CP Amending ITS on Main Indices And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Molnár Melina – a Tőzsde És Ami Mögötte

A Tőzsde és ami mögötte van Molnár Melina Budapesti Értéktőzsde Zrt. Budapesti Corvinus Egyetem, 2015. szeptember 30. Gondolatmenet A tőkepiac A tőzsdék szerepe a gazdaságban A tőkepiac szereplői Mi mozgatja az árakat, és mi a befektetőket? Hozam vs. kockázat 623 milliárd USD (1.) GDP: 134 milliárd USD 16 milliárd USD 73 milliárd USD (3.) 421 milliárd USD (2.) 24 milliárd USD (29.) Mi a tőzsde, és miért alakult ki? 4 | Pénzügyi piacok PÉNZÜGYI KÖZVETÍTŐK MEGTAKARÍTÓK FORRÁSIGÉNYLŐK • Háztartások • Háztartások • Állam • Állam • Vállalatok • Vállalatok Vállalatok növekedési forrásai BELSŐ KÜLSŐ FORRÁSOK FORRÁSOK Stratégiai Nyereség Bankhitel befektető Tulajdonosi tőke Támogatás TŐKEPIAC 6 | Pénzügyi piacok PÉNZÜGYI KÖZVETÍTŐK MEGTAKARÍTÓK FORRÁSIGÉNYLŐK • Háztartások • Háztartások • Állam • Állam • Vállalatok • Vállalatok Pénzügyi piacok PÉNZÜGYI KÖZVETÍTŐK MEGTAKARÍTÓK FORRÁSIGÉNYLŐK • Háztartások • Háztartások • Állam • Állam • Vállalatok • Vállalatok Mi a tőzsde és miért alakult ki? . Nagy földrajzi felfedezések . Első részvénytársaságok Finanszírozás és Kockázatmegosztás 1553 – Oroszország Társ., 1600 – Kelet-Indiai Társ.,1602 – Holland Kelet-Indiai Társaság, Amszterdami Tőzsde . Tőzsdék megalakulása 1566 – London 1602 – Amszterdam 1817 – New York 1864 – Budapesti Áru és Értéktőzsde A tőkepiac felépítése A Másodlagos Elsődleges piac piac VÁLLALAT TŐZSDE OTC Részvények Kötvények Csak Új értékpapír adásvétel Erős gazdaság VS virágzó tőkepiac Source: World Bank , 2012 11 | Erős gazdaság VS virágzó tőkepiac Source: World Bank -

Midwest Financial Brian Johnson, RFC 706 Montana Street Glidden, IA 51443 [email protected] 712-659-2156

Midwest Financial Brian Johnson, RFC 706 Montana Street Glidden, IA 51443 www.midwestfinancial.us [email protected] 712-659-2156 The SITREP for the week ending 08/06/2021 ***************************************************** SIT REP: n. a report on the current situation; a military abbreviation; from "situation report". In the markets: U.S. Markets: U.S. stocks recorded solid gains for the week and several indices hit record highs. The Dow Jones Industrial Average rose 273 points finishing the week at 35,209, a gain of 0.8%. The NASDAQ retraced all of last week’s decline by rising 1.1% to close at 14,836. By market cap, the large cap S&P 500 rose 0.9%, while the mid cap S&P 400 and small cap Russell 2000 gained 0.5% and 1.0%, respectively. International Markets: Major international markets also finished the week solidly in the green. Canada’s TSX added 0.9%, while the United Kingdom’s FTSE 100 gained 1.3%. France’s CAC 40 and Germany’s DAX rose 3.1% and 1.4%, respectively. China’s Shanghai Composite added 1.8%, while Japan’s Nikkei rallied 2%. As grouped by Morgan Stanley Capital International, developed markets finished up 1.0% and emerging markets gained 0.7%. Commodities: Precious metals had a difficult week. Gold retreated -3.0% to $1763.10 per ounce, while Silver fell a steeper -4.8% to $24.33. West Texas Intermediate crude oil gave up all of the last two week’s gains, declining -7.7% to $68.28 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -3%. -

Global Exchange Indices

Global Exchange Indices Country Exchange Index Argentina Buenos MERVAL, BURCAP Aires Stock Exchange Australia Australian S&P/ASX All Ordinaries, S&P/ASX Small Ordinaries, Stock S&P/ASX Small Resources, S&P/ASX Small Exchange Industriials, S&P/ASX 20, S&P/ASX 50, S&P/ASX MIDCAP 50, S&P/ASX MIDCAP 50 Resources, S&P/ASX MIDCAP 50 Industrials, S&P/ASX All Australian 50, S&P/ASX 100, S&P/ASX 100 Resources, S&P/ASX 100 Industrials, S&P/ASX 200, S&P/ASX All Australian 200, S&P/ASX 200 Industrials, S&P/ASX 200 Resources, S&P/ASX 300, S&P/ASX 300 Industrials, S&P/ASX 300 Resources Austria Vienna Stock ATX, ATX Five, ATX Prime, Austrian Traded Index, CECE Exchange Overall Index, CECExt Index, Chinese Traded Index, Czech Traded Index, Hungarian Traded Index, Immobilien ATX, New Europe Blue Chip Index, Polish Traded Index, Romanian Traded Index, Russian Depository Extended Index, Russian Depository Index, Russian Traded Index, SE Europe Traded Index, Serbian Traded Index, Vienna Dynamic Index, Weiner Boerse Index Belgium Euronext Belgium All Share, Belgium BEL20, Belgium Brussels Continuous, Belgium Mid Cap, Belgium Small Cap Brazil Sao Paulo IBOVESPA Stock Exchange Canada Toronto S&P/TSX Capped Equity Index, S&P/TSX Completion Stock Index, S&P/TSX Composite Index, S&P/TSX Equity 60 Exchange Index S&P/TSX 60 Index, S&P/TSX Equity Completion Index, S&P/TSX Equity SmallCap Index, S&P/TSX Global Gold Index, S&P/TSX Global Mining Index, S&P/TSX Income Trust Index, S&P/TSX Preferred Share Index, S&P/TSX SmallCap Index, S&P/TSX Composite GICS Sector Indexes -

Tracking Errors of Exchange Traded Funds in Bursa Malaysia

Munich Personal RePEc Archive Tracking Errors of Exchange Traded Funds in Bursa Malaysia Ku, Alfred Ing-Soon and Liew, Venus Khim-Sen and Puah, Chin-Hong RHB Investment Bank Berhad, 102, Pusat Pedada, Jalan Pedada, 96000 Sibu, Sarawak, Malaysia., Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak., Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak. 2019 Online at https://mpra.ub.uni-muenchen.de/107990/ MPRA Paper No. 107990, posted 27 May 2021 07:20 UTC Tracking Errors of Exchange Traded Funds in Bursa Malaysia Alfred Ing-Soon Ku RHB Investment Bank Berhad, 102, Pusat Pedada, Jalan Pedada, 96000 Sibu, Sarawak, Malaysia. Tel: 6-084-329214 E-mail: [email protected] Venus Khim-Sen Liew Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak. Tel: 6-082-584291 (Corresponding Author) E-mail: [email protected] Chin-Hong Puah Faculty of Economics and Business, Universiti Malaysia Sarawak, Jalan Datuk Mohammad Musa, 94300 Kota Samarahan, Sarawak. Tel: 6-082-584294 E-mail: [email protected] Citation: Liew, V.K.-S, Ku, A. I.-S., & Puah, C.-H. 2019. Tracking Errors of Exchange Traded Funds in Bursa Malaysia. Asian Journal of Accounting and Finance, 11(2), 96-109. Abstract This study measures the tracking errors of exchange traded funds (ETFs) listed in Bursa Malaysia. Five measures of tracking errors are estimated in this study for the seven ETFs involved. Overall, the best ETF is METFAPA with the least tracking error. -

Monthly Economic Update

122 Winnebago Street, Decorah, IA 52101 309 HWY 150 N, West Union, IA 52175 1-877-566-9468 Text: 563-412-4770 [email protected] Visit us at www.knoxfin.com In this month’s recap: stocks stay in rally mode, helped by hints that the U.S. and China may be closing in on a phase-one trade deal; hiring bounces back; key real estate indicators look stronger. Monthly Economic Update Presented by Jason Knox, AIF®, CRC®, December 2019 THE MONTH IN BRIEF The S&P 500 rose 3.4% in November and attained a series of record closes in the process. Earnings results helped stocks, as did intermittent signals that the first stage of a U.S.-China trade agreement might be near at hand. Job creation improved, and consumer spending lived up to market expectations; consumer confidence and business activity, not so much. Housing indicators communicated good news, and the rally in stocks made the commodity sector look less attractive. DOMESTIC ECONOMIC HEALTH Were the U.S. and China close to signing off on the first phase of a new trade deal? According to officials from both countries, the answer was yes. When would this phase- one deal be finalized? No definite answer emerged. On November 8, President Donald Trump said that such an agreement was near, and six days later, White House economic advisor Larry Kudlow said that negotiators were “getting close” to an accord. On November 26, China’s commerce ministry announced that trade representatives had “reached a consensus” on remaining issues, and President Trump said that negotiators were in the “final throes of a very important deal.” Still, November ended without any announcement that a phase-one pact had been reached.2,3 The Department of Labor’s latest employment report found that the economy generated 128,000 net new jobs in October. -

Are Retail Investors Less Aggressive on Small Price Stocks?

Are retail investors less aggressive on small price stocks? Carole M´etais∗ Tristan Rogery January 13, 2021 Abstract In this paper, we investigate whether number processing impacts the limit orders of retail investors. Building on existing literature in neuropsychology that shows that individuals do not process small numbers and large numbers in the same way, we study the influence of nominal stock price level on order aggressiveness. Using a unique database that allows us to identify order and trade records issued by retail investors on Euronext Paris, we show that retail investors, when posting non-marketable orders, are less aggressive on small price stocks than on large price stocks. This difference in order aggressiveness is not explained by differences in liquidity and other usual drivers of order aggressiveness. We provide additional evidence by showing that no such difference exists for limit orders of high frequency traders (HFTs) over the same period and the same sample of stocks. This finding confirms that our results are driven by a behavioral bias and not by differential market dynamics between small price stocks and large price stocks. ∗LaRGE Research Center, University of Strasbourg { Mailing address: 61 Avenue de la For^etNoire, 67000 Strasbourg FRANCE { Email: [email protected]. I acknowledge support from the French State through the National Agency for Research under the program Investissements d'Avenir ANR-11-EQPX- 006. yDRM Finance, Universit´eParis-Dauphine, PSL Research University { Mailing address: Place du Mar´echal de Lattre de Tassigny, 75775 Paris Cedex 16 FRANCE { Email: [email protected] 1 1 Introduction While conventional finance theory posits that nominal stock prices are irrelevant for firm valuation, a number of papers provide empirical evidence that nominal prices do impact investor behavior. -

Weekly Economic Update

Jim Saulnier Presents: QUARTERLY ECONOMIC UPDATE A review of 2Q 2015 QUOTE OF THE THE QUARTER IN BRIEF QUARTER A 2.10% June retreat left the S&P 500 down 0.23% for Q2 2015, putting an end to its “A problem is a 9-quarter winning streak. The quarter’s biggest economic events occurred in late chance for you to do June – Greece defaulted on its debt, the commonwealth of Puerto Rico said a default your best.” was imminent, and China’s stock market plunged. The Federal Reserve seemed committed to raising interest rates before the end of the year, even as it lowered its – Duke Ellington 2015 economic forecast. Spring brought more home buying, higher oil prices, improved hiring, and a number of encouraging signs that the economy was pulling QUARTERLY TIP out of a winter slump. Even with all those positives, the headwinds in the stock 1,2 Keeping federal tax market were too strong to allow a broad advance. returns, W-2s, 1099s, year-end account DOMESTIC ECONOMIC HEALTH statements, and The second quarter saw the Federal Reserve revise its projections for 2015 GDP sample pay stubs for downward; the spring forecast of 2.3-2.7% growth was reduced to 1.8-2% growth. Its 6-7 years is sensible, June 17 policy statement also signaled at least one interest rate hike later this year – in case you make an but perhaps only one, as more Fed officials now believed the central bank should error in reporting raise rates only once in 2015 with two calling for no move until 2016. -

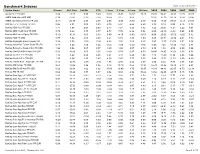

Benchmark Indexes Data As Of: 03/31/2011 Index Name Sharpe Std

Benchmark Indexes Data as of: 03/31/2011 Index Name Sharpe Std. Dev. 1st Qtr YTD 1 Year 3 Year 5 Year 10 Year 2010 2009 2008 2007 2006 Alerian MLP TR USD 0.89 23.25 5.99 5.99 33.02 20.03 16.57 17.25 35.85 76.41 -36.91 12.72 26.07 AMEX Gold Miners PR USD 0.39 47.82 -2.15 -2.15 35.65 8.12 9.68 - 33.94 37.30 -26.79 16.86 21.86 AMEX International Market PR USD -0.13 25.37 2.77 2.77 4.05 -5.95 -0.80 2.17 0.80 17.60 -39.51 16.18 21.51 BarCap 1-5 Yr Treasury TR USD 0.98 2.51 0.00 0.00 2.79 2.91 4.88 4.20 3.73 0.19 8.83 8.16 3.75 BarCap ABS Auto TR USD 1.17 5.68 0.63 0.63 2.47 7.21 6.23 5.12 3.25 26.07 -5.57 5.22 4.61 BarCap ABS Credit Card TR USD 0.79 9.42 0.77 0.77 4.73 7.76 6.86 5.84 6.55 29.89 -9.33 5.45 4.55 BarCap ABS Home Equity TR USD -0.19 16.91 0.00 0.00 0.00 -4.10 -5.80 -0.53 0.00 20.63 -36.00 -8.25 5.32 BarCap ABS TR USD 0.77 6.92 0.64 0.64 4.21 5.74 4.36 4.59 5.85 24.71 -12.72 2.21 4.70 BarCap Aggregate Bond Treasury TR 0.58 5.58 -0.16 -0.16 4.53 3.55 5.69 5.15 5.87 -3.57 13.74 9.01 3.08 BarCap Asian Pac Taiwan Dollar TR JPY 0.78 6.24 1.54 1.54 -2.45 -1.00 -2.50 -0.66 -2.26 7.45 -11.24 -7.52 2.81 BarCap Bellwether Swap 6 Mon TR USD 1.92 0.56 0.07 0.07 0.39 1.50 3.07 2.79 0.38 1.58 4.09 5.39 5.54 BarCap CMBS ERISA Eligible TR USD 0.53 18.46 2.05 2.05 12.62 8.79 6.87 6.53 20.40 28.45 -20.52 5.58 4.72 BarCap Credit 1-3 Yr TR USD 1.16 3.62 0.58 0.58 3.24 4.73 5.29 4.80 4.15 11.59 0.30 5.96 4.66 BarCap Credit 1-5 Yr TR USD 1.06 4.64 0.85 0.85 4.36 5.47 5.77 5.27 5.44 13.52 -1.13 6.09 4.69 BarCap Danish Krone Aggregate TR DKK 0.12 14.76 -

Press Release Paris – June 21St, 2021

Press Release Paris – June 21st, 2021 Europcar Mobility Group rejoins Euronext SBF 120 index Europcar Mobility Group, a major player in mobility markets, is pleased to announce that it has re-entered into the SBF 120 and CAC Mid 60 indices, in accordance with the decision taken by the Euronext Index Steering Committee. This re-entry, which took place after market close on Friday 18 June 2021, is effective from Monday 21 June 2021. The SBF 120 is one of the flagship indices of the Paris Stock Exchange. It includes the first 120 stocks listed on Euronext Paris in terms of liquidity and market capitalization. The CAC Mid 60 index includes 60 companies of national and European importance. It represents the 60 largest French equities beyond the CAC 40 and the CAC Next 20. It includes the 60 most liquid stocks listed in Paris among the 200 first French capitalizations. This total of 120 companies compose the SBF 120. Caroline Parot, CEO of Europcar Mobility Group, said: “Europcar Mobility Group welcomes the re-integration of the SBF 120 and CAC Mid 60. This follows the successful closing of the Group’s financial restructuring during Q1 2021, which allowed the Group to open a new chapter in its history. Europcar Mobility Group re-entry into the SBF 120 and CAC Mid 60 is an important step for our Group and recognizes the fact that we are clearly "back in the game”, in a good position to take full advantage of the progressive recovery of the Travel and Leisure market. In that perspective, our teams are fully mobilized for summer of 2021, in order to meet the demand and expectations of customers who are more than ever eager to travel”. -

Presentation

IMPORTANCE OF CAPITAL MARKETS RICHÁRD VÉGH CEO and Chairman of Budapest Stock Exchange IOSCO ANNUAL CONFERENCE Budapest, May 10, 2018 SUCCESSFUL AND DEVELOPED COUNTRIES HAVE STRONG CAPITAL MARKET 70 CH NOR 60 Reduces the cost of long-term funding. USD) AUT 50 DK FIN SWE Cost-effective way 40 ISR UK of transferring capital thousand KOR between industries. 30 HUN POL Supports 20 CHN innovation. IDN 10 GDP/CAPITA ( GDP/CAPITA A more stable and IND resilient monetary 0 0% 50% 100% 150% 200% 250% system. MARKET CAPITALIZATION/GDP Source: OECD (2016), World Bank (2016) 2 STRONG AND IMPROVING ECONOMY 1 YEAR CDS CURVE PERFORMANCE OF INDICES BUMIX 200 300% +203% BUX 260% CETOP BUX 150 BUMIX +133% 220% DJ STOXX 600 100 DAX 180% 140% 50 100% 0 60% 2013 2018 2015 2018 DEBT TO GDP (%) GDP GROWTH (%) CPI (%) UNEMPLOYMENT RATE (%) 76,6 76,7 76,0 4,3 6,2 73,6 4,0 4,1 4,0 2,9 3,0 2,5 5,1 3,2 2,4 4,2 MAIN MAIN 3,6 2,2 3,1 2,8 INDICATORS 0,9 0,5 14 15 16 17 15 16 17 18* 19* 20* 15 16 17 18* 19* 20* 15 16 17 18* 19* 20* 3 *Forecast Source: Bloomberg, MNB, AKK, MND STRONG GROWTH IN HOUSEHOLD WEALTH – BUT CONSERVATIVE SAVING STRUCTURE Institutional side Retail side ASSETS IN HUNGARIAN MUTUAL BREAKDOWN OF HUNGARIAN FUNDS 2018 Q1 HOUSEHOLD’S WEALTH (billion HUF) Other investment 18% (4% domestic, Shares in Stock Exchanges 14% foreign) 1,6% 48 000 Property Bank deposit 45 000 42 000 Stock T-bill 9266 39 000 billion HUF 36 000 Corp. -

Darkest Before Dawn – Shariah Perspective

Malaysia July 29, 2021 Strategy Darkest before dawn – Shariah perspective by Ivy NG Lee Fang, CFA │ T: (60) 3 2261 9073 │ E: [email protected] This report delineates our 2H21F equity strategy outlook from a Shariah perspective. The market was hit by a perfect storm in 1H21 with persistently high Covid-19 cases, multiple lockdowns, ESG concerns and political uncertainty. At the current run rate, we project Malaysia to be on track to inoculate around 70-80% of the population by 4Q21. We expect recovery stocks to see renewed interest in 4Q and the market to re-rate to our KLCI target of 1,604 pts, after an anticipated lacklustre 3Q21. We provide six trading themes for 2H21F in this report; our top Shariah sector picks are Islamic banking, healthcare, media, oil & gas, packaging, semiconductor, EMS, transport and utilities. Our top three Shariah stock picks are Gamuda, Telekom Malaysia and Unisem. IMPORTANT DISCLOSURES, INCLUDING ANY REQUIRED RESEARCH CERTIFICATIONS, ARE PROVIDED AT THE END OF THIS REPORT. IF THIS REPORT IS DISTRIBUTED IN THE UNITED STATES IT IS DISTRIBUTED BY CGS-CIMB SECURITIES (USA), INC. Powered by the EFA AND IS CONSIDERED THIRD-PARTY AFFILIATED RESEARCH. Platform Malaysia │ Strategy │ July 29, 2021 Content Page Key takeaways of our views on the outlook for 2H21F 3 Shariah-compliant investments 4 1H21 review 6 Outlook 17 Malaysian retail investors’ survey 27 ESG ratings from F4GBM index perspective 28 Key trading thematics 29 Risks 37 Market valuations 42 Economic outlook 44 Technical analysis 49 Top picks and sector ratings 51 2 Malaysia │ Strategy │ July 29, 2021 Key takeaways of our views on the outlook for 2H21F The market was hit by a perfect storm in 1H21 with persistently high Covid-19 cases, multiple lockdowns, ESG concerns and political uncertainty. -

Gedeon Richter Annual Report Gedeon Richtergedeon • Annual Report • 2011

GEDEON RICHTER ANNUAL REPORT GEDEON RICHTERGEDEON • ANNUAL REPORT • 2011 1901 2011 00Borito_annual_report_angol_2012_140_old.indd 1 3/25/12 2:29 PM Delivering quality therapy through generations 2011 01_angol_elso_resz_01_66.indd 1 3/26/12 2:23 PM 2 Contents CONTENTS Richter Group – Fact Sheet . 3 Consolidated Financial Highlights . 5 Chairman’s Statement . 7 Directors’ Report . 9 Information for Shareholders . 9 Shareholders’ Highlights . 9 Market Capitalisation . 9 Annual General Meeting . 10 Investor Relations Activities . 10 Dividend . 11 Information Regarding Richter Shares . 12 Shares in Issue . 12 Treasury Shares . 12 Registered Shareholders . 12 Share Ownership by Company Board Members . 13 Risk Management . 14 Corporate Governance . 16 Company’s Boards . 18 Board of Directors . 18 Executive Board . 21 Supervisory Committee . .22 Managing Director’s Review . 25 Operating Review . 29 Consolidated Turnover . 29 Markets – Pharmaceutical Segment . 31 Hungary . 32 International Sales . 34 European Union . 35 CIS . 37 USA . 38 Rest of the World . 38 Wholesale and Retail Activities . 39 Research and Development . 40 Female Healthcare . 42 Products . 46 Manufacturing and Supply . 50 Corporate Social Responsibility . 51 Environmental Policy . 51 Health and Safety at Work . 52 Work Health and Safety Management System . 52 Practical Implementation . 52 Community Involvement . 53 People . 54 Employees . 54 Recruitment and Individual Development . 55 Developing Leaders . 56 Remuneration and Other Employee Programmes . 56 Financial Review . 59 Key Financial Data . 59 Cost of Sales . 59 Gross Profit . 59 Operating Expenses . 60 Profit from Operations . 61 Net Financial Income . 61 Share of Profit of Associates . 62 Income Tax . 62 Profit for the Year . 62 Profit Attributable to Owners of the Parent . 62 Balance Sheet . 63 Cash Flow .