Half-Yearly Results 2019 Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Greater London Authority

Consumer Expenditure and Comparison Goods Retail Floorspace Need in London March 2009 Consumer Expenditure and Comparison Goods Retail Floorspace Need in London A report by Experian for the Greater London Authority March 2009 copyright Greater London Authority March 2009 Published by Greater London Authority City Hall The Queen’s Walk London SE1 2AA www.london.gov.uk enquiries 020 7983 4100 minicom 020 7983 4458 ISBN 978 1 84781 227 8 This publication is printed on recycled paper Experian - Business Strategies Cardinal Place 6th Floor 80 Victoria Street London SW1E 5JL T: +44 (0) 207 746 8255 F: +44 (0) 207 746 8277 This project was funded by the Greater London Authority and the London Development Agency. The views expressed in this report are those of Experian Business Strategies and do not necessarily represent those of the Greater London Authority or the London Development Agency. 1 EXECUTIVE SUMMARY.................................................................................................... 5 BACKGROUND ........................................................................................................................... 5 CONSUMER EXPENDITURE PROJECTIONS .................................................................................... 6 CURRENT COMPARISON FLOORSPACE PROVISION ....................................................................... 9 RETAIL CENTRE TURNOVER........................................................................................................ 9 COMPARISON GOODS FLOORSPACE REQUIREMENTS -

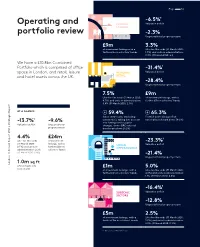

Download Our Operating and Portfolio Review

Page 36 -6.5%1 Operating and CENTRAL Valuation deficit LONDON portfolio review -2.3% Ungeared total property return £9m 3.3% of investment lettings with a Like-for-like voids (31 March 2020: further £1m in solicitors’ hands 1.3%) and units in administration: 0.3% (31 March 2020: nil) We have a £10.8bn Combined Portfolio which is comprised of office -31.4%1 space in London, and retail, leisure REGIONAL Valuation deficit and hotel assets across the UK. RETAIL -28.4% Ungeared total property return 7.5% £9m Like-for-like voids (31 March 2020: of investment lettings, with a 4.7%) and units in administration: further £7m in solicitors’ hands 5.8% (31 March 2020: 2.1%) AT A GLANCE 59.4% 65.3% Same centre sales (excluding Footfall down (ShopperTrak ¹ automotive), taking into account national benchmark down 58.2%) -13.7% -9.6% new lettings and occupier Valuation deficit Ungeared total changes, down (BRC national » Strategic Report property return benchmark down 29.2%) 4.4% £24m Like-for-like voids of investment -23.3%1 (31 March 2020: lettings, with a URBAN Valuation deficit 2.5%) and units in further £12m in OPPORTUNITIES administration: 2.2% solicitors’ hands (31 March 2020: 0.8%) -21.4% Ungeared total property return 1.0m sq ft Landsec // AnnualLandsec Report // 2021 of developments £1m 5.0% now on site of investment lettings, with a Like-for-like voids (31 March 2020: further £1m in solicitors’ hands 4.8%) and units in administration: 1.1% (31 March 2020: 0.4%) -16.4%1 SUBSCALE Valuation deficit SECTORS -12.8% Ungeared total property return £5m 2.5% of investment lettings, with a Like-for-like voids (31 March 2020: further £3m in solicitors’ hands 2.0%) and units in administration: 2.9% (31 March 2020: 0.9%) 1. -

Lewisham Town Centre Local Plan Submission Version

Lewisham local plan Lewisham town centre local plan Submission version September 2012 PLEASE NOTE: The maps and figures within this document will be professionally altered for the final publication version. Contents 1 The plan and context 3 1.1 Lewisham town centre and the Local Plan 4 1.2 Key characteristics of Lewisham town centre 6 1.3 Summary of issues and challenges for the town centre 11 1.4 How does the LTC Local Plan relate to other policy? 12 1.5 Sustainability Appraisal and Equalities Analysis Assessment 15 2 Vision and objectives 16 2.1 The vision 17 2.2 The objectives 18 2.3 From issues to objectives 20 3 Presumption in favour of sustainable development 22 4 The spatial strategy 24 4.1 The plan boundaries 25 4.2 Introducing policy areas and sites 27 4.3 Creating a cohesive and complete town centre experience 32 5 Policy Areas and sites 37 5.1 Lewisham Gateway Policy Area 37 5.2 Loampit Vale Policy Area 41 5.3 Conington Road Policy Area 46 5.4 Lee High Road Policy Area 51 5.5 Ladywell Policy Area 55 5.6 Central Policy Area 60 6 Area-wide policies 66 6.1 Growing the local economy 67 6.1.1 Employment 69 6.1.2 Housing 73 6.1.3 Shopping 76 6.2 Building a sustainable community 84 6.2.1 Urban design 85 Lewisham TCLP Adoption Version Contents 6.2.2 Sustainable movement 89 6.2.3 Community 95 6.3 Environmental management 100 7 Implementation, monitoring and risk 106 7.1 Implementation 107 7.2 Monitoring 111 7.3 Risk 113 8 Appendix 1 - Policy, guidance and evidence base linkages 115 9 Appendix 2 - Heritage assets 122 10 Appendix 3 - Delivery strategy and monitoring framework 125 11 Appendix 4 - Lewisham town centre infrastructure schedule 134 12 Appendix 5 - UDP proposals replaced by the LTCLP 143 13 Glossary 144 Lewisham TCLP Adoption Version The plan and context 1 Section 1 of the Lewisham Town Centre Local Plan (LTCLP) firstly introduces Lewisham town centre, its strengths, weaknesses and the opportunities for it to develop and improve in the next five to ten years. -

Title Landsec and Invesco Real Estate Welcome Orangetheory Fitness to Southside, Wandsworth. from Landsec Date 03.09.18 Landsec

Title Landsec and Invesco Real Estate welcome Orangetheory Fitness to Southside, Wandsworth. From Landsec Date 03.09.18 Landsec and Invesco Real Estate have welcomed Orangetheory Fitness to Southside, Wandsworth. The brand, home to an innovative gym concept, has opened a 4,939 sq ft unit on Garratt Lane. Top-of-the-line equipment, upbeat music and motivational personal trainers make Orangetheory Fitness the most energetic fitness environment around. The Southside studio has 13 treadmills, 13 rowing machines, 13 suspension unit systems, benches for sessions of 10 to 39 people, as well as bike and strider options. The studio also has separate men’s and women’s restrooms and showers for convenience and comfort. Lockers, courteous staff and modern equipment complete the Orangetheory Fitness experience. Orangetheory’s heart rate monitored training is designed to maintain a target zone that stimulates metabolism and increases energy after the workout has finished to keep the body burning calories for up to 36 hours. Deepan Khiroya, Senior Portfolio Director, Landsec, commented: “Our retail and leisure mix at Southside reflects the aspirational consumers that visit the centre on a regular basis; Orangetheory Fitness is an innovative and forward-thinking brand, who we are pleased to be able to add to our offering.” Cem Ahmet, Studio Manager, Orange Theory Fitness, commented: “Being a part of Southside, Wandsworth has been incredible for generating business and footfall. We have seen a dramatic increase in numbers week-on-week since opening and have created some amazing relationships with our fellow Southside shopping centre businesses.” Southside, a joint venture between Invesco Real Estate, the global real estate investment manager, and Landsec, is located in the heart of Wandsworth Town, and is home to over 80 retailers including Waitrose, River Island, Tiger and H&M. -

1. Entering Into a Competition Or Promotion Hosted by Us

PRIVACY & COOKIES POLICY This Privacy Notice may vary from time to time so please check it regularly. This Notice describes the types of information collected, how that information is used and disclosed, and how you can access, modify, or delete your information. Land Securities Properties Limited (company number 961477) whose registered office is at 100 Victoria Street London SW1E 5JL (“we”, “us” or “our”) is the ‘data controller’ for the personal data we collect. We are registered with the Information Commissioner’s Office with registration number Z5806812. 1. WIFI IN OUR CENTRES Please see (wifi Link) 2. MARKETING AND GUEST SERVICES HOW DO WE COLLECT INFORMATION ABOUT YOU? 1. Entering into a competition or promotion hosted by us or our third parties: You may provide us with personal data when you subscribe to these services either online or through a physical form. 2. Enrolling for a loyalty card or a club run at our centres: you will typically provide us with your name and contact details when you enrol for a loyalty card either online or through a physical form. 3. Feedback: providing feedback to us through our online surveys where you may provide your contact details and subscribe to receiving marketing information. Our main supplier for this service is Privacy Shield accredited and based in the United States so your data will be transferred securely and legally outside of the UK. You can also provide us feedback through writing to or emailing the centre with any comments, complaints or suggestions. 4. Website usage: We may also collect information from you automatically when you access and use our Online Services, including the time and duration of your visit, the referring URL, your Internet Protocol (IP) or MAC address, the type of device you use and its operating system. -

Limited and Guild Realisations Limited (Formerly Republic (Retail) Limited) - Both in Administration (Together ‘The Companies’)

Ernst & Young LLP 1 Bridgewater Place, Water Lane Leeds LS11 5QR T el: 0113 298 2200 Fax: 0113 298 2201 www.ey.com/uk TO ALL KNOWN CREDITORS 8 April 2013 Ref: RHK/JPS/TRJ/AE/PCF11.1 Direct line: 0113 298 2496 Direct fax: 0113 298 2206 Email: [email protected] Dear Sirs Republic (UK) Limited and Guild Realisations Limited (formerly Republic (Retail) Limited) - both in Administration (together ‘the Companies’) Further to my appointment as Joint Administrator of the Companies, I attach a copy of my statement of proposals in accordance with paragraph 49 of Schedule B1 to the Insolvency Act 1986. As you will note from the proposals, there is no prospect of any funds becoming available to unsecured creditors of either of the Companies other than by virtue of the prescribed part. As a consequence, I do not propose to summon meetings of creditors. If, however, creditors whose debts amount to at least 10% of total debts of either of the Companies make a request in the prescribed form within 8 business days of these proposals being sent out, a meeting will be held in that company. Copies of the prescribed form (Form 2.21B) are enclosed in case you wish to request a meeting. I would draw your attention to the provisions of Rule 2.37 of the Insolvency Rules 1986 which provide that if a meeting is requested, it will only be held if the expenses of summoning and holding such a meeting are paid by the creditor or creditors making the request and if security is first deposited with me for payment. -

Tall Buildings Study Draft

LEWISHAM TALL BUILDINGS STUDY DRAFT LONDON BOROUGH OF LEWISHAM Allies and Morrison Urban Practitioners February 2021 D R A F T D R A F T CONTENTS 1 INTRODUCTION AND CONTEXT 5 4 SENSITIVITY ASSESSMENT 53 1.1 Introduction, Purpose and Structure of the Study 5 4.1 Introduction 53 1.2 Introduction to The Borough 6 4.2 Assessment of Sensitivity 54 1.3 Tall Building Policy Context 7 4.3 World Heritage Sites 56 1.4 Other Relevant Guidance 10 4.4 Conservation Areas and Special Local Character 58 4.5 Listed Buildings 60 2 DEFINING WHAT IS TALL 15 4.6 Strategic and Local Views And Landmarks 62 2.1 Lewisham Borough Definition for Tall Buildings 15 4.7 Areas Characterised by Consistent Building Heights 64 2.2 Lewisham Borough Definition for Taller Buildings 15 4.8 Topography 66 2.3 Building Heights 16 4.9 Tall Building Sensitivity Map 68 2.4 Existing and Proposed Tall Buildings 18 4.10 Site Allocations 70 2.5 Average Building Heights by Area 20 2.6 Average Building Heights by Neighbourhood 22 2.7 Average Building Heights Area Analysis 24 2.8 Building Height Variance 25 2.9 Prevailing Heights 26 2.10 What is Tall 26 3 SUITABILITY ASSESSMENT 29 3.1 Introduction 29 3.2 Assessment of Suitability 30 3.3 High PTAL 32 3.4 Bakerloo Line Extension 34 3.5 Town Centres 36 3.6 Opportunity Areas 38 3.7 Growth Areas 40 3.8 Building Heights and Tall Building Clusters 42 3.9 Tall Building Suitability Map 44 3.10 Green, Open Space and Rivers 46 3.11 Cycling Transport Accessibility Level (CTAL) 48 3.12 Site Allocations 50 D R A F T D R A F T DRAFT LB LEWISHAM TALL -

96 Lewisham High Street, Lewisham London SE13 5JH

www.acuitus.co.uk lot 2 96 Lewisham High Street, Lewisham London SE13 5JH Rent Freehold Retail Investment • Entirely let to RAL Limited (t/a Quicksilver) • Nearby occupiers include Vodafone, £44,500 until 2028 Barclays Bank, Subway and Greggs per annum • Recently re-geared lease • 40 metres from Lewisham Shopping Centre exclusive • Prominent town centre position • Six Week Completion Available Ref: 4407/GT/WH PA: AS Location Description Miles: 1.4 miles south of Greenwich The property comprises a ground floor retail unit with office/storage 2 miles west of Blackheath Village accommodation on the first and second floors and a third floor attic 6 miles south-east of the City of London area which is currently unuseable. N Roads: A20, A21 Rail: Lewisham Rail (direct to Charing Cross & Cannon Street), Tenure Lewisham DLR (19 minutes to Canary Wharf) Freehold. Air: London City Airport VAT Situation VAT is not applicable to this lot. The property is situated in a prominent position on the western side of the pedestrianised High Street, close to its junction with Lee High Road. The property is situated 40 metres from an entrance to Lewisham Shopping Centre which houses retailers including Marks & Spencer, TK Maxx, BHS, H & M, Next, New Look and Boots Chemist. Other nearby occupiers include Vodafone, Barclays Bank, Subway and Greggs. Tenancy and accommodation Floor Use Floor Areas (Approx) Tenant Term Rent p.a.x. Reviews Ground Retail 118.64 sq m (1,277 sq ft) RAL LIMITED (1) 16 years and 17 days from £44,500 29/05/2017 First Office/Storage 48.62 sq m (523 sq ft) (t/a Quicksilver) 29/05/2012 until 14/06/2028 on a and LEWISHAM SHOPPING CENTRE Second Office 21.34 sq m (230 sq ft) full repairing and insuring lease 29/05/2022 Third Not Measured Totals 188.60 sq m (2,030 sq ft) £44,500 (1) As of 19th January 2012, RAL Ltd have a Dun & Bradstreet Rating of 4A1, showing minimum risk. -

Lewisham Local Plan Site Allocations – Central Area

Draft Lewisham Local Plan Site Allocations – Central area Regulation 18 stage ‘Preferred Approach’ Document Lewisham Gateway Site address: Lewisham Gateway Site, Lewisham High Street, London, SE13 Site details: Site size (ha): 5.52, Setting: Central, PTAL: In 2015: 6b, In 2021: 6b, In 2031: 6b, Ownership: Mixed public and private, Current use: Transport interchange How site was Lewisham Core Strategy (2011) and London SHLAA (2017) identified: Planning Opportunity Area, adjacent to Conservation Area, Critical Drainage Area, designations Flood Zones 1 and 2 and site constraints: Planning Full application DC/06/062375 granted in May 2009. Various reserved matters and Status: s73 minor material amendment granted April 2013 – February 2019. Started construction and development is partially complete. Timeframe for 2020/21 – 2024/25 2025/26 – 2029/30 2030/31 – 2034/35 2035/36 – 3039/40 delivery: Yes Indicative Net residential units: Non-residential floorspace: development 607 Town centre: 2,550 capacity: 1 Employment: 17,500 Existing planning consent DC/06/062375 - The comprehensive mixed use redevelopment of the Lewisham Gateway Site, SE13 (land between Rennell Street and Lewisham Railway Station) for 100000m² comprising retail (A1, A2, A3, A4 and A5), offices (B1), hotel (C1), residential (C3), education/health (D1) and leisure (D2) with parking and associated infrastructure, as well as open space and water features as follows: up to 57,000 m² residential (C3) up to 12,000 m² shops, financial & professional services (A1 & A2) up to 17,500 m² offices (B1) / education (D1) up to 5,000 m² leisure (D2) up to 4,000 m² restaurants & cafés and drinking establishments (A3 & A4) up to 3,000 m² hotel (C1) up to 1,000 m² hot food takeaways (A5) 500m² health (D1) provision of up to 500 car parking spaces revised road alignment of (part of) Lewisham High Street, Rennell Street, Molesworth Street and Loampit Vale and works to Lewisham Road. -

Sustainability Report 2017

Sustainability Report 2017 Making our experience count Progress Commitments Sustainability Complete Existing commitment (retained) On track Existing commitment (extended) performance Incomplete New commitment at a glance Our commitments and progress to date Creating jobs and opportunities Community employment Fairness Diversity Health, safety and security Commitment Commitment Commitment Commitment Help a total of 1,200 Ensure the working environments Make measurable improvements Maintain an exceptional standard disadvantaged people we control are fair and ensure that to the profile – in terms of gender, of health, safety and security secure jobs by 2020 everyone who is working on our ethnicity and disability – of our in all the working environments behalf – within an environment we employee mix we control Progress control – is paid at least the Living Wage by 2020 Progress Progress Employment secured for 962 people from Progress Participant in the National Chaired the Health in disadvantaged backgrounds Equality Standard assessment Construction Leadership Group Accreditation received from the process. Set specific diversity and launched Mates in Mind Living Wage Foundation metrics to be achieved by 2020 mental health programme Efficient use of natural resources Carbon Renewable energy Energy Waste Commitment Commitment Commitment Commitment Reduce carbon intensity (kgCO2/ Continue to procure 100% Reduce energy intensity (kWh/ Send zero waste to landfill with m2) by 40% by 2030 compared to renewable electricity across m2) by 40% by 2030 -

REGISTER of MEMBERS' FINANCIAL INTERESTS As at 6

REGISTER OF MEMBERS’ FINANCIAL INTERESTS as at 6 June 2016 _________________ Abbott, Ms Diane (Hackney North and Stoke Newington) 1. Employment and earnings Fees received for co-presenting BBC’s ‘This Week’ TV programme. Address: BBC Broadcasting House, Portland Place, London W1A 1AA. (Registered 04 November 2013) 14 May 2015, received £700. Hours: 3 hrs. (Registered 03 June 2015) 4 June 2015, received £700. Hours: 3 hrs. (Registered 01 July 2015) 18 June 2015, received £700. Hours: 3 hrs. (Registered 01 July 2015) 16 July 2015, received £700. Hours: 3 hrs. (Registered 07 August 2015) 8 January 2016, received £700 for an appearance on 17 December 2015. Hours: 3 hrs. (Registered 14 January 2016) 28 July 2015, received £4,000 for taking part in Grant Thornton’s panel at the JLA/FD Intelligence Post-election event. Address: JLA, 14 Berners Street, London W1T 3LJ. Hours: 5 hrs. (Registered 07 August 2015) 23rd October 2015, received £1,500 for co-presenting BBC’s “Have I Got News for You” TV programme. Address: Hat Trick Productions, 33 Oval Road Camden, London NW1 7EA. Hours: 5 hrs. (Registered 26 October 2015) 10 October 2015, received £1,400 for taking part in a talk at the New Wolsey Theatre in Ipswich. Address: Clive Conway Productions, 32 Grove St, Oxford OX2 7JT. Hours: 5 hrs. (Registered 26 October 2015) 21 March 2016, received £4,000 via Speakers Corner (London) Ltd, Unit 31, Highbury Studios, 10 Hornsey Street, London N7 8EL, from Thompson Reuters, Canary Wharf, London E14 5EP, for speaking and consulting on a panel. -

Annual Report 2020 Welcome to Landsec 2020 in Numbers Here Are Some of the Our Portfolio Important Financial and Non-Financial Performance Figures for Our Year

Annual Annual Report 2020 Landsec Annual Report 2020 Welcome to Landsec 2020 in numbers Here are some of the Our portfolio important financial and non-financial performance figures for our year. Some of these measures are impacted by Covid-19. 23.2p Dividend, down 49.1% 55.9p Adjusted diluted earnings per share (2019: 59.7p) Office Retail Specialist Our Office segment consists of Our Retail segment includes outlets, Our Specialist segment comprises high-quality, modern offices in great retail parks, large regionally dominant 17 standalone leisure parks, 23 hotels 1,192p locations in central London. Our offer shopping centres outside London and the iconic Piccadilly Lights in EPRA net tangible assets ranges from traditional long-term and shopping centres within London. central London. per share, down 11.6% leases through to shorter-term, flexible We also have great retail space within Pages 24-29 space. We also have significant our office buildings. development opportunities. Pages 24-29 Pages 24-29 -8.2% Total business return (2019: -1.1%) A £12.8bn portfolio Chart 1 10 1. West End office 26% 9 £11.7bn 2. City office 13% 8 1 Total contribution to 3. Mid-town office 11% the UK economy each 4. Southwark and other office 4% 7 year from people based 5. London retail 11% Combined at our assets 6. Regional retail 13% 7. Outlets 7% Portfolio 6 8. Retail parks 3% 2 9. Leisure and hotels 9% £(837)m 10. Other 3% 5 Loss before tax 3 4 (2019: £(123)m) Read more on pages 174-177 Comprising 24 million sq ft Chart 2 -4.5% Ungeared total property of space return (2019: 0.4%) 1 1.