WHO KILLED SAAB AUTOMOBILE?: Obituary of an Automotive Icon

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bakrutan-1984-01.Pdf

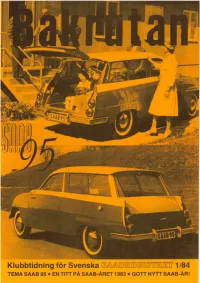

En vy Över utställningen på Saabs familjedag på Gustafsvik, Kristinehamn. Fotograf: Anita-Maria Karlsson. Saab. Ett mycket lyckat foto från årets ölandsträff Kai Perssons ombyggda 93/59. kycklinggul och soltak! Deltog i Sveriges snyggaste Bil - 83. Visst är den snygg! Fotograf: Gunnar Samuelsson. Linkopng. SVENSKA 0££M1111920Ulia32 21[18 c/o Lennart FrostelidFryxellsgatan 1 680 71 BJÖRNEBORG 0550/26062 PC. 476 52 46 - 6 • BAKRUTAN, - organ för Svenska Saabregistret, 680 71 BJÖRNEBORG Nr 1 1984 årgång 8 start 1976. Medlemsavgift 1984 50:- som skall betalas in på PC. 476 52 46 - 6 ---------- Som fullvärdig medlem räknas den som erlagt full avgift till Registret. Medlemsavgiften betalas per år, alltså till årets slut. Krav på tvåtaktsägande finns ej för att få medlemsskap i Registret SVENSKA SAABREGISTRETS mål är att bevara tvåtaktaren i originalskick att verka för god reservdelsförsörjning till medlemmarna till rimliga priser, att öka kunskapen om Saabens intressanta historia, samt att samarbeta med tillbehörsfirmor i syfte att pressa priser och ge medlem- marna god service. Annonsering i BAKRUTAN, är gratis för privatpersoner. Firmor och företag skall kontakta redaktören för kostnadsförslag. INNEHÅLLSFÖRTECKNING: 1. Framsidan SAAB 95159 22. GUSTAFSVIK öppet hus på Saab - 2. Bilder från sommarens träffar 55. TEMA SAAB 95 3. Redaktionellt 34. TEMA SAAB 95 4. Nya medlemmar 35. TEMA SAAB 95 / Klubbshoppen 5. Nya Medlemmar 56. Min Bil HANS EKLUND, Enköping 93F/60 6. Nya Medlemmar 37. Min Bil HANS EKLUND, -"- 7. Nya Medlemmar 38. Besök på Saabs museum i Trolghättan 8. BELLtIvuE TRADINGANNONS 39. -"- 40. Saabreklam 1954 9. NORGETRÄFF I LOEN 17BYt-&-f-ijällri- RAKRUTAN har jag gläd - 10.NORGETRÄFF I LOEN jen att få bifoga den nya datoriserade 11.SAAB 92/47 Medlemsmatrikeln. -

Exploring Local Governance in Urban Planning and Development

Exploring Local Governance in Urban Planning and Development The case of Lindholmen, Göteborg Doctoral dissertation Åsa von Sydow Stockholm 2004 TRITA-INFRA 04-026 ISRN KTH/INFRA/--04/026--SE ISSN 1651-0216 ISBN 91-7323-090-1 Royal Institute of Technology Department of Infrastructure Division of Urban Studies Unit of Urban Planning SE-100 44 Stockholm Telephone: +46 8 790 60 00 http://www.infra.kth.se/SP/ © Åsa von Sydow, 2004 Printed by Universitetsservice AB, Stockholm. ii Exploring Local Governance in Urban Planning and Development The case of Lindholmen, Göteborg Åsa von Sydow Royal Institute of Technology Department of Infrastructure Division of Urban Studies Abstract In the late 1970s the city of Göteborg was faced with massive job loss as well as an empty urban waterfront (Norra Älvstranden) due to the closing down of the shipyards. Since then Göteborg has been struggling to transform itself into a successful post-industrial city. The political leadership has worked diligently at promoting Göteborg as a knowledge and event city with the goal of creating growth in the region. After the shipyard crisis an area on the waterfront called Lindholmen was planned for housing, green areas and the preservation of an historically valuable building. In 1997, however, this all changed when the pri- vate company Ericsson started to look for a new office location and showed interest in the area. The company demanded the establishment of an IT-cluster consisting of 10 000 workplaces on the pier. This started a process which re- sulted in Lindholmen Science Park, a growth environment for knowledge in- tensive, high-tech companies. -

SCNA Historic Vehicle Collection

Saab Cars North America Heritage Vehicle Collection 2/3/2012 TERMS OF SALE x The Saab Heritage Collection described below will be sold as a single lot of 10 vehicles. x All vehicles will be sold to the highest bidder by Saab Cars North America, Inc. (“SCNA”) “as is/where is” in Sterling Heights, Michigan, without titles. The successful bidder will have the opportunity to inspect the vehicles. x SCNA will issue a “Bill of Sale” to the successful buyer upon entry of a Court Order confirming the sale. x Bids should be submitted to the attention of Dennis McTevia by email at [email protected] accompanied by a 25% cash deposit to Saab Cars North America, Inc. The cash deposit should be wired to: Bank: Comerica Bank One Woodward Avenue Detroit, Michigan 48226 ABA No: 072000096 Credit To: Saab Cars North America, Inc. Heritage Vehicle Deposit Account McTevia & Associates, LLC Account No: 1852854924 x The deadline for submission of bids is Friday, February 10, 2012, at 12:00 Noon EST. x The successful bidder will be notified no later than Friday, February 10, 2012, at 5:00 p.m. EST. The successful bidder and/or its agent will then have the option of conducting a physical inspection of the Heritage Collection by appointment no later than 5:00 p.m. EST Wednesday, February 15, 2012, which is the deadline for the payment of the remaining 75% balance from the successful bidder. x In the event the successful bidder declines to proceed, its 25% cash deposit will be returned and the next highest bidder will be notified. -

Road & Track Magazine Records

http://oac.cdlib.org/findaid/ark:/13030/c8j38wwz No online items Guide to the Road & Track Magazine Records M1919 David Krah, Beaudry Allen, Kendra Tsai, Gurudarshan Khalsa Department of Special Collections and University Archives 2015 ; revised 2017 Green Library 557 Escondido Mall Stanford 94305-6064 [email protected] URL: http://library.stanford.edu/spc Guide to the Road & Track M1919 1 Magazine Records M1919 Language of Material: English Contributing Institution: Department of Special Collections and University Archives Title: Road & Track Magazine records creator: Road & Track magazine Identifier/Call Number: M1919 Physical Description: 485 Linear Feet(1162 containers) Date (inclusive): circa 1920-2012 Language of Material: The materials are primarily in English with small amounts of material in German, French and Italian and other languages. Special Collections and University Archives materials are stored offsite and must be paged 36 hours in advance. Abstract: The records of Road & Track magazine consist primarily of subject files, arranged by make and model of vehicle, as well as material on performance and comparison testing and racing. Conditions Governing Use While Special Collections is the owner of the physical and digital items, permission to examine collection materials is not an authorization to publish. These materials are made available for use in research, teaching, and private study. Any transmission or reproduction beyond that allowed by fair use requires permission from the owners of rights, heir(s) or assigns. Preferred Citation [identification of item], Road & Track Magazine records (M1919). Dept. of Special Collections and University Archives, Stanford University Libraries, Stanford, Calif. Conditions Governing Access Open for research. Note that material must be requested at least 36 hours in advance of intended use. -

Freedom to Move in a Personal, Sustainable and Safe Way

VOLVO CAR GROUP ANNUAL REPORT 2020 Freedom to move in a personal, sustainable and safe way TABLE OF CONTENTS OVERVIEW 4 2020 Highlights 6 CEO Comment 8 Our Strenghts 10 The Volvo Car Group 12 Our Strategic Affiliates THE WORLD AROUND US 16 Consumer Trends 18 Technology Shift OUR STRATEGIC FRAMEWORK 22 Our Purpose 24 Strategic Framework HOW WE CREATE VALUE 28 Our Stakeholders 30 Our People and Culture 32 Product Creation 38 Industrial Operations 42 Commercial Operations MANAGEMENT REPORT 47 Board of Directors Report 52 Enterprise Risk Management 55 Corporate Governance Report FINANCIAL STATEMENTS 60 Contents Financial Report 61 Consolidated Financial Statements 67 Notes to the Consolidated Financial Statements 110 Parent Company Financial Statements 112 Notes to the Parent Company Financial Statements 118 Auditor’s Report 120 Board of Directors 122 Executive Management Team Freedom to move SUSTAINABILITY INFORMATION 124 Sustainability Management and Governance 129 Performance 2020 PERSONAL SUSTAINABLE SAFE 139 Sustainability Scorecard 144 GRI Index Cars used to be the symbol for personal freedom. Owning a car meant that you had the We commit to developing We commit to the highest We commit to pioneering 146 TCFD Index means to be independently mobile – that you owned not just a vehicle, but choice as and building the most per- standard of sustainability the safest, most intelligent 147 Auditor's Limited Assurance Report on sonal solutions in mobility: in mobility to protect technology solutions in Sustainability well. Nothing of that has changed, but the world we live in has. The earth, our cities and to make life less compli- the world we share. -

Koenigsegg to Embark on Evolutionary Journey for Future Growth

Koenigsegg to embark on evolutionary journey for future growth Press release 29 January 2019, Ängelholm, Sweden Koenigsegg AB is forming a strategic partnership with NEVS AB, enabling the development of parallel vehicle models in slightly higher volumes with emphasis on electrification, as well as strengthening growth opportunities in the hyper car segment. NEVS is making a capital injection of EUR 150 million, thereby taking a 20 percent minority stake in Koenigsegg’s parent company. Additionally, the parties are forming a joint venture to expand into new market segments where NEVS AB is contributing USD 150 million in starting capital for a 65 percent stake and Koenigsegg obtains 35 percent by contributing primarily with intellectual property, technology licenses, and product design. The partnership will deepen an already existing collaboration between Koenigsegg and NEVS, creating synergies between their geographical footprints, experiences and competencies. Koenigsegg already has a distinguished unique market position for hyper cars, and through the additional joint venture NEVS and Koenigsegg are partnering up to develop a product for new and untapped segments, leveraging both of the companies’ strengths. Through NEVS production facilities in Trollhättan, Koenigsegg will access additional capabilities as well as benefiting from the extensive automotive knowledge in the region, whilst maintaining their centre of excellence in Ängelholm. Alongside NEVS capacity for production in Trollhättan and China, NEVS through its majority owner Evergrande, has a wide distribution platform and channels through ownership in one of China’s largest car retailers. “Koenigsegg is breaking new ground, capitalising on our unique technology, performance track record and market position to explore and develop new products. -

VSCNA Registry April 24, 2009 Page 1 of 20

VSCNA Registry April 24, 2009 Page 1 of 20 ——————————————————————————————— ——————————————————————————————— Eric Nelson Home: (413)525-0211 Peter Maitland Home: (508)529-7737 131 Somers Rd Work: (860)727-2648 29 Mechanic St Work: (508)875-7222 East Longmeadow MA 01028- Member: 439 11/30/09 W Upton MA 01568-1579 Member: 117 05/31/10 1965 Blue Saab Monte Carlo 226000 miles 1968 Hussar Blue Saab 95 #58809 150000 miles Plate: 1971 Tan Saab 96 Ex-Jack Ashcraft car. Originally an Oregon car, purchased vintage ice racer from PA. Motor Sport Service complete 1700cc engine build 1972 Blue Saab 95 180000 miles with new MSS induction system using Weber 42DCNF ——————————————————————————————— synchronous carburetor, MSS exhaust, and Pertronix ignition. Jon B Liland Home: (413)477-6982 Engine dynamometer tests done by Jack Lawrence during 1278 Prouty Rd Work: engine break-in reached 120hp. Rebuilt Sonett transmission, PO Box 41 Member: 116 02/28/11 Ashcraft rear shock conversion, MSS springs, rebuilt 80 amp Hardwick MA 01037-0041 alternator, Carter electric fuel pump, refinished "soccer ball" 1967 Silver Saab Sonett II #147 13000 miles wheels with 165/15 tires. MC dash, Moto-Lita wooden 1968 Red Saab Sonett V4 57000 miles steering wheel, modern audio system, rebuilt everything. large turbo and very many modifications Never really restored, but painted in early '90's. Driven daily 1969 Green Saab 96 20000 miles 1969 True Blue Saab Sonett V4 #1430 55000 miles ~125hp Swedish "Rally" set up Original 1500cc engine and tranmission. Ex-Dale Holmes ——————————————————————————————— car from Southern California, restored to a high standard, has Roger S Harris Home: (413)739-1806 never had rust, much of the restoration work done by Bud 58 Rogers Ave Work: (413)736-7473 Clark. -

The Case of Saab Automobile AB from Core Capabilities Into Core Rigidities - a Trajectory Towards Demise

Master Degree Project in Knowledge-based Entrepreneurship The case of Saab Automobile AB From core capabilities into core rigidities - A trajectory towards demise Giacomo Buzzoni and Magnus Eklund Supervisor: Evangelos Bourelos Master Degree Project No. 2016:148 Graduate School The Case of Saab Automobile AB From Core Capabilities into Core Rigidities - A Trajectory Towards Demise © Giacomo Buzzoni & Magnus Eklund School of Business, Economics and Law, University of Gothenburg, Vasagatan 1, P.O. Box 600 SE 40530 Gothenburg, Sweden All rights reserved No part of this master thesis may be reproduced without prior written permission from the authors Acknowledgements First of all, we would like to thank our supervisor Evangelos Bourelos for his patience and effort in providing us with meaningful advice throughout these months of intense research. We would also like to express our appreciation and gratitude towards all our respondents who have allocated their valuable time to help us interpret this interesting case. Your passion, knowledge and commitment guided us through this journey, and we have enjoyed every single day of it. Finally, we would like to thank our peer students and all the people close to us for your support during our years of university studies. Without you, this would not have been possible. ABSTRACT This master thesis is addressing the case of Saab Automobile AB, creating a full historical reconstruction using primarily extensive quotes derived from semi-structured interviews with former Saab employees and other relevant actors. The aim is to depict and discuss the roots behind the company’s historically unique capabilities and its trajectory towards failure, together with the influence of General Motors’ ownership in this detrimental process. -

Samhällsförändring På Väg Perspektiv På Den Svenska Bilismens Utveckling Mellan 1950 Och 2007

Samhällsförändring på väg Perspektiv på den svenska bilismens utveckling mellan 1950 och 2007 Eva Lindgren Institutionen för ekonomisk historia 901 87 Umeå Umeå 2010 Avhandlingen ingår i serien Umeå Studies of Economic History Copyright©Eva Lindgren ISBN: 978-91-7264-988-0 ISSN: 0347-254-X Tryck: Print & Media Umeå, Sverige 2010 Abstract The aim of this thesis is to give a perspective on the development of the Swedish automobility, and the automobility’s role for economic historical development between 1950 and 2007 by studying the interaction between the diffusion of the private car on national and regional level, the households’ preferences and the government’s regulations of car ownership. The first paper compares car diffusion in Norway and Sweden in order to find explanations for the national and regional patterns. We ask whether the Norwegian time lag and the diffusion process can be explained with national differences in income, institutions, infrastructure and population settlements; or if regional differences in income and population density have affected the outcome? The conclusion is that car diffusion in Norway and Sweden displays two sides of the same coin; the national levels converged, but the process did not follow the same regional pattern. The second paper examines whether the diffusion of private cars followed the over-all socio-economic and geographical changes in Sweden from 1960 to 1975. In particular, it asks if ownership per capita followed changes in incomes or changes in population density (urbanisation). The analysis is based on Swedish parish-scale census material that includes all car owners for the years 1960, 1970 and 1975. -

92-96 Fakta, Page 1

92-96_fakta, Page 1 Förord Detta dokument handlar om vad SAAB, så vitt jag vet, sysslade med fram till tidigt sjuttiotal. Tyngdpunkten ligger på SAABs bilar och då både produktionsmodeller och konceptbilar. Egentligen skulle det bara handla om tvåtaktsmodellerna men det vore opraktiskt att inte ta med även SAAB 95/96 med V4-motorer. Dock avhandlas ej flygsektionen utom som information om hur SAAB tillkom. Bilmodellerna beskrivs så noga som möjligt. Det har inte alltid varit lätt att få tag på pålitliga specifikationer på vissa modeller, t.ex. GT 750 och GT 850. Mer än 50% av de internetsidor som påstod sig ha specifikationer på dessa påstod att motorn hade 6 ventiler !!!!! (Båda modellerna är ju 2-taktare) Behöver jag tala om att jag försvann ”som en avlöning” från dessa sidor. Dock går jag inte in på detaljspecifikationer när det gäller motorerna då jag planerar ett särskilt dokument om SAABs motorer men det projektet har ännu inte tagit form. Med i detta dokument finns, i så god kronologisk ordning som är praktiskt möjligt, kortfattade beskrivningar av annan produktion och projekt som försiggick under 50-, 60- och 70-tal. SAAB gör ett försök att producera en liten aluminiumbåt 1944, när krigslutet kunde skönjas, formades planerna att man skulle starta tillverkning av en liten aluminiumbåt. 1946 inleddes produktionen. Båtmodellen kallades för Saalina och var en nitad aluminiumkonstruktion, man hade ju gott om aluminiumplåt och nitar från flygplans- tillverkningen. I första hand var den avsedd att ros men kunde även ha en utombordsmotor. Båten var öppen men åtminstone ett exemplar blev halvdäckat och fick vindruta. -

Annual Report 2008

Annual Report 2008 adMatematik FCC Fraunhofer-Chalmers Research Centre for Industrial Mathematics © Fraunhofer-Chalmers Research Centre for Industrial Mathematics All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or any information storage and retrieval system, without permission in writing from FCC. This and other FCC reports are distributed by FCC Chalmers Science Park SE-412 88 Göteborg Sweden Telephone: +46 (0)31 7724000 Telefax: +46 (0)31 7724260 [email protected] www.fcc.chalmers.se Cover Simulation of mass transport through a gel structure using the FCC solver IBOFlow. The fi gure shows the velocity fi eld in a cutting plane, cf pages 16 and 43. Illustrations To illustrate our research on pages 12 - 43 we use pictures from Göteborg and Mölndal, see also the inner back cover. Annual Report 2008 Fraunhofer-Chalmers Research Centre for Industrial Mathematics, FCC Editors: Annika Eriksson, Uno Nävert Layout: Annika Eriksson Print: www.stromia.se Published in May 2009 Contents Preface 2 Profi le 4-5 Acknowledgements 6 Clients and Partners 7 Fraunhofer-Gesellschaft 8-9 Chalmers 10-11 Computational Engineering and Design 12 Electromagnetics 14-15 Fluid Dynamics 16-17 Optimization 18-19 Reliability and Risk Management 20 Fatigue Life 22-25 Geometry and Motion Planning 26 Geometry Assurance 28-29 Path Planning 30-33 Systems Biology and Bioimaging 34 Systems Biology 36-41 Bioimaging 42-43 Annual account (in Swedish) 44 Appendix 46 FCC Annual Report 2008 1 Preface For three years 2006-2008 the Centre has shown an annual income level slightly below thirty million Swedish crowns or three million euros, each year making a positive net. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, DC 20549-1004

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549-1004 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported) August 14, 2009 GENERAL MOTORS COMPANY (Exact Name of Company as Specified in its Charter) 333-160471 DELAWARE 27-03832222 (Commission File Number) (State or other jurisdiction (I.R.S. Employer of incorporation) Identification No.) 300 Renaissance Center, Detroit, Michigan 48265-3000 (Address of Principal Executive Offices) (Zip Code) (313) 556-5000 (Company’s telephone number, including area code) Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the company under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17-CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 8.01. Other Events On August 18, 2009 General Motors Company (“GM”) confirmed it signed a stock purchase agreement with Koenigsegg Group AB regarding the sale of 100% of the shares of Saab Automobile AB (“Saab”). The deal is expected to conclude in the next few months. Saab plans to exit legal reorganization shortly. The stock purchase agreement is subject to agreed upon closing conditions, including expected funding commitments from the European Investment Bank and/or other financial institutions, to be guaranteed by the Swedish government, as well as transitional assistance from GM.