301 Website: www.northerngasnetworks.co.uk Gas Emergencies: Call 0800 111 999* at any time. *All calls are recorded and may be monitored. 27 Phone 0113 397 5300 The National Gas Emergency Service is available 24 hours Web www.northerngasnetworks.co.uk a day, every day. FREEPHONE 0800 111 999*. *All calls are recorded and may be monitored Annual Review 2007 Contents The Year under Review 4 Chief Executive Offi cer’s Review 6 Ownership Structure 10 Business Strategy 11 Business Review 13 Performance Review 17 Corporate Governance 20 The Management Team 21 Board of Directors 23 Results Summary 2007 26 Corporate Directory 27 3 Northern Gas Networks The Year under Review In the second full calendar year of operations Northern Gas Networks continued to develop within the UK’s energy industry. Building on solid foundations, the company delivered improvements in its fi nancial effi ciency, in health and safety and in its customer service, positioning the organisation as one of the leaders in the UK gas industry. 4 Annual Review 2007 The company won a prestigious Utility Award for the work in delivering the new suite of computer systems which underpin daily operations. Northern Gas Networks delivers gas through 37,000km of Notable achievements during 2007 include the fi nalisation pipes to around 2.6m homes and businesses in the North of of the fi ve-year Price Control Review, under which Ofgem England, an area of 27,000 square miles covering northern sets the company’s revenue and operational targets for Cumbria, the North East and much of Yorkshire. -

A14 - Our Whole Systems Strategy 1

Final RIIO-2 Business Plan Submission December 2019 Appendix A14 - Our Whole Systems Strategy 1 Page left intentionally blank. Final RIIO-2 Business Plan Submission December 2019 Appendix A14 - Our Whole Systems Strategy 2 Foreword This document outlines Northern Gas Networks’ Whole Systems Strategy. This strategy addresses Ofgem’s business plan guidance for us to provide information on our approach to enabling whole systems solutions in our RIIO-2 Business Plan. We have developed this strategy in conjunction with key whole systems stakeholders. Importantly, NGN is committed to supporting the achievement of the UK’s net zero emission targets and our Whole Systems Strategy sets out how we intend to contribute. The purpose of this document has been to assist us with: • determining our role in the whole systems landscape; • determining how we will interact with other stakeholders in the creation of an integrated energy system; and • defining the actions that we will need to take to deliver against our objectives. We also note the interactions between this document, our Environmental Action Plan, Innovation Strategy and Customers in Vulnerable Situations Strategy: • Environmental Action Plan – this is the primary regulatory document that sets out the environmental impacts of our business operations as well as short-term initiatives to reduce these impacts and our long-term strategy to contribute to the net zero emission targets by 2050, for the benefit of customers. • Innovation Strategy – this sets out our approach to delivering innovation in RIIO-2 (particularly in relation to enabling the achievement of our net zero emission targets and supporting customers in vulnerable situations), with a focus on the benefits provided to customers. -

Hull Core Strategy - Contacts List (As at July 2011)

Hull Core Strategy - Contacts List (as at July 2011) Introduction This report provides details about the contacts made during the development of the Hull Core Strategy. It includes contact made at each plan making stage, as follows: • Issues and Options – August 2008 • Emerging Preferred Approach – February 2010 • Core Strategy Questionnaire – September 2010 • Spatial Options – February 2011 • Core Strategy Publication Version – July 2011 A list of Hull Development Forum members (as at July 2011) is also enclosed. This group has met over 15 times, usually on a quarterly basis. The report also sets out the specific and general organisations and bodies that have been contacted, in conformity with the Council’s adopted Statement of Community Involvement. Specific groups are indicated with an asterisk. Please note contacts will change over time. Issues and Options – August 2008 (Letter sent to Consultants/Agents) Your Ref: My Ref: PPI/KG/JP Contact: Mr Keith Griffiths «Title» «First_Name» «Surname» Tel: 01482 612389 «Job_Title» Fax: 01482 612382 Email: [email protected] «Org» th «Add1» Date: 4 August 2008 «Add2» «Add3» «Town» «Postcode» Dear Sir/Madam Hull Core Strategy - issues, options and suggested preferred option Please find enclosed the ‘Hull Core Strategy issues, options and suggested preferred option’ document for your consideration. Your views should be returned to us by the 5 September, 2008 by using the form provided. In particular, could you respond to the following key questions: 1. What do you think to the issues, objectives, options and suggested preferred option set out in the document? 2. How would you combine the options? 3. -

Ormen Lange and Nyhamna Expansion the Ormen Lange Story

ORMEN LANGE AND NYHAMNA EXPANSION THE ORMEN LANGE STORY 2001 PHASE 1 – DEVELOPMENT OF ORMEN LANGE AND NYHAMNA 2002 Nyhamna is selected as the land facility for the Ormen Lange gas. 2003 Start up of development offshore and onshore 2004 - the bigges ever industry project in Norwegian history. 2005 West Navigator starts drilling the world’s largest gas wells. 2006 Shell takes over as operator of Ormen Lange. First gas. 2007 PHASE 2 – ORMEN LANGE IN OPERATION 2008 First full year of operation. More wells are drilled. Tuning of the facility optimises production. First hot tap and x-mas tree installation from vessel instead of rig. 2009 2010 A fourth well template is installed north 2011 on the field. Start-up of subsea compression test pilot. 2012 PHASE 3 – FURTHER DEVELOPMENT AND EXPANSION OF NYHAMNA 2013 Start of the Nyhamna expansion project. Further development of Ormen Lange includes drilling of more wells, exploration of near field opportunities and seismic 2014 surveys. Photo: Lars Øvrum IMPORTANT FOR EUROPE. Ormen Lange exports natural gas to Europe, and has covered about 20 per cent of the UK’s total gas consumption since 2009. 20% Stable and reliable gas supply from Norway is important for ORMEN LANGE SUPPLIES EU countries that want improved utilisation of nearby resources THE UK WITH UP TO 20 PER - thereby reducing their dependency on gas import from outside CENT OF THE COUNTRY’S Europe. GAS NEEDS When the expansion project at Nyhamna is completed, the facility will be able to deliver gas equivalent to the consumption of 22 million homes in the UK and continental Europe. -

The Future of UK

NEW CHALLENGES FOR UK NATURAL GAS Steve R Jackson, Adrian J Finn & Terry R Tomlinson Costain Oil, Gas & Process Limited Manchester, United Kingdom ABSTRACT The United Kingdom’s self-sufficiency in natural gas has rapidly declined and for the first time the UK has become a net importer of natural gas. Dependence on imported natural gas is set to increase significantly. Some forecasts show the UK may need to import up to 40% of supplies by 2010 and up to 90% by 2020. Winter gas prices are now a factor of 10 higher than 4 years ago and this is seriously impacting big industrial consumers such as ammonia producers and power generators. At present, the main projected increase in imported gas is from Norway, mainly via the Langeled pipeline which landfalls in north-east England (carrying gas from the giant Ormen-Lange development by 2007/8) and from Europe via the existing Zeebrugge-Bacton Interconnector and the Balgzand-Bacton pipeline (operational by 2007). The latter two lines will link the UK with the European gas grid and may open up potential supply sources from the Former Soviet Union (FSU). Several LNG import terminal projects have been undertaken. The first to be completed is on the Isle of Grain near London, which commenced LNG imports during 2005. Two further LNG import terminals, Dragon and South Hook, are under construction at Milford Haven in Wales but will not be fully operational form some years. A further potential development is the upgrade of the former LNG import terminal at Canvey Island, near London. -

Modified UK National Implementation Measures for Phase III of the EU Emissions Trading System

Modified UK National Implementation Measures for Phase III of the EU Emissions Trading System As submitted to the European Commission in April 2012 following the first stage of their scrutiny process This document has been issued by the Department of Energy and Climate Change, together with the Devolved Administrations for Northern Ireland, Scotland and Wales. April 2012 UK’s National Implementation Measures submission – April 2012 Modified UK National Implementation Measures for Phase III of the EU Emissions Trading System As submitted to the European Commission in April 2012 following the first stage of their scrutiny process On 12 December 2011, the UK submitted to the European Commission the UK’s National Implementation Measures (NIMs), containing the preliminary levels of free allocation of allowances to installations under Phase III of the EU Emissions Trading System (2013-2020), in accordance with Article 11 of the revised ETS Directive (2009/29/EC). In response to queries raised by the European Commission during the first stage of their assessment of the UK’s NIMs, the UK has made a small number of modifications to its NIMs. This includes the introduction of preliminary levels of free allocation for four additional installations and amendments to the preliminary free allocation levels of seven installations that were included in the original NIMs submission. The operators of the installations affected have been informed directly of these changes. The allocations are not final at this stage as the Commission’s NIMs scrutiny process is ongoing. Only when all installation-level allocations for an EU Member State have been approved will that Member State’s NIMs and the preliminary levels of allocation be accepted. -

Northern Gas Networks

Network Innovation Annual Summary 2018-19 Innovating on the streets of the North of England Meet the Innovation team 1 4 2 3 5 Our core innovation team looks after the overall management of our NIA funded projects, sets the strategic direction, and identifies new and exciting opportunities. The team also provides support to colleagues across the business, helping them devise and deliver innovative ways of working, become earlier adopters of new innovations, and embrace an innovation mindset. We believe a culture of innovation should permeate our whole business, and not be restricted to a single function. Through collaboration with colleagues and suppliers, we’re developing novel solutions that make our customers’ lives easier, and make bills go further. 1 Richard Hynes-Cooper 4 Michael Charlton Head of Innovation Innovation Implementation Manager [email protected] [email protected] 2 Wayne Smith 5 Shannon Smith Innovation Manager Project Support [email protected] [email protected] 3 Jarred Knott Innovation and Regulation Support Contact us [email protected] [email protected] 2 | MEET THE INNOVATION TEAM INNOVATION REPORT 2019 Everyday innovation… innovation every day Mark Horsley Chief Executive Officer Northern Gas Networks Whether we are replacing pipes, responding Many of our innovation projects have now to gas emergencies, supporting vulnerable become business as usual, delivering cost communities or exploring new forms of energy, savings and customer benefits each and every innovation can help us do a better job, at a day. better price. As we prepare for our next regulatory period Like the other UK gas networks, we receive from 2021, with a new business plan, innovation funding from our regulator, Ofgem, to develop will continue to be at the heart of everything innovative products and techniques that allow we do – helping us to meet stretching us to do our core work more effectively. -

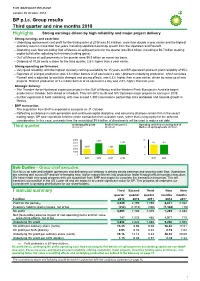

BP P.L.C. Group Results Third Quarter and Nine Months 2018 Highlights Third Quarter Financial Summary

FOR IMMEDIATE RELEASE London 30 October 2018 BP p.l.c. Group results Third quarter and nine months 2018 Highlights Strong earnings driven by high reliability and major project delivery • Strong earnings and cash flow: – Underlying replacement cost profit for the third quarter of 2018 was $3.8 billion, more than double a year earlier and the highest quarterly result in more than five years, including significant earnings growth from the Upstream and Rosneft. – Operating cash flow excluding Gulf of Mexico oil spill payments for the quarter was $6.6 billion, including a $0.7 billion working capital build (after adjusting for inventory holding gains). – Gulf of Mexico oil spill payments in the quarter were $0.5 billion on a post-tax basis. – Dividend of 10.25 cents a share for the third quarter, 2.5% higher than a year earlier. • Strong operating performance: – Very good reliability, with the highest quarterly refining availability for 15 years and BP-operated Upstream plant reliability of 95%. – Reported oil and gas production was 3.6 million barrels of oil equivalent a day. Upstream underlying production, which excludes Rosneft and is adjusted for portfolio changes and pricing effects, was 6.8% higher than a year earlier, driven by ramp-up of new projects. Rosneft production of 1.2 million barrels of oil equivalent a day was 2.8% higher than last year. • Strategic delivery: – The Thunder Horse Northwest expansion project in the Gulf of Mexico and the Western Flank B project in Australia began production in October, both ahead of schedule. They are BP’s fourth and fifth Upstream major projects to start up in 2018. -

Gas NIC Submission from National Grid Gas Distribution

Project Code/Version Number: NGGDGN03/2 1. Project Summary 1.1. Project Title HyDeploy The project will demonstrate that natural gas containing levels of 1.2. Project hydrogen beyond those in the GS(M)R specification can be Explanation distributed and utilised safely & efficiently for the first time in a section of the UK distribution network. Successful demonstration has the potential to facilitate 29TWh pa of decarbonised heat in the GB, and more by unlocking extensive hydrogen use. 1.3. Funding National Grid Gas Distribution licensee: 1.4.1. The Problem(s) it is exploring 1.4. Project The UK has committed to substantial carbon savings; heat description: contributes to a third of its current emissions. Reducing heating carbon intensity via hydrogen over the gas grid provides a customer-focused solution, but is limited by the current tight GS(M)R UK limits. 1.4.2. The Method(s) that it will use to solve the Problem(s) The first UK practical deployment of hydrogen onto a live gas network since the transition from town gas. Taking advantage of Keele University’s gas network risk manages project delivery and enables a more ambitious trial than would otherwise be achievable. This 3 year project, starting April 2017, is based on the principle of survey, test & trial necessary to secure HSE Exemption to GS(M)R and roll out the testing programme. 1.4.3. The Solution(s) it is looking to reach by applying the Method(s) The project provides a body of practical, referenceable data which is an essential pre-requisite to enable wider deployment of hydrogen and therefore delivery of cost-effective, non-disruptive carbon savings to the customer. -

Permit ID Installation ID Operator Name Installation Name 2013 2014

Installation Operator Name Installation Name 2013 2014 2015 2016 2017 2018 2019 2020 Permit ID ID DTI1015 204463 Premier Oil E&P UK Ltd Voyager Spirit FPSO 72,740 37,302 36,642 35,981 35,321 34,660 33,999 33,339 DTI1016 202656 Ithaca Energy UK Limited Athena 41,458 40,737 40,015 39,294 0000 DTI9910 207103 EnQuest Heather Limited EnQuest Producer 0 0 14,726 79,970 78,502 77,033 75,565 74,097 CNR International (UK) Petrojarl Banff DTI9950 206523 0 26,039 31,970 31,394 30,818 30,241 29,665 29,088 Limited FPSO Nexen Petroleum U.K. DTI9960 206591 Golden Eagle 0 6,010 26,378 27,736 27,227 26,718 26,209 25,699 Limited Anasuria Operating DTI9991 715 Anasuria 43,325 13,457 41,811 22,330 40,264 39,479 38,684 37,887 Company Limited DTI9999 8 Premier Oil E&P UK Ltd Balmoral 34,174 33,580 32,980 32,379 31,760 31,140 30,513 29,884 GB-DTI0200 2 Centrica Storage Ltd Rough 47/3B 66,144 64,995 63,833 62,658 30,736 30,136 29,530 28,921 GB-DTI0300 3 EnQuest Heather Limited Kittiwake Alpha 61,921 60,846 14,940 29,329 57,547 56,425 55,288 54,148 GB-DTI0400 4 Apache North Sea Limited Forties Alpha 69,336 68,131 66,913 65,682 64,437 63,181 61,909 60,632 GB-DTI0600 6 Apache North Sea Limited Forties Charlie 47,229 46,409 45,579 44,740 43,892 43,037 42,170 41,300 GB-DTI0700 7 Apache North Sea Limited Forties Delta 66,347 65,195 64,029 62,851 61,660 60,458 59,240 58,019 ConocoPhillips (UK) GB-DTI1000 10 Britannia 286,653 281,674 276,637 271,547 266,402 261,207 255,947 250,670 Britannia Limited GB-DTI-1001 693 Chrysaor Limited Lomond 65,871 64,727 63,570 62,400 61,218 60,024 58,815 57,603 GB-DTI-1002 696 Chrysaor Limited Everest North 41,385 40,666 39,939 39,204 38,461 37,711 36,952 36,190 GB-DTI1003 686 Britoil Ltd Bruce 142,795 280,628 137,805 270,538 265,413 260,237 254,997 249,739 Spirit Energy North Sea Oil Sevan Marine GB-DTI-1010 1123 127,129 124,921 122,687 120,430 118,148 115,844 113,512 111,171 Limited Hummingbird GB-DTI1011 18 Perenco UK Limited Thames Alpha 23,338 22,933 0 0 0000 Nexen Petroleum U.K. -

United Kingdom Overview

‹ Countries United Kingdom Last Updated: June 3, 2014 (Notes) full report Overview The United Kingdom is the largest producer of oil and the second-largest producer of natural gas in the European Union. Following years of exports of petroleum and natural gas, the UK became a net importer of all fossil fuels for the first time in 2013. The United Kingdom (UK) is the sixth largest economy in the world, as well as the largest producer of oil and the second-largest producer of natural gas in the European Union (EU). Following years of exports of both fuels, the UK became a net importer of natural gas and crude oil in 2004 and 2005, respectively. Production from UK oil and natural gas fields peaked around the late 1990s and has declined steadily over the past several years as the discovery of new reserves and new production has not kept pace with the maturation of existing fields. The UK became a net importer of petroleum products in 2013, making it a net importer of all fossil fuels for the first time. The UK government, aware of the country's increasing reliance on imported fuels, has developed key energy policies to address the domestic production declines. These include: using enhanced recovery from current and maturing oil and gas fields, promoting energy efficiency, decreasing the use of fossil fuels and thus reliance on imports, promoting energy trade cooperation with Norway, and decarbonizing the UK economy by investing heavily in renewable energy. However, for the UK to decarbonize its economy, huge investments in the energy infrastructure are needed.