Switzerland Wake up in Brief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

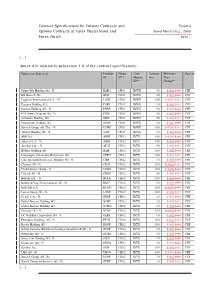

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1

Contract Specifications for Futures Contracts and Eurex14 Options Contracts at Eurex Deutschland and Stand March 2831, 2008 Eurex Zürich Seite 1 [....] Annex A in relation to subsection 1.6 of the contract specifications: Futures on Shares of Produkt- Group Cash Contract Minimum Currency ID ID** Market- Size Price ID** Change* Julius Bär Holding AG - N. BAEG CH01 XSWX 50 0.0010.01 CHF BB Biotech AG BIOF CH01 XSWX 50 0.0010.01 CHF Logitech International S.A. - N. LOGF CH01 XSWX 100 0.00010.01 CHF Pargesa Holding S.A. PARF CH01 XSWX 10 0.0010.01 CHF Sonova Holding AG - N. PHBF CH01 XSWX 50 0.0010.01 CHF PSP Swiss Property AG - N. PSPF CH01 XSWX 50 0.0010.01 CHF Schindler Holding AG SINF CH01 XSWX 50 0.0010.01 CHF Straumann Holding AG STMF CH01 XSWX 10 0.0010.01 CHF Swatch Group AG, The - N. UHRF CH01 XSWX 100 0.00010.01 CHF Valiant Holding AG - N. VATF CH01 XSWX 10 0.0010.01 CHF ABB Ltd. ABBF CH02 XVTX 100 0.00010.01 CHF Adecco S.A. - N. ADEF CH02 XVTX 100 0.0010.01 CHF Actelion Ltd. - N. ATLG CH02 XVTX 50 0.0010.01 CHF Bâloise Holding AG BALF CH02 XVTX 100 0.0010.01 CHF Compagnie Financière Richemont AG CFRH CH02 XVTX 100 0.0010.01 CHF Ciba Spezialitätenchemie Holding AG - N. CIBF CH02 XVTX 10 0.0010.01 CHF Clariant AG - N. CLNF CH02 XVTX 100 0.00010.01 CHF Credit Suisse Group - N. CSGG CH02 XVTX 100 0.00010.01 CHF Geberit AG - N. -

Julius Baer Multicooperation Annual Report 2005 As at June 30, 2005 (Audited)

Julius Baer Multicooperation Annual Report 2005 as at June 30, 2005 (audited) Subscriptions are only valid if made on the basis of the current Prospectus, the latest Annual Report and the latest Semi-Annual Report if published thereafter. The Articles of Association, the valid Prospectus and the Annual and Semi-Annual Reports may be obtained free of charge at the representative in Switzerland and the respective paying agent. Only the German version of the present Annual Report has been reviewed by the independent auditor. Consequently, the independent auditor's report only refers to the German version of the Report; other versions result from a conscientious translation made under the responsibility of the Board. In case of differences between the German version and the translation, the German version shall be the authentic text. AN INVESTMENT FUND DOMICILED IN LUXEMBOURG Representative in Switzerland: Julius Baer Investment Funds Services Ltd., Zurich Paying agent in Switzerland: Bank Julius Bär & Co. AG, Bahnhofstrasse 36, Postfach, CH - 8010 Zurich Paying agent in Germany: Bank Julius Bär (Deutschland) AG, Messe Turm, Friedrich-Ebert-Anlage 49, Postfach 15 01 52, D - 60061 Frankfurt on the Main Paying agent in Austria: Erste Bank der oesterreichischen Sparkassen AG, Graben 21, A - 1010 Vienna Contents Page Organisation and Management 4 Independent Auditor's Report 5 Notes to the Financial Statements 6 Julius Baer Multicooperation (Umbrella Fund) MCOO Julius Baer Multicooperation - Emerging Markets Value Stock Fund HESF Julius Baer Multicooperation -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Remuneration

REMUNERATION 124 Vifor Pharma Ltd. Annual Report 2020 HIGHLIGHTS PEOPLE 126 Chairwoman’s overview 128 Philosophy and approach to remuneration 130 Governance 134 Board and Executive remuneration 139 Remuneration awarded in 2020 and 2019 146 Overview of executive remuneration in 2020 and 2019 147 Outlook: changes in remuneration model for 2021 148 Statutory auditor’s report PORTFOLIO RESPONSIBILITY GOVERNANCE REMUNERATION FINANCE Vifor Pharma Ltd. Annual Report 2020 125 REMUNERATION CHAIRWOMAN’S OVERVIEW The remuneration “programs of Vifor Pharma are designed to support our corporate strategy and to ensure a sustainable performance towards our future objectives.” SUE MAHONY CHAIRWOMAN OF THE REMUNERATION COMMITTEE 126 Vifor Pharma Ltd. Annual Report 2020 HIGHLIGHTS “ We reward entrepreneurial Vifor Pharma’s remuneration philosophy aims to attract and retain highly talented and behaviour that ethical individuals who help us ensure the drives sustainable long-term competitiveness and success of our PEOPLE business, to meet the needs of patients, to performance and look after the interests of our stakeholders and the environment in order to deliver on the long-term value strategy and to sustain profitable growth. This report sets out the remuneration policies for creation.” the Board of Directors and Executive Commit- tee which are designed to help them achieve these goals. A year of unprecedented challenges for Chief Medical Officer and Gregory Oakes as countries and companies around the world President North America. PORTFOLIO has underlined the importance of a strong and transparent remuneration framework. The Remuneration Committee considers Vifor Notwithstanding, as in previous years, Vifor Pharma appropriately positioned to enable it Pharma’s philosophy and approach to remu- to compete successfully with its peers and to neration has remained stable: we reward support its ambitious growth plans. -

E 01 Pr..Sident

Dokument 1 25.03.2004 8:36 Uhr Seite 2 2003 Dokument 1 25.03.2004 8:36 Uhr Seite 3 Dokument 1 25.03.2004 8:37 Uhr Seite 4 Key Financial Data of the Lindt & Sprüngli Group 2003 2002 Change Income statement in % Consolidated sales CHF million 1 800.5 1 680.5 7.1 EBITDA CHF million 265.2 242.4 9.4 in % of consolidated sales % 14.7 14.4 EBIT CHF million 188.7 170.8 10.5 in % of consolidated sales % 10.5 10.2 Net income CHF million 122.4 101.9 20.1 in % of consolidated sales % 6.8 6.1 Cash flow CHF million 206.2 178.3 15.6 in % of consolidated sales % 11.5 10.6 Balance Sheet Total assets CHF million 1 592.3 1 492.1 6.7 Current assets CHF million 1 042.2 940.0 10.9 in % of total assets % 65.5 63.0 Fixed assets CHF million 550.1 552.1 –0.4 in % of total assets % 34.5 37.0 Long-term liabilities CHF million 382.6 379.8 0.7 in % of total assets % 24.0 25.5 Shareholders’ equity CHF million 728.7 608.9 19.7 in % of total assets % 45.8 40.8 Investments in fixed assets CHF million 75.1 77.6 –3.2 in % of cash flow % 36.4 43.5 Employees Average number of employees 6 011 6 029 –0.3 Sales per employee 1 000 CHF 299.5 278.7 7.5 Data per share Net income per share/10 PC CHF 562 468 20.1 Cash flow per share/10 PC CHF 947 819 15.6 Dividend per share/10 PC 1) CHF 140 110 27.3 Payout ratio % 24.9 23.5 Shareholders’ equity per share/10 PC CHF 3 345 2 799 19.5 Price registered share 31.12. -

Switzerland Fund A-CHF for Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021

pro.en.xx.20210831.LU0054754816.pdf Switzerland Fund A-CHF For Investment Professionals Only FIDELITY FUNDS MONTHLY PROFESSIONAL FACTSHEET SWITZERLAND FUND A-CHF 31 AUGUST 2021 Strategy Fund Facts The Portfolio Managers are bottom-up investors who believe share prices are Launch date: 13.02.95 correlated to earnings, and that strong earners will therefore outperform. They look to Portfolio manager: Andrea Fornoni, Alberto Chiandetti invest in companies where the market underestimates earnings because their Appointed to fund: 01.03.18, 01.08.11 sustainability is not fully appreciated. They also look for situations where the impact Years at Fidelity: 7, 15 company changes will have on earnings has not been fully recognised by the market. Fund size: CHF366m They aim to achieve a balance of different types of companies, so they can deliver Number of positions in fund*: 36 performance without adding undue risk. Fund reference currency: Swiss Franc (CHF) Fund domicile: Luxembourg Fund legal structure: SICAV Management company: FIL Investment Management (Luxembourg) S.A. Capital guarantee: No Portfolio Turnover Cost (PTC): 0.01% Portfolio Turnover Rate (PTR): 28.92% *A definition of positions can be found on page 3 of this factsheet in the section titled “How data is calculated and presented.” Objectives & Investment Policy Share Class Facts • The fund aims to provide long-term capital growth with the level of income expected Other share classes may be available. Please refer to the prospectus for more details. to be low. • The fund will invest at least 70% in Swiss company shares. Launch date: 13.02.95 • The fund has the freedom to invest outside its principal geographies, market sectors, industries or asset classes. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe SMID Cap 19 August 2021 Tradable Plus Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.72 UNITED Bureau Veritas S.A. 0.42 FRANCE Gjensidige Forsikring ASA 0.17 NORWAY KINGDOM Campari 0.31 ITALY Gn Store Nordic 0.53 DENMARK AAK 0.18 SWEDEN Carl Zeiss Meditec 0.33 GERMANY Halma 0.66 UNITED Aalberts NV 0.24 NETHERLANDS Castellum 0.32 SWEDEN KINGDOM ABN AMRO Bank NV 0.23 NETHERLANDS Centrica 0.2 UNITED Hargreaves Lansdown 0.39 UNITED Acciona S.A. 0.16 SPAIN KINGDOM KINGDOM Accor 0.32 FRANCE Chr. Hansen Holding A/S 0.43 DENMARK Hays 0.16 UNITED ACS Actividades Cons y Serv 0.3 SPAIN Clariant 0.21 SWITZERLAND KINGDOM Adecco Group AG 0.49 SWITZERLAND Coca-Cola HBC AG 0.33 UNITED HeidelbergCement AG 0.6 GERMANY Adevinta 0.21 NORWAY KINGDOM HelloFresh SE 0.67 GERMANY Admiral Group 0.43 UNITED Cofinimmo 0.21 BELGIUM Helvetia Holding AG 0.18 SWITZERLAND KINGDOM Commerzbank 0.35 GERMANY Hikma Pharmaceuticals 0.27 UNITED Aedifica 0.22 BELGIUM ConvaTec Group 0.25 UNITED KINGDOM Aegon NV 0.34 NETHERLANDS KINGDOM Hiscox 0.18 UNITED KINGDOM Aeroports de Paris 0.17 FRANCE Countryside Properties 0.16 UNITED Holmen AB 0.2 SWEDEN Ageas 0.46 BELGIUM KINGDOM Homeserve 0.17 UNITED Aker BP ASA 0.16 NORWAY Covestro AG 0.54 GERMANY KINGDOM Alfa Laval 0.52 SWEDEN Covivio 0.2 FRANCE Howden Joinery Group 0.3 UNITED Alstom 0.7 FRANCE Croda International 0.64 UNITED KINGDOM KINGDOM Alten 0.18 -

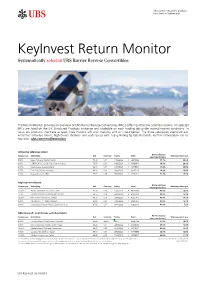

Keyinvest Return Monitor Systematically Selected UBS Barrier Reverse Convertibles

Structured investment products for clients in Switzerland KeyInvest Return Monitor Systematically selected UBS Barrier Reverse Convertibles The Return Monitor provides an overview of UBS Barrier Reverse Convertibles (BRCs) offering attractive potential returns. All selected BRCs are listed on the SIX Structured Products Exchange and tradeable on each trading day under normal market conditions. In focus are products that have at least three months left until maturity and an intact barrier. The three categories examined are: Attractive sideways return, high barrier distance and underlyings with a Buy Rating by UBS Research. Further information can be found on: ubs.com/renditemonitor Attractive sideways return Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 5.50% Bayer / Novartis / Roche / Sanofi 74.30 CHF 14/08/2020 A 39945568 15.1% 30.6% 8.00% CENTRICA PLC / E.ON / Electricite de France 78.70 EUR 10/08/2020 A 42686847 18.7% 28.2% 9.00% Credit Suisse / Deutsche Bank 82.10 CHF 13/07/2020 A 42078534 15.8% 26.3% 9.75% Enel / Fiat Chrysler / UniCredit 85.20 EUR 29/06/2020 39167120 28.3% 23.9% 9.00% Hewlett-Packard / IBM 93.27 USD 06/07/2020 A 42271711 31.2% 15.1% High barrier distance Barrier distance Coupon p.a. Underlying Ask Currency Expiry Valor Sideways return p.a. (worst performer) 12.00% Alcoa Corporation / US STEEL CORP 96.32 USD 12/06/2020 A 44506090 47.5% 15.3% 7.75% Colgate-Palmolive / Estée Lauder / L'Oréal 98.55 USD 22/06/2020 A 41905920 43.9% 15.4% 10.00% Nike / Under Armour Inc. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

Barry Callebaut “Cost Plus” Model Has Proven to Be Robust

Barry Callebaut 9-month key sales figures 2010/11 July 2011 Agenda Company and Industry Overview First 9 months highlights Outlook July 2011 Barry Callebaut 9 months key sales figures 2 Barry Callebaut is present in all of the stages of the chocolate industry value chain Cocoa Cocoa beans Plantations 80% Cocoa liquor ~54% ~46% Cocoa powder Cocoa butter BC core activity + Sugar, Milk, others + Sugar, Milk, + Sugar, Milk, fats, others others Powder mixes Compound/Fillings Chocolate couverture Customers: Food Manufactures Chocolatiers, Bakeries, Vending Dist. Etc July 2011 Barry Callebaut 9 months key sales figures 3 Barry Callebaut at a glance FY-2010 Sales Volume by Region FY-2010 Sales Volume by Product Group Food Service Global Sourcing & / Retail Cocoa Customers 16% 27% Consumer Products 10% Asia Europe Gourmet 4% 58% & Specialties 10% Food Cocoa Manufacturers 16% 64% Americas 22% Industrial Customers 73% FY-2010 Sales Volume: 1,3 mn tonnes FY-2010 Sales: CHF 5,213mn FY-2010 EBIT: CHF 370.4 mn FY-2010 Net Profit: CHF 251.7 mn July 2011 Barry Callebaut 9 months key sales figures 4 Barry Callebaut is the market leader in the open market Global Industrial Chocolate market in 2009 = 5,400,000 tonnes* (Long-term average annual market growth of approx 2-3%) Open market Integrated market Competitors Big 4 chocolate Others players 40% 49% 51% 80% Outsourced (long-term volumes) *BC estimates July 2011 Barry Callebaut 9 months key sales figures 5 Global leader in chocolate manufacturing Barry Callebaut is one of the of the top three cocoa grinders and the largest manufacturer of industrial chocolate, with estimated market share of 40% of sales volumes in the open market for industrial chocolate Cocoa Grinders Open Market for Chocolate ADM Barry Callebaut Kraft/ Cadbury Barry Callebaut Mars Cargill Nestlé Petra Foods Hershey Blommer Cargill Kraft/Cadbury Blommer ADM Nestlé Lindt Cémoi Ferrero Ferrero Other players 0 100 200 300 400 500 600 700 -100 100 300 500 700 900 1100 Volume ('000 MT) Sales Volume ('000 MT) Source: Barry Callebaut 2009/10 estimates (both charts). -

Jahresbericht 2013

JAHRESBERICHT 2013 JAHRESBERICHT 2013 Die Agenda Chemie Pharma Biotech JAHRESBERICHT 2013 Die Agenda Chemie Pharma Biotech scienceindustries Vorteile der Mitgliedschaft bei Kontakt: Wirtschaftsverband Chemie Pharma Biotech scienceindustries scienceindustries setzt sich nachhaltig für Mitglieder können über scienceindustries scienceindustries ein innovationsfreundliches Umfeld für die auf die geplanten staatlichen Regelungen Nordstrasse 15, Postfach Mitgliedunternehmen ein. 1882 gegründet, in den Bereichen Wirtschaftspolitik, CH-8021 Zürich gehören ihr heute rund 250 Unternehmen Chemie, Pharma, Biotechnologie, Umwelt- T +41 44 368 17 11 an. Die grösste Schweizer Exportindustrie schutz, Sicherheit und Technologie sowie F +41 44 368 17 70 beschäftigt in der Schweiz rund 70 000 Per- in Fragen des wissenschaftlich-technischen [email protected] sonen, weltweit über 338 000 Personen. Nachwuchses Einfluss nehmen. www.scienceindustries.ch In der Schweiz sind über 11 600 hochquali- Zudem erhalten Mitglieder von science- fizierte Mitarbeiter in der Forschung tätig. industries exklusiven Zugang zum Weitere 130 000 Arbeitskräfte in anderen Membernet, einer webbasierten Wissens- Branchen hängen von der Industrie Chemie plattform, die täglich mit E-Mail über alle Pharma Biotech ab. neueren politischen Geschäfte informiert, welche die Unternehmen in den science- Die Website www.scienceindustries.ch industries betreffen. informiert ausführlich über Ziele, Arbeits- weise, aktuelle Tätigkeiten und wichtige Weiter können Mitglieder Einsitz in Positionsbezüge