SEB Annual and Sustainability Report 2020 — 1 Introduction — This Is SEB

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AB SEB Bankas Annual Report

AB SEB bankas Annual report 2020 Translation note Financial statements have been prepared in Lithuanian and English languages. In all matters of interpretation of information, views or opinions, the Lithuanian language version of the financial statements takes precedence over the English language version. AB SEB bankas TABLE OF CONTENTS PAGES CONSOLIDATED ANNUAL REPORT 3 - 23 FINANCIAL STATEMENTS INCOME STATEMENT 24 STATEMENT OF COMPREHENSIVE INCOME 25 STATEMENT OF FINANCIAL POSITION 26 STATEMENT OF CHANGES IN EQUITY 27 - 28 STATEMENT OF CASH FLOWS 29 -30 NOTES TO THE FINANCIAL STATEMENTS 31 - 109 INDEPENDENT AUDITOR’S REPORT 110 – 113 Page 2 of 113 AB SEB bankas CONSOLIDATED ANNUAL REPORT FOR THE YEAR ENDED 31 DECEMBER 2020 (all amounts in EUR thousand unless otherwise stated) CONSOLIDATED ANNUAL REPORT OF AB SEB BANKAS GROUP FOR THE YEAR ENDED 31 DECEMBER 2020 1. Reporting period covered by the Consolidated Annual Report This Consolidated Annual Report (hereinafter the Report) has been prepared for the year ended 31 December 2020. All numbers presented are as of 31 December 2020 or for the year then ended, unless specified otherwise. The Consolidated Annual Report covers consolidated information on AB SEB Bankas (also referred as the Bank) and its subsidiary UAB “SEB investicijų valdymas” – together referred as the Group. 2. Information on branches and representative offices As of 31 December 2020, the Bank had three regional branches: AB SEB bankas Eastern Region Branch (address Konstitucijos ave. 24, LT-08105 Vilnius), AB SEB bankas Middle Region Branch (address Nemuno str. 3, LT-44295 Kaunas), and AB SEB bankas Western Region Branch (address H. -

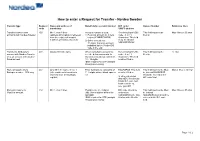

How to Enter a Request for Transfer - Nordea Sweden

How to enter a Request for Transfer - Nordea Sweden Transfer type Request Name and address of Beneficiary’s account number BIC code / Name of banker Reference lines code beneficiary SWIFT address Transfer between own 400 Min 1, max 4 lines Account number is used: Receiving bank’s BIC This field must not be Max 4 lines x 35 char accounts with Nordea Sweden (address information is retrieved 1) Personal account no = pers code - 8 or 11 filled in from the register of account reg no (YYMMDDXXXX) characters. This field numbers of Nordea, Sweden) 2) Other account nos = must be filled in 11 digits. Currency account NDEASESSXXX indicated by the 3-letter ISO code in the end Transfer to third party’s 401 Always fill in the name When using bank account no., Receiving bank’s BIC This field must not be 12 char account with Nordea Sweden see the below comments. In code - 8 or 11 filled in or to an account with another Sweden account nos consist of characters. This field Swedish bank 10 - 15 digits. must be filled in IBAN required for STP (straight through processing) Domestic payments to 402 Only fill in the name in line 1 Enter bankgiro no consisting of BGABSESS. This field This field must not be filled Max 4 lines x 35 char Bankgiro number - SEK only (other address information is 7 - 8 digits without blank spaces must be filled in. in. Instead BGABSESS retrieved from the Bankgiro etc should be entered in the register) In other currencies BIC code field than SEK: Receivning banks BIC code and bank account no. -

SEB's Results for the Second Quarter 2019

Press release Stockholm, 28 June 2019 Invitation – SEB’s results for the second quarter 2019 SEB’s results for the second quarter 2019 will be announced on Friday, 12 July, at 07:00 (Swedish time). In addition, presentations and the Fact Book will be available on sebgroup.com/ir. You are invited to participate in the following presentations: Results presentation Time: 09:00 (Swedish time) Venue: Kungsträdgårdsgatan 8, Stockholm Johan Torgeby, President and CEO, will present and comment upon the results. The presentation will be conducted in English. The results presentation can be followed live on sebgroup.com/ir and will also be available afterwards. Telephone conference Time: 13:00 (Swedish time) Johan Torgeby, Masih Yazdi, Finance Director, and Christoffer Geijer, Head of Investor Relations, will present the results, followed by a Q&A session. To participate, please call +44 (0)2071 928 000, quote conference id: 4839848 , at least 10 minutes in advance. The telephone conference audio webcast can be followed live on sebgroup.com/ir and will also be available afterwards. For further information, please contact Christoffer Geijer, Head of Investor Relations +46-8-763 83 19, +46-70-762 1006 Frank Hojem, Head of Media Relations +46-8-763 99 47, +46-70-763 99 47 SEB is a leading Nordic financial services group with a strong belief that entrepreneurial minds and innovative companies are key in creating a better world. SEB takes a long term perspective and supports its customers in good times and bad. In Sweden and the Baltic countries, SEB offers financial advice and a wide range of financial services. -

Nordea Group Annual Report 2018

Annual Report 2018 CEO Letter Casper von Koskull, President and Group CEO, and Torsten Hagen Jrgensen, Group COO and Deputy CEO. Page 4 4 Best and most accessible advisory, with an 21 easy daily banking experience, delivered at scale. Page 13 Wholesale Banking No.1 relationship Asset & Wealth bank in the Nordics Management with operational Personal Banking 13 excellence. Page 21 Commercial & Business Banking Our vision is to become the lead- ing Asset & Wealth Manager in the 25 Nordic market by 2020. Page 25 Best-in-class advisory and digital experience, 17 ef ciency and scale with future capabilities in a disruptive market. Page 17 Annual Report 2018 Contents 4 CEO letter 6 Leading platform 10 Nordea investment case – strategic priorities 12 Business Areas 35 Our people Board of Directors’ report 37 The Nordea share and ratings 40 Financial Review 2018 46 Business area results 49 Risk, liquidity and capital management 67 Corporate Governance Statement 2018 76 Non-Financial Statement 78 Conflict of interest policy 79 Remuneration 83 Proposed distribution of earnings Financial statements 84 Financial Statements, Nordea Group 96 Notes to Group fi nancial statements 184 Financial statements Parent company 193 Notes to Parent company fi nancial statements 255 Signing of the Annual Report 256 Auditor’s report Capital adequacy 262 Capital adequacy for the Nordea Group 274 Capital adequacy for the Nordea Parent company Organisation 286 Board of Directors 288 Group Executive Management 290 Main legal structure & Group organisation 292 Annual General Meeting & Financial calendar This Annual Report contains forward-looking statements macro economic development, (ii) change in the competitive that reflect management’s current views with respect to climate, (iii) change in the regulatory environment and other certain future events and potential fi nancial performance. -

Skandinaviska Enskilda Banken AB (Publ) (Herein the “Bank”, Or “SEB AB”) Is a Foreign Banking Organization Duly Organized and Existing Under the Laws of Sweden

SEB U.S. Resolution Plan Public Section October, 2013 TABLE OF CONTENTS Section 1: Public Section Introduction Summary of resolution plan A. Description of material entities B. Description of core business lines C. Summary financial information D. Description of derivative and hedging activities E. Memberships in material payment, clearing and settlement systems F. Description of foreign operations G. Material supervisory authorities H. Principal officers I. Corporate governance structure and processes related to resolution planning J. Description of material management information systems K. High-level description of resolution strategy This document contains certain forward-looking statements that reflect SEB’s current views with respect to future events. Forward-looking statements are all statements in this document that do not relate to historical facts and events. While these forward-looking statements represent SEB’s judgments and future expectations concerning the development, actual developments could differ from SEB’s expectations. SEB undertakes no obligation to publicly update or revise any forward- looking statements, whether as a result of new information, future events or otherwise. 1 Introduction Skandinaviska Enskilda Banken AB (publ) (herein the “Bank”, or “SEB AB”) is a foreign banking organization duly organized and existing under the laws of Sweden. In the United States, the Bank maintains a New York state-licensed branch (the “New York Branch”) and operates subsidiaries, as described below. This resolution plan (the “U.S. Resolution Plan”) is being filed by the Bank pursuant to Section 165(d) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and 12 C.F.R. -

Fitch Ratings ING Groep N.V. Ratings Report 2020-10-15

Banks Universal Commercial Banks Netherlands ING Groep N.V. Ratings Foreign Currency Long-Term IDR A+ Short-Term IDR F1 Derivative Counterparty Rating A+(dcr) Viability Rating a+ Key Rating Drivers Support Rating 5 Support Rating Floor NF Robust Company Profile, Solid Capitalisation: ING Groep N.V.’s ratings are supported by its leading franchise in retail and commercial banking in the Benelux region and adequate Sovereign Risk diversification in selected countries. The bank's resilient and diversified business model Long-Term Local- and Foreign- AAA emphasises lending operations with moderate exposure to volatile businesses, and it has a Currency IDRs sound record of earnings generation. The ratings also reflect the group's sound capital ratios Country Ceiling AAA and balanced funding profile. Outlooks Pandemic Stress: ING has enough rating headroom to absorb the deterioration in financial Long-Term Foreign-Currency Negative performance due to the economic fallout from the coronavirus crisis. The Negative Outlook IDR reflects the downside risks to Fitch’s baseline scenario, as pressure on the ratings would Sovereign Long-Term Local- and Negative increase substantially if the downturn is deeper or more prolonged than we currently expect. Foreign-Currency IDRs Asset Quality: The Stage 3 loan ratio remained sound at 2% at end-June 2020 despite the economic disruption generated by the lockdowns in the countries where ING operates. Fitch Applicable Criteria expects higher inflows of impaired loans from 4Q20 as the various support measures mature, driven by SMEs and mid-corporate borrowers and more vulnerable sectors such as oil and gas, Bank Rating Criteria (February 2020) shipping and transportation. -

SEB Creates New Division to Further Sharpen Its Private Banking Offering

SEB creates new division to further sharpen its Private Banking offering SEB is establishing a new division, Private Wealth Management & Family Office, to further strengthen its focus on entrepreneurs, individuals and families and their businesses in SEB’s home markets. William Paus, today Co-Head of SEB’s Large Corporates & Financial Institutions division, has been appointed Head of the new division. Ever since SEB was founded, the bank has supported individuals and companies in their value creation. Private Banking is part of SEB's DNA, and the segment has seen its assets under management (AuM) grow to more than SEK 1,000bn over the years, corresponding to nearly 50 per cent of SEB’s total AuM. Fuelled by successful entrepreneurship, a favourable macroeconomic environment including demographic factors and strong financial markets, the global Private Banking industry is growing. By gathering SEB’s expertise within Private Banking in one division, the bank further sharpens its offering in response to the continuously changing needs of the customers, aiming to grow SEB’s savings and investments business. “SEB has strong and longstanding relationships with customers ranging from entrepreneurs to professional family offices, and I am confident that we, by creating this dedicated Private Wealth Management & Family Office division, will be able to become an even more relevant partner for both new and existing customers in our home markets. Our aim is to take a leading position in this increasingly important segment by offering first-class investment advisory based on SEB's entire product range of analysis, IPOs and alternative investments. I am delighted that William Paus is taking on this new challenge within the bank,” says Johan Torgeby, SEB’s President and CEO. -

2019 Annual and Sustainability Report

2019 Annual and Sustainability Report Contents Swedbank in brief 2 Income, balance sheet and notes, Group The year in brief 4 Income statement 54 CEO statement 6 Statement of comprehensive income 55 Goals and results 8 Balance sheet 56 Value creation 10 Statement of changes in equity 57 Business model 12 Statement of cash flow 58 Sustainability 14 Notes 59 The share and owners 24 Income, balance sheet and notes, Parent company Board of Directors’ report Income statement 154 Financial analysis 26 Statement of comprehensive income 154 Swedish Banking 30 Balance sheet 155 Baltic Banking 31 Statement of changes in equity 156 Large Corporates & Institutions 32 Statement of cash flow 157 Group Functions & Other 33 Notes 158 Corporate governance report 34 Alternative performance measures 192 Board of Directors 46 Group Executive Committee 50 Sustainability Disposition of earnings 52 Sustainability report 194 Materiality analysis 195 Sustainability management 197 Notes 199 GRI Standards Index 212 Signatures of the Board of Directors and the CEO 217 Auditors’ report 218 Sustainability report – assurance report 222 Annual General Meeting 223 Market shares 224 Five-year summary – Group 225 Three-year summary – Business segments 228 Definitions 231 Contacts 233 Financial information 2020 Annual General Meeting 2020 Q1 Interim report 23 April The Annual General Meeting will be held on Thursday, 26 March at 11 am (CET) at Cirkus, Djurgårdsslätten Q2 Interim report 17 July 43–45, Stockholm, Sweden. The proposed record day for the dividend is 30 March 2020. The last day for Q3 Interim report 20 October trading in Swedbank’s shares including the right to the dividend is 26 March 2020. -

Swedbank Economic Outlook Is Available At

Completed: January 20, 2021, 06:30 Distributed: January 20, 2021, 07:00 Mattias Persson Global Head of Macro Research and Group Chief Economist [email protected] +46 8 5859 59 74 Andreas Wallström Axel Zetherström Liis Elmik Head of Forecasting Assistant Senior Economist Deputy Head of Macro Research Sweden [email protected] [email protected] andreas.wallströ[email protected] +46 8 5859 57 75 +372 888 72 06 +46 8 700 93 07 Marianna Rõbinskaja Robin Ahlén Øystein Børsum Economist Economist Chief Economist Norway [email protected] [email protected] +372 888 79 25 +46 8 700 93 08 Chief Credit Strategist [email protected] Cathrine Danin +47 91 18 56 35 Senior Economist Līva Zorgenfreija [email protected] Jon Espen Riiser Chief Economist Latvia +46 8 700 92 97 Analyst [email protected] [email protected] +371 6744 58 44 Jana Eklund +47 90 98 17 49 Senior Econometrician Agnese Buceniece [email protected] Marlene Skjellet Granerud Senior Economist +46 8 5859 46 04 Economist [email protected] [email protected] +371 6744 58 75 Knut Hallberg +47 94 30 53 32 Senior Economist Laura Orleāne [email protected] Economist +46 8 700 93 17 [email protected] Heidi Schauman +371 6744 42 13 Pernilla Johansson Chief Economist Finland Senior Economist [email protected] [email protected] +358 503 281 229 +46 40 24 23 31 Nerijus Mačiulis Sonja Liukkonen Deputy Group Chief Economist Maija Kaartinen Junior Economist Chief -

Volvo Car Group

VOLVO CAR GROUP GROUP CAR VOLVO Freedom to Move in a personal, sustainable and safe way. ANNUAL REPORT 2018 VOLVO CAR GROUP ANNUAL REPORT 2018 FREEDOM TO MOVE IN A PERSONAL, SUSTAINABLE AND SAFE WAY A GLOBAL FOOTPRINT Our cars are produced in factories around the globe; Gothenburg in Sweden, Ghent in Belgium, Chengdu, Daqing and Luqiao in China and Charleston in the US. Our mobility and subscription services are developed in Stockholm and Gothenburg in Sweden for consumers all over the world. Together our operations deliver on consumer demand for current and future mobility. Volvo Car Group is headquartered in Gothenburg, Sweden. TABLE OF CONTENTS OVERVIEW 2 2018 in Brief 4 Market Highlights 6 CEO Comment THE WORLD AROUND US 10 Changing Consumer Demands ... 12 ... and Technology Shift ... 14 ... Opens New Opportunities 16 The Volvo Car Group OUR STRATEGIC JOURNEY 20 Company Purpose 22 Strategic Framework 24 Company Transformation 26 Game Changing Business Transformation CREATING VALUE 36 Creating Sustainable Value and Growth 39 Product Creation 57 Manufacturing and Logistics 63 Consumer Experiences 67 People 75 Society MANAGEMENT REPORT 79 Board of Directors’ Report 82 Enterprise Risk Management 87 Corporate Governance Report FINANCIAL STATEMENTS 94 Contents Financial Report 95 Consolidated Financial Statements 100 Notes to the Consolidated Financial Statements 140 Parent Company Financial Statements 142 Notes to the Parent Company Financial Statements 148 Auditor’s Report 150 Board of Directors 152 Executive Management Team SUSTAINABILITY -

Annual Report 2010 Ii This Is Seb

vinjett Brödtext Annu A l report 2010 report l Annual Report 10 seb annual report 2010 ii this is seb SEB is a leading Nordic financial services group. As a relationship bank, SEB in Sweden and the Baltic countries offers financial advice and a wide range of other services. In Denmark, Finland, Norway and Germany the bank's operations have a strong focus on corporate and investment banking based on a full-service offering to corporate and institutional clients. The international nature of SEB's business is reflected in its presence in some 20 countries worldwide. The Group has about 17,000 employees. Markets Operating income Branches and repre- Geographical distribution, per cent sentative offices SEB representation worldwide 2010 2009 Sweden 56 (56) Beijing Singapore Norway 8 (9) Kiev Nice Germany 1) 8 (8) Warsaw Luxembourg Denmark 8 (7) Shanghai Moscow Finland 3 (3) New York Hong Kong Estonia 3 (3) Sao Paulo Latvia 3 (4) London Lithuania 4 (4) Geneva Other 7 (6) New Delhi SEB’s activities principally embrace customers based in the Nordic and Baltic countries and Germany. Sweden is the single largest market, accounting for more than half of operating income in 2010. 1) Excluding centralised treasury operations Key figures Return on equity 1) Net profit Tier 1 capital ratio 1) Dividend Per cent SEK bn Per cent SEK bn 25 15 15 5 20 12 12 4 15 9 9 3 10 6 6 2 5 3 3 1 0 0 0 0 2006 2007 2008 2009 2010 2006 2007 2008 2009 2010 2006 2007 2008 2009 2010 2006 2007 2008 2009 20101) Peer average Target: Sustainable profit growth Target: at least 7 per cent up to Target: 40 per cent of net profit per 1) Continuing operations and including 2008, 10 per cent share over a business cycle as from 2009, an interim until Basel Target: Highest among peers 1) A dividend of SEK 1.50 per share III effects have been analysed. -

Volvo Overseas Sales Brochure

DRIVE SAFELY IN EUROPE explore europe with volvo PIck-up youR neW custom BUIlt Volvo on A complImentaRY TRIP to EURope. GeneRous savIngs and unIQue BenefIts ARE Included. VOLVO OVERSEAS DELIVERY Traveling in your own custom-built Volvo is a great way of discovering the many faces of Europe. For the most part driving in Europe is pretty much like driving in the U.S. You drive on the right side of the road (except in the UK, Eire and Gibraltar) and if you need assistance you don’t need to worry: when you order your new Volvo through Volvo Overseas Delivery, you receive Volvo Assistance Europe, our round-the-clock roadside assistance program, free of charge. To make your tour even safer, please note that traffic regulations may differ from country to country. Specifications, features, and equipment shown in this catalog are based upon the latest information available at the time of publication. Volvo Cars of North America, LLC reserves the right to make changes at any time, without notice, to programs, colors, specifications, accessories, materials, and models. For additional information, please contact your authorized Volvo retailer. © 2008 Volvo Cars of North America, LLC. Printed on recycled paper. Enjoy a great vacation overseas, compliments of Volvo. Your nearest Volvo retailer will be happy to assist you with any inquiries or requests. For more details please visit: www.volvocars.us/mybagsarepacked, E-mail: [email protected] Phone: (800) 631-1667, Fax: (800) 992-3970, Hours: Monday-Friday, 8:30 AM to 5:00 PM EST. Volvo overseas delivery DISCOVER THE ROOTS OF VOLVO AND A WORLD OF SPECTACULAR REWARDS Welcome to Volvo Overseas Delivery, a unique way to buy your new custom-built car as well as a unique way to experience more of Europe.