Word That the Overly Positive Liquidity (From the Breadth 1900 4 Data) and Overly Bullish Sentiment Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Free Stock Screener Page 1

Free Stock Screener www.dojispace.com Page 1 Disclaimer The information provided is not to be considered as a recommendation to buy certain stocks and is provided solely as an information resource to help traders make their own decisions. Past performance is no guarantee of future success. It is important to note that no system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using The Shocking Indicator will provide information that guarantees profits or ensures freedom from losses. Copyright © 2005-2012. All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, without written prior permission from the author. Free Stock Screener www.dojispace.com Page 2 Bullish Engulfing Pattern is one of the strongest patterns that generates a buying signal in candlestick charting and is one of my favorites. The following figure shows how the Bullish Engulfing Pattern looks like. The following conditions must be met for a pattern to be a bullish engulfing. 1. The stock is in a downtrend (short term or long term) 2. The first candle is a red candle (down day) and the second candle must be white (up day) 3. The body of the second candle must completely engulfs the first candle. The following conditions strengthen the buy signal 1. The trading volume is higher than usual on the engulfing day 2. The engulfing candle engulfs multiple previous down days. 3. The stock gap up or trading higher the next day after the bullish engulfing pattern is formed. -

Copyrighted Material

INDEX Page numbers followed by n indicate note numbers. A Arnott, Robert, 391 Ascending triangle pattern, 140–141 AB model. See Abreu-Brunnermeier model Asks (offers), 8 Abreu-Brunnermeier (AB) model, 481–482 Aspray, Thomas, 223 Absolute breadth index, 327–328 ATM. See Automated teller machine Absolute difference, 327–328 ATR. See Average trading range; Average Accelerated trend lines, 65–66 true range Acceleration factor, 88, 89 At-the-money, 418 Accumulation, 213 Average range, 79–80 ACD method, 186 Average trading range (ATR), 113 Achelis, Steven B., 214n1 Average true range (ATR), 79–80 Active month, 401 Ayers-Hughes double negative divergence AD. See Chaikin Accumulation Distribution analysis, 11 Adaptive markets hypothesis, 12, 503 Ayres, Leonard P. (Colonel), 319–320 implications of, 504 ADRs. See American depository receipts ADSs. See American depository shares B 631 Advance, 316 Bachelier, Louis, 493 Advance-decline methods Bailout, 159 advance-decline line moving average, 322 Baltic Dry Index (BDI), 386 one-day change in, 322 Bands, 118–121 ratio, 328–329 trading strategies and, 120–121, 216, 559 that no longer are profitable, 322 Bandwidth indicator, 121 to its 32-week simple moving average, Bar chart patterns, 125–157. See also Patterns 322–324 behavioral finance and pattern recognition, ADX. See Directional Movement Index 129–130 Alexander, Sidney, 494 classic, 134–149, 156 Alexander’s filter technique, 494–495 computers and pattern recognition, 130–131 American Association of Individual Investors learning objective statements, 125 (AAII), 520–525 long-term, 155–156 American depository receipts (ADRs), 317 market structure and pattern American FinanceCOPYRIGHTED Association, 479, 493 MATERIALrecognition, 131 Amplitude, 348 overview, 125–126 Analysis pattern description, 126–128 description of, 300 profitability of, 133–134 fundamental, 473 Bar charts, 38–39 Andrews, Dr. -

Intermediate Indicators Section Review Questions

Section 9 Intermediate Indicators Section Review Questions Question 1 Which of the following statements about Average Directional Index (ADX) is NOT true? a) The ADX measures trend strength without regard to trend direction b) +DI and –DI are used to define directional movement when interpreting ADX c) The DI crossover system can be used to identify potential buy and sell signals d) A strong trending market is present when the ADX is above 50 Question 2 Which of the following are commonly used potential buy and sell signals when interpreting Moving Average Convergence Divergence (MACD)? a) Signal Line Crossover b) Centerline Crossover c) Divergences d) All of the above Question 3 The Money Flow Index (MFI) is also known as: a) Volume-weighted ADX b) Volume-weighted RSI c) Price-weighted Stochastics d) Price-weighted MACD Question 4 The default look-back period for calculating the Relative Strength Index (RSI) is? a) 12 b) 20 c) 14 d) 10 Question 5 When looking at the following indicators, which one is in overbought territory based on the traditional settings for each indicator? a) Slow Stochastics b) Money Flow Index c) Relative Strength Index d) All of the above Question 6 Which of the following statements is NOT true concerning On Balance Volume (OBV)? a) OBV is based on the theory that volume precedes price b) OBV was developed by Joe Granville c) Divergences should NOT be used to anticipate trend reversals when analyzing OBV d) OBV can be used to confirm a price trend Question 7 Which of the following are considered Market Breadth Indicators? a) Advance-Decline Line b) McClellan Oscillator c) Arms Index d) All of the above Section 9 Intermediate Indicators Section Review Answers 1) d 2) d 3) b 4) c 5) a 6) c 7) d . -

User Guide Index-Lab

Index-Lab User Guide © 2004-2009 FMR LLC. All rights reserved. Index-Lab User Guide by FMR LLC Revised: Friday, January 30, 2009 Index-Lab User Guide © 2004-2009 FMR LLC. All rights reserved. No parts of this work may be reproduced in any form or by any means - graphic, electronic, or mechanical, including photocopying, recording, taping, or information storage and retrieval systems - without the written permission of the publisher. Third party trademarks and service marks are the property of their respective owners. While every precaution has been taken in the preparation of this document, the publisher and the author assume no responsibility for errors or omissions, or for damages resulting from the use or misuse of information contained in this document or from the use or misuse of programs and source code that may accompany it. In no event shall the publisher and the author be liable for any loss of profit or any other commercial damage caused or alleged to have been caused directly or indirectly by this document. Printed: Friday, January 30, 2009 Special thanks to: Wealth-Lab's great on-line community whose comments have helped make this manual more useful for veteran and new users alike. EC Software, whose product HELP & MANUAL printed this document. I User Guide, Index-Lab Table of Contents Foreword 0 Part I Introduction 2 1 Index-Lab Overview........... ........................................................................................................................ 2 2 Wealth-Lab Online......... .Community................... -

Understanding Oscillators and Other Indicators

UNDERSTANDING OSCILLATORS AND OTHER INDICATORS Used in By Tom McClellan and Sherman McClellan UNDERSTANDING OSCILLATORS AND OTHER INDICATORS Used in Tile McClellan Market Report By Tom McClellan and Sherman McClellan No single indicator can show the whole picture of what the market is doing. A variety of carefully crafted indicators measuring selected stock market and interest rate data forms the basis for the integrated technical analysis provided in The McClellan Market Report. By looking at several different tools and using different time frames, we can better identify the forces acting to change the market. Our goal is to understand the probable future market structure based on our analysis of what has happened in the past. In each issue of The McClellan Market Report, there will be charts of several indices and indicators which we find meaningful in interpreting market action. Some of these are common indices that many analysts use, and some are completely of our own invention. Each of these indicators provides its piece to the puzzle of how the market might behave in the future. This booklet has been written in order that you may better understand the indicators we use, their methods of calculation, and our rationale for using them. Our objective in this booklet is for you, the reader, to be comfortable in their use and be able to integrate their messages into your trading or investing. To help you understand our analytical techniques, it is important to first understand a few basic definitions of terms used to describe our indicators. MOVING AVERAGES The most satisfactory investing comes whe~ the market is trending and you invest with the trend of the market. -

Data Visualization and Analysis

HTML5 Financial Charts Data visualization and analysis Xinfinit’s advanced HTML5 charting tool is also available separately from the managed data container and can be licensed for use with other tools and used in conjunction with any editor. It includes a comprehensive library of over sixty technical indictors, additional ones can easily be developed and added on request. 2 Features Analysis Tools Trading from Chart Trend Channel Drawing Instrument Selection Circle Drawing Chart Duration Rectangle Drawing Chart Intervals Fibonacci Patterns Chart Styles (Line, OHLC etc.) Andrew’s Pitchfork Comparison Regression Line and Channel Percentage (Y-axis) Up and Down arrows Log (Y-axis) Text box Show Volume Save Template Show Data values Load Template Show Last Value Save Show Cross Hair Load Show Cross Hair with Last Show Min / Max Show / Hide History panel Show Previous Close Technical Indicators Show News Flags Zooming Data Streaming Full Screen Print Select Tool Horizontal Divider Trend tool Volume by Price Horizonal Line Drawing Book Volumes 3 Features Technical Indicators Acceleration/Deceleration Oscillator Elliot Wave Oscillator Accumulation Distribution Line Envelopes Aroon Oscilltor Fast Stochastic Oscillator Aroon Up/Down Full Stochastic Oscillator Average Directional Index GMMA Average True Range GMMA Oscillator Awesome Oscillator Highest High Bearish Engulfing Historical Volatility Bollinger Band Width Ichimoku Kinko Hyo Bollinger Bands Keltner Indicator Bullish Engulfing Know Sure Thing Chaikin Money Flow Lowest Low Chaikin Oscillator -

Lecture 20: Technical Analysis Steven Skiena

Lecture 20: Technical Analysis Steven Skiena Department of Computer Science State University of New York Stony Brook, NY 11794–4400 http://www.cs.sunysb.edu/∼skiena The Efficient Market Hypothesis The Efficient Market Hypothesis states that the price of a financial asset reflects all available public information available, and responds only to unexpected news. If so, prices are optimal estimates of investment value at all times. If so, it is impossible for investors to predict whether the price will move up or down. There are a variety of slightly different formulations of the Efficient Market Hypothesis (EMH). For example, suppose that prices are predictable but the function is too hard to compute efficiently. Implications of the Efficient Market Hypothesis EMH implies it is pointless to try to identify the best stock, but instead focus our efforts in constructing the highest return portfolio for our desired level of risk. EMH implies that technical analysis is meaningless, because past price movements are all public information. EMH’s distinction between public and non-public informa- tion explains why insider trading should be both profitable and illegal. Like any simple model of a complex phenomena, the EMH does not completely explain the behavior of stock prices. However, that it remains debated (although not completely believed) means it is worth our respect. Technical Analysis The term “technical analysis” covers a class of investment strategies analyzing patterns of past behavior for future predictions. Technical analysis of stock prices is based on the following assumptions (Edwards and Magee): • Market value is determined purely by supply and demand • Stock prices tend to move in trends that persist for long periods of time. -

Investing with Volume Analysis

Praise for Investing with Volume Analysis “Investing with Volume Analysis is a compelling read on the critical role that changing volume patterns play on predicting stock price movement. As buyers and sellers vie for dominance over price, volume analysis is a divining rod of profitable insight, helping to focus the serious investor on where profit can be realized and risk avoided.” —Walter A. Row, III, CFA, Vice President, Portfolio Manager, Eaton Vance Management “In Investing with Volume Analysis, Buff builds a strong case for giving more attention to volume. This book gives a broad overview of volume diagnostic measures and includes several references to academic studies underpinning the importance of volume analysis. Maybe most importantly, it gives insight into the Volume Price Confirmation Indicator (VPCI), an indicator Buff developed to more accurately gauge investor participation when moving averages reveal price trends. The reader will find out how to calculate the VPCI and how to use it to evaluate the health of existing trends.” —Dr. John Zietlow, D.B.A., CTP, Professor of Finance, Malone University (Canton, OH) “In Investing with Volume Analysis, the reader … should be prepared to discover a trove of new ground-breaking innovations and ideas for revolutionizing volume analysis. Whether it is his new Capital Weighted Volume, Trend Trust Indicator, or Anti-Volume Stop Loss method, Buff offers the reader new ideas and tools unavailable anywhere else.” —From the Foreword by Jerry E. Blythe, Market Analyst, President of Winthrop Associates, and Founder of Blythe Investment Counsel “Over the years, with all the advancements in computing power and analysis tools, one of the most important tools of analysis, volume, has been sadly neglected. -

The Complete Guide to Market Breadth Indicators 00Morris-FM 8/11/05 5:57 PM Page Ii 00Morris-FM 8/11/05 5:57 PM Page Iii

00Morris-FM 8/11/05 5:57 PM Page i The Complete Guide to Market Breadth Indicators 00Morris-FM 8/11/05 5:57 PM Page ii 00Morris-FM 8/11/05 5:57 PM Page iii The Complete Guide to Market Breadth Indicators How to Analyze and Evaluate Market Direction and Strength Gregory L. Morris McGraw-Hill New York Chicago San Francisco Lisbon London Madrid Mexico City Milan New Delhi San Juan Seoul Singapore Sydney Toronto 00Morris-FM 8/11/05 5:57 PM Page iv Copyright © 2006 by The McGraw-Hill Companies. All rights reserved. Printed in the United States of America. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or dis- tributed in any form or by any means, or stored in a data base or retrieval sys- tem, without the prior written permission of the publisher. 1 2 3 4 5 6 7 8 9 0 DOC/DOC 0 9 8 7 6 ISBN 0-07-144443-2 McGraw-Hill books are available at special quantity discounts to use as pre- miums and sales promotions, or for use in corporate training programs. For more information, please write to the Director of Special Sales, Professional Publishing, McGraw-Hill, Two Penn Plaza, New York, NY 10121-2298. Or con- tact your local bookstore. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, or other professional service. -

Technical-Analysis-Bloomberg.Pdf

TECHNICAL ANALYSIS Handbook 2003 Bloomberg L.P. All rights reserved. 1 There are two principles of analysis used to forecast price movements in the financial markets -- fundamental analysis and technical analysis. Fundamental analysis, depending on the market being analyzed, can deal with economic factors that focus mainly on supply and demand (commodities) or valuing a company based upon its financial strength (equities). Fundamental analysis helps to determine what to buy or sell. Technical analysis is solely the study of market, or price action through the use of graphs and charts. Technical analysis helps to determine when to buy and sell. Technical analysis has been used for thousands of years and can be applied to any market, an advantage over fundamental analysis. Most advocates of technical analysis, also called technicians, believe it is very likely for an investor to overlook some piece of fundamental information that could substantially affect the market. This fact, the technician believes, discourages the sole use of fundamental analysis. Technicians believe that the study of market action will tell all; that each and every fundamental aspect will be revealed through market action. Market action includes three principal sources of information available to the technician -- price, volume, and open interest. Technical analysis is based upon three main premises; 1) Market action discounts everything; 2) Prices move in trends; and 3) History repeats itself. This manual was designed to help introduce the technical indicators that are available on The Bloomberg Professional Service. Each technical indicator is presented using the suggested settings developed by the creator, but can be altered to reflect the users’ preference. -

Market Analysis Technical Handbook Maryann [email protected] Fred Meissner, Jr

Concepts in technical analysis Technical Analysis Market Analysis | United States 18 July 2007 A Handbook of the basics Mary Ann Bartels +1 212 449 8038 Technical Research Analyst MLPF&S Market Analysis Technical Handbook [email protected] Fred Meissner, Jr. CMT +1 212 449 2603 Technical Research Analyst We cover the basics of Trend, Momentum and other MLPF&S technical indicators and methods [email protected] Table of Contents Introduction 3 Trends 5 Price Momentum Indicators 14 Reversals 17 The Importance of Volume 24 Support and Resistance 28 Market Breadth 31 Market Sentiment 39 The Fibonacci Concept 43 Putting It Together 49 Merrill Lynch does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Refer to important disclosures on page 53. 10633344 Concepts in technical analysis 18 July 2007 Contents Introduction 3 Trends 5 Price Momentum Indicators 14 Reversals 17 The Importance of Volume 24 Support and Resistance 28 Market Breadth 31 Market Sentiment 39 The Fibonacci Concept 43 Putting It Together 49 2 Concepts in technical analysis 18 July 2007 Introduction Price action of stocks, or financial markets in general, is a reflection of human nature. Price trends seem to be determined by investors’ decisions in response to a complex mix of psychological, sociological, political, economic and monetary factors. Technical analysis attempts to measure the strength of these trends and to forewarn of potential changes in these trends. -

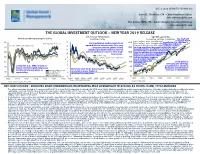

The Global Investment Outlook – New Year 2019 Release U.S

DEC 4 2018 (UPDATED TO NOV 30) Daniel E. Chornous, CFA Chief Investment Officer [email protected] Eric Savoie, MBA, CFA Senior Analyst, Investment Strategy [email protected] THE GLOBAL INVESTMENT OUTLOOK – NEW YEAR 2019 RELEASE U.S. 10-year T-Bond yield S&P 500 equilibrium Global purchasing managers' indices Equilibrium range Normalized earnings & valuations The S&P 500 Nov. '18 Range: 2141 - 3563 (Mid: 2852) is slightly below 65 16 5120 equilibrium (i.e. the band’s ISM Peak Aug 2018: 61.3 Our equilibrium model suggests an Nov. '19 Range: 2218 - 3691 (Mid: 2954)midpoint), and many Previous ISM Peak Feb 2011: 59.2 14 upward bias to interest rates for a very Current (30-November-18): 2760 other markets continue 60 long time into the future should 2560 to show significant discounts to their fair value. A significant rise in inflation and interest rates 12 inflation premiums and real rates of will eventually reduce the sustainable 55 interest ultimately return to their long- 1280 level for valuations, but normalizing 10 term norms. P/E’s and corporate profitability to Last Plot: 2.99% reflect current levels for these 50 8 Current Range: 2.12% - 3.90% (Mid: 3.01%) 640 critical variables suggests % stock market valuations are reasonable, but 45 6 320 certainly not Solid gains in “cheap” in all revenues and earnings 4 Led by the U.S., PMIs remain at 160 locations. propelled U.S. stocks in 40 particular, but threats to levels consistent with expansion, 2 But in the near-term, the pressure but the trend everywhere is both are accumulating.