London Council Directory of Members

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

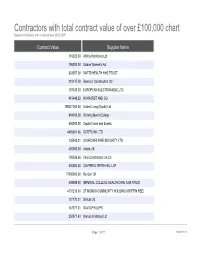

Contractors with Total Contract Value of Over £100,000 Chart Based on Contracts with a Value of Over 5000 GBP

Contractors with total contract value of over £100,000 chart Based on Contracts with a value of over 5000 GBP Contract Value Supplier Name 116325.00 Affinity Workforce Ltd 796000.00 Solace Women's Aid 323557.00 BARTS HEALTH NHS TRUST 210147.00 Boxmoor Construction Ltd 107420.30 EUROPEAN ELECTRONIQUE LTD 415448.22 HAYHURST AND CO 198221000.00 United Living (South) Ltd 894000.00 Working Men's College 450000.00 Capita Travel and Events 4405561.66 CATERLINK LTD 135545.21 CHURCHES FIRE SECURITY LTD 400000.00 Artelia UK 105036.66 Vinci Construction Uk Ltd 500000.00 CAMPBELL REITH HILL LLP 17000000.00 Re-Gen UK 408098.00 IMPERIAL COLLEGE HEALTHCARE NHS TRUST 4707213.00 ST MUNGO COMMUNITY HOUSING (GRIFFIN HSE) 131176.21 Softcat Ltd 147371.31 DAVID PHILLIPS 250971.43 Marcus & Marcus Ltd Page 1 of 22 10/02/2021 Contractors with total contract value of over £100,000 chart Based on Contracts with a value of over 5000 GBP 136044.00 CENTRAL & CECIL 198667.55 GODWIN & CROWNDALE TMC LTD 288142.90 PRICEWATERHOUSECOOPERS 494918.96 APEX HOUSING SOLUTIONS 425000.00 Rick Mather Architects LLP 148855.40 Alderwood LLA Ltd - Irchester 2 821312.26 Falcon Structural Repairs 1169203.00 Ark Build PLC 103675.37 MANOR HOSTELS (LONDON) LTD 319608347.72 VEOLIA ENVIRONMENTAL SERVICES (UK) PLC 299532.76 CASTLEHAVEN COMMUNITY ASSOC. 207757.50 PERSONALISATION SUPPORT IN CAMDEN 12000000.00 AD Construction Group 678874.77 St Johns Wood - Lifestyle Care (2011) PLC 424893.63 INSIGHT DIRECT (UK) LTD 150366.19 HOLLY LODGE ESTATE COMMITTEE 114136.63 SPECIALIST COMPUTER CENTRES 943735.13 Mihomecare 4800000.00 Turner & Townsend Project Management Ltd 140000000.00 Volkerhighways 233048.00 KPMG 1150000.00 LONDON DIOCESAN BOARD FOR SCHOOLS Page 2 of 22 10/02/2021 Contractors with total contract value of over £100,000 chart Based on Contracts with a value of over 5000 GBP 302480.00 DAISY DATA CENTRE SOLUTIONS LTD 30000000.00 Eurovia Infrastructure 140126.15 DAWSONRENTALS BUS & COACH LTD 261847.08 ST MARTIN OF TOURS HOUSING ASSOC. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

South East Maidstone Urban Extension Review of Cashflow Model and Viability

South East Maidstone Urban Extension Review of cashflow model and viability Prepared on behalf of Golding Homes 20 April 2012 Final DTZ 125 Old Broad Street London EC2N 2BQ PRIVATE & CONFIDENTIAL www.dtz.com Review of cashflow model and viability | Golding Homes Contents 1 Introduction 4 1.1 Basis of Instruction 4 2 Golding Homes Financial Model Structure 5 2.1 Key Scheme Details 5 2.2 The Financial Model 6 3 Review of Revenue Assumptions 8 3.1 Revenue 8 3.1.1 Market Sale Housing 8 3.1.2 Affordable Housing 9 3.2 Future House Prices, Absorption and Sales Rates 10 3.2.1 Assumptions about Sales/ Build Out Rates 11 3.3 New Homes Bonus 12 3.4 Current Housing Land Supply 12 4 Review of Cost Assumptions 14 4.1 Cost 14 4.1.1 Unit Sizes 14 4.1.2 Build Costs 14 4.1.3 Code for Sustainable Homes 15 4.1.4 Cost Inflation 15 4.2 On Costs 16 4.3 Planning Contributions (CIL & s106) 17 4.4 Finance Rate 18 4.5 Infrastructure Costs 19 4.6 Land Value 20 4.7 Profit 20 5 Scenario Analysis 22 6 Summary 24 6.1 Delivery Structure 24 6.2 Financial Returns 24 Final 2 Review of cashflow model and viability | Golding Homes Status of Report and Limitations This report contains information which may be commercially sensitive if released. Circulation should be limited to appropriate individuals within Golding Homes. The contents of this report are confidential to Golding Homes in the context in which the report is supplied and DTZ expressly disclaims any responsibility towards third parties in respect of the whole or any part of its contents. -

Solucom No. 5 Among IT Consulting Firms in France

Press release Paris, 17 June 2009 Solucom no. 5 among IT consulting firms in France The latest survey by Pierre Audouin Consultants (PAC), under the title “IT Consulting and Management Market, outlook 2008-2012”, published in May 2009, places Solucom no. 5 among IT consulting firms in France. A year ahead of target, Solucom has achieved its ambition of becoming one of the top 5 IT consulting firms by 2010, and has thus acquired a new status as one of the leading players in consulting. Solucom up there with the biggest names in IT consulting With a turnover estimated by PAC at € 94M in IT consulting in 2008, Solucom is in 5th position in the new rankings published by PAC. Ranked 9th in 2006 and 7th in 2007, Solucom has worked itself up to be alongside the biggest names in IT consulting, IBM, Capgemini, Logica and Accenture. 2008 figures Rank Firm Country of origin (€ million) 1 IBM US 194 2 Capgemini FR 173 3 Logica UK 151 4 Accenture US 139 5 Solucom FR 94 6 CSC US 90 7 Sopra Group FR 66 8 Orange Business Services FR 57 9 BearingPoint US 44 10 Atos Origin FR 41 Top 10 IT consulting firms in France (Source : PAC, May 2009) 2008: a change of status Solucom posted a turnover of € 101.9M for its fiscal year ending 31 March 2009. The sales successes achieved during the period together with the acquisition of Cosmosbay~Vectis have let the firm change its scale of operations. With 966 employees at end March 2009 Solucom is close to the 1,000 mark for staff it had initially targeted for 2010. -

EMPIRIC STUDENT PROPERTY PLC September 2016 AGENDA and PRESENTATION TEAM

EMPIRIC STUDENT PROPERTY PLC September 2016 AGENDA AND PRESENTATION TEAM Section Page Tim Attlee, MRICS – Founder and CIO Focus on student residential sector since 2009 The UK Student Jointly responsible for the acquisition, development 3 and investment management activities Accommodation Market Held senior roles at Knight Frank Qualified chartered surveyor Company Overview and 6 Highlights THE UK STUDENT ACCOMMODATION MARKET THE UK STUDENT ACCOMMODATION MARKET There are four key trends driving the growth in the purpose built student accommodation (“PBSA”) market The UK population is increasing, putting pressure on housing UK Population Projections (m) 75 70 65 60 55 2000 2004 2008 2012 2016 2020 2024 2028 2032 2036 2040 Source: ONS Local authorities are cutting back on HMOs Given the pressure on housing throughout the UK, local authorities have been attempting to move students out of the traditional “House in multiple occupation” (“HMO”) into PBSAs to provide more housing space for families and workers Source: Arcadis/EC Harris THE UK STUDENT ACCOMMODATION MARKET (CONT’D) Student numbers in the UK are growing at a strong rates Growth in student acceptances for Sept 2015 over Sept 2014 11.0% 3.9% 3.6% 1.9% All Students UK Students EU Students International Students Source: ONS (Non-EU) University owned housing stock is of poor quality "As New" Refurbishment Current university owned PBSA stock is of poor 57,122 quality. Of the 324,532 student beds owned by needed 267,410 universities, only 57,122 are “as new” with the remainder in need of refurbishment or replacement THE UK STUDENT ACCOMMODATION MARKET Demand for UK Higher Education to UK Higher Education keep rising Applicants vs. -

A Forensic Analysis of Security Events on System Z, Without the Use Of

16898: A Forensic Analysis of Security Events on System z, Without the Use of SMF Data Brian Marshall Vice President, Research and Development Vanguard Integrity Professionals Monday March 2, 2015 Insert Custom Session QR if Desired. Well, today it’s all about data! So, where is your data today? Wherever you are……. Your data on the move with tablets…. …and oh so many devices! Is your data in the cloud? In the hands of criminals? In the hands of other nations? In the hands of some government agency? We hear it every day! Because the truth is…. You are about to be compromised OR You have already been compromised Maybe you have better security…… The web became significantly more malicious, both as an attack vector and as the primary support element of other trajectories (i.e. social, mobile, e- mail, etc.). Attack Statistics Biggest IT Myths • Hey, it won’t happen to us! • Buy this tool <insert tool here> and it will solve all of your problems. • Let’s get the policy in place and we are good to go. • I passed my IT audit, I must be secure. Their M.O. The cyber spies typically enter targeted computer networks through “spearfishing” attaches, in which company official receives a creatively disguised email and it tricked into clicking on a link or attachment that then opens a secret door for hackers. They can’t get to me, I’m secure. • Hackers go after suppliers to get into larger companies. • Smaller companies tend not to have the funding, staff, or knowledge need to formalize – let alone maintain – more secure policies and procedures all combining to make them the path of least resistance….and the bad guys have discovered this. -

IDC Marketscape Names Accenture a Digital Strategy Leader | Accenture

IDC MarketScape IDC MarketScape: Worldwide Digital Strategy Consulting Services 2021 Vendor Assessment Douglas Hayward IDC MARKETSCAPE FIGURE FIGURE 1 IDC MarketScape Worldwide Digital Strategy Consulting Services Vendor Assessment Source: IDC, 2021 June 2021, IDC #US46766521 Please see the Appendix for detailed methodology, market definition, and scoring criteria. IDC OPINION This study represents the vendor assessment model called IDC MarketScape. This research is a quantitative and qualitative assessment of the characteristics that explain a vendor's current and future success in the digital strategy consulting services marketplace. This study assesses the capabilities and business strategies of 13 prominent digital strategy consulting services vendors. This evaluation is based on a comprehensive framework and a set of parameters expected to be most conducive to success in providing digital strategy consultancy. A significant component of this evaluation is the inclusion of digital strategy consulting buyers' perception of both the key characteristics and the capabilities of these providers. This client input was provided primarily from the vendors' clients, supplemented with a worldwide survey. Key findings include: . Consultancies are getting the basics right. Reference clients that IDC spoke with were impressed by the quality of the people from the leading digital strategy consultancies. On average, reference clients gave consultancies highest scores for people quality, action orientation, and client-specific insight. This indicates that digital strategy consultancies are getting the basics right — they are recruiting smart and empathetic people and are training and developing them well, they are getting to know their clients inside out, and they are producing very useful advice as a result. Clients want to be challenged more than ever by their digital strategy consultants. -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

Integrated Virtual Ethernet Adapter Technical Overview and Introduction

Front cover Integrated Virtual Ethernet Adapter Technical Overview and Introduction Unique and flexible up to 10 Gbps Ethernet industry standard virtualizable network solution Hardware accelerated for improved throughput Configurable connections between LPARs and the physical network without the Virtual I/O Server Laurent Agarini Giuliano Anselmi ibm.com/redbooks Redpaper International Technical Support Organization Integrated Virtual Ethernet Adapter Technical Overview and Introduction October 2007 REDP-4340-00 Note: Before using this information and the product it supports, read the information in “Notices” on page v. First Edition (October 2007) This edition applies to IBM AIX Version 6, Release 1, the IBM System p 570, 560, 550, and 520, and the Hardware Management Console Version 7. © Copyright International Business Machines Corporation 2007. All rights reserved. Note to U.S. Government Users Restricted Rights -- Use, duplication or disclosure restricted by GSA ADP Schedule Contract with IBM Corp. Contents Notices . .v Trademarks . vi Preface . vii The team that wrote this paper . vii Become a published author . viii Comments welcome. viii Chapter 1. Integrated Virtual Ethernet adapter overview . 1 1.1 Introduction . 2 1.2 Advanced hardware features . 3 1.3 Virtualization features . 3 1.3.1 Virtualized logical ports . 3 1.3.2 Physical ports and system integration. 4 1.4 System p virtualization review. 7 1.4.1 Virtualization features and options . 7 1.5 IVE and Virtual I/O Server positioning. 9 Chapter 2. Integrated Virtual Ethernet architecture. 11 2.1 Architecture introduction . 12 2.2 Logical and physical components . 13 2.2.1 IVE logical component introduction. 13 2.2.2 IVE and physical, logical, and port groups . -

A Comparative Study of Construction Cost and Commercial Management Services in the UK and China

PERERA, S., ZHOU, L., UDEAJA, C., VICTORIA, M. and CHEN, Q. 2016. A comparative study of construction cost and commercial management services in the UK and China. London: RICS. A comparative study of construction cost and commercial management services in the UK and China. PERERA, S., ZHOU, L., UDEAJA, C., VICTORIA, M. and CHEN, Q. 2016 © 2016 Royal Institution of Chartered Surveyors. This document was downloaded from https://openair.rgu.ac.uk Research May 2016 A Comparative Study of Construction Cost and Commercial Management Services in the UK and China 中英工程造价管理产业比较研究 GLOBAL/APRIL 2016/DML/20603/RESEARCH GLOBAL/APRIL rics.org/research A Comparative Study of Construction Cost and Commercial Management Services in the UK and China 中英工程造价管理产业比较研究 rics.org/research Report for Royal Institution of Chartered Surveyors Report written by: Prof. Srinath Perera PhD MSc IT BSc (Hons) QS MRICS AAIQS Chair in Construction Economics [email protected] kimtag.com/srinath Dr. Lei Zhou Senior Lecturer Dr. Chika Udeaja Senior Lecturer Michele Victoria Researcher Northumbria University northumbria-qs.org Prof. Qijun Chen Director of Human Resource Department, Shandong Jianzhu University RICS Research team Dr. Clare Eriksson FRICS Director of Global Research & Policy [email protected] Amanprit Johal Funded by: Global Research and Policy Manager [email protected] Published by the Royal Institution of Chartered Surveyors (RICS) RICS, Parliament Square, London SW1P 3AD www.rics.org The views expressed by the authors are not necessarily those of RICS nor any body connected with RICS. Neither the authors, nor RICS accept any liability arising from the use of this publication. -

Global Construction Disputes: a Longer Resolution

Global Construction Disputes Report 2013 Global Construction Disputes: A Longer Resolution echarris.com/contractsolutions Introduction Executive summary This is our third annual report into the construction The key finding of this year’s report into global disputes market. I hope that you will find it to be a construction disputes is that disputes are taking helpful commentary into the regional trends and longer to resolve. insights into a global industry that is often difficult to quantify. Overall, they are now taking over a year to resolve, with the average length of time for a dispute to last in 2012 Overall, this year’s report finds that disputes are taking being 12.8 months, compared to 10.6 months in 2011. longer to resolve and the causes are linked to many different This continues the trends for longer disputes - in 2010 factors, including: disputes were taking 9.1 months to resolve. ■ Disputes that are not settled through negotiation tend Whilst dispute durations are getting longer, the value of to indicate a polarisation of interests, and are likely to disputes was broadly stable in 2012. The average value only contain the most complex of issues; of global construction disputes in 2012 was US$31.7 million, down slightly from US$32.2 million in 2011. ■ Multi-geography, mixed cultures and the need to consult and engage with head offices can prolong the time it takes Longer disputes times – a global trend for a dispute to be concluded; The average length of disputes rose across Asia, the ■ Projects are increasing in complexity and so the issues Middle East and the UK. -

Graham Allison 格雷厄姆·艾利森

Graham Allison Douglas Dillon Professor of Government, Harvard Kennedy School 格雷厄姆·艾利森 哈佛肯尼迪学院道格拉斯-狄龙政府学教授 Graham Allison is the Douglas Dillon Professor of Government at Harvard University where he has taught for five decades. Dr. Allison is a leading analyst of national security with special interests in nuclear weapons, Russia, China, and decision-making. He was the “Founding Dean” of Harvard’s John F. Kennedy School of Government, and until 2017, served as Director of its Belfer Center for Science and International Affairs which is ranked the “#1 University Affiliated Think Tank” in the world. As Assistant Secretary of Defense in the first Clinton Administration, Dr. Allison received the Defense Department's highest civilian award, the Defense Medal for Distinguished Public Service, for "reshaping relations with Russia, Ukraine, Belarus, and Kazakhstan to reduce the former Soviet nuclear arsenal." This resulted in the safe return of more than 12,000 tactical nuclear weapons from the former Soviet republics and the complete elimination of more than 4,000 strategic nuclear warheads previously targeted at the United States and left in Ukraine, Kazakhstan, and Belarus when the Soviet Union disappeared. As Assistant Secretary of Defense under President Clinton and Special Advisor to the Secretary of Defense under President Reagan, he has been a member of the Secretary of Defense’s Advisory Board for every Secretary from Weinberger to Mattis. He has the sole distinction of having twice been awarded the Distinguished Public Service Medal, first by Secretary Cap Weinberger and second by Secretary Bill Perry. He has served on the Advisory Boards of the Secretary of State, Secretary of Defense, and the Director of the CIA.