Foresight Africa 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WHO Launches Hub in Berlin to Help Prevent Future Pandemics 1 September 2021

WHO launches hub in Berlin to help prevent future pandemics 1 September 2021 The COVID-19 pandemic "has taught the world many painful lessons," Tedros said. "One of the most clear is the need for new, powerful systems and tools for global surveillance to collect, analyze and disseminate data on outbreaks with the potential to become epidemics and pandemics." "Viruses move fast but data can move even faster," Tedros said. He added that the new center is one response to recommendations on what can be done to keep the world safer in the future, "filling a gap in the world's defenses." Tedros Adhanom Ghebreyesus, right, Director-General of the World Health Organization (WHO), and German Chancellor Angela Merkel, left, attend the inauguration ceremony of the 'WHO Hub For Pandemic And Epidemic Intelligence' at the Langenbeck-Virchow building in Berlin, Germany, Wednesday, Sept. 1, 2021. Credit: AP Photo/Michael Sohn, pool The World Health Organization on Wednesday inaugurated a new "hub" in Berlin that aims to help prepare the globe better to prevent future pandemics. Tedros Adhanom Ghebreyesus, right, Director-General of the World Health Organization (WHO), and German WHO Director-General Tedros Adhanom Chancellor Angela Merkel, left, attend the inauguration Ghebreyesus and German Chancellor Angela ceremony of the 'WHO Hub For Pandemic And Epidemic Merkel cut the ribbon to launch the new WHO Hub Intelligence' at the Langenbeck-Virchow building in for Pandemic and Epidemic Intelligence. WHO Berlin, Germany, Wednesday, Sept. 1, 2021. Credit: AP says Germany is making an initial investment of Photo/Michael Sohn, pool $100 million in the facility. -

Latin America and Caribbean Region LIST of ACRONYMS

Inclusive and Sustainable Industrial Development in Latin America and Caribbean Region LIST OF ACRONYMS ALBA Bolivarian Alliance for the Americas IPs Industrial Parks BIDC Barbados Investment and Development INTI National Institute of Industrial Corperation Technologies (Argentina) BRICS Brazil, Russian Federation, India, China ISID Inclusive and Sustainable Industrial and South Africa („emerging economies“) Development CAF Development Bank for Latin America ITPOs Investment and Technology Promotion CAIME High Level Centre for Research, Offices Training and Certification of Production LATU Technological Laboratory of Uruguay (Uruguayan Project) MERCOSUR Southern Common Market CAN Andean Community MoU Memorandum of Understanding CARICOM Caribbean Community ODS Ozone Depleting Substances CELAC Community of Latin American and OESC Organization of Eastern Caribbean States Caribbean States OFID OPEC Fund for International Development CFCs Chloro-Fluoro-Carbons PCBs Poly-Chlorinated Biphenyls CIU Uruguayan Chamber of Industries POPs Persistent Organic Pollutants CNI National Confederation of Brazil PPPs Public Private Partnerships COPEI Peruvian Committee on Small Industry RO Regional Office ECLAC Economic Commission for Latin America SDGs Sustainable Development Goals EU European Union SELA Latin American Economic System FAO Food and Agriculture Organization (UN SEZs Special Economic Zones System) SICA Central American Integration System GEF Global Environmental Facility SMEs Small and Medium-sized Enterprises GNIC Great Nicaraguan Interoceanic -

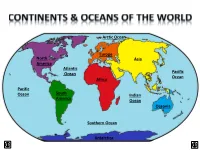

North America Other Continents

Arctic Ocean Europe North Asia America Atlantic Ocean Pacific Ocean Africa Pacific Ocean South Indian America Ocean Oceania Southern Ocean Antarctica LAND & WATER • The surface of the Earth is covered by approximately 71% water and 29% land. • It contains 7 continents and 5 oceans. Land Water EARTH’S HEMISPHERES • The planet Earth can be divided into four different sections or hemispheres. The Equator is an imaginary horizontal line (latitude) that divides the earth into the Northern and Southern hemispheres, while the Prime Meridian is the imaginary vertical line (longitude) that divides the earth into the Eastern and Western hemispheres. • North America, Earth’s 3rd largest continent, includes 23 countries. It contains Bermuda, Canada, Mexico, the United States of America, all Caribbean and Central America countries, as well as Greenland, which is the world’s largest island. North West East LOCATION South • The continent of North America is located in both the Northern and Western hemispheres. It is surrounded by the Arctic Ocean in the north, by the Atlantic Ocean in the east, and by the Pacific Ocean in the west. • It measures 24,256,000 sq. km and takes up a little more than 16% of the land on Earth. North America 16% Other Continents 84% • North America has an approximate population of almost 529 million people, which is about 8% of the World’s total population. 92% 8% North America Other Continents • The Atlantic Ocean is the second largest of Earth’s Oceans. It covers about 15% of the Earth’s total surface area and approximately 21% of its water surface area. -

State of the Region: Asia Pacific

kefk State of the region: Asia Pacific March 2021 Economy GDP growth, selected countries Business confidence - manufacturing PMIs % change on a yr ago 2020 Q2 2020 Q3 2020 Q4 2020 50=no change, seasonally adjusted 60 India -7.0 -24.4 -7.3 0.4 Japan -4.9 -10.3 -5.8 -1.3 55 Indonesia -2.1 -5.3 -3.5 -2.2 50 Korea -0.9 -2.8 -1.1 -1.2 45 Australia -2.4 -6.3 -3.7 -1.1 40 Thailand -6.2 -12.0 -6.4 -4.2 Malaysia -5.6 -17.1 -2.6 -3.4 35 World* -3.7 -8.9 -2.7 -1.5 30 * Market exchange rate basis Source: Eikon Datastream 25 Exchange rates 2015 2016 2017 2018 2019 2020 2021 India Indonesia Japan end of period, # per US$ 2020 Dec-20 Jan-21 Feb-21 Source: Markit US$ broad index 112.1 112.1 111.8 112.3 • Economic conditions have been improving in Asia Japanese yen (JPY) 103.3 103.3 104.7 106.5 Pacific. Q4 GDP declines eased across most of the Australian dollar (AUD) 1.29 1.29 1.30 1.29 countries in the region. Moreover, as of February the Sth Korean won (KRW) 1087 1087 1114 1128 manufacturing PMI was back or above pre-crisis levels Indian rupee (INR) 73.1 73.1 73.0 73.5 across the three key markets that we regularly track. Indonesian rupiah (IDR) 14050 14050 14030 14240 Thai baht (THB) 30.0 30.0 29.9 30.1 • The trade-weighted US dollar index rose by 0.5%, Malaysian ringgit (MYR) 4.02 4.02 4.04 4.05 partly reflecting optimism about the US economic Source: Board of Governors of the Federal Reserve System (US), Eikon Datastream recovery. -

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

KNOTLESS NETTING in AMERICA and OCEANIA T HE Question Of

116 AMERICAN ANTHROPOLOGIST [N. s., 37, 1935 48. tcdbada'b stepson, stepdaughter, son or KNOTLESS NETTING IN AMERICA daughter of wife's brother or sis AND OCEANIA By D. S. DAVIDSON ter, son or daughter of husband's brother or sister: reciprocal to the HE question of trans-Pacific influences in American cultureshas been two preceding terms 49. tcdtsa'pa..:B T seriously debated for a number of years. Those who favor a trans step~grandfather, husband of oceanic movement have pointed out many resemblances and several grandparent's'sister 50. tCLlka 'yaBB striking similarities between certain culture traits of the New World and step-grandmother, wife of grand Oceania. The theory of a historical relationship between these appearances parent's brother 51. tcde'batsal' is based upon the hypothesis that independent invention and convergence step-grandchild, grandchild of speaker's wife's (or speaker's hus in development are not reasonable explanations either for the great number band's) brother or sister: recipro of resemblances or for the certain complexities found in the two areas. c~l to the two preceding terms The well-known objections to the trans-Pacific diffusion theory can 52. tsi.J.we'bats husband Or wife of grandchild of be summarized as follows: speaker or speaker's brother or 1. That many of the so-called similarities at best are only resemblances sister; term possibly reciprocal between very simple traits which might be independently invented or 53. tctlsxa'xaBll son-in-law or daughter-in-law of discovered. speaker's wife's brother or sister, 2. -

Calendar of Observances 2021

Calendar of Observances 2021 The increasingly pluralistic population of the United States is made up of many different ethnic, cultural, faith and religious communities. To enhance mutual understanding among groups and promote inclusive communities, the ADL offers this resource as a tool to increase awareness of and respect for religious obligations and ethnic and cultural festivities that may affect students, colleagues and neighbors in your community. Religious Observations The calendar includes significant religious observances of the major faiths represented in the United States. It can be used when planning school exam schedules and activities, workplace festivities and community events. Note that Bahá’í, Jewish and Islamic holidays begin at sundown the previous day and end at sundown on the date listed. National and International Holidays The calendar notes U.S. holidays that are either legal holidays or observed in various states and communities throughout the country. Important national and international observances that may be commemorated in the U.S. are also included. Calendar System The dates of secular holidays are based on the Gregorian calendar, which is commonly used for civil dating purposes. Many religions and cultures follow various traditional calendar systems that are often based on the phases of the moon with occasional adjustments for the solar cycle. Therefore, specific Gregorian calendar dates for these observances will differ from year to year. In addition, calculation of specific dates may vary by geographical location and according to different sects within a religion. [NOTE: Observances highlighted in yellow indicate that the dates are tentative or not yet set by the organizations who coordinate them.] © 2020 Anti-Defamation League Page 1 https://www.adl.org/education/resources/tools-and-strategies/calendar-of-observances January 2021 January 1 NEW YEAR’S DAY The first day of the year in the Gregorian calendar, commonly used for civil dating purposes. -

Countries and Continents of the World: a Visual Model

Countries and Continents of the World http://geology.com/world/world-map-clickable.gif By STF Members at The Crossroads School Africa Second largest continent on earth (30,065,000 Sq. Km) Most countries of any other continent Home to The Sahara, the largest desert in the world and The Nile, the longest river in the world The Sahara: covers 4,619,260 km2 The Nile: 6695 kilometers long There are over 1000 languages spoken in Africa http://www.ecdc-cari.org/countries/Africa_Map.gif North America Third largest continent on earth (24,256,000 Sq. Km) Composed of 23 countries Most North Americans speak French, Spanish, and English Only continent that has every kind of climate http://www.freeusandworldmaps.com/html/WorldRegions/WorldRegions.html Asia Largest continent in size and population (44,579,000 Sq. Km) Contains 47 countries Contains the world’s largest country, Russia, and the most populous country, China The Great Wall of China is the only man made structure that can be seen from space Home to Mt. Everest (on the border of Tibet and Nepal), the highest point on earth Mt. Everest is 29,028 ft. (8,848 m) tall http://craigwsmall.wordpress.com/2008/11/10/asia/ Europe Second smallest continent in the world (9,938,000 Sq. Km) Home to the smallest country (Vatican City State) There are no deserts in Europe Contains mineral resources: coal, petroleum, natural gas, copper, lead, and tin http://www.knowledgerush.com/wiki_image/b/bf/Europe-large.png Oceania/Australia Smallest continent on earth (7,687,000 Sq. -

Obtaining and Using Evidence from Social Networking Sites

U.S. Department of Justice Criminal Division Washington, D.C. 20530 CRM-200900732F MAR 3 2010 Mr. James Tucker Mr. Shane Witnov Electronic Frontier Foundation 454 Shotwell Street San Francisco, CA 94110 Dear Messrs Tucker and Witnov: This is an interim response to your request dated October 6, 2009 for access to records concerning "use of social networking websites (including, but not limited to Facebook, MySpace, Twitter, Flickr and other online social media) for investigative (criminal or otherwise) or data gathering purposes created since January 2003, including, but not limited to: 1) documents that contain information on the use of "fake identities" to "trick" users "into accepting a [government] official as friend" or otherwise provide information to he government as described in the Boston Globe article quoted above; 2) guides, manuals, policy statements, memoranda, presentations, or other materials explaining how government agents should collect information on social networking websites: 3) guides, manuals, policy statements, memoranda, presentations, or other materials, detailing how or when government agents may collect information through social networking websites; 4) guides, manuals, policy statements, memoranda, presentations and other materials detailing what procedures government agents must follow to collect information through social- networking websites; 5) guides, manuals, policy statements, memorandum, presentations, agreements (both formal and informal) with social-networking companies, or other materials relating to privileged user access by the Criminal Division to the social networking websites; 6) guides, manuals, memoranda, presentations or other materials for using any visualization programs, data analysis programs or tools used to analyze data gathered from social networks; 7) contracts, requests for proposals, or purchase orders for any visualization programs, data analysis programs or tools used to analyze data gathered from social networks. -

Office Country Office City Agent Name Previous/Other Trading Name

Office Country Office City Agent Name Previous/Other Trading Name Principal Contact Main Email Website Phone Office Address Albania Tirana Study Care - Tirana [email protected] www.studycate.al Abdyl Frasheri Street Albania Tiranë Bridge Blue Pty Ltd - Albania Lika Shala [email protected] 377 45 255 988 K2-No.6 Rruga Naim Frashëri Algeria Algiers MasterWise Algeria MasterWise Ahmed Hamza [email protected] www.master-wise.com 213 021 27 4999 116 Boulevard Des Martyrs el Madania http://www.cwinternationaleducatio Argentina Buenos Aires CW International Education Carola Wober [email protected] 54 11 4801 0867 J.F. Segui 3967 Piso 6 A (1425) n.com Argentina Buenos Aires Latino Australia Education - Buenos Aires Milagros Pérez Herranz [email protected] http://www.latinoAustralia.com 54 11 4811 8633 Riobamba 972 4-C / Capital Federal 25 de Mayo 252 2-B Vicente Lopez Provincia de Argentina Buenos Aires TEDUCAustralia - Buenos Aires TEDUCA Group Carolina Muñoz [email protected] www.teducAustralia.com Buenos Aires Argentina Mendoza Latino Australia Education - Mendoza Milagros Pérez Herranz [email protected] www.latinoAustralia.com 54 261 439 0478 R. Obligado 37 - Oficina S3 Godoy Cruz Agency for Cultural Exchange Av Sargento Cayetano Beliera 3025 Edificio M3 2P Argentina Pilar ACE Australia Juan Martin Sanguinetti [email protected] www.ace-australia.com 54 911 38195291 Australia Pty Ltd Parque Austral Australia Adelaide 1st Education Australia Pty Ltd Sean Sun [email protected] -

Asia's Rise in the New World Trade Order

GED Study Asia’s Rise in the New World Trade Order The Effects of Mega-Regional Trade Agreements on Asian Countries Part 2 of the GED Study Series: Effects of Mega-Regional Trade Agreements Authors Dr. Cora Jungbluth (Bertelsmann Stiftung, Gütersloh), Dr. Rahel Aichele (ifo, München), Prof. Gabriel Felbermayr, PhD (ifo and LMU, München) GED Study Asia’s Rise in the New World Trade Order The Effects of Mega-Regional Trade Agreements on Asian Countries Part 2 of the GED Study Series: Effects of Mega-Regional Trade Agreements Asia’s Rise in the New World Trade Order Table of contents Executive summary 5 1. Introduction: Mega-regionals and the new world trade order 6 2. Asia in world trade: A look at the “noodle bowl” 10 3. Mega-regionals in the Asia-Pacific region and their effects on Asian countries 14 3.1 The Trans-Pacific Partnership (TPP): The United States’ “pivot to Asia” in trade 14 3.2 The Free Trade Area of the Asia-Pacific (FTAAP): An inclusive alternative? 16 3.3 The Regional Comprehensive Economic Partnership (RCEP): The ASEAN initiative 18 4. Case studies 20 4.1 China: The world’s leading trading nation need not fear the TPP 20 4.2 Malaysia: The “Asian Tiger Cub” profits from deeper transpacific integration 22 5. Parallel scenarios: Asian-Pacific trade deals as counterweight to the TTIP 25 6. Conclusion: Asia as the driver for trade integration in the 21st century 28 Appendix 30 Bibliography 30 List of abbreviations 34 List of figures 35 List of tables 35 List of the 20 Asian countries included in our analysis 36 Links to the fact sheets of the 20 Asian countries included in our analysis 37 About the authors 39 Imprint 39 4 Asia’s Rise in the New World Trade Order Executive summary Asia is one of the most dynamic regions in the world and the FTAAP, according to our calculations the RCEP also has the potential to become the key region in world trade has positive economic effects for most countries in Asia, in the 21st century. -

Eliminating Extreme Poverty in Africa: Trends, Policies and the Role of International Organizations

No 223 – May 2015 Eliminating Extreme Poverty in Africa: Trends, Policies and the Role of International Organizations Zorobabel Bicaba, Zuzana Brixiová and Mthuli Ncube Editorial Committee Rights and Permissions All rights reserved. Steve Kayizzi-Mugerwa (Chair) Anyanwu, John C. Faye, Issa The text and data in this publication may be Ngaruko, Floribert reproduced as long as the source is cited. Shimeles, Abebe Reproduction for commercial purposes is Salami, Adeleke O. forbidden. Verdier-Chouchane, Audrey The Working Paper Series (WPS) is produced by the Development Research Department of the African Development Bank. The WPS disseminates the Coordinator findings of work in progress, preliminary research Salami, Adeleke O. results, and development experience and lessons, to encourage the exchange of ideas and innovative thinking among researchers, development practitioners, policy makers, and donors. The findings, interpretations, and conclusions expressed in the Bank’s WPS are entirely those of the author(s) and do not necessarily represent the Copyright © 2015 view of the African Development Bank, its Board of African Development Bank Directors, or the countries they represent. Immeuble du Centre de Commerce International d' Abidjan (CCIA) 01 BP 1387, Abidjan 01 Côte d'Ivoire E-mail: [email protected] Working Papers are available online at http:/www.afdb.org/ Correct citation: Bicaba, Zorobabel; Brixiová, Zuzana and Ncube, Mthuli (2015), Eliminating Extreme Poverty in Africa: Trends, Policies and the Role of International Organizations, Working Paper Series N° 223 African Development Bank, Abidjan, Côte d’Ivoire. AFRICAN DEVELOPMENT BANK GROUP Eliminating Extreme Poverty in Africa: Trends, Policies and the Role of International Organizations Zorobabel Bicaba, Zuzana Brixiová and Mthuli Ncube1 Working Paper No.