Cycles, Psychology and Recovery from Financial Stress

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Copyrighted Material

INDEX Page numbers followed by n indicate note numbers. A Arnott, Robert, 391 Ascending triangle pattern, 140–141 AB model. See Abreu-Brunnermeier model Asks (offers), 8 Abreu-Brunnermeier (AB) model, 481–482 Aspray, Thomas, 223 Absolute breadth index, 327–328 ATM. See Automated teller machine Absolute difference, 327–328 ATR. See Average trading range; Average Accelerated trend lines, 65–66 true range Acceleration factor, 88, 89 At-the-money, 418 Accumulation, 213 Average range, 79–80 ACD method, 186 Average trading range (ATR), 113 Achelis, Steven B., 214n1 Average true range (ATR), 79–80 Active month, 401 Ayers-Hughes double negative divergence AD. See Chaikin Accumulation Distribution analysis, 11 Adaptive markets hypothesis, 12, 503 Ayres, Leonard P. (Colonel), 319–320 implications of, 504 ADRs. See American depository receipts ADSs. See American depository shares B 631 Advance, 316 Bachelier, Louis, 493 Advance-decline methods Bailout, 159 advance-decline line moving average, 322 Baltic Dry Index (BDI), 386 one-day change in, 322 Bands, 118–121 ratio, 328–329 trading strategies and, 120–121, 216, 559 that no longer are profitable, 322 Bandwidth indicator, 121 to its 32-week simple moving average, Bar chart patterns, 125–157. See also Patterns 322–324 behavioral finance and pattern recognition, ADX. See Directional Movement Index 129–130 Alexander, Sidney, 494 classic, 134–149, 156 Alexander’s filter technique, 494–495 computers and pattern recognition, 130–131 American Association of Individual Investors learning objective statements, 125 (AAII), 520–525 long-term, 155–156 American depository receipts (ADRs), 317 market structure and pattern American FinanceCOPYRIGHTED Association, 479, 493 MATERIALrecognition, 131 Amplitude, 348 overview, 125–126 Analysis pattern description, 126–128 description of, 300 profitability of, 133–134 fundamental, 473 Bar charts, 38–39 Andrews, Dr. -

Data Visualization and Analysis

HTML5 Financial Charts Data visualization and analysis Xinfinit’s advanced HTML5 charting tool is also available separately from the managed data container and can be licensed for use with other tools and used in conjunction with any editor. It includes a comprehensive library of over sixty technical indictors, additional ones can easily be developed and added on request. 2 Features Analysis Tools Trading from Chart Trend Channel Drawing Instrument Selection Circle Drawing Chart Duration Rectangle Drawing Chart Intervals Fibonacci Patterns Chart Styles (Line, OHLC etc.) Andrew’s Pitchfork Comparison Regression Line and Channel Percentage (Y-axis) Up and Down arrows Log (Y-axis) Text box Show Volume Save Template Show Data values Load Template Show Last Value Save Show Cross Hair Load Show Cross Hair with Last Show Min / Max Show / Hide History panel Show Previous Close Technical Indicators Show News Flags Zooming Data Streaming Full Screen Print Select Tool Horizontal Divider Trend tool Volume by Price Horizonal Line Drawing Book Volumes 3 Features Technical Indicators Acceleration/Deceleration Oscillator Elliot Wave Oscillator Accumulation Distribution Line Envelopes Aroon Oscilltor Fast Stochastic Oscillator Aroon Up/Down Full Stochastic Oscillator Average Directional Index GMMA Average True Range GMMA Oscillator Awesome Oscillator Highest High Bearish Engulfing Historical Volatility Bollinger Band Width Ichimoku Kinko Hyo Bollinger Bands Keltner Indicator Bullish Engulfing Know Sure Thing Chaikin Money Flow Lowest Low Chaikin Oscillator -

The Global Investment Outlook – New Year 2019 Release U.S

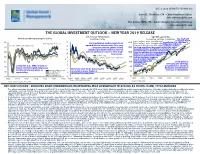

DEC 4 2018 (UPDATED TO NOV 30) Daniel E. Chornous, CFA Chief Investment Officer [email protected] Eric Savoie, MBA, CFA Senior Analyst, Investment Strategy [email protected] THE GLOBAL INVESTMENT OUTLOOK – NEW YEAR 2019 RELEASE U.S. 10-year T-Bond yield S&P 500 equilibrium Global purchasing managers' indices Equilibrium range Normalized earnings & valuations The S&P 500 Nov. '18 Range: 2141 - 3563 (Mid: 2852) is slightly below 65 16 5120 equilibrium (i.e. the band’s ISM Peak Aug 2018: 61.3 Our equilibrium model suggests an Nov. '19 Range: 2218 - 3691 (Mid: 2954)midpoint), and many Previous ISM Peak Feb 2011: 59.2 14 upward bias to interest rates for a very Current (30-November-18): 2760 other markets continue 60 long time into the future should 2560 to show significant discounts to their fair value. A significant rise in inflation and interest rates 12 inflation premiums and real rates of will eventually reduce the sustainable 55 interest ultimately return to their long- 1280 level for valuations, but normalizing 10 term norms. P/E’s and corporate profitability to Last Plot: 2.99% reflect current levels for these 50 8 Current Range: 2.12% - 3.90% (Mid: 3.01%) 640 critical variables suggests % stock market valuations are reasonable, but 45 6 320 certainly not Solid gains in “cheap” in all revenues and earnings 4 Led by the U.S., PMIs remain at 160 locations. propelled U.S. stocks in 40 particular, but threats to levels consistent with expansion, 2 But in the near-term, the pressure but the trend everywhere is both are accumulating. -

Using the Z-Trend Oscillator for Long-Term Bond Market Timing

Using the Z-TrendOscillator for Long-Term Bond Market Timing 6 Submitted by Robert T. Zukowski, CMT March4. 1996 Overview Because it reflects mass psychology, the Coppock Curve is labeled by tnost technicians attd traders as a setttimettt This paper examines the concept of modifying the indicator. As a result, the curve siguals market tops and Coppock Curve to better identify major tops attd bottoms bottoms quite well and proves to be a valuable addition to in the bond futures market for lottg-term positioning. The atty trader’s tool kit. Coppock combined art 1 l- and 14 modified versiott of the Coppock Curve is referred to as mouth ROC, smoothed over by a lo-tnottth weighted mov- the Z-Trend Oscillator. Most oscillators are used for trad- ing average, which cat1 be explaitted by the yearly titne ing periods of price consolidation, but the Z-Trend Oscil- cycles frequent in tnost tnarket indices. A buy signal oc- lator is specifically used for trading all market cottditiotts curs when the curve turns up or becotnes positively sloped from accumulation, to trending, to distribution. while below the zero litte. A sell sigttal occurs when the curve turns down or becomes negatively sloped while Introduction to Rate of Change and the above the zero line. Coppock Curve Otte of the older, sitnpler tcchttical ittdicators to un- The Problem - Indicator Consistency derstand is the rate of chattge or ROC for short. ROC catt When the Coppock Curve is applied to the monthly confirm tnarket trends and forewarn of market reversals. continuation chart of U.S. -

A LOOK AHEAD January 2019

Market Comment A LOOK AHEAD January 2019 As the saying goes, no one rings a bell at the top of the market. This well-known saying is certainly true. The reasons put forward for the correction seem somewhat far-fetched from our point of view; after all, rising interest rates and the trade conflict between the USA and China, in particular, have been talking points for months. Rather, it seems to us that after years of rising prices, the market was overpriced and overbought, and the mood among investors was over-optimistic. The sharp correction of the past few months did a lot of damage, especially in technical terms. Over the following pages, we explain why we first expect a significant countertrend rally before the stock markets continue their correction in 2019. Thus we recommend a highly defensive investment policy. A Look Back – Key Messages Last July Equities The current economic expansion is among the longest in history. Currencies But signs are mounting that the current cycle is mature and we We do expect the current dollar rally to be nearly over and see the risk of a recession by autumn 2019 the earliest. Taking the dollar to resume its downtrend in the second half of this into account that equity markets usually start to rollover months year. The Euro on the other hand is likely to retest major before a recession has become official, a top by the end of 2018 resistance at 1.25. In the big picture, we remain long-term seems possible. bearish on the dollar and view the current rally as only a From an Elliott Wave perspective, we continue to believe that the countertrend move within a long-term downtrend. -

Second Quarter 2016 Investor Letter

Second Quarter 2016 Investor Letter Portfolio Comments The second quarter was characterized by weakening economic conditions, easier monetary stances by central banks and rising commodity prices. Thus, our natural resource holdings outperformed, especially gold miners. Our long-term Treasury positions benefitted from slowing economic growth, and our defensive large-cap US stocks performed better than US stock indices. All-in-all, the portfolios performed well, with our small hedge positions the only categorical underperformer. We anticipated uncertainty during the quarter, so the effects of the Brexit vote were positive for our portfolios, especially our short euro positions. Second Quarter Market Conditions In April, crude oil was the big winner for the month, with West Texas Intermediate (WTI) crude rising 20% to end the month at $45.92. Equity markets, however, decoupled from the crude markets, failing to rise appreciably. US equity markets started April slowly, rose during the middle of the month, but a late month swoon took equity indices back toward unchanged, leaving only small gains. The S&P 500 was up just 0.39%, the Dow Jones Industrial Average gained just over 0.50%, while the Nasdaq Composite fell almost 2%, led down by earnings disappointments in a number of companies, most notably Apple and Microsoft. The Energy, Materials, Financials and Healthcare sectors had good gains in April, while Technology, Utilities and Telecoms were down the most. European stocks outpaced US stocks, with the European Stoxx 600 up 1.2% for the month. In other markets, gold was a big winner during the month, rising 4.5% and ending at 1,289.20/oz, while silver gained 15.4% to end April at $17.89/oz; mining stocks were also up strongly. -

GULF TIMES New Rating, Accreditation Programme to Benefit Qatar Smes

WORLD ENERGY | Page 3 LARGEST DEAL | Page 15 Nearing peak Microsoft to fossil fuels for buy LinkedIn electricity for $26.2bn Tuesday, June 14, 2016 Ramadan 9, 1437 AH MOTC REPORT: Page 16 GULF TIMES High ICT penetration in Qatar indicates BUSINESS growth potential QP seen keeping robust New rating, accreditation financial profile despite lower crude oil prices By Santhosh V Perumal For the Barzan gas project, a programme to benefi t Business Reporter $10.4bn financing (including equity) was secured in December 2011. LNG (liquefied natural gas) Qatar Petroleum (QP), whose projects were developed via breakeven prices on most of its the RasGas and Qatargas joint projects are considerably lower ventures, with a combined annual than in most other hydrocarbon production capacity of 77mn Qatar SMEs: QDB offi cial producing countries, is expected to tonnes. show “robust” financial profile as Additional projects aimed at By Peter Alagos its depth and quality of cash flows diversifying Qatar’s customer base Business Reporter enable financial flexibility even in from the North Field included the case of low sustained oil price Dolphin Energy; the Pearl GTL levels, according to Moody’s, a (gas-to-liquids) project; Al Khaleej atar Development Bank global credit rating agency. gas project, the second phase of (QDB) has launched a new Despite the negative impact of which was inaugurated in May Qprogramme that exempts the plunge in oil and gas prices 2010; a second condensate refinery small and medium-sized enterprises since the second half of 2014 on its at Ras Laffan as well as other (SMEs) from tender bond fees, and revenue and cash flow generation, large industrial ventures operated provides local companies access to QP continues to have a very solid under the 51%-owned Industries government projects and contracts. -

Technically Official: Stock Market Set to Rise

Technically Official: Stock Market Set To Rise Oct 27, 2020 By Peter Switzer, Switzer Report It’s technically official: stock market is set to rise! “I’ve seen a vision of the future…” and it’s very positive for stocks. Now this isn’t my vision, and, best of all, it’s supplied by a man known for his realistic views on the subject of the economy and markets. Percy Allan was a former New South Wales Treasury boss and put together an initiative that we supported called Market Timing. Regrettably, not enough investors were into getting insights when a market would crash or zoom off! That said, critics of market timing indicator watchers could ask: “Did they see this Coronavirus crash coming?” The cynic has a case with this one, as the virus-created pandemic and recession was from the furthest imaginable left-field ever! However, the Citi Bear Market checklist, which I watch closely, shows two important things that critics of market timing should remember. First, on the list of indicators that Citi’s smart market team watches, it doesn’t have anything like “pandemic threat” that has been an issue for markets in the past. Second, before the recent stock market crash, only four out of 18 indicators screamed get out of stocks. Before the dotcom crash, it was 17.5/18. And before the GFC, it was 13/18. And with the latter case, the debt ratings agencies didn’t tell us about their false rating on the exotic investment products (called CDOs), which rattled financial markets into a death spiral, taking stocks down 50%! If they did tell us the truth, that number might have been 15 out of 18, and the cautious market-timer might have gone to cash or at least defensive. -

Bullcharts Indicators

BullCharts Indicators Trade your own way BullCharts provides access Ergodic Candlestick Oscillator Price Rate of Change Fisher Transform - Signal Price Volume Trend to 175+ indicators and a Fisher Transform ROC Pring KST Oscillator continually expanding list of Force Index Projection Band some of the very latest Forecast Oscillator Projection Oscillator GMMACD - Ribbon Psychological Index analytical techniques on Gumbel's Indicator QStick stock market trends. Guppy Custom MMA R-Squared Guppy GMMACD $ Random Walk Index Accumulation & Distribution Guppy GMMACD % Range Indicator Accumulation Swing Index Guppy GMMACD-H $ Regression Oscillator Adaptive Moving Average Guppy GMMA CD-H % Relative Performance Alan Hull Money Histogram Guppy MMA Long Relative Strength Index Alan Hull Price\Volume Indicator Guppy MMA Oscillator Relative Volatility Index Alan Hull Range Indicator - Falling Guppy MMA Short RSI %B Alan Hull Range Indicator - Rising Guppy Multiple EMA S-ROC Alan Hull Rate of Return Hi-Lo Midpoint Short Trailing Stop Aroon Indicator High Low Channel SIROC Average True Range Bands Ichimoku Chart Slope Close Indicator Average True Range Impulse Smoothed ROC Balance of Power Inertia Standard Deviation Bands Bear Power Intraday Intensity Standard Deviation Bollinger %B Intraday Momentum Index Standard Error Band Bollinger Bands Kauffman's Adaptive RSI Stochastic Momentum Index Bollinger Bandwidth Keltner Channel Stochastic Momentum Buff Average Klinger Oscillator Stochastic Oscillator Bull and Bear Balance Histogram Linear Regression Slope -

Forecasting of Security Prices Using Relative Strength Index Method Dr

Forecasting of Security Prices Using Relative Strength Index Method Dr. Rama Naik M* *Lecturer, Department of Hunanities JNTUA College of Engineering, Ananthapur(A.P) ABSTRACT The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The indicator should not be confused with relative strength. The RSI is classified as a momentum oscillator, measuring the velocity and magnitude of directional price movements. Momentum is the rate of the rise or fall in price. The RSI computes momentum as the ratio of higher closes to lower closes: stocks which have had more or stronger positive changes have a higher RSI than stocks which have had more or stronger negative changes. The RSI is most typically used on a 14 day timeframe, measured on a scale from 0 to 100, with high and low levels marked at 70 and 30, respectively. Shorter or longer timeframes are used for alternately shorter or longer outlooks. More extreme high and low levels—80 and 20, or 90 and 10—occur less frequently but indicate stronger momentum. If the RSI is 70 or greater, then the instrument is assumed to be overbought (a situation in which prices have risen more than market expectations). An RSI of 30 or less is taken as a signal that the instrument may be oversold (a situation in which prices have fallen more than the market expectations). INTRODUCTION: Security analysis is the analysis of traceable financial instruments called securities. -

JSE Presentation

Useful Charting Tips COMMON TRADING MISTAKES Little Preparation or Training Being Too Emotional About Money Lack of Recordkeeping Anticipating Profits Blindly Following Mechanical Systems Not Learning How to Short Improper Timing COMMON CHARTING MISTAKES Not using bigger time frames & trading against the trend Using too many indicators & misusing them Following emotions rather than signals 5 STOCK MARKET STAGES Greed Stage Mark-Up Distribution Stage Stage Mark-down Accumulation Stage Stage 3 PHASES OF A TREND Excess Participation Accumulation Bull Trend Accumulation Participation Excess Bear Trend DATE BACK YOUR A USEFUL TIP CHARTS History repeats itself Dating back trendlines gives you an idea of how far 1 the momentum of the trend could go KEY HISTORICAL LEVELS Breaching important, dated back levels indicate a potential reversal and where price is potentially 2 headed Correction or reversal Prevents one from trading against the trend 3 The ability to distinguish between a reversal or correction in trend SGL (MONTHLY CHART) SGL (WEEKLY CHART) SGL (DAILY CHART) TOP-DOWN APPROACH TIP gives you such invaluable information about the markets Monthly stipulates which stage the trend is at Chart its like a certificate that indicates how the main market participants are behaving and thinking Weekly Chart most widely used by traders Daily reveal how the daily fluctuations are fitting in to the overall Chart picture Intra-day earlier entry and exit points Chart CHART FIRST Remember TRADING INDICATORS SECOND TOO MANY INDICATORS COULD GET YOU BROKE -

Word That the Overly Positive Liquidity (From the Breadth 1900 4 Data) and Overly Bullish Sentiment Data

450 INSIDE 445 N RASI PROMISES MORE P. 1 440 LA THE CLEL DEM. PRES. CYCLE P. 2 435 c KET GOLD COPPOCK CURVE P. 4 AR NASDAQ/NYSE VOLUME P. 5 430 T TIMING MODELS P. 6 425 OR REP ABI DOWNTURN P. 7 420 EURDOLLAR COT WORKING P. 8 AGAIN? 415 Prepared After the Market Close, January 21, 2014 Report #451, January 22, 2014 3500 4.25 RASI Above +500 4.2 3000 DJIA - Log Scale Wards Off Evil, At 4.15 2500 4.1 Least For Now 4.05 2000 Final price high 4 With all of the potential for prob- made here, at a Final price high 3.95 lems in the market, the bulls still have 1500 peak below +500 +500 made here, peak 3.9 one argument in their favor, which is at +500 1000 failures 3.85 that breadth data have been strong. ? 3.8 That means liquidity is good, and thus 500 the market is much more immune from 3.75 the worst sorts of problems. There can 0 3.7 still be garden variety corrections, and 3.65 -500 3.6 one is more than due right now. But a +500 3.55 -1000 Ratio-Adjusted Summation Index (RASI) fake out crash is off the table. 3.5 The key piece of evidence of that -1500 -1577 3.45 strong breadth is shown in the first 01/04/08 01/05/09 01/05/10 01/04/11 01/04/12 01/03/13 01/03/14 chart. The Ratio-Adjusted Summation rective dip and then is able to climb up liquidity, then the Fed should be first in Index (RASI) is just like our classic above +500, it says that the rally has line.