SEC News Digest, 07-26-1984

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Common Interest Privilege: Two Recent Cases Clarify Its Application

News from the Association of Insolvency & Restructuring Advisors Volume 25, Number 1 – April/May 2011 The Common Interest Privilege: Two Recent Cases Clarify Its Application to Protect Plan Negotiations Two recent decisions from the United States with the Ad Hoc Committee and the Pre-Petition Bankruptcy Court for the District of Delaware FCR. The Plan Parties withheld the documents Sara Beth Kohut add clarity to the application of the common on the grounds that they were protected under Young Conaway interest privilege to plan negotiations. In the case of the common interest doctrine.4 The documents Stargatt & Taylor, LLP Leslie Controls, Inc. (“Leslie”),1 Bankruptcy Judge included a memorandum from Leslie’s insurance Christopher S. Sontchi held that parties to a plan counsel analyzing the effect of the insurers’ likely pursuant to 11 U.S.C. § 524(g) could rely on their coverage positions and communications among the common interest in maximizing the debtor’s assets Plan Parties regarding that advice.5 On September to withhold from discovery certain documents 21, 2010, Judge Sontchi resolved the discovery exchanged during their prepetition negotiations. dispute by holding that the common interest Following Leslie, Bankruptcy Judge Kevin J. Carey privilege protected the documents because they similarly concluded that plan proponents in concerned and were exchanged in furtherance of the Tribune Company bankruptcy proceedings the Plan Parties’ shared legal interest in preserving could rely on a common interest to withhold the and maximizing the debtor’s total asset “pie,” even communications they shared while mediating a though the Plan Parties had conflicting interests as to Ed Harron settlement and proposed plan from discovery sought how the “pie” ultimately would be distributed. -

2014–2015 Annual Report

FISCAL2014 YEAR The 2014-15 fiscal year continued our community’s remarkable progress towards closing the meal gap in Southern Nevada. A few benchmarks offer heart lifting examples: • 35 million pounds of food were distributed through a service network of 1,300 partners • Over 13 million pounds of food rescued from 185 retail partners • More than 20,000 volunteers contributed 129,000 hours to alleviate hunger • Because of them, an average of 7,000 meals a day were distributed to children • A historic $10 million endowment gift was made by the Engelstad Family Foundation • Our SNAP team brought $6.8 million in benefits to 5,400 individuals Daily, Three Square is reminded of the extraordinary generosity of this community. It’s important because food insecurity remains stubbornly high, with only a small decrease in childhood hunger. Over 300,000 people in Southern Nevada still struggle with access to meals. Three Square’s Board of Directors is engaged and focused on sustainability, maintaining high standards of accountability, governance and stewardship. Culture became a fascination this past year as we strived to build a stronger, healthier, and more cohesive work environment for our staff team. While this pursuit is never finished, we were encouraged when the Southern Nevada Human Resources Association voted Three Square “Best Place to Work in Southern Nevada” (small business category).“Together, we can feed everyone,” is more than a tag line. It is rapidly becoming a reality because thousands of people like you decided to be part of the solution. Everyone at Three Square gives thanks for you, and hopes you will be blessed and nourished by your continued involvement and care. -

Fidelity® Total Market Index Fund

Quarterly Holdings Report for Fidelity® Total Market Index Fund May 31, 2021 STI-QTLY-0721 1.816022.116 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.3% Shares Value Shares Value COMMUNICATION SERVICES – 10.1% World Wrestling Entertainment, Inc. Class A (b) 76,178 $ 4,253,780 Diversified Telecommunication Services – 1.1% Zynga, Inc. (a) 1,573,367 17,055,298 Alaska Communication Systems Group, Inc. 95,774 $ 317,970 1,211,987,366 Anterix, Inc. (a) (b) 16,962 838,941 Interactive Media & Services – 5.6% AT&T, Inc. 11,060,871 325,521,434 Alphabet, Inc.: ATN International, Inc. 17,036 805,292 Class A (a) 466,301 1,099,001,512 Bandwidth, Inc. (a) (b) 34,033 4,025,764 Class C (a) 446,972 1,077,899,796 Cincinnati Bell, Inc. (a) 84,225 1,297,065 ANGI Homeservices, Inc. Class A (a) 120,975 1,715,426 Cogent Communications Group, Inc. (b) 66,520 5,028,912 Autoweb, Inc. (a) (b) 6,653 19,028 Consolidated Communications Holdings, Inc. (a) 110,609 1,035,300 Bumble, Inc. 77,109 3,679,641 Globalstar, Inc. (a) (b) 1,067,098 1,707,357 CarGurus, Inc. Class A (a) 136,717 3,858,154 IDT Corp. Class B (a) (b) 31,682 914,343 Cars.com, Inc. (a) 110,752 1,618,087 Iridium Communications, Inc. (a) 186,035 7,108,397 DHI Group, Inc. (a) (b) 99,689 319,005 Liberty Global PLC: Eventbrite, Inc. (a) 114,588 2,326,136 Class A (a) 196,087 5,355,136 EverQuote, Inc. -

Alphabetical Index

Alphabetical Index 1st Source Corporation 3 Aerojet-General Corporation 12 Allied/Egry Business Systems, Inc 25 20th Century Industries 3 Aeronautical Electric Co 13 Allied Materials Corporation 26 3COM Corporation 3 Aeronca Inc 13 Allied Paper Inc 26 3M 3 Aeroquip Corporation 13 Allied Products Company 26 A A Brunell Electroplating Aerospace Corporation 13 Allied Products Corporation 26 Corporation 4 Aetna Life & Casualty Company 13 Allied Security Inc 26 A B Dick Company 4 Aetna Life Insurance & Annuity Co 13 Allied Stores Corporation 26 A C Nielsen Co 4 Aetna Life Insurance Co 14 Allied Van Lines, Inc 27 A E Staley Mfg Co 4 Affiliated Bank Corporation of Allied-Lyons North America A G Edwards Inc 4 Wyoming 14 Corporation 27 A H Belo Corporation 4 Affiliated Bankshares of Colorado 14 Allied-Signal Aerospace Company 27 A H Robins Company, Inc 4 Affiliated Food Stores, Inc 14 Allied-Signal, Inc 27 A Johnson & Company, Inc 4 Affiliated Hospital Products, Inc 14 Allis-Chalmers Corporation 28 A L Williams Corporation (The) 4 Affiliated Publications, Inc 15 Allstate Insurance Group 28 A M Castle & Co 4 AFG Industries, Inc 15 Alltel Corporation 28 A 0 Smith Corporation 4 Ag Processing Inc 15 Alma Plastics Companies 28 A P Green Refractories Co 4 Agency-Rent-A-Car Inc 15 Aloha Inc 28 A Schulman Inc 4 AGRI Industries 16 Alpha Corporation of Tennessee 28 AT Cross Co 4 AGRIPAC Inc 16 Alpha Industries Inc 28 A Y McDonald Industries, Inc 4 Ags Computers Inc 16 Alpha Metals, Inc 29 A&E Products Group, Inc 4 AGWAY Inc 16 Alpha Microsystems 29 A&M Food -

Vanguard U.S. Stock Index Funds Mid-Capitalization Portfolios Annual Report December 31, 2020

Annual Report | December 31, 2020 Vanguard U.S. Stock Index Funds Mid-Capitalization Portfolios Vanguard Extended Market Index Fund Vanguard Mid-Cap Index Fund Vanguard Mid-Cap Growth Index Fund Vanguard Mid-Cap Value Index Fund Contents Your Fund’s Performance at a Glance ................ 1 About Your Fund’s Expenses......................... 2 Extended Market Index Fund ........................ 5 Mid-CapIndexFund.................................31 Mid-CapGrowthIndexFund.........................57 Mid-CapValueIndexFund...........................77 Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. Your Fund’s Performance at a Glance • Returns for the 12 months ended December 31, 2020, returns for the three Vanguard Mid-Cap Index Funds ranged from 2.43% for Investor Shares of Vanguard Mid-Cap Value Index Fund to 34.48% for Admiral Shares of Vanguard Mid-Cap Growth Index Fund. Vanguard Extended Market Index Fund, which includes both small- and mid-capitalization holdings, returned about 32%. Each fund closely tracked its target index. • The emergence of COVID-19 in early 2020 turned into a global health crisis, and aggressive attempts to contain it resulted in a sharp downturn in economic activity. Unemployment spiked, and sectors where social distancing isn't possible were hit hard. Stocks initially plummeted as infections surged, but they finished the year significantly higher, thanks in part to rapid and robust monetary and fiscal action by policymakers and the rollout of COVID-19 vaccines as the year drew to a close. -

Phase 3 Dissemination Additions

NASD BOND COUPON SYMBOL ISSUER NAME SHORT DESCRIPTION RATE MATURITY DATE AA.GA ADVANCE AGRO CAPITAL B.V. UNSECURED NOTE 13.000 11/15/2007 AA.GW REYNOLDS METALS COMPANY UNSECURED NOTE 09.200 4/24/2006 AACB.GA ALLIANCE ATLANTIS COMMUNICATIONSSENIOR SUBORDINATED NOTE 13.000 12/15/2009 AAI.GA AIRTRAN AIRWAYS, INC. SENIOR SECURED 11.270 4/12/2008 AAI.GC AIRTRAN HOLDINGS, INC. SENIOR UNSECURED NOTE 07.000 7/1/2023 AAIF.GA AAI.FOSTERGRANT, INC. SENIOR NOTE 10.750 7/15/2006 AANR.GB ALPHA NATURAL RESOURCES L.L.C. ACTUAL CPN/MAT TBD 00.000 12/31/2012 AAPL.GA APPLE COMPUTER, INC. UNSECURED NOTE 06.500 2/15/2004 ABC.GC BERGEN BRUNSWIG CORPORATION SUBORDINATED DEBENTURE 06.875 7/15/2011 ABC.GD BERGEN BRUNSWIG CORPORATION DEBENTURE 07.000 3/1/2006 ABCR.GA ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 12/31/2004 ABCR.GB ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 1/15/2004 ABGX.GB ABGENIX, INC SUBORDINATED NOTE 03.500 3/15/2007 ABLC.GA AMERICAN BUILDERS & CONTRACTORSSENIOR SUBORDINATED NOTE 10.625 5/15/2007 ABP.GE ABRAXAS PETE CORP. SR SECD NTS 100.000 12/1/2009 ABY.GC ABITIBI-CONSOLIDATED INC. SENIOR NOTE 06.950 4/1/2008 ABY.GD ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.400 4/1/2018 ABY.GE ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.500 4/1/2028 ABY.GF ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 08.500 8/1/2029 ABY.GG ABITIBI-CONSOLIDATED INC SENIOR UNSECURED NOTE 08.300 8/1/2005 ABY.GJ ABITIBI-CONSOLIDATED CO OF CANADAUNSECURED NOTE 05.250 6/20/2008 ABY.GN ABITIBI-CONSOLIDATED, INC. -

H Azardous M Aterial S Ites in N Ational C Ity

A PPENDIX E H AZARDOUS M ATERIAL S ITES IN N ATIONAL C ITY ........................................................................................................................ ........................................................................................................................ APPENDIX B - Hazardous Material Sites in National City Unauthorized Database MAP_ID NAME ADDRESS CITY ZIP ENVID Release 37 (FORMER) NAT'L CITY JEEP 3000 NATIONAL CITY NATIONAL CITY 92050 S104745661 ,LUST,San Diego Co. SAM,EMI,HIST Cortese, Yes 37 1 DAY PAINT & BODY 1146 NATIONAL CITY BLVD NATIONAL CITY 91950 S102423363 ,LUST, Yes 37 1 DAY PAINT & BODY 1146 NATIONAL CITY NATIONAL CITY 92050 S104745546 ,LUST,San Diego Co. SAM,EMI,HIST Cortese, Yes 37 1 DAY PAINT AND BODY CENTERS INCORPORATED 1146 NATIONAL BOULEVARD NATIONAL CITY 91950 1000161033 ,FINDS,RCRA-SQG, No/Not Known 34 10 OSBORN ST 10 OSBORN ST NATIONAL CITY 0 2002617090 ,ERNS, Yes 81 10,000 AUTO PARTS 310 W 35TH ST NATIONAL CITY 91950 S106061394 ,HMMD San Diego, No/Not Known 37 1211 MCKINLEY AVE 1211 MCKINLEY AVE NATIONAL CITY 91950 93309418 ,ERNS, Yes 37 1240 HOOVER, 213 CIVIC CENTER DR, 1240 HOOVER, 213 CIVIC CENTER DR, NATIONAL CITY 91950 93333430 ,ERNS, Yes 37 1247 HIGHLAND AVE 1247 HIGHLAND AVE SAN DIEGO 92101 98460279 ,ERNS, Yes 37 1313 BAY MARINA DR. 1313 BAY MARINA DR. NATIONAL CITY 91950 2006793647 ,ERNS, Yes 37 1400 WEST 28TH STREET 1400 WEST 28TH STREET NATIONAL CITY 91950 98450983 ,ERNS, Yes 37 1420 NATIONAL CITY BLVD. 1420 NATIONAL CITY BLVD. NATIONAL CITY 92050 91230884 ,ERNS, Yes 37 1495 E. 8TH ST 1495 E. 8TH ST CHULA VISTA 96492363 ,ERNS, Yes 37 1539 PLAZA BLVD 1539 PLAZA BLVD SAN DIEGO 2006787476 ,ERNS, Yes 37 1601 E 8TH ST. -

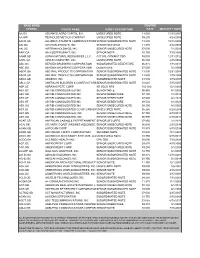

List of Section 13F Securities, First Quarter 2021

List of Section 13F Securities First Quarter FY 2021 Copyright (c) 2021 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2021, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2021. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by [ Section 13(f)(1) and Rule 13f-1] thereunder. -

Reminiscing the Early

5HPLQLVFLQJWKH(DUO\V Lê Minh Tân – Liên Đoàn TrườngSơn Explorer from 1981-1984 appeared: Như Mai, Linda Trang-Đài, Ngọc Lan. One of them, the mesmerizing Ngọc Lan who melt the heart of many of us, would remain forever young. At the corner of Bolsa and Bushard was Mỹ Hoa Supermarket, whose owner was thought to be related to the owner of Hòa-Bình Supermarket down the street (in the Hanoi Plaza today). ose two were in a price war against another Vietnamese supermarket, Dân Tiếp Vụ. e Phước Lộc ọ Mall had not come into existence yet, some plant nurseries were on its spot. Where ABC Supermarket would stand today was Alpha Beta, an American chain supermarket. Around OC, there were e early 80s. It was a typical weekend like any such supermarkets and department stores as Lucky, sun soaked weekend in OC. We were young, teens, full Zody’s, GemCo, FedCo, FedMart, Federated Group, of life. Our girls looked fabulous. We boys, well, nothing Montgomery Ward, Bullocks, and May Company. e to brag about. FOB, the boys were sun tanned, yet for Montgomery Ward department store even had a small some inexplicable reason, ... not very gorgeous, perhaps section selling Boy Scout uniforms and badges. due to our very long hair? Or maybe because we were Some other times, the boys would go watch “xì-ke” slim (overweight was still a concept quite foreign Chinese kung-fu movies at one of the only two to us). We would hang around a park, either La Palma Vietnamese-Chinese theaters ever exist in OC: Triều- Park or Ponderosa Park in Anaheim. -

USAA Mutual Funds Trust Schedule of Portfolio Investments USAA 500 Index Fund March 31, 2021 (Amounts in Thousands, Except for Shares) (Unaudited)

USAA Mutual Funds Trust Schedule of Portfolio Investments USAA 500 Index Fund March 31, 2021 (Amounts in Thousands, Except for Shares) (Unaudited) Security Description Shares Value Common Stocks (99.5%) Communication Services (11.1%): Activision Blizzard, Inc. 203,473 $ 18,923 Alphabet, Inc. Class C (a) 167,669 346,845 Altice USA, Inc. Class A (a) 19,684 640 AT&T, Inc. 1,999,281 60,518 Charter Communications, Inc. Class A (a) 36,587 22,575 Comcast Corp. Class A 1,228,617 66,481 Discovery, Inc. Class A (a)(b) 36,222 1,574 DISH Network Corp. Class A (a) 62,083 2,247 Electronic Arts, Inc. 79,783 10,800 Facebook, Inc. Class A (a) 621,970 183,189 Fox Corp. Class A 87,131 3,146 IAC/InterActiveCorp. (a) 18,074 3,910 Liberty Broadband Corp. Class A (a) 60,373 8,763 Liberty Media Corp-Liberty SiriusXM Class A (a) 77,809 3,430 Live Nation Entertainment, Inc. (a)(b) 45,040 3,813 Lumen Technologies, Inc. 275,118 3,673 Match Group, Inc. (a) 69,052 9,486 Netflix, Inc. (a) 121,545 63,405 News Corp. Class A 81,909 2,083 Omnicom Group, Inc. 59,007 4,375 Pinterest, Inc. Class A (a) 25,966 1,922 Sirius XM Holdings, Inc. (b) 293,199 1,786 Snap, Inc. Class A (a) 306,886 16,047 Take-Two Interactive Software, Inc. (a) 31,609 5,585 The Walt Disney Co. (a) 455,315 84,015 T-Mobile U.S., Inc. (a) 176,034 22,055 Twitter, Inc. -

Exclusivebrandsourcing Retailer/Wholesaler Database

EXCLUSIVEBRANDSOURCING RETAILER/WHOLESALER DATABASE Copyright 2015 © Exclusive Brands LLC N/A = Not Available or Not Applicable A.S. WATSON GROUP 1-5 Wo Liu Hang Road, Fo Tan, New Territories, Hong Kong, CHINA Tel: +852 2606-8833 Fax: +852 2695-3664 www.aswatson.com Total 2012 Revenues: $18.9 Billion(HK$ 146.6 Billion) +4 % Percentage of Sales in Exclusive Brands: N/A Principal Business: A.S. Watson is the retail group owned by Hutchison Whampoa Limited, a HK $ 398.4 billion ($51.3 billion) +4%, multi-national conglomerate, which is also active in port investments, infrastructure (energy, transportation, water, etc.), telecommunications, and finance. The company roots trace back to 1829 as a small dispensary, offering free medicine to poor Chinese in the province of Guangdong (Canton). A.S. Watson, now contributes 36.8% of total parent company revenues, through its operation of 10,865 retail outlets under some 20 banners located in 33 markets, specifically in 22 European countries and 20 countries in Asia. This business encompasses a diverse portfolio: health and beauty stores, luxury perfumeries and cosmetic outlets, supermarkets, consumer electronics and electrical appliances stores, and airport duty free shops. Divided into five sub-divisions, the company operates Health and Beauty China (HK$ 15.4 billion +17%) with 1,438 stores; Health and Beauty Asia (excluding mainland China) (HK$ 18.1 billion +7%) with 1,684 stores; Health and Beauty Europe (HK$ 61.6 billion +1%) with 5,599 stores; Luxury Europe (HK$ 16.6 billion -7%) with 1,656 stores; and Other Retail & Manufacturing (HK$ 36.9 billion +6%) with 488 stores and production of water and juices. -

National Federation of Music Clubs Young Artist Report

NATIONAL FEDERATION OF MUSIC CLUBS MICHAEL R. EDWARDS President 891 NW 73rd Avenue Plantation FL 33317-1141 Mobile: 954-325-0064 Email: [email protected] President’s Report 2019 This fall after a four-year process, states will be able to register using the new NFMC online system through an onboarding process. The brand new online system was developed to insure a reliable software program that simplifies the registration process for our members. The new system was not an upgrade of the old system. Data was all that could be salvaged and successfully transferred. I wish to thank IT Indiana, SJ Consulting and those who served on the steering committee and the practical and technical committees. They worked tirelessly toward a successful software system that will serve our membership for years to come. There was a slight increase in our membership this year. In 2017-2018 there was a steep decline in the Student/Collegiate Division. This was the result of a decline of 7,000 members in one state. The total membership dropped from 130,520 in 2015 to 121,789 in 2019. We need to start factoring in membership dues paid to NFMC to better track our membership. For example, the state that listed a 7,000 decline in the Student/Collegiate Division had paid only $75.00 in dues since it was a group. This is distorting the actual membership rolls. Last year I reported that there are some states that are not following the bylaws and standing rules. As a result, we now have members leaving their state to participate in other states.