European Psk Club Member List 001 - 500

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Information Translation JSC Inter RAO 2014 Annual Report

1 Information translation JSC Inter RAO 2014 Annual Report Preliminarily approved by the Board of Directors of JSC Inter RAO on April 07, 2015 (Minutes No. 138 of the meeting of the Board of Directors dated April 09, 2015). Management Board Boris Kovalchuk Chairman Chief Accountant Alla Vaynilavichute 2 Table of content 1 Report overview ........................................................................................................................ 4 2 General information on Inter RAO Group .................................................................................. 8 2.1 About Inter RAO Group ..................................................................................................... 8 2.2 Group's key performance indicators ................................................................................. 14 2.3 Inter RAO Group on the energy market ........................................................................... 15 2.4 Associations and partnerships ......................................................................................... 15 3 Statement for JSC Inter RAO shareholders and other stakeholders ........................................ 18 4 Development strategy of Inter RAO Group and its implementation ......................................... 21 4.1 Strategy of the Company ................................................................................................. 21 4.2 Business model .............................................................................................................. -

Moscow, Russia

Moscow, Russia INGKA Centres The bridge 370 STORES 38,6 MLN to millions of customers VISITORS ANNUALLY From families to fashionistas, there’s something for everyone meeting place where people connect, socialise, get inspired, at MEGA Belaya Dacha that connects people with inspirational experience new things, shop, eat and naturally feel attracted lifestyle experiences. Supported by IKEA, with more than to spend time. 370 stores, family entertainment and on-trend leisure and dining Our meeting places will meet people's needs & desires, build clusters — it’s no wonder millions of visitors keep coming back. trust and make a positive difference for local communities, Together with our partners and guests we are creating a great the planet and the many people. y w h e Mytischi o k v s la Khimki s o r a Y e oss e sh sko kov hel D RING RO c IR AD h ov Hwy TH S ziast ntu MOSCOW E Reutov The Kremlin Ryazansky Avenue Zheleznodorozhny Volgogradskiy Prospect Lyubertsy Kuzminki y Lyublino Kotelniki w H e o Malakhovka k s v a Dzerzhinsky h s r Zhukovskiy a Teply Stan V Catchment Areas People Distance Kashirskoe Hwy Lytkarino Novoryazanskoe Hwy ● Primary 1,600,000 < 20 km ● Secondary 1,600,000 20–35 km ● Tertiary 3,800,000 35–47 km Gorki Total area: <47 km: 7,000,000 Leninskiye Volodarskogo 55% 25 3 METRO 34 MIN CUSTOMERS BUS ROUTES STATIONS AVERAGE COME BY CAR NEAR BY COMMUTE TIME A region with Loyal customers MEGA Belaya Dacha is located at the heart of the very dynamic population development in strong potential the South-East of Moscow and attracts shoppers from all over Moscow and surrounding areas. -

MEGA Belaya Dacha Le N in G R Y a D W S H V K Olo O E K E O O Mytischi Lam H K Sk W S O Y Av E

MEGA Belaya Dacha Le n in g r y a d w s h V k olo o e k e o o Mytischi lam h k sk w s o y av e . sl o h r w a y Y M K Tver A Market overview D region Balashikha Dmitrov Krasnogorsk y Welcome v hw Sergiev-Posad hw uziasto oe y nt Klin Catchment Peoplesk Distance E Vladimir region izh or Reutov ov to MEGA N Mytischi Pushkin areas Schelkovo Belaya Dacha Moscow Zheleznodorozhny Primary 1,589,000 < 20 km Smolensk region Odintsovo N Naro-Fominsk o Podolsk v o ry a Klimovsk wy z Secondary 1,558,800 h 20–35 km a oe n k sk ins o Obninsk Kolomna M e y h hw w oe y Serpukhov Tertiary 3,787,300 35–47vsk km ALONG WITH LONDON’S WESTFIELD Kaluga region Kie AND ISTANBUL’S FORUM, MEGA BELAYA y y w Tula region h w h DACHA IS ONE OF EUROPE’S LARGEST e ko e Total area: 6,965,200 s o z h k RETAIL COMPLEXES. s lu Troitsk a v K a h s r a Domodedovo V It has more than 350 tenants and the centre Moscow has the highest density of retailers façade runs for four km. Major brands such of all Russian cities with tenants occupying as Auchan, Inditex brands, TopShop, H&M, 4.5 million square metres, according to fig- Uniqlo, T.G.I. Fridays, Debenhams, MAC, ures for 2013. Many world-famous retailers IKEA, OBI, MediaMarkt, Kinostar, Cosmic, have outlets here and the city is the first M.Video, Detsky Mir, Deti and Decathlon to show new trends. -

Violations of the Rights of Stateless Persons and Foreign Citizens in Light of the ECHR Judgment in “Kim V

m e m o r i a Anti-Discrimination Centre l The ward in a Temporary Foreign National Detention Center (SITDFN). Krasnoye Selo (Saint Petersburg) Photo by ADC Memorial VIOLATIONS OF THE RIGHTS OF STATELESS PERSONS AND FOREIGN CITIZENS in Light of the ECHR Judgment in “Kim v. Russia” Human Rights Report 2016 The Anti-discrimination Centre Memorial has spent many years defending the rights of people suffering form discrimination, and in particupar the rights of migrants and representatives of vulnerable minorities. This report describes negative impact of non-implementation of the ECHR judgement in “Kim v. Russia” (2014) on the situation of stateless persons and foreigners detained for months and years in “specialized institutions for the temporary detention” (SITDFN) in order «to guarantee the expultion». No access to legal aid, no judicial control of the term and soundness of deprivation of freedom, no legal opportunities of expulsion in case of stateless persons, inhuman conditions of detention in SITDFN – all this makes the life in “specialized institutions” a cruel punishment for people who did not commit any crimes. The problem of stateless persons and migrants in irregular situation is important not only for Russia and ex-Soviet countries, but for contemporary Europe as well; the ECHR judgement in “Kim v. Russia” should be taken into account by the countries who are members of the Council of Europe and the European Union. ADC Memorial is thankful to Viktor Nigmatulin, a detainee of SITDFN in Kemerovo (Siberis), for the materials provided for the report. TABLE OF CONTENTS Summary . 3 Preface STATELESSNESS AS A RESULT OF THE COLLAPSE OF THE SOVIET UNION . -

MEGA Khimki Tver Region Market Overview Welcome

MEGA Khimki Tver region Market overview Welcome Dmitrov L e y n Sergiev-Posad Catchment areas People Distance i w y n h to MEGA Khimki Klin g w r a e h V Vladimir d o ol s e o k ko k o region la o s k m e v s Pushkin s Mytischi ko h o av e w r sl t Schelkovo y i o h . r a w m y Y Primary 398,200 < 17 km D Zheleznodorozhny M K A Smolensk Moscow D Balashikha region Podolsk Naro-Fominsk Secondary 1,424,200 17–40 km Krasnogorsk y Klimovsk v hw hw uziasto oe y nt RUSSIA’S FIRST IKEA WAS OPENED IN sk E Obninsk izh Kolomna or Reutov Tertiary 3,150,656 40–140 km ov KHIMKI IN 2000. MEGA KHIMKI SOON N Serpukhov FOLLOWED IN 2004 AND BECAME THE Kaluga region LARGEST RETAIL COMPLEX IN RUSSIA Tula region Total area: 4,973,000 AT THE TIME. Odintsovo N o v o ry y a hw z e a ko n s sk Min o e wy h h w oe y vsk Kie Despite several new retail centres opening their doors along the Leningradskoe Shosse, y y w w h MEGA Khimki remains one of the district’s h e oe o sk k most popular shopping destinations, largely s h Troitsk z Scherbinka v u a al due to its location, well-designed layout and K h s r retail mix. a V Domodedovo New tenants and constant improvements to the centre have significantly increased customer numbers. -

Russian Theatre Festivals Guide Compiled by Irina Kuzmina, Marina Medkova

Compiled by Irina Kuzmina Marina Medkova English version Olga Perevezentseva Dmitry Osipenko Digital version Dmitry Osipenko Graphic Design Lilia Garifullina Theatre Union of the Russian Federation Strastnoy Blvd., 10, Moscow, 107031, Russia Tel: +7 (495) 6502846 Fax: +7 (495) 6500132 e-mail: [email protected] www.stdrf.ru Russian Theatre Festivals Guide Compiled by Irina Kuzmina, Marina Medkova. Moscow, Theatre Union of Russia, April 2016 A reference book with information about the structure, locations, addresses and contacts of organisers of theatre festivals of all disciplines in the Russian Federation as of April, 2016. The publication is addressed to theatre professionals, bodies managing culture institutions of all levels, students and lecturers of theatre educational institutions. In Russian and English. All rights reserved. No part of the publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission from the publisher. The publisher is very thankful to all the festival managers who are being in constant contact with Theatre Union of Russia and who continuously provide updated information about their festivals for publication in electronic and printed versions of this Guide. The publisher is particularly grateful for the invaluable collaboration efforts of Sergey Shternin of Theatre Information Technologies Centre, St. Petersburg, Ekaterina Gaeva of S.I.-ART (Theatrical Russia Directory), Moscow, Dmitry Rodionov of Scena (The Stage) Magazine and A.A.Bakhrushin State Central Theatre Museum. 3 editors' notes We are glad to introduce you to the third edition of the Russian Theatre Festival Guide. -

Industrial Framework of Russia. the 250 Largest Industrial Centers Of

INDUSTRIAL FRAMEWORK OF RUSSIA 250 LARGEST INDUSTRIAL CENTERS OF RUSSIA Metodology of the Ranking. Data collection INDUSTRIAL FRAMEWORK OF RUSSIA The ranking is based on the municipal statistics published by the Federal State Statistics Service on the official website1. Basic indicator is Shipment of The 250 Largest Industrial Centers of own production goods, works performed and services rendered related to mining and manufacturing in 2010. The revenue in electricity, gas and water Russia production and supply was taken into account only regarding major power plants which belong to major generation companies of the wholesale electricity market. Therefore, the financial results of urban utilities and other About the Ranking public services are not taken into account in the industrial ranking. The aim of the ranking is to observe the most significant industrial centers in Spatial analysis regarding the allocation of business (productive) assets of the Russia which play the major role in the national economy and create the leading Russian and multinational companies2 was performed. Integrated basis for national welfare. Spatial allocation, sectorial and corporate rankings and company reports was analyzed. That is why with the help of the structure of the 250 Largest Industrial Centers determine “growing points” ranking one could follow relationship between welfare of a city and activities and “depression areas” on the map of Russia. The ranking allows evaluation of large enterprises. Regarding financial results of basic enterprises some of the role of primary production sector at the local level, comparison of the statistical data was adjusted, for example in case an enterprise is related to a importance of large enterprises and medium business in the structure of city but it is located outside of the city border. -

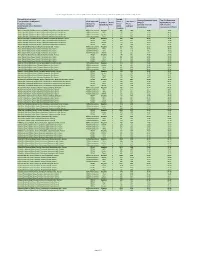

Appendix 2: Q4 (Oct-Dec) 2020 Cities in Russia Top Mobile Internet Providers Based on Average Download and Top 10% Speeds of Speedtest Intelligence Data

Appendix 2: Q4 (Oct-Dec) 2020 Cities in Russia Top Mobile Internet Providers based on average download and top 10% speeds of Speedtest Intelligence data City and Location Name Sample Average Download Speed Top 10% Download from Speedtest Intelligence / Claim Approved CoUnt / Test CoUnt / Provider / Rank / (Mbps) / Speed (Mbps) / Топ Название города, /Заявление Число Число Провайдер Ранг Средняя скорость 10% скорость местоположения из Speedtest одобрено точек замеров скачивания скачивания (Мбит/с) Intelligence замеров Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии MegaFon 1 468 1369 34.89 79.85 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии MTS 2 227 612 23.35 48.91 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии Beeline 3 125 516 18.92 34.17 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия All/Все технологии Tele2 4 204 571 18.60 41.73 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G MegaFon 1 439 1257 35.61 79.35 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G MTS 2 205 491 24.35 49.98 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G Beeline 3 113 430 20.07 34.29 Abakan, Republic of Khakassia, Russia / Абакан, Республика Хакасия, Россия LTE/4G Tele2 4 192 527 19.17 43.24 AksaY, Rostov Oblast, Russia / Аксай, Ростовская обл., Россия All/Все технологии MegaFon 1 207 417 28.17 -

Invest in Moscow Region

INVEST IN MOSCOW REGION LOCATION GENERAL INFORMATION Dubna Sergiev Posad Mytishchy Population - 7.1 million Korolev Khimki Balashiha Urban population - 80% Odintsovo Lyubertsy More than 100 000 people live Zhukovsky in 20 cities of Moscow Region Podolsk Shatura Zaraysk DEVELOPED TRANSPORT INFRASTRUCTURE Road density km/1000 km2 3 international airports 232 Total passengers - 60 million people/year The total volume of cargo transportation in Russia (%) Moscow Central Federal Region District of Russia Density of railways 40 km/1000 km2 60 26 - Volume of cargo transportation in Moscow and Central Federal Moscow Region Moscow District of Russia Region QUALIFIED WORK FORCE Key Facts: 4.5 million people are 18-60 years old Salaries are 30% lower than in Moscow 71% of population has a higher education or vocational training CITIES OF MOSCOW REGION HAVE HISTORICALLY HIGH PERSONNEL POTENTIAL INNOVATIVE, HIGH-TECH HI-TECH BIOTECHNOLOGY DEVELOPMENT and SPACE ENGINEERING PHARMACEUTICALS Korolev, Podolsk, Dubna Podolsk, Kolomna, Klimovsk Pushchino, Chernogolovka, Obolensky Population Population Population 464 793 people 404 583 people 47 615 people THE LARGEST CONSUMER MARKET IN RUSSIA Tver region 30 million people live in the Moscow agglomeration or 20% of Russia's Smolensk region 300 km population Yaroslavl 1/3 of consumer spending in Russia Kaluga region region Tula region Ivanovo region Vladimir region Ryazan region ECONOMIC AND INVESTMENT INDICATORS Gross regional product of Regions of the Russian Federation (2012, billion USD) 352.57 -

Download 'Market Study on Greenhouse Sector in the Russian Federation and Kazakhstan Republic'

MARKET STUDY GREENHOUSE SECTOR IN THE RUSSIAN FEDERATION AND KAZAKHSTAN REPUBLIC January 2020 1 Ltd. «Rusmarketconsulting» www.agricons.ru, [email protected] +7 (812) 712 50 14 CONTENT METHODOLOGY ................................................................................................................................. 5 THE RUSSIAN FEDERATION ............................................................................................................ 9 1 GREENHOUSE SECTOR SITUATION ........................................................................................ 9 1.1 RUSSIA IN THE WORLD ................................................................................................. 9 1.2 AREA AND STRUCTURE OF GREENHOUSES IN RUSSIA....................................... 10 1.3 MAIN TYPES OF PRODUCTS ...................................................................................... 13 1.4 BRIEF OVERVIEW OF THE SECTORS ....................................................................... 14 1.4.1 PRODUCTION OF GREENHOUSE VEGETABLES ....................................................................... 14 1.4.2 PRODUCTION OF CUT FLOWERS ................................................................................................ 16 1.4.3 PRODUCTION OF SEEDLINGS AND POTTED PLANTS .............................................................. 21 1.5 PRODUCTION OF GREENHOUSE GROWN VEGETABLES IN THE RUSSIAN FEDERATION .......................................................................................................................... -

As of June 30, 2018

LIST OF AFFILIATES Sberbank of Russia (full corporate name of the joint-stock company) Issuer code: 0 1 4 8 1 – В as 3 0 0 6 2 0 1 8 of (indicate the date on which the list of affiliates of the joint-stock company was compiled) Address of the issuer: 19, Vavilova St., Moscow 117997 (address of the issuer – the joint-stock company – indicated in the Unified State Register of Legal Entities where a body or a representative of the joint-stock company is located) Information contained in this list of affiliates is subject to disclosure pursuant to the laws of the Russian Federation on securities. Website: http://www.sberbank.com; http://www.e-disclosure.ru/portal/company.aspx?id=3043 (the website used by the issuer to disclose information) Deputy Chairperson of the Executive Board of Sberbank B. Zlatkis (position of the authorized individual of the joint-stock company) (signature) (initials, surname) L.S. “ 03 ” July 20 18 . Issuer codes INN (Taxpayer Identificat ion Number) 7707083893 OGRN (Primary State Registrati on Number) 1027700132195 I. Affiliates as of 3 0 0 6 2 0 1 8 Item Full company name (or name for a Address of a legal entity or place of Grounds for recognizing the entity Date on which Interest of the affiliate Percentage of ordinary No. nonprofit entity) or full name (if any) of residence of an individual (to be as an affiliate the grounds in the charter capital of shares of the joint- the affiliate indicated only with the consent of became valid the joint-stock stock company owned the individual) company, % by the affiliate, % 1 2 3 4 5 6 7 Entity may manage more than The Central Bank of the Russian 12, Neglinnaya St., Moscow 20% of the total number of votes 1 21.03.1991 50.000000004 52.316214 Federation 107016 attached to voting shares of the Bank 1. -

The Russian Food System's Transformation at Close Range: a Case Study of Two Oblast's

THE RUSSIAN FOOD SYSTEM' S TRANSFORMATION AT CLOSE RANGE : A CASE STUDY OF TWO OBLAST 'S Grigory Ioffe Radford University Tatyana Nefedova Institute of Geography, Russian Academy of Science s The National Council for Eurasian and East European Researc h 910 17th Street, N .W. Suite 300 Washington, D .C . 20006 TITLE VIII PROGRAM Project Information * Principal Investigator : Grigory Ioffe Council Contract Number : 815-07g Date : August 17, 200 1 Copyright Information Scholars retain the copyright on works they submit to NCEEER . However, NCEEE R possesses the right to duplicate and disseminate such products, in written and electroni c form, as follows : (a) for its internal use ; (b) to the U .S. Government for its internal use or fo r dissemination to officials of foreign governments ; and (c) for dissemination in accordance with the Freedom of Information Act or other law or policy of the U .S. government tha t grants the public access to documents held by the U .S. government . Additionally, NCEEER has a royalty-free license to distribute and disseminate paper s submitted under the terms of its agreements to the general public, in furtherance o f academic research, scholarship, and the advancement of general knowledge, on a non-profi t basis. All papers distributed or disseminated shall bear notice of copyright . Neithe r NCEEER, nor the U .S. Government, nor any recipient of a Contract product may use it fo r commercial sale . The work leading to this report was supported in part by contract or grant funds provided by the National Council for Eurasian and East European Research, funds which were made available by the U .S.