A Case Study: Miniso

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

South Dakota Town-Country Trade Relations: 1901-1931 P.H

South Dakota State University Open PRAIRIE: Open Public Research Access Institutional Repository and Information Exchange South Dakota State University Agricultural Bulletins Experiment Station 9-1-1932 South Dakota Town-Country Trade Relations: 1901-1931 P.H. Landis Follow this and additional works at: http://openprairie.sdstate.edu/agexperimentsta_bulletins Recommended Citation Landis, P.H., "South Dakota Town-Country Trade Relations: 1901-1931" (1932). Bulletins. Paper 274. http://openprairie.sdstate.edu/agexperimentsta_bulletins/274 This Bulletin is brought to you for free and open access by the South Dakota State University Agricultural Experiment Station at Open PRAIRIE: Open Public Research Access Institutional Repository and Information Exchange. It has been accepted for inclusion in Bulletins by an authorized administrator of Open PRAIRIE: Open Public Research Access Institutional Repository and Information Exchange. For more information, please contact [email protected]. Bulletin 27 4 September, 1932 �� Town-Counlrq Trade Relations 1901-1931 Department of Rural Sociology Agricultural Experiment Station of the South Dakota State College of Agriculture and Mechanic Arts Cooperating with the Bureau of Agricultural Economics United States Department of Agriculture Brookings, South Dakota CONTENTS Page 1. Introduction -------------------------------- 3 The Period and its Changes ________________ 3 Plan of Study ---------------------------- 6 Definition of Terms _______________________ 8 II. Factors in the Territorial Distribution of Trade Centers, 1901 to 1931 _____________________ 11 Geographical Factors _____________________ 11 Historical Factors ________________________ 14 III. Changing Life Habits as a Factor in Rural-Urban Trade Relations -------------------------- 15 Changes in Merchandising as Indices of Life IIabits ------------------------------- 15 Per Capita Distribution of Stores __________ 19 Urbanization as a Factor in Change ________ 22 Interdependence of Town and Country ______ 27 IV. -

COLLEGE RETIREMENT EQUITIES FUND Form NPORT-EX Filed 2019

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-EX Filing Date: 2019-05-29 | Period of Report: 2019-03-31 SEC Accession No. 0001752724-19-032064 (HTML Version on secdatabase.com) FILER COLLEGE RETIREMENT EQUITIES FUND Mailing Address Business Address 730 THIRD AVE 730 THIRD AVE CIK:777535| IRS No.: 136022042 | State of Incorp.:NY | Fiscal Year End: 1231 NEW YORK NY 10017 NEW YORK NY 10017 Type: NPORT-EX | Act: 40 | File No.: 811-04415 | Film No.: 19860841 2129164905 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document COLLEGE RETIREMENT EQUITIES FUND - Stock Account COLLEGE RETIREMENT EQUITIES FUND STOCK ACCOUNT SCHEDULE OF INVESTMENTS (unaudited) March 31, 2019 MATURITY VALUE PRINCIPAL ISSUER RATE DATE (000) BONDS - 0.0% GOVERNMENT BONDS - 0.0% U.S. TREASURY SECURITIES - 0.0% $ 300,000 United States Treasury Note 1.750% 05/15/22 $ 296 TOTAL U.S. TREASURY SECURITIES 296 TOTAL GOVERNMENT BONDS 296 (Cost $301) TOTAL BONDS 296 (Cost $301) EQUITY LINKED NOTES - 0.0% DIVERSIFIED FINANCIALS - 0.0% 70,600 *,j Morgan Stanley BV 0.000 06/14/19 1,997 16,000 *,†,j Morgan Stanley BV 0.000 07/11/19 671 TOTAL DIVERSIFIED FINANCIALS 2,668 TOTAL EQUITY LINKED NOTES 2,668 (Cost $2,304) SHARES COMPANY COMMON STOCKS - 99.1% AUTOMOBILES & COMPONENTS - 1.4% 21,551 e Adient plc 279 115,000 Aisan Industry Co Ltd 708 1,054,958 Aisin Seiki Co Ltd 37,766 90,300 * Akebono Brake Industry Co Ltd 101 200,290 * American Axle & Manufacturing Holdings, Inc 2,866 564,661 Apollo Tyres Ltd 1,813 1,069,495 Aptiv plc 85,014 41,713 e ARB Corp Ltd 510 31,949 Asahi India Glass Ltd 120 291 * Autoliv, Inc 21 1,625 e Autoneum Holding AG. -

DG Trip Generation Memorandum.Pdf

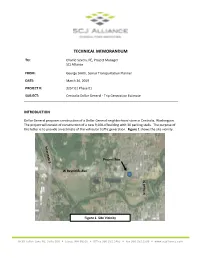

TECHNICAL MEMORANDUM TO: Charlie Severs, PE, Project Manager SCJ Alliance FROM: George Smith, Senior Transportation Planner DATE: March 26, 2019 PROJECT #: 3257.01 Phase 01 SUBJECT: Centralia Dollar General - Trip Generation Estimate INTRODUCTION Dollar General proposes construction of a Dollar General neighborhood store in Centralia, Washington. The project will consist of construction of a new 9,100-sf building with 30 parking stalls. The purpose of this letter is to provide an estimate of the vehicular traffic generation. Figure 1 shows the site vicinity. Project Site W Reynolds Ave N Pearl St N Pearl Figure 1. Site Vicinity 8730 Tallon Lane NE, Suite 200 Lacey, WA 98516 Office 360.352.1465 Fax 360.352.1509 www.scjalliance.com March 26, 2019 Page 2 of 3 PROPOSED DEVELOPMENT Dollar General is proposing construction of a 9,100-sf Dollar General store in Centralia. The development will be located on currently vacant property south of W Reynolds Avenue across the street from Centralia Self Storage. The development will provide one driveway on W Reynolds Avenue. The proposed project will provide 30 parking stalls on-site. The preliminary site plan is attached. SITE-GENERATED TRAFFIC VOLUMES Vehicle trip generation was calculated using the trip generation rates contained in the current edition of the Trip Generation report by the Institute of Transportation Engineers (ITE). The Variety Store category (land-use code #814) was determined to be the most applicable to this project. The following is a quote from the ITE description of the Variety Store Land Use: A variety store is a retail store that sells a broad range of inexpensive items often at a single price. -

Registration Document

REGISTRATION DOCUMENT 2018 CONTENTS 1 GROUP OVERVIEW 3 4 SUSTAINABLE DEVELOPMENT 157 1.1 Business environment, economic 4.1 Klépierre’s CSR strategy 158 model and strategy 4 4.2 Act for the Planet 162 1.2 Key figures 8 4.3 Act for Territories 179 1.3 Share ownership and stock information 12 4.4 Act for People 184 1.4 Background 12 4.5 Sustainability governance 200 1.5 Property portfolio as of December 31, 2018 14 4.6 Supplemental data, methodology 1.6 Simplified organization chart and concordance tables 203 as of December 31, 2018 25 1.7 Risk management 26 5 CORPORATE GOVERNANCE 219 BUSINESS FOR THE YEAR 35 5.1 Management and oversight of the Company 221 2 5.2 Compensation and benefits of executive 2.1 Business overview 36 corporate officers 244 2.2 Business activity by region 41 2.3 Net current cash flow 45 2.4 Investments, developments, and disposals 46 2.5 Parent company earnings and distribution 49 6 SHARE CAPITAL, SHARE 2.6 Portfolio valuation 49 OWNERSHIP, GENERAL 2.7 Financial policy 54 MEETING OF SHAREHOLDERS 267 2.8 EPRA performance indicators 57 2.9 Outlook 61 6.1 Share capital and share ownership 268 6.2 General Meeting of Shareholders 282 FINANCIAL STATEMENTS 63 3 ADDITIONAL INFORMATION 309 3.1 Consolidated financial statements 7 for the year ended December 31, 2018 64 7.1 General information 310 3.2 Statutory auditors’ report on the 7.2 Documents on display 312 consolidated financial statements 122 7.3 Statement by the person responsible for 3.3 Company financial statements for the year the registration document, which serves -

Secrets About Daiso, Japan's Fun and Quirky 100-Yen Shop!

VOLUME 7 NO. 15 SEPTEMBER 4 – SEPTEMBER 10, 2020 SUBMIT STORIES TO: [email protected] STRIPESJAPAN.COM FACEBOOK.COM/STRIPESPACIFIC FREE INSIDE INFO Mental Notes with Hilary Valdez INNER MANAGEMENT PAGE 3 7 secrets about Daiso, YUGAWARA BEACH Japan’s fun and quirky A GREAT PLACE TO HANG 10 Japan Photos courtesy of Live PAGE 7 100-yen shop! Pages 8-9 JAPAN TAKES BAKED GOODS ANOTHER LEVEL PAGE 10 GEISHA STRUGGLE TO PROTECT TRADITIONS AMID COVID-19 PAGE 16 Iwakuni family barred from bases after travel incident BY JOSEPH DITZLER, orders in place from U.S. Forces Japan and LIKE US ON STARS AND STRIPES MCAS Iwakuni to control the virus’ spread. FACEBOOK Published: August 28, 2020 The family violated Japan’s Japan at the time was experiencing the onset of a second wave of coronavirus cases. TOKYO — An American family that drew Quarantine Act, along with Friday’s release came with an apology: rebuke from Japan’s defense minister after orders in place from “The air station expresses sincere regret skirting coronavirus restrictions in July has U.S. Forces Japan. to our Japanese neighbors for any anxiety been barred from Marine Corps Air Station caused by this incident and we will continue Iwakuni, and all U.S. military installations, to strictly enforce appropriate COVID-19 for 10 years, according to Marine statements. risk mitigation measures.” The family of four arrived July 12 at Hane- COVID-19 is the respiratory disease da International Airport in central Tokyo by Japanese authorities at Haneda later caused by the coronavirus. and the following day boarded a commercial showed three of the family members were The family left Iwakuni on Aug. -

Spotlight Seoul Retail 2H 2018

Savills World Research Korea Spotlight Seoul Retail 2H 2018 savills.co.kr/research Spotlight | Seoul Retail 2H 2018 Spotlight Seoul Retail "Amidst the rise of online commerce and the shrinking share of offline retail sales, changes in the retail real estate environment are highly visible. Owner/operators continue to liquidate hypermarkets and department stores as the market for these assets remains stable. Investment targets are becoming more varied, such as buying small- and medium-sized buildings, partaking in shopping mall development projects, and converting office floors to retail floors." Sales of major retailers delivery solutions. As the number GRAPH 1 While traditional retailers are of tech-savvy consumers grows, Offline and online retail sales growth, experiencing stagnant offline sales, the online share of the retail market 2014 – 1H/2018 online sales have grown by double is expanding faster than 10% per annum. Recently, retailers in the digits annually over the past three Offline Online furniture, electronic goods and food 20% years, and grew 16.3% YoY in the first 17.7% 18.1% half of 2018. Online sales accounted categories have experienced strong 16.0% 16.3% sales growth. As of year-end 2017, for 19% of the total retail sector as of 15% 13.2% Q1/2018, and the sector’s growth can online sales of furniture and electronic be attributed to several factors: the goods were valued at KRW11.2 10% rise of single-person households and trillion, and the online food sector was valued at KRW11.9 trillion, growing working couples; the country’s high 4.5% 85% and 150% respectively in only 5% 3.5% penetration of smartphones; and the 3.0% 2.7% three years' time. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Mergers & Acquisitions Mexico Annual Issue

Seale & Associates Creative Solutions. Trusted Advice. MERGERS & ACQUISITIONS MEXICO 2019 ANNUAL ISSUE SUMMARY OF MERGERS & ACQUISITIONS IN MEXICO In 2019, the volume and value of announced transactions accumulated to 169 and USD$15.8 billion, respectively, representing a decrease in volume of 25.0% and an increase in reported value 33.7% Year-Over-Year. It is necessary to clarify that two megadeals in the infrastructure sector represent US$7.1 billion of the total value reported 18 18 18 16 17 16 16 13 13 12 11 9 10 Deal Volume in Mexico # of Transactions per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $15.8 226 2016 $8.6 210 2017 $11.4 240 2018 $8.6 $15.8 Deal Volume and 212 Value in Mexico Annual Transactions 2019 $8.7 $7.1* 169 (US$ billion) $7.1 *Megadeals Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. Trusted Advice. SUMMARY OF MERGERS & ACQUISITIONS BY MEXICAN COMPANIES ABROAD In 2019, the volume and value of announced transactions accumulated to 40 deals worth US$3.8 billion, representing a decrease in volume of 14.8% and a decrease in reported value of 26.9% Year-Over-Year 7 6 6 4 4 3 3 3 3 2 2 Deal Volume 1 Abroad # of Transactions 0 per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $13.4 47 2016 $9.6 49 2017 $8.9 39 2018 $5.2 47 Deal Volume and Value Abroad Annual Transactions (US$ billion) 2019 $3.8 40 Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. -

Valuation Multiples by Industry

Valuation Multiples by Industry https://www.eval.tech SIC Sector: (5200-5999) Retail Trade Report Date: 31 March 2021 Country: United States of America (U.S.A.) Industry Valuation Multiples The table below provides a summary of median industry enterprise value (EV) valuation multiples, as at the Report Date. The data is grouped by industry SIC code: EV Multiple Max # Rev EBITDA EBIT TotAss TanAss Retail-Lumber & Other Building Materials Dealers (5211) 6 1.52 13.48 16.37 3.01 3.38 Retail-Variety Stores (5331) 9 0.91 13.55 18.73 1.83 2.15 Retail-Grocery Stores (5411) 10 0.37 7.19 10.75 0.90 0.95 Retail-Auto Dealers & Gasoline Stations (5500) 21 0.94 12.34 17.63 1.64 1.74 Retail-Auto & Home Supply Stores (5531) 6 1.48 12.72 14.68 2.13 2.67 Retail-Apparel & Accessory Stores (5600) 7 1.17 14.18 39.80 1.34 1.45 Retail-Family Clothing Stores (5651) 10 1.23 15.85 53.84 1.31 1.56 Retail-Shoe Stores (5661) 5 - - - 1.24 1.20 Retail-Home Furniture, Furnishings & Equipment Stores 6 1.17 - - 1.22 2.20 (5700) Retail-Eating & Drinking Places (5810) 6 4.61 54.28 - 1.68 2.55 Retail-Eating Places (5812) 39 2.28 23.89 28.25 1.67 2.20 Retail-Miscellaneous Retail (5900) 7 2.16 - 18.46 1.49 2.69 Retail-Drug Stores And Proprietary Stores (5912) 7 0.59 16.69 39.50 0.78 1.38 Retail-Miscellaneous Shopping Goods Stores (5940) 8 0.79 7.46 10.79 0.95 1.16 Retail-Catalog & Mail-Order Houses (5961) 23 1.17 14.70 22.10 2.88 3.27 Retail-Retail Stores, Nec (5990) 12 0.91 10.77 13.84 1.32 1.28 © 2021 eVal 1 20210427 EV/Revenue Valuation Multiple We provide additional data relating to industry EV/Revenue valuation multiples: # Average Median Std. -

MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020

MINISO InvestorRoom MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020 GUANGZHOU, China, Dec. 18, 2020 /PRNewswire/ -- MINISO Group Holding Limited (NYSE: MNSO) ("MINISO" or the "Company"), a fast-growing global value retailer offering a variety of design-led lifestyle products, today announced its unaudited financial results for the first fiscal quarter ended September 30, 2020. Financial Highlights for the 2021 First Fiscal Quarter Ended September 30, 2020 Revenue for the fiscal quarter ended September 30, 2020, was RMB2,072.1 million (US$305.2 million), representing a decrease of 30.7% from the fiscal quarter endedS eptember 30, 2019, and an increase of 33.4% from the previous fiscal quarter ended June 30, 2020. Gross profit for the fiscal quarter ended September 30, 2020, was RMB522.4 million (US$76.9 million), representing a decrease of 44.3% from the fiscal quarter endedS eptember 30, 2019, and an increase of 37.7% from the previous fiscal quarter ended June 30, 2020. Loss from continuing operations for the fiscal quarter ended September 30, 2020, was RMB1,676.3 million (US$246.9 million) as compared to RMB20.3 million for the fiscal quarter ended September 30, 2019, and RMB74.8 million for the previous fiscal quarter ended June 30, 2020. Adjusted net profit[1] for the fiscal quarter ended September 30, 2020, was RMB102.1 million (US$15.0 million), representing a decrease of 74.6% from the fiscal quarter endedS eptember 30, 2019, and an increase of 140.8% from the previous fiscal quarter endedJ une 30, 2020. -

VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe

July 28, 2017 VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe WEEK ENDING JULY 27, 2017 SUMMARY PAGES 3-11 V-LIST 12 WATCHLIST 13 RATING PAGES 14-105 Viewpoint July 28, 2017 C OMPANY R ATING P AGES Click on company name below for a link to the rating page Shading indicates an updated rating page Agnico-Eagle Mines Ltd. 14 CGI Group Inc. 45 Macy’s, Inc. 76 Aimia Inc. 15 Choice Properties REIT 46 Magna International Inc. 77 Allied Properties REIT 16 Cogeco Cable Inc. 47 Manulife Financial Corp. 78 Air Canada 17 Constellation Software Inc. 48 Maple Leaf Foods Inc. 79 Amaya Inc. 18 Crescent Point Energy Corp. 49 Martinrea International Inc. 80 ARC Resources Ltd. 19 Crombie REIT 50 Metro Inc. 81 Artis REIT 20 CT Real Estate Investment Trust 51 National Bank of Canada 82 ATCO Ltd. 21 Dollarama Inc. 52 Newmont Mining Corp. 83 Badger Daylighting Ltd. 22 ECN Capital Corp. 53 Northland Power Inc. 84 Bank of Montreal 23 Element Fleet Management 54 Peyto Exploration & Development Corp. 85 Bank of Nova Scotia 24 Eldorado Gold Corp. 55 PrairieSky Royalty Ltd. 86 Barrick Gold Corp. 25 Emera Inc. 56 Quebecor Inc. 87 Baytex Energy Corp. 26 Empire Company Ltd. 57 Restaurant Brands International 88 BCE Inc. 27 Rogers Communications Inc. 89 Enbridge Inc. 58 BlackBerry Ltd. 28 Royal Bank of Canada 90 Encana Corp. 59 Boardwalk REIT 29 Enerplus Corp. 60 Shaw Communications Inc. 91 Bombardier Inc. 30 Fortis Inc. 61 Sun Life Financial Inc. 92 Bonavista Energy Corp. 31 George Weston Ltd. -

A Case of Daiso Japan Entry to Indonesia

Managing Differences as Internationalization Strategy; A Case of Daiso Japan Entry to Indonesia Inke Maria & Vinsensio Dugis Universitas Airlangga ABSTRACT It has been widely accepted that multinational corporations (MNCs) have been part of important agencies playing critical role in determining global governance. Increasing globalization, featuring in various forms, have critically facilitated the operation of MNCs globally and increasing influence of MNCs on global politics. However, differences that could come in the forms of culture, politics, geography, and economy, are still crucial obstacles for MNCs competing internationally. Therefore, building and employing a spot-on international strategy becomes a crucial issue. Taking-up a Daiso Japan entry to Indonesia as a case study, this article higlights how cultural adaptation could become a key success for an MNC. Equally, it reveals how far culture is needed by Daiso Japan when doing its international expansion into Indonesia. The case informed that some cultural elements such as language, customs, and manners can be instrumental elements supporting the success of employing cultural adaptation as an international strategy. These cultural elements are potential sources for adjusting with local culture through aggregation process. Keywords: adaptation, cultural aggregation, cultural differences, internationalization strategy. Telah dipahami secara luas bahwa korporasi multinasional (MNC) telah menjadi bagian penting agensi global yang memainkan peran krusial menentukan tatakelola global. Globalisasi yang semakin meningkat dan mewujud dalam berbagi bentuk telah memfasilitasi beroperasinya korporasi secara global serta peningkatan pengaruhnya terhadap politik global. Namun demikian, perbedaan yang dapat mewujud dalam bentuk kebudayaan, politik, geografi, dan ekonomi tetap menjadi hambatan berat bagi korporasi yang beroperasi secara global. Karena itu, membangun dan mengaplikasi strategi internasional yang sesuai dan tepat-guna menjadi isu penting.