The Common Interest Privilege: Two Recent Cases Clarify Its Application

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brief for Petitioner

No. 19-357 IN THE Supreme Court of the United States CITY OF CHICAGO, Petitioner, v. ROBBIN L. FULTON, JASON S. HOWARD, GEORGE PEAKE, AND TIMOTHY SHANNON, Respondents. ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE SEVENTH CIRCUIT BRIEF FOR PETITIONER MARK A. FLESSNER CRAIG GOLDBLATT BENNA RUTH SOLOMON Counsel of Record MYRIAM ZRECZNY KASPER DANIELLE SPINELLI ELLEN W. MCLAUGHLIN JOEL MILLAR CITY OF CHICAGO ISLEY GOSTIN OFFICE OF CORPORATION WILMER CUTLER PICKERING COUNSEL HALE AND DORR LLP 30 N. LaSalle Street 1875 Pennsylvania Ave., NW Suite 800 Washington, DC 20006 Chicago, Illinois 60602 (202) 663-6000 (312) 744-7764 [email protected] ALLYSON M. PIERCE WILMER CUTLER PICKERING HALE AND DORR LLP 250 Greenwich Street New York, NY 10007 (212) 230-8800 QUESTION PRESENTED Whether an entity that is passively retaining pos- session of property in which a bankruptcy estate has an interest has an affirmative obligation under the Bank- ruptcy Code’s automatic stay, 11 U.S.C. § 362, to return that property to the debtor or trustee immediately up- on the filing of the bankruptcy petition. (i) PARTIES TO THE PROCEEDING Petitioner is the City of Chicago. Respondents are Robbin L. Fulton, Jason S. How- ard, George Peake and Timothy Shannon. (ii) TABLE OF CONTENTS Page QUESTION PRESENTED ............................................... i PARTIES TO THE PROCEEDING .............................. ii TABLE OF AUTHORITIES .......................................... vi INTRODUCTION ............................................................. -

2014–2015 Annual Report

FISCAL2014 YEAR The 2014-15 fiscal year continued our community’s remarkable progress towards closing the meal gap in Southern Nevada. A few benchmarks offer heart lifting examples: • 35 million pounds of food were distributed through a service network of 1,300 partners • Over 13 million pounds of food rescued from 185 retail partners • More than 20,000 volunteers contributed 129,000 hours to alleviate hunger • Because of them, an average of 7,000 meals a day were distributed to children • A historic $10 million endowment gift was made by the Engelstad Family Foundation • Our SNAP team brought $6.8 million in benefits to 5,400 individuals Daily, Three Square is reminded of the extraordinary generosity of this community. It’s important because food insecurity remains stubbornly high, with only a small decrease in childhood hunger. Over 300,000 people in Southern Nevada still struggle with access to meals. Three Square’s Board of Directors is engaged and focused on sustainability, maintaining high standards of accountability, governance and stewardship. Culture became a fascination this past year as we strived to build a stronger, healthier, and more cohesive work environment for our staff team. While this pursuit is never finished, we were encouraged when the Southern Nevada Human Resources Association voted Three Square “Best Place to Work in Southern Nevada” (small business category).“Together, we can feed everyone,” is more than a tag line. It is rapidly becoming a reality because thousands of people like you decided to be part of the solution. Everyone at Three Square gives thanks for you, and hopes you will be blessed and nourished by your continued involvement and care. -

Edited Termination Under Subsections (B)(23) and (M), Lessors May Prefer to File a Stay Relief Motion Rather Than Submit a Certification

THE AUTOMATIC STAY UNDER BAPCPA Michael D. Sabbath Walter Homer Drake Professor of Bankruptcy Law Mercer University Walter F. George School of Law Macon, Georgia Table of Contents Page I. INTRODUCTION.................................................................................................................. 1 II. BAPCPA and Exceptions to the Automatic Stay............................................................. 4 A. Domestic Relations Proceedings..................................................................................... 4 B. Retirement Plan Repayments......................................................................................... 5 C. Ineligible Debtor .............................................................................................................. 6 D. Residential Property Evictions....................................................................................... 8 E. Ad Valorem Tax Liens .................................................................................................. 10 F. Post-Petition Infringement of Intellectual Property Rights ...................................... 11 III. BAPCPA and Termination of the Automatic Stay ........................................................ 15 B. Unexpired Lease of Personal Property........................................................................ 18 C. Multiple Bankruptcy Filings......................................................................................... 19 1. Section 362(c)(3) ........................................................................................................ -

Automatic Stay

UNITED STATES BANKRUPTCY COURT DISTRICT OF ARIZONA HOW TO FILE A MOTION FOR RELIEF FROM THE AUTOMATIC STAY What is the Automatic Stay? Once a Debtor has filed Bankruptcy, most proceedings against him are stayed, 11 USC Section 362 (a). - In order for a party to continue a proceeding against the debtor that was stayed because of the filing of the Bankruptcy and the Automatic Stay, he must file with the Bankruptcy Court a Motion for Relief from the Automatic Stay, or a Stipulation for Relief from the Automatic Stay if the other parties, the debtor and the trustee agree. Rules for reference 11 USC Section 362(a) Bankruptcy Rule 4001 Bankruptcy Rule 9014 Local Rule 4001-1 How is a Motion for Relief from the Automatic Stay Commenced? A motion is a written formal statement in which the party who is requesting the relief, the Movant, sets forth the legal basis, citing the applicable sections of the Bankruptcy Code and the Bankruptcy Rules, for the relief requested. The party against whom the relief is requested, the debtor and the trustee, if one has been appointed, are the Respondents. Each motion shall be supported by all documents which assert a valid perfected security interest and all documents which support an assertion of lack of adequate protection or of equity in the property. Is there a specific form provided by the Court for the Motion for Relief from the Automatic Stay? Each Motion for Relief from the Automatic Stay is unique and there is no specific form provided by the court for the motion. -

Fidelity® Total Market Index Fund

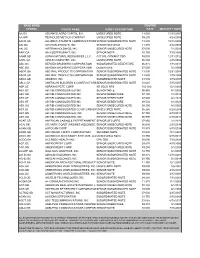

Quarterly Holdings Report for Fidelity® Total Market Index Fund May 31, 2021 STI-QTLY-0721 1.816022.116 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.3% Shares Value Shares Value COMMUNICATION SERVICES – 10.1% World Wrestling Entertainment, Inc. Class A (b) 76,178 $ 4,253,780 Diversified Telecommunication Services – 1.1% Zynga, Inc. (a) 1,573,367 17,055,298 Alaska Communication Systems Group, Inc. 95,774 $ 317,970 1,211,987,366 Anterix, Inc. (a) (b) 16,962 838,941 Interactive Media & Services – 5.6% AT&T, Inc. 11,060,871 325,521,434 Alphabet, Inc.: ATN International, Inc. 17,036 805,292 Class A (a) 466,301 1,099,001,512 Bandwidth, Inc. (a) (b) 34,033 4,025,764 Class C (a) 446,972 1,077,899,796 Cincinnati Bell, Inc. (a) 84,225 1,297,065 ANGI Homeservices, Inc. Class A (a) 120,975 1,715,426 Cogent Communications Group, Inc. (b) 66,520 5,028,912 Autoweb, Inc. (a) (b) 6,653 19,028 Consolidated Communications Holdings, Inc. (a) 110,609 1,035,300 Bumble, Inc. 77,109 3,679,641 Globalstar, Inc. (a) (b) 1,067,098 1,707,357 CarGurus, Inc. Class A (a) 136,717 3,858,154 IDT Corp. Class B (a) (b) 31,682 914,343 Cars.com, Inc. (a) 110,752 1,618,087 Iridium Communications, Inc. (a) 186,035 7,108,397 DHI Group, Inc. (a) (b) 99,689 319,005 Liberty Global PLC: Eventbrite, Inc. (a) 114,588 2,326,136 Class A (a) 196,087 5,355,136 EverQuote, Inc. -

04/27/2020 Creditors' Motion for Relief from Automatic Stay

Case 20-05012 Doc 29 Filed 04/27/20 Entered 04/27/20 16:00:50 Desc Main Document Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF ILLINOIS HITZ RESTURANT GROUP, LLC, ) Case No. 20-05012 ) Debtor ) Chapter 11 ) ) Honorable Donald R Cassling MOTION OF KASS MANAGEMENT SERVICES, INC. AND THE SOUTH LOOP SHOPS, LLC FOR RELIEF FROM THE AUTOMATIC STAY Creditors, KASS MANAGEMENT SERVICES, INC. AND THE SOUTH LOOP SHOPS, LLC (collectively “Landlord”), by and through their attorneys, Mario A. Sullivan, Johnson & Sullivan, Ltd., moves this Court to modify the automatic stay to permit it to take possession of the residential real estate commonly known as 825 South State Street, Chicago, Illinois 60605 (“Premises”). In support of its motion, Creditor states as follows: 1. On February 24, 2020, Debtor filed a voluntary petition for relief under Chapter 11 of the United States Code (“Code”). 2. Debtor continues to reside in the Premises as a Debtor and Debtor in Possession pursuant to the 11 USC §§1107 and 1008 of the Code. Background 3. The South Loop Shops, LLC is the owner of record for the Premises. 4. Kass Management Services, Inc. is the agent for the owner of the Premises and has full authority to proceed in all matters pertaining thereto. 5. Debtor is engaged in the operation and management of restaurant and bar at the Premises. 1 of 5 Case 20-05012 Doc 29 Filed 04/27/20 Entered 04/27/20 16:00:50 Desc Main Document Page 2 of 5 6. -

SEC News Digest, 07-26-1984

~)secnews digest Issue 84-145 U.S. SECURITIES AND EXCHANGE COMMI5~i " July 26, 1984 ADMINISTRATIVE PROCEEDINGS GARY L. JACKSON, CPA, DISQUALIFIED FROM PRACTICE Administrative Law Judge Jerome K. Soffer issued an initial decision permanently disqualifying Gary L. Jackson, a certified public accountant of San Francisco, California, from appearing or practicing before the Commission. The sanction was imposed based upon findings that Jackson had been permanently enjoined by a court of competent jurisdiction by reason of his misconduct in aiding and abetting the violation of the provisions and rules of the Securities Exchange Act of 1934 relating to the filing of registration statements. Specifically, the viola- tions involved the submission of financial statements not prepared in accordance with generally accepted accounting principles and auditing standards in the valuation of assets, and in the failure to disclose material information. JAY ERROLL WEINBERG BARRED The Commission instituted public administrative proceedings under the Advisers Act against Jay Erroll Weinberg, also known as Jeffrey Paul Weinberg and Jay P. Smythe, of Manhasset, New York. The Commission simultaneously accepted an Offer of Settlement in which weinberg, without admitting or denying the alleged violations, consented to findings of violations and a bar from association with any investment adviser. The Commission found that weinberg: wilfully violated the registration and antifraud provisions of the Advisers Act and the Commission's advertising rules by failing to .register with the commission as an investment adviser while publishing The OKford Report, an investment advisory newsletter and telephone "hotline" service; dissemi- nated blatantly false and misleading advertisements for The OKford Report; and had been convicted in New York State of crimes involving larceny and fraud and permanently enjoined from further violations of the Advisers Act [SEC v. -

Chapter 11: Personal Bankruptcy

11.0 PERSONAL BANKRUPTCY ISSUES 11.1 Overview The damages and dislocation caused by a disaster are expected to make some storm victims think about filing bankruptcy. Below is a summary of certain applicable sections of the Bankruptcy Code and answers to common questions asked about bankruptcy. This outline is meant to only be a bankruptcy primer. The current Bankruptcy Code was enacted in 1978 and has been amended several times since then. The most significant amendments to the Bankruptcy Code were implemented in 2005 by the Bankruptcy Abuse Prevention and Consumer Protection Act (the “BAPCPA”). The outline below is intended to highlight certain relevant provisions of the Bankruptcy Code and certain BAPCPA’s changes to it; however, it is advisable for any storm victim considering bankruptcy to consult a qualified bankruptcy attorney. To the extent that state law is relevant, the emphasis is on South Carolina law. 11.2 Most Common Issues/Questions • The bankruptcy process and decision to file • Pre-requisites or other requirements for filing • The Federal District for filing • Types of debts discharged in bankruptcy • Types of property exempt in bankruptcy • How marriage, divorce, and child support affect bankruptcy • The automatic stay 11.3 Summary of the Law There are four different chapters of the Bankruptcy Code affecting individuals: Chapter 7, Chapter 11, Chapter 12, and Chapter 13. Of these, Chapters 7 and 13 are generally most relevant to individuals. Chapter 7 A Chapter 7 case is sometimes called “liquidation.” In any individual bankruptcy case, certain types of property are exempt from creditors and are kept by the debtor. -

Alphabetical Index

Alphabetical Index 1st Source Corporation 3 Aerojet-General Corporation 12 Allied/Egry Business Systems, Inc 25 20th Century Industries 3 Aeronautical Electric Co 13 Allied Materials Corporation 26 3COM Corporation 3 Aeronca Inc 13 Allied Paper Inc 26 3M 3 Aeroquip Corporation 13 Allied Products Company 26 A A Brunell Electroplating Aerospace Corporation 13 Allied Products Corporation 26 Corporation 4 Aetna Life & Casualty Company 13 Allied Security Inc 26 A B Dick Company 4 Aetna Life Insurance & Annuity Co 13 Allied Stores Corporation 26 A C Nielsen Co 4 Aetna Life Insurance Co 14 Allied Van Lines, Inc 27 A E Staley Mfg Co 4 Affiliated Bank Corporation of Allied-Lyons North America A G Edwards Inc 4 Wyoming 14 Corporation 27 A H Belo Corporation 4 Affiliated Bankshares of Colorado 14 Allied-Signal Aerospace Company 27 A H Robins Company, Inc 4 Affiliated Food Stores, Inc 14 Allied-Signal, Inc 27 A Johnson & Company, Inc 4 Affiliated Hospital Products, Inc 14 Allis-Chalmers Corporation 28 A L Williams Corporation (The) 4 Affiliated Publications, Inc 15 Allstate Insurance Group 28 A M Castle & Co 4 AFG Industries, Inc 15 Alltel Corporation 28 A 0 Smith Corporation 4 Ag Processing Inc 15 Alma Plastics Companies 28 A P Green Refractories Co 4 Agency-Rent-A-Car Inc 15 Aloha Inc 28 A Schulman Inc 4 AGRI Industries 16 Alpha Corporation of Tennessee 28 AT Cross Co 4 AGRIPAC Inc 16 Alpha Industries Inc 28 A Y McDonald Industries, Inc 4 Ags Computers Inc 16 Alpha Metals, Inc 29 A&E Products Group, Inc 4 AGWAY Inc 16 Alpha Microsystems 29 A&M Food -

Vanguard U.S. Stock Index Funds Mid-Capitalization Portfolios Annual Report December 31, 2020

Annual Report | December 31, 2020 Vanguard U.S. Stock Index Funds Mid-Capitalization Portfolios Vanguard Extended Market Index Fund Vanguard Mid-Cap Index Fund Vanguard Mid-Cap Growth Index Fund Vanguard Mid-Cap Value Index Fund Contents Your Fund’s Performance at a Glance ................ 1 About Your Fund’s Expenses......................... 2 Extended Market Index Fund ........................ 5 Mid-CapIndexFund.................................31 Mid-CapGrowthIndexFund.........................57 Mid-CapValueIndexFund...........................77 Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. Your Fund’s Performance at a Glance • Returns for the 12 months ended December 31, 2020, returns for the three Vanguard Mid-Cap Index Funds ranged from 2.43% for Investor Shares of Vanguard Mid-Cap Value Index Fund to 34.48% for Admiral Shares of Vanguard Mid-Cap Growth Index Fund. Vanguard Extended Market Index Fund, which includes both small- and mid-capitalization holdings, returned about 32%. Each fund closely tracked its target index. • The emergence of COVID-19 in early 2020 turned into a global health crisis, and aggressive attempts to contain it resulted in a sharp downturn in economic activity. Unemployment spiked, and sectors where social distancing isn't possible were hit hard. Stocks initially plummeted as infections surged, but they finished the year significantly higher, thanks in part to rapid and robust monetary and fiscal action by policymakers and the rollout of COVID-19 vaccines as the year drew to a close. -

Phase 3 Dissemination Additions

NASD BOND COUPON SYMBOL ISSUER NAME SHORT DESCRIPTION RATE MATURITY DATE AA.GA ADVANCE AGRO CAPITAL B.V. UNSECURED NOTE 13.000 11/15/2007 AA.GW REYNOLDS METALS COMPANY UNSECURED NOTE 09.200 4/24/2006 AACB.GA ALLIANCE ATLANTIS COMMUNICATIONSSENIOR SUBORDINATED NOTE 13.000 12/15/2009 AAI.GA AIRTRAN AIRWAYS, INC. SENIOR SECURED 11.270 4/12/2008 AAI.GC AIRTRAN HOLDINGS, INC. SENIOR UNSECURED NOTE 07.000 7/1/2023 AAIF.GA AAI.FOSTERGRANT, INC. SENIOR NOTE 10.750 7/15/2006 AANR.GB ALPHA NATURAL RESOURCES L.L.C. ACTUAL CPN/MAT TBD 00.000 12/31/2012 AAPL.GA APPLE COMPUTER, INC. UNSECURED NOTE 06.500 2/15/2004 ABC.GC BERGEN BRUNSWIG CORPORATION SUBORDINATED DEBENTURE 06.875 7/15/2011 ABC.GD BERGEN BRUNSWIG CORPORATION DEBENTURE 07.000 3/1/2006 ABCR.GA ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 12/31/2004 ABCR.GB ABC RAIL PRODUCTS CORPORATION SENIOR SUBORDINATED NOTE 11.500 1/15/2004 ABGX.GB ABGENIX, INC SUBORDINATED NOTE 03.500 3/15/2007 ABLC.GA AMERICAN BUILDERS & CONTRACTORSSENIOR SUBORDINATED NOTE 10.625 5/15/2007 ABP.GE ABRAXAS PETE CORP. SR SECD NTS 100.000 12/1/2009 ABY.GC ABITIBI-CONSOLIDATED INC. SENIOR NOTE 06.950 4/1/2008 ABY.GD ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.400 4/1/2018 ABY.GE ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 07.500 4/1/2028 ABY.GF ABITIBI-CONSOLIDATED INC. SENIOR DEBENTURE 08.500 8/1/2029 ABY.GG ABITIBI-CONSOLIDATED INC SENIOR UNSECURED NOTE 08.300 8/1/2005 ABY.GJ ABITIBI-CONSOLIDATED CO OF CANADAUNSECURED NOTE 05.250 6/20/2008 ABY.GN ABITIBI-CONSOLIDATED, INC. -

H Azardous M Aterial S Ites in N Ational C Ity

A PPENDIX E H AZARDOUS M ATERIAL S ITES IN N ATIONAL C ITY ........................................................................................................................ ........................................................................................................................ APPENDIX B - Hazardous Material Sites in National City Unauthorized Database MAP_ID NAME ADDRESS CITY ZIP ENVID Release 37 (FORMER) NAT'L CITY JEEP 3000 NATIONAL CITY NATIONAL CITY 92050 S104745661 ,LUST,San Diego Co. SAM,EMI,HIST Cortese, Yes 37 1 DAY PAINT & BODY 1146 NATIONAL CITY BLVD NATIONAL CITY 91950 S102423363 ,LUST, Yes 37 1 DAY PAINT & BODY 1146 NATIONAL CITY NATIONAL CITY 92050 S104745546 ,LUST,San Diego Co. SAM,EMI,HIST Cortese, Yes 37 1 DAY PAINT AND BODY CENTERS INCORPORATED 1146 NATIONAL BOULEVARD NATIONAL CITY 91950 1000161033 ,FINDS,RCRA-SQG, No/Not Known 34 10 OSBORN ST 10 OSBORN ST NATIONAL CITY 0 2002617090 ,ERNS, Yes 81 10,000 AUTO PARTS 310 W 35TH ST NATIONAL CITY 91950 S106061394 ,HMMD San Diego, No/Not Known 37 1211 MCKINLEY AVE 1211 MCKINLEY AVE NATIONAL CITY 91950 93309418 ,ERNS, Yes 37 1240 HOOVER, 213 CIVIC CENTER DR, 1240 HOOVER, 213 CIVIC CENTER DR, NATIONAL CITY 91950 93333430 ,ERNS, Yes 37 1247 HIGHLAND AVE 1247 HIGHLAND AVE SAN DIEGO 92101 98460279 ,ERNS, Yes 37 1313 BAY MARINA DR. 1313 BAY MARINA DR. NATIONAL CITY 91950 2006793647 ,ERNS, Yes 37 1400 WEST 28TH STREET 1400 WEST 28TH STREET NATIONAL CITY 91950 98450983 ,ERNS, Yes 37 1420 NATIONAL CITY BLVD. 1420 NATIONAL CITY BLVD. NATIONAL CITY 92050 91230884 ,ERNS, Yes 37 1495 E. 8TH ST 1495 E. 8TH ST CHULA VISTA 96492363 ,ERNS, Yes 37 1539 PLAZA BLVD 1539 PLAZA BLVD SAN DIEGO 2006787476 ,ERNS, Yes 37 1601 E 8TH ST.