New Directions in Grocery Retailing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

01/2012009 TUE 14:45 PA.1 502 569 1270 Proquest 1 Xanedu

01/2012009 TUE 14:45 PA.1 502 569 1270 ProQuest 1 XanEdu Wa1"Mart Stores, Inc. In Forbes magazine's annual ranking of the richest Americans, the heirs of Sam Walton, the founder of Wal'Mart Stores, h.,held spots five through nine in 1993 with 9.5 billion each. Sam Walton, who died in April 1992, had built Wal*Mart into a phenomenal succ~,with a 20-par avenge return on equity of 3376, and compound average sale growth of 35%. At the end of 1993, WalSMart had a market value of $57.5 billion, and its sales pcr square foot were nearly ROO, compard with the industry average of $210. It was widely believed that WalDMart had revolutionized many aspedv of retailing, and it was wcll known for its heavy investment in information technology. David Class and Don Soderquist faced the Merge of following in Sam Walton's footsteps. Glass and SoderquLt, CEO and COO, had been running thc company since February 1988, when Walton, retaining tlic chairmanship, turned the job of CEO over to Glass. Their record spoke for itself-the company went from sales of $16 billion in 1987 to $67 billion in 1993, with earnings nearly quadrupling from $628 million to $23 billion. At the beginning of 1994, the company operated 1,953 Wal*Mart stores (mduding 68 supercenters), 419 warehouse clubs (Sam's Clubs), 81 warehouse outlcts (Bud's), and four hypermarkets. During 1994 WaleMart plmed to open 110 new WalDMxt stores, including 5 suprcenters, and 20 Sam's Clubs, and to expand or relocate approximately 70 of the older Wal*Mart stores (6of which would bc made into supercenters), and 5 Sam's Clubs. -

Hypermarket Lessons for New Zealand a Report to the Commerce Commission of New Zealand

Hypermarket lessons for New Zealand A report to the Commerce Commission of New Zealand September 2007 Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low-pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane. In market research it means understanding the big picture before you get into the details. PO BOX 10 202, Mt. Eden, Auckland 1030, New Zealand Tel: +64 9 623 1848; Fax: +64 9 353 1515; email: [email protected] www.coriolisresearch.com PROJECT BACKGROUND This project has the following background − In June of 2006, Coriolis research published a company newsletter (Chart Watch Q2 2006): − see http://www.coriolisresearch.com/newsletter/coriolis_chartwatch_2006Q2.html − This discussed the planned opening of the first The Warehouse Extra hypermarket in New Zealand; a follow up Part 2 was published following the opening of the store. This newsletter was targeted at our client base (FMCG manufacturers and retailers in New Zealand). -

Spartannash Corporate Responsibility Report

Corporate Responsibility Report Our Commitment. Our Impact. With nearly 16,000 associates serving We measure success based on customers located in 47 states as well as decreasing our environmental our military heroes throughout the world, impact, advancing our social SpartanNash recognizes the value of stewardship and sustaining our our voice and strategic importance of commitments in accordance with our resources. our financial performance. We are mindful that our business This report provides an overview of decisions, products, services and our journey and how SpartanNash is operations have a direct impact on leveraging both our voice and footprint the environment, our communities, to make a difference in the communities customers and co-workers. we serve. We define this conviction as our We invite you to take a look. As you’ll Corporate Responsibility. see, we take relationships seriously – so much so that our vision is to be a We also acknowledge that Corporate best-in-class business that feels local, Responsibility is a journey – not a one- where relationships matter. and-done activity, event or initiative. At SpartanNash, we’re investing in today, Consequently, we continually to ensure a better tomorrow. challenge ourselves to identify, align and integrate impactful practices Who is SpartanNash 2-3 throughout our wholesale and military Historical Timeline 4-5 distribution supply chains, more than Social Responsibility 6-21 155 corporate-owned retail stores, Environmental Sustainability 22-32 and three service centers. Dennis Eidson CEO and Chairman of the Board SpartanNash is a $7.7 billion Fortune 400 company that was formed in November 2013 when Spartan Stores, based in We are Grand Rapids, Michigan, merged with Nash Finch Company, SpartanNash based in Minneapolis, Minnesota. -

NGA Retail Membership List by State – Winter 2019

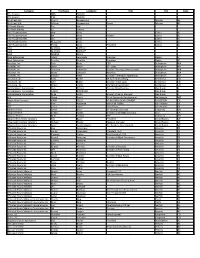

NGA Retail Membership List by State – Winter 2019 Company City State A & R Super Markets, Inc. Calera Alabama Autry Greer & Sons Inc Mobile Alabama Baker Foods, Inc. Pell City Alabama Bruce Management, Inc. Fort Payne Alabama Farmers IGA Foodliner Opp Alabama Food Giant, Inc. Bessemer Alabama Forster & Howell Inc Dothan Alabama Fourth Avenue Supermarket Bessemer Alabama Freeman's Shur-Valu Foods Dothan Alabama Fuller's Supermarket Greensboro Alabama Gateway Foodland Inc Double Spgs Alabama Gregerson's Foods, Inc. HQ Gadsden Alabama Holley Oil Company Wetumpka Alabama Johnson's Giant Food, Inc. Attalla Alabama Piggly Wiggly Warrior Alabama Pinnacle Foods dba Save A Lot Mobile Alabama Ragland Bros Retail Co's, Inc. Huntsville Alabama Renfroe, Inc. Montgomery Alabama Star Super Market, Inc. Huntsville Alabama Tallassee Super Foods Tallassee Alabama Western Supermarkets, Inc Birmingham Alabama Wright's Markets, Inc. Opelika Alabama Benjamin's IGA Wrangell Alaska City Market, Inc. Wrangell Alaska Copper Valley IGA Glennallen Alaska Country Foods IGA Kenai Alaska Cubbys Marketplace IGA Talkeetna Alaska Fairway Market IGA Skagway Alaska Hames Corporation Sitka Alaska Howsers IGA Supermarket Haines Alaska IGA Food Cache Delta Junction Alaska Tatsudas IGA Ketchikan Alaska Trading Union IGA Market Petersburg Alaska Freson Bros. Stony Plain Alberta Rodney's Supermarket Arima Arima Del Sol IGA #6 San Luis Arizona Ed's IGA Market Snowflake Arizona El Rancho Market IGA Chandler Arizona Food Town IGA Eloy Arizona Garrett's IGA Supermarket Rio Rico Arizona Norms IGA Kearny Arizona Olsens IGA Market Yuma Arizona RCCM Foodtown IGA Market Eloy Arizona Shopes Market IGA Coolidge Arizona The Butcher & The Farmer Marketplace IGA Buckeye Arizona Tonto Basin Market Place IGA Tonto Basin Arizona Wilburs IGA Market Saint Johns Arizona Cranford's Fresh World Little Rock Arkansas Cranford's Fresh World dba FoodWise Hot Springs Village White Hall Arkansas Cranford's Fresh World dba ShopWise Redfield Redfield Arkansas Cranford's Fresh World, Rison Rison Arkansas Dale Newman Management Co. -

Price Adjustment at Multiproduct Retailers Daniel Levy, Shantanu Dutta, Mark Bergen, Robert Venable

Price adjustment at multiproduct retailers Daniel Levy, Shantanu Dutta, Mark Bergen, Robert Venable To cite this version: Daniel Levy, Shantanu Dutta, Mark Bergen, Robert Venable. Price adjustment at multiproduct retailers. Managerial and Decision Economics, Wiley, 1998, 19 (2), pp.81-120. 10.1002/(SICI)1099- 1468(199803)19:23.0.CO;2-W. hal-02385586 HAL Id: hal-02385586 https://hal.archives-ouvertes.fr/hal-02385586 Submitted on 28 Nov 2019 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Forthcoming Managerial and Decision Economics, 1998 Price Adjustment at Multiproduct Retailers Daniel Levy Department of Economics Emory University Atlanta GA 30322 (404) 727-2941 [email protected] ShantanuDutta Department of Marketing School of Business Administration University of Southern California Los Angeles, CA 90089-1421 (213) 740-5038 [email protected] Mark Bergen Dept. of Logistics and Marketing Mgmt University of Minnesota Minneapolis, MN 55455 (612) 624-1821 [email protected] Robert Venable Robert W. Baird & Co. [email protected] Last Revision: December 30, 1997 JEL Codes: E31, E12, E50, G13, G14, L11, L15, L16, M21, M31, Q11, Q13 Key Words: Cost of Price Adjustment, Price Adjustment Process, Menu Cost, Posted Prices, Multiproduct Retailer, Price Rigidity, Sticky Prices, Frequency of Price Changes, Time Dependent Pricing, Retail Supermarket and Drugstore Chains 2 Abstract We empirically study the price adjustment process at multiproduct retail stores. -

Wal*Mart Stores, Inc

For the exclusive use of L. LI 9-794-024 REV: NOVEMBER 6, 2002 STEPHEN P. BRADLEY PANKAJ GHEMAWAT Wal*Mart Stores, Inc. In Forbes magazine’s annual ranking of the richest Americans, the heirs of Sam Walton, the founder of Wal*Mart Stores, Inc., held spots five through nine in 1993 with $4.5 billion each. Sam Walton, who died in April 1992, had built Wal*Mart into a phenomenal success, with a 20-year average return on equity of 33%, and compound average sales growth of 35%. At the end of 1993, Wal*Mart had a market value of $57.5 billion, and its sales per square foot were nearly $300, compared with the industry average of $210. It was widely believed that Wal*Mart had revolutionized many aspects of retailing, and it was well known for its heavy investment in information technology. David Glass and Don Soderquist faced the challenge of following in Sam Walton’s footsteps. Glass and Soderquist, CEO and COO, had been running the company since February 1988, when Walton, retaining the chairmanship, turned the job of CEO over to Glass. Their record spoke for itself—the company went from sales of $16 billion in 1987 to $67 billion in 1993, with earnings nearly quadrupling from $628 million to $2.3 billion. At the beginning of 1994, the company operated 1,953 Wal*Mart stores (including 68 supercenters), 419 warehouse clubs (Sam’s Clubs), 81 warehouse outlets (Bud’s), and four hypermarkets. During 1994 Wal*Mart planned to open 110 new Wal*Mart stores, including 5 supercenters, and 20 Sam’s Clubs, and to expand or relocate approximately 70 of the older Wal*Mart stores (65 of which would be made into supercenters), and 5 Sam’s Clubs. -

The Battlefields 20061

The Battlefield Software Only Warehouse Clubs Catalog Direct / Internet Retailers Electronic Boutique 900 BJ's Warehouse 110 4Sure.com GameStop (including FuncoLand) 1000 Costco Wholesale 425 Academic SuperStore Software Plus 1 Costco Wholesale (Canada) 63 Amazon.com Sam's 556 AtomicPark.com Hardware Retailers Bestbuy.com Hartco (Canada) 160 Office Superstores Bits.com IE Group/Connecting Point 200 Office Depot 1000 Buy.com (US and Canada) Office Depot (Canada) 35 Dell Computer Superstores / Chains Office Max 1000 Digital River @ Computers (Canada) 8 Staples 1235 DigitallyUnique.com ACP Superstore 1 Staples / Business Depot (Canada) 205 eCost.com Apple Stores 125 Educational Resources CompUSA 245 Corporate/Gov't Resellers Gateway Computer Warehouse 8 AAFES 200 Insight ComputerWare 8 Corporate Software 1 Journey Ed DataVision 1 EURPAC (including 8 Marines) 53 Microgistix Fred Meyer Stores 120 GTSI 1 NewEgg.com Fry's Electronics 27 Nexcom 44 Outpost.com (Fry's) Future Shop (Canada) 95 Softchoice 1 PC Connection (including Mac Connection) Hartco (Canada) 176 Softmart 1 PC Zones (including MacZones) Micro Center 19 Software Spectrum 1 Scholastic PC Club 44 ShopToshiba.com Additional Markets TigerDirect Consumer Electronics B&H Photo 2 Torcomp ABC Warehouse 35 Beach Camera 2 American TV & Appliance 15 Blockbuster 1000 Apple Specialists and Resellers Ballio's 2 Camelot (Canada) 330 AIS Computers 1 Best Buy 776 Century 21 Dept. Stores 5 Apple Stores 78 Best Buy (Canada) 35 Discovery Channel 45 Computer Advantage 1 Brandsmart USA 6 Entertainment Outlet 2 CryWolf 1 Circuit City 618 H S N 1 First Tech 1 Cousins 2 Media Play 55 Haddock Computers 2 Grants 8 Musicland Group 900 LA Computers 1 H.H. -

Retail Tobacco Licensees

licrept/d-rell01.w North Dakota Office of Attorney General Page: 1 User: MTESKY Current License List for RETAIL TOBACCO PRODUCTS (TR) 09/15/21 09:21:43 Expiration Date: On or after 06/30/2022 County: All Counties Sorted By: City License Licensee Name Title Address Phone 1 City St Zip CO ------------- ------------------------------ ------------------------------ --------------------------------------------- ------------- ---------------------- -- ---------- --- TR-08130 FORT INC THE FORT SALOON 505 BROADWAY 701-553-8780 ABERCROMBIE ND 58001 039 PO BOX 104 TR-01579 LUDVIG INC ABERCROMBIE STORE 507 BROADWAY 553-8809 ABERCROMBIE ND 58001 039 PO BOX 27 TR-08934 ADAMS GENERAL STORE LLC 410 MAIN ST 701-944-2260 ADAMS ND 58210 050 PO BOX 150 TR-08495 PATRIOT FUELS INC 14070 HWY 85 N 855-872-3835 ALEXANDER ND 58831 027 14070 HIGHWAY 85 N TR-08383 TA OPERATING LLC TA EXPRESS 14256 HWY 85 N 701-828-3352 ALEXANDER ND 58831 027 255 WASHINGTON ST STE 100 TWO NEWTON PLACE TR-08683 KRAMER COCKTAILS CORP MUDDY CREEK SALOON 110 MAIN ST 701-843-8469 ALMONT ND 58520 030 PO BOX 55 TR-08201 RUD CORPORATION RUD'S ALMONT 609 DAKOTA AVE 701-843-7508 ALMONT ND 58520 030 1310 N 8TH ST TR-09078 PIT 88 LLC 224 WOODARD AVE S 701-347-0251 AMENIA ND 58004 009 1468 12TH STREET CT TR-08252 MO'S BUNKER BAR LLC 203 COURT ST 701-879-2420 AMIDON ND 58620-2001 044 TR-00585 VETSCH WILLIAM & KATHY K B'S BAR 615 MAIN ST 701-465-3807 ANAMOOSE ND 58710 025 PO BOX 62 TR-09072 FARMERS UNION OIL COMPANY OF A 120 4TH ST S 326-4252 ANETA ND 58212 032 PO BOX 288 TR-00431 WHITETAIL BAR -

Page 1 Table of Cases (References Are to Pages.) 3M Co. V. Boulter

Table of Cases (References are to pages.) 3M Co. v. Boulter, 842 F. Supp. 2d 85, 40 Media L. Rep. (BNA) 1281 (D.D.C. 2012) .....................................16-26, 16-27 9-5 Fashions, Inc. v. Spurney, 538 So. 2d 228 (La. 1989) .................................................. 13-39 30 River Court E. Urban Renewal Co. v. Capograsso, 383 N.J. Super. 470, 892 A.2d 711 (App. Div. 2006) ...................................2-90, 8-62 50-Off Stores, Inc. v. Banque Paribas (Suisse) S.A., 1997 U.S. Dist. LEXIS 11136 (W.D. Tex. 1997) ..........8-18, 16-3 164 Mulberry St. Corp. v. Columbia Univ., 4 A.D.3d 49, 771 N.Y.S.2d 16 (1st Dep’t 2004) .................................................13-49, 13-50 360 Constr. Co. v. Atsalis Bros. Painting Co., 915 F. Supp. 2d 883 (E.D. Mich. 2012) .................................. 9-3 600 W. 115th St. v. Van Gutfield, 80 N.Y.2d 130, 603 N.E.2d 930, 589 N.Y.S.2d 825, 21 Media L. Rep. (BNA) 1811 (1992), cert. denied, 508 U.S. 910 (1993) ........ 4-26 7547 Corp. v. Parker & Parsley Dev. Partners, L.P., 38 F.3d 211 (5th Cir. 1994) ................................................ 16-57 A A Fisherman’s Best v. Recreational Fishing Alliance, 310 F.3d 183 (4th Cir. 2002), cert. denied, 539 U.S. 926 (2003) ............................................................. 3-14 Aafco Heating & Air Conditioning Co. v. Nw. Publ’ns, Inc., 162 Ind. App. 671, 321 N.E.2d 580 (1974), cert. denied, 424 U.S. 913 (1976) ............................................................. 6-12 (Sack, Rel. #6, 4/16) TOC–1 SACK ON DEFAMATION A&B-Abell Elevator Co. -

UC Berkeley Earlier Faculty Research

UC Berkeley Earlier Faculty Research Title Homeward Bound: Food-Related Transportation Strategies in Low Income and Transit Dependent Communities Permalink https://escholarship.org/uc/item/85n1j2bb Authors Gottlieb, Robert Fisher, Andrew Dohan, Marc et al. Publication Date 1996 eScholarship.org Powered by the California Digital Library University of California Homeward Bound: Food-Related Transportation Strategies in LowIncome and Transit Dependent Communities Robert Gottlieb Andrew Fisher Marc Dohan Linda O’Connor Virginia Parks Working Paper UCTCNo. 336 The University of California Transportation Center University of California Berkeley, CA 94720 The University of California Transportation Center The University of California Center activities. Researchers Transportation Center (UCTC) at other universities within the is one of ten regional units region also have opportunities mandated by Congress and to collaborate with UCfaculty established in Fall I988 to on seIected studies. support research, education, and training in surface trans- UCTC’seducational and portation. The UCCenter research programs are focused serves federal Region IX and on strategic planning for is supported by matching improving metropolitan grants from the U.S. Depart- accessibility, with emphasis ment of Transportation, the on the special conditions in California Department of Region IX. Particular attention Transportation (Caltrans), and is directed to strategies for the University. using transportation as an instrument of economic Based on the Berkeley development, while also ac- Campus, UCTCdraws upon commodatingto the region’s existing capabilities and persistent expansion and resources of the Institutes of while maintaining and enhanc- Transportation Studies at ing the quality of life there. Berkeley, Davis, Irvine, and Los Angeles; the Institute of The Center distributes reports Urban and Regional Develop- on its research in working ment at Berkeley; and several papers, monographs, and in academic departments at the reprints of published articles. -

2013 List of Registrants

Company FirstName LastName Title City State 4T's Grocery ANN TAYLOR 4T's Grocery TIM TAYLOR 5th Street IGA Sherry Huenemann Minden NE 5th Street IGA William Huenemann Owner Minden NE 99 Ranch Market Tee Jaw 99 Ranch Market Ty Truong A & R Supermarkets Ann Davis Calera AL A & R Supermarkets Bill Davis Partner Calera AL A & R Supermarkets Jan Davis Calera AL A & R Supermarkets Margarita Davis Calera AL A & R Supermarkets Phillip Davis President Calera AL AAIA MICHAEL BARRATT AAIA MICHAEL BARRATT AAIA ARLENE DAVIS Abco Enterprises Adam Sepulveda Manager Ogden VT Abco Enterprises Suzette Sharifan President Ogden VT Accelitec, Inc. Tom Bartz CEO Bellingham WA Accelitec, Inc. Steve Byron VP - Sales Bellingham WA Accelitec, Inc. Christine Schneider Director -Business Development Bellingham WA Accelitec, Inc. Marty Schroder Accelitec Bellingham WA Accelitec, Inc. Edward West Director - Merchant Operations Bellingham WA AccuCode, Inc. Todd Baillie VP Sales & Marketing Centennial CO AccuCode, Inc. John Butler Director of AO: Apps Centennial CO AccuCode, Inc. Robyn Crotty Marketing Coordinator Centennial CO Ace Hardware Corporation Curt DeHart Director New Business Oak Brook IL Ace Hardware Corporation CARLO MORANDO Oak Brook IL Ace Hardware Corporation Mike Smith Grocery Channel Manager Oak Brook IL ACS Chuck Daniel Dir of Corporate Development Nottingham MD Action Retail Services JOHN GILLIS VP BUSINESS DEVELOPMENT FULLERTON CA ADT Teal Hausman Jack of all Trades San Antonio TX ADT Cesar Lopez Sales/Buyer San Antonio TX Advance Pierre David Minx VP Strategic Sourcing Cincinnati OH Advance Pierre Shawn Sparks Director of Strategic Sourcing Enid OK Advance Pierre Mike Zelkind SVP Cincinnati OH Advanced Inventory Solutions Tim Bayer President Grand Rapids MI Advanced Inventory Solutions Richard Heetai Regional Manager Grand Rapids MI Advanced Inventory Solutions Steve Southerington Dir. -

Mac Reseller Newsletter 10-02

The Battle Field Software Mass Merchandisers (Continued) Warehouse Clubs Hardware Computer Super Stores Dillard's 200 Sam's 500 Office Supply Super Stores Rex Stores 130 Costco Wholesale 300 Mass Merchandise/Dept. Stores Radio Shack 6700 B.J.'s Warehouse 110 Consumer Electronic/Buying Groups London Drugs (Canada) 40 Warehouse Club 10 Office Superstores Zellers (Canada) 240 Bookstores Catalog Direct / Internet Retailers Corporate Reseller/Government Consumers Electronic/Buying Groups Warehouse Clubs Mac/Micro Warehouse 1 Catalog Direct Retailers Best Buy 475 Tiger Software 1 Circuit City Stores 620 PC Zone 1 National Distributors & Rack Jobbers J & R Electronics 1 PC Connection 1 The WIZ 17 Educational Resources 1 New Markets Good Guy's 72 Computability 1 Mac Specialists Future Shop (Canada) Scholastic 1 NATM Outpost 1 Software Only ABC Warehouse 38 CyberWarehouse 1 American TV & Appliance 10 Digital River 1 GameStop (including FuncoLand) 800 P.C.Richard 44 American Online 1 Electronic Boutique 820 RC Willey 3 Amazon.com 1 Software Plus 1 Roberds 15 4Sure.com 1 Sound Playground 4 Buy.com (U.S. and Canada) 1 Hardware Retailers American Furniture 3 Onvia.com (Canada) 1 Boscov's 21 ShopTohsiba 1 Computerland 100 Brandsmart USA 5 Dell 1 Micro-Age 150 H.H.Gregg 22 Gateway 1 IE. Group/Connecting Point 200 Cousins 2 Insight 1 PC Warehouse (purchase seperately) 87 Helig-Meyers 1200 AOL 1 Hartco (Canada) 160 Lack’s 10 Hollytron 3 National Distributors Computer Super Stores / Chains A & B Sound (Canada) 22 Ballio’s 2 Ingram Micro Tech Data Comp USA 226 Brick Warehousev (Canada) 64 Navarre Infogrames Micro Center 20 Nebraska Furniture Mart 1 Visco Entertainment EduTech Fry's Electronics 20 Dr.