Annexure I 20200331113817.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Full Report

CONTENTS 02 Unstoppable Corporate overview We have been persistent 02 Unstoppable in our aim to establishing 04 Chairman’s Message and maintaining market leadership to be able to achieve 06 Vice Chairman’s Message unprecedented growth for our 08 Board of Directors stakeholders. 10 Management Board 12 Key Performance Highlights 14 14 Integrated Report Integrated Report 28 Management Discussion & Analysis Apollo Tyres’ contribution 51 Sustainability Snapshot to social and economic development is critical to create and sustain an enabling environment for investment. This has enabled the Company’s positioning as a credible Statutory Reports stakeholder partner. 84 Board’s Report 95 Annual Report on CSR 28 102 Business Responsibility Report Management 126 Corporate Governance Report Discussion & Analysis Financial Statements 161 Standalone Financial Statements 223 Consolidated Financial Statements UNSTOPPABLE Since inception, we have worked towards establishing ourselves as a leading player in the sale and manufacture of tyres. We have been persistent in our aim to establishing and maintaining market leadership and be able to achieve unprecedented growth for our stakeholders. In FY2018-19 (FY2019), we continued to focus We are unstoppable in establishing our on our key revenue generating regions APMEA leadership across multiple segments. (Asia Pacific, Middle East and Africa, including Our consistently advancing product range coupled India) and Europe. We expanded our presence in with product innovations are enabling us to achieve Americas by added new territories and increasing the same. our value proposition. The APMEA operation continued its focus on consolidating its leadership We are unstoppable in working towards achieving and enhancing share in India through the cutting edge manufacturing capabilities and introduction of best in class and technologically world-class R&D. -

Chaipoint Outlets

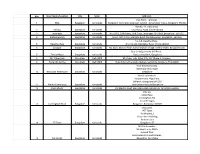

Sno Store Name/Location City State Address1 Chai Point , Terminal, 1 BIAL Bangalore Karnataka Bangalore International Airport Limited , Devanahali Taluka, Bangalore-560300 Plot No. 44, Electronics 2 Infosys Bangalore Karnataka City, Hosur Road, B'lore-560100 3 Jayanagar Bangalore Karnataka No.524/2, 10th Main, 33rd Cross, Jayanagar 4th Block, Bangalore - 560 011 4 Malleshwaram Bangalore Karnataka No.64, 18th Cross, Margosa Road, Malleshwaram, Bangalore - 560 055 No.A-8, Devatha Plaza, 5 Devatha Plaza Bangalore Karnataka No.131-132, Residency Road, B'lore-560025 6 Sarjapur Bangalore Karnataka No. 38/2, Ground Floor, Kaikondrahalli village, Varthur Hobli, Bangalore East Opp to Adigas hotel, MG Road , 7 Trinity Metro Bangalore Karnataka Next to Axis Bank, Bangalore 8 DLF Cyber Hub Gurugram Delhi NCR K5, Cyber hub, Cyber City, DLF Phase 3, Gurgaon 9 Huda City Centre Gurugram Delhi NCR Huda City Centre Metro Station, Sector 29, Gurgaon, HR 122009 Near Electronics City Bommasandra village 10 Narayana Healthcare Bangalore Karnataka Bangalore Mantri commercio Kariyammana Ahgrahara , Bellendur,Bangalore-560103 11 Mantri Commercio Bangalore Karnataka Near Sakara Hospital Bangalore 12 RMZ Infinity Bangalore Karnataka Old Madras Road, Bennigana Halli, Bangalore, Karnataka 560016 S No 50, Little Plaza, Cunningham Rd, Vasanth Nagar, 13 Cunningham Road Bangalore Karnataka Bangalore, Karnataka 560002 Chai point #77 Town Building No,3 Divya shree building Yamalur post 14 77 Town Bangalore Karnataka Bangalore -37 NH Cardio center NH Health city -258/a Ground floor, Bommasandra Industrial area, 15 NH Cardio Bangalore Karnataka Bangalore, Karnataka 16 Unitech Infospace Gurugram Delhi NCR Store No 6, Unitech Infospace SEZ Sector-21, Gurgaon 17 Salarpuria Softzone Bangalore Karnataka Salarpuria Softzone ,Outer ring road ,Near sarjapur junction ,Bangalore -43 John F. -

Annual Report 2013-14 Dlf Emporio Limited

ANNUAL REPORT 201314 DLF EMPORIO LIMITED CIN: U74920HR1999PLC034168 REGD. OFFICE: SHOPPING MALL, PHASE I, DLF CITY, GURGAON HARYANA 122 002 DLF EMPORIO LIMITED (Formerly known as Regency Park Property Management Services Limited) Regd. Office: Shopping Mall, Phase-I, DLF City, Gurgaon, Haryana-122 002 (CIN - U74920HR1999PLC034168) Website: www.dlfemporio.com Tel No: 011-42102180, Fax No: 011-41501771, E-mail: [email protected] NOTICE NOTICE is hereby given that the 15th Annual General Meeting of the Members of the Company will be held on Friday, August 22, 2014 at 10.00 A.M. at Registered Office of the Company at Shopping Mall, Phase – I, DLF City, Gurgaon, Haryana – 122 002 to transact the following businesses: ORDINARY BUSINESS: 1. To receive, consider and adopt the Audited Balance Sheet as at 31st March, 2014 and the Statement of Profit and Loss for the financial year ended on that date together with the reports of Directors and Auditors thereon. 2. To declare dividend on 4,000, 9% Non-Cumulative Redeemable Preference Shares of Rs.100/- each and 100, 12% Non-Cumulative Redeemable Preference Shares of Rs.100/- each. 3. To appoint a Director in place of Ms. Dinaz Madhukar, who retires by rotation and being eligible, offers herself for re-appointment. 4. To appoint the Statutory Auditors of the Company to hold office from the conclusion of this Annual General Meeting until the conclusion of the Next Annual General Meeting and to fix their remuneration. M/s Walker, Chandiok & Co LLP, the retiring Auditors are eligible for re- appointment. SPECIAL BUSINESS: 5. -

Omaxe New Chandigarh

https://www.propertywala.com/omaxe-new-chandigarh-mohali Omaxe New Chandigarh - Mullanpur, Mohali Omaxe 300 sq.yrd Residential Plot in Mullanpur New Chandigarh Omaxe New Chandigarh is residential land project located in ideal location of Mullanpur New Chandigarh. Project ID : J305763119 Builder: Omaxe Properties: Apartments / Flats, Independent Houses, Residential Plots / Lands, Commercial Plots / Lands Location: Omaxe New Chandigarh, Mullanpur, Mohali - 140901 (Chandigarh) Completion Date: Dec, 2014 Status: Started Description Omaxe New Chandigarh project, proposed over 1000 acres green land in New Chandigarh, is a modern integrated township. With New Chandigarh buzzing with development activities, the plots on offer in Omaxe New Chandigarh is sizes of 300 sq yard sizes, enabling you build a house the way you desire. Omaxe New Chandigarh has all modern facilities like schools, office-cum-shopping complex and space for recreational activities like amusement parks enthrall the township. The township is also home to one of Punjab’s tallest commercial hub, India Trade Tower. Infrastructure including educational institutions, hospitality, healthcare , beautiful landscaped gardens, kid's park, Long jogging track, underground drainage, medical facility, club with ultra-modern features to name a few add to the advantage of Omaxe New Chandigarh. Location Advantage :- Very good connectivity with Baddi, Nalagarh and Mohali. Location: 2.5 Kms From Sector 38 West , Chandigarh. Few minutes drive from Chandigarh City. Just New to Upcoming PCA Stadium at New Chandigarh . Beautiful view of mountains Shivalik Hills. Very near to PGI hosital and Punjab University / Punjab Engineering College Chandigarh. Proposed Bus Stand Mullanpur is near to Omaxe Plots/Township location. Near to Proposed Amusment Park / Film City by U.T Government. -

Notice LARSEN & TOUBRO LIMITED

LARSEN & TOUBRO LIMITED Regd. Office : L&T House, Ballard Estate, Mumbai 400 001. CIN : L99999MH1946PLC004768 Notice NOTICE IS HEREBY GIVEN THAT the Sixty-ninth Annual 9) To appoint a Director in place of Mr. A. M. Naik General Meeting of LARSEN & TOUBRO LIMITED will (DIN-00001514), who retires by rotation and is eligible be held at Birla Matushri Sabhagar, 19, Marine Lines, for re-appointment; Mumbai - 400 020 on Friday, August 22, 2014 at 3.00 10) To consider and, if thought fit, to pass with or without p.m. to transact the following business :- modification(s), as an ORDINARY RESOLUTION the 1) To consider and adopt the Balance Sheet as at March following: 31, 2014, the Profit & Loss Account for the year ended “RESOLVED THAT Mr. Subodh Bhargava on that date and the Reports of the Board of Directors (DIN-00035672) be and is hereby appointed as an and Auditors thereon; Independent Director of the Company to hold office 2) To declare a dividend on equity shares; up to March 29, 2017 with effect from April 1, 2014.” 3) To consider and, if thought fit, to pass with or without 11) To consider and, if thought fit, to pass with or without modification(s), as an ORDINARY RESOLUTION the modification(s), as an ORDINARY RESOLUTION the following: following: “RESOLVED THAT pursuant to Section 149(13) of the “RESOLVED THAT Mr. M. M. Chitale (DIN-00101004) Companies Act, 2013 the Independent Directors of the be and is hereby appointed as an Independent Director Company shall not be liable to retire by rotation.” of the Company to hold office up to March 31, 2019 4) To consider and, if thought fit, to pass with or without with effect from April 1, 2014.” modification(s), as an ORDINARY RESOLUTION the 12) To consider and, if thought fit, to pass with or without following: modification(s), as an ORDINARY RESOLUTION the “RESOLVED THAT the vacancy caused due to retirement following: by rotation of Mr. -

IN the BUSINESS of PROGRESS CONTENTS Apollo Tyres in Brief

Annual Report 2019-20 IN THE BUSINESS OF PROGRESS CONTENTS Apollo Tyres in brief 01-03 Apollo Tyres is one of the most trusted Corporate factsheet names in the manufacture and sale of tyres. The Company was founded in 1972 and is 04-13 headquartered in Gurugram, Haryana (India). Leadership and governance 06 Chairman’s message 08 Vice-Chairman’s message 10 Board of Directors Catering to all tyre segments 12 Management Team TRUCK AND BUS LIGHT TRUCK 14-77 Performance and progress 16 Key performance indicators 18 Know our capitals 20 Business model 22 Capital-wise information 36 Progress amidst volatility 38 Progress that is sustainable 40 Progress through people centricity 42 Value created for the stakeholders PASSENGER VEHICLES TWO-WHEELER 78-93 Management Discussion & Analysis 94-170 Statutory Reports 94 Board’s Report 107 Annual Report on CSR 113 Business Responsibility Report 138 Corporate Governance Report OFF-HIGHWAY 171-305 Financial Statements 171 Standalone 233 Consolidated Apollo Tyres’ success as a leading tyre such as: geo-political relations, economic manufacturer is inextricably linked with the growth, industry cyclicality, environmental progress of the people, the businesses we issues, technological innovation, safety and partner and the planet at large. We have consumer attitudes. Our FY20 performance is always persevered to exceed expectations, a reflection of the resulting uncertainties. It set new benchmarks and in some cases, is also a testament to our foundational values shape the future of the industry. and intrinsic strengths that have helped us navigate through these uncertainties. Our marquee brands, Apollo and Vredestein, enjoy premium positions in the commercial As we step into a new decade, replete with and passenger vehicle tyre segments in unexplored opportunities, we are keen on India and Europe, respectively. -

The Billionaire Club TOPEARNERS

The Billionaire Club TOPEARNERS Gross salary Name Designation Company Rs cr (2007) MUKESH AMBANI CMD Reliance Industries 30.46 P R R RAJHA CMD Madras Cements 24.78 KALANITHI MARAN CMD Sun TV 23.26 KAVERY KALANITHI Joint Managing Director Sun TV 23.26 KUMAR MANGALAM BIRLA Chairman Hindalco 17.53 BRIJMOHAN LALL MUNJAL Chairman Hero Honda Motors 15.62 PAWAN KANT MUNJAL MD & CEO Hero Honda Motors 15.54 SUNIL BHARTI MITTAL CMD Bharti Airtel 14.96 K ANJI REDDY Chairman Dr Reddy's Laboratories 14.40 A C SANGHVI Managing Director Ambuja Cements 14.04 SAJJAN JINDAL VC & MD JSW Steel 13.25 TAKAO EGUCHI Whole-time Director Hero Honda Motors 12.61 PANKAJ R PATEL CMD Cadila Healthcare 12.40 NAVEEN JINDAL Ex VC & MD Jindal Steel & Power 11.63 G V PRASAD VC & CEO Dr Reddy's Laboratories 10.87 SATISH REDDY MD & COO Dr Reddy's Laboratories 10.87 ONKAR S KANWAR CMD Apollo Tyres 9.98 E SUDHIR REDDY VC & MD IVRCL Infrastructures 9.85 M A M R MUTHIAH Managing Director Chettinand Cement 8.92 RAJIV SINGH Vice Chairman DLF 7.92 Y K HAMIED CMD Cipla 7.88 MURALI K DIVI CMD Divi's Laboratories 7.88 HITAL R MESWANI Executive Director Reliance Industries 7.77 NIKHIL R MESWANI Executive Director Reliance Industries 7.77 HABIL KHORAKIWALA CMD Wockhardt 7.76 K V MANI Managing Director Kalpataru Power Transmission 7.62 ASHOK KUMAR GOEL VC & MD Essel Propack 7.60 D JAYAVARTHANAVELU CMD Lakshmi Machine Works 7.43 AMAR LULLA Joint Managing Director Cipla 7.33 M K HAMIED Joint Managing Director Cipla 7.33 P R S OBEROI Chairman & Chief Executive EIH 6.88 RAVINDER JAIN Managing -

Model Portfolio Update

Model Portfolio update January 21, 2016 LatestDeal Team Model – PortfolioAt Your Service Large cap Midcap Name of the company Weightage(%) Name of the company Weightage(%) Auto 14 Aviation 6 Tata Motor DVR 4 Interglobe Aviation 6 Bosch 3 Auto 6 Maruti 4 Bharat Forge 6 EICHER Motors 3 BFSI 6 BFSI 23 BjjFiBajaj Finserve 6 HDFC Bank 8 Capital Goods 6 Axis Bank 3 HDFC 8 Bharat Electronics 6 Bajaj Finance 4 Cement 6 Capital Goods 5 Ramco Cement 6 L & T 5 Consumer 24 Cement 3 Symphony 6 UltraTech Cement 3 Supreme Ind 6 FMCG/Consumer 14 Kansai Nerolac 6 ITC 7 Pidilite 6 United Spirits 2 FMCG 8 Asian Paints 5 Nestle 8 IT 21 Infrastructure 8 Infosys 10 NBCC 8 TCS 8 Oil & Gas 6 Wipro 3 Meida 2 CtlCastrol 6 Zee Entertainment 2 Logistics 6 Metal 2 Container Corporation of India 6 Tata Steel 2 Pharma 12 Oil & Gas 4 Natco Pharma 6 Reliance Industries 4 Torrent Pharma 6 Pharma 12 Textile 6 Lupin 5 Arvind 6 Dr Reddys 4 Total 100 Aurobindo Pharma 3 Total 100 • Exclusion - Eicher Motors, Bajaj Finance (transferred to large cap), PVR, • Exclusion- State Bank of India, Bharti Airtel and ONGC CARE, Cummins & Shree Cement • Inclusion – Eicher Motors, Bajaj Finance (transferred from midcap), Wipro, • Inclusion – Ramco Cement, Bajaj Finserv, Supreme Industries, Indigo, Reliance Industries & Aurobindo Pharma Pidilite, Bharat Electronics and Bharat Forge Source: Bloomberg, ICICIdirect.com Research *Diversified portfolio - Combination of 70% large cap and 30% midcap portfolio OutperformanceDeal Team – At continues Your Service across all portfolios… • Our indicative large cap equity model portfolio (“Quality -20”) has • In the large cap space we continue to remain positive on pharma & IT. -

Annexure to the Board Report | L&T Annual Report 2019-20

Annexure ‘A’ to the Board Report and EnPI reduction of CG moulding energy consumption. Information as required to be given under Section 134(3) zz Implemented Smart COMM Energy Management (m) read with Rule 8(3) of the Companies (Accounts) system at ASW & Digital Dashboard. Rules, 2014. zz Replacement of conventional light fittings with [A] CONSERVATION OF ENERGY: Solar lighting system in SSII, Open yard-5 and (i) Steps taken or impact on conservation of Grit blasting & painting areas at Production/ energy: Utility areas at EWL Kancheepuram factory and Kansbahal works. zz Implementation of LED lights in HE-Hazira campus and other project sites and Solar Pipes in zz Replacement of conventional MH Lamps and SG fabrication area. fluorescent tube lights by LED lamps in working areas at office and projects as well as for street zz Installation of an Off Grid Mini-Solar Power Plant for meeting the energy requirement of site & lights. workmen habitats at Ranchi Smart City Project. zz Installation of energy efficient water coolers and submersible pumps zz Installed Local Pre/ Post Weld Heat Treatment (PWHT) using PID Technology which ensures zz Replacing existing aged inefficient Split AC units uniform heating and reduction in energy with energy efficient units wastage. zz Utilization of Chiller for HVAC System – Campus zz Implemented the use of Metal Halide (400 Watt) FMD initiated and control the chiller running EOT Crane under bay lights with LED Lights. hour for HVAC need during holidays and extended working hours. zz Installed Energy efficient burners for Furnaces and pre heating. zz Initiative has been taken for replacement of Air-Cooled Chiller with Water Cooled Chiller. -

Wadhwa Property

+91-9417013415 Wadhwa Property https://www.indiamart.com/wadhwa-property/ Providing houses dealing services, booths dealing services etc. Providing houses dealing services, booths dealing services etc. About Us Wadhwa Property was established in the year 1992. We are leading Service Provider of Real State Service. We introduce ourselves as property consultant dealing in the sales and purchase of property at Panchkula, Chandigarh, and nearby area. We are the channel partner for sales of DLF, Omaxe, Ireo, Ansal Api, Parag- Infratech. We also deal in sale and purchase of altus, UK infrastructure, Ecocity Gmada, Aerocity Gmada and Logix Group. We are known for sincere, efficient and clean deals. Our mission is to be the preeminent provider of superior Real State Services by consistently improving the quality of our product to add value for clients through innovation, foresight, integrity and aggressive performance and to serve with character and purpose that brings honor. For more information, please visit https://www.indiamart.com/wadhwa-property/aboutus.html PROPERTY DEALING SERVICE P r o d u c t s & S e r v i c e s Commercial Plots (DLF City Commercial Plot (DLF Hyde Centre) Park Arcade SCO) Commercial Shop (DLF Micro) Micro Shops (DLF Hyde Park) FLAT DEALING SERVICE P r o d u c t s & S e r v i c e s 2/3/4 BHK Flats (Omaxe) Luxury Flats (Omaxe The Lake) 3 BHK Flats (Omaxe The 3 BHK Floor (DLF Hyde Park) Lake Apartment) PLOT DEALING SERVICE P r o d u c t s & S e r v i c e s Residential Plots (Aerocity Commercial Plot (Aerocity) GMADA) Residential Plot (Aerocity SCO Plots (DLF Hyde Park) Gmada) OTHER SERVICES: P r o d u c t s & S e r v i c e s Shops Sale Service (DLF Residential House (DLF Hyde Park Micro) HYDE Park) SCO Plots ( DLF Hyde Park Arcade) F a c t s h e e t Year of Establishment : 1992 Nature of Business : Service Provider Total Number of Employees : Upto 10 People CONTACT US Wadhwa Property Contact Person: Dinesh Wadhwa Office Service Booth No. -

Reliance Industries Limited

Reliance Industries Limited December 03, 2018 Summary of rated instruments Previous Rated Amount Current Rated Amount Instrument* Rating Action1 (Rs. crore) (Rs. crore) Non-Convertible Debenture -- 2,000 [ICRA]AAA (Stable); Assigned Programme Non-Convertible Debenture 30,000 30,000 [ICRA]AAA (Stable); Outstanding Programme Commercial Paper 10,000 10,000 [ICRA]A1+; Outstanding Total 40,000 42,000 *Instrument details are provided in Annexure-1 Rationale The assigned rating favourably takes into account the robust financial risk profile of the company reflected by comfortable gearing levels, strong coverage indicators and low working capital intensity along with the overall healthy cash generation, supported mainly by the refinery and petrochemical segments and high non-operating income. The rating also factors in the company’s exceptional financial flexibility derived from its healthy liquid investment portfolio and superior fund-raising ability from the domestic and global banking as well as the capital markets. In FY2018, RIL completed certain large-scale expansions in the petrochemicals segment, including the refinery off-gas cracker (in January 2018), which would result in healthy growth in the revenues and operating profits from the business in the current fiscal. The rating further takes into account the established presence of RIL in the crude oil refining segment, its leadership position in the domestic petrochemicals industry with presence across several product segments and its integrated operations across exploration and production (E&P), refining and petrochemical businesses, providing diversity to the cash flow generation. The company operates one of the most complex refineries globally which improves its flexibility in terms of crude sourcing resulting in relatively high Gross Refining Margins (GRMs). -

The Indian Automotive Supplier Report Supplierbusiness

IHS AUTOMOTIVE The Indian Automotive Supplier Report SupplierBusiness 2015 edition supplierbusiness.com REGIONAL REPORT Indian Subcontinent SAMPLE IHS Automotive | Supplying Ford Contents Executive Summary 4 – Renault-Nissan third largest exporter 30 – Tata’s exports expected to decrease 30 Indian Economy and Business Environment 6 – Ford ups capacity in India to boost exports 30 Volatile GDP growth in BRICS 7 – Volkswagen increases exports from India 31 Per capita GDP seen rising 8 – Honda to grow exports from India 31 Inflation in check, for now 8 – GM to turn India into a global export hub 31 Consumer demand expected to improve 9 Foreign investments going up 9 Overview of Automotive Supplier Industry 32 Industrial production recovers 10 Speed bumps 33 Shrinking exports, a cause for concern 10 Positive sentiment returns 33 Indian currency expected to depreciate mildly in 2015, – Engine parts, the largest segment 33 2016 11 – AMT to gain traction 34 – Chassis production 35 The Indian Automotive Market 13 – Interiors production 35 – Maruti Suzuki boosts sales with new models 14 – Exteriors production 35 – Hyundai increases market share 15 – Thermal component production 35 – Mahindra stays leader of SUV segment 16 – Market share of HVAC systems suppliers 36 – Tata Motors plans to reclaim lost ground 16 – The proliferation of car security systems 36 – Honda strengthens position in India with diesel cars Top 10 automotive suppliers in India 36 17 – Motherson Sumi System Limited 37 Key trends in the Indian LV market 18 – Amtek Auto 37 – Hatchback