Short Selling – Allowed (100% of Securities for Sell Orders and Repo Open Orders) • Securities Lending – Repo with Netting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Supporting You in Kazakhstan

Supporting you in Kazakhstan Linklaters has been active in Kazakhstan for over fifteen years. Utilising its international and local experience, unrivalled ability to provide commercial advice and flexible problem-solving approach, Linklaters has advised many of the firm’s major clients on pursuing their business interests in Kazakhstan. Linklaters has extensive experience Our strong global network means that Adding value working with international corporate we are able to quickly assemble teams > An integrated and experienced CIS clients and financial institutions investing whenever needed by our clients. team, committed to understanding in Kazakhstan and leading Kazakh We frequently coordinate deals in the market across the region and corporates and financial institutions as Kazakhstan through our offices in ensuring our clients get the premium they access the international financial London, Moscow, Warsaw and across service they need to do deals markets and expand their activities Asia, where we have a number of efficiently and effectively inside and outside Kazakhstan. dedicated lawyers with a full awareness > A world class global law firm of the legal and commercial landscape Over the years, we have developed with unparalleled expertise of Kazakhstan. close relationships with local counsel, in executing international whose experience and expertise have Our deep understanding of the local transactions around the world proved instrumental in navigating our economy and politics makes us ideally > Experts in facilitating communication -

Reference,Map B4.1.1A,, Title,"Price of Mobile and Fixed Broadband Services (US$, Purchasing Power Parity, 2015)",, Subtitle,"A

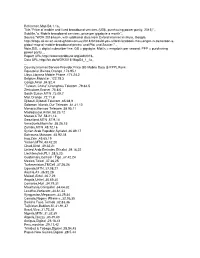

Reference,Map B4.1.1a,, Title,"Price of mobile and fixed broadband services (US$, purchasing power parity, 2015)",, Subtitle,"a. Mobile broadband services, price per gigabyte a month",, Source,"WDR 2016 team, with additional data from Oxford Internet Institute, Google, http://blogs.oii.ox.ac.uk/roughconsensus/2014/02/could-you-afford-facebook-messenger-in-cameroon-a- global-map-of-mobile-broadband-prices/ and Plot and Scatter.",, Note,DSL = digital subscriber line; GB = gigabyte; Mbit/s = megabits per second; PPP = purchasing power parity.,, Report URL,http://www.worldbank.org/wdr2016,, Data URL,http://bit.do/WDR2016-MapB4_1_1a,, ,,, Country,Internet Service Provider,Price GB Mobile Data ($ PPP),Rank Equatorial Guinea,Orange ,173.95,1 Libya,Libyana Mobile Phone ,171.24,2 Belgium,Mobistar ,122.78,3 Congo,Airtel ,94.52,4 "Taiwan, China",Chunghwa Telecom ,79.64,5 Zimbabwe,Econet ,76.8,6 South Sudan,MTN ,73.09,7 Mali,Orange ,72.11,8 Djibouti,Djibouti Telecom ,65.08,9 Solomon Islands,Our Telecom ,61.31,10 Monaco,Monaco Telecom ,58.95,11 Madagascar,Airtel ,58.23,12 Macao,CTM ,58.21,13 Swaziland,MTN ,57.9,14 Venezuela,Movistar ,55.26,15 Zambia,MTN ,48.72,16 Syrian Arab Republic,Syriatel ,46.89,17 Botswana,Mascom ,45.92,18 Iraq,Zain ,45.65,19 Yemen,MTN ,43.42,20 Chad,Airtel ,39.32,21 United Arab Emirates,Etisalat ,39.16,22 Liechtenstein,FL1 ,38.5,23 Guatemala,Comcel / Tigo ,37.42,24 Mexico,Telcel ,37.36,25 Turkmenistan,TMCell ,37.26,26 Uganda,MTN ,37.08,27 Austria,A1 ,36.92,28 Malawi,Airtel ,36.7,29 Angola,Unitel ,36.69,30 Comoros,Huri ,34.79,31 -

Turkcell Annual Report 2010

TURKCELL ANNUAL REPORT 2010 GET MoRE oUT of LIfE WITh TURKCELL CoNTENTS PAGE our Vision / our Values / our Strategic Priorities 4 Turkcell Group in Numbers 6 Turkcell: Leading Communication and Technology Company 8 Letter from the Chairman 10 Board Members 12 Letter from the CEo 14 Executive officers 16 Superior Technologies 22 More Advantages 32 Best Quality Service 40 More Social Responsibility 46 Awards 53 Managers of Turkcell Affiliates 54 Subsidiaries 56 human Resources 62 Mobile Telecommunication Sector 66 International Ratings 72 Investor Relations 74 Corporate Governance 78 Turkcell offices 95 Consolidated financial Statement and Independent Audit Report 96 Dematerialization of The Share Certificates of The Companies That Are Traded on The Stock Exchange 204 The Board’s Dividend Distribution Proposal 205 2 3 oUR VISIoN oUR STRATEGIC PRIoRITIES To ease and enrich the lives of our customers with communication and As a Leading Communication and Technology Company, technology solutions. • to grow in our core mobile communication business through increased use of voice and data, • to grow our existing international subsidiaries with a focus on profitability, oUR VALUES • to grow in the fixed broadband business by creating synergy among Turkcell Group companies through our fiber optic infrastructure, • We believe that customers come first • to grow in the area of mobility, internet and convergence through new • We are an agile team business opportunities, • We promote open communication • to grow in domestic and international markets through communications, • We are passionate about making a difference technology and new business opportunities, • We value people • to develop new service platforms that will enrich our relationship with our customers through our technical capabilities. -

ANNUAL REPORT 2013 Vol. I CONSOLIDATED

Vol. I Vol. II ANNUAL REPORT 2013 JOINT-STOCK COMPANY CONSOLIDATED FINANCIAL STATEMENTS SOVEREIGN WEALTH FUND «SAMRUK-KAZYNA» 1. INTRODUCTION 5. CORPORATE GOVERNANCE KZ 1.1 ABOUT THE ETYMOLOGY OF THE WORD “SAMRUK-KAZYNA” 5.1. PRINCIPLES AND REPORT ON CORPORATE GOVERNANCE 1.2. SAMRUK-KAZYNA JSC IN FIGURES AND FACTS IN 2013 5.2. THE COMPOSITION OF THE BOARD OF DIRECTORS. REPORT ON WORK OF THE BOARD OF RU 1.3. IMPORTANT EVENTS OF SAMRUK-KAZYNA JSC IN 2012 DIRECTORS 5.2.1. The composition of the Board of Directors, CV of the Members of the Board of Directors of 2. WELCOME ADDRESS BY THE CHAIRMAN OF THE BOARD Samruk-Kazyna JSC OF DIRECTORS OF SAMRUK-KAZYNA JSC 5.2.2. Report on the Work of the Board of Directors of Samruk-Kazyna JSC for 2013 EN 3. WELCOME ADDRESS BY THE CHIEF EXECUTIVE OF SAMRUK-KAZYNA JSC 5.3. THE COMPOSITION OF THE MANAGEMENT BOARD OF Samruk-Kazyna JSC. REPORT ON 4. ABOUT US WORK OF THE MANAGEMENT BOARD OF Samruk-Kazyna JSC 4.1. THE LIST AND BRIEF INFORMATION ON MAJOR SUBSIDIARIES OF SAMRUK-KAZYNA JSC 5.3.1. Composition of the Management Board, CV of the top manager of Samruk-Kazyna JSC 4.2. ORGANIZATION STRUCTURE OF SAMRUK KAZYNA JSC 5.3.2. Report on work of the Management Board of Samruk-Kazyna JSC 4.3. MAIN ACTIVITIES, GOALS AND OBJECTIVES OF SAMRUK-KAZYNA JSC 5.4. SUMMARY ON REMUNERATION OF THE MEMBERS OF THE MANAGEMENT BOARD AND 4.4. ENHANCING THE LONG-TERM VALUE OF COMPANIES THE BOARD OF DIRECTORS OF SAMRUK-KAZYNA JSC 4.4.1. -

Kazakhtelecom – Leading Telecom Operator in Kazakhstan April 2019

Kazakhtelecom – leading telecom operator in Kazakhstan April 2019 1 Important Notice The information contained in this document (the ‘Corporate Presentation’) has been prepared by Kazakhtelecom JSC (‘Kazakhtelecom’, ‘KT’). Kazakhtelecom is a Kazakh incorporated and registered company listed on the Kazakhstan Stock Exchange (‘KASE’). This corporate presentation has not been fully verified and is subject to material updating, revision and further verification and amendment without notice. While the information contained herein has been prepared in good faith, neither Kazakhtelecom nor any of its directors, officers, shareholders, agents, employees or advisers give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this Corporate Presentation, or any revision thereof, or of any other written or oral information made or to be made available to any interested party or its advisers (all such information being referred to as ‘Information’) and liability therefore is expressly disclaimed. Accordingly, neither Kazakhtelecom nor any of its directors, officers, shareholders, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained herein or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this Corporate Presentation. The views of Kazakhtelecom’s management/directors/shareholders set out in this Corporate Presentation could ultimately prove to be incorrect. No warranty, express or implied, is given by the presentation of these figures and investors should place no reliance on Kazakhtelecom’s estimates cited, in this Corporate Presentation. -

Doing Business in Kazakhstan

DOING BUSINESS 2021 IN KAZAKHSTAN Doing Business in Kazakhstan 2021 Baker McKenzie – CIS, Limited Almaty office Samal Towers, 8th Floor 97 Zholdasbekov Street Almaty, Kazakhstan 050051 Phone: +7 727 3 300 500 Facsimile: +7 727 258 40 00 [email protected] www.bakermckenzie.com The information in this brochure is for informational purposes only and it may not reflect the most current legal developments, judgments or settlements. This information is not offered as legal or any other advice on any particular matter. The Firm and the contributing authors expressly disclaim all liability to any person in respect of anything and in respect of the consequences of anything done or omitted wholly or partly in reliance upon the whole or any part of the contents of Baker McKenzie’s “Doing Business in Kazakhstan” brochure. No client or other reader should act or refrain from acting on the basis of any matter contained in this brochure without seeking the appropriate legal or other professional advice on the particular facts and circumstances. Doing Business in Kazakhstan Table of Contents 1 Kazakhstan — an overview ..................................................... 1 1.1 Geography .................................................................... 1 1.2 Population .................................................................... 1 1.3 History.......................................................................... 1 1.4 Government and political system ................................. 2 1.5 Economy ..................................................................... -

Turkcell the Digital Operator

Turkcell the Digital Operator Turkcell Annual Report 2018 About Turkcell Turkcell is a digital operator headquartered in Turkey, serving its customers with its unique portfolio of digital services along with voice, messaging, data and IPTV services on its mobile and fixed networks. Turkcell Group companies operate in 5 countries – Turkey, Ukraine, Belarus, Northern Cyprus, Germany. Turkcell launched LTE services in its home country on April 1st, 2016, employing LTE-Advanced and 3 carrier aggregation technologies in 81 cities. Turkcell offers up to 10 Gbps fiber internet speed with its FTTH services. Turkcell Group reported TRY 21.3 billion revenue in FY18 with total assets of TRY 42.8 billion as of December 31, 2018. It has been listed on the NYSE and the BIST since July 2000, and is the only NYSE-listed company in Turkey. Read more at www.turkcell.com.tr/english-support All financial results in this annual report are prepared in accordance with International Financial Reporting Standards (IFRS) and expressed in Turkish Lira (TRY or TL) unless otherwise stated. TABLE OF CONTENTS TRY Turkcell Group 16 Chairman’s Message 21.3 20 Board of Directors 22 Message from the CEO billion 26 Executive Officers 28 Top Management of Subsidiaries REVENUES 30 Turkcell Group 31 Our Vision, Target, Strategy and Approach 32 2018 at a Glance 34 2018 Highlights 36 The World’s 1st Digital Operator Brand: Lifecell 37 Turkcell’s Digital Services 2018 Operations 38 Exemplary Digital Operator 40 Our Superior Technology 41.3% 46 Our Consumer Business EBITDA 52 Our -

Increasing Broadband Internet Penetration in the OIC Member Countries

Standing Committee for Economic and Commercial Cooperation of the Organization of Islamic Cooperation (COMCEC) Increasing Broadband Internet Penetration In the OIC Member Countries COMCEC COORDINATION OFFICE February 2017 Standing Committee for Economic and Commercial Cooperation of the Organization of Islamic Cooperation (COMCEC) Increasing Broadband Internet Penetration In the OIC Member Countries COMCEC COORDINATION OFFICE February 2017 This report has been commissioned by the COMCEC Coordination Office to Telecom Advisory Services, LLC. Views and opinions expressed in the report are solely those of the author(s) and do not represent the official views of the COMCEC Coordination Office or the Member States of the Organization of Islamic Cooperation. Excerpts from the report can be made as long as references are provided. All intellectual and industrial property rights for the report belong to the COMCEC Coordination Office. This report is for individual use and it shall not be used for commercial purposes. Except for purposes of individual use, this report shall not be reproduced in any form or by any means, electronic or mechanical, including printing, photocopying, CD recording, or by any physical or electronic reproduction system, or translated and provided to the access of any subscriber through electronic means for commercial purposes without the permission of the COMCEC Coordination Office. For further information please contact: COMCEC Coordination Office Necatibey Caddesi No: 110/A 06100 Yücetepe Ankara/TURKEY Phone: 90 312 294 57 10 Fax: 90 312 294 57 77 E-mail: [email protected] Web: www.comcec.org Table of Contents EXECUTIVE SUMMARY 1 I. INTRODUCTION 8 II. CONCEPTUAL FRAMEWORK REGARDING bROADbAND PENETRATION 11 II.1. -

Ratings Raised on Some Government-Related Entities of Kazakhstan After Sovereign Upgrade

December 24, 2010 Ratings Raised On Some Government-Related Entities Of Kazakhstan After Sovereign Upgrade Primary Credit Analyst: Elena Anankina, Moscow (7) 495-783-4130; [email protected] Secondary Contacts: Sergei Gorin, Moscow 7 495 783 4132; [email protected] Etai Rappel, Tel Aviv (1) 922-3-753-9718; [email protected] Andreas Kindahl, Stockholm (46) 8-440-5907; [email protected] Lidia Polakovic, London (44) 20-7176-3985; [email protected] • We have raised our ratings on the Republic of Kazakhstan. • We are therefore raising our ratings on government-related entities Kazakhstan Temir Zholy, JSC Kaztemirtrans, JSC NC KazMunayGas, and KazTransGas, based on our methodology for government-related entities. • We are affirming our ratings on JSC KazMunaiGas Exploration Production and KazTransOil, while ratings on four other government-related entities remain unchanged. MOSCOW (Standard & Poor's) Dec. 24, 2010--Standard & Poor's Ratings Services said today it raised its ratings on several Kazakhstan-based government-related entities (GREs) and their subsidiaries following its upgrade of the Republic of Kazakhstan (foreign currency BBB/Stable/A-3, local currency BBB+/Stable/A-2; national scale rating 'kzAAA'). For further details see "Republic of Kazakhstan FC And LC Long-Term Ratings Raised By One Notch To 'BBB' and 'BBB+'; Outlook Remains Stable", published on Dec. 23, 2010 on RatingsDirect. The rating actions are based on our GRE methodology. We raised our long-term corporate credit ratings on railway company Kazakhstan Temir Zholy (KTZ) to 'BBB-' from 'BB+', reflecting our expectation of "very high" likelihood of extraordinary government support. Our assessment of KTZ's stand-alone credit quality remains at 'b+'. -

Program Performance Audit Report

ASIAN DEVELOPMENT BANK PPA: KAZ 31091 PROGRAM PERFORMANCE AUDIT REPORT ON THE PENSION REFORM PROGRAM (Loan 1589-KAZ) IN KAZAKHSTAN September 2003 CURRENCY EQUIVALENTS Currency Unit – tenge (T) At Appraisal At Project Completion At Operations Evaluation (August 1997) (March 2000) (April 2003) T1.00 = $0.01325 $0.00705 $0.00658 $1.00 = T75.50 T141.89 T152.00 ABBREVIATIONS ADB – Asian Development Bank COS – country operational strategy CRAAPF – Committee for Regulation of Activity of Accumulation Pension Funds GDP – gross domestic product IBRD – International Bank for Reconstruction and Development MLSP – Ministry of Labor and Social Protection MOF – Ministry of Finance NBK – National Bank of Kazakhstan NPA – National Pension Authority NSC – National Securities Commission OEM – Operations Evaluation Mission PAYGO – pay-as-you-go PCR – project completion report PPAR – program performance audit report PRIL – Pension Reform Implementation Loan SAF – State Accumulation Fund SIC – social identification code SPPC – State Pension Payment Center TA – technical assistance USAID – United States Agency for International Development NOTES (i) In this report, "$" refers to US dollars. (ii) The fiscal year (FY) of the Government ends on 31 December. FY before a calendar year denotes the year in which the fiscal year ends. Operations Evaluation Department, PE-628 CONTENTS Page BASIC DATA ii EXECUTIVE SUMMARY iii I. BACKGROUND 1 A. Rationale 1 B. Formulation 2 C. Purpose and Outputs 2 D. Cost, Financing, and Executing Arrangements 3 E. Completion and Self-Evaluation 3 F. Operations Evaluation 4 II. PLANNING AND IMPLEMENTATION PERFORMANCE 4 A. Formulation and Design 4 B. Achievement of Policy Reform Measures 5 C. Program Management 9 III. -

Kazakhstan Stock Exchange"

JSC "KAZAKHSTAN STOCK EXCHANGE" PRESS - RELEASE Almaty February 5, 2013 Results of Kazakhstan Stock Exchange activities in 2012 HIGHLIGHTS: 1. Main projects of Kazakhstan Stock Exchange (KASE). 2. "People's IPO" on KASE and exchange trading technologies. 3. Performance indicators of the exchange and exchange market. *** Projects of the year Main projects implemented by KASE in 2012 include, in the first place, improvement of the Exchange's operational quality in order to align it with requirements of the new legislation on risk reduction. In the course of that work KASE had to notably change its organizational structure and internal regulatory base. The restructuring process turned out to be labour-intensive and influenced virtually all structural units of the Exchange. The most important project in this field is the implementation of a new system to monitor KASE members – their financial strength and solvency which are checked continuously. One of apparent results of that monitoring are the new 60 pages of Exchange members on KASE website disclosing a big volume of open data necessary for investors seeking a partner on Kazakhstan's financial market. Another remarkable project of the year was the implementation of the first stage of the "Peoples' IPO" program, the main nationwide project on Kazakhstan's stock market in 2012. During the preparation and conducting of the IPO the Exchange accomplished a lot of work, including measures on a scale unprecedented for Kazakhstan, which made the first share offering under the "People's IPO" a success. Due to the project's uniqueness many aspects of KASE activities were overhauled: rules of subscription were developed, special software (including a separate trading module) was designed, and a comprehensive testing of the trading system was conducted in terms of accepting and processing of a big number of orders. -

JSC Kazmunaygas TABLE of CONTENTS

JSC KazMunayGas TABLE OF CONTENTS 01 COMPANY OVERVIEW ...........................3 04 CORPORATE RESPONSIBILITY .................................97 Overview of KMG ....................................4 Climate change .....................................98 Geography of assets ................................6 KMG efforts to realise KMG in figures .......................................12 sustainable development goals ........... 102 Market trends and challenges ................14 Ecological responsibility ...................... 104 Social responsibility ............................. 118 02 STRATEGY OVERVIEW .........................19 Statement from the Chairman 05 CORPORATE GOVERNANCE ...............129 LIMITS AND of the Board of Directors .......................20 Risk management ................................130 RESTRICTIONS Strategy ................................................22 Corporate governance ..........................138 OF THE ANNUAL Performance metrics .............................26 Information for shareholders REPORT KMG business model .............................28 and investors .......................................182 Transformation and privatisation ...........30 The JSC National Company KazMunayGas IFRS and a number of recommendations 06 FINANCIAL STATEMENTS ................... 191 (“KMG” or the “Company”) Annual Report for from international GRI standards on Digitalisation ........................................34 2018 includes operating results for KMG and the presentation of financial results and Terms,