ANNUAL-REPORT-2019-2020.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minda Corp Kotak

The Research Report is only for reference purposes for residents in India, but not for the purposes of advising or recommending on any investment. Kotak Securities Limited or its affiliates are not seeking any business relationship with any viewer of this report nor does Kotak Securities or its affiliates assume any liability for acting on this report nor does it take any responsibility to update information provided in this report. Company Report Minda Corp. (MDA) BUY Automobiles December 07, 2015 INITIATING COVERAGE Sector view: Attractive Harness the potential. Minda Corporation is one of the leading suppliers of locksets, Price (`): 89 wiring harness and instrument clusters in the Indian automotive market. Our positive view on the stock is underpinned by (1) Minda’s technology tie-ups with global Target price (`): 110 suppliers that give it access to MNC OEMs, (2) its ability to gain market share across BSE-30: 25,530 segments and (3) robust growth potential from new products such as steering roll connectors and sensors. We expect 25% EPS CAGR over FY2016-20E and initiate coverage with a BUY rating; our TP of `110 is based on 15X September 2017E EPS. Technology tie-ups and strong relationship with OEMs to drive market share gains Minda Corporation is well-placed to deliver 20% revenue CAGR over the next five years led by INSIDE (1) market share gains across segments, (2) expansion of product offerings with existing Key technology customers and (3) new products. We expect Minda Furukawa’s market share in wiring harness partners and their to increase to 16% by FY2020 (from 7% currently) led by market share gains with Maruti. -

Fact Sheet-Covers-Dec16-Ctc.Cdr

TOLL FREE NON TOLL FREE SMS WEBSITE 1800 425 0090 +91-40-23001181 IQ to 5757590 www.edelweissmf.com Content Market Commentary - Equity 3 Market Commentary – Debt 4 Equity Funds Edelweiss Absolute Return Fund 5 Edelweiss Arbitrage Fund 7 Edelweiss Economic Resurgence Fund 9 Edelweiss ELSS Fund 10 Edelweiss Equity Opportunities Fund 12 Edelweiss Equity Savings Advantage Fund 13 Edelweiss Mid and Small Cap Fund 15 Edelweiss Prudent Advantage Fund 17 Edelweiss Tax Advantage Fund 19 Edelweiss Top 100 Fund 20 Balanced Fund Edelweiss Balanced Advantage Fund 22 Fixed Income Funds Edelweiss Banking & PSU Debt Fund 23 Edelweiss Bond Fund 24 Edelweiss Corporate Debt Opportunities Fund 25 Edelweiss Government Securities Fund 26 Edelweiss Liquid Fund 27 Edelweiss Short Term Income Fund 28 Edelweiss Treasury Fund 29 Exchange Traded Funds Edelweiss ETF - Nifty Bank 30 Edelweiss ETF - Nifty 50 31 Edelweiss ETF - Nifty Quality 30 32 Overseas Fund of Funds Edelweiss Asean Equity Offshore Fund 33 Edelweiss Emerging Markets Opportunities Equity Offshore Fund 34 Edelweiss Europe Dynamic Equity Offshore Fund 35 Edelweiss Greater China Equity Offshore Fund 36 Edelweiss US Value Equity Offshore Fund 37 Scheme Performance (Other than Direct Plan) 38 - 44 Scheme Performance (Direct) 45 - 49 SIP Performance 50 - 51 Schemes managed by Fund Manager 52 - 53 How to Read Factsheet 54 2 Market Commentary - Equity What we said last time – Globally, the US Federal Reserve meeting could Outlook for the coming month assume significance as investors would assess the tone of monetary policy Globally, statements and policies of the newly elected President as he assumes action and its future implications. -

Autos & Auto Parts Sector

16 July 2020 Equity Research Asia Pacific | Japan Autos & Auto Parts Sector Post COVID-19 global auto sector outlook Automobiles & Components | Connections Series Connections Series Summary: The global auto/auto parts sector has sustained a significant impact from The Credit Suisse Connections Series leverages our COVID-19, but we see signs of a gradual recovery. In this connection series, our auto exceptional breadth of macro and micro research to teams located globally have summarized updated views on each region, auto demand deliver incisive cross-sector and cross-border outlook, topics surrounding the sector following COVID-19 impact, and investment thematic insights for our clients. recommendations in each of our respected regional sectors. Research Analysts Sector overview: While we forecast 2020 global demand to drop significantly due to Masahiro Akita COVID-19, we see room for growth beyond 2021 and opportunities for multiple reratings 81 3 4550 7361 /overall positive performance in the markets. Considering the pace of recovery seen in [email protected] China and the US (two of the largest markets), our regional sector preference at this point Koji Takahashi is China > US, followed by Japan and Korea where names with high exposures to China 81 3 4550 7884 and US seem attractive. On the other hand, recovery from COVID-19 in emerging markets [email protected] has been relatively slow. With this in mind, we think recovery in India and Indonesia is more or less limited over the short term, but our expectations for medium-to-long-term growth in Bin Wang both markets remains unchanged. -

PRODUCT PRICE LIST 2015-16 : V 1.4

Warranty: 24 Months Warranty: 24 Months Home UPS Batteries Solar Products High Capacity Product 16Amp 16Amp 16Amp Power Accessories Solar accesories Solar Projects Warranty: 24 Months PRODUCT PRICE LIST 2015-16 : v 1.4 *Price upon request: +91-96506 36366 Price List All Products index Content 02 HomeUPSEconomyRange 03 HomeUPSRegularRange 03 HomeUPSRegularRangeSQUARE&SINEWAVE 04 HomeUPSPremiumRange 05 SolarHomeUPS 06 Warranty: 24 Months Battery-SolarTubular 06 Battery-LeadAcid 07 Battery-Tubular 08 BatteryTrolley 09 Battery-Automative 10-11 SolarHomeLightingSystem 12 SolarStreetLightingSystem 12 HighCapacityInverterSeries 13 DSPSineWaveInverterSeries 14-15 Intelli-QOnlineUPSSeries(1P-1P) 16 Intelli-QOnlineUPSSeries(3P-3P) 17 SolarPowerConditioningUnit 18-19 SolarInverter 19-20 SolarChargeController 21-22 Warranty: 24 Months SolarConversionKit 23 BatteryChargers 23 BatteryEqualizerss 24 SolarPanel 25 PowerAccessories-PowerGuard 26 BatteryWaterToppingKit 27 Warranty: 24 Months *Price upon request: +91-96506 36366 Warranty: 24 Months Warranty: 24 Months Warranty: 24 Months *Price upon request: +91-96506 36366 PRICE LIST HOME UPS - ECONOMY RANGE (SQUARE WAVE) Pico without Battery Micron Digital HUPS Shiny Sine Wave HUPS 250/12V 250/12V • For small homes and business • For small homes and business • Huge savings on electricity bills due • Portable & lightweight • Portable & lightweight to SMPS based charger • Solar Compatible 2 CFLs+1 Fan+1 Tube Light+1 Laptop 2 CFLs+1 Fan+1 Tube Light 2 CFLs+2 Fans+1 TV 2 CFLs+ 1 Tube Light+ 1 TV Warranty: -

Bosch Automotive Filters Bodyguard of the Engine Contents

Bosch Automotive Filters Bodyguard of the engine Contents 1 90 years of Bosch Fuel Filters 4 2 History of Filtration 5 3 Bosch - A Strong Partner in the Filtration Business 6 4 Rely on Bosch Filters 8 5 Bosch Fuel Filters - Diesel 9 6 Bosch Fuel Filters - Gasoline (Petrol) 11 7 Bosch Fuel Filters in Comparison 12 8 Bosch Oil Filters 13 9 Bosch Oil Filters in Comparison 15 10 Bosch Air Filters 16 11 Bosch Air Filters in Comparison 18 12 Bosch Cabin Filters 19 13 Bosch Cabin Filters in Comparison 20 14 HCV Filter Application Chart 21 15 Cross Reference Filter Application Chart 30 16 LCV Filter Application Chart 38 17 Farm Filter Application Chart 40 18 Passenger Car Filter Application Chart 42 19 3-Wheeler Filter Application Chart 50 20 2-Wheeler Filter Application Chart 51 3 History of Filtration 90 years of Since 1930, Bosch Fuel Filters have been protecting the injection systems of motor Bosch Fuel Filters: vehicles. They reliably separate particles and water from fuel and contribute to optimum To be continued! engine performance. 1936 2001 2020 The first filter made of a special Bosch Gasoline Filters Bosch Filters – for paper – a material still used and for in-tank units today’s and future further developed down to the mobility present day 1930 1998 2009 First Bosch Fuel Bosch Common-Rail Diesel Bosch Common-Rail Filters Filter with integrated water Diesel Filter for biodiesel separator applications For tomorrow‘s mobility, filters will continue being important! Understanding Filtration Bosch filters protect all the important and expensive components in vehicles, especially vehicles with modern In future, Bosch will continue to provide accurately fitting and matching filters – no matter which fuels or drive gasoline and diesel injection systems which have lower tolerance levels. -

Daimler's Big Divide and the Road Ahead for India

Rs 100 pEssentialro readingfe fors thes Automotiveion industryal Vol. 17 No. 5 Total pages: 48 15 February 2021 www.autocarpro.in BRAND FINDER INDUSTRY ACMA .............................. 14 Ampere Vehicles ..............7 Ashok Leyland ............... 14 Ather Energy ...................7 Daimler’s big divide and Bajaj Auto ...................... 25 Benelli India ................... 12 Bgauss ..............................7 the road ahead for India Bharat Benz .................. 30 Ceat Tyres ........................7 Cooper Corporation ...... 24 Daimler .......................... 28 Daimler India CV ........... 30 Earth Energy EV ........... 42 Gemopai ...........................7 GWM India ........................5 Hero Electric ....................7 Hyundai Motor India ..6, 14 JBM Group ................... 32 Maruti Suzuki India ..10, 14 Mercedes-Benz ............. 28 MG Motor India ................6 Nissan Motor India ..........3 Okinawa Autotech ...........7 Pure EV ............................7 QuantumScape ............. 36 REE Automotive ........... 40 Renault ........................... 31 Renault India .................. 21 Revolt Motor ....................7 With Daimler planning to spin off its truck business and create a new Mercedes-Benz SKF India ..........................6 Skoda Auto India ..............9 identity for cars, there will be new challenges and opportunities to reckon with. The Stellantis ........................ 31 move could also have some interesting implications for the India market Page 28 Suzuki Motor Corp -

Months) ASHOK LEYLAND Gensets (GNS

Battery Details Warranty Terms C20 Capacity (AH) MANUFACTURER SEGMENT GENSET MODELS Fuel 20HR (REF) Brand Battery Type Battery SAP CODE FOC (Months) 10-KVA-AL485G1/15-KVA-AL485G1/ 20- GenSets ASHOK LEYLAND KVA-AL485G2/25-KVA-AL485AG3/ 30-KVA- Diesel 130Ah SF SONIC JUMBO JMB1300 FSM0-JMB1300 0 - 12 (GNS) AL4102G1 100-KVA-AL6DTIG1/125-KVA-AL6DTIG2/140-KVA- ASHOK LEYLAND SF SONIC JUMBO JMB1500 FSM0-JMB1500 0 - 12 GenSets AL680TAG2/160-KVA-AL680TAG3/180-KVA-AL615G2/200- Diesel 150Ah (GNS) KVA-AL615G1/250-KVA-AL618.42D/500-KVA - ASHOK LEYLAND BLACK PANTHER BP150R(MF) FBP0-BP150R(MF) 0 - 6 BF8M1015CP 10-KVA-AL485G1/15-KVA-AL485G1/20-KVA-AL485G2/25- ASHOK LEYLAND KVA-AL485AG3/30-KVA-AL4102G1/35-KVA- SF SONIC JUMBO JMB1000 FSM0-JMB1000 0 - 12 GenSets ALW04DMK1/40-KVA-ALW04DMK1/45-KVA- Diesel 100Ah (GNS) ASHOK LEYLAND ALW04DMK1/50-KVA-ALW04DT/62.5-KVA-ALW04DT/82.5- BLACK PANTHER BP100L(MF) FBP0-BP100L(MF) 0 - 6 KVA-ALW04DTI. GenSets C18-500 KVA/C18-600KVA/C18-625KVA/C3412- CATERPILLAR INDIA Diesel 200 Ah SF SONIC JUMBO JMB2000 FSM0-JMB2000 0 - 12 (GNS) 725KVA/C32-1010KVA/C3512-1500KVA/C3516-2000KVA 5-KVA-EA 10/7.5-KVA-EA16/10-KVA-EA16/15-KVA- GREEN FIELD ENTERPRISES BLACK PANTHER BP88L(MF) FBP0-BP88L(MF) 0 - 6 EA20/15-KVA-HA294/15-KVA-RV2PG/45-KVA-4R 1040/40- Diesel 88Ah GREEN FIELD ENTERPRISES KVAHA 494 TC/ SF SONIC JUMBO JMB88LTR FSM0-JMB88LTR 0 - 12 20-KVA-RV 3 PG;25-KVA-RB 33;25-KVA-HA 394;30-KVA-3R GREEN FIELD ENTERPRISES 1040;30-KVA-RB 33;35-KVA-HA 494;40-KVA-4R 1040;45- Diesel 130Ah SF SONIC JUMBO JMB1300 FSM0-JMB1300 0 - 12 KVA-4R 1040;40-KVA-HA -

Electric Vehicles Report Part 2

Title EV Landscape: Opportunities for India's Auto Component Industry Year July, 2021 Authors Corporate & Government Advisory, YES BANK and Automotive Component Manufacturers Association of India (ACMA) This report is a publication of YES BANK Ltd. and ACMA, and so YES BANK and ACMA have editorial control over the content, including opinions, advice, statements, services, offers etc. that is represented in this report. However, YES BANK and ACMA will not be liable for any loss or damage caused by the reader's reliance on information obtained through this report. This report may contain third party contents and third-party resources. YES BANK and ACMA take no responsibility for third party content, advertisements or third party applications that are printed on or through this report, nor does it take any responsibility for the goods or services provided by its advertisers or for any error, omission, deletion, defect, theft or destruction or unauthorised access to, or alteration of, any user communication. Further, YES BANK and ACMA do not assume any responsibility or liability for any loss or damage, including personal injury or death, resulting from use of this report or from any content for communications or materials available on this report. The contents are provided for your reference only. The reader/ buyer understands that except for the information, products and services clearly identified as being supplied by YES BANK and ACMA, it does not operate, control or endorse any information, products, or services appearing in the report in any way. All other information, products and services offered through the report are offered by third parties, which are not affiliated in any manner to YES BANK and ACMA. -

Warranty Policy & Procedures for Vehicles

AL Warranty (Vehicles) Warranty Policy & Procedures For Vehicles ASHOK LEYLAND LIMITED Technical Service Group Marketing Division, Nandanam Chennai September 2008 1 AL Warranty (Vehicles) FOREWORD The Warranty policy of Ashok Leyland covering the terms of warranty offered for various models of vehicles marketed by AL in India and the procedure to be followed in administering the Policy is given in this Manual. This manual contains the latest information on AL’s warranty policy and any further revision to the policy will be communicated to the recipients of manual for updation. Information on Free Services offered by AL on various models of vehicles is also included in this Manual. In this manual wherever the word ‘Dealer’ is used, it shall also include ‘Authorised Service Centre’ whether appointed AL or by a Dealer. Ashok Leyland Limited Marketing Division Technical Service Group Chennai Dated: September 2008 2 AL Warranty (Vehicles) UPDATION OF AMENDMENTS This Manual contains the updated information on warranty policy as on September 2008 . On each page, in the left hand bottom corner the month and year of issue are printed. In this issue, all pages will show “Issue: September 08 /0”, the numeral ‘0’ denoting first issue. Any future amendments to the policy will be issued in the form of a “Warranty Policy Amendment”. This amendment sheet bearing the Section and Page Number can be inserted in place of the relevant Section/Page that has been superseded. For example, the first amendment to page 3-1 if done in October 2006 will show at left hand bottom corner “Issue: Oct 06/1” and will replace the page 3-1 bearing the notation “Issue: Oct 06/0”. -

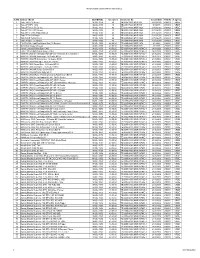

Microautotech Speed Governor Approval List S.NO. Vehicle Model

MicroAutotech Speed Governor Approval List S.NO. Vehicle Model SLD MODEL Set speed Certificate No. Issued Date TAC No. T.agency 1 Tata -407 LCV Diesel MASL-1050 40 TE/2004/322/CMVR/819 22/12/2004 V90001 VRDE 2 Tata LPT/SFC 1612 MASL-1050 40 TE/2004/322/CMVR/889 9/4/2005 V90001 VRDE 3 Tata LPT 1615 TC Diesel MASL-1050 40 TE/2005/408/CMVR/1029 21/10/2005 V90001 VRDE 4 Tata LPT 1613 TC Diesel MASL-1050 40 TE/2005/408/CMVR/1029 21/10/2005 V90001 VRDE 5 Tata SK 1613 TC Tipper Diesel MASL-1050 40 TE/2005/408/CMVR/1029 21/10/2005 V90001 VRDE 6 Tata LPT 1109 Diesel MASL-1050 40 TE/2005/408/CMVR/1029 21/10/2005 V90001 VRDE 7 Tata 709 E Turbo Diesel MASL-1050 40 TE/2005/408/CMVR/1029 21/10/2005 V90001 VRDE 8 Tata LP 1512 TC Diesel MASL-1050 40 TE/2005/408/CMVR/1029 21/10/2005 V90001 VRDE 9 FJ 470 CNG High Roof Omni Bus (15 Seater) MASL-1050 40,50,60 TE/2005/409/CMVR/1074 9/1/2006 V90001 VRDE 10 Mahindra Voyger (Diesel) MASL-1050 40,50,60 TE/2005/403/CMVR/1072 9/1/2006 V90001 VRDE 11 Ashok Leyland Viking Bus- CNG MASL-1050 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 V90001 VRDE 12 Eicher 10.59 RHD Cab & Body - CNG MASL-1050 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 V90001 VRDE 13 HM RTV CNG Green Ranger-DA-ST-CB-15 Seater & its Variants :- MASL-1050 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 V90001 VRDE 14 HM RTV CNG HR Passenger 16 Seater BS III MASL-1050 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 V90001 VRDE 15 HM RTV CNG HR School Bus 16 Seater BS III MASL-1050 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 V90001 VRDE 16 HM RTV CNG Passenger -

Type Approval Procedure for Electric and Hybrid Electric Vehicles Introduced in Market for Pilot / Demonstration Projects Intended for Government Scheme

AIS-131 AUTOMOTIVE INDUSTRY STANDARD Type Approval Procedure for Electric and Hybrid Electric Vehicles introduced in market for Pilot / Demonstration Projects intended for Government Scheme PRINTED BY THE AUTOMOTIVE RESEARCH ASSOCIATION OF INDIA P.B. NO. 832, PUNE 411 004 ON BEHALF OF AUTOMOTIVE INDUSTRY STANDARDS COMMITTEE UNDER CENTRAL MOTOR VEHICLE RULES – TECHNICAL STANDING COMMITTEE SET-UP BY MINISTRY OF ROAD TRANSPORT AND HIGHWAYS (DEPARTMENT OF ROAD TRANSPORT ANDHIGHWAYS) GOVERNMENT OF INDIA January 2015 I AIS-131 Status chart of the standard to be used by the purchaser for updating the record Sr. Corrigenda. Amendment Revision Date Remark Misc. No. General remarks : II AIS-131 INTRODUCTION The Government of India felt the need for a permanent agency to expedite the publication of standards and development of test facilities in parallel when the work on the preparation of the standards is going on, as the development of improved safety critical parts can be undertaken only after the publication of the standard and commissioning of test facilities. To this end, the erstwhile Ministry of Surface Transport (MOST) has constituted a permanent Automotive Industry Standards Committee (AISC) vide order No. RT-11028/11/97-MVL dated September 15, 1997. The standards prepared by AISC will be approved by the permanent CMVR Technical Standing Committee (CTSC). After approval, the Automotive Research Association of India, (ARAI), Pune, being the Secretariat of the AIS Committee, has published this standard. For better dissemination of this information ARAI may publish this standard on their web site. Globally, automotive industry is passing through a paradigm shift. The past century has been the era of internal combustion engine (ICE) primarily on account of the ease of use, availability and low-cost of fossil fuels. -

Motherson Sumi Systems

Equity Research INDIA October 11, 2020 BSE Sensex: 40509 Motherson Sumi Systems BUY Maintained ICICI Securities Limited is the author and A closer look at SAMIL’s businesses Rs121 distributor of this report Motherson Sumi Systems (MSS) management hosted investors for an interaction on the top-10 businesses incubated under Samvardhana Motherson International Company update and (SAMIL), which is to be merged into MSS. earnings revision Key takeaways from the call Automobiles SAMIL has a total portfolio of 17-18 companies with 15 JV partners from six countries generating overall revenue of Rs28bn and 13.3% EBITDA in FY20 spread Target price: Rs158 across 50 facilities. The total capital invested in SAMIL (ex-of SMRPBV/MSSL) is ~Rs28bn. Earnings revision Top 10 businesses have witnessed a CAGR growth of 25% in the past five years, (%) FY21E FY22E clocked ~Rs24bn in revenue in FY20 (refer Table 1). Top 10 businesses generated Sales ↑ 4.6 ↑ 5.9 EBITDA ↑ 6.9 ↑ 7.0 RoCE of 23% and 17% in FY19/20, respectively. Interestingly, all business segments PAT ↑ 33.3 ↑ 5.6 have vastly experienced management teams with >10years association with Motherson group. Target price revision Management indicated 8 of the top 10 businesses are consistent dividend paying Rs158 from Rs126 companies, only metal solutions company (weak RoCE), which was recently Shareholding pattern established at the behest of the customer, is in growth phase. Dec Mar Jun SAMIL shared services provide centralised umbrella entity for M&A support, ‘19 ‘20 ‘20 Promoters 61.7 61.7 61.7 procurement support, compliance, audit and legal support, travel and facility Institutional construction management services to all businesses under MSSL and SAMIL.