Technological Tying and the Intensity of Price Competition: an Empirical

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gaming in Libraries by Matthew Cole Introduction

Play your way to the top: Gaming in libraries By Matthew Cole Introduction Video games have come a long way since who have rarely or never played a video Atari’s suite of arcade games was released game to people who have either played on a home console. Children of the first video games for a significant portion of their video game wave have become adults lives, or had many friends who did. These themselves, and according to some counts, new researchers are uncovering deeper this population of first-wave gamers levels of impact and influence than their accounts for approximately 56 million predecessors because people who engage in members of the North American workforce an activity understand it better than those (Beck & Wade, 2004). This is important for who do not. various reasons. First, it shows that people It is important to recognize that video games who play video games are not destined to be facilitate learning rather than. General anti-social, brain-dead, basement hermits; in perception of video gaming ranges between fact, they will enter the workforce proving to those who classify it as solely recreational be as successful and resourceful as their and those who recognize the educational non-gaming counterparts. Secondly, it potential of video games. Both ends of this shows that people who play video games as spectrum touch on core principles of public children and teenagers continue to do so as libraries information and entertainment. adults. Finally, it means that the type of Therefore, this article will look at how video people who are currently researching the games can fit into the mandate and societal effects of gaming have changed from those expectations of a public library. -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for the Nine-Month Period Ended December 2008 (Briefing Date: 2009/1/30) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Consolidated Statements of Income Transition million yen FY3/2005 FY3/2006 FY3/2007 FY3/2008 FY3/2009 Apr.-Dec.'04 Apr.-Dec.'05 Apr.-Dec.'06 Apr.-Dec.'07 Apr.-Dec.'08 Net sales 419,373 412,339 712,589 1,316,434 1,536,348 Cost of sales 232,495 237,322 411,862 761,944 851,283 Gross margin 186,877 175,017 300,727 554,489 685,065 (Gross margin ratio) (44.6%) (42.4%) (42.2%) (42.1%) (44.6%) Selling, general, and administrative expenses 83,771 92,233 133,093 160,453 183,734 Operating income 103,106 82,783 167,633 394,036 501,330 (Operating income ratio) (24.6%) (20.1%) (23.5%) (29.9%) (32.6%) Other income 15,229 64,268 53,793 37,789 28,295 (of which foreign exchange gains) (4,778) (45,226) (26,069) (143) ( - ) Other expenses 2,976 357 714 995 177,137 (of which foreign exchange losses) ( - ) ( - ) ( - ) ( - ) (174,233) Income before income taxes and extraordinary items 115,359 146,694 220,713 430,830 352,488 (Income before income taxes and extraordinary items ratio) (27.5%) (35.6%) (31.0%) (32.7%) (22.9%) Extraordinary gains 1,433 6,888 1,047 3,830 98 Extraordinary losses 1,865 255 27 2,135 6,171 Income before income taxes and minority interests 114,927 153,327 221,734 432,525 346,415 Income taxes 47,260 61,176 89,847 173,679 133,856 Minority interests -91 -34 -29 -83 35 Net income 67,757 92,185 131,916 258,929 212,524 (Net income ratio) (16.2%) (22.4%) (18.5%) (19.7%) (13.8%) - 1 - Nintendo Co., Ltd. -

Playzine Issue 28

NAVIGATE |01 PSP FREE! Issue 28 | May 2009 REVIEWED! PSP FIRST LOOK! DS Phantasy Star Portable The classic role- PS2 PlayZine player hits the PSP! Free Magazine for Handheld and Wii Gamers. Pass it on to your friends and family JAK & DAXTER: Wii THE LOST FRONTIER EXCLUSIVE! The dynamic duo are back! PSP Rabbids Go Home REVIEWED! Wii The manic aliens go it alone. Find out more inside! PES 2009 Now it’s on the Wii, too Wii FIRST LOOK! DS REVIEWED! MOTION-TASTIC! Wii MotionPlus Henry revealed Hatsworth What it does, and the KLONOA Puzzler meets Platform perfection? platformer games you’ll be playing CONTROL NAVIGATE |02 PlayZine Damien McFerran Damien now realises that QUICK FINDER Every game’s just a click away! NINTENDO DS rabbits are in fact mad aliens Henry Hatsworth in The called Rabbids. Bless. Puzzling Adventure CHECK PREVIEWS Sony PSP WelcomeTHIS! Jack & Daxter: Sony PSP There are exciting times NINTENDO WII The Lost Frontier Phantasy Star Portable Dead Space Extraction ahead. Firstly the new Klonoa REVIEWS Spore Hero MotionPlus adaptor could Grand Slam Tennis NINTENDO WII change the way we play Wii Tiger Woods Monsters vs. Aliens PGA Tour 10 PES 2009 games forever, and secondly, there are MOnsters Rabbids Go Home Tenchu some amazing games due out between vs. Aliens now and Christmas. Make sure you stay MORE FREE MAGAZINES! LATEST ISSUES! with us, and we promise to bring you all plus loads the info on the games that matter. more reviews! Dean Mortlock, Editor PES 2009 DON’T MISS [email protected] Phantasy Star Portable THIS! Tenchu Jak & Daxter: Rabbids The Lost Frontier DON’T MISS ISSUE 29 SUBSCRIBE FOR FREE! Go Home Another classic WARNING! MULTIMEDIA DISABLED! series is If you are reading this, then you didn’t choose “Play” heading to PSP! when Adobe Reader asked you about multimedia when you opened the magazine. -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for Fiscal Year Ended March 2011 (Briefing Date: 2011/4/26) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Consolidated Statements of Income Transition million yen FY3/2007 FY3/2008 FY3/2009 FY3/2010 FY3/2011 Net sales 966,534 1,672,423 1,838,622 1,434,365 1,014,345 Cost of sales 568,722 972,362 1,044,981 859,131 626,379 Gross profit 397,812 700,060 793,641 575,234 387,965 (Gross profit ratio) (41.2%) (41.9%) (43.2%) (40.1%) (38.2%) Selling, general, and administrative expenses 171,787 212,840 238,378 218,666 216,889 Operating income 226,024 487,220 555,263 356,567 171,076 (Operating income ratio) (23.4%) (29.1%) (30.2%) (24.9%) (16.9%) Non-operating income 63,830 48,564 32,159 11,082 8,602 (of which foreign exchange gains) (25,741) ( - ) ( - ) ( - ) ( - ) Non-operating expenses 1,015 94,977 138,727 3,325 51,577 (of which foreign exchange losses) ( - ) (92,346) (133,908) (204) (49,429) Ordinary income 288,839 440,807 448,695 364,324 128,101 (Ordinary income ratio) (29.9%) (26.4%) (24.4%) (25.4%) (12.6%) Extraordinary income 1,482 3,934 339 5,399 186 Extraordinary loss 720 10,966 902 2,282 353 Income before income taxes and minority interests 289,601 433,775 448,132 367,442 127,934 Income taxes 115,348 176,532 169,134 138,896 50,262 Income before minority interests - - - - 77,671 Minority interests in income -37 -99 -91 -89 50 Net income 174,290 257,342 279,089 228,635 77,621 (Net income ratio) (18.0%) (15.4%) (15.2%) (15.9%) (7.7%) - 1 - Nintendo Co., Ltd. -

The Game Inspector: a Case Study in Gameplay Preservation

Special issue Preserving Play August 2018 120-148 The Game Inspector: a case study in gameplay preservation James Newman Bath Spa University Abstract : This paper presents the development of the Game Inspector at the National Videogame Arcade (United Kingdom) and the implementation of this device through a case study of Super Mario Bros. This development has been influenced by previous research and ongoing debates about the preservation of the playable experience. Considering the accessibility issues emerging from the difficulty and complexity of video games, I explain the benefits of annotated audiovisual documentation in the context of museum exhibitions. Keywords : Video game preservation, Video game exhibition, Super Mario Bros., National Videogame Arcade On 28 March 2015, the UK’s National Videogame Arcade (NVA) opened its doors to the public. Located in the centre of Nottingham, it is a ‘cultural centre for video games…equal parts art gallery, museum exhibit and educational centre’ (Parkin 2015a). Alongside myriad consoles, computers and Coin-Op cabinets, objects and artefacts specifically collected and donated by The Game Inspector: a case study in gameplay preservation members of the public and industry veterans alike, a new category of interpretative exhibit was unveiled: The Game Inspector. Bespoke devices designed and fabricated by the NVA’s curatorial and engineering teams, the Game Inspectors allow visitors to explore a variety of videogames, investigating their level designs, object and enemy placement, discovering multiple routes and exits, and revealing hidden items, power-ups, secret rooms and even secret stages - with one important twist. All of this discovery and investigation is achieved without actually playing the games themselves. -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for Fiscal Year Ended March 2009 (Briefing Date: 2009/5/8) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Consolidated Statements of Income Transition million yen FY3/2005 FY3/2006 FY3/2007 FY3/2008 FY3/2009 Net sales 515,292 509,249 966,534 1,672,423 1,838,622 Cost of sales 298,115 294,133 568,722 972,362 1,044,981 Gross margin 217,176 215,115 397,812 700,060 793,641 (Gross margin ratio) (42.1%) (42.2%) (41.2%) (41.9%) (43.2%) Selling, general, and administrative expenses 105,653 124,766 171,787 212,840 238,378 Operating income 111,522 90,349 226,024 487,220 555,263 (Operating income ratio) (21.6%) (17.7%) (23.4%) (29.1%) (30.2%) Other income 37,868 70,897 63,830 48,564 32,159 (of which foreign exchange gains) (21,848) (45,515) (25,741) ( - ) ( - ) Other expenses 4,098 487 1,015 94,977 138,727 (of which foreign exchange losses) ( - ) ( - ) ( - ) (92,346) (133,908) Income before income taxes and extraordinary items 145,292 160,759 288,839 440,807 448,695 (Income before income taxes (28.2%) (31.6%) (29.9%) (26.4%) and extraordinary items ratio) (24.4%) Extraordinary gains 1,735 7,360 1,482 3,934 339 Extraordinary losses 1,625 1,648 720 10,966 902 Income before income taxes and minority interests 145,402 166,470 289,601 433,775 448,132 Income taxes 57,962 68,138 115,348 176,532 169,134 Minority interests 24 -46 -37 -99 -91 Net income 87,416 98,378 174,290 257,342 279,089 (Net income ratio) (17.0%) (19.3%) (18.0%) (15.4%) (15.2%) - 1 - Nintendo Co., Ltd. -

SEGA Mega Drive / Genesis Music Interface

On the Development of an Interface Framework in Chipmusic: Theoretical Context, Case Studies and Creative Outcomes by Sebastian Tomczak Submitted in fulfilment of the requirements for the degree of Doctor of Philosophy Elder Conservatorium of Music Faculty of Humanities and Social Sciences The University of Adelaide March, 2011 2 Table of Contents ! " # $ %$$ & ' ! "# $% & ' "( ) " $% ! * + % "" ()*+$,* + -- ,-'* ) . ' // , % // + % /0 ,-'* ) . ' 1 2 ) / , + 3 ()*+ (. + ,-'* ,+ 0 , % ,-'* 0 + % 3( $% ,-'* ,+ 1 2 ) 3 , + 34 '/00+ / * 3## 3 , % 0# + % 0 $% * 3## 1 2 ) 00 , + 4" * ),+ 1.2 3+ 4- '- . + &5 4/ , % 4 + % 43 '- . + &5 1 2 ) 40 , + # ( ( 0 -5 + ( ' ,!#3*6 $5 ,703/4 " * ! 8-9 " !% ,**(# / ! / 3 ## 3!* . 4 ## 31!5 6 & $5 0 (#( : * ) $ 6 (#( : + $ 1 )+ + ;##4< (#" : + $ 1 9 - + ;#(#< (#3 : + $ 1 * ;## #(#< ((# : + $ 1 - = ;##< ((" ## 3 ! (& 4 ,% 1 * 3## ((4 %!%& ))6 # ))7 #" ))7 $!#""# )0( ' )00 ,% 1 &5 (" %!%& )01 # )01 #" )01 $!#""# )03 ,% 1 ,-'* ,+ (3 %!%& )04 # )05 #" )05 $!#""# )06 ' )1( ,% 1 ,-'* ) . ' ("# %!%& )1( # )1) #" )10 $!#""# )11 ' )12 1#&. 4 List of Figures and Tables !%$$ & ' '!7+'/'+# & - !( # 8 + 9" 1 -!& +7+'/'+# & !5$ 8# $& & $ 0: /!5$ 8# $& & $ 40: !;( (;/-4 -

Welcome This Week

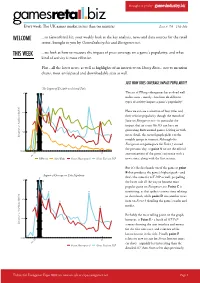

Brought to you by Every week: The UK games market in less than ten minutes Issue 5: 7th - 13th July WELCOME ...to GamesRetail.biz, your weekly look at the key analysis, news and data sources for the retail sector, brought to you by GamesIndustry.biz and Eurogamer.net. THIS WEEK ...we look at how to measure the impact of press coverage on a game's popularity, and what kind of activity is most effective. Plus - all the latest news, as well as highlights of an interview on Heavy Rain... not to mention charts, most-anticipated and downloadable stats as well. JUST HOW DOES COVERAGE IMPACT POPULARITY? The Impact of E3 2009 on Selected Titles #1 The art of PRing videogames has evolved well E3 online now - mostly - but how do different types of activity impact a game's popularity? #10 Here we can see a selection of four titles and their relative popularity though the month of June on Eurogamer.net - in particular the impact that an event like E3 can have on generating buzz around games. Diving in with #100 more detail, the second graph picks out the Eurogamer.net Popularity (Ranked) notable jumps in interest. Although the Eurogamer.net gamespace for Forza 3 existed the previous day, at point A we see the official #1000 Jul announcement of the game's existence with a Jun '09 FIFA 10 Alan Wake Forza Motorsport 3 Gran Turismo PSP news story, along with the first screens. But it's the first hands-on of the game at point B that produces the game's highest peak - and Impact of Coverage on Title Popularity B that's the same for GT PSP as well, propelling #1 E3 the latter title all the way to become most popular game on Eurogamer.net. -

Conduit 2 Takes the War Worldwide

FOR IMMEDIATE RELEASE CONDUIT 2 TAKES THE WAR WORLDWIDE SEGA And High Voltage To Deliver The Most Complete Shooter On Wii LONDON & SAN FRANCISCO (April 31st, 2010) – SEGA® Europe Ltd. and SEGA® of America, Inc. are excited to announce Conduit™ 2, the new collaboration with High Voltage Software, Inc., developer of the award-winning Wii shooter, The Conduit. Conduit 2 will be released exclusively for the Wii™ system from Nintendo® in Fall 2010. Building upon the success of the original, Conduit 2 takes players to the far reaches of the world to stop an alien invasion which can be fought in single-player, online multi-player battles, and all-new off and online co-op modes. Armed with advanced and powerful weapons, players can expect massive action in large, multi-tiered levels featuring dynamic environments, cinematic battles, giant adversaries, and deep customisation features. Conduit 2 introduces Team Invasion Mode, the new co-op mode where players will be able to battle side-by-side with up to four friends on the same screen. Additionally Team Invasion Mode can be played online. Conduit 2 also features a new and more expansive 12-player online competitive multiplayer mode with larger and more intricate indoor and outdoor battlefields. Conduit 2 supports Nintendo Wi-Fi Connection, Wii Speak™ and offers increased multiplayer security. “The Conduit 2 will set a new bar for online multiplayer games on the Wii with great new gameplay modes and improved security. On top of that Conduit 2 features a fantastic new single player adventure that will blow the minds of fans of the original game,” said Gary Knight, European Marketing Director at SEGA Europe. -

000NAG Leipzig Supplement 2008

A FREE NAG SUPPLEMENT ON THE BIGGEST SHOW IN GAMING – SPONSORED BY ELECTRONIC ARTS AND LOOK & LISTEN editor michael james Green-haired jolly giants and [email protected] supplemental grunts geoff burrows dane remendes their stupid questions… art director chris bistline was going to list a whole lot of statistics and seats in the food courts, spend ages in the toilets senior designer chris savides numbers here about the convention and how and by the end of the day are carrying enough big and impressive it was, but this information rubbish from the show fl oor to make a donkey tide media I is terminally boring and ultimately meaningless to choke. I don’t like these people much because they p o box 237 olivedale everyone except executive types. Therefore, here’s get in the way, dominate press events with inane 2158 the light version: the Games Convention is Europe’s questions about release dates and “Will it have co- south africa tel +27 11 704 2679 premier gaming convention. It attracts all the op play?” They also don’t pay attention to what the fax +27 11 704 4120 major players in the business as well as thousands producer or developer is saying… you can almost of journalists from around the world and tens of see them cringe at some of the questions. They thousands of consumers. If you play games and live come from all over Europe; from small, obscure little in Germany, you have to be there. It’s big, it’s fun, and Websites that have a few hundred visitors a week. -

Video Game Design and Interactivity: the Semiotics of Multimedia in Instructional Design

Video Game Design and Interactivity: The Semiotics of Multimedia in Instructional Design Kristopher Blair Alexander A Research-creation Thesis in the Department of Education Presented in Partial Fulfillment of the Requirements For the Degree of Doctor of Philosophy (Education) at Concordia University Montreal, Quebec April 2016 © Kristopher Blair Alexander, 2016 CONCORDIA UNIVERSITY School of Graduate Studies This is to certify that the thesis prepared By: Kristopher Blair Alexander Entitled: Video Game Design and Interactivity: The Semiotics of Multimedia in Instructional Design and submitted in partial fulfillment of the requirements for the degree of Doctor of Philsophy (Educational Technology) complies with the regulations of the University and meets the accepted standards with respect to originality and quality Signed by the Final Examining Committee: ___________________________________ Chair Carolina Cambre ___________________________________ Examiner Giuliana Cucinelli ___________________________________ Examiner Robert M. Bernard ___________________________________ Examiner Juan Carlos Castro ___________________________________ Examiner Jacques Viens ___________________________________ Supervisor Vivek Venkatesh Approved by _____________________________________________________ Richard Schmid, Chair _________________ 2016 __________________________________________ Abstract Video Games and Interactivity: The Semiotics of Multimedia in Instructional Design Kristopher Blair Alexander, Ph.D. Concordia University, 2016 This creation-as-research -

FY 2010 1St Quarter Results

FYFY 20201010 1st1st QuarterQuarter ResultsResults August 3rd, 2009 SEGA SAMMY HOLDINGS INC. [Disclaimer] The contents of this material and comments made during the questions and answers etc of this briefing session are the judgment and projections of the Company’s management based on currently available information. These contents involve risk and uncertainty and the actual results may differ materially from these contents/comments. ※Numbers of plan for the year ended March 30, 2010 on this documents are based on the numbers publicized on May 13, 2009 © SEGA SAMMY HOLDINGS INC. All Rights Reserved. Contents 【FY2010 1st Quarter Results】 FY 2010 1Q Highlight 2 Consolidated Income Statement 3 Cost and Expenses 4 Consolidated Balance Sheet 5 Segment Information 6 Segment Results :Pachislot Pachinko 6 Segment Results :Amusement Machine 10 Segment Results :Amusement Facilities 12 Segment Results :Consumer Business 14 Listed Subsidiaries Results 18 Sammy Networks / SEGA TOYS 19 TAIYO ELEC / TMS Entertainment 20 Appendix 22 -1- © SEGA SAMMY HOLDINGS INC. All Rights Reserved. Highlights ・Net Sales:60.4 Billion, Operating loss:7.8 Billion (8.5 Billion), Net loss:10.2 Billion (10.9 Billion) Net Sales・Profits *Numbers shown in parentheses are based on previous accounting policy ・Decreased sales, but operating loss shrunk year on year, in line with plan ⇒No adjustment to interim and full year plan ・Increased sales and decreased operating loss compare to prior period ・Pachislot unit sales :With no launch of new titles planned during the 1Q, Overall