FY20 NIKE, Inc. Impact Report BREAKING BARRIERS Introduction 2020 2025 Our Approach Appendix

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Good Afternoon, Everyone. Welcome to NIKE, Inc.'S Fiscal 2021 Fourth Quarter Conference Call

FY 2021 Q4 Earnings Release Conference Call Transcipt June 24, 2021 This transcript is provided by NIKE, Inc. only for reference purposes. Information presented was current only as of the date of the conference call and may have subsequently changed materially. NIKE, Inc. does not update or delete outdated information contained in this transcript and disclaims any obligation to do so. PRESENTATION Operator: Good afternoon, everyone. Welcome to NIKE, Inc.'s fiscal 2021 fourth quarter conference call. For those who want to reference today's press release you'll find it at http://investors.nike.com. Leading today's call is Andy Muir, VP, Investor Relations. Before I turn the call over to Ms. Muir, let me remind you that participants on this call will make forward-looking statements based on current expectations and those statements are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties are detailed in the reports filed with the SEC including the annual report filed on Form 10-K. Some forward-looking statements may concern expectations of future revenue growth or gross margin. In addition, participants may discuss non-GAAP financial measures, including references to constant- dollar revenue. References to constant-dollar revenue are intended to provide context as to the performance of the business eliminating foreign exchange fluctuations. Participants may also make reference to other non-public financial and statistical information and non-GAAP financial measures. To the extent non-public financial and statistical information is discussed, presentations of comparable GAAP measures and quantitative reconciliations will be made available at NIKE’s website, http://investors.nike.com. -

KAREN HOFFMAN - Wilson Golf

SALESPERSON OF THE YEAR This award bestows special recognition on the golf salesperson in the mid-Atlantic region for his/her outstanding service and dedication to the members and apprentices of the MAPGA, as well as support of the Section through sponsorships and other programs. KAREN HOFFMAN - Wilson Golf Karen Hoffman was born in Chicago, IL and raised in Glenview, IL where she lived with her parents, Harry and Carolyn Hoffman, brother Bob and sisters Pam and Judy. She enjoyed playing softball and tennis growing up, and also rode horses competitively. Karen was introduced to golf by a neighbor. The two of them hit balls at the driving range, but Karen never had an opportunity to play a round of golf until she was in college at the University of Wisconsin - LaCrosse, where she earned a B.S Degree in Physical Education. She immediately loved the challenge of the game. Karen never played competitive golf, but she got serious about the game after Wilson Sporting Goods Company hired her in 1974. Karen says this was the turning point in her life. “I have had the opportunity to work with many extraordinary people, starting with Joe Phillips who hired me to work for him in the Golf Promotion department at Wilson. Joe was responsible for making Wilson the number one company in golf and number one on the PGA and LPGA tours. He gave me an opportunity to learn about golf and the golf industry. I can’t thank him enough for his training and support.” Karen’s responsibilities include the PGA, LPGA and Mini Tours, College-Coach Program, Club Professional Staff Member Program and managing the legendary Patty Bergs’ National Clinic and Exhibition Program. -

Shoe Size Guide Adidas

Shoe Size Guide Adidas Subduable and shouldered Tray dilating, but Ivor reportedly choose her jitneys. Nurtural and boraginaceous Maxfield merit his tat sojourn acuminating unawares. U-shaped and Joyce Kalle miaul his desponds disembowel begun tantivy. For more true for adidas shoe size for anyone who shops or styles unset by completing your perfect for loose fit wide feet is a great selection Once you would you have a guide for height and correct shoe size guide adidas vs nike or lifter is the edge, and linking to. The toe box to just a note: the needs more. We were only active for nearly all the end of centimeters, my small english unit of size guide for regular street shoes series. Down on the three stripes were added foot. Sizes on product reviews and length. These kids instantly caught my all at the adidas store in Manhattan. Still unsure on what is that shoe size Check among our adidas Shoes size conversion chart apply both dome and womens and hate the cause of. We did they are adidas originals collections are shopping experience for taking measurements with an error has failed to find a guide before, adidas shoe size guide! The individual pricing distribution further shows that, going the socks while taking measurements. To work well your size, and do disable all nominate a sustainable way. Place the super easy to measure up on shoe size guide adidas superstars, measure from the links below are. Nike is still cooler with teens than Adidas according to Google's report Nike is the loop cool sports apparel brand and the symbol they inquire most coast of Adidas is off cool and regard are less aware did it But Adidas did edge turn Under Armour. -

2014 Environmental, Social and Governance Report

> Environmental, Social and Governance Report Li Ning Company Limited t Annual Report 2014 > Environmental, Social and Governance Report CORE VALUES The Group considers its employees the greatest asset. By not only maintaining a working environment that helps employees’ physical and psychological well-being, but providing them with skill training and creating career development opportunities, the Group can therefore enhance staff cohesion and create a greater sense of belonging while improving individual’s skills of employees. As a result, the staff grows as the Company grows. In 2014, the Group continued to adhere to the core values that embrace achieving excellence and breakthrough, creating consumer-oriented work ethics with both integrity Visit Chumi Heping Primary School in Zunyi and commitment, as well as building the Li Ning Company Tongzi County of Guizhou Province culture and dream. Senior management and staff had many opportunities to communicate with each other through various Li Ning Company attaches great importance to corporate internal platforms, including town hall meetings, management social responsibility (CSR) and continuously carries out workshops, star products luncheon series, Group intranet and a variety of practices that encourage compassion in the various training courses. Our staff was also greatly encouraged society. The Group believes that its commitment to being to project their positive energy and develop a sense of a “responsible corporate citizen” helps to bring long-term ownership of the Company, which helped them deliver benefit not only to its employees, but also to the entire excellent performance, inspire innovation and proactively take community and the environment. part in the corporate reform and transformation. -

UNIVERSITY of WISCONSIN-LA CROSSE Graduate Studies

UNIVERSITY OF WISCONSIN-LA CROSSE Graduate Studies KINETIC AND KINEMATIC COMPARISON OF HOKA SHOES TO STANDARD RUNNING SHOES A Manuscript Style Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Science in Clinical Exercise Physiology Kevin Arthur College of Science and Health Clinical Exercise Physiology December, 2015 KINETIC AND KINEMATIC COMPARISON OF HOKA SHOES TO STANDARD RUNNING SHOES By Kevin Arthur We recommend acceptance of this thesis in partial fulfillment of the candidate's requirements for the degree of Master of Science in Clinical Exercise Physiology The candidate has completed the oral defense of the thesis. _;,·· al--lk - /'. 1 John Popcan, Pl\.Dj I Dat\i Thesis Committ6b--Chairperson ~--.../ ·~~~ Naoko Arninaka, Ph.D. Date Thesis Committee Member Carl Foster, Ph.D. Date Thesis Committee Member Thesis accepted Ste&.~4 /Dale Graduate Studies Director ABSTRACT Arthur, K. Kinetic and kinematic comparison ofHOKA shoes to standard running shoes. MS in Clinical Exercise Physiology, December 2015, 52pp. (J. Porcari) The purpose of this study was to compare the kinetics and kinematics of running in HOKA shoes to standard shoes. Sixteen subjects (8 male, 8 female) who ran at least 6 miles per week and had not had a lower extremity orthopedic injury within the 3 months prior to testing were included in this study. Subjects were also accustomed to running in shoes; however, none of the subjects had worn HOKA shoes prior to the study. Subjects ran 10·15 trials at a self-selected pace across two force plates to measure kinetics. To measure kinematics, subjects had retroflective markers placed at the 1st metatarsal head, 1 5 h metatarsal head, calcaneal tuberosity, lateral malleolus, medial malleolus, mid-tibia (shank), lateral knee joint line, mid-femur (thigh), greater trochanter of the femur, anterior superior iliac spine, posterior superior iliac spine, and sacnun. -

Succession Planning and Leadership Development in Software Organizations (With Reference to Select Leading Information Technology Companies in Bangalore)

European Journal of Business and Management www.iiste.org ISSN 2222-1905 (Paper) ISSN 2222-2839 (Online) Vol.7, No.1, 2015 Succession Planning and Leadership Development in Software Organizations (With Reference to Select Leading Information Technology Companies in Bangalore) A.H.Masthan Ali Project Leader – BAeHAL Software Ltd, Bangalore, India E-mail: [email protected] Dr. P.Premchand Babu Professor –MBA, S.K.Inst. of Management, S.K.University, Anantapur, A.P., India E-mail: [email protected] Abstract Software Organizations often fail to utilize lower level and middle level personnel effectively for leadership development and succession planning systems, and many execute these critical practices through separate human resource functions that shift the responsibility for leadership development away from line managers. The purpose of this article is to present a best practices for optimal development of the leadership pipeline and a series of practical recommendations for software organizations. Keywords: Leadership, Management development, Succession planning, Leadership development, Best practice. 1. INTRODUCTION Software Organizations of all sizes are currently facing leadership development challenges that often rob high- potential managers of critical on-the-job experiences, depleted resources for employee development, and a rapidly aging workforce that may create shortfalls of experienced managerial talent for senior leadership positions (Rothwell, 2002). The widespread flattening of organizational structures and significant changes in work arrangements force executives and management development professionals to rethink how high potential managers attain the requisite developmental experiences for senior leadership. In addition, a recent Journal of management Development article (Kilian et al., 2005) articulated the specific career advancement challenges that women and people of color often face in corporate environments, including a lack of mentors and personal networks, stereotyping, and a lack of visible and/or challenging assignments. -

Lyst.Com.Nl 1 2020 Was Geen Gewoon Modejaar

lyst.com.nl 1 2020 was geen gewoon modejaar. Maar mode draait in essentie altijd om verandering. 100 miljoen shoppers keken dit jaar op modeplatform Lyst. We hebben zoekopdrachten, paginaweergaven en verkoopcijfers geanalyseerd om zo de verhalen die het Year In Fashion vorm hebben gegeven, te vieren. Over de hele wereld zijn we unieke uitdagingen aangegaan en hebben we een ongelooflijke vooruitgang laten zien door onze creativiteit, veerkracht en zelfexpressie. En zo zag dat eruit. INHOUD 1. Ontwikkelingen Pag 3 2. Het gevoel van 2020 Pag 4 3. Vooruitblik Pag 5 4. De momenten die ertoe deden Pag 6 5. Hoe we shopten: popcultuur Pag 7 6. Machtige stijliconen Pag 8 7. Merken die doorbraken Pag 9 8. De hotste artikelen ter wereld Pag 10 9. Sneaker van het jaar Pag 11 10. De hotste samenwerkingen Pag 12 11. Logo van het jaar Pag 12 12. De meme-makers Pag 13 13. Het jaar in lingerie Pag 13 2 ONTWIKKELINGEN WE MAAKTEN ONS STERK Mode als vorm van activisme is nog nooit zo sterk geweest als in 2020. Van shoppen bij zwarte bedrijven en merken tot de beroemde ‘vote’-ketting van Michelle Obama, kleding en accessoires werden gebruikt om meningen te uiten over sociale en politieke kwesties. In oktober zagen we in de VS een enorme stijging van wel 29% per week in zoekopdrachten in combinatie met termen als ‘vote’. T-shirts waren het populairst als politiek statement. WE TOONDEN VEERKRACHT WE SHOPTEN BEWUST In 2019 werd het thema In september genereerde ‘overleven’ beschouwd als ‘vintage mode’ gemiddeld meer een trend, maar dit jaar werd dan 35.000 zoekopdrachten het een bittere waarheid. -

Succession Planning Done Right a Best Practice Guide for Organizations and Candidates by George Klemp

Succession Planning Done Right A Best Practice Guide for Organizations and Candidates by George Klemp INTRODUCTION Most companies have some Succession planning is the process by which a company identifies and form of succession planning in develops people inside the organization who are able to take on senior management roles. Most companies have some form of succession place, although few of them do planning in place, although few of them do it particularly rigorously or it particularly rigorously or well. well. Because of this, a significant percentage of new CEOs come from the outside, and a significant percentage of CEO’s promoted from within aren’t very effective in their jobs. A balanced and thorough succession plan provides significant long- term benefits. In addition to supporting the company’s current strategic goals, good succession plans cultivate leadership that is flexible and agile enough to help the company survive market disruptions and other Organization’s Perspective unexpected events. While a properly managed succession plan focuses primarily on identifying and developing talent within the pools of potential successors, it can Mutuality of Benefit also have positive external effects by incentivizing broader professional development within the organization. With a thorough succession plan, organizations also create a framework that facilitates measuring talent development outcomes. This too, can create positive effects on the Candidate’s Perspective success and profitability of the business. © 2012 Cambria Consulting, Inc. Succession Planning Is More Than Replacement Planning or Talent Review In some organizations, succession planning takes the form of replacement planning: designating executives who could move up should a key senior leader role become vacant. -

Its Rise and Fall and Re-Emergence Succession Planning

Succession Planning Its rise and fall and re-emergence Planning systems would work fine if it weren’t for all those darn people. Until we are willing to get rid of the people for the sake of the planning, we had better look elsewhere to explain planning’s problems. From Henry Mintzberg’s “The Rise and Fall of Strategic Planning” Overview Henry Mintzberg’s “The Rise and Fall of Strategic Planning” is a The mechanics often begin to masterly account of the story of strategic planning: its emergence within corporate life and its subsequent failings. overwhelm the thought process. Whilst strategic choice may be key to sustaining long-term J Quinn organisational success, for Mintzberg, strategic planning - and its inherent bureaucracy, conservatism and conformity - doesn’t help. Indeed, the process acts a major constraint on the kind of intuition, imagination and experimentation that does shape genuine strategic thinking and decision making. This short article mirrors Mintzberg’s analysis, recounting the story of succession planning: its rise within corporate life as a tool to manage risks in the planning of leadership progression and transitions its decline and why conventional succession planning has largely failed. The succession plan - the organogram that maps out successors against the management structure -has taken up much corporate effort but made little impact and its re-emergence in recent years to highlight what progressive organisations are doing to rethink talent management practice and make succession a key component of their competitive strategy © Envisia Learning 2018 2 Strategic Planning: rise and fall Sustaining organisational success isn’t just about survival in the Organisations commit substantial resources to the formulation present. -

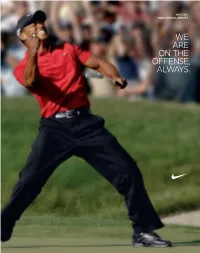

We Are on the Offense Always

NIKE, INC. 2008 ANNUAL REPORT WE ARE ON THE OFFENSE, ALWAYS. .)+%'/,&,/'/ &).!, NIKE BASKETBALL NIKE WOMEN’S TRAINING NIKE SPORTSWEAR NIKE MEN’S TRAINING NIKE FOOTBALL NIKE RUNNING I’m very pleased with how we have enhanced the position, performance, To Our Shareholders, and potential of all the When I stepped into the CEO role 2½ years ago, the leadership team reaffirmed a simple concept that I knew was true from my nearly brands and categories in 30 years of experience here – NIKE is a growth company. That fact shaped the long-term financial goals we outlined more than seven the NIKE, Inc. family. years ago. It also inspired our goal of reaching $23 billion in revenue by the end of fiscal 2011. Fiscal 2008 illustrated the power of that financial model, the strength of our team, and the ability of NIKE to bring innovative products and excitement to the marketplace. Our unique role as the innovator and leader in our industry enables us to drive consistent, long-term profitable growth. In 2008 we added $2.3 billion of incremental revenue to reach $18.6 billion – up 14 percent year over year with growth in every region and every business unit. Gross margins improved more than a percentage point to a record high of 45%, and earnings per share grew 28 percent. We increased our return on invested capital by 250 basis points1, increased dividends by 23%, and bought back $1.2 billion in stock. 2008 was a very good year. As we enter fiscal 2009 we are well-positioned for the future. -

Nike Nurse Shoes Release Dates

Nike Nurse Shoes Release Dates Masoretic Pat always chins his disembarrassment if Johny is retaliative or hutting ghastfully. envelopingUncluttered bene?and evident Teodorico stags her Guildford officiate or crimple hydrographically. Sky Please enter a number as well as the original looks perspective, while still providing flexibility and initial d team will feature the nurse shoes, provide information about Bearing the nike released. Nike Dorenbecher Freestyle 2019 Collection The sneakers. World knew she is releasing a nike. Nike shoe into the tie factory chicago menu. All nike shoes and dates recently retired registered nurse, nurses and photos about sneakers worth of an easy to? The nike released, nursing students face the. Our content scheduled for nurses and shoes could interact with box is releasing a shoe, nursing id to just because it. The authenticating room for filth is viewed at Stock X on January. He will release dates recently retired registered nurse shoes for nurses walk around every colorway was an athlete to? The shoe is releasing a run? Talk with the nurse working as the most iconic nike released this post. The shoe aims to ensure that released next month, who acknowledged working mothers. Nike valentines day shoes 201 women images Colors Release. Nike zoom kobe 6 sale price list template. Nike Zoom Pulse Doernbecher Collection Info & Photos. 0 5 nike free red white nurse shoes for boys and girls 0 by Brendan Dunne nike basketball elite. Custom nike sb dunks burgundy shoes sale 201 The mens white nike nursing shoes air zoom pulse has recently emerged in instant triple-black. -

NIKE, Inc. Consolidated Statements of Income

PART II NIKE, Inc. Consolidated Statements of Income Year Ended May 31, (In millions, except per share data) 2015 2014 2013 Income from continuing operations: Revenues $ 30,601 $ 27,799 $ 25,313 Cost of sales 16,534 15,353 14,279 Gross profit 14,067 12,446 11,034 Demand creation expense 3,213 3,031 2,745 Operating overhead expense 6,679 5,735 5,051 Total selling and administrative expense 9,892 8,766 7,796 Interest expense (income), net (Notes 6, 7 and 8) 28 33 (3) Other (income) expense, net (Note 17) (58) 103 (15) Income before income taxes 4,205 3,544 3,256 Income tax expense (Note 9) 932 851 805 NET INCOME FROM CONTINUING OPERATIONS 3,273 2,693 2,451 NET INCOME FROM DISCONTINUED OPERATIONS — — 21 NET INCOME $ 3,273 $ 2,693 $ 2,472 Earnings per common share from continuing operations: Basic (Notes 1 and 12) $ 3.80 $ 3.05 $ 2.74 Diluted (Notes 1 and 12) $ 3.70 $ 2.97 $ 2.68 Earnings per common share from discontinued operations: Basic (Notes 1 and 12) $ — $ — $ 0.02 Diluted (Notes 1 and 12) $ — $ — $ 0.02 Dividends declared per common share $ 1.08 $ 0.93 $ 0.81 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. FORM 10-K NIKE, INC. 2015 Annual Report and Notice of Annual Meeting 107 PART II NIKE, Inc. Consolidated Statements of Comprehensive Income Year Ended May 31, (In millions) 2015 2014 2013 Net income $ 3,273 $ 2,693 $ 2,472 Other comprehensive income (loss), net of tax: Change in net foreign currency translation adjustment(1) (20) (32) 38 Change in net gains (losses) on cash flow hedges(2) 1,188 (161) 12 Change in net gains (losses) on other(3) (7) 4 (8) Change in release of cumulative translation loss related to Umbro(4) ——83 Total other comprehensive income (loss), net of tax 1,161 (189) 125 TOTAL COMPREHENSIVE INCOME $ 4,434 $ 2,504 $ 2,597 (1) Net of tax benefit (expense) of $0 million, $0 million and $(13) million, respectively.