Spotlight Seoul Retail 2H 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COLLEGE RETIREMENT EQUITIES FUND Form NPORT-EX Filed 2019

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-EX Filing Date: 2019-05-29 | Period of Report: 2019-03-31 SEC Accession No. 0001752724-19-032064 (HTML Version on secdatabase.com) FILER COLLEGE RETIREMENT EQUITIES FUND Mailing Address Business Address 730 THIRD AVE 730 THIRD AVE CIK:777535| IRS No.: 136022042 | State of Incorp.:NY | Fiscal Year End: 1231 NEW YORK NY 10017 NEW YORK NY 10017 Type: NPORT-EX | Act: 40 | File No.: 811-04415 | Film No.: 19860841 2129164905 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document COLLEGE RETIREMENT EQUITIES FUND - Stock Account COLLEGE RETIREMENT EQUITIES FUND STOCK ACCOUNT SCHEDULE OF INVESTMENTS (unaudited) March 31, 2019 MATURITY VALUE PRINCIPAL ISSUER RATE DATE (000) BONDS - 0.0% GOVERNMENT BONDS - 0.0% U.S. TREASURY SECURITIES - 0.0% $ 300,000 United States Treasury Note 1.750% 05/15/22 $ 296 TOTAL U.S. TREASURY SECURITIES 296 TOTAL GOVERNMENT BONDS 296 (Cost $301) TOTAL BONDS 296 (Cost $301) EQUITY LINKED NOTES - 0.0% DIVERSIFIED FINANCIALS - 0.0% 70,600 *,j Morgan Stanley BV 0.000 06/14/19 1,997 16,000 *,†,j Morgan Stanley BV 0.000 07/11/19 671 TOTAL DIVERSIFIED FINANCIALS 2,668 TOTAL EQUITY LINKED NOTES 2,668 (Cost $2,304) SHARES COMPANY COMMON STOCKS - 99.1% AUTOMOBILES & COMPONENTS - 1.4% 21,551 e Adient plc 279 115,000 Aisan Industry Co Ltd 708 1,054,958 Aisin Seiki Co Ltd 37,766 90,300 * Akebono Brake Industry Co Ltd 101 200,290 * American Axle & Manufacturing Holdings, Inc 2,866 564,661 Apollo Tyres Ltd 1,813 1,069,495 Aptiv plc 85,014 41,713 e ARB Corp Ltd 510 31,949 Asahi India Glass Ltd 120 291 * Autoliv, Inc 21 1,625 e Autoneum Holding AG. -

Secrets About Daiso, Japan's Fun and Quirky 100-Yen Shop!

VOLUME 7 NO. 15 SEPTEMBER 4 – SEPTEMBER 10, 2020 SUBMIT STORIES TO: [email protected] STRIPESJAPAN.COM FACEBOOK.COM/STRIPESPACIFIC FREE INSIDE INFO Mental Notes with Hilary Valdez INNER MANAGEMENT PAGE 3 7 secrets about Daiso, YUGAWARA BEACH Japan’s fun and quirky A GREAT PLACE TO HANG 10 Japan Photos courtesy of Live PAGE 7 100-yen shop! Pages 8-9 JAPAN TAKES BAKED GOODS ANOTHER LEVEL PAGE 10 GEISHA STRUGGLE TO PROTECT TRADITIONS AMID COVID-19 PAGE 16 Iwakuni family barred from bases after travel incident BY JOSEPH DITZLER, orders in place from U.S. Forces Japan and LIKE US ON STARS AND STRIPES MCAS Iwakuni to control the virus’ spread. FACEBOOK Published: August 28, 2020 The family violated Japan’s Japan at the time was experiencing the onset of a second wave of coronavirus cases. TOKYO — An American family that drew Quarantine Act, along with Friday’s release came with an apology: rebuke from Japan’s defense minister after orders in place from “The air station expresses sincere regret skirting coronavirus restrictions in July has U.S. Forces Japan. to our Japanese neighbors for any anxiety been barred from Marine Corps Air Station caused by this incident and we will continue Iwakuni, and all U.S. military installations, to strictly enforce appropriate COVID-19 for 10 years, according to Marine statements. risk mitigation measures.” The family of four arrived July 12 at Hane- COVID-19 is the respiratory disease da International Airport in central Tokyo by Japanese authorities at Haneda later caused by the coronavirus. and the following day boarded a commercial showed three of the family members were The family left Iwakuni on Aug. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

A Case of Daiso Japan Entry to Indonesia

Managing Differences as Internationalization Strategy; A Case of Daiso Japan Entry to Indonesia Inke Maria & Vinsensio Dugis Universitas Airlangga ABSTRACT It has been widely accepted that multinational corporations (MNCs) have been part of important agencies playing critical role in determining global governance. Increasing globalization, featuring in various forms, have critically facilitated the operation of MNCs globally and increasing influence of MNCs on global politics. However, differences that could come in the forms of culture, politics, geography, and economy, are still crucial obstacles for MNCs competing internationally. Therefore, building and employing a spot-on international strategy becomes a crucial issue. Taking-up a Daiso Japan entry to Indonesia as a case study, this article higlights how cultural adaptation could become a key success for an MNC. Equally, it reveals how far culture is needed by Daiso Japan when doing its international expansion into Indonesia. The case informed that some cultural elements such as language, customs, and manners can be instrumental elements supporting the success of employing cultural adaptation as an international strategy. These cultural elements are potential sources for adjusting with local culture through aggregation process. Keywords: adaptation, cultural aggregation, cultural differences, internationalization strategy. Telah dipahami secara luas bahwa korporasi multinasional (MNC) telah menjadi bagian penting agensi global yang memainkan peran krusial menentukan tatakelola global. Globalisasi yang semakin meningkat dan mewujud dalam berbagi bentuk telah memfasilitasi beroperasinya korporasi secara global serta peningkatan pengaruhnya terhadap politik global. Namun demikian, perbedaan yang dapat mewujud dalam bentuk kebudayaan, politik, geografi, dan ekonomi tetap menjadi hambatan berat bagi korporasi yang beroperasi secara global. Karena itu, membangun dan mengaplikasi strategi internasional yang sesuai dan tepat-guna menjadi isu penting. -

Establishment Address Score2 Inspection Date 3 Nations Brewing Co

No Food Prep - 1 inspection/year permitting PER Light Food Prep - 2 inspections/year Complaint COM Heavy Food Prep - 3-4 inspections/year updated 10/19/2020 Followup FOL Heavy Food Prep - 2-3 inspections/year consultation CON pass/fail due to pub. disaster Establishment Address Score2 Inspection Date 3 Nations Brewing Co. 1033 E VANDERGRIFF DR permitting02/25/2020 55 Degrees 1104 ELM ST temp clsd 07/14/2020 7 Degrees Ice Cream Rolls 2150 N JOSEY LN #124 95 06/22/2020 7 Leaves Café 2540 OLD DENTON RD #116 96 12/12/2019 7-Eleven 1865 E ROSEMEADE PKWY 97 01/06/2020 7-Eleven 2145 N JOSEY LN 90 02/19/2020 7-Eleven 2230 MARSH LN 92 03/10/2020 7-Eleven 2680 OLD DENTON RD 96 08/27/2020 7-Eleven 3700 OLD DENTON RD 92 02/05/2020 7-Eleven #32379 1545 W HEBRON PKWY 93 10/13/2020 7-Eleven Convenience Store #36356B 4210 N JOSEY LN 100 09/02/2020 1102 Bubble Tea & Coffee 4070 SH 121 98 10/13/2020 85C Bakery & Cafe 2540 OLD DENTON RD 91 02/18/2020 99 Pocha 1008 Mac Arthur Dr #120 95 09/16/2019 99 Ranch Market - Bakery 2532 OLD DENTON RD 92 07/21/2020 99 Ranch Market - Hot Deli 2532 OLD DENTON RD 96 07/21/2020 99 Ranch Market - Meat 2532 OLD DENTON RD 88 07/15/2020 99 Ranch Market - Produce 2532 OLD DENTON RD 88 07/15/2020 99 Ranch Market - Seafood 2532 OLD DENTON RD 90 07/21/2020 99 Ranch Market -Supermarket 2532 OLD DENTON RD 93 07/15/2020 A To Z Beer and Wine 1208 E BELT LINE RD #118 87 12/11/2019 A1 Chinese Restaurant 1927 E BELT LINE RD 91 02/11/2020 ABE Japanese Restaurant 2625 OLD DENTON RD 95 10/08/2020 Accent Foods 1617 HUTTON DR 97 02/11/2020 -

Jan Bormeth Vilhelmsen Og Ma

0 ucvbnmqwertyuiopåasdfghjklæøzxcv Executive Summary The master thesis at hand is a study of the Danish retail store chain Tiger and EQT’s decision to acquire a 70% stake in the company. The aim in this thesis is twofold. Firstly, a valuation of Zebra per June 30, 2015, will be conducted. Secondly, an analysis of the value creation during EQT’s ownership period is performed. The main objective in this thesis is to estimate the fair Enterprise Value per June 30, 2015, through a DCF-analysis. Based on Zebra’s strategic position and its historical financial performance, the expected future earnings and cash flow generations were forecasted and resulted in an Enterprise Value of DKK 8,864 million from which the Group accounted for DKK 8,350 million and the Japanese Joint Venture for DKK 515 million. Based on these figures, Zebra’s fair value of equity comprises DKK 7,789 million. Of this figure, EQT’s share of the equity amounts to DKK 5,219 million and DKK 2,874 million when correcting for the 50/50 owned subsidiaries. At EQT’s entry in the beginning of 2013, the purchase price for its stake was DKK 1,600 million, according to different sources, resulting in an IRR for EQT on 26.48% per year. This IRR is satisfying since it is above the expected return for Private Equity investments which historically has a threshold for an IRR on over 20% per year, and in more recent time a threshold between 12-17% per year. The objective in the second part of this thesis is to analyze how EQT has created or destroyed value during its ownership period based on an IRR for Zebra, excluding the Japanese Joint Venture. -

DAISOGEL Packing Materials for Process Purification

[ PROCESS PURIFICATION ] ™™ DAISOGELDAISOGELPacking Materials for Process Purification DAISOGELPacking Material for Process Purification - offered by Waters Waters Corporation and DAIso CO., LTD., Osaka, Japan, have jointly entered into a collaboration to globally market and supply DAIsoGEL™ bulk packing materials for process chromatography. By combining the purification expertise of both organizations, pharmaceutical and biopharmaceutical companies’ scaling processes for lab-scale to pilot plant or process-scale manufacturing, can now benefit from an unparalleled level of technical and product support. Daisogel Packing Materials . Silica-based packing materials for pharmaceutical and biopharmaceutical chromatographic purifications . High mass loading and excellent resolution . Excellent durability with extended acidic and alkaline resistance . Available in multiple kilograms Daisogel Analytical and Preparative HPLC Columns Packed by Waters . Analytical columns for screening and method development of isolation and purification methods . Preparative columns packed with Waters patented Prep OBD™ Technology for scaling up [3] DAISOGEL Columns Packed with Waters OBD Technology ColUMN PERFORMANCE – IdENTIFYING THE PRoblEM Laboratory-scale HPLC purification presents many challenges to the chromatographer. Inconsistency in column-to-column performance and OBD Optimized Bed Density lifetimes often result in lost samples, repeat purification runs and poor scalability from small to larger volume columns. Common HPLC prep High-pressure Slurry Packing Axial-ram Slurry Packing column failures are due to mechanical instabilities, especially voids in the Localized Bed Expansion Near Inlet Localized Compression Near Inlet packed bed. The patented OBD Technology1 combines optimized packing processes with a unique set of column designs ensuring increased lifetime OBD Process and better reproducibility. Optimum Bed Density Throughout When a column is used in a preparative HPLC system, it must remain stable during operation. -

Expansion Guide North America / Summer 2016

Retail & Restaurant Expansion Guide North America / Summer 2016 interactive menu click to get started INTRODUCTION ICSC PERSPECTIVE APPAREL ENTERTAINMENT ARTS / CRAFTS / HOBBIES FINANCIAL SERVICES AUTOMOTIVE FOOD-RELATED BEER / LIQUOR / WINE GROCERY BOOKS / MEDIA / TOYS HEALTH AND BEAUTY CARDS / GIFTS / NOVELTY HOME-RELATED CHILDCARE / LEARNING CENTERS JEWELRY CONSUMER ELECTRONICS MISCELLANEOUS RETAIL DEPARTMENT STORE PETS / PETCARE DISCOUNTERS / SUPERSTORES RESTAURANTS DRUG STORE / PHARMACY SPORTING GOODS North American Retail & Restaurant Expansion Guide Summer 2016 INTRODUCTION Welcome to the inaugural edition of the Cushman & Wakefield North American Retailer and Restaurant Expansion Guide In this report, we track the growth plans of thousands of major retail and restaurant chains and public statements made by company executives, and reliable “word on the street” throughout the United States and Canada. This is not your typical retail research report gathered from the retail and brokerage communities. Additionally, in cases where we were in that the purpose of the Expansion Guide is not to create hard metrics or to provide either unable to obtain reliable data or where we received questionable information, we numbers-driven statistical analysis. Certainly, our tracking of such data heavily informs provided our own estimates of current unit counts and likely growth in the year ahead. our standard research efforts from our quarterly reports to white papers on special topics. These estimates were based upon a mix of factors, including recent growth history and But the ultimate goal of this publication is to provide a glimpse of likely growth over the sector health. coming year across all of the major retail sectors from a mix of various concepts as we know or understand them. -

Daiso-Industries-Co

IP PHL FFICE OF THE H I L I PP I N E S DAISO INDUSTRIES CO., LTD., } I PC No. 14-2012-00365 Opposer, Opposition to: } Appln. Serial No. 4-2012-002507 } Date Filed: 29 February 2012 -versus- } TM: "MY SHOP- ALL DAISO" } MA. OLIVIA D. TAN, } Respondent- Applicant. } x-- ~x NOTICE OF DECISION ROMULO MABANTA, BUENAVENTURA SAYOC & DE LOS ANGELES Counsel for Opposer 21st Floor, Philamlife Tower 8767 Paseo de Roxas, Makati City LIN & PARTNERS LAW FIRM Counsel for Respondent- Applicant 301 Toyama Group Center Bldg. No. 22 Timog Avenue, Quezon City GREETINGS: Please be informed that Decision No. 2016 - 4SS dated December 12, 2016 (copy enclosed) was promulgated in the above entitled case. Pursuant to Section 2, Rule 9 of the IPOPHL Memorandum Circular No. 16-007 series of 2016, any party may appeal the decision to the Director of the Bureau of Legal Affairs within ten (10) days after receipt of the decision together with the payment of applicable fees. Taguig City, December 13, 2016. MARILYN F. RETUTAL IPRS IV Bureau of Legal Affairs Republic of the Philippines INTELLECTUAL PROPERTY OFFICE Intellectual Property Center # 28 Upper McKinley Road, McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634 Philippines •www.ipophil.qov.ph T: +632-2386300 • F: +632-5539480 •[email protected] IP INTELLECTUAL PROPERTY OFFICE OF THE PHILIPPINES DAISO INDUSTRIES CO., LTD., IPC No. 14-2012-00365 Opposer, Opposition to: -versus- Application No. 4-2012-002507 Date Filed: 29 February 2012 Trademark: "MY SHOP-ALL MA. OLIVIA D. TAN, } DAISO" Respondent-Applicant. } -x Decision No. -

Great Mall Current Web Lease Plan 447 Great Mall Drive Milpitas, CA 95035 Modified: September 28, 2021 CORP # 5250

representation oragreementbyLandlordthattheCenter,CommonAreas,buildingsand/or configuration andoccupantsoftheCenteratanytime. exhibit willatanytimebeoccupantsoftheCenter. stores willbeasillustratedonthisexhibit,orthatanytenantswhichmayreferenced This exhibitisprovidedforillustrativepurposesonly,andshallnotbedeemedtoawarranty, Modified: September 28,2021 Landlord reservestherighttomodifysize, OFF BROADWAYSHOES GAMESTOP RETAIL CLAIRE'S RETAIL MOOK ART GALLERY COLD STONE ALL ON TARGET CREAMERY ZOOM IN AT&T HOT TOPIC DAISO JAPAN OAKLEY VAULT ENZO COLLECTION LIDS GREAT NAILS & BEAUTY SALON ANNE'S AUNTIE T-MOBILE RETAIL FARGO WELLS TEEZ RETAIL CUSTOM RETAIL YW RELAXATION DANIEL'S JEWELERS VITAMIN WORLD JOURNEYS ICING FIELDS/TCBY MRS. LEGENDS COMICS & GAMES RETAIL RETAIL EDDIE BAUER OUTLET FINISH LINE TOP LINE THE BODY FRAGRANCE RETAIL WETZEL'S SHOP WEARHOUSE THE CHILDREN'S PLACE OUTLET OUTLET/GYMBOREE AMERICAN EAGLE OUTFITTERS BEAUTY PRETTY SPENCER'S TUXEDO JOLLIBEE BBY WINDSOR MARF NEW BALANCE Current Web LeasePlan CORNER INVU POTATO STARBUCKS STATE FARM A5 JEWELERS VALLIANI VANS OUTLET CREAM PAPAYA CLOTHING CO. RETAILZUMIEZ ADIDAS CHAMPS SPORTS SALT TREE GNC BATH & BODY WORKS UNDER ARMOUR GELATO VITA LA DOLCE LA THE HATCLUB MINISO TOMMY HILFIGER SAM'S KEBAB JAMBA JUICE KHAN'S KING BURGER GREAT CHARLEY'S SARKU JAPAN SARKU CINNABON SGH RUBY THAI RUBY RETAIL KAY JEWELERS OUTLET POPEYES SUBWAY BROW LOVING O'NEILL GUESS ART FRESH VILLA HUT CAJUN & RETAIL THE COSMETICS GRILL COMPANY STORE FOOT LOCKER OUTLET CROCS WAIKIKI PAGODA PIERCING BANTER -

FTSE Global All Cap Ex Canada China a Inclusion

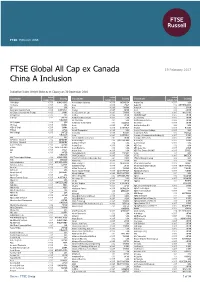

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V. -

Microbeads in Rinse-Off PCC-C Products

Report prepared by Report prepared for Department of Agriculture, Water and the Environment An assessment of the presence of microbeads in rinse-off personal care, cosmetic and cleaning products currently available within the Australian retail market Project report Final report - 30 November 2020 Project title: An assessment of the presence of microbeads in rinse-off personal care, cosmetic and cleaning products currently available within the Australian retail market Report title: Project report Client: Department of Agriculture, Water and the Environment Authors: Kyle O’Farrell and Fiona Harney Project reference: A21514 Document reference: R04-02-A21514 Date: 30 November 2020 Report citation: N/A Disclaimer This report has been prepared on behalf of and for the exclusive use of the Department of Agriculture, Water and the Environment, and is subject to and issued in accordance with the agreement between the Department of Agriculture, Water and the Environment and Envisage Works. Envisage Works accepts no liability or responsibility whatsoever for any use of or reliance upon this report by any third party. Envisage Works contact details ABN: 12 584 231 841 Post: PO Box 7050, Reservoir East VIC 3073 E-mail: [email protected] Phone: +61 (0)3 9016 5490 Figure 1 – Assorted skin care products An assessment of the presence of microbeads in rinse-off personal care, cosmetic and cleaning products Page ii currently available within the Australian retail market – Project report Envisage Works – Positive Impact Consulting CONTENTS EXECUTIVE