How to Make Long- Distance Work

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Issue 185 Feb 2020 SPECIAL FEATURE on HOW the LATEST

Issue 185 ● Feb 2020 www.railfuture.org.uk/East+Anglia twitter.com/RailfutureEA Railfuture campaigns for better services over a bigger railway (passengers + freight) Join us for £20 per year www.railfuture.org.uk/join SPECIAL FEATURE ON HOW THE LATEST TRAIN TECHNOLOGY CAN BENEFIT PASSENGERS Image reproduced courtesy of Petards Rail Technology— www.petards.com Inside this edition of RAIL EAST... • East West Rail - Progress at last! • Station footfall for 2018/19 • Look back over last 10 years • Easy Stations — the winners • What we expect in the next 10 • A giant leap for train technology • Cambridge South consultation • Whittlesford audit improvements RAIL EAST 185 — FEBRUARY 2020 Railfuture East Anglia www.railfuture.org.uk TOPICS COVERED IN THIS ISSUE OF RAIL EAST In this issue’s 24 pages we have fewer (but longer) articles than last time and only five authors. Contributions are welcome from readers. Contact info on page 23. Chair’s thoughts – p.3 Easy Stations winners announced – plus how do our stations compare with Germany’s? And a snapshot of progress with platform development work at Stevenage East West Rail big announcement (1) – p.5 Preferred route for the central section is finally published – now the serious work begins East West Rail big announcement (2) – p.7 Progress on the western section, as Transport & Works Order is published and work on the ground is set to start Another critical consultation – Cambridge South – p.8 Momentum builds on this key item of passenger infrastructure – Railfuture’s wish- list for the new station -

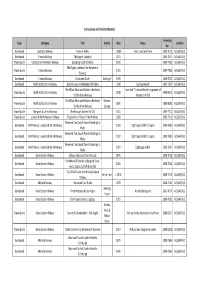

Serial Asset Type Active Designation Or Undertaking?

Serial Asset Type Active Description of Record or Artefact Registered Disposal to / Date of Designation, Designation or Number Current Designation Class Designation Undertaking? Responsible Meeting or Undertaking Organisation 1 Record YES Brunel Drawings: structural drawings 1995/01 Network Rail 22/09/1995 Designation produced for Great Western Rly Co or its Infrastructure Ltd associated Companies between 1833 and 1859 [operational property] 2 Disposed NO The Gooch Centrepiece 1995/02 National Railway 22/09/1995 Disposal Museum 3 Replaced NO Classes of Record: Memorandum and Articles 1995/03 N/A 24/11/1995 Designation of Association; Annual Reports; Minutes and working papers of main board; principal subsidiaries and any sub-committees whether standing or ad hoc; Organisation charts; Staff newsletters/papers and magazines; Files relating to preparation of principal legislation where company was in lead in introducing legislation 4 Disposed NO Railtrack Group PLC Archive 1995/03 National Railway 24/11/1995 Disposal Museum 5 YES Class 08 Locomotive no. 08616 (formerly D 1996/01 London & 22/03/1996 Designation 3783) (last locomotive to be rebuilt at Birmingham Swindon Works) Railway Ltd 6 Record YES Brunel Drawings: structural drawings 1996/02 BRB (Residuary) 22/03/1996 Designation produced for Great Western Rly Co or its Ltd associated Companies between 1833 and 1859 [Non-operational property] 7 Record YES Brunel Drawings: structural drawings 1996/02 Network Rail 22/03/1996 Designation produced for Great Western Rly Co or its Infrastructure -

Can Competition for and in the Market Co-Exist in Terms of Delivering Cost Efficient Services? Evidence from Open Access Train O

Transportation Research Part A 113 (2018) 114–124 Contents lists available at ScienceDirect Transportation Research Part A journal homepage: www.elsevier.com/locate/tra Can competition for and in the market co-exist in terms of delivering cost efficient services? Evidence from open access train T operators and their franchised counterparts in Britain ⁎ Phill Wheata, , Andrew S.J. Smitha, Torris Rasmussenb a Institute for Transport Studies, University of Leeds, UK b Norwegian Railway Directorate, Norway ARTICLE INFO ABSTRACT Keywords: This paper aims to inform an important policy debate in Europe on how best to open up pas- Returns to density senger rail markets to increased competition: and specifically, whether to allow open access train Competition-in-the-market operators alongside franchised (tendered) operators. The paper utilises new British data to Competition-for-the-market analyse the cost side of this debate. Our data is unique in that we have cost data by route level for both the incumbent (corresponding to British franchises) and the open access operators, as op- posed to only having cost data on the incumbent at the network level as in other countries. The open access operators are found to have comparable unit costs to franchised operators. This is unexpected considering the significant returns to density that benefit the larger franchised op- erators. This is subsequently found to be due to lower input prices and an ‘open access business model’ effect that outweigh any density disadvantages. Overall we find that there are negligible cost disadvantages of allowing open access operators to compete with franchised intercity op- erators. -

Leeds Thesis Template

Understanding the Relationship Between Capacity Utilisation and Performance and the Implications for the Pricing of Congested Rail Networks John Alexander Haith Submitted in accordance with the requirements for the degree of Doctor of Philosophy The University of Leeds Institute for Transport Studies February, 2015 - ii - The candidate confirms that the work submitted is his own, except where work which has formed part of jointly-authored publications has been included. The contribution of the candidate and the other authors to this work has been explicitly indicated below. The candidate confirms that appropriate credit has been given within the thesis where reference has been made to the work of others. Elements of the work contained in this thesis have previously appeared in the published paper:- Haith, J., Johnson, D. and Nash, C. 2014.The Case for Space: the Measurement of Capacity Utilisation, its Relationship with Reactionary Delay and the Calculation of the Capacity Charge for the British Rail Network. Transportation Planning and Technology 37 (1) February 2014 Special Issue: Universities’ Transport Study Group UK Annual Conference 2013. Where there is specific use of the contents of the above paper in this thesis reference is made to it in the appropriate part of the text. However, general use of the work contained in the paper is particularly made in Chapter 5 (Methodology), Chapter 6 (The Data Set) and Chapter 7 (Results). It should also be noted that all research and analysis contained in this thesis (and the paper) was conducted by the candidate. Secondly, substantial additional analysis was conducted between the finalisation of the paper and the writing of this thesis meaning that the results of the research have expanded significantly. -

Competitive Tendering of Rail Services EUROPEAN CONFERENCE of MINISTERS of TRANSPORT (ECMT)

Competitive EUROPEAN CONFERENCE OF MINISTERS OF TRANSPORT Tendering of Rail Competitive tendering Services provides a way to introduce Competitive competition to railways whilst preserving an integrated network of services. It has been used for freight Tendering railways in some countries but is particularly attractive for passenger networks when subsidised services make competition of Rail between trains serving the same routes difficult or impossible to organise. Services Governments promote competition in railways to Competitive Tendering reduce costs, not least to the tax payer, and to improve levels of service to customers. Concessions are also designed to bring much needed private capital into the rail industry. The success of competitive tendering in achieving these outcomes depends critically on the way risks are assigned between the government and private train operators. It also depends on the transparency and durability of the regulatory framework established to protect both the public interest and the interests of concession holders, and on the incentives created by franchise agreements. This report examines experience to date from around the world in competitively tendering rail services. It seeks to draw lessons for effective design of concessions and regulation from both of the successful and less successful cases examined. The work RailServices is based on detailed examinations by leading experts of the experience of passenger rail concessions in the United Kingdom, Australia, Germany, Sweden and the Netherlands. It also -

Class 150/2 Diesel Multiple Unit

Class 150/2 Diesel Multiple Unit Contents How to install ................................................................................................................................................................................. 2 Technical information ................................................................................................................................................................. 3 Liveries .............................................................................................................................................................................................. 4 Cab guide ...................................................................................................................................................................................... 15 Keyboard controls ...................................................................................................................................................................... 16 Features .......................................................................................................................................................................................... 17 Global System for Mobile Communication-Railway (GSM-R) ............................................................................. 18 Registering .......................................................................................................................................................................... 18 Deregistering - Method 1 ............................................................................................................................................ -

St.Paul's Church, Hills Rd, Cambridge Is the New Venue for Our Next Branch Meeting on Saturday, 7 December at 14.00 Hrs

ISSUE160 December 2013 Internet at www.railfuture.org.uk www.railfuture.org.uk/east html St.Paul's Church, Hills Rd, Cambridge is the new venue for our next Branch Meeting on Saturday, 7 December at 14.00 hrs. The main topic will be Cambridge Railway Station and its development within the larger scheme for CB1 submitted by Brookgate Developments. Our Guest Speaker will Geraint Hughes of Greater Anglia Railways with, hopefully, contributions from a representative of Brookgate. There will be plenty of opportunity for questions. The focus will not be on the Brookgate scheme per se, but on its relationship to the railway and its customers. So do join us for what promises to be a stimulating meeting. 1 NEWS Halesworth Station Footfall Count 2013 Railfuture East Anglia joined up with the East Suffolk Travellers' Association at Halesworth Station on October 17th to count the passengers using trains and buses from the station, Reports, Mike Farahar. The numbers were up an impressive 43% compared to the same time last year following the introduction of an hourly train service on the northern part of the Ipswich to Lowestoft line following investment in the passing loop at Beccles, and the improvements to the bus service between Halesworth and Southwold. Every train was surveyed,from 05.56 to 23.10 and 337 passengers boarded or alighted, compared to 235 in 2012. The number of bus transfers was also encouraging but would benefit from additional advertising including marketing the possibility of using the bus from Bungay as a feeder service into the trains. -

Britain's Rail Delivery Group, Comprising the Chief Executives of the Rail Owning Groups, Freight Operators and Network Rail T

Written evidence from the Rail Delivery Group (ROR 01) 1. This is the response of the Rail Delivery Group (RDG) to the Transport Select Committee’s call for evidence on the reform of the railways. 2. The RDG welcomes the Government’s support for the RDG contained in the Command Paper ‘Reforming our Railways: Putting the Customer First’, which was published today. The Paper calls on the Rail Delivery Group to provide leadership to the industry and to respond to the Government’s strategic challenges. The Command Paper lays out the Government’s vision for an expanding and efficient railway that meets the needs of passengers, freight users and taxpayers. The Government sees the Rail Delivery Group leading the industry in driving up efficiency and demand for the railway. This is a challenge that the Group accepts. 3. The Command Paper calls on the Rail Delivery Group to lead the rail industry in working together to deliver a more efficient, more affordable railway. The Rail Delivery Group is pleased that the Government has recognised that the Group is taking and shaping the industry’s agenda for a sustained programme of improved management and running of the rail network. 4. The Command Paper lists the six priority areas being addressed by the Group • Asset, programme and supply chain management; • Contractual and regulatory reform; • Technology, innovation and working practices; • Train utilisation; • A whole-system approach; and • Industry planning 5. The Rail Delivery Group was created to unlock efficiencies that will improve Britain’s railways. In its first nine months the Group has identified opportunities for a range of savings, for example in asset management through earlier involvement of the operators in planning work on the network. -

Publicity Material List

Early Guides and Publicity Material Inventory Type Company Title Author Date Notes Location No. Guidebook Cambrian Railway Tours in Wales c 1900 Front cover not there 2000-7019 ALS5/49/A/1 Guidebook Furness Railway The English Lakeland 1911 2000-7027 ALS5/49/A/1 Travel Guide Cambrian & Mid-Wales Railway Gossiping Guide to Wales 1870 1999-7701 ALS5/49/A/1 The English Lakeland: the Paradise of Travel Guide Furness Railway 1916 1999-7700 ALS5/49/A/1 Tourists Guidebook Furness Railway Illustrated Guide Golding, F 1905 2000-7032 ALS5/49/A/1 Guidebook North Staffordshire Railway Waterhouses and the Manifold Valley 1906 Card bookmark 2001-7197 ALS5/49/A/1 The Official Illustrated Guide to the North Inscribed "To Aman Mosley"; signature of Travel Guide North Staffordshire Railway 1908 1999-8072 ALS5/29/A/1 Staffordshire Railway chairman of NSR The Official Illustrated Guide to the North Moores, Travel Guide North Staffordshire Railway 1891 1999-8083 ALS5/49/A/1 Staffordshire Railway George Travel Guide Maryport & Carlisle Railway The Borough Guides: No 522 1911 1999-7712 ALS5/29/A/1 Travel Guide London & North Western Railway Programme of Tours in North Wales 1883 1999-7711 ALS5/29/A/1 Weekend, Ten Days & Tourist Bookings to Guidebook North Wales, Liverpool & Wirral Railway 1902 Eight page leaflet/ 3 copies 2000-7680 ALS5/49/A/1 Wales Weekend, Ten Days & Tourist Bookings to Guidebook North Wales, Liverpool & Wirral Railway 1902 Eight page leaflet/ 3 copies 2000-7681 ALS5/49/A/1 Wales Weekend, Ten Days & Tourist Bookings to Guidebook North Wales, -

Drucksache 19/27457 19

Deutscher Bundestag Drucksache 19/27457 19. Wahlperiode 10.03.2021 Antwort der Bundesregierung auf die Kleine Anfrage der Abgeordneten Torsten Herbst, Frank Sitta, Oliver Luksic, weiterer Abgeordneter und der Fraktion der FDP – Drucksache 19/26671 – Entwicklung der wirtschaftlichen Lage der Arriva PLC Vorbemerkung der Fragesteller Im Jahr 2010 hat die Deutsche Bahn AG (DB AG) für rund 2,7 Mrd. Euro in- klusive der Übernahme vorhandener Schulden das britische Unternehmen Ar- riva PLC erworben. Mit Sitz in Sunderland betreibt Arriva in mehreren euro- päischen Ländern Bus- und Bahnverkehre. Zunächst galt das Unternehmen als wirtschaftliche attraktive Akquisition für die DB AG. So erwirtschaftete Arri- va Anfang der 2010er-Jahre mit rund 50 000 Mitarbeitern einen Jahresumsatz von mehr als 5 Mrd. Euro. (https://www.handelsblatt.com/26044118.html) Vor dem Hintergrund der immer weiter steigenden Schuldenlast des DB-Konzerns unternahm der DB-Vorstand im Jahr 2019 zunächst den Versuch, Arriva zu verkaufen. Zu diesem Zeitpunkt beliefen sich die Schulden der DB AG, auch aufgrund neuer Bilanzierungsvorgaben, auf 25 Mrd. Euro. Geplant war zu- nächst, durch den Komplettverkauf bis zu vier Mrd. Euro einzunehmen. Im weiteren Verlauf des Jahres 2019 scheiterte der Verkaufsversuch jedoch. Medienberichten war zu diesem Zeitpunkt zu entnehmen, dass dem DB- Aufsichtsrat die von Investoren genannten Angebote zu niedrig gewesen sei- en. So sollte zumindest der ursprüngliche Kaufpreis von rund 3 Mrd. Euro durch den Verkauf erzielt werden (https://www.spiegel.de/wirtschaft/unterneh men/arriva-und-brexit-deutsche-bahn-blaest-boersengang-bei-britischer-tochte r-ab-a-1292544.html). Da ein solches Angebot nicht vorlag, entschied die DB AG daraufhin, Arriva im Jahr 2020 an die Börse zu bringen. -

Performance Monitoring Report on NATIONAL RAIL

Performance monitoring report on NATIONAL RAIL PASSENGER SERVICES IN THE LONDON AREA Quarter 1 2002-03 (April to June 2002) Prepared by LTUC Research and Policy Team 6 Middle Street London EC1A 7JA October 2002 CONTENTS Section 1 Public performance measure (PPM) Section 2 Lost minutes Section 3 National passenger survey (NPS) (not reported this quarter) Section 4 Passengers in excess of capacity (PIXC) (not reported this quarter) Section 5 Passenger complaints (not reported this quarter) Section 6 Impartial retailing survey (not reported this quarter) Section 7 Glossary and definitions Annex A PPM results for Quarter 1 2001-02 (table) Annex B PPM results for Quarter 1 2001-02 (chart) Annex C 3-year PPM trends – all trains (chart) Annex D 3-year PPM trends – London and south east peak trains (chart) Annex E Lost minutes – Quarter 1 2002-03 (table) Annex F NPS results (not reported this quarter) Annex G Narrative commentaries supplied by the following operators : c2c, Chiltern, Connex South Eastern, First Great Eastern, Gatwick Express, Silverlink, South West Trains, Thameslink, West Anglia Great Northern, Anglia, First Great Western, Great North Eastern, Midland Mainline and Virgin West Coast. OVERVIEW OF QUARTER • Reliability of most London and south east operators has continued to improve but was still below the levels reached prior to the aftermath of the Hatfield derailment. • Wide variations between operators continued, ranging from 9% of trains delayed or cancelled to 24%. • Nearly all operators performed relatively well in weekday peaks, with only a slight decrease on c2c, First Great Eastern and Silverlink. • Longer-distance operators’ performance was 1.5% better than in the previous year and 2% better than in the preceding quarter. -

Invitation to Tender

Greater Anglia Franchise - Invitation to Tender Greater Anglia Franchise Invitation to Tender 21 April 2011 Page 1 Greater Anglia Franchise - Invitation to Tender TABLE OF CONTENTS IMPORTANT NOTICE................................................................................................................................................... 4 SECTION 1: INTRODUCTION AND CONTEXT ................................................................................................ 6 1.1 PURPOSE OF THIS INVITATION TO TENDER ....................................................................................................... 6 1.2 SCOPE OF THE GREATER ANGLIA FRANCHISE .................................................................................................. 6 1.3 THE DEPARTMENT'S OBJECTIVES FOR THE GREATER ANGLIA FRANCHISE....................................................... 6 1.4 CLOSING DATE FOR BIDS.................................................................................................................................. 6 SECTION 2: INFORMATION AND INSTRUCTIONS TO BIDDERS............................................................... 7 2.1 FRANCHISING TIMETABLE AND PROCESS ......................................................................................................... 7 2.2 RESTRICTION ON COMMUNICATIONS/PRESS RELEASES ETC DURING FRANCHISE COMPETITION ...................... 7 2.3 CHANGES IN CIRCUMSTANCES ........................................................................................................................